|

Item 1.01.

|

Entry into a Material Definitive Agreement

|

On February 14, 2020, Warrior Met Coal, Inc. (the “Company”) entered into a net operating loss carryforwards (“NOLs”) rights plan (the “Rights Agreement”) with Computershare Trust Company, N.A., as rights agent. In connection therewith, the Board of Directors of the Company (the “Board”) declared a dividend of one preferred share purchase right (“Right”) for each outstanding share of the Company’s common stock, par value $0.01 per share (the “Common Stock”). The dividend is payable on February 28, 2020 to stockholders of record as of the close of business on February 28, 2020 (the “Record Date”). In addition, one Right will automatically attach to each share of Common Stock issued between the Record Date and the Distribution Date (as defined below).

The Board adopted the Rights Agreement in an effort to prevent the imposition of significant limitations under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), on its ability to utilize its current NOLs to reduce its future tax liabilities. If the Company experiences an “ownership change,” as defined in Section 382 of the Code, the Company’s ability to fully utilize the NOLs on an annual basis will be substantially limited, and the timing of the usage of the NOLs could be substantially delayed, which could therefore significantly impair the value of those benefits. Generally, an “ownership change” occurs if the percentage of the Company’s stock owned by one or more “five percent stockholders” increases by more than fifty percentage points over the lowest percentage of stock owned by such stockholders at any time during the prior three-year period or, if sooner, since the last “ownership change” experienced by the Company. The Rights Agreement is intended to supplement the restrictions on the transfer or other disposition of shares of the Common Stock contained in the Company’s Certificate of Incorporation (“Certificate of Incorporation”), the extension of which the stockholders of the Company approved at the Company’s 2019 Annual Meeting.

In general terms, the Rights Agreement works by imposing a significant penalty upon any person or group that acquires 4.99% or more of the outstanding Common Stock or any existing stockholder who currently owns 5.00% or more of the Common Stock that acquires any additional shares of Common Stock without the approval of the Board (such person, group or existing stockholder, an “Acquiring Person”). The Rights Agreement also gives discretion to the Board to determine that someone is an Acquiring Person even if they do not own 4.99% or more of the outstanding Common Stock but do own 4.99% or more in value of the Company’s outstanding stock, as determined pursuant to Section 382 of the Code and the regulations promulgated thereunder. In addition, the Board has established procedures to consider requests to exempt certain acquisitions of the Company’s securities from the Rights Agreement if the Board determines that doing so would not limit or impair the availability of the NOLs or is otherwise in the best interests of the Company.

The following is a general description of the terms of the Rights Agreement. This description is qualified in its entirety by the full text of the Rights Agreement, which is included as Exhibit 4.1 to this Current Report on Form 8-K and incorporated herein by reference.

The Rights. The Board authorized the issuance of a Right with respect to each share of Common Stock outstanding on the Record Date. The Rights will initially trade with, and will be inseparable from, the Common Stock. New Rights will accompany any new shares of Common Stock issued after the Record Date until the earlier of the Distribution Date, the redemption date or the expiration date of the Rights, as described below. Prior to exercise, a Right does not give its holder any dividend, voting or liquidation rights.

Exercise Price. Each Right will allow its registered holder to purchase from the Company one one-thousandth of a share of Series A Junior Participating Preferred Stock, par value $0.01 per share of the Company (the “Preferred Stock”), for $31.00, subject to adjustment under certain circumstances (the “Purchase Price”), once the Rights become exercisable.

Exercisability. The Rights will not be exercisable until the earlier to occur of:

|

|

•

|

10 business days following public announcement that a person or group of affiliated or associated persons has become an Acquiring Person or such earlier date that a majority of the Board becomes aware of the existence of such Acquiring Person, or

|

|

|

•

|

10 business days (or a later date determined by the Board before any person or group becomes an Acquiring Person) following the commencement of, or announcement of an intention to make, a tender or exchange offer which, if completed, would result in that person or group becoming an Acquiring Person.

|

The date when the Rights become exercisable is referred to as the “Distribution Date.” Until the Distribution Date, the Rights are evidenced, with respect to any Common Stock certificates outstanding as of the Record Date, by such Common Stock certificates, and with respect to any shares of Common Stock held in uncertificated form as of the Record Date, by the book entries in the book-entry system for the Common Stock, in each case together with a copy of a Summary of Rights that the Company will send to all holders of record of Common Stock as of the Record Date. Until the Distribution Date, new Common Stock certificates issued after the Record Date upon transfer or new issuance of shares of Common Stock will contain a legend regarding the Rights (which certificates will evidence the associated Rights) and the Company will deliver a notice regarding the Rights upon the transfer or new issuance of shares of Common Stock held in book-entry form (which book-entries will evidence the associated Rights). Until the Distribution Date (or earlier redemption, exchange, termination or expiration of the Rights), the surrender for transfer of any certificates for Common Stock or book-entry shares, with or without such legend, notice or Summary of Rights, will also constitute the transfer of the associated Rights. After the Distribution Date, the Rights will separate from the Common Stock and be evidenced solely by Right certificates that the Company will mail to all eligible holders of Common Stock. Any Rights held by an Acquiring Person or an associate or affiliate thereof and certain transferees thereof will be null and void and may not be exercised.

Consequences of a Person or Group Becoming an Acquiring Person. If a person or group of affiliated or associated persons becomes an Acquiring Person, all holders of Rights except the Acquiring Person or an associate or affiliate thereof and certain transferees thereof may, upon exercise of a Right, purchase for the Purchase Price shares of Common Stock with a market value of two times the Purchase Price, based on the market price of the Common Stock prior to such acquisition. If the Company does not have a sufficient number of shares of Common Stock available, the Company may under certain circumstances substitute shares of Preferred Stock or other securities or property for the Common Stock into which the Rights would have otherwise been exercisable.

Exempt Persons. The Board recognizes that there may be instances when an acquisition of shares of the Common Stock that would cause a stockholder to become an Acquiring Person may not jeopardize or endanger, in any material respect, the availability of the NOLs to the Company. Accordingly, the Rights Agreement grants discretion to the Board to designate a person as an “Exempt Person.” The Board can revoke an “Exempt Person” designation if it subsequently makes a contrary determination regarding whether a person jeopardizes or endangers in any material respect the availability of the NOLs to the Company.

Preferred Stock Provisions.

Each one one-thousandth of a share of Preferred Stock, if issued:

|

|

•

|

will not be redeemable.

|

|

|

•

|

will entitle the holder to quarterly dividend payments equal to the dividend paid on one share of Common Stock.

|

|

|

•

|

will entitle the holder upon liquidation, dissolution or winding-up of the Company to receive the greater of (a) $0.01 per one one-thousandth of a share of Preferred Stock (plus any accrued but unpaid dividends) and (b) an amount equal to the payment made on one share of Common Stock.

|

|

|

•

|

will have the same voting power as one share of Common Stock.

|

|

|

•

|

if shares of Common Stock are exchanged via merger, consolidation, or a similar transaction, will entitle the holder to a payment equal to the payment made on one share of Common Stock.

|

The value of one one-thousandth interest in a share of Preferred Stock should approximate the value of one share of Common Stock.

Expiration. The Rights will expire on the earliest of (i) the close of business on February 14, 2023, (ii) the close of business on the first anniversary of the date of entry into the Rights Agreement, if stockholder approval of the Rights Agreement has not been received by or on such date, (iii) the time at which the Rights are redeemed as provided in the Rights Agreement, (iv) the time at which the Rights are exchanged as provided in the Rights Agreement, (v) the time at which the Board determines that the NOLs are fully utilized or no longer available under Section 382 of the Code, (vi) the effective date of the repeal of Section 382 of the Code if the Board determines that the Rights Agreement is no longer necessary or desirable for the preservation of NOLs, or (vii) the closing of any merger or other acquisition transaction involving the Company pursuant to an agreement of the type described in the Rights Agreement.

Redemption. The Board may redeem the Rights for $0.01 per Right at any time before any person or group becomes an Acquiring Person. If the Board redeems any Rights, it must redeem all of the Rights. Once the Rights are redeemed, the only right of the holders of Rights will be to receive the redemption price of $0.01 per Right. The redemption price will be adjusted if the Company has a stock split or issues stock dividends of its Common Stock.

Exchange. After a person or group becomes an Acquiring Person, but before an Acquiring Person owns 50% or more of the outstanding Common Stock, in lieu of the consequences described above in “Consequences of a Person or Group Becoming an Acquiring Person,” the Board may extinguish the Rights by exchanging one share of Common Stock or an equivalent security for each Right, other than Rights held by the Acquiring Person or an affiliate or associate thereof and certain transferees thereof, which will have become null and void.

Anti-Dilution Provisions. The Purchase Price of the Preferred Stock, the number of shares of Preferred Stock issuable and the number of outstanding Rights are subject to adjustment to prevent dilution that may occur as a result of certain events, including among others, a stock dividend, a stock split, or a reclassification of the Preferred Stock or Common Stock. With certain exceptions, no adjustments to the Purchase Price will be required until cumulative adjustments require an adjustment of at least 1% in such Purchase Price.

Amendments. The terms of the Rights Agreement may be amended by the Board without the consent of the holders of the Rights except that after a person or group becomes an Acquiring Person, the Board may not amend the agreement in a way that adversely affects holders of the Rights.

|

Item 3.03.

|

Material Modification to Rights of Security Holders

|

The information required by this Item 3.03 is incorporated by reference from Item 5.03 below.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

|

In connection with the adoption of the Rights Agreement, the Board approved a Certificate of Designations of Series A Junior Participating Preferred Stock designating 140,000 shares of Preferred Stock (the “Certificate of Designations”). The Company filed the Certificate of Designations on February 14, 2020 with the Secretary of State of the State of Delaware and the Certificate of Designations became effective on such date. A description of the Preferred Stock is set forth in Item 1.01 of this Current Report on Form 8-K and is incorporated into this Item 5.03 by reference. Such description is qualified in its entirety by reference to the Certificate of Designations. The full text of the Certificate of Designations is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

On February 14, 2020, the Company issued a press release announcing the declaration of the Rights dividend and the adoption of the Rights Agreement. A copy of the press release is filed with this report as Exhibit 99.1 and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Exhibit Description

|

|

|

|

|

|

|

|

|

3.1

|

|

|

Certificate of Designations of Series A Junior Participating Preferred Stock of Warrior Met Coal, Inc., as filed with the Secretary of State of the State of Delaware on February 14, 2020.

|

|

|

|

|

|

|

|

|

4.1

|

|

|

Rights Agreement, dated as of February 14, 2020 between Warrior Met Coal, Inc. and Computershare Trust Company, N.A., as rights agent (including the form of Certificate of Designations of Series A Junior Participating Preferred Stock attached thereto as Exhibit A, the form of Right Certificate attached thereto as Exhibit B and the Summary of Rights to Purchase Preferred Shares attached thereto as Exhibit C).

|

|

|

|

|

|

|

|

|

4.2

|

|

|

Form of Right Certificate (incorporated by reference to Exhibit B of the Rights Agreement filed as Exhibit 4.1 of this Current Report on Form 8-K).

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press release, dated February 14, 2020.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrior Met Coal, Inc.

|

|

|

|

|

|

|

|

|

|

Date: February 14, 2020

|

|

|

|

By:

|

|

/s/ Dale W. Boyles

|

|

|

|

|

|

|

|

Dale W. Boyles

|

|

|

|

|

|

|

|

Chief Financial Officer

|

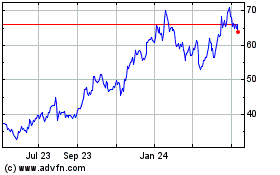

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

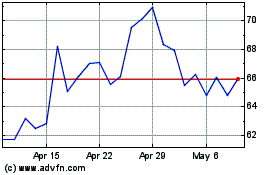

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From Jul 2023 to Jul 2024