Net revenue increased 12.2% year over year to

$172.0 million

Average Revenue per Customer increased 8.4%

year over year to $270

Warby Parker Inc. (NYSE: WRBY) (the “Company”), a

direct-to-consumer lifestyle brand focused on vision for all, today

announced financial results for the first quarter ended March 31,

2023.

“Our first quarter performance represents a solid start to

2023,” said Co-Founder and Co-CEO Dave Gilboa. “We achieved double

digit revenue growth, ahead of expectations and well above the

current industry forecasted growth rate. We are particularly

pleased to be driving strong market share gains while expanding

adjusted EBITDA margin. Our teams are doing an excellent job of

capturing demand in the current environment through our compelling

value proposition, expanding portfolio of products and services,

and delivering world class customer service.”

“While we continue to be cautious about near-term trends given

the uncertain macroeconomic outlook, we remain optimistic about

Warby Parker’s future,” added Co-Founder and Co-CEO Neil

Blumenthal. “We are still in the early stages of building our store

footprint and developing our holistic vision offering and see a

long runway for sustained, profitable growth in the years

ahead.”

First Quarter 2023 Year Over Year

Highlights

- Net revenue increased $18.8 million, or 12.2%, to $172.0

million.

- GAAP net loss improved $23.3 million to $10.8 million.

- Adjusted EBITDA(1) increased $17.0 million to $17.7 million and

adjusted EBITDA margin(1) improved 9.8 points from 0.5% to

10.3%.

First Quarter 2023 Year Over Year

Financial Results

- Net revenue increased $18.8 million, or 12.2%, to $172.0

million.

- Average Revenue per Customer increased 8.4% to $270. Active

Customers increased 2.5%, to 2.29 million.

- Gross profit increased 5.7% to $94.8 million.

- Gross margin was 55.1% compared to 58.5% in the prior year. The

decline in gross margin was primarily driven by the impact of the

growth in store count driving higher store occupancy and

depreciation costs, an increase in salary and benefit costs

associated with optometrists as we scale our eye exam offering

across our fleet, to 155 exam locations, up from 114 in the prior

year period, and the increased penetration of contact lenses, which

carry lower gross margins than eyeglasses, reflecting Warby

Parker’s strategy to grow its contact lens offering.

- Selling, general and administrative expenses (“SG&A”) was

62.3% of revenue, down from 80.5% of revenue in the prior year, a

decline of $16.2 million to $107.2 million, primarily driven by

reduced marketing costs, lower stock-based compensation, and

adjustments to our cost structure made last year. Adjusted

SG&A(1) decreased to $87.2 million, or 50.7% of revenue, down

from $96.2 million, or 62.8% of revenue in the prior year.

- GAAP net loss decreased $23.3 million to $10.8 million,

primarily as a result of the decrease in SG&A described

above.

- Adjusted EBITDA(1) increased $17.0 million to $17.7 million and

adjusted EBITDA margin(1) improved 9.8 points to 10.3%.

- Opened 6 new stores during the quarter, ending with 204

stores.

Balance Sheet Highlights

Warby Parker ended the first quarter of 2023 with $204.3 million

in cash and cash equivalents.

2023 Outlook

For the full year 2023, Warby Parker is maintaining the

following guidance:

- Net revenue of $645 to $660 million, representing growth of 8%

to 10% versus full year 2022.

- Adjusted EBITDA(1) of approximately $51.5 million, or adjusted

EBITDA margin(1) of approximately 7.9%.

- 40 new store openings bringing the total projected store count

at year end to approximately 240.

“Both our top and bottom line exceeded guidance in the first

quarter highlighted by our adjusted EBITDA margin of 10.3%,” said

Chief Financial Officer Steve Miller. “Our disciplined and balanced

approach to driving growth and profitability is fueling solid

overall results despite the macroeconomic headwinds that continue

to pressure the market. We believe we are well positioned to

continue advancing our business in 2023 and remain confident that

the strategic course we have set for the Company will yield

meaningful benefits for consumers and our shareholders over the

long term.”

The guidance and forward-looking statements made in this press

release and on our conference call are based on management's

expectations as of the date of this press release.

(1) Please see the reconciliation of non-GAAP financial measures

to the most comparable GAAP financial measure in the section titled

“Non-GAAP Financial Measures” below.

Webcast and Conference

Call

A conference call to discuss Warby Parker’s first quarter 2023

results, as well as second quarter and full year 2023 outlook, is

scheduled for 8:00 a.m. ET today. To participate, please dial

833-470-1428 from the U.S. or 404-975-4839 from international

locations. The conference passcode is 104220. A live webcast of the

conference call will be available on the investors section of the

Company’s website at investors.warbyparker.com where presentation

materials will also be posted prior to the conference call. A

replay will be made available online approximately two hours

following the live call for a period of 90 days.

Forward-Looking

Statements

This press release and the related conference call, webcast and

presentation contain forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

These statements may relate to, but are not limited to,

expectations of future operating results or financial performance,

including expectations regarding achieving profitability,

delivering stakeholder value, growing market share, and our

guidance for the quarter ending June 30, 2023 and year ending

December 31, 2023; expectations regarding the number of new store

openings during the year ending December 31, 2023; management’s

plans, priorities, initiatives and strategies; and expectations

regarding growth of our business. Forward-looking statements are

inherently subject to risks and uncertainties, some of which cannot

be predicted or quantified. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “toward,” “will,” or

“would,” or the negative of these words or other similar terms or

expressions. You should not put undue reliance on any

forward-looking statements. Forward-looking statements should not

be read as a guarantee of future performance or results and will

not necessarily be accurate indications of the times at, or by,

which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at

the time those statements are made and are based on current

expectations, estimates, forecasts, and projections as well as the

beliefs and assumptions of management as of that time with respect

to future events. These statements are subject to risks and

uncertainties, many of which involve factors or circumstances that

are beyond our control, that could cause actual performance or

results to differ materially from those expressed in or suggested

by the forward-looking statements. In light of these risks and

uncertainties, the forward-looking events and circumstances

discussed in this press release may not occur and actual results

could differ materially from those anticipated or implied in the

forward-looking statements. These risks and uncertainties include

our ability to manage our future growth effectively; our

expectations regarding cost of goods sold, gross margin, channel

mix, customer mix, and selling, general, and administrative

expenses; increases in component and shipping costs and changes in

supply chain; our reliance on our information technology systems

and enterprise resource planning systems for our business to

effectively operate and safeguard confidential information; our

ability to engage our existing customers and obtain new customers;

planned new retail stores in 2023 and going forward; an overall

decline in the health of the economy and other factors impacting

consumer spending, such as recessionary conditions, inflation and

government instability; our ability to compete successfully; our

ability to manage our inventory balances and shrinkage; the growth

of our brand awareness; our ability to recruit and retain

optometrists, opticians, and other vision care professionals; a

resurgence of COVID-19 or the spread of new infectious diseases;

the effects of seasonal trends on our results of operations; our

ability to stay in compliance with extensive laws and regulations

that apply to our business and operations; our ability to

adequately maintain and protect our intellectual property and

proprietary rights; our reliance on third parties for our products,

operation and infrastructure; our duties related to being a public

benefit corporation; the ability of our Co-Founders and Co-CEOs to

exercise significant influence over all matters submitted to

stockholders for approval; the effect of our multi-class structure

on the trading price of our Class A common stock; and the increased

expenses associated with being a public company. Additional

information regarding these and other risks and uncertainties that

could cause actual results to differ materially from the Company's

expectations is included in our most recent reports filed with the

SEC on Form 10-K and Form 10-Q. Except as required by law, we do

not undertake any obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments, or otherwise.

Additional information regarding these and other factors that

could affect the Company’s results is included in the Company’s SEC

filings, which may be obtained by visiting the SEC's website at

www.sec.gov. Information contained on, or that is referenced or can

be accessed through, our website does not constitute part of this

document and inclusions of any website addresses herein are

inactive textual references only.

Glossary

Active Customer is defined as a unique customer that has made at

least one purchase of any product or service in the preceding

12-month period.

Average Revenue per Customer is defined as net revenue for a

given period divided by the number of Active Customers as of the

end of that same period.

Non-GAAP Financial

Measures

We use adjusted EBITDA, adjusted EBITDA margin, adjusted net

income, adjusted earnings per share, adjusted cost of goods sold

(“adjusted COGS”), adjusted gross profit, and adjusted selling,

general, and administrative expenses (“adjusted SG&A”) as

important indicators of our operating performance. Collectively, we

refer to these non-GAAP financial measures as our “Non-GAAP

Measures.” The Non-GAAP Measures, when taken collectively with our

GAAP results, may be helpful to investors because they provide

consistency and comparability with past financial performance and

assist in comparisons with other companies, some of which use

similar non-GAAP financial information to supplement their GAAP

results.

Adjusted EBITDA is defined as net income (loss) before interest

and other income, taxes, and depreciation and amortization as

further adjusted for asset impairment costs, stock-based

compensation expense and related employer payroll taxes,

amortization of cloud-based software implementation costs, and

non-recurring costs such as major system implementation costs.

Adjusted EBITDA margin is defined as adjusted EBITDA divided by net

revenue.

Adjusted net income (loss) is defined as net income (loss)

adjusted for stock-based compensation expense and related employer

payroll taxes and non-recurring costs such as major system

implementation costs, and as further adjusted for estimated income

tax on such adjusted items.

Adjusted earnings (loss) per share is defined as adjusted net

income (loss) divided by adjusted weighted average shares

outstanding.

Adjusted COGS is defined as cost of goods sold adjusted for

stock-based compensation expense and related employer payroll

taxes.

Adjusted gross profit is defined as net revenue minus adjusted

COGS.

Adjusted SG&A is defined as SG&A adjusted for

stock-based compensation expense and related employer payroll taxes

and non-recurring costs such as major system implementation

costs.

The Non-GAAP Measures are presented for supplemental

informational purposes only. A reconciliation of historical GAAP to

Non-GAAP financial information is included under “Selected

Financial Information” below.

We have not reconciled our adjusted EBITDA margin guidance to

GAAP net income (loss) margin, or net margin, or adjusted EBITDA

guidance to GAAP net income (loss) because we do not provide

guidance for GAAP net margin or GAAP net income (loss) due to the

uncertainty and potential variability of stock-based compensation

and taxes, which are reconciling items between GAAP net margin and

adjusted EBITDA margin and GAAP net income (loss) and adjusted

EBITDA, respectively. Because such items cannot be reasonably

provided without unreasonable efforts, we are unable to provide a

reconciliation of the adjusted EBITDA margin guidance to GAAP net

margin and adjusted EBITDA guidance to GAAP net income (loss).

However, such items could have a significant impact on GAAP net

margin and GAAP net income (loss).

About Warby Parker

Warby Parker (NYSE: WRBY) was founded in 2010 with a mission to

inspire and impact the world with vision, purpose, and

style–without charging a premium for it. Headquartered in New York

City, the co-founder-led lifestyle brand pioneers ideas, designs

products, and develops technologies that help people see, from

designer-quality prescription glasses (starting at $95) and

contacts, to eye exams and vision tests available online and in

more than 200 retail stores across the U.S. and Canada.

Warby Parker aims to demonstrate that businesses can scale, do

well, and do good in the world. Ultimately, the brand believes in

vision for all, which is why for every pair of glasses or

sunglasses sold, they distribute a pair to someone in need through

their Buy a Pair, Give a Pair program. To date, Warby Parker has

worked alongside its nonprofit partners to distribute more than 13

million glasses to people in need.

Selected Financial Information

Warby Parker Inc. and

Subsidiaries

Consolidated Balance Sheets

(Unaudited)

(Amounts in thousands, except

share data)

March 31, 2023

December 31, 2022

Assets

Current assets:

Cash and cash equivalents

$

204,261

$

208,585

Accounts receivable, net

962

1,435

Inventory

64,411

68,848

Prepaid expenses and other current

assets

14,927

15,700

Total current assets

284,561

294,568

Property and equipment, net

140,476

138,628

Right-of-use lease assets

123,278

127,014

Other assets

9,566

8,497

Total assets

$

557,881

$

568,707

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

19,958

$

20,791

Accrued expenses

47,996

58,222

Deferred revenue

18,886

25,628

Current lease liabilities

21,710

22,546

Other current liabilities

2,489

2,370

Total current liabilities

111,039

129,557

Non-current lease liabilities

148,922

150,832

Other liabilities

1,574

1,672

Total liabilities

261,535

282,061

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.0001 par value; Class A:

750,000,000 shares authorized at March 31, 2023 and December 31,

2022, 96,282,522 and 96,115,202 issued and outstanding at March 31,

2023 and December 31, 2022, respectively; Class B: 150,000,000

shares authorized at March 31, 2023 and December 31, 2022,

19,318,298 and 19,223,572 shares issued and outstanding as of March

31, 2023 and December 31, 2022, respectively, convertible to Class

A on a one-to-one basis

12

12

Additional paid-in capital

912,110

890,915

Accumulated deficit

(614,446

)

(603,634

)

Accumulated other comprehensive loss

(1,330

)

(647

)

Total stockholders’ equity

296,346

286,646

Total liabilities and stockholders’

equity

$

557,881

$

568,707

Warby Parker Inc. and

Subsidiaries

Consolidated Statements of

Operations (Unaudited)

(Amounts in thousands, except

share and per share data)

Three Months Ended March

31,

2023

2022

Net revenue

$

171,968

$

153,218

Cost of goods sold

77,177

63,572

Gross profit

94,791

89,646

Selling, general, and administrative

expenses

107,221

123,386

Loss from operations

(12,430

)

(33,740

)

Interest and other loss, net

1,879

146

Loss before income taxes

(10,551

)

(33,594

)

Provision for income taxes

261

539

Net loss

$

(10,812

)

$

(34,133

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.09

)

$

(0.30

)

Weighted average shares used in computing

net loss per share attributable to common stockholders, basic and

diluted

116,159,428

114,103,766

Warby Parker Inc. and

Subsidiaries

Consolidated Statements of

Cash Flows (Unaudited)

(Amounts in thousands)

Three Months Ended March

31,

2023

2022

Cash flows from operating activities

Net loss

$

(10,812

)

$

(34,133

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

9,140

6,910

Stock-based compensation

19,780

27,144

Asset impairment charges

395

227

Amortization of cloud-based software

implementation costs

363

—

Change in operating assets and

liabilities:

Accounts receivable, net

473

163

Inventory

4,442

(7,147

)

Prepaid expenses and other assets

(657

)

(4,316

)

Accounts payable

(921

)

751

Accrued expenses

(7,826

)

(2,158

)

Deferred revenue

(6,744

)

(2,654

)

Other current liabilities

119

129

Right-of-use lease assets and current and

non-current lease liabilities

988

2,571

Other liabilities

(97

)

2,217

Net cash provided by (used in) operating

activities

8,643

(10,296

)

Cash flows from investing activities

Purchases of property and equipment

(12,385

)

(16,060

)

Net cash used in investing activities

(12,385

)

(16,060

)

Cash flows from financing activities

Proceeds from stock option exercises

81

180

Net cash provided by financing

activities

81

180

Effect of exchange rates on cash

(662

)

84

Net decrease in cash and cash

equivalents

(4,323

)

(26,092

)

Cash and cash equivalents, beginning of

period

208,585

256,416

Cash and cash equivalents, end of

period

$

204,262

$

230,324

Supplemental disclosures

Cash paid for income taxes

$

97

$

34

Cash paid for interest

50

35

Cash paid for amounts included in the

measurement of lease liabilities

10,849

6,941

Non-cash investing and financing

activities:

Purchases of property and equipment

included in accounts payable and accrued expenses

$

2,957

$

4,241

Warby Parker Inc. and

Subsidiaries

Reconciliation of GAAP to

Non-GAAP Measures (Unaudited)

The following table reconciles

adjusted EBITDA and adjusted EBITDA margin to the most directly

comparable GAAP measure, which is net loss:

Three Months Ended March

31,

2023

2022

unaudited (in

thousands)

Net loss

$

(10,812

)

$

(34,133

)

Adjusted to exclude the following:

Interest and other loss, net

(1,878

)

(146

)

Provision for income taxes

261

539

Depreciation and amortization expense

9,140

6,910

Asset impairment charges

395

227

Stock-based compensation expense(1)

19,866

27,377

Amortization of cloud-based software

implementation costs(2)

363

—

ERP implementation costs(3)

403

—

Adjusted EBITDA

17,738

774

Adjusted EBITDA margin

10.3

%

0.5

%

(1)

Represents expenses related to

the Company’s equity-based compensation programs and related

employer payroll taxes, which may vary significantly from period to

period depending upon various factors including the timing, number,

and the valuation of awards granted, and vesting of awards

including the satisfaction of performance conditions. For the three

months ended March 31, 2023 and 2022, the amount includes $0.1

million and $0.2 million, respectively, of employer payroll costs

associated with releases of RSUs and option exercises.

(2)

Represents the amortization of

costs capitalized in connection with the implementation of

cloud-based software.

(3)

Represents internal and external

non-capitalized costs related to the implementation of our new

Enterprise Resource Planning (“ERP”) system.

Warby Parker Inc. and

Subsidiaries

Reconciliation of GAAP to

Non-GAAP Measures (Unaudited)

The following table presents our

non-GAAP, or adjusted, financial measures for the periods presented

as a percentage of revenue. Each cost and operating expense is

adjusted for stock-based compensation expense and related employer

payroll taxes and ERP implementation costs, if applicable.

Reported

Adjusted

Three Months Ended

March 31,

Three Months Ended

March 31,

2023

2022

2023

2022

(unaudited, in

thousands)

(unaudited, in

thousands)

Cost of goods sold

$

77,177

$

63,572

$

76,979

$

63,337

% of Revenue

44.9

%

41.5

%

44.8

%

41.3

%

Gross profit

$

94,791

$

89,646

$

94,989

$

89,881

% of Revenue

55.1

%

58.5

%

55.2

%

58.7

%

Selling, general, and administrative

expenses

$

107,221

$

123,386

$

87,150

$

96,244

% of Revenue

62.3

%

80.5

%

50.7

%

62.8

%

Net (loss) income

$

(10,812

)

$

(34,133

)

$

6,855

$

(4,385

)

% of Revenue

(6.3

)%

(22.3

)%

4.0

%

(2.9

)%

Warby Parker Inc. and

Subsidiaries

Reconciliation of GAAP to

Non-GAAP Measures (Unaudited)

The following table reflects a

reconciliation of each non-GAAP, or adjusted, financial measure to

its most directly comparable financial measure prepared in

accordance with GAAP:

Three Months Ended March

31,

2023

2022

(unaudited, in

thousands)

Cost of goods sold

$

77,177

$

63,572

Adjusted to exclude the following:

Stock-based compensation expense(1)

198

235

Adjusted cost of goods sold

$

76,979

$

63,337

Gross profit

$

94,791

$

89,646

Adjusted to exclude the following:

Stock-based compensation expense(1)

198

235

Adjusted gross profit

$

94,989

$

89,881

Selling, general, and administrative

expenses

$

107,221

$

123,386

Adjusted to exclude the following:

Stock-based compensation expense(1)

19,668

27,142

ERP implementation costs(2)

403

—

Adjusted selling, general, and

administrative expenses

$

87,150

$

96,244

Net loss

$

(10,812

)

$

(34,133

)

Provision for income taxes

261

539

Loss before income taxes

(10,551

)

(33,594

)

Adjusted to exclude the following:

Stock-based compensation expense(1)

19,866

27,377

ERP implementation costs(2)

403

—

Adjusted provision for income taxes(3)

(2,863

)

1,832

Adjusted net income (loss)

$

6,855

$

(4,385

)

Adjusted weighted average shares -

diluted

116,910,723

114,103,766

Adjusted diluted loss per share

$

0.06

$

(0.04

)

(1)

Represents expenses related to

the Company’s equity-based compensation programs and related

employer payroll taxes, which may vary significantly from period to

period depending upon various factors including the timing, number,

and the valuation of awards granted, and vesting of awards

including the satisfaction of performance conditions. For the three

months ended March 31, 2023 and 2022, the amount includes $0.1

million and $0.2 million, respectively, of employer payroll costs

associated with releases of RSUs and option exercises, all of which

is included in SG&A.

(2)

Represents internal and external

non-capitalized costs related to the implementation of our new ERP

system.

(3)

The adjusted provision for income

taxes is based on long-term estimated annual effective tax rate

29.46% in both 2023 and 2022. The Company may adjust its adjusted

tax rate as additional information becomes available or events

occur which may materially affect this rate, including impacts from

the rapidly evolving global tax environment, significant changes in

our geographic mix, merger and acquisition activity, or changes in

our business outlook.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230508005760/en/

Investor Relations: Brendon Frey, ICR

Investors@warbyparker.com

Media: Lena Griffin lena@derris.com

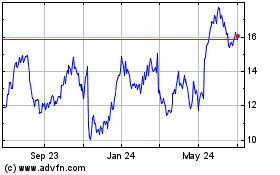

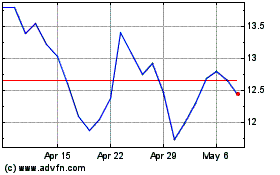

Warby Parker (NYSE:WRBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Warby Parker (NYSE:WRBY)

Historical Stock Chart

From Nov 2023 to Nov 2024