Current Report Filing (8-k)

August 03 2020 - 4:48PM

Edgar (US Regulatory)

0001522727false00015227272020-05-052020-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 3, 2020

USA Compression Partners, LP

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-35779

|

|

75-2771546

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

111 Congress Avenue, Suite 2400

Austin, Texas 78701

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (512) 473-2662

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common units representing limited partner interests

|

|

USAC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On August 3, 2020 (the “Amendment Effective Date”), USA Compression Partners, LP (the “Partnership”) entered into Amendment No. 1 (the “First Amendment”) to its Sixth Amended and Restated Credit Agreement among the Partnership, as borrower, the guarantors party thereto, the lenders party thereto and JPMorgan Chase Bank, N.A., as agent and LC Issuer (as defined therein) (as amended from time to time, the “Credit Agreement”).

The First Amendment amended the Credit Agreement to, among other items, increase the maximum funded debt to EBITDA ratio to (i) 5.75 to 1.00 for the fiscal quarters ending September 30, 2020 and December 31, 2020, (ii) 5.50 to 1.00 for the fiscal quarters ending March 31, 2021 and June 30, 2021 and (iii) 5.25 to 1.00 for the fiscal quarters ending September 30, 2021 and December 31, 2021 (reverting back to 5.00 to 1.00 for each fiscal quarter thereafter). In addition, the First Amendment provides that the 0.5 increase in maximum funded debt to EBITDA ratio applicable to certain future acquisitions (for the six consecutive month period in which any such acquisition occurs) is only available beginning with the fiscal quarter ending September 30, 2021, and in any case shall not increase the maximum funded debt to EBITDA ratio above 5.50 to 1.00.

The First Amendment also provides that, from the Amendment Effective Date until the last day of the fiscal quarter ending December 31, 2021 (the “Covenant Relief Period”), the availability requirement in order to make restricted payments from capital contributions and from available cash are each increased from $100 million to $250 million and the availability requirement in order to make prepayments of the Partnership’s senior notes, any subordinated indebtedness or any other indebtedness for borrowed money is increased from $100 million to $250 million. In addition, during the Covenant Relief Period, the applicable margin for Eurodollar borrowings is increased from a range of 2.00%-2.75% to a range of 2.25%- 3.00%. The First Amendment further provides that the Partnership becomes guarantor of the obligations of all other guarantors under the Credit Agreement.

As of the close of business on the Amendment Effective Date, the Loan Parties (as defined in the Credit Agreement) had approximately $435.0 million of outstanding borrowings and no outstanding letters of credit under the Credit Agreement. The Credit Agreement will mature in April 2023. Amounts borrowed and repaid under the Credit Agreement may be re-borrowed.

In connection with entering into the First Amendment, the Partnership paid certain amendment fees to certain lenders party thereto and paid a certain arrangement fee to the arranger of the First Amendment.

The disclosure contained in this Item 2.03 does not purport to be a complete description of the First Amendment and is qualified in its entirety by reference to the First Amendment, which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USA COMPRESSION PARTNERS, LP

|

|

|

|

|

|

|

|

|

|

By:

|

USA Compression GP, LLC,

|

|

|

|

|

its General Partner

|

|

|

|

|

|

|

Date:

|

August 3, 2020

|

By:

|

/s/ Christopher W. Porter

|

|

|

|

|

Christopher W. Porter

|

|

|

|

|

Vice President, General Counsel and Secretary

|

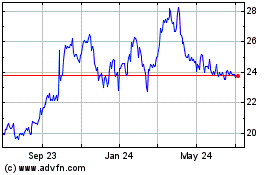

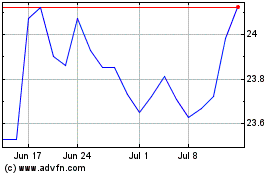

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Apr 2023 to Apr 2024