Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

June 18 2024 - 1:01PM

Edgar (US Regulatory)

FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 6/18/2024

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

26, Boulevard Royal, 4th floor

L-2449 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-Fa Form 40-F __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes __ Noa

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s press release announcing that Brazilian Court Orders Ternium to Pay an Indemnification in Connection with its Acquisition of a Participation in Usiminas in 2012.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

By: /s/ Guillermo Etchepareborda By: /s/ Sebastián Martí

Name: Guillermo Etchepareborda Name: Sebastián Martí

Title: Attorney in Fact Title: Attorney in Fact

Dated: June 18, 2024

Sebastián Martí

Ternium - Investor Relations

+1 (866) 890 0443

+54 (11) 4018 8389

www.ternium.com

Brazilian Court Orders Ternium to Pay an Indemnification in Connection with its Acquisition of a Participation in Usiminas in 2012

Luxembourg, June 18, 2024 – Ternium S.A. (NYSE: TX) announced today that the Brazilian Superior Court of Justice (SCJ) resolved that Ternium’s subsidiaries Ternium Investments and Ternium Argentina, and Tenaris’s subsidiary Confab, all of which compose the T/T Group under the Usiminas shareholders agreement, should pay Companhia Siderúrgica Nacional, or CSN, an indemnification in connection with the acquisition by the T/T Group of a participation in Usiminas in January 2012.

CSN and various entities affiliated with CSN had filed a lawsuit in Brazil against the T/T Group, alleging that, under applicable Brazilian laws and rules, the acquirers were required to launch a tag-along tender offer to all non-controlling holders of Usiminas ordinary shares for a price per share equal to 80% of the price per share paid in such acquisition.

On September 23, 2013, the first instance court dismissed the CSN lawsuit, and on February 8, 2017, the court of appeals upheld the first instance court decision. On March 7, 2023, the SCJ rejected CSN’s appeal by majority vote. The composition of the SCJ panel in charge of the case subsequently changed and CSN made several submissions in connection with the SCJ decision, including a motion for clarification with the SCJ that challenged the merits of its earlier decision.

At today’s session, the SCJ completed its voting on CSN’s motion for clarification and reversed, by majority vote, its March 7, 2023 decision and granted CSN an indemnification, with CSN being allowed to retain ownership of the Usiminas ordinary shares it currently owns. Depending on how the indemnification is calculated by other courts, and assuming monetary adjustment and interest through May 31, 2024, the potential aggregate indemnification payable by Ternium Investments and Ternium Argentina could reach up to BRL3.2 billion (approximately $0.6 billion) and BRL1.1 billion (approximately $0.2 billion), respectively.

The Company continues to believe that all of CSN's claims and allegations are groundless and without merit, as confirmed by several opinions of Brazilian legal counsel, two decisions issued by the Brazilian securities regulator in February 2012 and December 2016, the first and second instance court decisions and the March 7, 2023 SCJ decision referred to above. The Company also believes that today’s SCJ decision on CSN’s motion for clarification is contrary to applicable substantive and procedural law. Accordingly, once the SCJ written votes are made available, Ternium Investments and Ternium Argentina will file all available motions and appeals against the SCJ decision.

Forward Looking Statements

Some of the statements contained in this press release are “forward-looking statements”. Forward-looking statements are based on management’s current views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements. These risks include but are not limited to risks arising from uncertainties as to

gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase steel products and other factors beyond Ternium’s control.

About Ternium

Ternium is a leading steel producer in the Americas, providing advanced steel products to a wide range of manufacturing industries and the construction sector. We invest in low carbon emissions steelmaking technologies to support the energy transition and the mobility of the future. We also support the development of our communities, especially through educational programs in Latin America. More information about Ternium is available at www.ternium.com.

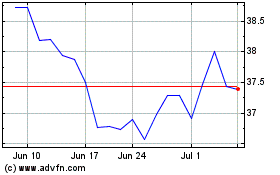

Ternium (NYSE:TX)

Historical Stock Chart

From Nov 2024 to Dec 2024

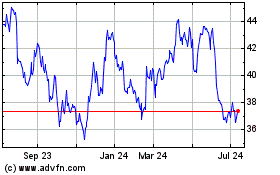

Ternium (NYSE:TX)

Historical Stock Chart

From Dec 2023 to Dec 2024