Purchased $77.4 million of mortgage indebtedness across seven

Sonida communities for $40.2 million, representing a 48%

discount

Company to invest in high-returning capital projects within the

existing portfolio

$25 million of equity capital will be available for potential

acquisitions and working capital

Sonida Senior Living, Inc. (“Sonida” or the “Company”) (NYSE:

SNDA), a leading owner-operator of communities and services for

seniors, announced the execution of a $47.75 million equity private

placement, including an investment from Conversant Capital, the

Company’s largest shareholder. The Company plans to use this new

capital for the completion of its balance sheet repositioning,

continued investments in value-enhancing community improvements,

broader community programming and identified bolt-on acquisition

opportunities from its robust pipeline.

The shares were issued at $9.50 per share, a 5% premium to the

30-day volume weighted average price prior to closing. The equity

private placement will close in two tranches. The first tranche of

$32 million closed on February 1, 2024, and the second tranche of

$16 million will close on or around March 31, 2024, subject to

shareholder approval of an increase to the Company’s authorized

shares of common stock. The holders of a majority of the Company’s

voting securities have agreed to vote in favor of such an

increase.

“In an economic environment characterized by limited capital and

available financing for senior living assets, we believe this

transaction reflects our investors’ confidence in Sonida as a

premium long-term investment and operating platform with

significant upside potential. We could not be more pleased with the

ongoing partnership between the Sonida team and our investor base

and look forward to completing accretive investments in the near

term,” said Brandon Ribar, President and Chief Executive

Officer.

“Since Conversant made its original investment in Sonida in

November 2021, we’ve been working diligently with the management

team along three key initiatives – improving operations,

strengthening the balance sheet and growing the business. Today’s

transaction allows us to shift the Company’s focus towards the

third initiative: accelerating the growth of the business,” said

Michael Simanovsky, Founder and Managing Partner of Conversant

Capital. “As counter-cyclical investors, we are very excited about

the Company’s increasingly active pipeline of acquisitions and look

forward to partnering with banks and other asset owners as we

continue to grow Sonida’s operating platform.”

Sonida has used a portion of the proceeds to purchase all seven

of the remaining loans held by Protective Life, which was completed

on February 2, 2024. The $40.2 million purchase price represents

52% of the outstanding Protective Life indebtedness of $77.4

million. The debt purchase has been financed with $24.8 million of

mortgage debt provided by Ally Bank, currently Sonida’s

second-largest lending partner, through an expansion of the

Company’s existing Ally Bank term loan. This transaction

significantly strengthens the Company’s balance sheet, reducing

total indebtedness by $52.6 million, or 9%, and annual debt service

costs by approximately $3.2 million. After completing these

transactions, the Company’s indebtedness was $580.7 million as of

February 2, 2024. The Company’s debt has a weighted-average

remaining term of 3.7 years, with only $31.8 million maturing prior

to December 2026. Finally, 92% of the Company’s outstanding debt is

interest only through 2026.

“This capital infusion, coupled with the steady, foundational

margin improvements achieved over the past 12 months, allows the

Company to further focus on revenue-driving and margin-enhancing

efforts and laying the groundwork for operational scalability as we

look to grow the portfolio,” said Kevin Detz, Chief Financial

Officer.

Specific planned capital expenditure projects include high-value

conversions of existing apartments to Magnolia TrailsTM memory care

units and the opening of additional wings within highly occupied

communities. The Company has also budgeted to accelerate the

deployment of recently introduced technology that has improved

operating efficiencies, quality of care and resident

experience.

After considering the equity capital for the Protective Life

debt purchase and the planned capital expenditure projects

described above, the Company will have approximately $25 million of

equity capital available for acquisitions and working capital

purposes, including near-term opportunities in the Company’s

pipeline.

The Company is engaged in advanced discussions with a private

equity sponsor to acquire a majority interest in a four-asset

portfolio, with three of the assets reinforcing Sonida’s Texas

footprint. The Company believes such an acquisition would result in

a double-digit stabilized cap rate with minimal incremental general

and administrative expenses required to manage the communities.

This acquisition opportunity remains subject to confirmatory due

diligence and final documentation. Sonida is actively pursuing

additional accretive growth opportunities varying in size,

geography and structure. The capital earmarked for growth is

expected to provide certainty and speed in executing on near-term,

bolt-on investment opportunities as they arise.

Safe Harbor

The forward-looking statements in this Current Report on Form

8-K, including, but not limited to, statements relating to the

timing and completion of the second closing of the private

placement and potential acquisition opportunities, are subject to

certain risks and uncertainties that could cause the Company’s

actual results and financial condition to differ materially,

including, but not limited to, the Company’s ability to obtain

stockholder approval of an increase in the number of authorized

shares of common stock; the satisfaction of all conditions to the

second closing of the private placement; other risks related to the

consummation of the private placement, including the risk that the

second closing of the private placement will not be consummated

within the expected time period or at all; the costs related to the

private placement; the impact of the private placement on the

Company’s business; any legal proceedings that may be brought

related to the private placement; and the other risks and factors

identified from time to time in the Company’s reports filed with

the Securities and Exchange Commission, including the impact of

COVID-19, including the actions taken to prevent or contain the

spread of COVID-19, the transmission of its highly contagious

variants and sub-lineages and the development and availability of

vaccinations and other related treatments, or another epidemic,

pandemic or other health crisis; the Company’s ability to generate

sufficient cash flows from operations, additional proceeds from

debt financings or refinancings, and proceeds from the sale of

assets to satisfy its short- and long-term debt obligations and to

make capital improvements to the Company’s communities; increases

in market interest rates that increase the cost of certain of the

Company’s debt obligations; increased competition for, or a

shortage of, skilled workers, including due to the COVID-19

pandemic or general labor market conditions, along with wage

pressures resulting from such increased competition, low

unemployment levels, use of contract labor, minimum wage increases

and/or changes in overtime laws; the Company’s ability to obtain

additional capital on terms acceptable to it; the Company’s ability

to extend or refinance its existing debt as such debt matures,

including the Company’s ability to complete the modifications to

its loan agreements; the Company’s compliance with its debt

agreements, including certain financial covenants and the risk of

cross-default in the event such non-compliance occurs; the

Company’s ability to complete acquisitions and dispositions upon

favorable terms or at all; the risk of oversupply and increased

competition in the markets which the Company operates; the

Company’s ability to improve and maintain controls over financial

reporting and remediate the identified material weakness discussed

in its recent Quarterly and Annual Reports filed with the SEC; the

departure of the Company’s key officers and personnel; the cost and

difficulty of complying with applicable licensure, legislative

oversight, or regulatory changes; risks associated with current

global economic conditions and general economic factors such as

inflation, the consumer price index, commodity costs, fuel and

other energy costs, competition in the labor market, costs of

salaries, wages, benefits, and insurance, interest rates, and tax

rates; and changes in accounting principles and

interpretations.

About Sonida

Dallas-based Sonida Senior Living, Inc. is a leading

owner-operator of independent living, assisted living and memory

care communities and services for senior adults. The Company

provides compassionate, resident-centric services and care as well

as engaging programming operating 71 senior housing communities in

18 states with an aggregate capacity of approximately 8,000

residents, including 61 communities which the Company owns and 10

communities that the Company manages on behalf of third parties.

For more information, visit www.sonidaseniorliving.com or connect

with the Company on Facebook, Twitter or LinkedIn.

About Conversant Capital

Conversant Capital LLC is a private investment firm founded in

2020. The firm pursues credit and equity investments in the real

estate, digital infrastructure and hospitality sectors in both the

public and private markets. Further information is available at

www.conversantcap.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206459854/en/

Sonida Investor and Media Contact: Kevin Detz

kdetz@sonidaliving.com

Conversant Media Contact: Prosek Partners Josh Clarkson / Devin

Shorey jclarkson@prosek.com / dshorey@prosek.com

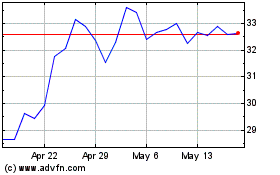

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Jan 2024 to Jan 2025