- Q4 FY24 revenues of $1.74 billion, 7.7% organic growth(1);

FY24 revenues of $7.44 billion, 7.4% organic growth(1); organic

growth reflects impacts of divestitures and additional five working

days in the prior year

- Q4 FY24 net income of $39 million, adjusted EBITDA(1) of

$127 million or 7.3% of revenue; FY24 net income of $477 million,

adjusted EBITDA(1) of $668 million or 9.0% of revenue; impacted by

higher incentive-based compensation

- Q4 FY24 diluted earnings per share of $0.74, adjusted

diluted earnings per share(1) of $1.43; FY24 diluted earnings per

share of $8.88, adjusted diluted earnings per share(1) of

$7.88

- Q4 FY24 cash flows provided by operating activities of $63

million, transaction-adjusted free cash flow(1) of $119 million;

FY24 cash flows provided by operating activities of $396 million,

transaction-adjusted free cash flow(1) of $486 million

- Updated FY25 guidance reflects higher revenue and free cash

flow(1)

Science Applications International Corporation (Nasdaq: SAIC), a

premier Fortune 500® technology integrator driving our nation's

digital transformation across the defense, space, civilian, and

intelligence markets, today announced results for the fourth

quarter and full fiscal year ended February 2, 2024.

“We delivered strong financial results in the quarter with

revenue, earnings per share and free cash flow ahead of

expectations,” said Toni Townes-Whitley, SAIC Chief Executive

Officer. “As we embark on the next phase of our corporate strategy

to become the premier mission integrator in our market, I am

confident that the investments we are making in Fiscal Year 2025

will accelerate our ability to drive value for all our

stakeholders. I want to thank all of our employees for a strong

Fiscal Year 2024, their enthusiasm towards embracing our vision,

and their focus on execution of our strategy.”

Fourth Quarter and Full Fiscal Year

2024: Summary Operating Results

Three Months Ended

Year Ended

February 2, 2024

Percent change

February 3, 2023

February 2, 2024

Percent change

February 3, 2023

(in millions, except per share

amounts)

Revenues

$

1,737

(12

)%

$

1,968

$

7,444

(3

)%

$

7,704

Operating income

79

(33

)%

118

741

48

%

501

Operating income as a percentage of

revenues

4.5

%

-150bps

6.0

%

10.0

%

350bps

6.5

%

Adjusted operating income(1)

89

(32

)%

131

519

(1

)%

526

Adjusted operating income as a percentage

of revenues

5.1

%

-160bps

6.7

%

7.0

%

20bps

6.8

%

Net income attributable to common

stockholders

39

(47

)%

74

477

59

%

300

EBITDA(1)

118

(26

)%

160

891

35

%

658

EBITDA as a percentage of revenues

6.8

%

-130bps

8.1

%

12.0

%

350bps

8.5

%

Adjusted EBITDA(1)

127

(26

)%

171

668

(2

)%

680

Adjusted EBITDA as a percentage of

revenues

7.3

%

-140bps

8.7

%

9.0

%

20bps

8.8

%

Diluted earnings per share

$

0.74

(45

)%

$

1.34

$

8.88

65

%

$

5.38

Adjusted diluted earnings per share(1)

$

1.43

(30

)%

$

2.04

$

7.88

4

%

$

7.55

Net cash provided by operating

activities

$

63

(57

)%

$

145

$

396

(26

)%

$

532

Free cash flow(1)

$

97

(34

)%

$

148

$

414

(9

)%

$

457

Transaction-adjusted free cash flow(1)

$

119

(20

)%

$

148

$

486

6

%

$

457

(1)Non-GAAP measure, see Schedule 5 for

information about this measure

The Company utilizes a 52/53 week fiscal year ending on the

Friday closest to January 31, with fiscal quarters typically

consisting of 13 weeks. Fiscal year 2024 consisted of 52 weeks,

while fiscal year 2023 consisted of 53 weeks with the extra week

occurring in the fourth quarter.

Fourth Quarter Summary

Results

Revenues for the quarter decreased $231 million compared to the

prior year quarter primarily due to the sale of the logistics and

supply chain management business (Supply Chain Business) ($183

million), the deconsolidation of the Forfeiture Support Associates

J.V. (FSA) ($37 million), five additional working days in the prior

year period, contract completions, and a reserve on a customer

receivable related to a program completed prior to FY2022,

partially offset by ramp up on new and existing contracts.

Adjusting for the impact of the divestiture, deconsolidation and

estimated impact of the additional five working days in the prior

year period, revenues increased by approximately 7.7%.

Operating income as a percentage of revenues decreased to 4.5%

for the quarter as compared to 6.0% in the comparable prior year

period primarily due to the sale of the Supply Chain Business,

deconsolidation of FSA, higher incentive-based compensation

expense, including acceleration of stock-based compensation related

to the reorganization and executive transition, and a reserve on a

customer receivable related to a program completed prior to

FY2022.

Adjusted EBITDA(1) as a percentage of revenues for the quarter

was 7.3%, compared to 8.7% for the prior year quarter primarily due

to the sale of the Supply Chain Business, deconsolidation of FSA,

higher incentive-based compensation expense, including acceleration

of stock-based compensation related to the reorganization and

executive transition, and a reserve on a customer receivable

related to a program completed prior to FY2022.

Diluted earnings per share for the quarter was $0.74 compared to

$1.34 in the prior year quarter. Adjusted diluted earnings per

share(1) was $1.43 for the quarter compared to $2.04 in the prior

year quarter. The weighted-average diluted shares outstanding

during the quarter decreased to 52.7 million shares from 55.3

million during the prior year quarter.

Fiscal Year 2024 Summary

Results

Revenues for the fiscal year decreased $260 million compared to

the prior year primarily due to the sale of the Supply Chain

Business ($493 million) and the deconsolidation of FSA ($143

million), contract completions, and five additional working days in

the prior year period. This was partially offset by ramp up in

volume on existing and new contracts. Adjusting for the impact of

the divestiture, deconsolidation and estimated impact of the

additional five working days in the prior year period, revenues

grew approximately 7.4%.

Operating income as a percentage of revenues for the fiscal year

was 10.0%, an increase from 6.5% of revenues in the prior fiscal

year. The increase was primarily due to the sale of the Supply

Chain business ($233 million), deconsolidation of FSA ($7 million),

improved profitability across our contract portfolio and lower

acquisition and integration costs, partially offset by higher

incentive-based compensation expense, including acceleration of

stock-based compensation related to the reorganization and

executive transition.

Adjusted EBITDA(1) as a percentage of revenues for the fiscal

year increased to 9.0%, compared to 8.8% in the prior fiscal year.

The increase was driven by improved profitability across our

contract portfolio, partially offset by higher incentive-based

compensation expense, including acceleration of stock-based

compensation related to the reorganization and executive

transition.

Diluted earnings per share for the year was $8.88 compared to

$5.38 in the prior year. Adjusted diluted earnings per share(1) was

$7.88 for the year compared to $7.55 in the prior year. The

weighted-average diluted shares outstanding during the year

decreased to 53.7 million shares from 55.8 million shares during

the prior year.

Cash Generation and Capital

Deployment

Total cash flows provided by operating activities for the fourth

quarter were $63 million, a decrease of $82 million compared to the

prior year quarter, primarily due to lower cash provided by the

Master Accounts Receivable Purchase Agreement (MARPA) Facility with

MUFG Bank, LTD and other changes in working capital.

Total cash flows provided by operating activities for the year

were $396 million, a decrease of $136 million from the prior year,

primarily due to lower cash provided by the Master Accounts

Receivable Purchase Agreement (MARPA) Facility with MUFG Bank, LTD

and higher tax payments in the current year, partially offset by

lower incentive-based compensation payments in the current year and

other changes in working capital.

During the quarter, SAIC deployed $116 million of capital,

consisting of $86 million of share repurchases in accordance with

established repurchase plans, $19 million in cash dividends to

shareholders, and $11 million of capital expenditures. For the

year, SAIC deployed $463 million of capital, consisting of share

repurchases of $357 million (approximately 3.3 million shares) in

accordance with established repurchase plans, cash dividends of $79

million to shareholders, and $27 million of capital

expenditures.

(1)Non-GAAP measure, see Schedule 5 for information about this

measure

Quarterly Dividend

Declared

As previously announced, subsequent to fiscal year-end, the

Company’s Board of Directors ("Board of Directors") declared a cash

dividend of $0.37 per share of the Company’s common stock payable

on April 26, 2024 to stockholders of record on April 12, 2024. SAIC

intends to continue paying dividends on a quarterly basis, although

the declaration of any future dividends will be determined by the

Board of Directors each quarter and will depend on earnings,

financial condition, capital requirements and other factors.

Backlog and Contract

Awards

Net bookings for the quarter were approximately $1.4 billion,

which reflects a book-to-bill ratio of approximately 0.8. Net

bookings for the year were approximately $6.7 billion, which

reflects a book-to-bill ratio of approximately 0.9.

SAIC’s estimated backlog at the end of fiscal year 2024 was

approximately $22.8 billion of which $3.5 billion was funded.

SAIC was awarded the following contracts during the quarter:

Notable New Awards:

U.S. Navy Torpedo Test Sets: During the quarter, SAIC was

awarded a five-year, $80 million contract by the U.S. Navy for the

completion of the MK710 TSTS design and then to produce and deliver

MK 710 Torpedo System Test Sets (TSTS) to enhance the Navy’s

capability to provide the Submarine force with high quality, tested

and validated MK 48 heavyweight torpedoes. Under the contract, SAIC

will provide MK 710 TSTS which will be used to test and validate

the integrity and operational status of warshot MK 48 heavyweight

torpedoes prior to delivery to the Navy. The testing and validation

of exercise torpedoes supports the training, tactics development

and certification of torpedo upgrades for Navy.

U.S. Navy Hypersonics Advanced Concepts and Strategic

Missions Programs: During the quarter, SAIC was awarded a

five-year, $63 million contract from the U.S. Navy to support

hypersonics advanced concepts and strategic mission solutions for

the Navy’s Strategic Systems Programs (SSP) and the Naval Surface

Warfare Center (NSWC) Crane, Ind., Strategic Systems Hardware

Division (GXW). Under the new contract, SAIC will enhance

hypersonics advanced concepts and strategic missions focused on

next-generation systems, subsystems, components, features and

technologies to include Hardware-in-the-Loop (HWIL) and

Software-in-the-Loop (SWIL) simulations, manufacturing techniques

and other strategic mission areas.

Notable Recompete Awards:

U.S. Army Reserve Command (USARC): During the quarter,

SAIC was awarded a five-year (one year base, plus four, one-year

option periods), $141 million contract to provide system support to

the USARC through their United States Army Reserve Command

Information Technology Support Services (USARC ITSS II) contract.

Under this contract, SAIC will support USARC’s mission by

consolidating enterprise IT services at a global scale through

standardized, responsive and cost-effective solutions. The USARC

ITSS II program will be managed out of Fort Liberty, North

Carolina, and provide a wide range of IT services for more than

65,000 users across over 700 locations, primarily in the U.S. with

additional sites in Asia, Europe, Pacific region and Puerto Rico.

This effort will focus on delivering mission value and enhanced

user experience, while improving cybersecurity, network

availability and reliability for USARC and its customers.

U.S. Space and Intelligence Community: During the

quarter, SAIC was awarded approximately $315 million of contract

awards by space and intelligence community organizations. These

awards represent a combination of new business and recompetes.

Notable Awards Subsequent to Period End (not included in current

quarter bookings):

U.S. Space Force: Subsequent to the end of the quarter,

SAIC was awarded a five-year (one year base, plus four, one-year

option periods), $444 million contract to support Digital

Transformation, Acquisition, Modernization and Modification (DTAMM)

for the U.S. Space Force's Space Systems Command and Space Launch

Deltas (SLDs) 30 and 45. SAIC will support the modernization of the

space launch range instrumentation. The efforts will support an

accelerated national launch cadence across the Eastern Range (ER)

and Western Range (WR) including Cape Canaveral Space Force Station

and Patrick Space Force Base in Fla. and Vandenberg Space Force

Base in Calif. Experts from SAIC and partners will collaborate to

modernize antiquated instrumentation and processes to enable a

faster and more integrated launch environment. SAIC remains at the

forefront of national priorities to explore, secure and influence

space by leveraging industry expertise and legacy in this domain.

In addition to DTAMM, SAIC's work facilitates future unmanned

spacecraft, earth science data-collecting satellites, space-ground

systems for military joint all-domain command and control and

more.

Other Notable News

SAIC Announces to Realign Organization to Optimize Strategic

Pivots and Increase Organic Growth: During the quarter, SAIC

announced a business reorganization that replaces its current two

operating sectors with five customer facing business groups

supported by the enterprise organizations, including the Innovation

Factory. The reorganization is effective February 3, 2024 and is

designed to enhance management's involvement with customers and

advance SAIC’s innovation and go-to-market strategy.

SAIC’s ReadyOne™ software named Big Idea at the 2024 BIG

Innovation Awards: The Business Intelligence Group named SAIC’s

ReadyOne™ software a winning product at the of the 2024 BIG

Innovation Awards. This annual business awards program recognizes

organizations, products, and people that are bringing new ideas to

life in innovative ways. ReadyOne™ is SAIC’s platform to rapidly

install and configure readily usable digital engineering ecosystems

for engineering teams and stakeholders.

Fiscal Year 2025

Guidance

The Company's outlook for fiscal year 2025 is being provided.

The table below summarizes fiscal year 2025 guidance and represents

our views as of March 18, 2024.

PRIOR

CURRENT

Fiscal Year

Fiscal Year

2025 Guidance

2025 Guidance

Revenue

$7.25B - $7.40B

$7.35B - $7.50B

Adjusted EBITDA(1)

-

$680M - $700M

Adjusted EBITDA Margin %(1)

9.4% - 9.6%

9.2% - 9.4%

Adjusted Diluted EPS(1)

$8.00 - $8.20

$8.00 - $8.20

Free Cash Flow(1)

$480M - $500M

$490M - $510M

(1)Non-GAAP measure, see Schedule 5 for

information about this measure

Webcast Information

SAIC management will discuss operations and financial results in

an earnings conference call beginning at 10 a.m. Eastern time on

March 18, 2024. The conference call will be webcast simultaneously

to the public through a link on the Investor Relations section of

the SAIC website (http://investors.saic.com). We will be providing

webcast access only – “dial-in” access is no longer available.

Additionally, a supplemental presentation will be available to the

public through links to the Investor Relations section of the SAIC

website. After the call concludes, an on-demand audio replay of the

webcast can be accessed on the Investor Relations website.

About SAIC

SAIC® is a premier Fortune 500® technology integrator focused on

advancing the power of technology and innovation to serve and

protect our world. Our robust portfolio of offerings across the

defense, space, civilian and intelligence markets includes secure

high-end solutions in mission IT, enterprise IT, engineering

services and professional services. We integrate emerging

technology, rapidly and securely, into mission critical operations

that modernize and enable critical national imperatives.

We are approximately 24,000 strong; driven by mission, united by

purpose, and inspired by opportunities. SAIC is an Equal

Opportunity Employer, fostering a culture of diversity, equity and

inclusion, which is core to our values and important to attract and

retain exceptional talent. Headquartered in Reston, Virginia, SAIC

has annual revenues of approximately $7.4 billion. For more

information, visit saic.com. For ongoing news, please visit our

newsroom.

GAAP to Non-GAAP Guidance

Reconciliation

The Company does not provide a reconciliation of forward-looking

adjusted diluted EPS to GAAP diluted EPS or adjusted EBITDA margin

to GAAP net income due to the inherent difficulty in forecasting

and quantifying certain amounts that are necessary for such

reconciliation. Because certain deductions for non-GAAP exclusions

used to calculate net income may vary significantly based on actual

events, the Company is not able to forecast GAAP diluted EPS or

GAAP net income with reasonable certainty. The variability of the

above charges may have an unpredictable and potentially significant

impact on our future GAAP financial results.

Forward-Looking

Statements

Certain statements in this release contain or are based on

“forward-looking” information within the meaning of the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by words such as “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“guidance,” and similar words or phrases. Forward-looking

statements in this release may include, among others, estimates of

future revenues, operating income, earnings, earnings per share,

charges, total contract value, backlog, outstanding shares and cash

flows, as well as statements about future dividends, share

repurchases and other capital deployment plans. Such statements are

not guarantees of future performance and involve risk,

uncertainties and assumptions, and actual results may differ

materially from the guidance and other forward-looking statements

made in this release as a result of various factors. Risks,

uncertainties and assumptions that could cause or contribute to

these material differences include those discussed in the “Risk

Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and “Legal Proceedings”

sections of our Annual Report on Form 10-K, as updated in any

subsequent Quarterly Reports on Form 10-Q and other filings with

the SEC, which may be viewed or obtained through the Investor

Relations section of our website at www.saic.com or on the SEC’s

website at www.sec.gov. Due to such risks, uncertainties and

assumptions you are cautioned not to place undue reliance on such

forward-looking statements, which speak only as of the date hereof.

SAIC expressly disclaims any duty to update any forward-looking

statement provided in this release to reflect subsequent events,

actual results or changes in SAIC’s expectations. SAIC also

disclaims any duty to comment upon or correct information that may

be contained in reports published by investment analysts or

others.

Schedule 1:

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

CONDENSED AND CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

Three Months Ended

Year Ended

February 2, 2024

February 3, 2023

February 2, 2024

February 3, 2023

(in millions, except per share

amounts)

Revenues

$

1,737

$

1,968

$

7,444

$

7,704

Cost of revenues

1,545

1,746

6,572

6,816

Selling, general and administrative

expenses

114

102

373

374

Acquisition and integration costs

—

2

1

13

Gain on divestitures, net of transaction

costs

—

—

(240

)

—

Other operating income

(1

)

—

(3

)

—

Operating income

79

118

741

501

Interest expense, net

32

32

120

118

Other (income) expense, net

(1

)

1

1

8

Income before income taxes

48

85

620

375

Provision for income taxes

(9

)

(10

)

(143

)

(72

)

Net income

$

39

$

75

$

477

$

303

Net income attributable to non-controlling

interest

—

1

—

3

Net income attributable to common

stockholders

$

39

$

74

$

477

$

300

Weighted-average number of shares

outstanding:

Basic

52.0

54.6

53.1

55.3

Diluted

52.7

55.3

53.7

55.8

Earnings per share:

Basic

$

0.75

$

1.36

$

8.98

$

5.42

Diluted

$

0.74

$

1.34

$

8.88

$

5.38

Schedule 2:

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

CONDENSED AND CONSOLIDATED

BALANCE SHEETS

(Unaudited)

February 2, 2024

February 3, 2023

(in millions)

ASSETS

Current assets:

Cash and cash equivalents

$

94

$

109

Receivables, net

914

936

Inventory, prepaid expenses and other

current assets

123

152

Total current assets

1,131

1,197

Goodwill

2,851

2,911

Intangible assets, net

894

1,009

Property, plant, and equipment, net

91

92

Operating lease right of use assets

152

158

Deferred income taxes

—

14

Other assets

195

162

Total assets

$

5,314

$

5,543

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable and accrued

liabilities

$

711

$

767

Accrued payroll and employee benefits

370

328

Long-term debt, current portion

77

31

Total current liabilities

1,158

1,126

Long-term debt, net of current portion

2,022

2,343

Operating lease liabilities

147

152

Deferred income taxes

28

—

Other long-term liabilities

174

218

Equity:

Total common stockholders' equity

1,785

1,694

Non-controlling interest

—

10

Total stockholders' equity

1,785

1,704

Total liabilities and stockholders'

equity

$

5,314

$

5,543

Schedule 3:

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

CONDENSED AND CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended

Year Ended

February 2, 2024

February 3, 2023

February 2, 2024

February 3, 2023

(in millions)

Cash flows from operating activities:

Net income

$

39

$

75

$

477

$

303

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

36

39

142

157

Amortization of off-market customer

contracts

—

(2

)

(5

)

(14

)

Amortization of debt issuance costs

3

1

7

9

Deferred income taxes

16

12

(17

)

(17

)

Stock-based compensation expense

26

13

68

48

Gain on divestitures

—

—

(247

)

—

Impairment of assets

—

4

—

4

Other

(5

)

—

(8

)

—

Increase (decrease) resulting from changes

in operating assets and liabilities, net of the effect of the

acquisitions and divestitures:

Receivables

96

123

(46

)

79

Inventory, prepaid expenses, and other

current assets

(56

)

(17

)

(43

)

(10

)

Other assets

(19

)

1

(14

)

6

Accounts payable and accrued

liabilities

(128

)

(47

)

13

(9

)

Accrued payroll and employee benefits

53

(68

)

49

(36

)

Operating lease assets and liabilities,

net

(1

)

(2

)

(4

)

(3

)

Other long-term liabilities

3

13

24

15

Net cash provided by operating

activities

63

145

396

532

Cash flows from investing activities:

Expenditures for property, plant, and

equipment

(11

)

(7

)

(27

)

(25

)

Purchases of marketable securities

(2

)

(2

)

(8

)

(7

)

Sales of marketable securities

1

1

6

4

Proceeds from divestitures

—

—

356

—

Cash divested upon deconsolidation of

joint venture

—

—

(8

)

—

Other

2

(5

)

(5

)

(8

)

Net cash (used in) provided by investing

activities

(10

)

(13

)

314

(36

)

Cash flows from financing activities:

Dividend payments to stockholders

(19

)

(20

)

(79

)

(83

)

Principal payments on borrowings

(166

)

(210

)

(441

)

(990

)

Issuances of stock

4

4

17

16

Stock repurchased and retired or withheld

for taxes on equity awards

(89

)

(59

)

(382

)

(267

)

Proceeds from borrowings

—

210

160

840

Debt issuance costs

—

—

—

(6

)

Distributions to non-controlling

interest

—

(1

)

—

(3

)

Net cash used in financing activities

(270

)

(76

)

(725

)

(493

)

Net (decrease) increase in cash, cash

equivalents and restricted cash

(217

)

56

(15

)

3

Cash, cash equivalents and restricted cash

at beginning of period

320

62

118

115

Cash, cash equivalents and restricted cash

at end of period

$

103

$

118

$

103

$

118

Schedule 4:

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

BACKLOG

(Unaudited)

The estimated value of our total backlog

as of the dates presented was:

February 2, 2024

November 3, 2023

February 3, 2023

(in millions)

Funded backlog

$

3,539

$

4,036

$

3,554

Negotiated unfunded backlog

19,224

19,102

20,248

Total backlog

$

22,763

$

23,138

$

23,802

Backlog represents the estimated amount of future revenues to be

recognized under negotiated contracts and task orders as work is

performed and excludes contract awards which have been protested by

competitors until the protest is resolved in our favor. SAIC

segregates backlog into two categories, funded backlog and

negotiated unfunded backlog. Funded backlog for contracts with

government agencies primarily represents contracts for which

funding is appropriated less revenues previously recognized on

these contracts, and does not include the unfunded portion of

contracts where funding is incrementally appropriated or authorized

by the U.S. government and other customers even though the contract

may call for performance over a number of years. Funded backlog for

contracts with non-government agencies represents the estimated

value of contracts which may cover multiple future years under

which SAIC is obligated to perform, less revenues previously

recognized on these contracts. Negotiated unfunded backlog

represents the estimated future revenues to be earned from

negotiated contracts for which funding has not been appropriated or

authorized, and unexercised priced contract options. Negotiated

unfunded backlog does not include any estimate of future potential

task orders expected to be awarded under indefinite delivery,

indefinite quantity ("IDIQ"), U.S. General Services Administration

("GSA") schedules or other master agreement contract vehicles, with

the exception of certain IDIQ contracts where task orders are not

competitively awarded and separately priced but instead are used as

a funding mechanism, and where there is a basis for estimating

future revenues and funding on future anticipated task orders.

Schedule 5:

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

NON-GAAP FINANCIAL

MEASURES

(Unaudited)

This schedule describes the non-GAAP financial measures included in

this earnings release. While we believe that these non-GAAP

financial measures may be useful in evaluating our financial

information, they should be considered as supplemental in nature

and not as a substitute for financial information prepared in

accordance with GAAP. Reconciliations, definitions, and how we

believe these measures are useful to management and investors are

provided below. Other companies may define similar measures

differently.

EBITDA, Adjusted

EBITDA and Adjusted Operating Income

Three Months Ended

Year Ended

February 2, 2024

February 3, 2023

February 2, 2024

February 3, 2023

(in millions)

Revenues

$

1,737

$

1,968

$

7,444

$

7,704

Net income

39

75

477

303

Interest expense, net and loss on sale of

receivables

34

36

129

126

Provision for income taxes

9

10

143

72

Depreciation and amortization

36

39

142

157

EBITDA(1)

$

118

$

160

$

891

$

658

EBITDA as a percentage of revenues

6.8

%

8.1

%

12.0

%

8.5

%

Acquisition and integration costs

—

2

1

13

Restructuring and impairment costs

15

17

23

24

Depreciation included in acquisition and

integration costs and restructuring and impairment costs

(1

)

(2

)

(1

)

(3

)

Recovery of acquisition and integration

costs and restructuring and impairment costs

(5

)

(6

)

(6

)

(12

)

Gain on divestitures, net of transaction

costs

—

—

(240

)

—

Adjusted EBITDA(1)

$

127

$

171

$

668

$

680

Adjusted EBITDA as a percentage of

revenues

7.3

%

8.7

%

9.0

%

8.8

%

Operating income

$

79

$

118

$

741

$

501

Operating income as a percentage of

revenues

4.5

%

6.0

%

10.0

%

6.5

%

Acquisition and integration costs

—

2

1

13

Restructuring and impairment costs

15

17

23

24

Recovery of acquisition and integration

costs and restructuring and impairment costs

(5

)

(6

)

(6

)

(12

)

Gain on divestitures, net of transaction

costs

—

—

(240

)

—

Adjusted operating income(1)

$

89

$

131

$

519

$

526

Adjusted operating income as a percentage

of revenues

5.1

%

6.7

%

7.0

%

6.8

%

EBITDA is a performance measure that is

calculated by taking net income and excluding interest and loss on

sale of receivables, provision for income taxes, and depreciation

and amortization. Adjusted EBITDA and adjusted operating income are

performance measures that exclude the impact of non-recurring

transactions that we do not consider to be indicative of our

ongoing operating performance. The acquisition and integration

costs relate to the Company's acquisitions. The gain on

divestitures includes gains associated with the deconsolidation of

FSA and the sale of the logistics and supply chain management

business, net of transaction costs. We believe that these

performance measures provide management and investors with useful

information in assessing trends in our ongoing operating

performance and may provide greater visibility in understanding the

long-term financial performance of the Company.

(1)Non-GAAP measure, see above for definition.

Schedule 5

(continued):

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

NON-GAAP FINANCIAL

MEASURES

(Unaudited)

Adjusted Diluted

Earnings Per Share

Three Months Ended February 2,

2024

As Reported

Acquisition and integration

costs

Restructuring and impairment

costs

Recovery of acquisition and

integration costs and restructuring and impairment costs

Amortization of intangible

assets

Gain on divestitures, net of

transaction costs

Non-GAAP results(1)

Income before income taxes

48

—

15

(5

)

29

—

87

Income tax expense

(9

)

—

(1

)

1

(5

)

2

(12

)

Net income attributable to common

stockholders

$

39

$

—

$

14

$

(4

)

$

24

$

2

$

75

Diluted EPS attributable to common

stockholders

$

0.74

$

—

$

0.27

$

(0.08

)

$

0.46

$

0.04

$

1.43

Three Months Ended February 3,

2023

As Reported

Acquisition and integration

costs

Restructuring and impairment

costs

Recovery of acquisition and

integration costs and restructuring and impairment costs

Amortization of intangible

assets

Non-GAAP results(1)

Income before income taxes

85

2

17

(6

)

31

129

Income tax expense

(10

)

—

(2

)

1

(4

)

(15

)

Net Income

75

2

15

(5

)

27

114

Less: Net income attributable to

non-controlling interest

1

—

—

—

—

1

Net income attributable to common

stockholders

$

74

$

2

$

15

$

(5

)

$

27

$

113

Diluted EPS attributable to common

stockholders

$

1.34

$

0.03

$

0.27

$

(0.09

)

$

0.49

$

2.04

Adjusted diluted earnings per share is a

performance measure that excludes the impact of non-recurring

transactions that we do not consider to be indicative of our

ongoing operating performance. The acquisition and integration

costs relate to the Company's acquisitions. The gain on

divestitures includes gain associated the sale of the logistics and

supply chain management business, net of transaction costs.

Adjusted diluted earnings per share also excludes amortization of

intangible assets because we do not have a history of significant

acquisition activity, we do not acquire businesses on a predictable

cycle, and the amount of an acquisition's purchase price allocated

to intangible assets and the related amortization term are unique

to each acquisition. We believe that this performance measure

provides management and investors with useful information in

assessing trends in our ongoing operating performance and may

provide greater visibility in understanding the long-term financial

performance of the Company.

(1)Non-GAAP measure, see above for definition.

Schedule 5

(continued):

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

NON-GAAP FINANCIAL

MEASURES

(Unaudited)

Adjusted Diluted

Earnings Per Share

Year Ended February 2,

2024

As Reported

Acquisition and integration

costs

Restructuring and impairment

costs

Recovery of acquisition and

integration costs and restructuring and impairment costs

Amortization of intangible

assets

Gain on divestitures, net of

transaction costs

Non-GAAP results(1)

Income before income taxes

620

1

23

(6

)

115

(240

)

513

Income tax expense

(143

)

—

(2

)

1

(21

)

75

(90

)

Net income attributable to common

stockholders

$

477

$

1

$

21

$

(5

)

$

94

$

(165

)

$

423

Diluted EPS attributable to common

stockholders

$

8.88

$

0.02

$

0.39

$

(0.09

)

$

1.75

$

(3.07

)

$

7.88

Year Ended February 3,

2023

As Reported

Acquisition and integration

costs

Restructuring and impairment

costs

Recovery of acquisition and

integration costs and restructuring and impairment costs

Amortization of intangible

assets

Non-GAAP results(1)

Income before income taxes

375

13

24

(12

)

125

525

Income tax expense

(72

)

(2

)

(5

)

2

(24

)

(101

)

Net Income

$

303

$

11

$

19

$

(10

)

$

101

$

424

Less: Net income attributable to

non-controlling interest

3

—

—

—

—

3

Net income attributable to common

stockholders

$

300

$

11

$

19

$

(10

)

$

101

$

421

Diluted EPS attributable to common

stockholders

$

5.38

$

0.20

$

0.34

$

(0.18

)

$

1.81

$

7.55

Adjusted diluted earnings per share is a

performance measure that excludes the impact of non-recurring

transactions that we do not consider to be indicative of our

ongoing operating performance. The acquisition and integration

costs relate to the Company's acquisitions. The gain on

divestitures includes gains associated with the deconsolidation of

FSA and the sale of the logistics and supply chain management

business, net of transaction costs. Adjusted diluted earnings per

share also excludes amortization of intangible assets because we do

not have a history of significant acquisition activity, we do not

acquire businesses on a predictable cycle, and the amount of an

acquisition's purchase price allocated to intangible assets and the

related amortization term are unique to each acquisition. We

believe that this performance measure provides management and

investors with useful information in assessing trends in our

ongoing operating performance and may provide greater visibility in

understanding the long-term financial performance of the

Company.

(1)Non-GAAP measure, see above for definition.

Schedule 5

(continued):

SCIENCE APPLICATIONS

INTERNATIONAL CORPORATION

NON-GAAP FINANCIAL

MEASURES

(Unaudited)

Free Cash

Flow

Three Months Ended

Year Ended

February 2, 2024

February 3, 2023

February 2, 2024

February 3, 2023

(in millions)

Net cash provided by operating

activities

$

63

$

145

$

396

$

532

Expenditures for property, plant, and

equipment

(11

)

(7

)

(27

)

(25

)

Cash used (provided) by MARPA Facility

45

10

45

(50

)

Free cash flow(1)

$

97

$

148

$

414

$

457

L&SCM divestiture transaction fees

—

—

7

—

L&SCM divestiture cash taxes

18

—

74

—

L&SCM divestiture transition

services

4

—

(9

)

—

Transaction-adjusted free cash

flow(1)

$

119

$

148

$

486

$

457

FY25 Guidance

(in millions)

Net cash provided by operating

activities

$520M to $540M

Expenditures for property, plant, and

equipment

Approximately $30M

Free cash flow(1)

$490M to $510M

Free cash flow is calculated by taking

cash flows provided by operating activities less expenditures for

property, plant, and equipment and less cash flows from our Master

Accounts Receivable Purchasing Agreement ("MARPA Facility") for the

sale of certain designated eligible U.S. government receivables.

Under the MARPA Facility, the Company can sell eligible receivables

up to a maximum amount of $300 million. Transaction-adjusted free

cash flow excludes cash taxes, transaction fees, and other costs

related to the divestiture of the logistics and supply chain

management business from free cash flow as previously defined. We

believe that free cash flow and transaction-adjusted free cash flow

provides management and investors with useful information in

assessing trends in our cash flows and in comparing them to other

peer companies, many of whom present similar non-GAAP liquidity

measures. These measures should not be considered as a measure of

residual cash flow available for discretionary purposes.

(1)Non-GAAP measure, see above for definition.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240315356837/en/

Investor Relations: Joe DeNardi, +1.703.488.8528,

joseph.w.denardi@saic.com

Media: Thais Hanson, +1.703.676.8215,

publicrelations@saic.com

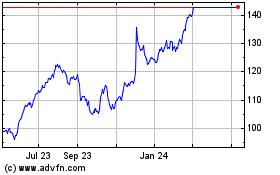

Science Applications (NYSE:SAIC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Science Applications (NYSE:SAIC)

Historical Stock Chart

From Nov 2023 to Nov 2024