Saul Centers, Inc. Announces Tax Treatment of 2004 Dividends

January 13 2005 - 9:53AM

PR Newswire (US)

Saul Centers, Inc. Announces Tax Treatment of 2004 Dividends

BETHESDA, Md., Jan. 13 /PRNewswire-FirstCall/ -- Saul Centers, Inc.

(NYSE:BFS), an equity real estate investment trust (REIT),

announced today the income tax treatment for its 2004 Common Stock

and Preferred Stock dividends. The Company declared and paid four

quarterly Common Stock dividends of $.39 per share each, totaling

$1.56 per share during 2004. For tax purposes, 80.0% of the Common

Stock dividend ($1.248 per share) is characterized as ordinary

income, while 20.0% ($.312 per share) is characterized as return of

capital. The Company declared and paid four Preferred Stock

dividends totaling $1.811 per depositary share during 2004. For tax

purposes, 100.0% of the Preferred Stock dividends are characterized

as ordinary income. The information will be reported to

shareholders on Form 1099-DIV. Saul Centers is a self-managed,

self-administered equity real estate investment trust headquartered

in Bethesda, Maryland. Saul Centers currently operates and manages

a real estate portfolio of 40 community and neighborhood shopping

center and office properties totaling approximately 7.2 million

square feet of leasable area. Over 83% of the Company's cash flow

is generated from properties in the metropolitan Washington,

DC/Baltimore area. DATASOURCE: Saul Centers, Inc. CONTACT: Scott V.

Schneider of Saul Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

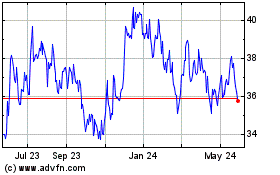

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

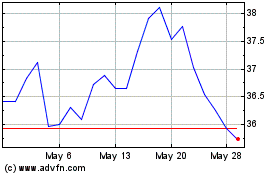

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024