Saul Centers Acquires Shopping Centers and Development Site

March 03 2004 - 5:59PM

PR Newswire (US)

Saul Centers Acquires Shopping Centers and Development Site

BETHESDA, Md., March 3 /PRNewswire-FirstCall/ -- Saul Centers, Inc.

, an equity Real Estate Investment Trust (REIT), acquired two

grocery anchored shopping centers during February 2004. The Company

completed the acquisition of the 130,000 square foot Countryside

shopping center, its fourth neighborhood shopping center investment

in fast-growing Loudoun County, Virginia. The center is 95% leased,

anchored by a 47,000 square foot Safeway supermarket and was

acquired for a purchase price of $29.7 million. The Company's

investments in the Ashburn Village, Broadlands Village and

Countryside shopping centers and the Lansdowne land parcel are the

dominant grocery anchored retail sites in these planned

communities, each containing between 1,500 and 5,000 homes with

average 3 mile household incomes of over $98,000. The Company added

Publix to its list of grocery anchor tenants with the February

acquisition of Boca Valley Plaza in Boca Raton, Florida. Boca

Valley Plaza is a 121,000 square foot neighborhood shopping center

on U.S. Highway 1 in a very attractive demographic area of South

Florida. Three-mile average household incomes total over $83,000.

The center, constructed in 1988, is90% leased and is anchored by a

42,000 square foot Publix supermarket. The property was acquired

for $17.6 million, subject to the assumption of a $9.2 million

mortgage with an interest rate of 6.82%, maturing in 2007. Publix

is the dominant grocer in South Florida with an estimated 50%

market share of grocery store sales in the tri-county area of

Miami-Dade, Broward and Palm Beach Counties. Finally, the Company

purchased 3.4 acres of vacant land adjacent to its 109,000 square

foot Lowe's anchoredKentlands square shopping center in

Gaithersburg, Maryland, with plans to develop a 41,000 square foot

retail /office building comprised of 25,000 square feet of in-line

retail space and 16,000 square feet of professional office suites.

Construction is expected to commence in the spring of 2004. Total

development costs, including the land acquisition, are projected to

total $7.1 million. Substantial completion is scheduled for the

fall of 2004. The property was purchased from a subsidiary of Chevy

Chase Bank, a related party entity. The purchase price was

determined by independent third party appraisals. Saul Centers

currently operates and manages a real estate portfolio of 38

community and neighborhood shopping centers and office properties

totaling approximately 6.8 million square feet of leasable area.

Over 80% of the Company's cash flow is generated from properties in

the metropolitan Washington, D.C./Baltimore area. DATASOURCE: Saul

Centers, Inc. CONTACT: Scott V. Schneider of Saul Centers, Inc.,

+1-301-986-6220 Web site: http://www.saulcenters.com/

Copyright

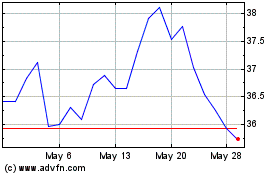

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

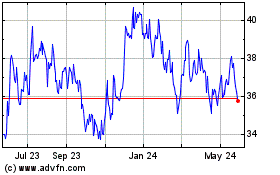

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024