Saul Centers, Inc. Reports Third Quarter Operating Results

BETHESDA, Md., Nov. 5 /PRNewswire-FirstCall/ -- Saul Centers, Inc.

, an equity real estate investment trust (REIT), announced its

third quarter operating results. Total revenues for the quarter

ended September 30, 2003 increased 5.1% to $24,659,000 compared to

$23,471,000 for the 2002 quarter. Operating income before gain on

property sold and minority interests increased 27.8% to $7,035,000

compared to $5,503,000 for the comparable 2002 quarter. The Company

reported net income of $5,012,000 or $.32/share for the 2003

quarter, a per share increase of 33.3% compared to net income of

$3,486,000 or $0.24/share for the 2002 quarter (basic &

diluted). For the nine month period ending September 30, 2003,

total revenues increased 3.3% to $71,755,000 compared to

$69,455,000 for the 2002 period. Operating income before gain on

property sold and minority interests increased 3.5% to $19,590,000

compared to $18,928,000 for the comparable 2002 period. The Company

reported net income of $13,527,000 or $.87/share for the 2003

period, a per share decrease of 10.3% compared to net income of

$14,303,000 or $0.97/share for the 2002 period (basic &

diluted). Net income in the 2002 nine month period included

recognition of a gain on property sold of $1,426,000 when it was

awarded a final settlement for the condemnation and purchase of the

Company's Park Road property by the District of Columbia. Overall

same property net operating income for the total portfolio

increased 0.6% for the 2003 third quarter and decreased 1.2% for

the 2003 nine month period compared to the same periods in 2002.

Net operating income is calculated as total revenue less property

operating expenses, provision for credit losses and real estate

taxes. The same property comparisons exclude Ashburn Village Phase

IV, placed in service during the summer of 2002, Kentlands Square

acquired in September 2002 and Old Forte Village acquired July

2003. Same center net operating income in the shopping center

portfolio increased 0.5% for the 2003 third quarter and decreased

1.1% for the 2003 nine month period. The decrease in same center

net operating income in the shopping center portfolio for the nine

month period was primarily attributable to increased current year

snow removal expenses. Same center net operating income in the

office portfolio increased 0.8% for the 2003 third quarter and

decreased 1.3% for the 2003 nine month period compared to the same

period in 2002. Net operating income in the office portfolio during

the quarter and nine month periods ended September 30, 2003 was

adversely impacted by the February 2003 expiration of a major

tenant lease (120,000 square feet, 53% of the leasable area) at 601

Pennsylvania Avenue. As of September 30, 2003, 601 Pennsylvania

Avenue was 91.4% leased. As of September 30, 2003, 93.8% of the

portfolio was leased, compared to 94.3% a year earlier. This

decrease in the percentage of space leased is primarily due to

approximately 50,000 square feet of redevelopment space at the

recently acquired Old Forte Village shopping center. Funds From

Operations (FFO), a widely accepted non-GAAP financial measure of

operating performance for real estate investment trusts, increased

4.5% to $11,584,000 in the 2003 third quarter compared to

$11,081,000 for the same quarter in 2002. FFO is defined as net

income, plus minority interests, extraordinary items and real

estate depreciation and amortization, excluding gains and losses

from property sales. On a fully diluted per share basis, FFO was

$0.55 per share for both of the 2003 and 2002 third quarters. For

the nine month period ending September 30, 2003, FFO decreased 1.0%

to $32,466,000 compared to $32,810,000 for the 2002 period. On a

fully diluted per share basis, FFO was $1.57 per share for the 2003

nine month period, a 4.3% decrease from $1.64 per share for the

same period last year. The decrease in the nine month FFO was

primarily attributable to decreased net operating income at the

Company's 601 Pennsylvania Avenue office building. Saul Centers is

a self-managed, self-administered equity real estate investment

trust headquartered in Bethesda, Maryland. Saul Centers currently

operates and manages a real estate portfolio of 36 community and

neighborhood shopping center and office properties totaling

approximately 6.6 million square feet of leasable area. Over 80% of

the Company's cash flow is generated from properties in the

metropolitan Washington, DC/Baltimore area. Saul Centers, Inc.

Condensed Consolidated Balance Sheets ($ in thousands) September

30, December 31, 2003 2002 Assets (Unaudited) Real estate

investments Land $ 95,878 $ 90,469 Buildings 420,596 405,153

Construction in progress 20,698 8,292 537,172 503,914 Accumulated

depreciation (161,153) (150,286) 376,019 353,628 Cash and cash

equivalents 2,169 1,309 Accounts receivable and accrued income, net

13,249 12,505 Prepaid expenses 19,567 15,712 Deferred debt costs,

net 4,255 4,125 Other assets 2,275 1,408 Total assets $ 417,534 $

388,687 Liabilities Notes payable $ 400,668 $ 380,743 Accounts

payable, accrued expenses and other liabilities 18,115 16,727

Deferred income 4,355 4,484 Total liabilities 423,138 401,954

Stockholders' Equity (Deficit) Common stock 157 152 Additional paid

in capital 91,507 79,131 Accumulated deficit (97,268) (92,550)

Total stockholders' equity (deficit) (5,604) (13,267) Total

liabilities and stockholders' equity (deficit) $ 417,534 $ 388,687

Saul Centers, Inc. Condensed Consolidated Statements of Operations

(Unaudited) (In thousands, except per share amounts) Three Months

Ended Nine Months Ended September 30, September 30, 2003 2002 2003

2002 Revenue Base rent $ 19,751 $ 19,184 $ 57,733 $ 56,532 Expense

Recoveries 3,303 3,207 10,473 9,317 Percentage Rent 438 446 1,102

1,220 Other 1,167 634 2,447 2,386 Total revenue 24,659 23,471

71,755 69,455 Operating Expenses Property operating expenses 2,653

2,441 8,261 7,165 Provision for credit losses 26 131 118 402 Real

estate taxes 2,130 1,947 6,391 5,917 Interest expense 6,566 6,335

19,526 18,757 Amortization of deferred debt expense 201 180 598 504

Depreciation and amortization 4,549 5,578 12,876 13,882 General and

administrative 1,499 1,356 4,395 3,900 Total operating expenses

17,624 17,968 52,165 50,527 Operating Income 7,035 5,503 19,590

18,928 Gain on property disposition - - - 1,426 Minority Interests

(2,023) (2,017) (6,063) (6,051) Net Income $ 5,012 $ 3,486 $ 13,527

$ 14,303 Per Share Amounts: Net income (basic) $ 0.32 $ 0.24 $ 0.87

$ 0.97 Net income (fully diluted) $ 0.32 $ 0.24 $ 0.87 $ 0.97

Weighted average common stock outstanding: Common stock 15,683

14,924 15,516 14,788 Effect of dilutive options 16 25 14 19 Fully

diluted weighted average common stock 15,699 14,949 15,530 14,807

Saul Centers, Inc. Supplemental Information (Unaudited) (In

thousands, except per share amounts) Three Months Ended Nine Months

Ended September 30, September 30, 2003 2002 2003 2002 Funds From

Operations (FFO)(1) Net Income $ 5,012 $ 3,486 $ 13,527 $ 14,303

Less: Gain on sale of property - - - (1,426) Add: Real property

depreciation & amortization 4,549 5,578 12,876 13,882 Add:

Minority Interests 2,023 2,017 6,063 6,051 Funds From Operations $

11,584 $ 11,081 $ 32,466 $ 32,810 Per Share Amounts(basic and fully

diluted): Funds From Operations $ 0.55 $ 0.55 $ 1.57 $ 1.64

Weighted average shares outstanding: Fully diluted weighted average

common stock 15,699 14,949 15,530 14,807 Convertible limited

partnership units 5,184 5,173 5,181 5,172 Fully diluted &

converted weighted average shares 20,883 20,122 20,711 19,979 Same

Property Net Operating Income (2) Net Income $ 5,012 $ 3,486 $

13,527 $ 14,303 Add: Interest expense 6,566 6,335 19,526 18,757

Add: Amortization of deferred debt expense 201 180 598 504 Add:

Depreciation and amortization 4,549 5,578 12,876 13,882 Add:

General and administrative 1,499 1,356 4,395 3,900 Less: Gain on

property disposition - - - (1,426) Add: Minority Interests 2,023

2,017 6,063 6,051 Property net operating income 19,850 18,952

56,985 55,971 Less: Acquisition & developments (914) (125)

(1,804) (125) Total same property net operating income $ 18,936 $

18,827 $ 55,181 $ 55,846 Total Shopping Centers $ 12,711 $ 12,654 $

37,166 $ 37,595 Total Office Properties 6,225 6,173 18,015 18,251

Total same property net operating income $ 18,936 $ 18,827 $ 55,181

$ 55,846 (1) FFO is a widely accepted non-GAAP financial measure of

operating performance of real estate investment trusts ("REITs").

FFO is defined by the National Association of Real Estate

Investment Trusts as net income, computed in accordance with GAAP,

plus minority interests, extraordinary items and real estate

depreciation and amortization, excluding gains or losses from

property sales. FFO does not represent cash generated from

operating activities in accordance with GAAP and is not necessarily

indicative of cash available to fund cash needs, which is disclosed

in the Consolidated Statements of Cash Flows in the Company's SEC

reports for the applicable periods. FFO should not be considered as

an alternative to net income, its most directly comparable GAAP

measure, as an indicator of the Company's operating performance, or

as an alternative to cash flows as a measure of liquidity.

Management considers FFO a supplemental measure of operating

performance and along with cash flow from operating activities,

financing activities and investing activities, it provides

investors with an indication of the ability of the Company to incur

and service debt, to make capital expenditures and to fund other

cash needs. FFO may not be comparable to similarly titled measures

employed by other REITs. (2) Although same property net operating

income and property net operating income are GAAP financial

measures, the Company has elected to present a reconciliation of

the measures to net income. DATASOURCE: Saul Centers, Inc. CONTACT:

Scott V. Schneider of Saul Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

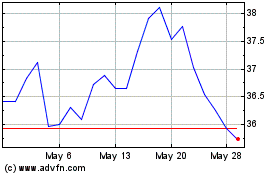

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

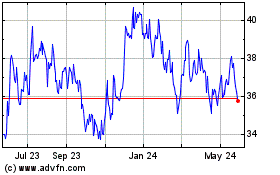

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024