Saul Centers Announces Pricing of Up to $100 Million Preferred Equity Offering

October 30 2003 - 6:12PM

PR Newswire (US)

Saul Centers Announces Pricing of Up to $100 Million Preferred

Equity Offering BETHESDA, Md., Oct. 30 /PRNewswire-FirstCall/ --

Saul Centers, Inc. , an equity real estate investment trust (REIT),

today announced that it has priced an offering of 3,500,000

depositary shares, each representing 1/100th of a share of 8%

Series A Cumulative Redeemable Preferred Stock. All of the

depositary shares are being sold by Saul Centers. The depositary

shares may be redeemed, in whole or in part, at the $25.00

liquidation preference at the Company's option on or after November

5, 2008. The depositary shares will pay an annual dividend of $2.00

per share, equivalent to 8% of the $25.00 liquidation preference.

The first dividend we pay on January 15, 2004 will be for less than

a full quarter and will cover the period from the first date we

issue and sell the depositary shares through December 31, 2003. The

Series A preferred stock has no stated maturity, is not subject to

any sinking fund or mandatory redemption and is not convertible

into any other securities of the Company. Investors in the

depositary shares will generally have no voting rights, but will

have limited voting rights if the Company fails to pay dividends

for six or more quarters (whether or not declared or consecutive)

and in certain other events. The Company has granted the

underwriters an over-allotment option to purchase up to an

additional 500,000 depositary shares, which is exercisable within

30 days after closing. Net proceeds from the issuance, excluding

any proceeds from the over- allotment, are estimated to be

approximately $84.3 million and will be used to fund acquisitions

and redevelopments and to repay amounts outstanding under the

Company's revolving credit facility. An application has been filed

to list the depositary shares on the New York Stock Exchange under

the symbol "BFS PrA." The offering is expected to close on November

5, 2003. The offering is underwritten by Friedman, Billings, Ramsey

& Co., Inc. and Ferris, Baker Watts, Incorporated. The

securities may not be sold nor may offers to buy be accepted prior

to the time that the prospectus supplement is final. This

communication shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

Copies of the final prospectus supplement relating to this offering

may be obtained from Friedman, Billings, Ramsey & Co., Inc.,

1001 19th Street North, Arlington, VA 22209, Telephone: (703)

312-9500. Saul Centers is a self-managed, self-administered equity

real estate investment trust headquartered in Bethesda, Maryland.

Saul Centers currently operates and manages a real estate portfolio

of 36 community and neighborhood shopping center and office

properties totaling approximately 6.6 million square feet of

leasable area. Over 80% of the Company's cash flow is generated

from properties in the metropolitan Washington, DC/Baltimore area.

This press release contains "forward-looking" statements. For this

purpose, any statements contained in this press release that are

not statements of historical fact may be deemed to be

forward-looking statements. Words such as "believes,"

"anticipates," "plans," "expects," "will," "intends" and similar

expressions are intended to identify forward-looking statements.

Saul Centers does not undertake any obligation to update

forward-looking statements. DATASOURCE: Saul Centers, Inc. CONTACT:

Scott V. Schneider of Saul Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

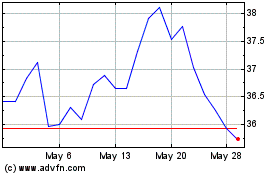

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

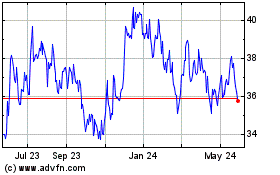

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024