SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 9, 2014

Saul Centers, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Maryland | | 1-12254 | | 52-1833074 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

|

| | |

| | |

7501 Wisconsin Avenue, Bethesda, Maryland | | 20814 |

(Address of Principal Executive Offices) | | (Zip Code) |

(301) 986-6200

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective as of May 9, 2014, Mr. J. Page Lansdale was promoted and named as President and Chief Operating Officer of Saul Centers, Inc. (the “Company”). Mr. Lansdale, age 56, served as our Executive Vice President – Real Estate since September 4, 2012. Prior to that time, he served as a Senior Vice President of the Company since 2009. Beginning in 1990, Mr. Lansdale held various positions with Chevy Chase Bank, F.S.B., including most recently Senior Vice President of Corporate Real Estate from 2004 to 2009.

Also effective as of May 9, 2014, Ms. Christine Nicolaides Kearns was hired as the Company’s Executive Vice President and Chief Legal and Administrative Officer. Prior to joining the Company, Ms. Kearns, age 53, was a Partner with the law firm Pillsbury Winthrop Shaw Pittman LLP for 20 years, most recently serving as the Managing Partner of the firm’s Washington, DC office.

Mr. Lansdale and Ms. Kearns are also officers of other entities affiliated with the Company and controlled by B. Francis Saul II and his family members, which we refer to as the Saul Organization. The Company believes that these officers will spend sufficient management time to meet their responsibilities as its officers.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On May 9, 2014, the Company held its Annual Meeting of Stockholders, at which B. Francis Saul II, John E. Chapoton, H. Gregory Platts, James E. Symington and John R. Whitmore were reelected to the Board of Directors for three year terms expiring at the 2017 Annual Meeting. The terms of the remaining Board members did not expire as of the May 9, 2014 meeting, and those individuals continue as directors of the Company. Holders of 19,731,631 shares of the Company’s common stock voted in person at the meeting or by proxy (representing 96.7% of the 20,406,351 shares eligible to vote) as follows:

In Favor Withheld Not Voted

B. Francis Saul II 18,093,736 258,871 1,379,024

John E. Chapoton 18,239,333 113,274 1,379,024

H. Gregory Platts 18,295,908 56,699 1,379,024

James E. Symington 17,927,831 424,776 1,379,024

John R. Whitmore 17,925,792 426,815 1,379,024

The stockholders voted for the ratification of Ernst & Young as independent public accountants as follows:

In Favor Opposed Abstain

19,636,919 82,774 11,938

The stockholders voted to approve the compensation paid to the Company’s named executive officers, as disclosed in the Company’s Proxy Statement for the 2014 Annual Meeting of Stockholders:

In Favor Opposed Abstain

18,132,383 180,269 39,955

Item 8.01. Other Events.

The Company posted on its web site, www.saulcenters.com, a presentation given by management at the Company’s annual meeting of stockholders. The presentation is Exhibit 99. (a) to this current report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

99.(a) Annual Meeting Presentation

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

SAUL CENTERS, INC. |

| |

By: | | /s/ Scott V. Schneider |

| | Scott V. Schneider |

| | Senior Vice President and Chief Financial Officer |

Dated: May 13, 2014

EXHIBIT INDEX

|

| | |

| | |

Exhibit No.

| | Description

|

99. (a) | | Annual Meeting Presentation, delivered May 9, 2014. |

Annual Meeting of Stockholders 1 We have prepared a brief slide show to present balance sheet and operating performance highlights of 2013 and recent first quarter 2014 activity, and our current and future development plans.

20 Years a Public REIT20 ars a Pu lic REI Properties - 29 to 56 operating properties Leasable area - 5.3 to 9.3 million square feet Total capitalization - $500 million to $2.3 billion Compounded annual return - 11.5% 2 August 2013 marked our 20th anniversary as a public REIT. Through expansion and redevelopment of our core properties and selective acquisition and development, our portfolio has grown from 29 operating properties with 5.3 million square feet to 56 properties with 9.3 million square feet. Our total capitalization has increased from $500 million in 1993 to $2.3 billion today. Over this 20 year period, total return to our shareholders, including both dividends and share price appreciation, has averaged 11.5% compounded annually.

20 Years a Public REIT20 ars a Pu lic REI 73.0% 27.0% 1994 Shopping Center Mixed / Use 85.3% 14.7% 75.6% 24.4% 79.4% 20.6% 1994 Washington DC / Baltimore Other 1994 2013 3 Our geographic focus continues to be in the metropolitan Washington, DC market. Over 85% of our 2013 property operating income was generated in this market, an increase from 79% at our outset. The stability of grocery-anchored neighborhood and community shopping centers continues to be our core business. Over 75% of our 2013 property operating income was from shopping centers, compared to 73% in 1994.

94.0% 94.7% 96.8% 95.8% 94.9% 91.9% 91.9% 89.9% 92.1% 93.6% 93.9% 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 1s t Q 20 14 A ve ra ge L ea sin g Pe rc en ta ge Overall Portfolio Leasing Percentage (Excluding properties under development) u 10-year average = 93.6% 4 Overall leasing percentages improved since 2011, and averaged 93.9% during the first quarter 2014. This is an increase from a low of 89.9% during 2011, and now exceeds our 10-year average of 93.6%.

2013 Balance Sheet Highlights $140 million Preferred Stock Issue $71 million New Permanent Financings $72 million Construction-to-Permanent Loan 5 During 2013, we completed several equity and debt transactions which have improved our balance sheet and reduced our overall cost of capital. We issued $140 million of perpetual preferred stock in order to redeem higher coupon issues. We completed $71 million of new long term financings to repay higher rate maturing debt. In October 2013, we closed on an 18-year, $72 million construction-to-permanent loan, at a 4.88% interest rate, to finance the construction of our Park Van Ness residential project.

Preferred Stock Issued $140 million 6 7/8% Perpetual Series C Redeemed $140 million higher coupon preferred All $80 million of 9% Series B $60 million of 8% Series A Reduced preferred stock dividends Weighted avg. rate reduced 1.3% from 8.4% to 7.1% Annual dividends reduced $2.3 million 6 In February of 2013, we issued $140 million of Series C perpetual preferred stock which has a coupon of 6 7/8%. The proceeds of this offering were used to redeem all $80 million of our 9% Series B and $60 million of our 8% Series A preferred shares. As a result of this offering, our weighted average cost of preferred equity was reduced from 8.4% to 7.1%. Preferred dividends have been reduced by $2.3 million annually.

15-Year Financings Beacon CenterBeacon Cente $35 million @ 3.51% Hampshire Langley 18 million @ 4.04% Seabreeze Plaza 18 million @ 3.99% Total $71 million @ 3.76% 2013 Permanent Financings 7 In 2013, we completed 3 shopping center financings totaling $71 million. The weighted average 15-year rate on these loans was 3.76%. This reduced our overall weighted average interest rate on fixed rate debt by 15 basis points to 5.67%, from 5.82%.

$15 $29 $28 $62 $61 $11 $37 $9 $67 $20 $135 $42 $30 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 20 26 20 27 20 28 (Excludes scheduled amortization) Year Debt Matures $0 $50 $100 $150 M ill io ns Mortgage Debt Maturities May 1, 2014 Weighted average maturity of mortgage debt 10.0 years 8 Our mortgage debt maturities are shown here. Total maturities for the next four years through 2018 are only $72 million, less than 10% of our total debt. Maturities are well staggered during the next 10 years, with the largest single year totaling only $67 million between now and 2025.

Balance Sheet Strength 96% fixed rate, nonrecourse debt Average mortgage interest rate is 5.53% $175 million credit line - $172 million available 601 Pennsylvania Ave., free & clear of debt 9 96% of our total debt is fixed rate, nonrecourse debt. The favorable interest rate environment in 2013 allowed us to lower our overall weighted average mortgage interest rate to 5.53%. We have $172 million available under our $175 million line of credit, and have additional financial flexibility with one of our most valuable assets, 601 Pennsylvania Avenue, now held free and clear of debt. As of May 2014, 21 of our 56 operating properties are held free and clear of debt. In our view, we think these properties which support line borrowings, when combined with 601 Pennsylvania Avenue, are worth $500 million and provide us borrowing capacity between $250 and $300 million, to provide funding for future acquisition opportunities and our development pipeline.

20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 1Q 2 01 4 Year End $500 $1,000 $1,500 $2,000 M ill io ns Common Equity Preferred Equity Debt Market Capitalization HighlightsMarket Capitalization Highlight 3/31/2014 closing price = $47.36/sh 59.4% 37.1% 8.0% $603 $357 $100 $1.1 B $2.3 B $1,303 $814 $180 10 As of March 31, 2014, our total combined debt and equity capitalization was $2.3 billion, compared to $1.1 billion 10 years ago. Total debt is currently $814 million. Preferred stock represents about 8% of our capital base. All of our preferred stock is perpetual and $40 million is currently callable. As you can see here, since late 2011, our debt level has remained flat, while our common equity value has grown. As a result, our capital structure's leverage ratio of debt to total capitalization has improved from 44% in 2010 to our current level of 37%.

$2.20 $2.42 $2.57 $2.75 $2.68 $2.40 $2.12 $2.03 $2.26 $2.37 $0.71 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 1Q 2014 FFO/share Dividends/share Current dividend of $.40/share equates to an annual dividend of $1.60/share. 1.531.60 1.68 1.77 1.88 Funds From Operations (FFO) & Dividends 1.56 1.44 0.40 1.44 1.441.44 11 FFO results for the past 10 years are highlighted here. FFO declined each year after 2007, due to the economic downturn's impact on our portfolio and several nonrecurring events. FFO started increasing in 2012 and has risen steadily since. We reduced the annual dividend rate to $1.44 per share during the downturn, allowing us to retain additional cash flow during this challenging period. For the recent April 30, 2014 dividend, we raised the dividend 11% to an annual rate of $1.60 per share.

64% 70% 64% 68% 71% 64% 61% 56% 2007 2008 2009 2010 2011 2012 2013 1Q 2014 D iv id en d Pa yo ut Dividend as a % of FFO Conservative FFO payout ratio: 61% of 2013 FFO was paid out in dividends. 12 Over the past 5 years, we paid out an average of 66% of FFO as dividends. While the dividend payout increased from 2009 to 2011, the 2012 level decreased and the 2013 level reached our historic low of 61%. Despite raising our latest quarterly dividend by 11% to $0.40 per share, our ratio of dividends to first quarter FFO further dropped to a comfortable 56%. This conservative payout strategy allows us to maintain excess cash flows to provide capital to internally fund acquisition and development activities and to retire debt.

Shopping Centers (2013) 50 retail properties generated 75% of property operating income 32 centers were grocery anchored & produced 77% of retail property operating income Grocers reported sales averaging $491 per square foot, but 10 stores reported sales in excess of $600 per square foot Tenant renewal rate 78% in 2013 Cranberry Square, Westminster, Maryland 13 During 2013, our 50 retail properties produced 75% of overall property operating income. 32 were anchored by a grocery store, and produced 77% of our retail property operating income. The grocery business continues to be very competitive throughout the country. Sales volumes for the 25 grocery stores that have been in our centers for the past five years are only 2% higher than 2009 levels. Despite the slow sales growth, sales volumes are healthy. Grocery sales averaged $491 per square foot, and ten of these stores reported sales in excess of $600 per square foot. Our high 78% tenant renewal rate is significant because high tenant retention results in a continuation of rental income with lower re-leasing expenses and no revenue down time.

Favorable Demographics $40,000 $60,000 $80,000 $100,000 $120,000 Saul Centers Avg.... $104,000 National Avg........... $71,800 Average household income within three mile radius of Saul Centers' retail properties exceeds the national average Saul Centers Avg... National Avg... Source: U.S. Census Bureau, Census 2010 ESRI forecasts for 2013. 14 The long-term success of our core portfolio hinges largely on prime infill locations. Saul Centers' properties 3-mile trade areas have average household incomes of $104,000, compared to the national average of $71,800. Our 3 and 5 mile population counts average 93,000, and 223,000, respectively, which are representative of very strong infill locations.

Retail Operating Highlights Leasing percentage trending upward Small shop space leased improved from 86.9% to 90.4% Retail rental rates increasing Retail same center property operating income averaging 3.6% last 8 quarters 15 Slowly improving economic conditions have had a positive impact on our operating performance since the second quarter of 2012. Our overall leasing percentage has trended upward, positively impacted by small shop leasing improvement from 86.9% at the beginning of 2013 to 90.4% currently. Retail rental rates have also been increasing slightly over expiring rents since early 2012. These factors have resulted in retail property operating income growth averaging 3.6% for each of the last 8 quarters, after being negative for the three years prior.

95.8% 94.8% 93.4% 92.2% 91.0% 92.7% 94.3% 94.8% 2007 2008 2009 2010 2011 2012 2013 1Q '14 A ve ra ge L ea sin g Pe rc en ta ge Retail Leasing Percentage 16 Our retail leasing percentage averaged 94.8% in the most recent quarter, up from a low of 91.0% in 2011.

Retail Rental Rates 10.1% -1.2% -6.8% -6.3% 1.6% 0.1% 3.5% 2008 2009 2010 2011 2012 2013 1Q '14 Sa m e Sp ac e Re nt al R at e Ch an ge 5-yr avg. prior to 2008 = 8.7% 17 On a same space basis, retail rental rate increases over expiring rents averaged 8.7% for the 5 year period prior to 2008. In 2008, rental rates increased a strong 10% for new and renewal leases. Retail rental rates decreased an average of nearly 5% for the 3-year period from 2009 to 2011. During 2012, rents turned positive and have remained positive since.

Retail Same Property NOI GrowthRetail Same Property NOI Growt 1.2% -3.5% -0.7% -2.2% 2.0% 3.6% 6.7% 20 08 20 09 20 10 20 11 20 12 20 13 1Q '1 4 Pe rc en ta ge C ha ng e 5-yr avg.. prior to 2008 = 2.8% 18 During the 5-years prior to 2008, on a same property basis, we achieved average annual retail property operating income growth of 2.8%. Retail same property growth was 1.2% during 2008. During the period 2009 to 2011, we had declines averaging 2.1% per year. While modest, positive growth of 2.0% returned during 2012 and has continued through 2013. The current quarter's growth, when excluding the impact of the large lease termination fee that I discussed earlier, was 1.4%

Major Retail Tenants Tenant Name Locations Retail SF % 2013 Total Revenue Giant Food 10 7.5% 4.8% Safeway 8 5.0% 2.6% Capital One Bank 19 0.8% 2.2% CVS 7 1.6% 1.7% Publix 5 3.1% 1.4% Lowe's Home Center 2 3.3% 1.4% Harris Teeter 3 1.8% 1.3% Home Depot 2 3.1% 1.1% Staples 3 0.8% 0.9% Trader Joe's 3 0.5% 0.8% Totals 62 27.5% 18.2% Top 10 retail tenants provided only 18% of the Company's 2013 Total Revenue 19 A diverse retail tenant base minimizes exposure to any one tenant's credit. Only Giant Food, at 4.8% and Safeway at 2.6% accounted for more than 2.5% of our total revenue in 2013. Our top 10 retail tenants comprise only 18% of total revenue, with 60% of this revenue generated by major regional and national supermarkets, a very stable source of income.

Beacon Center, Alexandria, Virginia Beacon Center 20 These next few slides will provide an overview of some recent activities at several of our shopping centers. Beacon Center is a 358,000 square foot community shopping center in Alexandria, Virginia, anchored by Giant Food, Lowe's Home Improvement Center, Marshalls and the recently opened Home Goods. More than 51,000 households, with annual household incomes averaging over $118,000, are located within a three-mile radius of the center. In February 2013, Office Depot departed Beacon Center when their lease expired. We re-leased the space to Home Goods, which opened in October 2013. The center is one of our five largest retail properties as measured both by square footage and operating income.

Countryside MarketPlace, Sterling, Virginia Countryside 21 Countryside MarketPlace is one of the oldest and best located shopping centers along Route 7 in Loudoun County, Virginia. This 138,000 square foot shopping center is anchored by Safeway and CVS Pharmacy and has a McDonalds and Starbucks. 28,000 households, with annual household incomes averaging $121,000, are located within a three-mile radius of the center. During 2013, the Company reconfigured the traffic flow and parking areas, and improved the overall visibility and access. The leasing percentage has improved from 85.7% at March 31, 2013 to 93.7% currently.

Kentlands Square, Gaithersburg, Maryland Kentlands Square 22 We own a total of 403,000 square feet of community shopping center space in the Kentlands area of Gaithersburg, Maryland, in Montgomery County. More than 38,000 households, with annual household incomes averaging over $117,000, are located within a three-mile radius of the center. During 2013, we acquired a 1.1 acre parcel containing a restaurant building at the main entrance to the shopping center. We signed a lease with Brasserie Beck restaurant, which opened last week. Since acquiring the main portion of our Kentlands holdings in September 2011, we have increased our annualized base rents during the past 2-plus years by over $750,000.

Office/Mixed-Use Properties 1.5 million square feet 25% of property operating income Avenel Business Park, Gaithersburg, MD 601 Pennsylvania Ave.., Washington DC Clarendon Center, Arlington, VA 23 Our office/mixed-use space totals over 1.5 million square feet, representing 25% of our total property operating income. The most significant of our office/mixed-use properties are Clarendon Center and 601 Pennsylvania Avenue, which produce almost 70% of the office/mixed-use cash flow.

Major Office Tenants Tenant NameTen Nam Locations Rentable SF % 2013 Total Revenue Year Expiring American Health Ins. Plans 1 3.8% 1.8% 2026 Airline Reporting Corp. 1 4.7% 1.7% 2023 National Gallery of Art 1 2.4% 1.4% 2019 Credit Union Natl. Assn. 1 2.0% 1.0% 2023 HQ Global Workplace 1 1.4% 0.8% 2024 US Government 2 2.2% 0.6% 2018 Gene Dx 1 6.5% 0.7% 2020 AECOM (former Earth Tech) 1 2.3% 0.6% 2014 Cannon Washington 1 1.4% 0.5% 2022 Pharmaceutical Care 1 1.1% 0.5% 2015 Totals 11 27.8% 9.6% Top 10 office tenants provided only 10% of the Company's 2013 Total Revenue 24 Our top 10 office tenants produce 9.6% of our revenue, with no single tenant in more than 1 location in our portfolio, except the U.S. Government occupying 2 spaces. Six of the ten major office tenants have lease expirations in year 2020 or later. Only two tenants, representing 1.1% of our rental revenue, have leases expiring before 2018.

Clarendon Center Lyon Place Apartments North Block Office Building 25 Our most significant mixed-use property is Clarendon Center, located on two blocks adjacent to the Clarendon Metro station in Arlington County, Virginia. The property includes Lyon Place, a residential tower with 244 luxury apartment units, 42,000 square feet of street-level retail and 170,000 square feet of office space. The retail space is 100% leased and anchored by Trader Joe's and the office space is 97% leased. The apartment units have remained leased at an average of 98% -100% every quarter since initial lease-up was completed in mid-2011, even as several new competitive buildings have been delivered in the Clarendon sub-market during the past year.

601 Pennsylvania Ave. NW, Washington DC 601 Pennsylvania Ave. 26 We have just commenced a significant lobby, elevator and building common area upgrade at 601 Pennsylvania Avenue which will modernize the finishes of this premier office building. We successfully renewed leases that were due to expire in 2014 for 125,000 square feet, or 55% of the building. The majority of these lease extensions were for 10 years or longer. 601 Pennsylvania Avenue is currently 95% leased.

Development Park Van Ness Construction Progress Photo, May 8, 2014 Street View to Rock Creek Park 4455 Connecticut Ave. NW, Washington DC 27 By the end of April 2013, we negotiated and terminated the last of the tenants in Van Ness Square. We completed demolition of the old office building in March 2014. We have hired Clark Construction to build a 271 unit, luxury residential project named Park Van Ness. Park Van Ness will have 9,000 square feet of retail space, below street-level parking, and amenities such as a community room, landscaped courtyards, a fitness room and a rooftop pool and deck. Construction is expected to be completed in late 2015 at a cost of $93 million, a portion of which will be funded by a $72 million construction-to-permanent loan.

Rockville Pike, Montgomery County, MD Development sites acquired in 2010-2014 with mixed-use potential of over 2.5 million SF Twinbrook holdings 9.2 acres White Flint holdings 7.6 acres M Future Development Pipeline M 28 Looking beyond our development of Park Van Ness, we are currently focusing our future development pipeline along Rockville Pike near Metro Red Line stations, White Flint and Twinbrook. Since 2010, we acquired several one and two-story retail properties in this area totaling 17 acres, and having zoning for development totaling over 2.5 million square feet of new residential and commercial space. During April 2014, we achieved a significant development milestone with the County's approval of our White Flint Sketch Plan totaling 1.6 million square feet of mixed-use space.

NYSE Symbol: B F S Hunt Club Corners, Apopka, Florida Annual Meeting of Stockholders 29 We remain committed to, and confident in, the long-term performance of our core retail and mixed-use properties. Our balance sheet is strong, and we are prepared for new opportunities during this period of economic recovery. I now welcome any questions you may have. (after questions) Adjournment

Forward-looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws. These statements are generally characterized by terms such as "believe," "expect" and "may." Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, our actual results could differ materially from those given in the forward-looking statements as a result of changes in factors which include, among others, the following: continuing risks related to the challenging domestic and global credit markets and their effect on discretionary spending; risks related to our tenants’ ability to pay rent and our reliance on significant tenants; risks related to our substantial relationships with entities affiliated with our senior management; risks of financing, such as increases in interest rates, restrictions imposed by our debt, our ability to meet existing financial covenants and our ability to consummate planned and additional financings on acceptable terms; risks related to our development activities; risks that our growth will be limited if we cannot obtain additional capital; risks that planned and additional acquisitions or redevelopments may not be consummated, or if they are consummated, that they will not perform as expected; risks generally incident to the ownership of real property; risks related to our status as a REIT for federal income tax purposes; and such other risks as described in Part I, Item 1A of our Form 10-K for the year ended December 31, 2011. 30

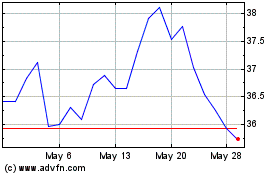

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

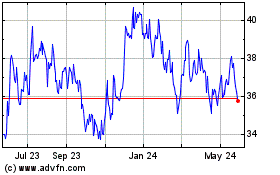

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024