Saul Centers, Inc. Prices Offering of 9% Series B Cumulative Redeemable Preferred Depositary Shares

March 20 2008 - 7:50PM

PR Newswire (US)

BETHESDA, Md., March 20 /PRNewswire-FirstCall/ -- Saul Centers,

Inc. (NYSE:BFS) (the "Company") today announced that it priced

3,000,000 depositary shares, each representing a 1/100th fractional

interest in a share of the Company's 9% Series B Cumulative

Redeemable Preferred Stock, at an initial public offering price of

$25.00 per depositary share. The dividend rate of the Series B

Cumulative Redeemable Preferred Stock underlying the depositary

shares will be at a fixed rate of 9% of the liquidation preference

per year, which is equivalent to an annual dividend of $2.25 per

depositary share. Dividends will be paid quarterly in arrears. The

offering is expected to result in approximately $72.1 million of

net proceeds to the Company (assuming no exercise of the

underwriters' over-allotment option). The offering is being made

pursuant to a shelf registration statement and is expected to close

on March 27, 2008, subject to customary closing conditions. Up to

450,000 additional depositary shares may be issued pursuant to the

underwriters' over-allotment option within 30 days of the initial

issuance of the depositary shares. The Company anticipates listing

the depositary shares on the New York Stock Exchange. The joint

book-running managers for the offering are RBC Capital Markets

Corporation and Raymond James & Associates, Inc. The lead

manager for the offering is Ferris, Baker Watts, Incorporated. The

co-managers for the offering are Janney Montgomery Scott LLC and

BB&T Capital Markets, a division of Scott & Stringfellow,

Inc. This communication shall not constitute an offer to sell or

the solicitation of an offer to buy nor shall there be any sale of

these securities in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

other jurisdiction. Copies of the prospectus and the prospectus

supplement, subject to completion, relating to these securities may

be obtained from RBC Capital Markets Corporation and Raymond James

& Associates, Inc. You should direct any requests to RBC

Capital Markets Corporation, 165 Broadway, New York, NY 10006, by

fax: (212) 428-6260, or to Raymond James & Associates, Inc.,

880 Carillon Parkway, St. Petersburg, FL 33716, by phone: (727)

567-2586, or by fax: (727) 567-8010. You may also obtain a copy of

the prospectus and the prospectus supplement, subject to

completion, and other documents the Company has filed with the

Securities and Exchange Commission for free by visiting the

Commission's Web site at http://www.sec.gov/. Saul Centers is a

self-managed, self-administered equity real estate investment trust

headquartered in Bethesda, Maryland. Saul Centers currently

operates and manages a real estate portfolio of 48 community and

neighborhood shopping center and office properties totaling

approximately 8.0 million square feet of leasable area. Over 80% of

the Company's cash flow is generated from properties in the

metropolitan Washington, DC/Baltimore, MD area. More information

about Saul Centers is available on the Company's web site at

http://www.saulcenters.com/. Statements in this press release that

are not strictly historical are "forward-looking" statements.

Forward-looking statements involve known and unknown risks, which

may cause the Company's actual results to differ materially from

expected results. These risks include, among others, general

economic conditions, local real estate conditions and the

availability of capital. Additional information concerning these

and other factors that could cause actual results to differ

materially from those forward-looking statements is contained from

time to time in the Company's Securities and Exchange Commission

filings, including, but not limited to, Item 1A. Risk Factors of

the Company's annual report on Form 10-K. Copies of each filing may

be obtained from the Company or the Commission. Consequently, such

forward-looking statements should be regarded solely as reflections

of the Company's current operating plans and estimates. Actual

operating results may differ materially from what is expressed or

forecast in this press release. The Company undertakes no

obligation to publicly release the results of any revisions to

these forward-looking statements that may be made to reflect events

or circumstances after the date these statements were made.

DATASOURCE: Saul Centers, Inc. CONTACT: Scott V. Schneider of Saul

Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

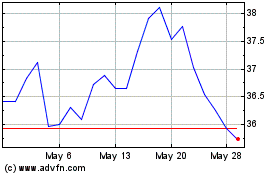

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

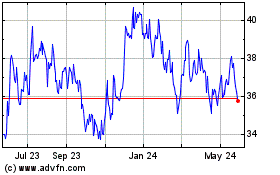

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024