BETHESDA, Md., Aug. 8 /PRNewswire-FirstCall/ -- Saul Centers, Inc.

(NYSE:BFS), an equity real estate investment trust (REIT),

announced its operating results for the quarter ended June 30,

2007. Total revenue for the quarter ended June 30, 2007 increased

9.9% to $37,077,000 compared to $33,748,000 for the 2006 quarter.

Operating income, defined as net income available to common

stockholders before minority interests and preferred stock

dividends, increased 14.8% to $11,077,000 for the 2007 quarter

compared to $9,648,000 for the comparable 2006 quarter. Net income

available to common stockholders was $6,926,000 or $0.39 per

diluted share for the 2007 quarter, a per share increase of 14.7%

compared to net income available to common stockholders of

$5,797,000 or $0.34 per diluted share for the 2006 quarter. The

operating income increase for the 2007 quarter was produced by (1)

Lansdowne Town Center, the 188,000 square foot shopping center

development near Leesburg, Virginia, which commenced operations

during the fourth quarter 2006, (2) successful leasing activity at

several core properties and (3) to a lesser extent other

development properties. Same property revenue for the total

portfolio increased 4.7% for the 2007 quarter compared to the 2006

quarter and same property operating income increased 3.7%. The same

property comparisons exclude the results of operations of

properties not in operation for each of the comparable reporting

periods. Same property operating income in the shopping center

portfolio increased 3.1% for the 2007 quarter compared to the prior

year's quarter. Same property operating income in the office

portfolio grew 5.9% for the 2007 quarter. Successful leasing

activity at several core properties produced the significant

portion of increased property operating income for the 2007

quarter. For the six month period ended June 30, 2007, total

revenues increased 9.7% to $73,761,000 compared to $67,215,000 for

the 2006 period. Operating income before minority interests and

preferred stock dividends increased 15.3% to $22,086,000 compared

to $19,157,000 for the comparable 2006 period. Net income available

to common stockholders was $13,800,000 or $0.78 per diluted share

for the 2007 period, a per share increase of 16.4% compared to

$11,504,000 or $0.67 per diluted share for the 2006 period. Overall

same property revenues for the total portfolio increased 5.0% for

the 2007 six month period compared to the same period in 2006 and

same property operating income increased 3.6%. Shopping center same

property operating income increased 3.2% due to successful leasing

activity at several core shopping centers and office same property

operating income increased 4.9%. As of June 30, 2007, 95.7% of the

operating portfolio was leased, compared to 96.6% a year earlier.

The company's significant development property, the 188,000 square

foot Lansdowne Town Center, was 91.3% leased at June 30, 2007. On a

same property basis, 95.8% of the portfolio was leased, compared to

the prior year level of 96.6%. Approximately half of the 2007

leasing percentage decrease resulted from the departure of a 32,000

square foot local grocery anchor at Belvedere shopping center in

Baltimore, Maryland. Funds From Operations (FFO) available to

common shareholders (after deducting preferred stock dividends)

increased 10.9% to $15,580,000 in the 2007 quarter compared to

$14,048,000 for the same quarter in 2006. On a diluted per share

basis, FFO available to common shareholders increased 8.1% to $0.67

per share in 2007 compared to $0.62 per share for the 2006 quarter.

FFO, a widely accepted non-GAAP financial measure of operating

performance for real estate investment trusts, is defined as net

income plus minority interests, extraordinary items and real estate

depreciation and amortization, excluding gains and losses from

property sales. FFO increased in the 2007 quarter due to increased

operating income from (1) Lansdowne Town Center, (2) successful

leasing activity at several core properties and (3) to a lesser

extent acquisition and development properties. FFO available to

common shareholders for the 2007 six month period increased 11.1%

to $31,037,000 from $27,933,000 during the 2006 period. FFO

available to common shareholders increased 8.1% to $1.34 per

diluted share for the 2007 six month period compared to $1.24 per

diluted share for the 2006 period. Saul Centers is a self-managed,

self-administered equity real estate investment trust headquartered

in Bethesda, Maryland. Saul Centers currently operates and manages

a real estate portfolio of 48 community and neighborhood shopping

center and office properties totaling approximately 8.0 million

square feet of leasable area. Over 80% of the Company's property

operating income is generated from properties in the metropolitan

Washington, DC/Baltimore area. Saul Centers, Inc. Condensed

Consolidated Balance Sheets ($ in thousands) June 30, December 31,

2007 2006 (Unaudited) Assets Real estate investments Land $157,830

$154,047 Buildings and equipment 652,201 631,797 Construction in

progress 46,505 56,017 856,536 841,861 Accumulated depreciation

(223,652) (214,210) 632,884 627,651 Cash and cash equivalents

11,535 8,061 Accounts receivable and accrued income, net 30,458

33,248 Deferred leasing costs, net 16,363 18,137 Prepaid expenses,

net 1,349 2,507 Deferred debt costs, net 5,266 5,328 Other assets

9,012 5,605 Total assets $706,867 $700,537 Liabilities Mortgage

notes payable $520,345 $487,443 Revolving credit facility - 35,000

Dividends and distributions payable 12,115 11,558 Accounts payable,

accrued expenses and other liabilities 15,029 16,409 Deferred

income 11,273 12,251 Total liabilities 558,762 562,661 Minority

Interests 5,305 5,785 Stockholders' Equity Preferred stock 100,000

100,000 Common stock 176 173 Additional paid in capital 153,870

141,554 Accumulated deficit (111,246) (109,636) Total stockholders'

equity 142,800 132,091 Total liabilities and stockholders' equity

$706,867 $700,537 Saul Centers, Inc. Condensed Consolidated

Statements of Operations (In thousands, except per share amounts)

Three Months Ended Six Months Ended June 30, June 30, 2007 2006

2007 2006 (Unaudited) (Unaudited) Revenue Base rent $29,531 $27,190

$58,552 $54,090 Expense recoveries 6,282 5,407 12,880 10,920

Percentage rent 312 272 514 598 Other 952 879 1,815 1,607 Total

revenue 37,077 33,748 73,761 67,215 Operating Expenses Property

operating expenses 4,343 3,963 9,148 7,931 Provision for credit

losses 103 107 215 187 Real estate taxes 3,538 2,994 7,064 6,046

Interest expense and amortization of deferred debt 8,325 8,072

16,619 16,091 Depreciation and amortization of deferred leasing

costs 6,503 6,400 12,951 12,776 General and administrative 3,188

2,564 5,678 5,027 Total operating expenses 26,000 24,100 51,675

48,058 Operating Income 11,077 9,648 22,086 19,157 Minority

Interests (2,151) (1,851) (4,286) (3,653) Net Income 8,926 7,797

17,800 15,504 Preferred Dividends (2,000) (2,000) (4,000) (4,000)

Net Income Available to Common Stockholders $6,926 $5,797 $13,800

$11,504 Per Share Net Income Available to Common Stockholders:

Diluted $0.39 $0.34 $0.78 $0.67 Weighted Average Common Stock

Outstanding: Common stock 17,531 16,993 17,473 16,952 Effect of

dilutive options 176 132 190 142 Diluted weighted average common

stock 17,707 17,125 17,663 17,094 Saul Centers, Inc. Supplemental

Information (In thousands, except per share amounts) Three Months

Ended Six Months Ended June 30, June 30, 2007 2006 2007 2006

(Unaudited) (Unaudited) Reconciliation of Net Income to Funds From

Operations (FFO): (1) Net Income $8,926 $7,797 $17,800 $15,504 Add:

Real property depreciation & amortization 6,503 6,400 12,951

12,776 Add: Minority interests 2,151 1,851 4,286 3,653 FFO 17,580

16,048 35,037 31,933 Less: Preferred dividend (2,000) (2,000)

(4,000) (4,000) FFO available to common shareholders $15,580

$14,048 $31,037 $27,933 Weighted Average Shares Outstanding:

Diluted weighted average common stock 17,707 17,125 17,663 17,094

Convertible limited partnership units 5,417 5,400 5,416 5,374

Diluted & converted weighted average shares 23,124 22,525

23,079 22,468 Per Share Amounts: FFO available to common

shareholders $0.67 $0.62 $1.34 $1.24 Reconciliation of Net Income

to Same Property Operating Income: Net Income $8,926 $7,797 $17,800

$15,504 Add: Interest expense and amortization of deferred debt

8,325 8,072 16,619 16,091 Add: Depreciation and amortization of

deferred leasing costs 6,503 6,400 12,951 12,776 Add: General and

administrative 3,188 2,564 5,678 5,027 Less: Interest income (143)

(99) (238) (166) Add: Minority interests 2,151 1,851 4,286 3,653

Property operating income 28,950 26,585 57,096 52,885 Less:

Acquisitions & developments (1,435) (64) (2,940) (617) Total

same property operating income $27,515 $26,521 $54,156 $52,268

Total Shopping Centers $20,549 $19,940 $40,269 $39,034 Total Office

Properties 6,966 6,581 13,887 13,234 Total same property operating

income $27,515 $26,521 $54,156 $52,268 DATASOURCE: Saul Centers,

Inc. CONTACT: Scott V. Schneider of Saul Centers, Inc.,

+1-301-986-6220 Web site: http://www.saulcenters.com/

Copyright

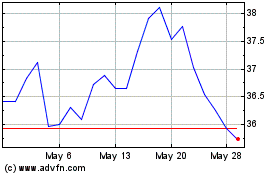

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

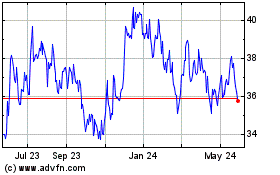

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024