BETHESDA, Md., Feb. 22 /PRNewswire-FirstCall/ -- Saul Centers, Inc.

(NYSE:BFS), an equity real estate investment trust (REIT),

announced its operating results for the quarter and year ended

December 31, 2006. Total revenue for the quarter ended December 31,

2006 increased 9.5% to $35,903,000 compared to $32,774,000 for the

2005 quarter. Operating income, defined as net income available to

common stockholders before minority interests and preferred stock

dividends, increased 12.8% to $10,988,000 for the 2006 quarter

compared to $9,740,000 for the comparable 2005 quarter. Net income

available to common stockholders was $6,855,000 or $0.39 per

diluted share for the 2006 quarter, a per share increase of 11.4%

compared to net income available to common stockholders of

$5,890,000 or $0.35 per diluted share for the 2005 quarter. For the

year ended December 31, 2006, total revenue increased 8.6% to

$137,978,000 compared to $127,015,000 for the 2005 year. Operating

income before minority interests and preferred stock dividends

increased 9.3% to $40,473,000 in 2006 compared to $37,025,000 in

2005. Net income available to common stockholders was $24,680,000

or $1.43 per diluted share in 2006, resulting in a per share

increase of 12.6% compared to net income available to common

stockholders of $21,227,000 or $1.27 per diluted share in 2005.

Successful leasing activity at several core shopping centers and

operating income from development properties produced the

significant portion of increased operating income for the 2006

quarter and year. Same property revenue for the total portfolio

increased 3.2% for the 2006 fourth quarter compared to the same

quarter in 2005 and same property operating income increased 4.4%.

The same property comparisons exclude the results of operations of

properties not in operation for each of the comparable reporting

periods. Same property operating income in the shopping center

portfolio increased 5.2% for the 2006 fourth quarter compared to

the prior year's quarter. Same property operating income in the

office portfolio grew 2.4% for the 2006 quarter. Same property

revenue for the total portfolio increased 4.3% for the 2006 year

compared to the 2005 year and same property operating income

increased 4.5%. Same property operating income in the shopping

center portfolio increased 6.0% from 2005 to 2006. Successful

leasing activity at several core shopping centers produced the

significant portion of increased shopping center operating income

for the 2006 quarter and year. Same property operating income in

the office portfolio grew 0.7% for the 2006 year. As of December

31, 2006, excluding development properties, 96.3% of the operating

portfolio was leased, compared to 97.1% a year earlier. The

company's significant development property, the 188,000 square foot

Lansdowne Towne Center, was 85.0% leased at year-end 2006. On a

same property basis, 96.7% of the portfolio was leased, compared to

the prior year level of 97.1%. The 2006 leasing percentages

decreased due to the departure of two local grocery anchors at the

Belvedere and West Park shopping centers totaling 59,000 square

feet. Funds From Operations (FFO) available to common shareholders

(after deducting preferred stock dividends) increased 13.0% to

$15,397,000 in the 2006 fourth quarter compared to $13,628,000 for

the same quarter in 2005. On a diluted per share basis, FFO

available to common shareholders increased 9.8% to $0.67 per share

in 2006 compared to $0.61 per share for the 2005 quarter. FFO, a

widely accepted non-GAAP financial measure of operating performance

for real estate investment trusts, is defined as net income plus

minority interests, extraordinary items and real estate

depreciation and amortization, excluding gains and losses from

property sales. FFO available to common shareholders for the 2006

year increased 9.2% to $58,121,000 compared to $53,222,000 in 2005.

Diluted per share FFO available to common shareholders increased

6.2% to $2.57 per share in 2006 compared to $2.42 per share for the

2005 year. During the 2005 year, the Company included $1,555,000

($0.07 per diluted share) in FFO due to the resolution of a land

use dispute with a property owner adjacent to Lexington Mall. FFO

increased in the 2006 quarter and 2006 year, despite the impact of

the one-time Lexington Mall land use settlement included in the

prior year period, due to increased operating income from

successful leasing activity at several core shopping centers and

operating income from new developments. During 2006, the Company

paid four quarterly dividends to its common stockholders totaling

$1.68 per share, compared to $1.60 paid per share in 2005. On

January 31, 2007, the Company paid a quarterly dividend of $0.42

per share to its common stockholders. Also during 2006, the Company

acquired two grocery anchored shopping centers, Hunt Club Corners

and Smallwood Village Center, totaling 299,000 square feet, and

developed two neighborhood shopping centers, Lansdowne Towne Center

and Broadlands Village III, totaling 211,000 square feet. Saul

Centers is a self-managed, self-administered equity real estate

investment trust headquartered in Bethesda, Maryland. Saul Centers

currently operates and manages a real estate portfolio of 47

community and neighborhood shopping center and office properties

totaling approximately 7.9 million square feet of leasable area.

Over 80% of the Company's property operating income is generated

from properties in the metropolitan Washington, DC/Baltimore area.

Saul Centers, Inc. Condensed Consolidated Balance Sheets ($ in

thousands) December 31, December 31, 2006 2005 Assets (Unaudited)

Real estate investments Land $154,047 $139,421 Buildings and

equipment 631,797 575,504 Construction in progress 56,017 47,868

841,861 762,793 Accumulated depreciation (214,210) (195,376)

627,651 567,417 Cash and cash equivalents 8,061 8,007 Accounts

receivable and accrued income, net 33,248 23,410 Deferred leasing

costs, net 18,137 19,834 Prepaid expenses, net 2,507 2,540 Deferred

debt costs, net 5,328 5,875 Other assets 5,605 4,386 Total assets

$700,537 $631,469 Liabilities Mortgage notes payable $487,443

$471,931 Revolving credit facility 35,000 10,500 Dividends and

distributions payable 11,558 11,319 Accounts payable, accrued

expenses and other liabilities 16,409 13,679 Deferred income 12,251

9,558 Total liabilities 562,661 516,987 Minority Interests 5,785

3,068 Stockholders' Equity Preferred stock 100,000 100,000 Common

stock 173 169 Additional paid in capital 141,554 123,339

Accumulated deficit (109,636) (112,094) Total stockholders' equity

132,091 111,414 Total liabilities and stockholders' equity $700,537

$631,469 Saul Centers, Inc. Condensed Consolidated Statements of

Operations (In thousands, except per share amounts) Three Months

Ended Years Ended December 31, December 31, 2006 2005 2006 2005

Revenue (Unaudited) (Unaudited) Base rent $28,295 $25,784 $110,121

$99,448 Expense recoveries 5,914 5,343 22,636 20,027 Percentage

rent 843 639 1,767 2,057 Other 851 1,008 3,454 5,483 Total revenue

35,903 32,774 137,978 127,015 Operating Expenses Property operating

expenses 4,083 4,031 16,278 14,724 Provision for credit losses 98

54 400 237 Real estate taxes 3,328 2,870 12,503 11,040 Interest

expense and amortization of deferred debt 8,298 7,658 32,534 30,207

Depreciation and amortization of leasing costs 6,409 5,888 25,648

24,197 General and administrative 2,699 2,533 10,142 9,585 Total

operating expenses 24,915 23,034 97,505 89,990 Operating Income

10,988 9,740 40,473 37,025 Minority Interests (2,133) (1,850)

(7,793) (7,798) Net Income 8,855 7,890 32,680 29,227 Preferred

Dividends (2,000) (2,000) (8,000) (8,000) Net Income Available to

Common Stockholders $6,855 $5,890 $24,680 $21,227 Per Share Net

Income Available to Common Stockholders: Diluted $0.39 $0.35 $1.43

$1.27 Weighted Average Common Stock Outstanding: Common stock

17,278 16,840 17,075 16,663 Effect of dilutive options 199 119 158

107 Diluted weighted average common stock 17,477 16,959 17,233

16,770 Saul Centers, Inc. Supplemental Information (In thousands,

except per share amounts) Three Months Ended Years Ended December

31, December 31, 2006 2005 2006 2005 Reconciliation of Net Income

to Funds From Operations (FFO)(1) (Unaudited) (Unaudited) Net

Income $8,855 $7,890 $32,680 $29,227 Add: Real property

depreciation & amortization 6,409 5,888 25,648 24,197 Add:

Minority interests 2,133 1,850 7,793 7,798 FFO 17,397 15,628 66,121

61,222 Less: Preferred dividends (2,000) (2,000) (8,000) (8,000)

FFO available to common shareholders $15,397 $13,628 $58,121

$53,222 Weighted Average Shares Outstanding: Diluted weighted

average common stock 17,477 16,959 17,233 16,770 Convertible

limited partnership units 5,416 5,291 5,395 5,233 Diluted &

converted weighted average shares 22,893 22,250 22,628 22,003 Per

Share Amounts: FFO available to common shareholders $0.67 $0.61

$2.57 $2.42 Reconciliation of Net Income to Same Property Operating

Income Net Income $8,855 $7,890 $32,680 $29,227 Add: Interest

expense and amortization of deferred debt 8,298 7,658 32,534 30,207

Add: Depreciation and amortization of leasing costs 6,409 5,888

25,648 24,197 Add: General and administrative 2,699 2,533 10,142

9,585 Less: Interest income (114) (140) (334) (661) Add: Minority

interests 2,133 1,850 7,793 7,798 Property operating income 28,280

25,679 108,463 100,353 Less: Acquisitions & developments

(1,779) (304) (7,523) (1,828) Less: Lexington property operating

income - - (20) (1,966) Total same property operating income

$26,501 $25,375 $100,920 $96,559 Total Shopping Centers $19,493

$18,532 $73,745 $69,577 Total Office Properties 7,008 6,843 27,175

26,982 Total same property operating income $26,501 $25,375

$100,920 $96,559 (1) The National Association of Real Estate

Investment Trusts (NAREIT) developed FFO as a relative non-GAAP

financial measure of performance of an equity REIT in order to

recognize that income-producing real estate historically has not

depreciated on the basis determined under GAAP. FFO is defined by

NAREIT as net income, computed in accordance with GAAP, plus

minority interests, extraordinary items and real estate

depreciation and amortization, excluding gains or losses from

property sales. FFO does not represent cash generated from

operating activities in accordance with GAAP and is not necessarily

indicative of cash available to fund cash needs, which is disclosed

in the Company's Consolidated Statements of Cash Flows for the

applicable periods. There are no material legal or functional

restrictions on the use of FFO. FFO should not be considered as an

alternative to net income, its most directly comparable GAAP

measure, as a indicator of the Company's operating performance, or

as an alternative to cash flows as a measure of liquidity.

Management considers FFO a meaningful supplemental measure of

operating performance because it primarily excludes the assumption

that the value of the real estate assets diminishes predictably

over time (i.e. depreciation), which is contrary to what we believe

occurs with our assets, and because industry analysts have accepted

it as a performance measure. FFO may not be comparable to similarly

titled measures employed by other REITs. DATASOURCE: Saul Centers,

Inc. CONTACT: Scott V. Schneider of Saul Centers, Inc.,

+1-301-986-6220 Web site: http://www.saulcenters.com/

Copyright

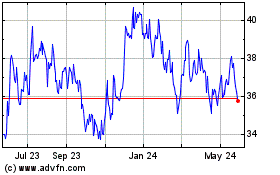

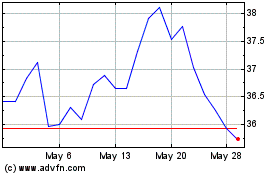

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024