BETHESDA, Md., April 26 /PRNewswire-FirstCall/ -- Saul Centers,

Inc. (NYSE:BFS), an equity real estate investment trust (REIT),

announced its operating results for the quarter ended March 31,

2006. Total revenues for the quarter ended March 31, 2006 increased

10.4% to $33,467,000 compared to $30,307,000 for the 2005 quarter.

Operating income, defined as net income available to common

stockholders before minority interests and preferred stock

dividends, increased 10.1% to $9,509,000 compared to $8,639,000 for

the comparable 2005 quarter. Net income available to common

stockholders was $5,707,000 or $0.33 per diluted share for the 2006

quarter, a per share increase of 17.9% compared to net income

available to common stockholders of $4,610,000 or $0.28 per diluted

share for the 2005 quarter. Successful leasing activity at several

core shopping centers and operating income from developments

completed during the trailing twelve months produced the

significant portion of increased operating income for the 2006

first quarter. Same property revenues for the total portfolio

increased 4.5% for the 2006 first quarter compared to the same

quarter in 2005 and same property operating income increased 4.6%.

Same property operating income in the shopping center portfolio

increased 6.4% for the 2006 first quarter compared to the prior

year's quarter. Same property operating income in the office

portfolio was unchanged for the 2006 quarter. Successful leasing

activity at several core shopping centers was the primary

contributor to the improvement in same property results. The same

property comparisons exclude the results of operations of

properties not in operation for each of the comparable reporting

periods. Additionally, Lexington Mall results are not included in

same property performance due to the planned redevelopment of the

center. Property operating income is calculated as total property

revenue less property operating expenses, provision for credit

losses and real estate taxes. As of March 31, 2006, 96.8% of the

operating portfolio was leased, compared to 92.4% a year earlier.

The 2005 leasing percentage was adversely impacted by 133,000

square feet of vacant space in the Lexington Mall which the Company

was not leasing in anticipation of redeveloping the shopping

center. Since September 30, 2005, the Company has been actively

planning the redevelopment of the property and has taken the space

out of service. On a same property basis, 96.8% of the portfolio

was leased, compared to the prior year level of 93.9%. The increase

in 2006 leasing percentage resulted from the lease-up of space at

Great Eastern Plaza, Southside Plaza and Olde Forte Village and to

a lesser extent, improved leasing at several other properties.

Funds From Operations (FFO) available to common shareholders (after

deducting preferred stock dividends) increased 13.3% to $13,885,000

in the 2006 first quarter compared to $12,254,000 for the same

quarter in 2005. The $1,631,000 increase in FFO available to common

shareholders in the 2006 quarter resulted primarily from increased

operating income from successful leasing activity at several core

shopping centers and operating income from new developments. On a

diluted per share basis, FFO available to common shareholders

increased 10.7% to $0.62 per share in 2006 compared to $0.56 for

the 2005 quarter. FFO, a widely accepted non-GAAP financial measure

of operating performance for real estate investment trusts, is

defined as net income plus minority interests, extraordinary items

and real estate depreciation and amortization, excluding gains and

losses from property sales. Saul Centers is a self-managed,

self-administered equity real estate investment trust headquartered

in Bethesda, Maryland. Saul Centers currently operates and manages

a real estate portfolio of 45 community and neighborhood shopping

center and office properties totaling approximately 7.6 million

square feet of leasable area. Over 80% of the Company's cash flow

is generated from properties in the metropolitan Washington,

DC/Baltimore area. Saul Centers, Inc. Condensed Consolidated

Balance Sheets ($ in thousands) March 31, December 31, 2006 2005

Assets (Unaudited) Real estate investments Land $145,760 $139,421

Buildings 595,728 575,504 Construction in progress 50,376 47,868

791,864 762,793 Accumulated depreciation (200,267) (195,376)

591,597 567,417 Cash and cash equivalents 7,754 8,007 Accounts

receivable and accrued income, net 23,505 23,410 Lease acquisition

costs, net 20,212 19,834 Prepaid expenses 2,293 2,540 Deferred debt

costs, net 5,916 5,875 Other assets 6,918 4,386 Total assets

$658,195 $631,469 Liabilities Mortgage notes payable $490,519

$471,931 Revolving credit facility 10,500 10,500 Dividends and

distributions payable 11,379 11,319 Accounts payable, accrued

expenses and other liabilities 17,818 13,679 Deferred income 10,601

9,558 Total liabilities 540,817 516,987 Minority Interests 4,606

3,068 Stockholders' Equity Preferred stock 100,000 100,000 Common

stock 170 169 Additional paid in capital 126,115 123,339

Accumulated deficit (113,513) (112,094) Total stockholders' equity

112,772 111,414 Total liabilities and stockholders' equity $658,195

$631,469 Saul Centers, Inc. Condensed Consolidated Statements of

Operations (In thousands, except per share amounts) Three Months

Ended March 31, 2006 2005 Revenue (Unaudited) Base rent $26,900

$24,132 Expense recoveries 5,513 4,980 Percentage rent 326 504

Other 728 691 Total revenue 33,467 30,307 Operating Expenses

Property operating expenses 3,968 3,773 Provision for credit losses

80 54 Real estate taxes 3,052 2,583 Interest expense and deferred

debt amortization 8,019 7,409 Depreciation and amortization 6,376

5,615 General and administrative 2,463 2,234 Total operating

expenses 23,958 21,668 Operating Income 9,509 8,639 Minority

Interests (1,802) (2,029) Net Income 7,707 6,610 Preferred

Dividends (2,000) (2,000) Net Income Available to Common

Stockholders $5,707 $4,610 Per Share Net Income Available to Common

Stockholders: Basic $0.34 $0.28 Diluted $0.33 $0.28 Weighted

Average Common Stock Outstanding: Common stock 16,911 16,468 Effect

of dilutive options 152 89 Diluted weighted average common stock

17,063 16,557 Saul Centers, Inc. Supplemental Information (In

thousands, except per share amounts) Three Months Ended March 31,

2006 2005 Reconciliation of Net Income to (Unaudited) Funds From

Operations (FFO) (1) Net Income $7,707 $6,610 Add: Real property

depreciation & amortization 6,376 5,615 Add: Minority interests

1,802 2,029 FFO 15,885 14,254 Less: Preferred dividends (2,000)

(2,000) FFO available to common shareholders $13,885 $12,254

Weighted Average Shares Outstanding: Diluted weighted average

common stock 17,063 16,557 Convertible limited partnership units

5,347 5,201 Diluted & converted weighted average shares 22,410

21,758 Per Share Amounts: FFO available to common shareholders

$0.62 $0.56 Reconciliation of Net Income to Same Property Operating

Income Net Income $7,707 $6,610 Add: Interest expense and deferred

debt amortization 8,019 7,409 Add: Depreciation and amortization

6,376 5,615 Add: General and administrative 2,463 2,234 Less:

Interest income (67) (140) Add: Minority interests 1,802 2,029

Property operating income 26,300 23,757 Less: Acquisitions &

developments (1,584) (95) Less: Lexington Mall (19) (56) Total same

property operating income $24,697 $23,606 Total Shopping Centers

$18,045 $16,958 Total Office Properties 6,652 6,648 Total same

property operating income $24,697 $23,606 (1) FFO is a widely

accepted non-GAAP financial measure of operating performance of

real estate investment trusts ("REITs"). FFO is defined by the

National Association of Real Estate Investment Trusts as net

income, computed in accordance with GAAP, plus minority interests,

extraordinary items and real estate depreciation and amortization,

excluding gains or losses from property sales. FFO does not

represent cash generated from operating activities in accordance

with GAAP and is not necessarily indicative of cash available to

fund cash needs, which is disclosed in the Consolidated Statements

of Cash Flows in the Company's SEC reports for the applicable

periods. FFO should not be considered as an alternative to net

income, its most directly comparable GAAP measure, as an indicator

of the Company's operating performance, or as an alternative to

cash flows as a measure of liquidity. Management considers FFO a

supplemental measure of operating performance and along with cash

flow from operating activities, financing activities and investing

activities, it provides investors with an indication of the ability

of the Company to incur and service debt, to make capital

expenditures and to fund other cash needs. FFO may not be

comparable to similarly titled measures employed by other REITs.

DATASOURCE: Saul Centers, Inc. CONTACT: Scott V. Schneider of Saul

Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

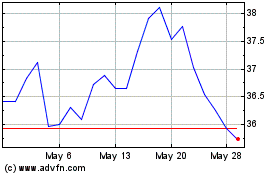

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

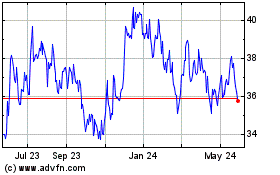

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024