BETHESDA, Md., Nov. 8 /PRNewswire-FirstCall/ -- Saul Centers, Inc.

(NYSE:BFS), an equity real estate investment trust, announced its

third quarter 2005 operating results. Total revenue for the quarter

ended September 30, 2005 increased 14.2% to $33,182,000 compared to

$29,044,000 for the 2004 quarter. Third quarter 2005 revenue

included $1,801,000 related to resolution of a land use dispute

with a property owner adjacent to its Lexington Mall. The

resolution of the land dispute, together with the recapture of the

Dillard's store space provides the Company favorable alternatives

for redeveloping the shopping center. Operating income before

minority interests, real estate sale gains and preferred stock

dividends increased 10.2% to $9,694,000 compared to $8,793,000 for

the comparable 2004 quarter. After minority interests, real estate

sale gains and preferred stock dividends, the Company reported net

income available to common stockholders of $5,856,000 or $0.35 per

share (basic & diluted) for the 2005 quarter, a per share

increase of 6.1% compared to net income available to common

stockholders of $5,355,000 or $0.33 per share (basic & diluted)

for the 2004 quarter. As a result of the recent developments

related to Lexington Mall, the Company increased depreciation

expense by $1,515,000 representing a one-time charge related to the

shortened useful life of vacant buildings at the property,

exclusive of the Dillard's space. The Company also increased

general and administrative expenses by $246,000 for the write-off

of abandoned redevelopment costs associated with pre-settlement

land use plans. During the 2004 quarter the Company recorded a

$572,000 property sale gain resulting from the State of Maryland's

condemnation of a small strip of unimproved land for road widening

at the White Oak shopping center. Overall same property revenue for

the total portfolio increased 2.0% for the 2005 third quarter

compared to the same quarter in 2004 and same property operating

income increased 0.9%. The same property comparisons exclude the

results of operations of properties not in operation for each of

the comparable reporting periods. The Lexington Mall results are

not included in same property performance. Property operating

income is calculated as total property revenue less property

operating expenses, provision for credit losses and real estate

taxes. Same center property operating income in the shopping center

portfolio increased 1.6% for the 2005 third quarter, compared to

the prior year's quarter. Same property operating income in the

office portfolio decreased 1.0% for the 2005 quarter. For the nine

month period ended September 30, 2005, total revenue increased

13.2% to $94,241,000 compared to $83,273,000 for the 2004 period.

Operating income before minority interests, real estate sale gains

and preferred stock dividends increased 7.2% to $27,285,000

compared to $25,451,000 for the comparable 2004 period. Net income

available to common stockholders was $15,337,000 or $0.92 per share

(basic & diluted) for the 2005 period, a per share increase of

7.0% (diluted) compared to net income available to common

stockholders of $13,946,000 or $0.87 per share (basic) and $0.86

per share (diluted) for the 2004 period. Overall same property

revenue for the total portfolio increased 3.2% for the 2005 nine

month period compared to the same period in 2004 and same property

operating income increased 2.0%. The shopping center portfolio same

center operating income increased 2.2% and the office portfolio

grew 1.5%. As of September 30, 2005, 97.2% of the operating

portfolio was leased, compared to 94.2% a year earlier. The 2004

leasing percentage was adversely impacted by 133,000 square feet of

vacant space in the Lexington Mall which the Company had not leased

in anticipation of redeveloping the shopping center. As of

September 30, 2005, the Company has been actively planning the

redevelopment of the property and has taken the space out of

service. On a same property basis, 97.0% of the portfolio was

leased, compared to the prior year level of 95.9%. The increase in

2005 leasing percentage resulted from the lease-up of space at Olde

Forte and Southside Plaza and to a lesser extent, the full lease-up

of Washington Square. Funds From Operations (FFO) available to

common shareholders (after deducting preferred stock dividends)

increased 20.7% to $14,856,000 in the 2005 third quarter compared

to $12,304,000 for the same quarter in 2004. FFO, a widely accepted

non-GAAP financial measure of operating performance for real estate

investment trusts, is defined as net income, plus minority

interests, extraordinary items and real estate depreciation and

amortization, excluding gains and losses from property sales. The

$2,552,000 increase in FFO available to common shareholders in the

2005 quarter resulted primarily from the combination of (1) the

resolution of the Lexington Mall land use dispute and (2) increased

operating income from retail acquisition and development

properties. On a diluted per share basis, FFO available to common

shareholders increased 17.5% to $0.67 per share in 2005 compared to

$0.57 per share for the 2004 quarter. FFO available to common

shareholders for the 2005 nine month period increased 13.3% to

$39,594,000 from $34,947,000 during the 2004 period. Diluted per

share FFO available to common shareholders increased 9.8% to $1.80

per share in 2005 compared to $1.64 per share for the 2004 period.

FFO available to common shareholders before the Lexington Mall

impact was $13,301,000 or $0.60 per share (basic & diluted) for

the 2005 quarter and $38,039,000 or $1.74 per share (basic &

diluted) for the nine months ended September 30, 2005. On October

31, 2005, Saul Centers paid a quarterly dividend of $0.42 per share

on its common stock, representing a $0.02 per share increase (5.0%)

over the prior quarter's dividend and an annualized dividend rate

of $1.68 per share. Saul Centers is a self-managed,

self-administered equity real estate investment trust headquartered

in Bethesda, Maryland. Saul Centers currently operates and manages

a real estate portfolio of 42 community and neighborhood shopping

center and office properties totaling approximately 7.3 million

square feet of leaseable area. Over 80% of the Company's cash flow

is generated from properties in the metropolitan Washington,

DC/Baltimore area. Saul Centers, Inc. Condensed Consolidated

Balance Sheets ($ in thousands) September 30, December 31, 2005

2004 Assets (Unaudited) Real estate investments Land $124,915

$119,029 Buildings 534,872 521,161 Construction in progress 57,380

42,618 717,167 682,808 Accumulated depreciation (191,699) (181,420)

525,468 501,388 Cash and cash equivalents 27,344 33,561 Accounts

receivable and accrued income, net 22,448 20,654 Lease acquisition

costs, net 17,031 17,745 Prepaid expenses 3,704 2,421 Deferred debt

costs, net 5,930 5,011 Other assets 3,337 2,616 Total assets

$605,262 $583,396 Liabilities Mortgage notes payable $461,416

$453,646 Dividends and distributions payable 11,247 10,424 Accounts

payable, accrued expenses and other liabilities 13,985 12,318

Deferred income 8,427 6,044 Total liabilities 495,075 482,432

Minority Interests 1,484 - Stockholders' Equity Preferred stock

100,000 100,000 Common stock 168 164 Additional paid in capital

119,429 106,886 Accumulated deficit (110,894) (106,086) Total

stockholders' equity 108,703 100,964 Total liabilities and

stockholders' equity $605,262 $583,396 Saul Centers, Inc. Condensed

Consolidated Statements of Operations (In thousands, except per

share amounts) Three Months Ended Nine Months Ended September 30,

September 30, 2005 2004 2005 2004 Revenue (Unaudited) (Unaudited)

Base rent $25,023 $23,324 $73,664 $67,351 Expense Recoveries 5,004

4,448 14,684 12,360 Percentage Rent 407 440 1,418 1,144 Other 2,748

832 4,475 2,418 Total revenue 33,182 29,044 94,241 83,273 Operating

Expenses Property operating expenses 3,437 3,186 10,693 8,948

Provision for credit losses 50 131 183 299 Real estate taxes 2,830

2,325 8,170 7,204 Interest expense and deferred debt amortization

7,525 7,008 22,549 19,908 Depreciation and amortization 7,162 5,511

18,309 15,496 General and administrative 2,484 2,090 7,052 5,967

Total operating expenses 23,488 20,251 66,956 57,822 Operating

Income 9,694 8,793 27,285 25,451 Gain on Property Disposition - 572

- 572 Minority Interests (1,838) (2,010) (5,948) (6,077) Net Income

7,856 7,355 21,337 19,946 Preferred Dividends (2,000) (2,000)

(6,000) (6,000) Net Income Available to Common Stockholders $5,856

$5,355 $15,337 $13,946 Per Share Net Income Available to Common

Stockholders: Basic $0.35 $0.33 $0.92 $0.87 Diluted $0.35 $0.33

$0.92 $0.86 Weighted Average Common Stock Outstanding: Common stock

16,733 16,227 16,604 16,088 Effect of dilutive options 127 68 103

42 Diluted weighted average common stock 16,860 16,295 16,707

16,130 Saul Centers, Inc. Supplemental Information (In thousands,

except per share amounts) Three Months Ended Nine Months Ended

September 30, September 30, 2005 2004 2005 2004 (Unaudited)

(Unaudited) Reconciliation of Net Income to Funds From Operations

(FFO)(1) Net Income $7,856 $7,355 $21,337 $19,946 Less: Gain on

sale of property - (572) - (572) Add: Real property depreciation

amortization 7,162 5,511 18,309 15,496 Add: Minority interests

1,838 2,010 5,948 6,077 FFO 16,856 14,304 45,594 40,947 Less:

Preferred dividends (2,000) (2,000) (6,000) (6,000) FFO available

to common shareholders $14,856 $12,304 $39,594 $34,947 Weighted

Average Shares Outstanding: Diluted weighted average common stock

16,860 16,295 16,707 16,130 Convertible limited partnership units

5,236 5,196 5,214 5,193 Diluted & converted weighted average

shares 22,096 21,491 21,921 21,323 Per Share Amounts: FFO available

to common shareholders $0.67 $0.57 $1.80 $1.64 Reconciliation of

Net Income to Same Property Operating Income Net Income $7,856

$7,355 $21,337 $19,946 Add: Interest expense and deferred debt

amortization 7,525 7,008 22,549 19,908 Add: Depreciation and

amortization 7,162 5,511 18,309 15,496 Add: General and

administrative 2,484 2,090 7,052 5,967 Less: Gain on property

disposition - (572) - (572) Less: Interest income (224) (70) (521)

(176) Add: Minority interests 1,838 2,010 5,948 6,077 Property

operating income 26,641 23,332 74,674 66,646 Less: Acquisitions

& developments (1,280) - (8,869) (3,953) Less: Lexington

property operating income (1,846) (20) (1,926) (77) Total same

property operating income $23,515 $23,312 $63,879 $62,616 Total

Shopping Centers $16,758 $16,487 $43,740 $42,784 Total Office

Properties 6,757 6,825 20,139 19,832 Total same property operating

income $23,515 $23,312 $63,879 $62,616 (1) FFO is a widely accepted

non-GAAP financial measure of operating performance of real estate

investment trusts ("REITs"). FFO is defined by the National

Association of Real Estate Investment Trusts as net income,

computed in accordance with GAAP, plus minority interests,

extraordinary items and real estate depreciation and amortization,

excluding gains or losses from property sales. FFO does not

represent cash generated from operating activities in accordance

with GAAP and is not necessarily indicative of cash available to

fund cash needs, which is disclosed in the Consolidated Statements

of Cash Flows in the Company's SEC reports for the applicable

periods. FFO should not be considered as an alternative to net

income, its most directly comparable GAAP measure, as an indicator

of the Company's operating performance, or as an alternative to

cash flows as a measure of liquidity. Management considers FFO a

supplemental measure of operating performance and along with cash

flow from operating activities, financing activities and investing

activities, it provides investors with an indication of the ability

of the Company to incur and service debt, to make capital

expenditures and to fund other cash needs. FFO may not be

comparable to similarly titled measures employed by other REITs.

DATASOURCE: Saul Centers, Inc. CONTACT: Scott V. Schneider of Saul

Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

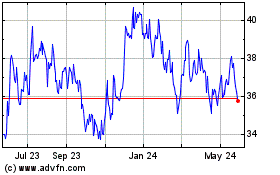

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

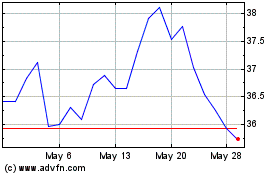

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024