Sasol 1st Half Revenue Fell on Lower Sales Volumes; Cuts Fiscal Year 2023 Mining Guidance

January 24 2023 - 1:47AM

Dow Jones News

By Anthony O. Goriainoff

Sasol Ltd. said Tuesday that revenue for the first half of

fiscal 2023 fell on year, and that it was cutting its mining

guidance to reflect current performance levels pending improvement

amid pricing and demand volatility.

The South African chemicals-and-energy group said that this

stemmed from the volatile global macro economic environment as well

as the potential for continuing disruption from utility company

Eskom and logistics operator Transnet on its suppliers and

customers.

The company generated revenue for the half year ended Dec. 31 of

$4.76 billion compared with $4.86 billion for the first half of

fiscal 2022. The company said this was driven by a 5% fall in sales

volumes in the period due mostly to lower Eurasia volumes offset by

higher sales volumes in America.

The company said mining guidance was in the 900 tons to 1,000

tons per continuous miner per shift range, down from a previous

guidance of 950 tons to 1,050 tons per continuous miner per

shift.

Sasol said this downward revision didn't affect its production

guidance for Secunda Operations or Chemicals Africa.

"Sasol remains well positioned in the current oil price and

refining margin environment, despite the negative impact from the

weaker global economic growth, disrupted supply chains, depressed

chemicals prices and higher feedstock and energy costs," the

company said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

January 24, 2023 01:32 ET (06:32 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

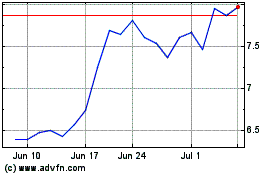

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2024 to May 2024

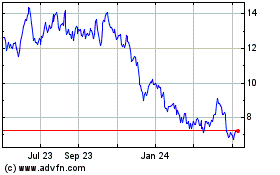

Sasol (NYSE:SSL)

Historical Stock Chart

From May 2023 to May 2024