Satyam Recovery Taking Shape

February 21 2009 - 3:01PM

PR Newswire (US)

- Consulting and IT leader has signed deals worth more than $250

million since Jan. 7 HYDERABAD, India, Feb. 21 /PRNewswire/ --

Satyam Computer Services Limited (NYSE:SAY), a leading global

consulting and information technology services provider, today

announced that its recovery is proceeding very well, and that

efforts to restore stakeholder confidence and ensure business

continuity have been extremely successful. "The board is satisfied

with the progress of the company's stabilization program and

appreciates the sustained efforts of the company's associates, who

have placed its revival on a fast track," said Kiran Karnik,

chairman of Satyam's board of directors. Associates' commitment to

client service and indomitable team spirit have done more than keep

customers from leaving Satyam after the company's accounting

crisis, which came to light Jan. 7. In fact, since that day,

"associates' dedication and the tireless efforts of the board have

helped Satyam win new purchase orders and extensions totaling more

than $250 million," said Satyam Chief Executive Officer A.S. Murty.

The contract wins include a $50 million project, plus numerous

others representing a broad range of industries, technologies and

geographies. "These wins reflect a positive trend," Murty said.

"More than half of this value comes from new purchase orders. That

fact reinforces the confidence customers have expressed to us

during our frequent discussions with them." Satyam also announced

that on Saturday, its board met for the seventh time since Jan. 10.

In addition to other key developments, it established a process for

potential strategic investors, and will seek regulatory approvals

early next week. Should the government consent, the board will

announce the specific process potential investors must follow.

Additionally, the board: -- Formally indicated to the Indian

Ministry of Corporate Affairs that it intends to remove

Pricewaterhouse Coopers (PWC) as statutory auditors. PWC has also

been notified, and resigned from the role. The board will soon

appoint new statutory auditors. -- Authorized Murty to complete and

implement a plan to retain key associates and endorsed plans

already under way to reduce expenses and optimize profits. --

Explained how it is using its recent infusion of $130 million. "It

is being used to meet immediate and near-term operating

requirements, including payments to vendors," said Board Member

T.N. Manoharan. "Furthermore, we are now receiving unsolicited

offers from banks for additional funding." Special advisors to the

board Homi Khusrokhan and Partho Datta also attended the meeting,

as did Satyam's legal advisors and several BCG representatives.

About Satyam Satyam (NYSE:SAY), a leading global business and

information technology services company, delivers consulting,

systems integration, and outsourcing solutions to clients in

numerous industries across the globe. Satyam leverages deep

industry and functional expertise, leading technology practices,

and an advanced, global delivery model to help clients transform

their highest-value business processes and improve their business

performance. The company's professionals excel in engineering and

product development, supply chain management, client relationship

management, business process quality, business intelligence,

enterprise integration, and infrastructure management, among other

key capabilities. Satyam development and delivery centers in the

US, Canada, Brazil, the UK, Hungary, Egypt, UAE, India, China,

Malaysia, Singapore, and Australia serve numerous clients,

including many Fortune 500 organizations. For more information, see

http://www.satyam.com/. Safe Harbor This press release contains

forward-looking statements within the meaning of section 27A of

Securities Act of 1933, as amended, and section 21E of the

Securities Exchange Act of 1934, as amended. The forward-looking

statements contained herein are subject to certain risks and

uncertainties that could cause actual results to differ materially

from those reflected in the forward-looking statements. Satyam

undertakes no duty to update any forward-looking statements. For a

discussion of the risks associated with our business, please see

the discussions under the heading "Risk Factors" in our report on

Form 6-K concerning the quarter ended September 30, 2008, furnished

to the Securities and Exchange Commission on November 7, 2008, and

the other reports filed with the Securities and Exchange Commission

from time to time. These filings are available at

http://www.sec.gov/. DATASOURCE: Satyam Computer Services Limited

CONTACT: For clarifications, write to us at or contact our global

Satyam PR representatives: US, Jim Swords, , +1-703-877-2225, or

Europe, Sandeep Thawani, , +44-783-010-3838, or Asia-Pacific, Dan

Bleakman, , +61-439-408-484, or Reshma Wad Jan, , +65-98-140-507

Web Site: http://www.satyam.com/

Copyright

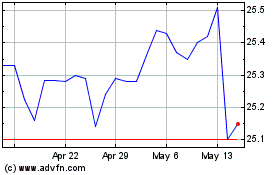

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

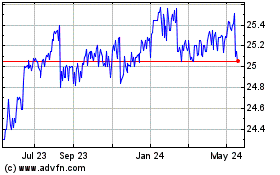

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Jul 2023 to Jul 2024