UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

salesforce.com, inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which the transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which the transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of the transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Salesforce Proxy Supplement May 2020

2020 Proxy Statement Highlights Continued

stockholder engagement on a year-round basis, engaging >50% of shares outstanding. New Fiscal Year in Review section summarizing the proxy highlights with financial performance, corporate responsibility initiatives, stockholder engagement, and

board and governance overview. Disclosure highlighting ISG Principles alignment in our corporate governance policies and practices. Expanded ESG Section representing our continued focus on ESG and efforts taken to advance disclosures in line with

our core values and align disclosures with SASB and TCFD recommendations. Request to increase shares authorized under the 2013 Equity Incentive Plan and the 2004 Employee Stock Purchase Plan. Enhanced PRSU Disclosure illustrating the outcome of

previously earned PRSUs and how the outstanding PRSUs are tracking.

Company Overview The global leader in

customer relationship management (CRM) technology Founded in 1999, public listing in 2004 (NYSE: CRM). Salesforce is the #1 CRM software provider worldwide by revenue for 7 consecutive years1 Fastest growing top five enterprise software company with

$17.1B in revenue in FY20 (~29% Y/Y). Doubled operating cash flow ($2.16B - $4.33B) over the past three years (FY17 – FY20) while doubling revenue ($8.4B - $17.1B). Headquartered in San Francisco, with a global presence of 49,000+ employees

focused on CRM. Integrated Philanthropy Model (1-1-1). Leader in Innovation Leader in Culture Leader in Philanthropy 1Source: IDC, Worldwide Semiannual Software Tracker, April 2020. CRM market includes the following IDC-defined functional markets:

Sales Force Productivity and Management, Marketing Campaign Management, Customer Service, Contact Center, Advertising, and Digital Commerce Applications.

Salesforce Customer 360 Trusted . Smart .

Flexible . Sustainable

FY20 Financial Results Consistent top-line

revenue and cash flow growth Revenue Operating Cash Flow 1 27% CAGR 26% CAGR (Fiscal years end on January 31 of the specified year) 1Non-GAAP operating margin excludes the effects of stock-based compensation and amortization of acquisition-related

intangibles. Refer to the Appendix for an explanation of non-GAAP financial measures, and why we believe these measures can be useful, as well as a reconciliation of non-GAAP financial measures to the most comparable GAAP measures.

Return to Stockholders Salesforce has a

track record of delivering significant total stockholder returns Five-Year Cumulative Total Return Nasdaq Computer: $257 S&P 500 Index: $162 Salesforce: $323 Nasdaq 100: $217 Total returns over 5 years based on an initial investment of $100.

Data for the Standard & Poor’s 500 Index, the Nasdaq Computer & Data Processing Index and the Nasdaq 100 Index assume reinvestment of dividends. The comparisons on the graph above are based upon historical data and are not indicative

of, nor intended to forecast, future performance of our stock.

Board of Directors Ongoing and proactive

board refreshment practices 11 Average tenure (years): 4 New directors since 2014: 6 Software Industry 4 Sales Distribution 7 International Experience 10 Public Company Board 5 Cloud Computing Technology 4 Marketing/Branding 4 Diversity 8

Entrepreneurship/VC 3 Government/Law/Military 7 Public or Large Company CEO/Executive 3 Finance/Accounting Diverse and Dynamic Experience Colin Powell Marc Benioff (CEO) Craig Conway Alan Hassenfeld Neelie Kroes Sanford Robertson (LID) John Roos

Susan Wojcicki Robin Washington Maynard Webb Parker Harris

Compensation Program Framework Align

executive compensation with the interests of our stockholders Base Salary Pay Component FY 2020 Metrics Rationale Provides compensation for day-to-day responsibilities for all employees Drives achievement of key annual corporate performance goals

Objective: Attract and retain the right talent to lead our Company in a dynamic, innovative and competitive environment Philosophy: Tie a significant portion of compensation to the performance of our common stock and other metrics of Company

performance Performance-Based Cash Bonus Revenue Operating Cash Flow Non-GAAP Income from Operations Establishes direct alignment with Company and stock price performance and the interests of stockholders Performance-Based Restricted Stock Units

Restricted Stock Units Stock Options Stock Price Stock Price Relative TSR Absolute TSR Relative TSR with absolute TSR payout cap N/A CEO LTI mix (~60% PRSUs and ~40% stock options) establishes even greater emphasis on Company performance

Seeking stockholder approval of 2013 Equity

Incentive Plan share pool increase of 31.5 million shares. The increased share pool is required to meet our forecasted needs. The proposed share increase is expected to last approximately one to two years. We operate in a highly competitive industry

and geographies for employee talent. Long-term equity continues to be a key component of our compensation program. Our Compensation Committee thoughtfully manages our equity incentive program to manage long-term stockholder dilution while also

attracting, rewarding and retaining employees. For example, our three-year average burn rate was 1.8% for fiscal years 2018 through 2020. Management Proposal: Amend 2013 Equity Incentive Plan The Board recommends a vote FOR amendment and restatement

of the 2013 Equity Incentive Plan to increase the number of shares authorized for issuance by 31.5 million shares.

Seeking stockholder approval of 2004

Employee Stock Purchase Plan share pool increase of 10 million shares. We operate in a highly competitive industry and geographies for employee talent. Our ESPP is an essential tool that helps us compete for talent in the labor markets in which we

operate. Our ESPP is a crucial element in rewarding and encouraging current employees by promoting stock ownership which in turn aligns their interests with those of our stockholders. Management Proposal: Amend 2004 ESPP The Board recommends a vote

FOR amendment and restatement of the 2004 Employee Stock Purchase Plan to increase the number of shares authorized for employee purchase by 10 million shares.

Protecting Our Planet FY20 highlights

continued commitment to creating a sustainable future for all Carbon and Energy Strategy Committed to achieve 100% renewable energy for our global operations by the end of fiscal 2022. In fiscal 2020, Salesforce procured electricity from renewable

energy resources equivalent to 63 percent of what we use globally. Global Collaboration and Initiatives Salesforce, along with a coalition of businesses and U.N. leaders, has pursued setting 1.5 degree science-based emissions reduction targets in

order to combat climate change. In January 2020, the World Economic Forum and certain partners, including Salesforce, launched 1t.org with a goal to conserve, restore and grow 1 trillion trees within this decade. Sustainability Cloud In fiscal 2020,

we launched Salesforce Sustainability Cloud, a carbon accounting product for businesses and governments to track and manage their greenhouse gas emissions. Salesforce Sustainability Cloud is a prebuilt solution that empowers businesses to quickly

track, analyze, and report reliable environmental data to help them reduce their carbon emissions. Company goals are aspirational and may change. Statements regarding Company’s goals are not guarantees or promises that they will be

met.

Empowering the Community We believe that

businesses can be powerful platforms for social change Philanthropy is core to Salesforce Pioneered the 1-1-1 model of integrated corporate philanthropy, dedicating 1% of Salesforce’s equity, 1% of employee time, and 1% of product to

communities around the world. To date, over 46,000 nonprofits and higher education use our technology, we’ve donated ~$330 million in grants and contributed more than 4.9 million hours of employee volunteering around the world. In fiscal 2020,

Salesforce.org officially became a part of Salesforce and is now a dedicated vertical within Salesforce focused on furthering these philanthropic efforts with the use of Salesforce’s platform. Enabling the workforce through Trailhead Our free

online learning platform, Trailhead, allows anyone to learn in-demand technology and business skills, earn resume-worthy credentials and connect to mentorship opportunities with the Trailblazer Community. To date, over 20 million badges have been

earned on Trailhead. Civic Engagement in line with our values Salesforce’s Government Affairs and Public Policy team works with policymakers and elected officials around the globe on issues that matter to our stakeholders. Salesforce is

nonpartisan in our work, and we support candidates and eligible organizations of any party who align with our core values.

COVID-19 Response Empowering our

workforce to stay healthy Protecting Our Workforce Proactively closed our offices around the world and provided allowances for employees to equip their home workspaces. Provided frequent communication and updates, including company-wide video calls

led by senior management and participation of Board members and guest experts in psychology and other medical fields. Launched a daily company-wide video program featuring physical and mental health experts and other informative and inspirational

speakers. Announced a 90-day pledge of no significant layoffs effective March 2020. Continued to pay our on-site service providers so that suppliers compensate their hourly employees who provide on-site services at our offices with their regular pay

for the time they otherwise would have worked.

COVID-19 Response Commitment to our

stakeholders, and putting our values into action Integrated Philanthropy Partnered with numerous local and national charities, including expanding our support to organizations like the Italian Red Cross, Madrid Food Bank, and the New York COVID-19

Emergency Fund. Continue to match employee donations to eligible organizations. Worked with government agencies, hospitals and relief organizations to help address the personal protective equipment shortage for medical personnel. Providing our

technology to companies to support their own philanthropic efforts. Innovation & Customer Support Salesforce Care Small Business Grants, supporting small businesses as they work to replenish materials, pay salaries, or adapt their business

models. Quip Starter, for customers and non-profits to help their teams collaborate while employees work away from the office. Tableau’s COVID-19 Data Hub, to help organizations around the world see and understand data about the pandemic in

near realtime. AppExchange COVID-19 Resource Center, a dedicated resource to support employee, customer, and community needs with applications built by partners and Salesforce Labs.

Fostering Employee Success Support our

values of trust, customer success, innovation and equality Creating a Culture of Equality Our diversity makes us stronger. As of October 31, 2019 approximately 44 percent of our U.S. workforce was made up of underrepresented groups. Our goal is to

increase this figure to 50 percent by 2023. To date, we have committed over $12 million to promote equal pay for equal work. Continued progress on workforce development Twice a year in our Employee Opinion Survey, we ask more than 60 questions

across eight factors: engagement, manager 101, ethics, wellbeing, senior leadership, innovation, job satisfaction, and psychological safety. The results of this survey has led to major company initiatives, such as our Camp B-Well Wellness Program

which provides resources, information, and support for employees who want to live well every day, in every way. Supporting employee wellness We are committed to supporting our employees’ and their families’ wellbeing by offering

flexible, competitive benefits, and through major life events. We also offer generous time off and leave programs to help rejuvenate our employees, including volunteer time off (VTO), our parental leave program, and other programs and benefits.

Operating with Integrity and Trust

Support our values of trust, customer success, innovation and equality Establish policies consistent with business ethics and corporate governance requirements A substantial majority of our board members are independent of Salesforce and its

management. Our Code of Conduct and Business Conduct Principles are both publicly available and describe the way we treat employees and key stakeholders and clearly communicate our values and expectations. Board oversees our ESG efforts Our Audit

Committee oversees cybersecurity matters and meets regularly with our Chief Trust Officer. Our Governance Committee oversees our ESG programs as set forth in its charter. The Privacy Committee oversees our privacy matters and meets regularly with

our Office of Ethical and Humane Use of Technology. Trust, Security, and Privacy We have made and will continue to make substantial investments in our cybersecurity programs. We believe that effective cybersecurity requires an ecosystem-wide

approach which is why we work with partners and stakeholders across the globe to support legislation and initiatives such as the Cybersecurity Tech Accord.

Forward-Looking Statements "Safe harbor"

statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements about the company's financial and operating results, which may include expected GAAP and non-GAAP financial and other

operating and non-operating results, including revenue, net income, diluted earnings per share, operating cash flow growth, operating margin improvement, expected revenue growth, expected current remaining performance obligation growth, expected tax

rates, stock-based compensation expenses, amortization of purchased intangibles, shares outstanding, market growth, environmental, social and governance goals and expected capital allocation, including mergers and acquisitions, capital expenditures

and other investments. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect,

the company’s results could differ materially from the results expressed or implied by the forward-looking statements it makes. The risks and uncertainties referred to above include -- but are not limited to -- risks associated with the effect

of general economic and market conditions; the impact of geopolitical events, natural disasters and actual or threatened public health emergencies, such as the ongoing Coronavirus pandemic; the impact of foreign currency exchange rate and interest

rate fluctuations on our results; our business strategy and our plan to build our business, including our strategy to be the leading provider of enterprise cloud computing applications and platforms; the pace of change and innovation in enterprise

cloud computing services; the seasonal nature of our sales cycles; the competitive nature of the market in which we participate; our international expansion strategy; the demands on our personnel and infrastructure resulting from significant growth

in our customer base and operations, including as a result of acquisitions; our service performance and security, including the resources and costs required to avoid unanticipated downtime and prevent, detect and remediate potential security

breaches; the expenses associated with our data centers and third-party infrastructure providers; additional data center capacity; real estate and office facilities space; our operating results and cash flows; new services and product features,

including any efforts to expand our services beyond the CRM market; our strategy of acquiring or making investments in complementary businesses, joint ventures, services, technologies and intellectual property rights; the performance and fair value

of our investments in complementary businesses through our strategic investment portfolio; our ability to realize the benefits from strategic partnerships, joint ventures and investments; the impact of future gains or losses from our strategic

investment portfolio, including gains or losses from overall market conditions that may affect the publicly traded companies within our strategic investment portfolio; our ability to execute our business plans; our ability to successfully integrate

acquired businesses and technologies; our ability to continue to grow unearned revenue and remaining performance obligation; our ability to protect our intellectual property rights; our ability to develop our brands; our reliance on third-party

hardware, software and platform providers; our dependency on the development and maintenance of the infrastructure of the Internet; the effect of evolving domestic and foreign government regulations, including those related to the provision of

services on the Internet, those related to accessing the Internet, and those addressing data privacy, cross-border data transfers and import and export controls; the valuation of our deferred tax assets and the release of related valuation

allowances; the potential availability of additional tax assets in the future; the impact of new accounting pronouncements and tax laws; uncertainties affecting our ability to estimate our tax rate; uncertainties regarding our tax obligations in

connection with potential jurisdictional transfers of intellectual property, including the tax rate, the timing of the transfer and the value of such transferred intellectual property; the impact of expensing stock options and other equity awards;

the sufficiency of our capital resources; factors related to our outstanding debt, revolving credit facility and loan associated with 50 Fremont; compliance with our debt covenants and lease obligations; current and potential litigation involving

us; and the impact of climate change. Further information on these and other factors that could affect the company’s financial results is included in the reports on Forms 10-K, 10-Q and 8-K and in other filings it makes with the Securities and

Exchange Commission from time to time. These documents are available on the SEC Filings section of the Investor Information section of the company’s website at www.salesforce.com/investor. Salesforce.com, inc. assumes no obligation and

does not intend to update these forward-looking statements, except as required by law.

Appendix Non-GAAP Financial Measures

Non-GAAP Financial Measures GAAP to

Non-GAAP Financial Reconciliation This presentation includes information about non-GAAP income from operations (“non-GAAP financial measures”). These non-GAAP financial measures are measurements of financial performance that are not

prepared in accordance with U.S. generally accepted accounting principles and computational methods may differ from those used by other companies. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for

comparable GAAP measures and should be read only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Management uses both GAAP and non-GAAP measures when planning, monitoring, and evaluating

the company’s performance. The primary purpose of using non-GAAP measures is to provide supplemental information that may prove useful to investors and to enable investors to evaluate the company’s results in the same way management

does. Management believes that supplementing GAAP disclosure with non-GAAP disclosure provides investors with a more complete view of the company’s operational performance and allows for meaningful period-to-period comparisons and analysis of

trends in the company’s business. Further, to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the company’s relative

performance against other companies that also report non-GAAP operating results. Non-GAAP Operating Margin is the proportion of non-GAAP income from operations as a percentage of GAAP revenue. Non-GAAP income from operations excludes the impact of

the following items: stock-based compensation, and amortization of acquisition-related intangibles. (in millions) Fiscal Year Ended January 31, Non-GAAP income from operations 2017 2018 2019 2020 GAAP income (loss) from operations $ 218 $ 454

$ 535 $ 297 Plus: Amortization of purchased intangibles 225 287 447 792 Stock-based expense 820 997 1,283 1,785 Non-GAAP income from operations $ 1,263 $ 1,738 $ 2,265 $

2,874 Revenue $ 8,347 $ 10,540 $ 13,282 $ 17,098 Non-GAAP Operating Margin 15.0% 16.5% 17.1% 16.8%

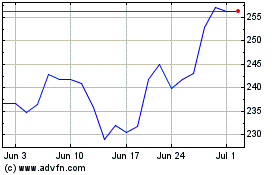

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024