Renasant Corporation (NYSE: RNST) (the “Company”) today announced

earnings results for the second quarter of 2024.

| (Dollars in thousands, except

earnings per share) |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

| Net income and

earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

38,846 |

|

$ |

39,409 |

|

$ |

28,643 |

|

|

$ |

78,255 |

|

$ |

74,721 |

|

|

After-tax loss on sale of securities |

|

— |

|

|

— |

|

|

(18,085 |

) |

|

|

— |

|

|

(17,870 |

) |

|

Basic EPS |

|

0.69 |

|

|

0.70 |

|

|

0.51 |

|

|

|

1.39 |

|

|

1.33 |

|

|

Diluted EPS |

|

0.69 |

|

|

0.70 |

|

|

0.51 |

|

|

|

1.38 |

|

|

1.33 |

|

|

Adjusted diluted EPS (Non-GAAP)(1) |

|

0.69 |

|

|

0.65 |

|

|

0.83 |

|

|

|

1.33 |

|

|

1.64 |

|

|

Impact to diluted EPS from after-tax loss on sale of securities

(including impairments) |

|

— |

|

|

— |

|

|

0.32 |

|

|

|

— |

|

|

0.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“The financial results for the quarter reflect

good performance and improved balance sheet strength,” remarked C.

Mitchell Waycaster, Chief Executive Officer of the Company. “As we

build capital, it enhances our ability to grow the company and

build upon these results.”

Quarterly Highlights

Earnings

- Net income for the second quarter

of 2024 was $38.8 million; diluted EPS and adjusted diluted

EPS (non-GAAP)(1) were each $0.69

- Net interest income (fully tax

equivalent) for the second quarter of 2024 was $127.6 million, up

$1.7 million on a linked quarter basis

- For the second quarter of 2024, net

interest margin was 3.31%, up 1 basis point on a linked quarter

basis

- Cost of total deposits was 2.47%

for the second quarter of 2024, up 12 basis points on a linked

quarter basis

- Noninterest income decreased $2.6

million on a linked quarter basis primarily due to a decrease in

mortgage banking income. During the first quarter of 2024, the

Company sold a portion of its mortgage servicing rights (“MSR”),

recognizing a gain of $3.5 million with no such sale in the second

quarter of 2024

- Mortgage banking income decreased

$1.7 million on a linked quarter basis. Excluding the gain

recognized in the first quarter on the sale of a portion of

Renasant's MSR, mortgage banking income increased $1.8 million on a

linked quarter basis. The mortgage division generated $0.6 billion

in interest rate lock volume in the second quarter of 2024, an

increase of $0.2 billion on a linked quarter basis. Gain on sale

margin was 1.69% for the second quarter of 2024, down 9 basis

points on a linked quarter basis.

- Noninterest expense decreased $0.9

million on a linked quarter basis. Excluding the effect of certain

charitable contributions and FDIC special assessment expense

incurred in the first quarter, noninterest expense increased

approximately $0.8 million on a linked quarter basis. Seasonality

in our mortgage division resulted in higher levels of expense

driven from increased volumes. These expenses were slightly offset

by savings in other areas

Balance Sheet

- Loans increased $104.2 million on a

linked quarter basis, representing 3.4% annualized net loan

growth

- Securities decreased $39.2 million

on a linked quarter basis due to net cash outflows during the

quarter of $43.1 million and a positive fair market value

adjustment in our available-for-sale portfolio of $3.9 million

- Deposits at June 30, 2024

increased $18.1 million on a linked quarter basis. Brokered

deposits decreased $183.7 million on a linked quarter basis to

$158.6 million at June 30, 2024. Noninterest bearing deposits

increased $23.3 million on a linked quarter basis and represented

24.8% of total deposits at June 30, 2024

Capital and Liquidity

- Book value per share and tangible

book value per share (non-GAAP)(1) increased 1.3% and 2.4%,

respectively, on a linked quarter basis

- The Company has a $100 million

stock repurchase program that is in effect through October 2024;

there was no buyback activity during the second quarter of

2024

Credit Quality

- The Company recorded a provision

for credit losses of $3.3 million for the second quarter of 2024,

compared to $2.4 million for the first quarter of 2024

- The ratio of allowance for credit

losses on loans to total loans was 1.59% at June 30, 2024

compared to 1.61% at March 31, 2024

- The coverage ratio, or the

allowance for credit losses on loans to nonperforming loans, was

203.88% at June 30, 2024, compared to 270.87% at

March 31, 2024

- Net loan charge-offs for the second

quarter of 2024 were $5.5 million, or 0.18% of average loans on an

annualized basis

- Nonperforming loans to total loans

increased to 0.78% at June 30, 2024 compared to 0.59% at

March 31, 2024, and criticized loans (which include classified

and special mention loans) to total loans decreased to 2.62% at

June 30, 2024, compared to 2.76% at March 31, 2024

Sale of Renasant Insurance

- Effective July 1, 2024, Renasant

sold the assets of its insurance agency for cash proceeds to

Renasant Bank of $56.4 million, recognizing an estimated after-tax

impact to earnings of $36.4 million, which is net of estimated

merger-related expenses. The financial effects of the sale will be

reflected in the third quarter of 2024

(1) This is a non-GAAP financial measure. A

reconciliation of all non-GAAP financial measures disclosed in this

release from GAAP to non-GAAP is included in the tables at the end

of this release. The information below under the heading “Non-GAAP

Financial Measures” explains why the Company believes the non-GAAP

financial measures in this release provide useful information and

describes the other purposes for which the Company uses non-GAAP

financial measures.

Income Statement

| (Dollars in thousands, except

per share data) |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

| Interest

income |

|

|

|

|

|

|

|

|

|

Loans held for investment |

$ |

198,397 |

|

$ |

192,390 |

|

$ |

188,535 |

$ |

181,129 |

|

$ |

173,198 |

|

|

$ |

390,787 |

|

$ |

334,985 |

|

|

Loans held for sale |

|

3,530 |

|

|

2,308 |

|

|

3,329 |

|

3,751 |

|

|

2,990 |

|

|

|

5,838 |

|

|

4,727 |

|

|

Securities |

|

10,410 |

|

|

10,700 |

|

|

10,728 |

|

10,669 |

|

|

14,000 |

|

|

|

21,110 |

|

|

29,091 |

|

|

Other |

|

7,874 |

|

|

7,781 |

|

|

7,839 |

|

10,128 |

|

|

6,978 |

|

|

|

15,655 |

|

|

12,408 |

|

| Total interest

income |

|

220,211 |

|

|

213,179 |

|

|

210,431 |

|

205,677 |

|

|

197,166 |

|

|

|

433,390 |

|

|

381,211 |

|

| Interest

expense |

|

|

|

|

|

|

|

|

|

Deposits |

|

87,621 |

|

|

82,613 |

|

|

77,168 |

|

70,906 |

|

|

51,391 |

|

|

|

170,234 |

|

|

84,257 |

|

|

Borrowings |

|

7,564 |

|

|

7,276 |

|

|

7,310 |

|

7,388 |

|

|

15,559 |

|

|

|

14,840 |

|

|

30,963 |

|

| Total interest

expense |

|

95,185 |

|

|

89,889 |

|

|

84,478 |

|

78,294 |

|

|

66,950 |

|

|

|

185,074 |

|

|

115,220 |

|

| Net interest

income |

|

125,026 |

|

|

123,290 |

|

|

125,953 |

|

127,383 |

|

|

130,216 |

|

|

|

248,316 |

|

|

265,991 |

|

| Provision for credit

losses |

|

|

|

|

|

|

|

|

|

Provision for loan losses |

|

4,300 |

|

|

2,638 |

|

|

2,518 |

|

5,315 |

|

|

3,000 |

|

|

|

6,938 |

|

|

10,960 |

|

|

Recovery of unfunded commitments |

|

(1,000 |

) |

|

(200 |

) |

|

— |

|

(700 |

) |

|

(1,000 |

) |

|

|

(1,200 |

) |

|

(2,500 |

) |

| Total provision for

credit losses |

|

3,300 |

|

|

2,438 |

|

|

2,518 |

|

4,615 |

|

|

2,000 |

|

|

|

5,738 |

|

|

8,460 |

|

| Net interest income

after provision for credit losses |

|

121,726 |

|

|

120,852 |

|

|

123,435 |

|

122,768 |

|

|

128,216 |

|

|

|

242,578 |

|

|

257,531 |

|

| Noninterest

income |

|

38,762 |

|

|

41,381 |

|

|

20,356 |

|

38,200 |

|

|

17,226 |

|

|

|

80,143 |

|

|

54,519 |

|

| Noninterest

expense |

|

111,976 |

|

|

112,912 |

|

|

111,880 |

|

108,369 |

|

|

110,165 |

|

|

|

224,888 |

|

|

219,373 |

|

| Income before income

taxes |

|

48,512 |

|

|

49,321 |

|

|

31,911 |

|

52,599 |

|

|

35,277 |

|

|

|

97,833 |

|

|

92,677 |

|

| Income

taxes |

|

9,666 |

|

|

9,912 |

|

|

3,787 |

|

10,766 |

|

|

6,634 |

|

|

|

19,578 |

|

|

17,956 |

|

| Net

income |

$ |

38,846 |

|

$ |

39,409 |

|

$ |

28,124 |

$ |

41,833 |

|

$ |

28,643 |

|

|

$ |

78,255 |

|

$ |

74,721 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted net income

(non-GAAP)(1) |

$ |

38,846 |

|

$ |

36,572 |

|

$ |

42,887 |

$ |

41,833 |

|

$ |

46,728 |

|

|

$ |

75,421 |

|

$ |

92,591 |

|

| Adjusted pre-provision net

revenue (“PPNR”) (non-GAAP)(1) |

$ |

51,812 |

|

$ |

48,231 |

|

$ |

52,614 |

$ |

57,214 |

|

$ |

59,715 |

|

|

$ |

100,043 |

|

$ |

123,575 |

|

| |

|

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

0.69 |

|

$ |

0.70 |

|

$ |

0.50 |

$ |

0.75 |

|

$ |

0.51 |

|

|

$ |

1.39 |

|

$ |

1.33 |

|

| Diluted earnings per

share |

|

0.69 |

|

|

0.70 |

|

|

0.50 |

|

0.74 |

|

|

0.51 |

|

|

|

1.38 |

|

|

1.33 |

|

| Adjusted diluted earnings per

share (non-GAAP)(1) |

|

0.69 |

|

|

0.65 |

|

|

0.76 |

|

0.74 |

|

|

0.83 |

|

|

|

1.33 |

|

|

1.64 |

|

| Average basic shares

outstanding |

|

56,342,909 |

|

|

56,208,348 |

|

|

56,141,628 |

|

56,138,618 |

|

|

56,107,881 |

|

|

|

56,275,628 |

|

|

56,058,585 |

|

| Average diluted shares

outstanding |

|

56,684,626 |

|

|

56,531,078 |

|

|

56,611,217 |

|

56,523,887 |

|

|

56,395,653 |

|

|

|

56,607,947 |

|

|

56,330,295 |

|

| Cash dividends per common

share |

$ |

0.22 |

|

$ |

0.22 |

|

$ |

0.22 |

$ |

0.22 |

|

$ |

0.22 |

|

|

$ |

0.44 |

|

$ |

0.44 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This is a non-GAAP financial measure. A

reconciliation of all non-GAAP financial measures disclosed in this

release from GAAP to non-GAAP is included in the tables at the end

of this release. The information below under the heading “Non-GAAP

Financial Measures” explains why the Company believes the non-GAAP

financial measures in this release provide useful information and

describes the other purposes for which the Company uses non-GAAP

financial measures.

Performance Ratios

| |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

|

Return on average assets |

0.90 |

% |

0.92 |

% |

0.65 |

% |

0.96 |

% |

0.66 |

% |

|

0.91 |

% |

0.87 |

% |

| Adjusted return on average

assets (non-GAAP)(1) |

0.90 |

|

0.86 |

|

0.99 |

|

0.96 |

|

1.08 |

|

|

0.88 |

|

1.08 |

|

| Return on average tangible

assets (non-GAAP)(1) |

0.98 |

|

1.00 |

|

0.71 |

|

1.05 |

|

0.73 |

|

|

0.99 |

|

0.96 |

|

| Adjusted return on average

tangible assets (non-GAAP)(1) |

0.98 |

|

0.93 |

|

1.08 |

|

1.05 |

|

1.18 |

|

|

0.96 |

|

1.18 |

|

| Return on average equity |

6.68 |

|

6.85 |

|

4.93 |

|

7.44 |

|

5.18 |

|

|

6.77 |

|

6.84 |

|

| Adjusted return on average

equity (non-GAAP)(1) |

6.68 |

|

6.36 |

|

7.53 |

|

7.44 |

|

8.45 |

|

|

6.52 |

|

8.48 |

|

| Return on average tangible

equity (non-GAAP)(1) |

12.04 |

|

12.45 |

|

9.26 |

|

13.95 |

|

9.91 |

|

|

12.25 |

|

13.04 |

|

| Adjusted return on average

tangible equity (non-GAAP)(1) |

12.04 |

|

11.58 |

|

13.94 |

|

13.95 |

|

15.94 |

|

|

11.81 |

|

16.07 |

|

| Efficiency ratio (fully

taxable equivalent) |

67.31 |

|

67.52 |

|

75.11 |

|

64.38 |

|

73.29 |

|

|

67.41 |

|

67.26 |

|

| Adjusted efficiency ratio

(non-GAAP)(1) |

66.60 |

|

68.23 |

|

66.18 |

|

63.60 |

|

62.98 |

|

|

67.41 |

|

62.13 |

|

| Dividend payout ratio |

31.88 |

|

31.43 |

|

44.00 |

|

29.33 |

|

43.14 |

|

|

31.65 |

|

33.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital and Balance Sheet Ratios

| |

As of |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

|

Shares outstanding |

|

56,367,924 |

|

|

56,304,860 |

|

|

56,142,207 |

|

|

56,140,713 |

|

|

56,132,478 |

|

|

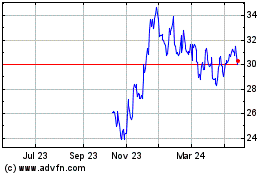

Market value per share |

$ |

30.54 |

|

$ |

31.32 |

|

$ |

33.68 |

|

$ |

26.19 |

|

$ |

26.13 |

|

|

Book value per share |

|

41.77 |

|

|

41.25 |

|

|

40.92 |

|

|

39.78 |

|

|

39.35 |

|

|

Tangible book value per share (non-GAAP)(1) |

|

23.89 |

|

|

23.32 |

|

|

22.92 |

|

|

21.76 |

|

|

21.30 |

|

|

Shareholders’ equity to assets |

|

13.45 |

% |

|

13.39 |

% |

|

13.23 |

% |

|

13.00 |

% |

|

12.82 |

% |

|

Tangible common equity ratio (non-GAAP)(1) |

|

8.16 |

|

|

8.04 |

|

|

7.87 |

|

|

7.55 |

|

|

7.37 |

|

|

Leverage ratio |

|

9.81 |

|

|

9.75 |

|

|

9.62 |

|

|

9.48 |

|

|

9.22 |

|

|

Common equity tier 1 capital ratio |

|

10.75 |

|

|

10.59 |

|

|

10.52 |

|

|

10.46 |

|

|

10.30 |

|

|

Tier 1 risk-based capital ratio |

|

11.53 |

|

|

11.37 |

|

|

11.30 |

|

|

11.25 |

|

|

11.09 |

|

|

Total risk-based capital ratio |

|

15.15 |

|

|

15.00 |

|

|

14.93 |

|

|

14.91 |

|

|

14.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This is a non-GAAP financial measure. A

reconciliation of all non-GAAP financial measures disclosed in this

release from GAAP to non-GAAP is included in the tables at the end

of this release. The information below under the heading “Non-GAAP

Financial Measures” explains why the Company believes the non-GAAP

financial measures in this release provide useful information and

describes the other purposes for which the Company uses non-GAAP

financial measures.

Noninterest Income and Noninterest Expense

| (Dollars in thousands) |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

| Noninterest

income |

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

$ |

10,286 |

$ |

10,506 |

$ |

10,603 |

|

$ |

9,743 |

|

$ |

9,733 |

|

|

$ |

20,792 |

$ |

18,853 |

|

|

Fees and commissions |

|

3,944 |

|

3,949 |

|

4,130 |

|

|

4,108 |

|

|

4,987 |

|

|

|

7,893 |

|

9,663 |

|

|

Insurance commissions |

|

2,758 |

|

2,716 |

|

2,583 |

|

|

3,264 |

|

|

2,809 |

|

|

|

5,474 |

|

5,255 |

|

|

Wealth management revenue |

|

5,684 |

|

5,669 |

|

5,668 |

|

|

5,986 |

|

|

5,338 |

|

|

|

11,353 |

|

10,478 |

|

|

Mortgage banking income |

|

9,698 |

|

11,370 |

|

6,592 |

|

|

7,533 |

|

|

9,771 |

|

|

|

21,068 |

|

18,288 |

|

|

Net losses on sales of securities (including impairments) |

|

— |

|

— |

|

(19,352 |

) |

|

— |

|

|

(22,438 |

) |

|

|

— |

|

(22,438 |

) |

|

Gain on extinguishment of debt |

|

— |

|

56 |

|

620 |

|

|

— |

|

|

— |

|

|

|

56 |

|

— |

|

|

BOLI income |

|

2,701 |

|

2,691 |

|

2,589 |

|

|

2,469 |

|

|

2,402 |

|

|

|

5,392 |

|

5,405 |

|

|

Other |

|

3,691 |

|

4,424 |

|

6,923 |

|

|

5,097 |

|

|

4,624 |

|

|

|

8,115 |

|

9,015 |

|

| Total noninterest

income |

$ |

38,762 |

$ |

41,381 |

$ |

20,356 |

|

$ |

38,200 |

|

$ |

17,226 |

|

|

$ |

80,143 |

$ |

54,519 |

|

| Noninterest

expense |

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

$ |

70,731 |

$ |

71,470 |

$ |

71,841 |

|

$ |

69,458 |

|

$ |

70,637 |

|

|

$ |

142,201 |

$ |

140,469 |

|

|

Data processing |

|

3,945 |

|

3,807 |

|

3,971 |

|

|

3,907 |

|

|

3,684 |

|

|

|

7,752 |

|

7,317 |

|

|

Net occupancy and equipment |

|

11,844 |

|

11,389 |

|

11,653 |

|

|

11,548 |

|

|

11,865 |

|

|

|

23,233 |

|

23,270 |

|

|

Other real estate owned |

|

105 |

|

107 |

|

306 |

|

|

(120 |

) |

|

51 |

|

|

|

212 |

|

81 |

|

|

Professional fees |

|

3,195 |

|

3,348 |

|

2,854 |

|

|

3,338 |

|

|

4,012 |

|

|

|

6,543 |

|

7,479 |

|

|

Advertising and public relations |

|

3,807 |

|

4,886 |

|

3,084 |

|

|

3,474 |

|

|

3,482 |

|

|

|

8,693 |

|

8,168 |

|

|

Intangible amortization |

|

1,186 |

|

1,212 |

|

1,274 |

|

|

1,311 |

|

|

1,369 |

|

|

|

2,398 |

|

2,795 |

|

|

Communications |

|

2,112 |

|

2,024 |

|

2,026 |

|

|

2,006 |

|

|

2,226 |

|

|

|

4,136 |

|

4,206 |

|

|

Other |

|

15,051 |

|

14,669 |

|

14,871 |

|

|

13,447 |

|

|

12,839 |

|

|

|

29,720 |

|

25,588 |

|

| Total noninterest

expense |

$ |

111,976 |

$ |

112,912 |

$ |

111,880 |

|

$ |

108,369 |

|

$ |

110,165 |

|

|

$ |

224,888 |

$ |

219,373 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Banking Income

| (Dollars in thousands) |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

|

Gain on sales of loans, net |

$ |

5,199 |

$ |

4,535 |

$ |

1,860 |

$ |

3,297 |

$ |

4,646 |

|

$ |

9,734 |

$ |

9,416 |

|

Fees, net |

|

2,866 |

|

1,854 |

|

2,010 |

|

2,376 |

|

2,859 |

|

|

4,720 |

|

4,665 |

|

Mortgage servicing income, net |

|

1,633 |

|

4,981 |

|

2,722 |

|

1,860 |

|

2,266 |

|

|

6,614 |

|

4,207 |

| Total mortgage banking

income |

$ |

9,698 |

$ |

11,370 |

$ |

6,592 |

$ |

7,533 |

$ |

9,771 |

|

$ |

21,068 |

$ |

18,288 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet

| (Dollars in thousands) |

As of |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

| Assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

851,906 |

|

$ |

844,400 |

|

$ |

801,351 |

|

$ |

741,156 |

|

$ |

946,899 |

|

|

Securities held to maturity, at amortized cost |

|

1,174,663 |

|

|

1,199,111 |

|

|

1,221,464 |

|

|

1,245,595 |

|

|

1,273,044 |

|

|

Securities available for sale, at fair value |

|

749,685 |

|

|

764,486 |

|

|

923,279 |

|

|

909,108 |

|

|

950,930 |

|

|

Loans held for sale, at fair value |

|

266,406 |

|

|

191,440 |

|

|

179,756 |

|

|

241,613 |

|

|

249,615 |

|

|

Loans held for investment |

|

12,604,755 |

|

|

12,500,525 |

|

|

12,351,230 |

|

|

12,168,023 |

|

|

11,930,516 |

|

|

Allowance for credit losses on loans |

|

(199,871 |

) |

|

(201,052 |

) |

|

(198,578 |

) |

|

(197,773 |

) |

|

(194,391 |

) |

|

Loans, net |

|

12,404,884 |

|

|

12,299,473 |

|

|

12,152,652 |

|

|

11,970,250 |

|

|

11,736,125 |

|

|

Premises and equipment, net |

|

280,966 |

|

|

282,193 |

|

|

283,195 |

|

|

284,368 |

|

|

285,952 |

|

|

Other real estate owned |

|

7,366 |

|

|

9,142 |

|

|

9,622 |

|

|

9,258 |

|

|

5,120 |

|

|

Goodwill and other intangibles |

|

1,008,062 |

|

|

1,009,248 |

|

|

1,010,460 |

|

|

1,011,735 |

|

|

1,013,046 |

|

|

Bank-owned life insurance |

|

387,791 |

|

|

385,186 |

|

|

382,584 |

|

|

379,945 |

|

|

377,649 |

|

|

Mortgage servicing rights |

|

72,092 |

|

|

71,596 |

|

|

91,688 |

|

|

90,241 |

|

|

87,432 |

|

|

Other assets |

|

306,570 |

|

|

289,466 |

|

|

304,484 |

|

|

298,352 |

|

|

298,530 |

|

|

Total assets |

$ |

17,510,391 |

|

$ |

17,345,741 |

|

$ |

17,360,535 |

|

$ |

17,181,621 |

|

$ |

17,224,342 |

|

| |

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Noninterest-bearing |

$ |

3,539,453 |

|

$ |

3,516,164 |

|

$ |

3,583,675 |

|

$ |

3,734,197 |

|

$ |

3,878,953 |

|

|

Interest-bearing |

|

10,715,760 |

|

|

10,720,999 |

|

|

10,493,110 |

|

|

10,422,913 |

|

|

10,216,408 |

|

|

Total deposits |

|

14,255,213 |

|

|

14,237,163 |

|

|

14,076,785 |

|

|

14,157,110 |

|

|

14,095,361 |

|

|

Short-term borrowings |

|

232,741 |

|

|

108,121 |

|

|

307,577 |

|

|

107,662 |

|

|

257,305 |

|

|

Long-term debt |

|

428,677 |

|

|

428,047 |

|

|

429,400 |

|

|

427,399 |

|

|

429,630 |

|

|

Other liabilities |

|

239,059 |

|

|

250,060 |

|

|

249,390 |

|

|

256,127 |

|

|

233,418 |

|

|

Total liabilities |

|

15,155,690 |

|

|

15,023,391 |

|

|

15,063,152 |

|

|

14,948,298 |

|

|

15,015,714 |

|

| |

|

|

|

|

|

| Shareholders’

equity: |

|

|

|

|

|

|

Common stock |

|

296,483 |

|

|

296,483 |

|

|

296,483 |

|

|

296,483 |

|

|

296,483 |

|

|

Treasury stock |

|

(97,534 |

) |

|

(99,683 |

) |

|

(105,249 |

) |

|

(105,300 |

) |

|

(105,589 |

) |

|

Additional paid-in capital |

|

1,304,782 |

|

|

1,303,613 |

|

|

1,308,281 |

|

|

1,304,891 |

|

|

1,301,883 |

|

|

Retained earnings |

|

1,005,086 |

|

|

978,880 |

|

|

952,124 |

|

|

936,573 |

|

|

907,312 |

|

|

Accumulated other comprehensive loss |

|

(154,116 |

) |

|

(156,943 |

) |

|

(154,256 |

) |

|

(199,324 |

) |

|

(191,461 |

) |

| Total shareholders’

equity |

|

2,354,701 |

|

|

2,322,350 |

|

|

2,297,383 |

|

|

2,233,323 |

|

|

2,208,628 |

|

| Total liabilities and

shareholders’ equity |

$ |

17,510,391 |

|

$ |

17,345,741 |

|

$ |

17,360,535 |

|

$ |

17,181,621 |

|

$ |

17,224,342 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income and Net Interest Margin

| (Dollars in thousands) |

Three Months Ended |

| |

June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

| |

AverageBalance |

InterestIncome/Expense |

Yield/ Rate |

AverageBalance |

InterestIncome/Expense |

Yield/ Rate |

AverageBalance |

InterestIncome/Expense |

Yield/ Rate |

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

Loans held for investment |

$ |

12,575,651 |

$ |

200,670 |

6.41 |

% |

$ |

12,407,976 |

$ |

194,640 |

6.30 |

% |

$ |

11,877,592 |

$ |

175,549 |

5.93 |

% |

| Loans held for sale |

|

219,826 |

|

3,530 |

6.42 |

% |

|

155,382 |

|

2,308 |

5.94 |

% |

|

192,539 |

|

2,990 |

6.21 |

% |

|

Taxable securities |

|

1,832,002 |

|

9,258 |

2.02 |

% |

|

1,891,817 |

|

9,505 |

2.01 |

% |

|

2,481,712 |

|

12,353 |

1.99 |

% |

|

Tax-exempt securities(1) |

|

263,937 |

|

1,451 |

2.20 |

% |

|

270,279 |

|

1,505 |

2.23 |

% |

|

367,410 |

|

2,165 |

2.36 |

% |

| Total securities |

|

2,095,939 |

|

10,709 |

2.04 |

% |

|

2,162,096 |

|

11,010 |

2.04 |

% |

|

2,849,122 |

|

14,518 |

2.04 |

% |

| Interest-bearing balances with

banks |

|

595,030 |

|

7,874 |

5.32 |

% |

|

570,336 |

|

7,781 |

5.49 |

% |

|

524,307 |

|

6,978 |

5.34 |

% |

| Total interest-earning

assets |

|

15,486,446 |

|

222,783 |

5.77 |

% |

|

15,295,790 |

|

215,739 |

5.66 |

% |

|

15,443,560 |

|

200,035 |

5.19 |

% |

| Cash and due from banks |

|

187,519 |

|

|

|

188,503 |

|

|

|

189,668 |

|

|

| Intangible assets |

|

1,008,638 |

|

|

|

1,009,825 |

|

|

|

1,013,811 |

|

|

| Other assets |

|

688,766 |

|

|

|

708,895 |

|

|

|

690,885 |

|

|

| Total assets |

$ |

17,371,369 |

|

|

$ |

17,203,013 |

|

|

$ |

17,337,924 |

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand(2) |

$ |

7,094,411 |

$ |

56,132 |

3.17 |

% |

$ |

6,955,989 |

$ |

52,500 |

3.03 |

% |

$ |

6,114,067 |

$ |

29,185 |

1.91 |

% |

|

Savings deposits |

|

839,638 |

|

729 |

0.35 |

% |

|

860,397 |

|

730 |

0.34 |

% |

|

1,004,096 |

|

813 |

0.32 |

% |

|

Brokered deposits |

|

294,650 |

|

3,944 |

5.37 |

% |

|

445,608 |

|

5,987 |

5.39 |

% |

|

809,613 |

|

10,295 |

5.10 |

% |

|

Time deposits |

|

2,487,873 |

|

26,816 |

4.34 |

% |

|

2,319,420 |

|

23,396 |

4.06 |

% |

|

1,735,567 |

|

11,098 |

2.57 |

% |

| Total interest-bearing

deposits |

|

10,716,572 |

|

87,621 |

3.28 |

% |

|

10,581,414 |

|

82,613 |

3.13 |

% |

|

9,663,343 |

|

51,391 |

2.13 |

% |

| Borrowed funds |

|

564,672 |

|

7,564 |

5.37 |

% |

|

544,564 |

|

7,276 |

5.35 |

% |

|

1,204,968 |

|

15,559 |

5.18 |

% |

| Total interest-bearing

liabilities |

|

11,281,244 |

|

95,185 |

3.39 |

% |

|

11,125,978 |

|

89,889 |

3.24 |

% |

|

10,868,311 |

|

66,950 |

2.47 |

% |

| Noninterest-bearing deposits |

|

3,509,109 |

|

|

|

3,518,612 |

|

|

|

4,039,087 |

|

|

| Other liabilities |

|

243,285 |

|

|

|

244,142 |

|

|

|

212,818 |

|

|

| Shareholders’ equity |

|

2,337,731 |

|

|

|

2,314,281 |

|

|

|

2,217,708 |

|

|

| Total liabilities and

shareholders’ equity |

$ |

17,371,369 |

|

|

$ |

17,203,013 |

|

|

$ |

17,337,924 |

|

|

| Net interest income/ net interest

margin |

|

$ |

127,598 |

3.31 |

% |

|

$ |

125,850 |

3.30 |

% |

|

$ |

133,085 |

3.45 |

% |

| Cost of funding |

|

|

2.58 |

% |

|

|

2.46 |

% |

|

|

1.80 |

% |

| Cost of total deposits |

|

|

2.47 |

% |

|

|

2.35 |

% |

|

|

1.50 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) U.S. Government and some U.S. Government Agency securities

are tax-exempt in the states in which the Company operates.(2)

Interest-bearing demand deposits include interest-bearing

transactional accounts and money market deposits.

Net Interest Income and Net Interest

Margin, continued

| (Dollars in thousands) |

Six Months Ended |

| |

June 30, 2024 |

June 30, 2023 |

| |

AverageBalance |

InterestIncome/Expense |

Yield/ Rate |

AverageBalance |

InterestIncome/Expense |

Yield/ Rate |

| Interest-earning assets: |

|

|

|

|

|

|

|

Loans held for investment |

$ |

12,491,814 |

$ |

395,310 |

6.35 |

% |

$ |

11,783,585 |

$ |

339,519 |

5.81 |

% |

| Loans held for sale |

|

187,604 |

|

5,838 |

6.22 |

% |

|

148,221 |

|

4,727 |

6.38 |

% |

|

Taxable securities(1) |

|

1,861,909 |

|

18,763 |

2.02 |

% |

|

2,557,997 |

|

25,670 |

2.01 |

% |

|

Tax-exempt securities |

|

267,108 |

|

2,956 |

2.21 |

% |

|

382,130 |

|

4,510 |

2.36 |

% |

| Total securities |

|

2,129,017 |

|

21,719 |

2.04 |

% |

|

2,940,127 |

|

30,180 |

2.05 |

% |

| Interest-bearing balances with

banks |

|

582,683 |

|

15,655 |

5.40 |

% |

|

494,434 |

|

12,408 |

5.06 |

% |

| Total interest-earning

assets |

|

15,391,118 |

|

438,522 |

5.72 |

% |

|

15,366,367 |

|

386,834 |

5.07 |

% |

| Cash and due from banks |

|

188,011 |

|

|

|

193,703 |

|

|

| Intangible assets |

|

1,009,232 |

|

|

|

1,012,690 |

|

|

| Other assets |

|

701,770 |

|

|

|

675,648 |

|

|

| Total assets |

$ |

17,290,131 |

|

|

$ |

17,248,408 |

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

Interest-bearing demand(2) |

$ |

7,025,200 |

$ |

108,632 |

3.10 |

% |

$ |

6,090,549 |

$ |

49,483 |

1.64 |

% |

|

Savings deposits |

|

850,018 |

|

1,459 |

0.34 |

% |

|

1,028,315 |

|

1,639 |

0.32 |

% |

|

Brokered deposits |

|

370,129 |

|

9,931 |

5.38 |

% |

|

603,822 |

|

14,713 |

4.91 |

% |

|

Time deposits |

|

2,403,646 |

|

50,212 |

4.20 |

% |

|

1,650,683 |

|

18,422 |

2.25 |

% |

| Total interest-bearing

deposits |

|

10,648,993 |

|

170,234 |

3.21 |

% |

|

9,373,369 |

|

84,257 |

1.81 |

% |

| Borrowed funds |

|

554,618 |

|

14,840 |

5.36 |

% |

|

1,243,049 |

|

30,963 |

5.01 |

% |

| Total interest-bearing

liabilities |

|

11,203,611 |

|

185,074 |

3.32 |

% |

|

10,616,418 |

|

115,220 |

2.19 |

% |

| Noninterest-bearing deposits |

|

3,513,860 |

|

|

|

4,212,081 |

|

|

| Other liabilities |

|

246,654 |

|

|

|

217,573 |

|

|

| Shareholders’ equity |

|

2,326,006 |

|

|

|

2,202,336 |

|

|

| Total liabilities and

shareholders’ equity |

$ |

17,290,131 |

|

|

$ |

17,248,408 |

|

|

| Net interest income/ net interest

margin |

|

$ |

253,448 |

3.30 |

% |

|

$ |

271,614 |

3.56 |

% |

| Cost of funding |

|

|

2.52 |

% |

|

|

1.57 |

% |

| Cost of total deposits |

|

|

2.41 |

% |

|

|

1.25 |

% |

| |

|

|

|

|

|

|

|

|

(1) U.S. Government and some U.S. Government Agency securities

are tax-exempt in the states in which the Company operates.(2)

Interest-bearing demand deposits include interest-bearing

transactional accounts and money market deposits.

Supplemental Margin

Information

| (Dollars in thousands) |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

| Earning asset

mix: |

|

|

|

|

|

|

|

Loans held for investment |

|

81.20 |

% |

|

81.12 |

% |

|

76.91 |

% |

|

|

81.16 |

% |

|

76.68 |

% |

|

Loans held for sale |

|

1.42 |

|

|

1.02 |

|

|

1.25 |

|

|

|

1.22 |

|

|

0.96 |

|

|

Securities |

|

13.53 |

|

|

14.14 |

|

|

18.45 |

|

|

|

13.83 |

|

|

19.13 |

|

|

Interest-bearing balances with banks |

|

3.85 |

|

|

3.72 |

|

|

3.39 |

|

|

|

3.79 |

|

|

3.23 |

|

|

Total |

|

100.00 |

% |

|

100.00 |

% |

|

100.00 |

% |

|

|

100.00 |

% |

|

100.00 |

% |

| |

|

|

|

|

|

|

| Funding sources

mix: |

|

|

|

|

|

|

|

Noninterest-bearing demand |

|

23.73 |

% |

|

24.03 |

% |

|

27.09 |

% |

|

|

23.88 |

% |

|

28.41 |

% |

|

Interest-bearing demand |

|

47.97 |

|

|

47.50 |

|

|

41.01 |

|

|

|

47.73 |

|

|

41.07 |

|

|

Savings |

|

5.68 |

|

|

5.88 |

|

|

6.74 |

|

|

|

5.78 |

|

|

6.93 |

|

|

Brokered deposits |

|

1.99 |

|

|

3.04 |

|

|

5.43 |

|

|

|

2.51 |

|

|

4.07 |

|

|

Time deposits |

|

16.82 |

|

|

15.84 |

|

|

11.64 |

|

|

|

16.33 |

|

|

11.13 |

|

|

Borrowed funds |

|

3.81 |

|

|

3.71 |

|

|

8.09 |

|

|

|

3.77 |

|

|

8.39 |

|

|

Total |

|

100.00 |

% |

|

100.00 |

% |

|

100.00 |

% |

|

|

100.00 |

% |

|

100.00 |

% |

| |

|

|

|

|

|

|

| Net interest income collected

on problem loans |

$ |

(146 |

) |

$ |

123 |

|

$ |

364 |

|

|

$ |

(23 |

) |

$ |

756 |

|

| Total accretion on purchased

loans |

|

897 |

|

|

800 |

|

|

874 |

|

|

|

1,697 |

|

|

1,759 |

|

| Total impact on net interest

income |

$ |

751 |

|

$ |

923 |

|

$ |

1,238 |

|

|

$ |

1,674 |

|

$ |

2,515 |

|

| Impact on net interest

margin |

|

0.02 |

% |

|

0.02 |

% |

|

0.03 |

% |

|

|

0.02 |

% |

|

0.03 |

% |

| Impact on loan yield |

|

0.02 |

|

|

0.03 |

|

|

0.04 |

|

|

|

0.03 |

% |

|

0.04 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Portfolio

| (Dollars in thousands) |

As of |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

| Loan

Portfolio: |

|

|

|

|

|

|

Commercial, financial, agricultural |

$ |

1,847,762 |

$ |

1,869,408 |

$ |

1,871,821 |

$ |

1,819,891 |

$ |

1,729,070 |

|

Lease financing |

|

102,996 |

|

107,474 |

|

116,020 |

|

120,724 |

|

122,370 |

|

Real estate - construction |

|

1,355,425 |

|

1,243,535 |

|

1,333,397 |

|

1,407,364 |

|

1,369,019 |

|

Real estate - 1-4 family mortgages |

|

3,435,818 |

|

3,429,286 |

|

3,439,919 |

|

3,398,876 |

|

3,348,654 |

|

Real estate - commercial mortgages |

|

5,766,478 |

|

5,753,230 |

|

5,486,550 |

|

5,313,166 |

|

5,252,479 |

|

Installment loans to individuals |

|

96,276 |

|

97,592 |

|

103,523 |

|

108,002 |

|

108,924 |

|

Total loans |

$ |

12,604,755 |

$ |

12,500,525 |

$ |

12,351,230 |

$ |

12,168,023 |

$ |

11,930,516 |

|

|

|

|

|

|

|

|

|

|

|

|

Credit Quality and Allowance for Credit Losses on

Loans

| (Dollars in thousands) |

As of |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

| Nonperforming

Assets: |

|

|

|

|

|

|

Nonaccruing loans |

$ |

97,795 |

|

$ |

73,774 |

|

$ |

68,816 |

|

$ |

69,541 |

|

$ |

55,439 |

|

|

Loans 90 days or more past due |

|

240 |

|

|

451 |

|

|

554 |

|

|

532 |

|

|

36,321 |

|

|

Total nonperforming loans |

|

98,035 |

|

|

74,225 |

|

|

69,370 |

|

|

70,073 |

|

|

91,760 |

|

|

Other real estate owned |

|

7,366 |

|

|

9,142 |

|

|

9,622 |

|

|

9,258 |

|

|

5,120 |

|

|

Total nonperforming assets |

$ |

105,401 |

|

$ |

83,367 |

|

$ |

78,992 |

|

$ |

79,331 |

|

$ |

96,880 |

|

| |

|

|

|

|

|

| Criticized

Loans |

|

|

|

|

|

|

Classified loans |

$ |

191,595 |

|

$ |

206,502 |

|

$ |

166,893 |

|

$ |

186,052 |

|

$ |

219,674 |

|

|

Special Mention loans |

|

138,343 |

|

|

138,366 |

|

|

99,699 |

|

|

89,858 |

|

|

56,616 |

|

|

Criticized loans(1) |

$ |

329,938 |

|

$ |

344,868 |

|

$ |

266,592 |

|

$ |

275,910 |

|

$ |

276,290 |

|

| |

|

|

|

|

|

| Allowance for credit losses on

loans |

$ |

199,871 |

|

$ |

201,052 |

|

$ |

198,578 |

|

$ |

197,773 |

|

$ |

194,391 |

|

| Net loan charge-offs |

$ |

5,481 |

|

$ |

164 |

|

$ |

1,713 |

|

$ |

1,933 |

|

$ |

3,901 |

|

| Annualized net loan

charge-offs / average loans |

|

0.18 |

% |

|

0.01 |

% |

|

0.06 |

% |

|

0.06 |

% |

|

0.13 |

% |

| Nonperforming loans / total

loans |

|

0.78 |

|

|

0.59 |

|

|

0.56 |

|

|

0.58 |

|

|

0.77 |

|

| Nonperforming assets / total

assets |

|

0.60 |

|

|

0.48 |

|

|

0.46 |

|

|

0.46 |

|

|

0.56 |

|

| Allowance for credit losses on

loans / total loans |

|

1.59 |

|

|

1.61 |

|

|

1.61 |

|

|

1.63 |

|

|

1.63 |

|

| Allowance for credit losses on

loans / nonperforming loans |

|

203.88 |

|

|

270.87 |

|

|

286.26 |

|

|

282.24 |

|

|

211.85 |

|

| Criticized loans / total

loans |

|

2.62 |

|

|

2.76 |

|

|

2.16 |

|

|

2.27 |

|

|

2.32 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Criticized loans include loans in risk

rating classifications of classified and special mention.

CONFERENCE CALL INFORMATION:A

live audio webcast of a conference call with analysts will be

available beginning at 10:00 AM Eastern Time (9:00 AM Central Time)

on Wednesday, July 24, 2024.

The webcast is accessible through Renasant’s

investor relations website at www.renasant.com or

https://event.choruscall.com/mediaframe/webcast.html?webcastid=4YF7gjk4.

To access the conference via telephone, dial 1-877-513-1143 in the

United States and request the Renasant Corporation 2024 Second

Quarter Earnings Webcast and Conference Call. International

participants should dial 1-412-902-4145 to access the conference

call.

The webcast will be archived on

www.renasant.com after the call and will remain accessible for

one year. A replay can be accessed via telephone by dialing

1-877-344-7529 in the United States and entering conference number

8556122 or by dialing 1-412-317-0088 internationally and entering

the same conference number. Telephone replay access is available

until August 7, 2024.

ABOUT RENASANT CORPORATION:

Renasant Corporation is the parent of Renasant

Bank, a 120-year-old financial services institution. Renasant has

assets of approximately $17.5 billion and operates 185 banking,

lending, mortgage and wealth management offices throughout the

Southeast as well as offering factoring and asset-based lending on

a nationwide basis.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS:

This press release may contain, or incorporate

by reference, statements about Renasant Corporation that constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Statements preceded

by, followed by or that otherwise include the words “believes,”

“expects,” “projects,” “anticipates,” “intends,” “estimates,”

“plans,” “potential,” “focus,” “possible,” “may increase,” “may

fluctuate,” “will likely result,” and similar expressions, or

future or conditional verbs such as “will,” “should,” “would” and

“could,” are generally forward-looking in nature and not historical

facts. Forward-looking statements include information about the

Company’s future financial performance, business strategy,

projected plans and objectives and are based on the current beliefs

and expectations of management. The Company’s management believes

these forward-looking statements are reasonable, but they are all

inherently subject to significant business, economic and

competitive risks and uncertainties, many of which are beyond the

Company’s control. In addition, these forward-looking statements

are subject to assumptions with respect to future business

strategies and decisions that are subject to change. Actual results

may differ from those indicated or implied in the forward-looking

statements, and such differences may be material. Prospective

investors are cautioned that any forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties and, accordingly, investors should not place undue

reliance on these forward-looking statements, which speak only as

of the date they are made.

Important factors currently known to management

that could cause our actual results to differ materially from those

in forward-looking statements include the following: (i) the

Company’s ability to efficiently integrate acquisitions into its

operations, retain the customers of these businesses, grow the

acquired operations and realize the cost savings expected from an

acquisition to the extent and in the timeframe anticipated by

management; (ii) the effect of economic conditions and interest

rates on a national, regional or international basis; (iii) timing

and success of the implementation of changes in operations to

achieve enhanced earnings or effect cost savings; (iv) competitive

pressures in the consumer finance, commercial finance, financial

services, asset management, retail banking, factoring and mortgage

lending and auto lending industries; (v) the financial resources

of, and products available from, competitors; (vi) changes in laws

and regulations as well as changes in accounting standards; (vii)

changes in policy by regulatory agencies; (viii) changes in the

securities and foreign exchange markets; (ix) the Company’s

potential growth, including its entrance or expansion into new

markets, and the need for sufficient capital to support that

growth; (x) changes in the quality or composition of the Company’s

loan or investment portfolios, including adverse developments in

borrower industries or in the repayment ability of individual

borrowers or issuers of investment securities, or the impact of

interest rates on the value of our investment securities portfolio;

(xi) an insufficient allowance for credit losses as a result of

inaccurate assumptions; (xii) changes in the sources and costs of

the capital we use to make loans and otherwise fund our operations,

due to deposit outflows, changes in the mix of deposits and the

cost and availability of borrowings; (xiii) general economic,

market or business conditions, including the impact of inflation;

(xiv) changes in demand for loan products and financial services;

(xv) concentration of deposit and credit exposure; (xvi) changes or

the lack of changes in interest rates, yield curves and interest

rate spread relationships; (xvii) increased cybersecurity risk,

including potential network breaches, business disruptions or

financial losses; (xviii) civil unrest, natural disasters,

epidemics and other catastrophic events in the Company’s geographic

area; (xix) the impact, extent and timing of technological changes;

and (xx) other circumstances, many of which are beyond management’s

control.

Management believes that the assumptions

underlying the Company’s forward-looking statements are reasonable,

but any of the assumptions could prove to be inaccurate. Investors

are urged to carefully consider the risks described in the

Company’s filings with the Securities and Exchange Commission (the

“SEC”) from time to time, including its most recent Annual Report

on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which

are available at www.renasant.com and the SEC’s website at

www.sec.gov.

The Company undertakes no obligation, and

specifically disclaims any obligation, to update or revise

forward-looking statements, whether as a result of new information

or to reflect changed assumptions, the occurrence of unanticipated

events or changes to future operating results over time, except as

required by federal securities laws.

NON-GAAP FINANCIAL MEASURES:

In addition to results presented in accordance

with generally accepted accounting principles in the United States

of America (“GAAP”), this press release and the presentation slides

furnished to the SEC on the same Form 8-K as this release contain

non-GAAP financial measures, namely, (i) adjusted loan yield, (ii)

adjusted net interest income and margin, (iii) pre-provision net

revenue (including on an as-adjusted basis), (iv) adjusted net

income, (v) adjusted diluted earnings per share, (vi) tangible book

value per share, (vii) the tangible common equity ratio, (viii)

certain performance ratios (namely, the ratio of pre-provision net

revenue to average assets, the return on average assets and on

average equity, and the return on average tangible assets and on

average tangible common equity (including each of the foregoing on

an as-adjusted basis)), and (ix) the adjusted efficiency ratio.

These non-GAAP financial measures adjust GAAP

financial measures to exclude intangible assets, including related

amortization, and/or certain gains or charges (although, for the

second quarter of 2024, there were no excluded gains or charges),

with respect to which the Company is unable to accurately predict

when these charges will be incurred or, when incurred, the amount

thereof. Management uses these non-GAAP financial measures when

evaluating capital utilization and adequacy. In addition, the

Company believes that these non-GAAP financial measures facilitate

the making of period-to-period comparisons and are meaningful

indicators of its operating performance, particularly because these

measures are widely used by industry analysts for companies with

merger and acquisition activities. Also, because intangible assets

such as goodwill and the core deposit intangible can vary

extensively from company to company and, as to intangible assets,

are excluded from the calculation of a financial institution’s

regulatory capital, the Company believes that the presentation of

this non-GAAP financial information allows readers to more easily

compare the Company’s results to information provided in other

regulatory reports and the results of other companies.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in the

tables below under the caption “Non-GAAP Reconciliations”.

None of the non-GAAP financial information that

the Company has included in this release or the accompanying

presentation slides are intended to be considered in isolation or

as a substitute for any measure prepared in accordance with GAAP.

Investors should note that, because there are no standardized

definitions for the calculations as well as the results, the

Company’s calculations may not be comparable to similarly titled

measures presented by other companies. Also, there may be limits in

the usefulness of these measures to investors. As a result, the

Company encourages readers to consider its consolidated financial

statements in their entirety and not to rely on any single

financial measure.

Non-GAAP Reconciliations

| (Dollars in thousands, except

per share data) |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

| Adjusted

Pre-Provision Net Revenue (“PPNR”) |

|

|

|

|

|

|

|

Net income (GAAP) |

$ |

38,846 |

|

$ |

39,409 |

|

$ |

28,124 |

|

$ |

41,833 |

|

$ |

28,643 |

|

|

$ |

78,255 |

|

$ |

74,721 |

|

| Income taxes |

|

9,666 |

|

|

9,912 |

|

|

3,787 |

|

|

10,766 |

|

|

6,634 |

|

|

|

19,578 |

|

|

17,956 |

|

| Provision for credit losses

(including unfunded commitments) |

|

3,300 |

|

|

2,438 |

|

|

2,518 |

|

|

4,615 |

|

|

2,000 |

|

|

|

5,738 |

|

|

8,460 |

|

| Pre-provision net revenue

(non-GAAP) |

$ |

51,812 |

|

$ |

51,759 |

|

$ |

34,429 |

|

$ |

57,214 |

|

$ |

37,277 |

|

|

$ |

103,571 |

|

$ |

101,137 |

|

| Gain on extinguishment of

debt |

|

— |

|

|

(56 |

) |

|

(620 |

) |

|

— |

|

|

— |

|

|

|

(56 |

) |

|

— |

|

| Gain on sales of MSR |

|

— |

|

|

(3,472 |

) |

|

(547 |

) |

|

— |

|

|

— |

|

|

|

(3,472 |

) |

|

— |

|

| Losses on sales of securities

(including impairments) |

|

— |

|

|

— |

|

|

19,352 |

|

|

— |

|

|

22,438 |

|

|

|

— |

|

|

22,438 |

|

| Adjusted pre-provision net

revenue (non-GAAP) |

$ |

51,812 |

|

$ |

48,231 |

|

$ |

52,614 |

|

$ |

57,214 |

|

$ |

59,715 |

|

|

$ |

100,043 |

|

$ |

123,575 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted

Net Income and Adjusted Tangible Net Income |

|

|

|

|

|

|

| Net income (GAAP) |

$ |

38,846 |

|

$ |

39,409 |

|

$ |

28,124 |

|

$ |

41,833 |

|

$ |

28,643 |

|

|

$ |

78,255 |

|

$ |

74,721 |

|

| Amortization of

intangibles |

|

1,186 |

|

|

1,212 |

|

|

1,274 |

|

|

1,311 |

|

|

1,369 |

|

|

|

2,398 |

|

|

2,795 |

|

| Tax effect of adjustments

noted above(1) |

|

(233 |

) |

|

(237 |

) |

|

(240 |

) |

|

(269 |

) |

|

(266 |

) |

|

|

(472 |

) |

|

(569 |

) |

| Tangible net income

(non-GAAP) |

$ |

39,799 |

|

$ |

40,384 |

|

$ |

29,158 |

|

$ |

42,875 |

|

$ |

29,746 |

|

|

$ |

80,181 |

|

$ |

76,947 |

|

| |

|

|

|

|

|

|

|

|

| Net income (GAAP) |

$ |

38,846 |

|

$ |

39,409 |

|

$ |

28,124 |

|

$ |

41,833 |

|

$ |

28,643 |

|

|

$ |

78,255 |

|

$ |

74,721 |

|

| Gain on extinguishment of

debt |

|

— |

|

|

(56 |

) |

|

(620 |

) |

|

— |

|

|

— |

|

|

|

(56 |

) |

|

— |

|

| Gain on sales of MSR |

|

— |

|

|

(3,472 |

) |

|

(547 |

) |

|

— |

|

|

— |

|

|

|

(3,472 |

) |

|

— |

|

| Losses on sales of securities

(including impairments) |

|

— |

|

|

— |

|

|

19,352 |

|

|

— |

|

|

22,438 |

|

|

|

— |

|

|

22,438 |

|

| Tax effect of adjustments

noted above(1) |

|

— |

|

|

691 |

|

|

(3,422 |

) |

|

— |

|

|

(4,353 |

) |

|

|

694 |

|

|

(4,568 |

) |

| Adjusted net income

(non-GAAP) |

$ |

38,846 |

|

$ |

36,572 |

|

$ |

42,887 |

|

$ |

41,833 |

|

$ |

46,728 |

|

|

$ |

75,421 |

|

$ |

92,591 |

|

| Amortization of

intangibles |

|

1,186 |

|

|

1,212 |

|

|

1,274 |

|

|

1,311 |

|

|

1,369 |

|

|

|

2,398 |

|

|

2,795 |

|

| Tax effect of adjustments

noted above(1) |

|

(233 |

) |

|

(237 |

) |

|

(240 |

) |

|

(269 |

) |

|

(266 |

) |

|

|

(472 |

) |

|

(569 |

) |

| Adjusted tangible net income

(non-GAAP) |

$ |

39,799 |

|

$ |

37,547 |

|

$ |

43,921 |

|

$ |

42,875 |

|

$ |

47,831 |

|

|

$ |

77,347 |

|

$ |

94,817 |

|

| Tangible

Assets and Tangible Shareholders’ Equity |

|

|

|

|

|

|

| Average shareholders’ equity

(GAAP) |

$ |

2,337,731 |

|

$ |

2,314,281 |

|

$ |

2,261,025 |

|

$ |

2,231,605 |

|

$ |

2,217,708 |

|

|

$ |

2,326,006 |

|

$ |

2,202,336 |

|

| Average intangible assets |

|

1,008,638 |

|

|

1,009,825 |

|

|

1,011,130 |

|

|

1,012,460 |

|

|

1,013,811 |

|

|

|

1,009,232 |

|

|

1,012,690 |

|

| Average tangible shareholders’

equity (non-GAAP) |

$ |

1,329,093 |

|

$ |

1,304,456 |

|

$ |

1,249,895 |

|

$ |

1,219,145 |

|

$ |

1,203,897 |

|

|

$ |

1,316,774 |

|

$ |

1,189,646 |

|

| |

|

|

|

|

|

|

|

|

| Average assets (GAAP) |

$ |

17,371,369 |

|

$ |

17,203,013 |

|

$ |

17,195,840 |

|

$ |

17,235,413 |

|

$ |

17,337,924 |

|

|

$ |

17,290,131 |

|

$ |

17,248,408 |

|

| Average intangible assets |

|

1,008,638 |

|

|

1,009,825 |

|

|

1,011,130 |

|

|

1,012,460 |

|

|

1,013,811 |

|

|

|

1,009,232 |

|

|

1,012,690 |

|

| Average tangible assets

(non-GAAP) |

$ |

16,362,731 |

|

$ |

16,193,188 |

|

$ |

16,184,710 |

|

$ |

16,222,953 |

|

$ |

16,324,113 |

|

|

$ |

16,280,899 |

|

$ |

16,235,718 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ equity

(GAAP) |

$ |

2,354,701 |

|

$ |

2,322,350 |

|

$ |

2,297,383 |

|

$ |

2,233,323 |

|

$ |

2,208,628 |

|

|

$ |

2,354,701 |

|

$ |

2,208,628 |

|

| Intangible assets |

|

1,008,062 |

|

|

1,009,248 |

|

|

1,010,460 |

|

|

1,011,735 |

|

|

1,013,046 |

|

|

|

1,008,062 |

|

|

1,013,046 |

|

| Tangible shareholders’ equity

(non-GAAP) |

$ |

1,346,639 |

|

$ |

1,313,102 |

|

$ |

1,286,923 |

|

$ |

1,221,588 |

|

$ |

1,195,582 |

|

|

$ |

1,346,639 |

|

$ |

1,195,582 |

|

| |

|

|

|

|

|

|

|

|

| Total assets (GAAP) |

$ |

17,510,391 |

|

$ |

17,345,741 |

|

$ |

17,360,535 |

|

$ |

17,181,621 |

|

$ |

17,224,342 |

|

|

$ |

17,510,391 |

|

$ |

17,224,342 |

|

| Intangible assets |

|

1,008,062 |

|

|

1,009,248 |

|

|

1,010,460 |

|

|

1,011,735 |

|

|

1,013,046 |

|

|

|

1,008,062 |

|

|

1,013,046 |

|

| Total tangible assets

(non-GAAP) |

$ |

16,502,329 |

|

$ |

16,336,493 |

|

$ |

16,350,075 |

|

$ |

16,169,886 |

|

$ |

16,211,296 |

|

|

$ |

16,502,329 |

|

$ |