Registration No. 333-

As filed with the Securities and Exchange Commission on October 19, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________________

|

The Procter & Gamble Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

Ohio

(State or Other Jurisdiction of Incorporation or Organization)

|

|

31-0411980

(I.R.S. Employer Identification No.)

|

|

One Procter & Gamble Plaza, Cincinnati, Ohio 45202

(513) 983-1100

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

|

The Procter & Gamble Company Direct Stock Purchase Plan

Deborah P. Majoras, Chief Legal Officer and Secretary

The Procter & Gamble Company

One Procter & Gamble Plaza, Cincinnati, Ohio 45202

(513) 983-1100

(Name, address, including zip code, and telephone number,

Including area code, of agent for service)

________________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☒

|

|

|

Accelerated filer

|

☐

|

|

|

Non-accelerated filer

|

☐

|

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

☐

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities To Be Registered

|

Amount To Be Registered

|

Proposed Maximum Offering Price Per Unit1

|

Proposed Maximum Offering Price

|

Amount of Registration Fee2

|

|

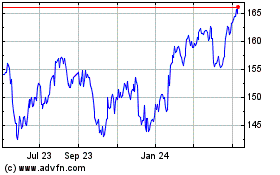

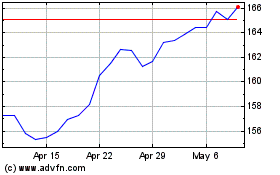

Common Stock (without par value)

|

14,500,000

|

$143.64

|

$2,082,780,000

|

$227,231.30

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act on the basis of the average of the high and low prices of the Common Stock on

the New York Stock Exchange on October 15, 2020, within five business days prior to filing.

|

|

(2)

|

Pursuant to Rule 457(p) under the Securities Act, the registrant is applying the filing fee of $6,100.73 associated with certain unsold securities under its Registration Statement on Form

S-3ASR (File No. 333-221037), originally filed by the registrant on October 20, 2017, to partially offset the entire registration fee of $227,231.30 that would otherwise be due in connection with this Registration Statement. As a result,

$221,130.57 is being remitted herewith.

|

PROSPECTUS

The Procter & Gamble Company

14,500,000 Shares of Common Stock (without par value)

To Participants in The Procter & Gamble Company Direct Stock Purchase Plan

All purchases of securities made pursuant to the The Procter & Gamble Company Direct Stock Purchase Plan (the “Plan”) may be made on any securities exchange on which common stock of

The Procter & Gamble Company (“P&G”) is traded, in the over-the-counter market or by negotiated transactions. The Company has no control over the prices at which the Plan Administrator purchases shares of P&G common stock pursuant to the

Plan. For detailed information regarding the terms and conditions of purchases made under the Plan, you should carefully read this prospectus and any supplement before you invest. You should also read the “Incorporation of Certain Information by

Reference” section of this prospectus for information on us and our financial statements. P&G’s common stock is listed on the New York Stock Exchange under the ticker symbol “PG”.

INVESTING IN OUR SECURITIES INVOLVES RISKS. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER THE CAPTION “RISK FACTORS” BEGINNING ON PAGE 2 OF THIS

PROSPECTUS, IN THE DOCUMENTS INCORPORATED BY REFERENCE INTO THIS PROSPECTUS AND IN ANY APPLICABLE PROSPECTUS SUPPLEMENT BEFORE YOU MAKE AN INVESTMENT IN OUR SECURITIES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR

ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is October 19, 2020.

No person has been authorized to give any information or to make any representations other than those contained or incorporated by reference in

this prospectus and if given or made, such information or representations must not be relied upon as having been authorized. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the

securities described in this prospectus, or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date listed on the bottom of the

front cover of this prospectus. You should not assume that the information contained in the documents incorporated by reference in this prospectus is accurate as of any date other than the respective dates of those documents. Our business, financial

condition, results of operations and prospects may have changed since those dates.

|

|

Page

|

|

|

1

|

|

|

1

|

|

|

2

|

|

|

2

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

5

|

|

|

6

|

|

|

6

|

|

|

7

|

|

|

7

|

|

|

8

|

|

|

8

|

|

|

8

|

|

|

9

|

|

|

9

|

|

|

11

|

|

|

11

|

|

|

12

|

|

|

12

|

|

|

12

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

14

|

|

|

14

|

|

|

15

|

|

|

15

|

PROSPECTUS SUMMARY

THE PROCTER & GAMBLE COMPANY DIRECT STOCK PURCHASE PLAN

The Procter & Gamble Company Direct Stock Purchase Plan (“Plan”) is a plan designed to encourage long- term investment in The Procter & Gamble Company (“the Company” or

“P&G”) common stock (“Common Stock”) by providing eligible investors with a convenient and economical method to purchase Company shares and to reinvest cash dividends toward the purchase of additional shares.

Key features of the Plan are listed below:

• Make your initial investment directly through the Plan – no need for a broker

• Conduct easy recurring or periodic investments by automatic bank debit or by sending in a check

• Invest over time with a company you know and trust

• Reinvest all or a portion of your dividend

• Access your account and perform transactions online

• Put your investment dollars to work by purchasing full and fractional shares

• Benefit from low transaction fees

• Eliminate the need to track and safekeep certificated shares by depositing them into the Plan

• Sell your shares directly through the Plan

To the extent required by applicable law in certain jurisdictions, shares offered under the Plan are offered through the Plan Administrator. It is recommended that this prospectus be

retained for future reference.

The Procter & Gamble Company is focused on providing branded consumer packaged goods of superior quality and value to improve the lives of the world’s

consumers. The Company was incorporated in Ohio in 1905, having first been established as a New Jersey corporation in 1890, and was built from a business founded in Cincinnati in 1837 by William Procter and James Gamble. Today, our products are sold in

more than 180 countries and territories. Our principal executive offices are located at One Procter & Gamble Plaza, Cincinnati, Ohio 45202, and our telephone number is (513) 983-1100.

Contact Information

Internet: shareowneronline.com

Available 24 hours a day, 7 days a week for access to account information and answers to many common questions and general inquiries.

To enroll in the Plan:

|

If you are an existing registered shareowner:

|

|

If you are a new investor:

|

|

1. Go to shareowneronline.com

2. Select Register then Register for Online Access

3. Enter your

Company Name, Authentication ID* and Account Number

*If you do not have your Authentication ID, select I don’t know and

complete the online form to have it sent to you. For security, this number is required for first time sign on.

|

|

1. Go to shareowneronline.com

2. Under Register then Buy Shares in a Company

3. Select The Procter & Gamble

Company

4. Invest in this company and follow the instructions to buy shares

|

Email

Go to shareowneronline.com and select Contact Us.

Telephone

1-800-742-6253 Toll-Free

651-450-4064 outside the United States

Customer Care Specialists are available Monday through Friday, from 7:00 a.m. to 7:00 p.m. Central Time.

You may also access your account information 24 hours a day, 7 days a week using our automated voice response system.

Written correspondence and deposit of certificated shares*:

EQ Shareowner Services

P.O. Box 64856

St. Paul, MN 55164-0856

Certified and overnight delivery

EQ Shareowner Services

1110 Centre Pointe Curve, Suite 101

Mendota Heights, MN 55120-4100

*If sending in a certificate for deposit, see Certificate Deposit Information.

Our business is subject to significant risks. You should carefully consider the risks and uncertainties described in this Prospectus, any accompanying prospectus

supplement and the documents incorporated by reference herein and therein, including the risks and uncertainties described in our consolidated financial statements and the notes to those financial statements and the risks and uncertainties described in

our Annual Report on Form 10-K for the year ended June 30, 2020, as amended, and in any subsequent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K under Item 1A, “Risk Factors” as well as in any subsequent periodic or current reports

filed with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that include “Risk Factors,” or that discuss risks to us, which are incorporated by reference in this Prospectus

or any applicable prospectus supplement. Before making an investment decision, you should carefully consider these risks, as well as any other information that we include or incorporate by reference in this Prospectus or any applicable prospectus

supplement. If any of the risks and uncertainties described in this Prospectus, any applicable prospectus supplement or the documents incorporated by reference herein or therein actually occur, our business, financial condition and results of

operations could be adversely affected in a material way. This could cause the trading price of our common stock to decline, perhaps significantly, and you may lose part or all of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included or incorporated by reference in this prospectus, other than purely historical information, including estimates, projections, statements

relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section

27A of the Securities Act of 1933 and Section 21E of the Exchange Act. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may

cause results to differ materially from those expressed or implied in the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or

otherwise, except to the extent required by law.

Risks and uncertainties to which our forward-looking statements are subject include, without limitation: (1) the ability to successfully manage global financial risks, including foreign

currency fluctuations, currency exchange or pricing controls and localized volatility; (2) the ability to successfully manage local, regional or global economic volatility, including reduced market growth rates, and to generate sufficient income and

cash flow to allow the Company to affect the expected share repurchases and dividend payments; (3) the ability to manage disruptions in credit markets or changes to our credit rating; (4) the ability to maintain key manufacturing and supply

arrangements (including execution of supply chain optimizations and sole supplier and sole manufacturing plant arrangements) and to manage disruption of business due to factors outside of our control, such as natural disasters, acts of war or

terrorism, or disease outbreaks; (5) the ability to successfully manage cost fluctuations and pressures, including prices of commodities and raw materials, and costs of labor, transportation, energy, pension and healthcare; (6) the ability to stay on

the leading edge of innovation, obtain necessary intellectual property protections and successfully respond to changing consumer habits and technological advances attained by, and patents granted to, competitors; (7) the ability to compete with our

local and global competitors in new and existing sales channels, including by successfully responding to competitive factors such as prices, promotional incentives and trade terms for products; (8) the ability to manage and maintain key customer

relationships; (9) the ability to protect our reputation and brand equity by successfully managing real or perceived issues, including concerns about safety, quality, ingredients, efficacy or similar matters that may arise; (10) the ability to

successfully manage the financial, legal, reputational and operational risk associated with third-party relationships, such as our suppliers, contract manufacturers, distributors, contractors and external business partners; (11) the ability to rely on

and maintain key company and third party information and operational technology systems, networks and services, and maintain the security and functionality of such systems, networks and services and the data contained therein; (12) the ability to

successfully manage uncertainties related to changing political conditions (including the United Kingdom’s exit from the European Union) and potential implications such as exchange rate fluctuations and market contraction; (13) the ability to

successfully manage regulatory and legal requirements and matters (including, without limitation, those laws and regulations involving product liability, product and packaging composition, intellectual property, labor and employment, antitrust, data

protection, tax, environmental, and accounting and financial reporting) and to resolve pending matters within current estimates; (14) the ability to manage changes in applicable tax laws and regulations including maintaining our intended tax treatment

of divestiture transactions; (15) the ability to successfully manage our ongoing acquisition, divestiture and joint venture activities, in each case to achieve the Company’s overall business strategy and financial objectives, without impacting the

delivery of base business objectives; (16) the ability to successfully achieve productivity improvements and cost savings and manage ongoing organizational changes, while successfully identifying, developing and retaining key employees, including in

key growth markets where the availability of skilled or experienced employees may be limited; and (17) the ability to successfully manage the demand, supply, and operational challenges associated with a disease outbreak, including epidemics, pandemics,

or similar widespread public health concerns (including the novel coronavirus, COVID-19, outbreak). For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer

to our most recent Form 10-K, Form 10-Q and Form 8-K reports incorporated by reference herein.

Purchases of Common Stock under the Plan will be made in the open market and the Company will not receive any proceeds under the Program.

DETERMINATION OF OFFERING PRICE

The cost of shares of the Company’s Common Stock acquired under the Plan is the average price of all shares purchased for each Investment Period, plus any brokerage

charges and applicable transaction fees (see Investment Summary and Fees).

TERMS AND CONDITIONS OF THE DIRECT STOCK PURCHASE PLAN

The following is a description of The Direct Stock Purchase Plan of the Company:

The purpose of the Plan is to encourage long-term investment in the Company by offering eligible participants a convenient and economical way to buy shares of the

Company’s Common Stock and to reinvest cash dividends toward the purchase of additional shares.

The Plan is administered by Equiniti Trust Company d/b/a EQ Shareowner Services (“EQ” or the "Plan Administrator"). EQ also serves as the Company’s stock transfer and

dividend disbursing agent.

Participation in the Plan is entirely voluntary. You may join the Plan at any time and request that your account be closed whenever you wish.

Any person or entity is eligible to enroll in the Plan provided that the enrollment procedures are satisfied as described below under the heading “How to Enroll.”

Enrollment in the Plan is voluntary and may not be available to investors in certain countries. Persons residing outside of the United States should determine whether they are subject to any governmental regulation prohibiting their participation.

• After being furnished with a copy of this prospectus, any shareholder of record may enroll in the Plan.

• Shareholders of record who are not employees may enroll by signing an Account Authorization Form (“AAF”) and submitting it to EQ. Forms

and all other Plan documents may be obtained from EQ or by accessing them through our website at shareowneronline.com.

• If you are an employee of the Company and wish to enroll in the Plan through payroll deductions, wherever offered, you may initiate the

deduction by following the enrollment instructions provided under “Life & Career” on my.pg.com.

• Persons or entities who are not shareholders of record may enroll by completing an AAF and submitting it to EQ. In addition to your AAF,

you must include your initial investment by authorizing an automatic withdrawal from your checking or savings account, or by sending a first-party check made payable to “EQ Shareowner Services” in U.S. dollars and drawn on a U.S. or Canadian financial

institution. Cash, money orders, traveler’s checks or third-party checks are not accepted. The minimum initial investment in the Plan is required. You may also enroll and make your initial investment in the Plan online at shareowneronline.com. There is a onetime enrollment fee for new participants (see Investment Summary and Fees). If you are an employee of the Company, there is a minimum investment required per

deduction if using the payroll deduction feature (see Investment Summary and Fees).

• If you currently own shares P&G Common Stock that are held on your behalf by a bank or broker (in “street name”), you can instruct the

bank or broker to transfer at least one share to a book-entry Direct Registration Shares (“DRS”) account registered in your name. Once the process is complete, you will receive a statement showing the deposit of shares to book-entry DRS. Upon receipt

of the statement, you can enroll in the Plan as an existing registered shareowner.

• You can reinvest all or a portion of your P&G cash dividends. You also have the choice to receive your dividends in a cash payment.

When you enroll in the Plan, you may select the option to automatically reinvest your dividend. If you do not select an option, the Plan Administrator will default your choice to full reinvestment. You may change your election at any time online, by

telephone or by sending a new AAF by mail. Changes received after the record date of a dividend will be effective for the following dividend. The record date is usually ten calendar days after a dividend is declared.

• Once you have enrolled, your participation continues automatically unless terminated by the Company or you request that your Plan account

be closed (refer to sections “Closing Your Account” and “Termination”).

Optional Cash Investments

Any initial, recurring, or one-time optional cash investment will be invested within five (5) trading days, and no later than 35 trading days, except where

postponement is necessary to comply with Regulation M under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or other applicable provisions of securities law. In making purchases for the participant’s account, the Plan Administrator

may commingle the participant’s funds with those of other participants of the Plan. Purchases may be subject to certain fees and conditions (see Investment Summary and Fees).

• Checks – To make an investment by mail, payments must be in U.S. dollars and

drawn on a U.S. or Canadian financial institution. Cash, money orders, traveler’s checks or third-party checks are not accepted.

• Automatic investments – A participant may setup a one-time, semi-monthly or

monthly automatic withdrawal from a designated bank account. The request may be submitted online, by telephone or by sending an AAF by mail (see Contact Information). Requests are processed and become effective

as promptly as administratively possible. Once the automatic withdrawal is initiated, funds will be debited from the participant’s designated bank account on or about the 5th and/or the 20th of each month and will be invested in P&G Common Stock

within five (5) trading days. Changes or a discontinuation of automatic withdrawals can be made online, by telephone or by using the Transaction Request Form attached to the participant’s statement. To be effective with respect to a particular

investment date, a change request must be received by the Plan Administrator at least 15 trading days prior to the investment date.

Participants will not earn interest on funds held by the Plan Administrator. During the period that any

initial investment or optional cash investment is pending, the collected funds in the possession of the Plan Administrator may be invested in certain Permitted Investments. For purposes of this Plan, “Permitted Investments” shall mean the Plan

Administrator may hold the funds uninvested or invested in deposit products. The risk of any loss from such Permitted Investments shall be the responsibility of the Plan Administrator. Investment income from such Permitted Investments shall be retained

by the Plan Administrator.

A minimum optional cash investment via Automatic Investment or check is required. You may make optional

cash investments up to the total maximum in a calendar year. Optional cash investments in excess of the maximum limit for any calendar year or below the required minimum will be returned to you. There is no obligation to make optional cash payments at

any time (see Investment Summary and Fees).

Wherever available, employees may use payroll deductions to purchase shares in the Plan. If you wish to

change any aspect of your payroll deduction selection, you must go into my.pg.com; Life & Career; Pay & Retirement; My Paycheck Deductions and submit the appropriate changes. The minimum investment is

required per payroll deduction (see Investment Summary and Fees).

If any optional cash investment, including payment by check or automatic withdrawal, is returned for any

reason, the Plan Administrator will remove from the participant’s account any Common Stock purchased with such funds, and will sell these shares. The Plan Administrator may also sell additional Common Stock in the account to recover a returned funds

fee for each optional cash investment returned unpaid for any reason and may sell additional shares as necessary to cover any market loss incurred by the Plan Administrator.

Dividend Reinvestment Options

The Plan Administrator will invest P&G dividend funds as soon as administratively possible and no later than 30 trading days following the dividend payable date.

A participant can elect to reinvest all or a portion of the dividends payable (if any) to purchase additional shares of P&G Common Stock. The participant may also

have the choice to receive the full dividend in a cash payment. The following describes the available options:

Full dividend reinvestment – All cash dividends payable on shares held in the Plan, along with any shares

held in physical certificate form or through book-entry DRS, will be used to purchase additional shares. The participant will not receive cash dividends from P&G; instead, all dividends will be reinvested. Whole and fractional shares will be

allocated to the Plan account. (RD)

Partial dividend reinvestment by percentage – A participant may elect to reinvest a portion of the

dividend and receive the remainder in cash. The percentage elected will be applied to the total shares held in the Plan, along with any shares held in physical certificate form or held through book-entry DRS. A participant may elect percentages from

10%-90%, in increments of 10%. The cash portion of dividends will be sent by check unless the participant has elected to have those dividends deposited directly to a designated bank account. (RX-N)

An example of partial reinvestment by percentage: A participant has a total of 150 shares; 120 shares are held in the Plan,

15 in physical certificate form and 15 shares in book-entry DRS. The participant chooses to have 50% of the total dividend reinvested. This will equate to 75 shares having dividends reinvested and 75 shares having dividends paid in cash.

Partial dividend reinvestment by share amount – A participant may elect to reinvest a portion of the

dividend and receive the remainder in cash. The partial elected to reinvest will be applied to the total shares held in the Plan, along with any shares held in physical certificate form or held through book-entry DRS. The cash portion of dividends will

be sent by check unless the participant has elected to have those dividends deposited directly to a designated bank account. (RP-N)

Partial cash dividend by share amount – A participant may elect to be paid cash for a portion of the

dividend and reinvest the remainder. The partial elected to be paid will be applied to the total shares held in the Plan, along with any shares held in physical certificate form or held through book-entry DRS. The cash portion of dividends will be sent

by check unless the participant has elected to have those dividends deposited directly to a designated bank account. (PS-N)

Cash dividends – All dividends payable to the participant will be paid in cash. This includes the

dividend payable on all shares held in the Plan, any shares held in physical certificate form or held through book-entry DRS. The participant’s dividend payment will be sent by check unless the participant has elected to have those dividends deposited

directly to a designated bank account. (RP0)

Direct Deposit of Cash Dividends

For electronic direct deposit of any dividend funds, contact the Plan Administrator to request a Direct Deposit of Dividends Authorization Form. The participant

should include a voided check or deposit slip from the bank account for which to set up direct deposit. If the shares are jointly owned, all owners must sign the form.

Investment Purchase and Pricing

Purchases are made through a broker, generally within five (5) trading days from receipt of your investment amount.

Shares are purchased in the open market. Your purchase price will be the weighted average purchase price per share for all shares purchased through the Plan for that

investment date.

Investments, other than payroll deductions, received less than one (1) business day before any Investment Date will not be available for investment until the next

Investment Date.

PARTICIPANTS WILL RECEIVE NO INTEREST FROM THE COMPANY OR THE PLAN ADMINISTRATOR ON ANY FUNDS HELD PENDING INVESTMENT.

EQ may commingle your funds with those of other participants for the purpose of executing purchases.

The Company has no control over the times when and the prices at which EQ purchases shares of Common Stock. The amount of shares of Common Stock to be purchased, the

manner in which these shares are purchased, and the selection of a broker through which purchases may be executed for the Plan are also determined by EQ.

Investment Summary and Fees

|

Summary

|

|

|

|

Minimum cash investments

|

|

|

|

Minimum one-time initial purchase for new investors

|

$250.00

|

|

|

Minimum one-time optional cash investment

|

$50.00

|

|

|

Minimum recurring automatic investments

|

$50.00

|

|

Minimum employee payroll deduction

|

$10.00

|

|

|

|

|

|

|

Maximum cash investments

|

|

|

Maximum annual investment

|

$6,000,000.00

|

|

|

|

|

|

|

Dividend reinvestment options

|

|

|

Reinvest options

|

Full, Partial, None

|

|

|

|

|

|

|

Fees

|

|

|

|

Investment fees

|

|

|

Initial enrollment (new investors only)

|

$15.00

|

|

Dividend reinvestment

|

5% / $3.00 max

|

|

Check investment

|

$5.00

|

|

|

One-time automatic investment

|

$1.00

|

|

Recurring automatic investment

|

$1.00

|

|

Employee payroll deduction

|

$0.00

|

|

|

Dividend purchase trading fee per share

|

$0.03

|

|

|

Optional cash purchase trading fee per share

|

$0.03

|

|

Payroll purchase trading fee per share

|

$0.03

|

|

|

|

|

|

Sales fees

|

|

|

Batch Order

|

$15.00

|

|

Market Order

|

$25.00

|

|

|

Limit Order per transaction (Day/GTD/GTC)

|

$30.00

|

|

Stop Order

|

$30.00

|

|

Sale trading fee per share

|

$0.12

|

|

Direct deposit of sale proceeds

|

$5.00

|

|

|

|

|

|

Other fees

|

|

|

Certificate deposit

|

$0.00

|

|

Returned check / Rejected automatic bank withdrawals

|

$35.00 per item

|

|

Prior year duplicate statements

|

$15.00 per year

|

|

|

|

|

Direct Registration System (DRS)

We have adopted a direct registration system, or DRS, for book-entry share registration and transfer of our Common Stock. No certificates representing your shares

will be mailed to you. Under DRS, instead of receiving stock certificates, you will receive a statement reflecting your ownership interest in your shares. DRS is a method of recording shares of stock in electronic, or book-entry form, meaning shares

can be registered in your name on the books of The Procter & Gamble Company without the need for physical certificates. Shares held in book-entry under DRS have all the traditional rights and privileges of shares held in certificated form.

DRS eliminates the risk and cost of paper certificates,

while enabling you to maintain the benefits of direct ownership, including the ability to participate in the Plan. If you hold any shares in book-entry form, you may at any time choose to have all or a portion of your book-entry shares transferred to

your broker electronically by contacting your broker or dealer. When using your broker to facilitate a share transfer, you will need to provide them with a copy of your DRS account statement.

|

•

|

EQ will provide a detailed statement for each week in which your Plan account has optional investment, sale or transfer activity. This statement will describe all transactions for the calendar year-to-date.

|

• Statements will not be mailed following dividend reinvestments. Participants can enroll online at shareowneronline.com.

Once enrolled, participants may then elect electronic notification, meaning eDelivery of statements, reports, prospectuses and other materials under the applicable securities laws.

|

•

|

Annual statements reflecting calendar year-to-date activity will be mailed to all participants.

|

|

•

|

Participants who are employees of the Company will not receive activity statements for payroll deductions. Their account information is available at shareowneronline.com.

|

|

•

|

At a participant’s request, EQ will provide a historical statement. There may be a fee for a duplicate statement for participants (see Investment Summary and Fees). A

first-party check (payable in U.S. dollars and drawn on a U.S. or Canadian financial institution) must be made payable to “EQ Shareowner Services” and must accompany the written request.

|

|

•

|

All notices, statements and reports will be sent to your address of record. Many States have enacted abandoned property laws which may require the Company or EQ to remit to the State all stock and dividends held in

those Plan accounts for which the owner cannot be located. Accordingly, you should promptly notify EQ of any change of address.

|

Share Certificates and Share Safekeeping

Shares purchased for your Plan account are held by EQ.

• At the time of enrollment in the Plan, or at any later time, you may deposit any of your Common Stock certificates with EQ for safekeeping. Shares

represented by the deposited certificates will be included in book-entry form in your Plan account.

|

•

|

If you wish to have only a portion of your cash dividends on Common Stock held in your Plan account reinvested, you must notify EQ, in writing or online at shareowneronline.com

|

|

•

|

If you wish to have none of your cash dividends reinvested, your shares may be placed in Direct Registration System form. Direct Registration System is a securities industry initiative that provides for electronic direct registration of securities on our books, in your existing EQ account registration and allows shares to be transferred between EQ and your broker electronically.

|

|

•

|

Shares deposited are treated in the same manner as shares purchased through the Plan and may be transferred or sold through the Plan for tax purposes. It is important that you keep records of the original purchase

price of these shares for subsequent gain or loss calculations.

|

|

•

|

Shares held in Plan accounts may not be pledged.

|

A participant may elect to deposit physical P&G Common Stock certificate(s) for safekeeping, by sending the certificate(s) to the Plan Administrator together with instructions to deposit the certificate(s).

The certificate(s) will show as surrendered with the corresponding credit to Plan shares. The transaction will appear on the Plan account statement, and shares will be held by the Plan Administrator in its name or nominee name. These shares will be

held until the participant sells, withdraws or terminates participation in the Plan. Because the participant bears the risk of loss in sending stock certificate(s), it is recommended that the participant sends them registered, insured for at least 3%

of the current market value and request a return receipt.

Optional Mail Loss Insurance

The participant is advised that choosing registered, express or certified mail alone will not provide full protection, should the certificates become lost or stolen.

Mail loss insurance provides the coverage needed to replace and reissue the shares should they become lost or stolen through the mail. As the Plan Administrator, EQ can provide low-cost loss insurance for certificates being returned for conversion to

book-entry form. Replacement transaction fees may also apply.

To take advantage of the optional mail loss insurance, simply include a check in the amount of $10.00, made payable to ‘EQ Surety Program’, along with the

certificates and instructions. Choose an accountable mail delivery service such as Federal Express, United Parcel Service, DHL, Express Mail, Purolator, TNT, or United States Postal Service Registered Mail. Any one shipping package may not contain

certificates exceeding a total value of $100,000. The value of certificate shares is based on the closing market price of the Common Stock on the trading day prior to the documented mail date.

Claims related to lost certificates under this service must be made within 60 days of the documented delivery service mail date. A copy of the certificate(s) mailed,

along with proof that it was sent by trackable mail should be submitted with the claim. This is specific coverage for the purpose of converting shares to book-entry form and the surety is not intended to cover certificates being tendered for

certificate breakdown or exchange for other certificates.

Sales are usually made through a broker, who will receive brokerage commissions. Typically, the shares are sold through the exchange on which the common shares of

P&G are traded. Depending on the number of P&G shares to be sold and current trading volume, sale transactions may be completed in multiple transactions and over the course of more than one day. All sales are subject to market conditions,

system availability, restrictions and other factors. The actual sale date, time or price received for any shares sold through the Plan cannot be guaranteed.

Participants may instruct the Plan Administrator to sell shares under the Plan through a Batch Order, Market Order, Day Limit Order, Good-’Til-Date/Canceled Limit

Order or Stop Order.

Batch Order (online, telephone, mail) – The Plan Administrator will combine each request to sell through

the Plan with other Plan participant sale requests for a Batch Order. Shares are then periodically submitted in bulk to a broker for sale on the open market. Shares will be sold no later than five business days (except where deferral is necessary under

state or federal regulations). Bulk sales may be executed in multiple transactions and over more than one day depending on the number of shares being sold and current trading volumes. Once entered, a Batch Order request cannot be canceled.

Market Order (online or telephone) – The participant’s request to sell shares in a Market Order will be

at the prevailing market price when the trade is executed. If such an order is placed during market hours, the Plan Administrator will promptly submit the shares to a broker for sale on the open market. Once entered, a Market

Order request cannot be canceled. Sales requests submitted near the close of the market may be executed on the next trading day, along with other requests received after market close.

Day Limit Order (online or telephone) – The participant’s request to sell shares in a Day Limit Order will

be promptly submitted by the Plan Administrator to a broker. The broker will execute as a Market Order when and if the stock reaches or exceeds the specified price on the day the order was placed (for orders placed outside of market hours, the next

trading day). The order is automatically canceled if the price is not met by the end of that trading day. Depending on the number of shares being sold and current trading volumes, the order may only be partially filled and the remainder of the order

canceled. Once entered, a Day Limit Order request cannot be canceled by the participant.

Good-’Til-Date/Canceled (GTD/GTC) Limit Order (online or telephone) – A GTD/GTC Limit Order request will

be promptly submitted by the Plan Administrator to a broker. The broker will execute as a Market Order when and if the stock reaches or exceeds the specified price at any time while the order remains open (up to the date requested or 90 days for GTC).

Depending on the number of shares being sold and current trading volumes, sales may be executed in multiple transactions and may be traded on more than one day. The order or any unexecuted portion will be automatically canceled if the price is not met

by the end of the order period. The order may also be canceled by the applicable stock exchange or the participant.

Stop Order (online or telephone) – The Plan Administrator will promptly submit a participant’s request to

sell shares in a Stop Order to a broker. A sale will be executed when the stock reaches a specified price, at which time the Stop Order becomes a Market Order and the sale will be at the prevailing market price when the trade is executed. The price

specified in the order must be below the current market price (generally used to limit a market loss).

Sales proceeds will be net of any fees to be paid by the participant (see Investment Summary and Fees for details). The Plan

Administrator will deduct any fees or applicable tax withholding from the sale proceeds. Sales processed on accounts without a valid Form W-9 for U.S. citizens or Form W-8BEN for non-U.S. citizens will be subject to Federal Backup Withholding. This tax

can be avoided by furnishing the appropriate and valid form prior to the sale. Forms are available online at shareowneronline.com.

A check for the proceeds of the sale of shares (in U.S. dollars), less applicable taxes and fees, will generally be mailed by first class mail as soon as

administratively possible after settlement date. If a participant submits a request to sell all or part of the Plan shares, and the participant requests net proceeds to be automatically deposited to a checking or savings account, the participant must

provide a voided blank check for a checking account or blank savings deposit slip for a savings account. If the participant is unable to provide a voided check or deposit slip, the participant’s written request must have the participant’s signature(s)

medallion guaranteed by an eligible financial institution for direct deposit. Requests for automatic deposit of sale proceeds that do not provide the required documentation will not be processed and a check for the net proceeds will be issued.

A participant who wishes to sell shares currently held in certificate form may send them in for deposit to the Plan Administrator and then proceed with the sale. To

sell shares through a broker of their choice, the participant may request the broker to transfer shares electronically from the Plan account to their brokerage account.

P&G’s share price may fluctuate between the time the sale request is received and the time the sale is completed on the open market. The Plan Administrator shall

not be liable for any claim arising out of failure to sell on a certain date or at a specific price. Neither the Plan Administrator nor any of its affiliates will provide any investment recommendations or investment advice with respect to transactions

made through the Plan. This risk should be evaluated by the participant and is a risk that is borne solely by the participant.

The Insider Trading Policy provides that the participant may not trade in P&G’s Common Stock if in possession of material, non-public information about the

company. Share sales by employees, Affiliates and Section 16 officers must be made in compliance with P&G’s Insider Trading Policy.

Transfer and Gift of Shares

To authorize a transfer or gift of P&G shares, a participant must submit a Stock Power Form with instructions to transfer ownership of shares, to the Plan

Administrator. The Form can be found at shareowneronline.com. For additional assistance regarding the transfer of Plan shares, contact the Plan Administrator (see Contact

Information). The Form will require a “Medallion Signature Guarantee” by a financial institution. A Medallion Signature Guarantee is a special guarantee for securities and may be obtained through a financial institution such as a broker, bank,

savings and loan association, or credit union who participates in the Medallion Signature Guarantee program. The guarantee ensures that the individual requesting the transfer of securities is the owner of those securities. Most banks and brokers

participate in the Medallion Signature Guarantee program.

If a participant’s request to transfer all Plan shares in an account is received between a dividend record date and payable date, the request will be processed, and a

separate dividend check will be mailed to the participant.

A participant can also gift shares from a Plan account to a non-participant by making an initial cash investment to establish an account in the recipient’s name. An

optional cash investment can also be submitted on behalf of an existing Plan participant (see Investment Summary and Fees). If a participant’s investments or transfers are made to an existing account, dividends

on the shares credited to such investments or transfers will be invested in accordance with the elections made by the existing account owner.

A participant may terminate participation in the Plan at any time by instruction to the Plan Administrator. Requests can be made online, by telephone or through the

mail (see Contact Information). A participant requesting termination may elect to retain P&G shares or to sell all or a portion of the shares in the account. If a participant chooses to retain the Plan

shares, they will be converted and held in book-entry DRS. Any fractional shares will be sold, and a check will be sent to the participant for the proceeds. If a participant chooses to sell the Plan shares, the Plan Administrator will sell such shares

at the current market value and will send the proceeds to the participant, less fees and any applicable taxes. If no election is made in the request for termination, whole Plan shares will be converted to book-entry DRS. Upon termination, any uninvested contributions will be returned to the participant. Any future dividends will be paid in cash, unless the participant rejoins the Plan.

If the participant’s request to terminate their participation in the Plan is received on or after a dividend record date, but before the dividend payable date, the

participant’s termination will be processed as soon as administratively possible, and a separate dividend check will be mailed to the participant.

If you are an employee of the Company and are using the payroll deduction feature, you must cancel your payroll deduction through Employee Resources at “Life &

Career” on my.pg.com prior to closing your account.

The Plan Administrator reserves the right to terminate participation in the Plan if a participant does not have at least one whole share in the Plan. Upon

termination, the participant may receive the cash proceeds from the sale of any fractional share, less any transaction fee and brokerage commission.

The Company reserves the right to amend or terminate the Plan at any time and, upon any termination, to take appropriate action required to cause a distribution to

you of all whole shares, the cash value of any fractional share, and any cash held in your account.

The reinvestment of dividends does not relieve the participant of any income tax that may be payable on such dividends. The Plan Administrator will report to all participants and the

Internal Revenue Service (“IRS”) the amount of dividends credited to their accounts on Form 1099-DIV. For non-U.S. participants receiving U.S. sourced dividends, they will be reported on Form 1042-S.

If a participant sells shares through the Plan Administrator, a Form 1099-B or Form 1042-S as applicable for reporting the proceeds from the sale will be sent to the

participant and the IRS.

Tax withholding will be applicable on accounts without a valid Form W-9 for U.S. citizens or Form W-8BEN for non-U.S. citizens. A participant can avoid this tax by

furnishing the appropriate and valid form prior to the sale. Forms are available at shareowneronline.com.

A foreign person (nonresident alien individual or foreign entity) is subject to tax withholding at a 30% rate on the gross amount of certain payments of U.S. source

income including dividends, unless the beneficial owner of the payment is entitled to a reduced rate of, or exemption from, withholding tax under an income tax treaty. Foreign Entity owned accounts may also be subject to 30% withholding on all

applicable U.S. sourced income, including dividends, as required by the Foreign Account Tax Compliance Act (“FATCA”). Gross proceeds received from the sale, maturity or exchange of securities that can produce U.S. sourced dividends or interest will

also be subject to potential FATCA withholding effective on January 1, 2019. Foreign persons should consult with their tax advisors or counsel as to which tax certification form they are required to provide and for more specific information regarding

the withholding requirements under Chapters 3 and 4 (FATCA) of the U.S. Internal Revenue Code.

Annual account statements, which contain a detailed record of a participant’s purchases and sales, should be retained for tax purposes to assist with determining cost

basis.

The participant should consult a personal tax advisor concerning proper tax treatment of these amounts as interpretations may differ, and laws, regulations and

rulings may change over time.

This Plan assumes that each participant will use the first-in, first-out (FIFO) method when determining the tax basis of any shares sold. Participants may designate

their preference for a different method of determining the tax basis of shares by identifying this preference in writing to the Plan Administrator. Participants may designate their preference for specific

identification cost basis at any time.

Participants in the Plan will receive voting materials and have the sole right to vote the Common Stock of P&G represented by the shares held for them in the

Plan. In the event the participant does not provide direction for voting, the Plan shares will not be voted.

The participant is encouraged to read the information carefully. Votes may be submitted online, by telephone or by returning the signed, dated proxy card. A

participant’s shares will be voted in accordance with the most recent submitted instructions.

Stock Dividend, Split, and Distribution of Rights

It is understood that any stock dividends or stock splits distributed by P&G on Common Stock held by the Plan Administrator for the participant will be credited

to the participant’s account. This will include all whole and fractional shares.

In the event that P&G makes available to its shareowners any rights to subscribe for additional Common Stock, the rights to subscribe will be based on any shares

held in and outside of the Plan. Any new shares distributed by P&G resulting from the exercise of the rights will be issued directly to the participant.

In the event P&G makes available to its shareowners rights to purchase additional Common Stock or other securities, the Plan Administrator will sell such rights

accruing in Common Stock for the participant. The funds will be combined with the next regular dividend or optional cash investment for reinvestment. If a participant desires to independently exercise the

purchase rights, the participant should request that whole Common Stock be issued in book-entry DRS.

Neither the Company nor Equiniti Trust Company d/b/a EQ Shareowner Services (“EQ”) shall be liable under the Plan for any act

done in good faith or any good faith omission to act including, without limitation, any claims for liability:

• arising out of failure to terminate the participant’s participation in the Plan upon the participant’s death;

• with respect to the prices at which shares are purchased or sold for a participant’s account and the times at which purchases or sales are made; and

• in connection with the value of shares after their purchase by EQ.

THE DIVIDEND POLICY OF THE COMPANY IS NOT AFFECTED BY THIS PLAN AND WILL CONTINUE TO DEPEND ON EARNINGS, FINANCIAL REQUIREMENTS AND OTHER FACTORS.

THE COMPANY CANNOT ASSURE YOU OF A PROFIT OR PROTECT YOU AGAINST A LOSS ON SHARES OF COMMON STOCK PURCHASED UNDER THE PLAN.

The terms and conditions of the Plan and its operation shall be governed by the laws of the State of Ohio without regard to the choice of law provisions of the State

of Ohio, whether common law or statutory.

DESCRIPTION OF PROCTER & GAMBLE CAPITAL STOCK

The Company's Amended Articles of Incorporation authorize the issuance of 10,000,000,000 shares of Common Stock, 600,000,000 shares of Class A Preferred Stock and 200,000,000 shares of

Class B Preferred Stock, all of which are without par value ("Common Stock," "Class A Preferred Stock," and "Class B Preferred Stock," respectively). There are no shares of Class B Preferred Stock currently outstanding.

The holders of Common Stock and Class A Preferred Stock are entitled to one vote per share on each matter submitted to a vote of shareholders. The holders of Class B Preferred Stock,

if any, are not entitled to vote other than as provided by law. The Company's Board of Directors (the "Board") is not classified and each member is elected annually. The Company’s Amended Articles of Incorporation provide for directors in uncontested

director elections to be elected by a simple majority vote. Additionally, to the extent that Ohio law would otherwise impose a supermajority vote requirement on actions to be taken at meetings of the Company’s shareholders, the Company’s Amended

Articles of Incorporation require only a vote of a majority of the Company’s outstanding capital stock that is entitled to vote on such matters.

The holders of Class A Preferred Stock and, if issued, Class B Preferred Stock have the right to receive dividends prior to the payment of dividends on the Common Stock. The Board has

the power to determine certain terms relative to any Class A Preferred Stock and Class B Preferred Stock to be issued, such as the power to establish different series and to set dividend rates, the dates of payment of dividends, the cumulative dividend

rights and dates, redemption rights and prices, sinking fund requirements, restrictions on the issuance of such shares or any series thereof, liquidation price and conversion rights. Also, the Board may fix such other express terms as may be permitted

or required by law. In the event of any liquidation or dissolution, the holders of the Common Stock are entitled to receive as a class, pro rata, the residue of the assets after payment of the liquidation price to the holders of Class A Preferred Stock

and, if issued, Class B Preferred Stock.

The Board has determined the terms of shares of Class A Preferred Stock issued as Series A ESOP Convertible Class A Preferred Stock, which can only be held by a trustee or trustees of

an employee stock ownership plan or other benefit plan of the Company. Upon transfer of Series A ESOP Convertible Class A Preferred Stock to any other person, such transferred shares shall be automatically converted into shares of Common Stock. Each

share of Series A ESOP Convertible Class A Preferred Stock has a cumulative dividend of $.5036075 per year and a liquidation price of $6.82 per share (as adjusted for the stock splits on October 20, 1989, May 15, 1992, August 22, 1997 and May 21, 2004,

and the Smucker transaction effective June 1, 2002), is redeemable by the Company or the holder without regard to any arrearage in the payment of dividends, is convertible at the option of the holder into one share of Common Stock and has certain

anti-dilution protections associated with the conversion rights. Appropriate adjustments to dividends and liquidation price will be made to give effect to any future stock splits, stock dividends or similar changes to the Series A ESOP Convertible

Class A Preferred Stock.

The Board has also determined the terms of shares of Class A Preferred Stock issued as Series B ESOP Convertible Class A Preferred Stock. Each share of Series B ESOP Convertible Class

A Preferred Stock has a cumulative dividend of $1.022 per year and a liquidation price of $12.96 per share (as adjusted for the stock splits on August 22, 1997 and May 21, 2004, and the Smucker transaction effective June 1, 2002), is redeemable by the

Company or the holder under certain circumstances, is convertible at the option of the holder into one share of Common Stock and has certain anti-dilution protections associated with the conversion rights. Appropriate adjustments to dividends and

liquidation price will be made to give effect to any future stock splits, stock dividends or similar changes to the Series B ESOP Convertible Class A Preferred Stock.

All of the issued shares of Common Stock of the Company are fully paid and non-assessable. Common Stock does not have any conversion rights and is not subject to any redemption

provisions. No holder of shares of any class of the Company’s capital stock has or shall have any right, pre-emptive or other, to subscribe for or to purchase from the Company any of the shares of any class of the Company hereafter issued or sold. No

shares of any class of the Company’s capital stock are subject to any sinking fund provisions or to calls, assessments by, or liabilities of the Company.

INTERESTS OF NAMED COUNSEL

The legality of the shares of Common Stock offered hereby has been passed upon for the Company by Ms. Jennifer Henkel, Director and Assistant General Counsel, The

Procter & Gamble Company. Ms. Henkel is an owner of Common Stock of the Company and may be a participant in the Plan.

The financial statements incorporated in this Prospectus by reference from the Company's Annual Report on Form 10-K, as amended, for the year ended June 30, 2020, and

the effectiveness of the Procter & Gamble Company's internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated

herein by reference. Such financial statements have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Securities and Exchange Commission (the “SEC”) allows us to “incorporate by reference” into this document the information which P&G filed with the SEC. This

means that we can disclose important information by referring you to those documents. Any information referred to in this way is considered part of this prospectus from the date we file that document. The

information incorporated by reference is an important part of this prospectus and information that P&G files later with the SEC will automatically update and supersede this information. The following documents filed by the Company (File No. 1-434)

with the SEC pursuant to the Exchange Act, are incorporated herein by reference:

• The Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020, as amended; and

• The Company’s Current Reports on Form 8-K filed on August 12, 2020, September 16, 2020, October 13, 2020, (SEC Accession No.

0001193125-20-268528), and October 15, 2020.

All reports and other documents filed by the Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this registration

statement and prospectus and prior to the filing of a post- effective amendment, which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, but excluding any information furnished to,

rather than filed with, the SEC, shall be incorporated by reference herein and shall be deemed to be a part of this prospectus from the dates of filing of such reports and documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this

registration statement and prospectus to the extent that a statement contained in any subsequent prospectus or prospectus supplement hereunder or in any document subsequently filed with the Commission which also is or is deemed to be incorporated by

reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement or prospectus. All documents incorporated

by reference into the Form S-3 of which this prospectus is a part are also incorporated by reference, unless the information therein is superseded by a later filing.

WHERE YOU CAN FIND MORE INFORMATION

The Company will provide without charge to each person to whom a copy of this prospectus is delivered,

upon the oral or written request of such person, a copy of any or all of the documents which are incorporated by reference in this prospectus, other than exhibits to such documents (unless such exhibits are specifically incorporated by reference into

such documents). Requests should be directed to the Plan Administrator (see Contact Information).

The Company files annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document

the Company has filed or will file with the SEC from the SEC’s public website at www.sec.gov.

You may also get a copy of these reports from our website at www.pg.com. Please note, however, that we have not incorporated any other

information by reference from our website, other than the documents listed above.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with

different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume the information in this prospectus or any supplemental prospectus is accurate as of any date other than the date

on the front of those documents.

PART II

Information Not Required in Prospectus

Item 14. Other

Expenses of Issuance and Distribution

The following is a statement of the expenses (which are estimated) to be incurred by the Registrant in connection with the distribution of the securities registered under this registration statement:

|

|

Amount

to be paid

|

|

|

SEC registration fee

|

$227,232

|

|

|

Accounting fees and expenses

|

$10,000

|

|

|

Total

|

$237,232

|

|

Item 15. Indemnification of Directors and Officers

Set forth below is a description of certain provisions of the Ohio Revised Code (“ORC”) and the Company’s Regulations, as such provisions relate to the

indemnification of the directors and officers of the registrant. This description is intended only as a summary and is qualified in its entirety by reference to the ORC and the Company’s Regulations.

Section 1701 of the ORC provides that a corporation must indemnify its directors, officers, employees, and agents against expenses reasonably incurred in

connection with a successful defense (on the merits or otherwise) of any action, suit, or proceeding.

A corporation may indemnify its directors, officers, employees, and agents against expenses, including attorneys’ fees, judgments, fines and amounts paid in

settlement, in connection with actions, suits, or proceedings (except for derivative actions by or in the right of the corporation), whether civil, criminal, administrative, or investigative. The corporation may indemnify such persons if the

individual has acted in good faith and in a manner that the individual believed to be in the best interests of the corporation and, with respect to a criminal action, had no reasonable cause to believe their conduct was unlawful. The determination as

to whether this standard of conduct has been met must be made by the court, a majority of the disinterested directors, by independent legal counsel, or by the shareholders.

A similar standard applies in the case of derivative actions, except that indemnification may only extend to expenses, including attorney’s fees, incurred in

connection the defense or settlement of such action. If the person seeking indemnification has been found liable to the corporation in such an action, the court must approve the indemnification.

As permitted by the ORC, Article V of the Company’s Regulations require the Company to indemnify, to the fullest extent permitted by law, any person who was or is

a party or is threatened to be made a party to any threatened, pending, or completed claim, action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that he or she (a) is or was a Director, officer

or employee of the Company or its subsidiaries, (b) is or was serving at the request of the Company or its subsidiaries as a director, trustee, officer, partner, managing member or position of similar capacity, or employee of a Company subsidiary or

another corporation, limited liability company, partnership, joint venture, trust, employee benefit plan, or other enterprise (whether domestic or foreign, nonprofit or for profit), or (c) is or was providing to third party organizations volunteer

services that were duly authorized in accordance with the Company’s process for approval of such activities, against all liabilities and expenses actually and reasonable incurred by or imposed on him or her in connection with, or arising out of, any

such claim, action, suit or proceeding. This indemnity will be provided unless the person (a) failed to act in good faith, in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Company and its subsidiaries,

(b) acted or failed to act, in either case, with deliberate intent to cause injury to the Company and its subsidiaries or with reckless disregard for the best interests of the Company or its subsidiaries, or (c) knowingly engaged in criminal activity.

The Company’s Directors, officers and certain other key employees of the Company are insured by directors and officers liability insurance policies. The Company

pays the premiums for this insurance.

|

|

|

|

Item 16.

|

Exhibits

|

|

|

|

|

|

|

(3-1)*

|

|

(3-2)*

|

|

|

(5)

|

|

|

(23)(a)

|

|

|

(23)(b)

|

|

|

(24)

|

|

*Incorporated by reference to previously filed document.

Item 17. Undertakings

The Registrant hereby undertakes:

(a) (1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration

statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the

registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration

statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule

430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that

prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the

purpose of determining liability of a Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned

Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the

undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing prospectus relating to the offering

containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(b) That, for

purposes of determining any liability under the Securities Act of 1933, each filing of The Procter & Gamble Company’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as

indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant have been advised that in