UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| |

[ ] |

Preliminary Proxy Statement |

| |

[ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

[x] |

Definitive Proxy Statement |

| |

[ ] |

Definitive Additional Materials |

| |

[ ] |

Soliciting Material Pursuant to § 240.14a-12 |

PRINCIPAL REAL ESTATE INCOME FUND

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

Payment of Filing Fee (Check appropriate box):

| |

[x] |

No fee required |

| |

[ ] |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

|

|

EXPLANATORY NOTE

This Amendment No. 1 to Schedule 14A (the “Amendment”)

is being filed to amend and replace the proxy card included in the Definitive Proxy Statement filed by Principal Real Estate Fund (the

"Fund") with the Securities and Exchange Commission on February 21, 2025 (the "Proxy Statement"). After filing the

Proxy Statement, the Fund discovered that an incorrect version of the proxy card was inadvertently filed with the Proxy Statement. The Amendment is additionally being filed to update the mailing date of the proxy

statement. No

other changes to the Proxy Statement have been made.

PRINCIPAL REAL ESTATE INCOME FUND

(the “Fund”)

1290 Broadway, Suite 1000

Denver, Colorado 80203

(855) 838-9485

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 11, 2025 AT 10:00 A.M. MOUNTAIN

TIME

To the Shareholders of the Fund:

Notice is hereby given that the Annual Meeting of

Shareholders (the “Meeting”) of the Fund will be held as a telephone conference call meeting at which no one will be allowed

to attend in person, on Friday, April 11, 2025, at 10:00 a.m. Mountain Time, for the following purposes:

| 1. | To elect two (2) Trustees; |

| 2. | To consider and vote upon such other matters, including adjournments, as may properly come before the Meeting or any adjournments

thereof. |

These items are discussed in greater detail in the attached Proxy Statement.

Shareholders of record at the close of business on February 7, 2025 are

entitled to a notice of and to vote at the Meeting and any adjournments thereof.

We will be hosting this year’s Meeting as a

telephone conference call. There is no physical location for the Meeting. To participate in the Meeting, you must email attendameeting@equiniti.com no later than 3:00 p.m. Mountain Time on April 7, 2025 and provide your full name and address.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE SIZE OF YOUR

HOLDINGS IN THE FUND. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE ASK THAT YOU PLEASE EITHER VOTE VIA THE INTERNET, BY TELEPHONE

OR COMPLETE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE

UNITED STATES.

| |

By Order of the Board of Trustees of:

Principal Real Estate Income Fund |

| |

|

| |

|

| |

Robert McClure |

| |

President |

March 7, 2025

The Meeting is important. Kindly indicate your

vote as to the items to be discussed at the meeting by following the instructions in the attached proxy card or the voting instruction

form. You may still attend the Meeting, even if you vote your shares beforehand.

PRINCIPAL REAL ESTATE INCOME FUND

(the “Fund”)

1290 Broadway, Suite 1000

Denver, Colorado 80203

(855) 838-9485

PROXY STATEMENT

This Proxy Statement is furnished in connection with

the solicitation of proxies by the Board of Trustees of the Fund (the “Board of Trustees”) for use at the Annual Meeting of

Shareholders of the Fund (the “Meeting”) to be held to be held as a telephone conference call meeting at which no one will

be allowed to attend in person on Friday, April 11, 2025, at 10:00 a.m. Mountain Time and at any adjournments thereof.

We will be hosting this year’s Meeting as a

telephone conference call. There is no physical location for the Meeting. To participate in the Meeting, you must email attendameeting@equiniti.com

no later than 3:00 p.m. Mountain Time on April 7, 2025 and provide your full name and address. You will then receive an email from EQ

Fund Solutions (“EQFS”) containing the conference call dial-in information and instructions for participating in the Meeting.

If you hold your shares through an intermediary, such

as a bank or broker, you must register in advance to attend the Meeting. To register, you must submit proof of your proxy power (legal

proxy) reflecting your Fund holdings along with your name and email address to EQFS, the Fund’s tabulator. You may forward an email

from your intermediary or attach an image of your legal proxy to attendameeting@equiniti.com.

Requests for registration must be received no later than 3:00 p.m. Mountain Time on April 7, 2025. You will then receive an email from

EQFS containing the conference call dial-in information and instructions for participating in the Meeting.

This Proxy Statement was first mailed to shareholders

on or about March 7, 2025.

Other Methods of Proxy Solicitation

In addition to the solicitation of proxies by mail,

officers of the Fund and officers and regular employees of SS&C GIDS, Inc. (“GIDS”), the Fund’s transfer agent,

ALPS Fund Services, Inc. (“ALPS”), the Fund’s administrator, and affiliates of GIDS, ALPS or other representatives of

the Fund may also solicit proxies by telephone, Internet, or in person. The expenses incurred in connection with preparing the Proxy Statement

and its enclosures will be paid by the Fund. The Fund will also reimburse brokerage firms and others for their expenses in forwarding

solicitation materials to the beneficial owners of the Fund’s Common Shares (as defined below). In addition, the Fund has engaged

EQFS to assist in the proxy effort for the Fund. Under the terms of the engagement, EQFS will be providing a web site for the dissemination

of these proxy materials and tabulation services.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON FRIDAY, APRIL 11, 2025, AT 10:00 A.M. MOUNTAIN TIME

THE FUND’S MOST RECENT ANNUAL REPORT, INCLUDING

AUDITED FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED OCTOBER 31, 2024, AND THE PROXY MATERIALS, ARE AVAILABLE UPON REQUEST, WITHOUT

CHARGE, BY WRITING TO THE FUND AT 1290 BROADWAY, SUITE 1000, DENVER, COLORADO 80203, BY CALLING THE FUND AT (855) 838-9485, BY THE INTERNET

AT WWW.PRINCIPALCEF.COM. SHAREHOLDERS ARE ENCOURAGED TO REVIEW THESE MATERIALS BEFORE VOTING. REQUESTS FOR ANY COPIES OF THE PROXY

MATERIALS SHOULD BE MADE BY NO LATER THAN MARCH 24, 2025 TO HELP ENSURE TIMELY DELIVERY.

If the enclosed proxy card is properly executed

and returned in time to be voted at the Meeting, and if you give no instructions on the proxy card, then the Common Shares represented

thereby will be voted “FOR” the proposals listed in the accompanying Notice of Annual Meeting of Shareholders and will be

voted in the discretion of the proxy holders as to any other matters that may properly come before the Meeting. Any shareholder who

has given a proxy has the right to revoke it at any time prior to its exercise either by attending the Meeting and voting his or her Common

Shares via telephone or by submitting a letter of revocation or a later-dated proxy to the Fund at the above address prior to the date

of the Meeting.

The holders of thirty-three and one third (33 1/3)

percent of the outstanding Common Shares on the record date present via telephone or by proxy shall constitute a quorum at the Meeting

for purposes of conducting business. If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient

votes to approve any of the proposed items are not received, the persons named as proxies may propose one or more adjournments of the

Meeting to permit further solicitation of proxies. A shareholder vote may be taken on one or more of the proposals in this Proxy Statement

prior to such adjournment if sufficient votes have been received for approval and it is otherwise appropriate. Any such adjournment for

the Meeting will require the affirmative vote of a majority of those Common Shares present at the Meeting via telephone or by proxy. If

a quorum is present, the persons named as proxies will vote those proxies that they are entitled to vote “FOR” any proposal

in favor of such adjournment and will vote those proxies required to be voted “AGAINST” any proposal against such adjournment.

Eligibility to Vote

At the close of business on February 7, 2025 (the

“Record Date”), only shareholders of record are entitled to receive notice of the Meeting and to vote those Common Shares

for which they are the record owners, at either the Meeting or any adjournment or postponement thereof.

Shares Entitled to Vote

The Fund has one class of capital stock: common shares

of beneficial interest, no par value per share (“Common Shares”). As of the Record Date, the Fund had 6,694,109 Common Shares

outstanding.

Number of Votes per Common Share

The holders of Common Shares are entitled to one vote

for each full share and an appropriate fraction of a vote for each fractional share held.

PROPOSAL 1

ELECTION OF NOMINEES TO

THE FUND’S BOARD OF TRUSTEES

Nominees for the Fund’s Board of Trustees

The Fund’s Board of Trustees is divided into

three classes, each class having a term of three years. Each year the term of office for one class will expire. Listed below are the nominees

for the Board of Trustees. One nominee has been nominated by the Board of Trustees for election to a one-year term to expire at the Fund’s

2026 Annual Meeting of Shareholders or until their successors are duly elected and qualified. The other nominee has been nominated by

the Board of Trustees for election to a three-year term to expire at the Fund’s 2028 Annual Meeting of Shareholders or until their

successors are duly elected and qualified.

| Proposal |

Class |

Expiration

of Term if Elected |

| Independent Trustee/Nominee |

|

|

| Stephanie J. Bullington |

Class I |

2026 Annual Meeting |

| JoEllen L. Legg |

Class III |

2028 Annual Meeting |

Unless authority is withheld, it is the intention

of the persons named in the proxy to vote the proxy “FOR” the election of the nominees named above. The nominees have indicated

that they each have consented to serve as a Trustee if elected at the Meeting. However, if a designated nominee declines or otherwise

becomes unavailable for election, the proxy confers discretionary power on the persons named therein to vote in favor of a substitute

nominee or nominees.

Information About the Nominees’ Professional

Experience and Qualifications

JoEllen L. Legg - Ms. Legg has been a Trustee

of the Fund since March 2024. She currently serves on the Fund’s Qualified Legal Compliance Committee, Nominating and Corporate

Governance Committee and on the Audit Committee JoEllen Legg currently serves as a Trustee of the Reaves Utility Income Fund and was formerly

Counsel with Practus, LLP, a law firm (2017-2019). She previously served as Vice President and Assistant General Counsel of ALPS Fund

Services, Inc., an administrator and transfer agent, and of ALPS Distributors, Inc., a broker-dealer, as Senior Counsel (Corporate and

Securities) of Adelphia Communications Corporation, a public cable company, and held Associate positions at Fried, Frank, Harris, Shriver

& Jacobson, LLP and Patton Boggs LLP (law firms). Ms. Legg has served a Trustee of the Reaves Utility Income Fund since 2022. Ms.

Legg also serves as a member of the Reaves Utility Income Fund's Audit Committee and chair of the Reaves Utility Income Fund’s Nominating

and Corporate Governance Committee. She was selected to serve as a Trustee of the Fund based on her financial services and investment

management experience.

Stephanie J. Bullington - Ms. Bullington is

a contractor with Populus Group, LLC, a firm providing non-permanent workforce programs for employers. Prior to joining Populus Group,

Ms. Bullington was the Chief Financial Officer (“CFO”) at Ascentris, a real estate private equity firm based in Denver, Colorado.

Ms. Bullington was responsible for financial and tax reporting, corporate profitability analysis and strategic financial planning. Prior

to joining Ascentris in May 2023, Ms. Bullington served as the Director of US Fund Oversight for Janus Henderson Investors overseeing

the US funds. Ms. Bullington additionally served as the Assistant Treasurer to the Janus Investment Funds, Janus Aspen Series, Janus Detroit

Street, and Clayton Street Trust Funds. Prior to October 2020, Ms. Bullington served as a Director of Fund Accounting at Invesco following

its acquisition of OFI Global Asset Management, Inc. (OppenheimerFunds, Inc.) in May 2019. While at OppenheimerFunds, Ms. Bullington held

a variety of roles, including Vice President, Treasurer to the Oppenheimer Exchange Traded Funds, Assistant Treasurer to the Oppenheimer

Mutual Funds, Assistant Treasurer to the Oppenheimer Exchange Traded Funds and Assistant Vice President. Ms. Bullington started her career

as an auditor at Deloitte & Touche LLP. Ms. Bullington has over 20 years of financial service industry experience, and graduated Magna

Cum Laude from the University of Maryland, College Park, with Bachelor of Science degrees in Accounting and Finance. Ms. Bullington is

a CFA charterholder and holds CPA licenses in Colorado and Georgia. Ms. Bullington is active with the CFA Society of Colorado Board, serving

in numerous roles over the past five years, including Director and President.

Information About Each Trustee’s Professional

Experience and Qualifications

Provided below is a brief summary of the specific

experience, qualifications, attributes or skills for each Trustee that warranted their consideration as a Trustee candidate to the Board

of Trustees, which is structured as an investment company under the Investment Company Act of 1940, as amended (“1940 Act”).

Rick A. Pederson – Mr. Pederson has served

as a Trustee of the Fund since April 2013. He currently serves on the Fund’s Qualified Legal Compliance Committee, Nominating and

Corporate Governance Committee and on the Audit Committee. Mr. Pederson has been a long-time manager of private equity and real estate

investment funds, and has served on the boards of several private companies and not-for-profit entities. He was selected to serve as a

Trustee of the Fund based on his business and financial services experience.

Jeremy Held – Mr. Held has served as

a Trustee of the Fund since December 2017 and Chair since January 2025. He currently serves on the Fund’s Qualified Legal Compliance

Committee, Nominating and Corporate Governance Committee and on the Audit Committee and has been designated by the Board of Trustees as

an ‘‘audit committee financial expert,’’ as defined in SEC rules. Mr. Held is responsible for helping guide the

strategic direction of Bow River’s registered asset management business including investment oversight, research and product development.

Prior to joining Bow River Capital, Mr. Held was the Chief Investment Officer (“CIO”) at ALPS Advisors, Inc., a Denver-based

asset manager that specializes in real assets and alternative investments. Mr. Held began his career at ALPS in 1996 and led a variety

of business initiatives over two decades, including the launch of the firm’s asset management business in 2007. As CIO, Mr. Held

was responsible for all aspects of the ALPS Asset Management business and ultimately helped it grow to more than $20 billion in assets

under management. Mr. Held graduated from the University of Colorado with a degree in International Business. He is a CFA® charter

holder and is a member of the CFA Society of Denver. He is a member of the Board of Directors of Habitat for Humanity of Metro Denver.

He was selected to serve as a Trustee of the Fund based on his business, financial services and investment management experience.

Also, additional information regarding each Trustee’s

current age, principal occupations and other directorships, if any, that have been held by the Trustees is provided in the table below.

Additional Information About Each Trustee and the

Fund’s Officers

The table below sets forth the names and age of the

Trustees and principal officers of the Fund, the year each was first elected or appointed to office, their term of office, their principal

business occupations during at least the last five years, the number of portfolios overseen by each Trustee or the Fund Complex, and their

other directorships of public companies. Unless noted otherwise, the address for the Trustees and officers is 1290 Broadway, Suite 1000,

Denver, Colorado 80203. The "independent trustees" consist of those trustees who are not "interested persons" of the

Fund, as that term is defined under the 1940 Act.

INDEPENDENT TRUSTEES AND NOMINEES

| Name and Year of Birth |

Position(s) Held with Registrant |

Term of Office and Length of Time Served(4) |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex(1) Overseen by Trustees or Nominee(2) |

Other Directorships(3) Held by Trustee During Past 5 Years |

|

Stephanie J. Bullington

(1977) |

Nominee for Trustee |

N/A |

Serves as a contractor with Populus Group, LLC, a firm providing nonpermanent workforce solutions (October 2024–current). Previously served as CFO for Ascentris, a real estate private equity firm (May 2023-June 2024), Director of US Fund Oversight with Janus Henderson Investors (October 2020-May 2023) and Assistant Treasurer to the Janus Investment Funds, Janus Aspen Series, Janus Detroit Street and Clayton Street Trust Funds (October 2020 – May 2023), and Invesco, Director, Fund Accounting (June 2019 – September 2020). |

1 |

N/A |

|

Jeremy Held

(1974) |

Trustee and Chair |

Term expires in 2027. Has served since December 2017. Has served as Chair since January 2025. |

Jeremy Held, CFA, is currently responsible for Bow River Capital’s registered asset management business and serves as the President and Chairman of the Investment Committee for the Bow River Capital Evergreen Fund (private equity investment fund). Prior to joining Bow River Capital in 2019, Mr. Held was the Director of Research and Chief Investment Officer (CIO) at ALPS Advisors. Mr. Held began his career at ALPS in 1996 and helped lead a variety of business initiatives over two decades, including the launch of the firm’s asset management business in 2007. |

1 |

Bow River Capital Evergreen Fund (1 fund) |

|

JoEllen L. Legg

(1961) |

Nominee for Trustee |

Term expires in 2025. Has served since March 2024. |

Served as Counsel with Practus, LLP, a law firm (2017-2019). Prior to this, served as Vice President, Assistant General Counsel (2012-2016), Vice President, Senior Associate Counsel (2011-2012), and Vice President, Associate Counsel (2007-2011) at ALPS Fund Services, Inc. |

1 |

Reaves Utility Income Fund (1 fund) |

|

Rick A. Pederson

(1952) |

Trustee |

Term expires in 2027. Has served since April 2013. |

Chief Strategy Officer, Bow River Capital (2003 – present); President, Foundation Properties Inc. (1994 – Present) Board Member, Kivu Consulting (2018-2022); Advisory Board Member, Citywide Banks (2017-present); Board Member, Strong-Bridge Consulting, (2015 – 2019); Trustee, National Western Stock Show (2010 – present); Director, History Colorado (2015-2019); Trustee, Boettcher Foundation, (2018 – present). |

24 |

Segall Bryant & Hamill Trust (14 funds); ALPS ETF Trust (23 funds). |

OFFICERS

| Name and Year of Birth |

Position(s) Held with Registrant |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex(1) Overseen by Trustees |

Other

Directorships(2) Held by Trustee During Past 5 Years |

|

Robert McClure

(1969) |

President |

Has served since September 2023. |

Rob McClure joined SS&C ALPS Advisors in January 2020 and serves as a Director of Research. In this role Rob is responsible for investment manager research and oversight as well as sales and distribution support and new product development. Prior to joining ALPS, Rob served for five years as Client Portfolio Manager at Oppenheimer Funds, where he worked closely the firm’s distribution organization to represent Oppenheimer’s domestic value equity team with external clients. Prior to joining Oppenheimer Funds, Rob spent 17 years as a Director in the HOLT division at Credit Suisse in New York, where he led a team focused on providing HOLT’s proprietary corporate performance and valuation platform to hedge funds, mutual funds and pension funds. Rob holds a Bachelor of Arts degree in Economics from the University of Illinois at Urbana-Champaign and a Master of Business Administration from Loyola University-Chicago. |

N/A |

N/A |

|

Matthew Sutula

(1985) |

Chief Compliance Officer (“CCO”) |

Has served since December 2019. |

Mr. Sutula previously served as the Fund’s interim Chief Compliance Officer from September 2019 to December 2019. Mr. Sutula joined ALPS in 2012 and currently serves as Chief Compliance Officer of AAI. Prior to his current role, Mr. Sutula served as Compliance Manager and Senior Compliance Analyst for AAI, as well as Compliance Analyst for ALPS Fund Services, Inc. Prior to joining ALPS, he spent seven years at Morningstar, Inc. in various analyst roles supporting the registered investment company databases. Because of his position with ALPS, Mr. Sutula is deemed an affiliate of the Fund as defined under the 1940 Act. Mr. Sutula is also Chief Compliance Officer of ALPS ETF Trust, ALPS Variable Investment Trust, Liberty All-Star Equity Fund and Liberty All-Star Growth Fund, Inc. From September 2019 to September 2022 he also served as Chief Compliance Officer of RiverNorth Opportunities Fund, Inc. |

N/A |

N/A |

|

Erich Rettinger

(1985) |

Treasurer |

Has served since December 2021. |

Mr. Rettinger is Vice President of ALPS Advisors (since 2021) and serves as Treasurer of Principal Real Estate Income Fund, Liberty All-Star Equity Fund, Liberty All-Star Growth Fund, Inc., and President of ALPS Variable Investment Trust. From March 2021 to March 2024 he served as Treasurer of ALPS Variable Investment Trust. From December 2021 to October 2022 he also served as Treasurer of RiverNorth Opportunities Fund, Inc. From 2013-2021, he served as Vice President and Fund Controller of ALPS Fund Services. |

N/A |

N/A |

|

Michael Herrera

(1985) |

Assistant Treasurer |

Has served since September 2024. |

Mr. Herrera is Manager of Fund Operations of AAI (since 2022) and has served as Assistant Treasurer of ALPS ETF Trust since February 2024. Michael was previously a Fund Controller of ALPS Fund Services (2016 – 2018) and Assistant Fund Controller of ALPS Fund Services (2013 – 2016). |

N/A |

N/A |

|

Brendan Hamill

(1986) |

Secretary |

Has served since June 2024. |

Mr. Hamill rejoined ALPS in April 2024, and is currently Vice President and Principal Legal Counsel. Prior to his current role, Mr. Hamill was an Attorney-Adviser at the U.S. Securities and Exchange Commission (October 2022-March 2024), Vice President and Principal Legal Counsel at ALPS (August 2021-October 2022), and an attorney at Lewis Brisbois Bisgaard & Smith, LLP (law firm) (December 2018-August 2021). Mr. Hamill also serves as Secretary of each of the ALPS ETF Trust, Financial Investors Trust, and the ALPS Variable Investment Trust. |

N/A |

N/A |

| (1) | The term “Fund Complex” means two or more registered investment companies that: |

| (a) | hold themselves out to investors as related companies for purposes of investment and investor services;

or |

| (b) | have a common investment adviser or that have an investment adviser that is an affiliated person of

the investment adviser of any of the other registered investment companies. |

| (2) | The number of funds within the fund complex overseen by a trustee includes portfolios that a nominee

would oversee if elected. |

| (3) | The numbers enclosed parenthetically represent the number of funds overseen in each directorship that

the Trustee has held. Regarding ALPS ETF Trust and ALPS Variable Investment Trust, all funds are included in the total funds in the Fund

Complex column. |

| (4) | Officers are elected annually. Each officer will hold such office until a successor has been elected

by the Board of Trustees. |

Beneficial Ownership of Common Shares(1)

Set forth in the table below is the dollar range of equity securities held

in the Fund and on an aggregate basis for all funds overseen in a family of investment companies overseen by each Trustee.

| Name of Trustee/Nominee |

Dollar Range of Equity

Securities Held in the Fund(2) |

Aggregate Dollar Range of Equity Securities Held in All

Funds in the Family of Investment Companies |

| Stephanie J. Bullington |

None |

None |

| Jeremy Held |

$10,001 - $50,000 |

$10,001 - $50,000 |

| JoEllen L. Legg |

None |

None |

| Rick A. Pederson |

None |

None |

| (1) | This information has been furnished by each Trustee and nominee for election as Trustee as of December 31, 2024. “Beneficial

Ownership” is determined in accordance with Section 16a-1(a)(2) under

the Securities Exchange Act of 1934, as amended (the “1934 Act”). |

| (2) | Ownership amount constitutes less than 1% of the total Common Shares outstanding. |

Trustee Transactions with Fund Affiliates

As of December 31, 2024, none of the trustees who

are not “interested persons” (as defined in the 1940 Act) (each an “Independent Trustee” and collectively the

“Independent Trustees”), nor members of their immediate families owned securities, beneficially or of record, in ALPS Advisors

or Principal Real Estate Investors, LLC (the “Sub-Adviser”), or an affiliate or person directly or indirectly controlling,

controlled by, or under common control with ALPS Advisors or Sub-Adviser. Furthermore, over the past five years, neither the Independent

Trustees nor members of their immediate families have any direct or indirect interest, the value of which exceeds $120,000, in ALPS Advisors

or Sub-Adviser or any of their respective affiliates. In addition, for the fiscal year ended October 31, 2024, neither the Independent

Trustees nor members of their immediate families have conducted any transactions (or series of transactions) or maintained any direct

or indirect relationship in which the amount involved exceeds $120,000 and to which ALPS Advisors or Sub-Adviser or any of their respective

affiliates was a party.

Trustee Compensation

The following table sets forth certain information

regarding the compensation of the Fund’s Trustees for the fiscal year ended October 31, 2024. Officers of the Fund who are employed

by ALPS or ALPS Advisors receive no compensation or expense reimbursement from the Fund or any other fund in the Fund Complex.

| Name of Trustee/Nominee |

Aggregate Compensation

from Fund(1) |

Pension or Retirement

Benefits Accrued as Part

of Fund Expenses |

Total Compensation

from the Fund and Fund

Complex Paid to

Trustees(2) |

Number of Funds in Trustee’s Fund

Complex |

| Non-Interested Trustees |

| Jeremy Held |

$50,750 |

$0 |

$50,750 |

1 |

| JoEllen L. Legg |

$34,500 |

$0 |

$34,500 |

1 |

| Rick A. Pederson |

$47,000 |

$0 |

$233,500 |

24 |

| Jerry G. Rutledge(3) |

$50,000 |

$0 |

$231,500 |

10 |

| Ernest J. Scalberg(4) |

$15,250 |

$0 |

$15,250 |

1 |

| Nominee for Non-Interested Trustees |

| Stephanie J. Bullington |

$0 |

$0 |

$0 |

N/A |

| Total |

$197,500 |

$0 |

$565,500 |

|

| (1) | Represents the total compensation paid to such persons by the Fund during the fiscal year ended October 31, 2024. |

| (2) | Represents the total compensation paid to such Trustee by the Trustee’s Fund Complex during the

fiscal year ended October 31, 2024. The Fund Complex for Mr. Pederson consists of the Fund and all funds within the ALPS ETF Trust. The

Fund Complex for Mr. Rutledge consists of the Fund and 9 funds within the Financial Investors Trust. The Fund Complex for Mses. Bullington

and Legg and Mr. Held consists of the Fund. |

| (3) | Mr. Rutledge was a Trustee as of October 31, 2024. Mr. Rutledge passed away in January 2025. |

| (4) | On March 11, 2024, Mr. Scalberg resigned from his role as Trustee of the Principal Real Estate Income

Fund. |

Each Non-Interested Trustee of the Fund receives an

annual retainer of $24,000 and an additional $5,000 for attending each meeting of the Board of Trustees. In addition to the Attendance

Fee, the Chairman of the Board of Trustees is paid a meeting fee of $1,500 for each meeting of the Board of Trustees and the Chairman

of the Audit Committee of the Board of Trustees is paid a meeting attendance fee of $1,250 for each meeting of the Audit Committee of

the Board of Trustees. The Trustees are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at meetings of

the Board of Trustees.

During the fiscal year ended October 31, 2024, the

Board of Trustees met six times. Each Trustee then serving in such capacity attended at least 75% of the meetings of Trustees and of any

Committee of which he or she is a member.

Leadership Structure of the Board of Trustees

The Board of Trustees, which has overall responsibility

for the oversight of the Fund’s investment programs and business affairs, believes that it has structured itself in a manner that

allows it to effectively perform its oversight obligations. The Trustees also complete an annual self-assessment during which the Trustees

review their overall structure and consider where and how its structure remains appropriate in light of the Fund’s current circumstances.

The Board of Trustees has appointed Mr. Held, an Independent Trustee, to serve in the role of Chairman of the Board of Trustees (“Chairman”).

The Chairman’s role is to preside at all meetings of the Board of Trustees and in between meetings of the Board of Trustees to generally

act as the liaison between the Board of Trustees and the Fund’s officers, attorneys and various other service providers, including

but not limited to ALPS and other such third parties servicing the Fund.

The Fund has three standing committees, each of which

enhances the leadership structure of the Board of Trustees: the Audit Committee; the Nominating and Corporate Governance Committee; and

the Qualified Legal Compliance Committee. The Audit Committee, Nominating and Corporate Governance Committee, and the Qualified Legal

Compliance Committee are each chaired by, and composed of, members who are Independent Trustees.

Oversight of Risk Management

The Fund is confronted with a multitude of risks,

such as investment risk, counter party risk, valuation risk, political risk, risk of operational failures, business continuity risk, regulatory

risk, legal risk and other risks not listed here. The Board of Trustees recognizes that not all risk that may affect the Fund can be known,

eliminated or even mitigated. In addition, there are some risks that may not be cost effective or an efficient use of the Fund’s

limited resources to moderate. As a result of these realities, the Board of Trustees, through its oversight and leadership, has and will

continue to deem it necessary for shareholders of the Fund to bear certain and undeniable risks, such as investment risk, in order for

the Fund to operate in accordance with its prospectus, statement of additional information and other related documents.

However, as required under the 1940 Act, the Board

of Trustees has adopted on the Fund’s behalf a vigorous risk program that mandates the Fund’s various service providers, including

ALPS, to adopt a variety of processes, procedures and controls to identify various risks, mitigate the likelihood of such adverse events

from occurring and/or attempt to limit the effects of such adverse events on the Fund. The Board of Trustees fulfills its leadership role

by receiving a variety of quarterly written reports prepared by the Fund’s Chief Compliance Officer (“CCO”) that (1)

evaluate the operation, policies and policies of the Fund’s service providers, (2) make known any material changes to the policies

and procedures adopted by the Fund or its service providers since the CCO’s last report and (3) disclose any material compliance

matters that occurred since the date of the last CCO report. In addition, the Independent Trustees meet quarterly in executive sessions

without the presence of any Interested Trustees, ALPS, the Sub-Adviser or any of their affiliates. This configuration permits the Independent

Trustees to effectively receive the information and have private discussions necessary to perform their risk oversight role, exercise

independent judgment, and allocate areas of responsibility between the full Board of Trustees, its various committees and certain officers

of the Fund. Furthermore, the Independent Trustees have engaged independent legal counsel and auditors to assist the Independent Trustees

in performing their oversight responsibilities. As discussed above and in consideration of other factors not referenced herein, the Board

of Trustees has determined its leadership role concerning risk management as one of oversight and not active management of the Fund’s

day-to-day risk management operations.

Audit Committee Report

The Audit Committee of the Board of Trustees (“Audit

Committee”) is comprised of Messrs. Held (Financial Expert and Chairman) and Pederson and Ms. Legg. The role of the Fund’s

Audit Committee is to assist the Board of Trustees in its oversight of (i) the quality and integrity of Fund’s financial statements,

reporting process and the independent registered public accounting firm (the “independent accountants”) and reviews thereof,

(ii) the Fund’s accounting and financial reporting policies and practices, its internal controls and, as appropriate, the internal

controls of certain service providers, (iii) the Fund’s compliance with legal and regulatory requirements and (iv) the independent

accountants’ qualifications, independence and performance. The Audit Committee is also required to prepare an audit committee report

pursuant to the rules of the SEC for inclusion in the Fund’s annual proxy statement. The Audit Committee operates pursuant to the

Audit Committee Charter (the “Audit Committee Charter”) that was most recently reviewed and approved by the Audit Committee

on June 10, 2024, at which time the Audit Committee determined it had no changes to recommend to the Board of Trustees. The Audit Committee

Charter is available at the Fund’s website, www.principalcef.com. As set forth in the Audit Committee Charter, management is responsible

for maintaining appropriate systems for accounting and internal control, and the Fund’s independent accountants are responsible

for planning and carrying out proper audits and reviews. The independent accountants are ultimately accountable to the Board of Trustees

and to the Audit Committee, as representatives of shareholders. The independent accountants for the Fund report directly to the Audit

Committee.

In performing its oversight function, at a meeting

held on December 18, 2024, the Audit Committee reviewed and discussed with management of the Fund and the independent accountant, Cohen

& Company, Ltd. (“Cohen”), the audited financial statements of the Fund as of and for the fiscal year ended October 31,

2024, and discussed the audit of such financial statements with the independent accountant.

In addition, the Audit Committee discussed with the

independent accountants the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight

Board (“PCAOB”) and the SEC and received the written disclosures and letter required by the PCAOB regarding the relationships

between Cohen and the Fund and the impact that any such relationships might have on the objectivity and independence of Cohen.

As set forth above, and as more fully set forth in

the Audit Committee Charter, the Audit Committee has significant duties and powers in its oversight role with respect to the Fund’s

financial reporting procedures, internal control systems and the independent audit process.

The members of the Audit Committee are not, and do

not represent themselves to be, professionally engaged in the practice of auditing or accounting and are not employed by the Fund for

accounting, financial management or internal control purposes. Moreover, the Audit Committee relies on and makes no independent verification

of the facts presented to it or representations made by management or the independent verification of the facts presented to it or representation

made by management or the Fund’s independent accountant. Accordingly, the Audit Committee’s oversight does not provide an

independent basis to determine that management has maintained appropriate accounting and/or financial reporting principles and policies,

or internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore,

the Audit Committee’s considerations and discussions referred to above do not provide assurance that the audit of the Fund’s

financial statements has been carried out in accordance with generally accepted accounting standards or that the financial statements

are presented in accordance with generally accepted accounting principles.

Based on its consideration of the audited financial

statements and the discussions referred to above with management and the Fund’s independent accountant, and subject to the limitations

on the responsibilities and role of the Audit Committee set forth in the Audit Committee Charter and those discussed above, the Audit

Committee recommended to the Board of Trustees that the Fund’s audited financial statements be included in the Fund’s Annual

Report for the fiscal year ended October 31, 2024.

SUBMITTED BY THE AUDIT COMMITTEE OF THE FUND’S

BOARD OF TRUSTEES

Jeremy Held

Rick A. Pederson

Jerry G. Rutledge

JoEllen L. Legg

December 18, 2024

The Audit Committee met three times during the fiscal

year ended October 31, 2024. The Audit Committee is composed of four Independent Trustees, namely Messrs. Held, Pederson and Ms. Legg.

None of the members of the Audit Committee are “interested persons” of the Fund.

Based on the findings of the Audit Committee, the

Audit Committee has determined that Mr. Held is the Fund’s “audit committee financial expert,” as defined in the rules

promulgated by the SEC, and as required by NYSE Listing Standards. Mr. Held serves as the Chairman of the Audit Committee.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee

of the Board of Trustees (“Nominating and Corporate Governance Committee”) is comprised of Messrs. Held, Pederson and Ms.

Legg (Chairman). The Nominating and Corporate Governance Committee operates pursuant to the Nominating and Corporate Governance Committee

Charter. The Nominating and Corporate Governance Committee is responsible for identifying and recommending to the Board of Trustees individuals

believed to be qualified to become Board of Trustees members in the event that a position is vacated or created. The Nominating and Corporate

Governance Committee Charter is available at the Fund’s website: www.principalcef.com. The Nominating and Corporate Governance Committee

will consider Trustee candidates recommended by shareholders. In considering candidates submitted by shareholders, the Nominating and

Corporate Governance Committee will take into consideration the needs of the Board of Trustees, the qualifications of the candidate and

the interests of shareholders. The Nominating and Corporate Governance Committee has not adopted a formal diversity policy, but it may

consider diversity of professional experience, education and skills when evaluating potential nominees for Board of Trustees membership.

Shareholders wishing to recommend candidates to the Nominating and Corporate Governance Committee should submit such recommendations to

the Secretary of the Fund, who will forward the recommendations to the committee for consideration. The submission must include: (i) a

brief description of the business desired to be brought before the annual or special meeting and the reasons for conducting such business

at the annual or special meeting, (ii) the name and address, as they appear on the Fund’s books, of the shareholder proposing such

business or nomination, (iii) a representation that the shareholder is a holder of record of stock of the Fund entitled to vote at such

meeting and intends to appear via telephone or by proxy at the meeting to present such nomination; (iv) whether the shareholder plans

to deliver or solicit proxies from other shareholders; (v) the class and number of shares of the Common Shares of the Fund, which are

beneficially owned by the shareholder and the proposed nominee to the Board of Trustees, (vi) any material interest of the shareholder

or nominee in such business; (vii) to the extent to which such shareholder (including such shareholder’s principals) or the proposed

nominee to the Board of Trustees has entered into any hedging transaction or other arrangement with the effect or intent of mitigating

or otherwise managing profit, loss, or risk of changes in the value of the Common Shares or the daily quoted market price of the Fund

held by such shareholder (including shareholder’s principals) or the proposed nominee, including independently verifiable information

in support of the foregoing; and (viii) such other information regarding such nominee proposed by such shareholder as would be required

to be included in a proxy statement filed pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended. Each eligible

shareholder or shareholder group may submit no more than one independent trustee nominee each calendar year. The Nominating and Corporate

Governance Committee has not determined any minimum qualifications necessary to serve as a Trustee of the Fund. The Nominating and Corporate

Governance Committee met four times during the fiscal year ended October 31, 2024.

Qualified Legal Compliance Committee

The Qualified Legal Compliance Committee of the Board

of Trustees (“QLCC”) is comprised of Messrs. Pederson (Chairman) and Held and Ms. Legg. The QLCC operates pursuant to the

Qualified Legal Compliance Committee Guidelines. Each member of the QLCC must be a member of the Fund’s Board of Trustees who is

not employed, directly or indirectly, by the Fund and who is not an “interested person” of the Fund as defined in section

2(a)(19) of the 1940 Act. The QLCC shall consist, at a minimum, of at least three members, including at least one member of the Fund’s

Audit Committee.

Among other responsibilities, the QLCC is responsible

for (i) receiving reports of certain material breaches or violations of certain U.S. laws or regulations or fiduciary duties, (ii) reporting

evidence of such breaches or violations to the Fund’s Principal Executive Officer (“PEO”), (iii) determining whether

an investigation of such breaches or violations is required, (iv) if the QLCC determines an investigation is required, initiating such

investigation, (v) at the conclusion of such investigation, recommending that the Fund implement an appropriate response to evidence of

a breach or violation and (vi) informing the PEO and the Board of Trustees of the results of the investigation.

The QLCC shall meet as often as it deems necessary

to perform its duties and responsibilities. The QLCC met one time during the fiscal year ended October 31, 2024.

Compensation Committee

The Fund does not have a compensation committee.

Other Board of Trustees Related Matters

The Fund does not require Trustees to attend the Annual

Meeting of Shareholders. No Trustees attended the 2024 Annual Meeting of Shareholders.

Required Vote

The presence via telephone or by proxy of one-third

of the Fund’s shares that are entitled to vote constitutes a quorum.

The affirmative vote of a plurality of votes cast

for the nominees by the holders entitled to vote for the particular nominee is necessary for the election of the nominees.

THE BOARD OF TRUSTEES RECOMMENDS THAT SHAREHOLDERS

OF THE FUND VOTE “FOR” THE TRUSTEE NOMINEES.

GENERAL INFORMATION

Independent Registered Public Accounting Firm

At the December meeting of the Board of Trustees,

the Board of Trustees selected Cohen to serve as the Fund’s independent registered public accounting firm for the Fund’s fiscal

year ending October 31, 2025. Cohen acted as the Fund’s independent registered public accounting firm for the fiscal year ended

October 31, 2024. The Fund knows of no direct financial or material indirect financial interest of Cohen in the Fund. A representative

of Cohen will not be present at the Meeting, but will be available by telephone and will have an opportunity to make a statement if they

desire to do so. A Cohen representative will also be available to respond to appropriate questions.

Principal Accounting Fees and Services

The table provided below sets forth the aggregate

fees billed by Cohen for services rendered to the Fund, during the Fund’s fiscal years ended October 31, 2024 and October 31, 2023.

The fees are for the following work:

| (1) | Audit Fees for professional services provided by Cohen for the audit of the Fund’s annual financial statements or services

that are normally provided by the accountant in connection with statutory and regulatory filings or engagements; |

| (2) | Audit-Related Fees for assurance and related services by Cohen that are reasonably related to the performance of the audit

of the Fund’s financial statements and are not reported under “Audit Fees;” |

| (3) | Tax Fees for professional services by Cohen for tax compliance, tax advice, and tax planning; and |

| (4) | All Other Fees for products and services provided by Cohen other than those services reported in above under “Audit Fees,”

“Audit-Related Fees,” and “Tax Fees.” |

| |

2024 |

2023 |

Pre-Approved by

Audit Committee |

| Audit Fee |

$32,000 |

$32,000 |

Yes |

| Audit-Related Fees |

$0 |

$0 |

N/A |

| Tax Fees |

$4,000 |

$4,000 |

Yes |

| All Other Fees |

$0 |

$0 |

N/A |

| Non-Audit Fees |

$0 |

$0 |

N/A |

The Fund’s Audit Committee Charter requires

that the Audit Committee pre-approve or establish pre-approval policies and procedures concerning all audit and non-audit services to

be provided by Cohen, the Fund’s independent registered public accounting firm. Further, the Audit Committee Charter mandates that

the Audit Committee pre-approve or establish pre-approval policies and procedures concerning all permitted non-audit services to be provided

by Cohen to ALPS Advisors and to entities controlling, controlled by, or under common control with ALPS Advisors and that provide ongoing

services to the Fund, if the services relate directly to the operations and financial reporting of the Fund. Except, however, de minimis

non-audit services may, to the extent permitted by applicable law, be approved prior to completion of the audit. The Audit Committee

has also established detailed pre-approval policies and procedures for pre-approval of such services in accordance with applicable laws.

The Fund requires that the Audit Committee maintain these pre-approval policies and procedures to ensure that the provision of these services

by Cohen does not impair its independence.

The following table shows the ownership as of December

31, 2024 of the Fund’s Common Shares by each Trustee and the Fund’s principal executive officer and principal financial officer

(each an “Executive Officer” and together, the “Executive Officers”). Each Trustee and Executive Officer and all

Trustees and Executive Officers as a group owned less than 1% of the Fund’s outstanding shares as of December 31, 2024.

| Trustees & Executive Officer’s Names |

Total Shares Owned and Nature of Ownership |

| Jeremy Held |

2,000, Beneficial |

| JoEllen Legg |

None |

| Rick A. Pederson |

None |

| Robert McClure* |

None |

| Erich Rettinger** |

None |

| All Trustees and Executive Officers as a Group |

2,000 |

| * | Robert McClure is the Principal Executive Officer of the Fund. |

| ** | Erich Rettinger is the Principal Financial Officer of the Fund |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act and Section 30(h) of

the 1940 Act, and the rules thereunder, require the Fund’s officers and Trustees, ALPS Advisors’ officers and directors, affiliated

persons of ALPS Advisors’, and persons who beneficially own more than 10% of a registered class of the Fund’s Common Shares

to file reports of ownership and changes in ownership with the SEC and the NYSE and to furnish the Fund with copies of all Section 16(a)

forms they file. Based solely on a review of the reports filed, the Fund believes that during fiscal year end on October 31, 2024, all

Section 16(a) filing requirements applicable to the Fund’s officers, Trustees, ALPS Advisors’ officers and directors, affiliated

persons of ALPS Advisors’ and persons who beneficially own more than 10% of the Fund’s Common Shares were complied with.

Ownership of Shares

The following chart lists each Shareholder or group of Shareholders who

beneficially (or of record) owned more than 5% of the shares for the Fund as of February 7, 2025.

Any person or entity that beneficially owns, directly

or through one or more controlled companies, more than 25% of the voting securities of a company is presumed to “control”

such company. Accordingly, to the extent that a person or entity is identified as the beneficial owner of more than 25% of the voting

securities of the Fund, or is identified as the record owner of more than 25% of the Fund and has voting and/ or investment powers, that

person or entity may be presumed to control the Fund. A controlling Shareholder’s vote could have a more significant effect on matters

presented to Shareholders for approval than the vote of other Fund Shareholders.

| Shareholder Name and Address(1) |

Number of

Shares Owned |

Percentages of

Share Owned |

|

Saba Capital Management, L.P.

405 Lexington Avenue, 58th Floor

New York, New York 10174 |

411,915(2) |

6.15%(2) |

|

Boaz R. Weinstein

405 Lexington Avenue, 58th Floor

New York, New York 10174 |

|

|

|

Saba Capital Management GP, LLC

405 Lexington Avenue, 58th Floor

New York, NY 10174 |

|

|

|

Bulldog Investors, LLP

80 West-Plaza Two,

250 Pehle Ave., Suite 708,

Saddle Brook, NJ 07663 |

211,845 |

3.31% |

|

Phillip Goldstein & Andrew Dakos(3)

80 West-Plaza Two,

250 Pehle Ave., Suite 708,

Saddle Brook, NJ 07663 |

420,848(4) |

6.29%(4) |

| (1) | The table above shows 5% or greater shareholders’ ownership of Shares as the Record Date. The information contained in this

table is based on Schedule 13G filings made on or before the Record Date. |

| (2) | Saba Capital Management, L.P., Boaz R. Weinstein and Saba Capital Management GP, LLC filed their Schedule 13G jointly and did not

differentiate holdings as to each entity. |

| (3) | Messrs. Goldstein and Dakos are partners at Bulldog Investors, LLP. |

| (4) | Messrs. Goldstein and Dakos filed their Schedule 13G jointly and did not differentiate holdings as to each reporting person. |

The Investment Adviser and Administrator

ALPS Advisors, Inc. is the investment adviser for

the Fund, and its business address is 1290 Broadway, Suite 1000, Denver, Colorado 80203. The sub-adviser is Principal Real Estate Investors,

LLC and its business address is 801 Grand Avenue, Des Moines, Iowa 50309.

ALPS is the administrator for the Fund, and its business address is 1290

Broadway, Suite 1000, Denver, Colorado 80203.

Other Information

Since the beginning of the Fund’s most recently

completed fiscal year, no Trustee has purchased or sold securities exceeding 1% of the outstanding securities of any class of GIDS or

its subsidiaries, or the Sub-Adviser or its parent or subsidiaries.

As of December 31, 2024, no Independent Trustee or

any of their immediate family members owned beneficially or of record any class of securities of ALPS Advisors, the Sub-Adviser or any

person controlling, controlled by or under common control with any such entity.

Payment of Solicitation Expenses

The Fund will pay the expenses of the preparation,

printing and mailing of this Proxy Statement and its enclosures and of all solicitations. The Fund has engaged EQFS , a professional proxy

solicitation firm, to assist in the solicitation of the proxy for the Fund, at an estimated cost of $11,599 plus any out-of-pocket expenses.

Such expenses will be paid by the Fund. Among other things, EQFS will be: (i) required to maintain the confidentiality of all shareholder

information; (ii) prohibited from selling or otherwise disclosing shareholder information to any third party; and (iii) required to comply

with applicable telemarketing laws. The Fund will also reimburse brokerage firms and others for their expenses in forwarding solicitation

material to Shareholders.

Delivery of Proxy Statement

Only one copy of this Proxy Statement may be mailed

to each household, even if more than one person in the household is a Fund Shareholder, unless the Fund has received contrary instructions

from one or more of the household’s Shareholders. If a Shareholder needs an additional copy of this Proxy Statement, would like

to receive separate copies in the future, or would like to request delivery of a single copy to Shareholders sharing an address, please

contact (855) 838-9485.

Other Business

The Trustees do not intend to bring any matters before

the Meeting other than the Proposal described in this Proxy Statement, and the Trustees are not aware of any other matters to be brought

before the Meeting by others. Because matters not known at the time of the solicitation may come before the Meeting, the proxy as solicited

confers discretionary authority with respect to such matters as properly come before the Meeting, including any adjournment(s), postponement(s)

or delays thereof, and it is the intention of the persons named as attorneys-in-fact in the proxy (or their substitutes) to vote the proxy

in accordance with their judgment on such matters.

Shareholder Communications with Board of Trustees

Shareholders may mail written communications to the

Fund’s Board of Trustees, to committees of the Board of Trustees or to specified individual Trustees in care of the Secretary of

the Fund, 1290 Broadway, Suite 1000, Denver, Colorado 80203. All shareholder communications received by the Secretary will be forwarded

promptly to the Board of Trustees, the relevant Board of Trustees’ committee or the specified individual Trustees, as applicable,

except that the Secretary may, in good faith, determine that a shareholder communication should not be so forwarded if it does not reasonably

relate to the Fund or its operations, management, activities, policies, service providers, Board of Trustees, officers, shareholders or

other matters relating to an investment in the Fund or is purely ministerial in nature.

Submission of Certain Shareholder Proposals

To submit a shareholder proposal for the Fund’s

2026 annual meeting of shareholders, a shareholder is required to give to the Fund notice of, and specified information with respect to

any proposals pursuant to Rule 14a-8 under the 1934 Act, by November 7, 2025. In addition, pursuant to the Fund’s By-Laws, a shareholder

is required to give to the Fund notice of, and specified information with respect to, any proposals that such shareholder intends to present

at the 2026 annual meeting no earlier than October 8, 2025, or approximately 150 days prior to the first anniversary of the date of

the Fund’s proxy statement and no later than November 7, 2025, or 120 days prior to the first anniversary of the date of the Fund’s

proxy statement. Under the circumstances described in, and upon compliance with, Rule 14a-4(c) under the 1934 Act, the Fund may solicit

proxies in connection with the 2026 annual meeting, which confer discretionary authority to vote on any shareholder proposals of which

the Secretary of the Fund does not receive notice in accordance with the aforementioned date. Timely submission of a proposal does not

guarantee that such proposal will be included.

IF VOTING BY PAPER PROXIES, IT IS IMPORTANT THAT

PROXIES BE RETURNED PROMPTLY. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE THEREFORE URGED TO COMPLETE, SIGN, DATE, AND RETURN

THE PROXY CARD AS SOON AS POSSIBLE IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

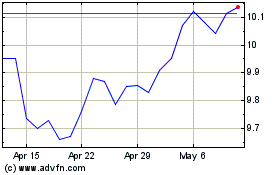

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

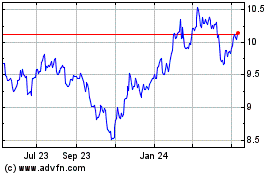

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Mar 2024 to Mar 2025