Full Year Overview

- Total Revenues of $1.03 billion, an increase of 3% from a year

ago

- GAAP Pretax Income of $201 million and Adjusted Pretax Income

of $221 million

- GAAP Diluted EPS of $3.51 and Adjusted EPS of $3.92

Fourth Quarter Overview

- Total Revenues of $280 million, a decrease of 11% from a year

ago

- GAAP Pretax Income of $60 million and Adjusted Pretax Income of

$61 million

- GAAP Diluted EPS of $0.95 and Adjusted EPS of $1.08

2022 Investments and Capital Management

- 9% increase in Company-wide headcount

- 2.2 million share equivalents repurchased; record open market

repurchases of 1.7 million shares

- $223 million of cash, cash equivalents and short-term

investments at year end and had no funded debt

Paul J. Taubman, Chairman and Chief Executive Officer, said, “We

are pleased with our 2022 financial performance, delivering

year-over-year revenue growth. These results were achieved in a

difficult market environment as our integrated capabilities enabled

us to serve our clients with differentiated insights and expertise.

Across all of our businesses, we delivered strong relative

performance. As before, we remain confident in our future growth

prospects.”

PJT Partners Inc. (the “Company” or “PJT Partners”) (NYSE: PJT)

today announced its financial results for the full year and quarter

ended December 31, 2022.

Revenues

The following table sets forth revenues for the three months and

year ended December 31, 2022 and 2021:

Three Months Ended

December 31,

Year Ended

December 31,

2022

2021

% Change

2022

2021

% Change

(Dollars in Millions)

Revenues

Advisory

$

230.8

$

232.6

(1%)

$

823.5

$

762.7

8%

Placement

43.4

79.1

(45%)

192.9

216.7

(11%)

Interest Income & Other

5.8

1.6

263%

9.1

12.5

(27%)

Total Revenues

$

280.0

$

313.3

(11%)

$

1,025.5

$

991.9

3%

Year Ended

Total Revenues increased to $1.03 billion for the year, up 3%

from $992 million for the prior year.

Advisory Revenues increased to $823 million for the year, up 8%

from $763 million for the prior year, principally due to an

increase in restructuring revenues.

Placement Revenues decreased to $193 million for the year, down

11% from $217 million for the prior year, due to a decrease in

corporate placement revenues.

Interest Income & Other decreased $3 million for the year

compared with the prior year principally due to a reduction in the

fair market value on certain equity securities received as part of

transaction compensation.

Three Months Ended

Total Revenues decreased to $280 million for the current

quarter, down 11% from $313 million for the prior year.

Advisory Revenues decreased to $231 million for the current

quarter, down 1% from $233 million for the prior year. Decreases in

strategic advisory and secondary advisory revenues were almost

entirely offset by an increase in restructuring revenues.

Placement Revenues decreased to $43 million for the current

quarter, down 45% from $79 million for the prior year, principally

due to a decrease in corporate placement revenues.

Interest Income & Other increased $4 million for the current

quarter compared with the prior year principally due to more

favorable foreign currency rates.

Expenses

The following tables set forth information relating to the

Company’s expenses for the three months and year ended December 31,

2022 and 2021:

Year Ended December 31,

2022

2021

GAAP

As Adjusted

GAAP

As Adjusted

(Dollars in Millions)

Expenses

Compensation and Benefits

$

669.1

$

657.4

$

640.0

$

625.2

% of Revenues

65.2

%

64.1

%

64.5

%

63.0

%

Non-Compensation

$

154.9

$

147.6

$

132.5

$

124.5

% of Revenues

15.1

%

14.4

%

13.4

%

12.5

%

Total Expenses

$

824.0

$

805.0

$

772.5

$

749.6

% of Revenues

80.4

%

78.5

%

77.9

%

75.6

%

Pretax Income

$

201.5

$

220.5

$

219.4

$

242.3

% of Revenues

19.6

%

21.5

%

22.1

%

24.4

%

Three Months Ended December

31,

2022

2021

GAAP

As Adjusted

GAAP

As Adjusted

(Dollars in Millions)

Expenses

Compensation and Benefits

$

180.2

$

180.2

$

205.2

$

201.0

% of Revenues

64.4

%

64.4

%

65.5

%

64.2

%

Non-Compensation

$

39.7

$

38.5

$

33.3

$

31.3

% of Revenues

14.2

%

13.7

%

10.6

%

10.0

%

Total Expenses

$

220.0

$

218.7

$

238.4

$

232.3

% of Revenues

78.6

%

78.1

%

76.1

%

74.1

%

Pretax Income

$

60.0

$

61.3

$

74.8

$

81.0

% of Revenues

21.4

%

21.9

%

23.9

%

25.9

%

Compensation and Benefits

Expense

Year Ended

GAAP Compensation and Benefits Expense was $669 million for the

year compared with $640 million for the prior year. Adjusted

Compensation and Benefits Expense was $657 million for the year

compared with $625 million for the prior year. The adjusted

compensation accrual rate was 64.1% compared with 63.0% for the

prior year.

Three Months Ended

GAAP Compensation and Benefits Expense was $180 million for the

quarter compared with $205 million for the prior year. Adjusted

Compensation and Benefits Expense was also $180 million for the

current quarter compared with $201 million for the prior year.

Non-Compensation Expense

Year Ended

GAAP Non-Compensation Expense was $155 million for the year

compared with $132 million for the prior year. Adjusted

Non-Compensation Expense was $148 million for the year compared

with $124 million for the prior year.

The increase in GAAP and Adjusted Non-Compensation Expense was

principally due to an additional $16 million in Travel and Related

resulting from increased levels of business travel. Excluding

Travel and Related, GAAP and Adjusted Non-Compensation Expense

increased 5% and 6%, respectively, compared with prior year

results.

Three Months Ended

GAAP Non-Compensation Expense was $40 million for the current

quarter compared with $33 million for the prior year. Adjusted

Non-Compensation Expense was $38 million for the current quarter

compared with $31 million for the prior year.

The increase in GAAP and Adjusted Non-Compensation Expense was

principally due to an additional $3.6 million in Travel and Related

resulting from increased levels of business travel and an

additional $2.4 million in Professional Fees.

Provision for Taxes

As of December 31, 2022, PJT Partners Inc. owned 62.4% of PJT

Partners Holdings LP. PJT Partners Inc. is subject to corporate

U.S. federal and state income tax while PJT Partners Holdings LP is

subject to New York City unincorporated business tax and other

entity-level taxes imposed by certain state and foreign

jurisdictions. Please refer to Note 11. “Stockholders’ Equity” in

the “Notes to Consolidated Financial Statements” in “Part II. Item

8. Financial Statements and Supplementary Data” of the Company’s

Annual Report on Form 10-K for the year ended December 31, 2021 for

further information about the corporate ownership structure. The

effective tax rate for GAAP Net Income for the three months ended

December 31, 2022 and 2021 was 23.2% and 14.3%, respectively. The

effective tax rate for GAAP Net Income for the years ended December

31, 2022 and 2021 was 18.2% and 13.4%, respectively.

In calculating Adjusted Net Income, If-Converted, the Company

has assumed that all outstanding Class A partnership units in PJT

Partners Holdings LP (“Partnership Units”) (excluding the unvested

partnership units that have yet to satisfy certain market

conditions) have been exchanged into shares of the Company’s Class

A common stock, subjecting all of the Company’s income to

corporate-level tax.

The effective tax rate for Adjusted Net Income, If-Converted for

the year ended December 31, 2022 was 26.0% compared with 22.3% for

the prior year. The tax rate increase was primarily due to a lesser

tax benefit received from the delivery of vested shares at values

in excess of the original grant prices.

Capital Management and Balance Sheet

As of December 31, 2022, the Company held cash, cash equivalents

and short-term investments of $223 million and had no funded

debt.

During the year ended December 31, 2022, the Company repurchased

1.7 million shares of Class A common stock in the open market,

exchanged 250 thousand Partnership Units for shares of Class A

common stock, exchanged 226 thousand Partnership Units for cash and

net share settled 275 thousand shares of Class A common stock to

satisfy employee tax obligations. During the fourth quarter 2022,

the Company repurchased 124 thousand shares of Class A common stock

in the open market, exchanged 38 thousand Partnership Units for

cash and net share settled 15 thousand shares of Class A common

stock to satisfy employee tax obligations.

In total during the year ended December 31, 2022, the Company

repurchased 2.2 million share equivalents at an average price of

$66.02 per share. During the fourth quarter 2022, the Company

repurchased 177 thousand share equivalents at an average price of

$73.84 per share.

As of December 31, 2022, the Company’s remaining repurchase

authorization was $174 million.

The Company intends to repurchase 143 thousand Partnership Units

for cash on February 14, 2023 at a price to be determined by the

volume-weighted average price per share of the Company’s Class A

common stock on February 9, 2023.

Dividend

The Board of Directors of PJT Partners Inc. has declared a

quarterly dividend of $0.25 per share of Class A common stock. The

dividend will be paid on March 22, 2023 to Class A common

stockholders of record as of March 8, 2023.

Quarterly Investor Call Details

PJT Partners will host a conference call on February 7, 2023 at

8:30 a.m. ET to discuss its full year and fourth quarter 2022

results. The conference call can be accessed via the internet at

www.pjtpartners.com or by dialing +1 (888) 254-3590 (U.S. domestic)

or +1 (720) 543-0214 (international), passcode 4189218. For those

unable to listen to the live broadcast, a replay will be available

following the call at www.pjtpartners.com.

About PJT Partners

PJT Partners is a premier global advisory-focused investment

bank. We offer a unique portfolio of advisory services designed to

help our clients achieve their strategic objectives. Our team of

senior professionals delivers a range of strategic advisory,

capital markets advisory, restructuring and special situations and

shareholder advisory services to corporations, financial sponsors,

institutional investors and governments around the world. We also

provide private fund advisory and fundraising services for

alternative investment strategies, including private equity, real

estate, hedge funds and private credit. To learn more about PJT

Partners, please visit our website at www.pjtpartners.com.

Forward-Looking Statements

Certain material presented herein contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). Forward-looking

statements include certain information concerning future results of

operations, business strategies, acquisitions, financing plans,

competitive position, potential growth opportunities, potential

operating performance improvements, the effects of competition and

the effects of future legislation or regulations. Forward-looking

statements include all statements that are not historical facts and

can be identified by the use of forward-looking terminology such as

the words “believe,” “expect,” “opportunity,” “plan,” “intend,”

“anticipate,” “estimate,” “predict,” “potential,” “continue,”

“may,” “might,” “should,” “could” or the negative of these terms or

similar expressions.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations, and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy, and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks, and

changes in circumstances that are difficult to predict, many of

which are outside our control. Our actual results and financial

condition may differ materially from those indicated in the

forward-looking statements. Therefore, you should not place undue

reliance upon any of these forward-looking statements. Important

factors that could cause our actual results and financial condition

to differ materially from those indicated in the forward-looking

statements include, among others, the following: (a) changes in

governmental regulations and policies; (b) cyberattacks, security

vulnerabilities, and internet disruptions, including breaches of

data security and privacy leaks, data loss, and business

interruptions; (c) failure of our computer systems or communication

systems during a catastrophic event, including as a result of the

increased use of remote work environments and virtual platforms;

(d) the impact of catastrophic events on the U.S. and the global

economy, including business disruptions, pandemics, reductions in

employment and an increase in business failures; (e) the impact of

catastrophic events on our employees and our ability to provide

services to our clients and respond to their needs; (f) the failure

of third-party service providers to perform their functions; and

(g) volatility in the political and economic environment, including

as a result of inflation and rising interest rates.

Any of these factors, as well as such other factors discussed in

the “Risk Factors” section of the Company’s Annual Report on Form

10-K for the year ended December 31, 2021, filed with the United

States Securities and Exchange Commission (“SEC”), as such factors

may be updated from time to time in the Company’s periodic filings

with the SEC, accessible on the SEC’s website at www.sec.gov, could

cause the Company’s results to differ materially from those

expressed in forward-looking statements. There may be other risks

and uncertainties that the Company is unable to predict at this

time or that are not currently expected to have a material adverse

effect on its business. Any such risks could cause the Company’s

results to differ materially from those expressed in

forward-looking statements.

Non-GAAP Financial Measures

The following represent key performance measures that management

uses in making resource allocation and/or compensation decisions.

These measures should not be considered substitutes for, or

superior to, financial measures prepared in accordance with

GAAP.

Management believes the following non-GAAP measures, when

presented together with comparable GAAP measures, are useful to

investors in understanding the Company’s operating results:

Adjusted Pretax Income; Adjusted Net Income; Adjusted Net Income,

If-Converted, in total and on a per-share basis (referred to as

“Adjusted EPS”); Adjusted Compensation and Benefits Expense and

Adjusted Non-Compensation Expense. These non-GAAP measures,

presented and discussed in this earnings release, remove the

significant accounting impact of: (a) transaction-related

compensation expense, including expense related to Partnership

Units with both time-based vesting and market conditions as well as

equity-based and cash awards granted in connection with the

acquisition of CamberView Partners Holdings, LLC (“CamberView”);

(b) intangible asset amortization associated with Blackstone Inc.’s

(“Blackstone”) initial public offering (“IPO”), the acquisition of

PJT Capital LP, and the acquisition of CamberView; and (c) the net

change to the amount the Company has agreed to pay Blackstone

related to the net realized cash benefit from certain

compensation-related tax deductions. Reconciliations of the

non-GAAP measures to their most directly comparable GAAP measures

and further detail regarding the adjustments are provided in the

Appendix.

To help investors understand the effect of the Company’s

ownership structure on its Adjusted Net Income, the Company has

presented Adjusted Net Income, If-Converted. This measure

illustrates the impact of taxes on Adjusted Pretax Income, assuming

all Partnership Units (excluding the unvested Partnership Units

that have yet to satisfy certain market conditions) were exchanged

for shares of the Company’s Class A common stock, resulting in all

of the Company’s income becoming subject to corporate-level tax,

considering both current and deferred income tax effects. This tax

rate excludes a number of adjustments, including the tax benefits

of the adjustments for transaction-related compensation expense and

amortization expense.

Appendix

GAAP Condensed Consolidated Statements of Operations

(unaudited)

Reconciliations of GAAP to Non-GAAP Financial Data

(unaudited)

Summary of Shares Outstanding (unaudited)

Footnotes

PJT Partners Inc.

GAAP Condensed Consolidated

Statements of Operations (unaudited)

(Dollars in Thousands, Except

Share and Per Share Data)

Three Months Ended

December 31,

Year Ended

December 31,

2022

2021

2022

2021

Revenues

Advisory

$

230,784

$

232,599

$

823,496

$

762,723

Placement

43,405

79,081

192,890

216,692

Interest Income and Other

5,764

1,586

9,119

12,530

Total Revenues

279,953

313,266

1,025,505

991,945

Expenses

Compensation and Benefits

180,242

205,174

669,141

640,040

Occupancy and Related

9,422

8,898

35,253

34,686

Travel and Related

7,726

4,094

25,197

9,073

Professional Fees

5,548

3,193

27,200

27,209

Communications and Information

Services

4,078

4,512

16,897

18,060

Depreciation and Amortization

3,319

4,215

15,475

15,750

Other Expenses

9,625

8,341

34,871

27,678

Total Expenses

219,960

238,427

824,034

772,496

Income Before Provision for Taxes

59,993

74,839

201,471

219,449

Provision for Taxes

13,923

10,721

36,699

29,494

Net Income

46,070

64,118

164,772

189,955

Net Income Attributable to Non-Controlling

Interests

21,496

29,222

74,238

83,787

Net Income Attributable to PJT Partners

Inc.

$

24,574

$

34,896

$

90,534

$

106,168

Net Income Per Share of Class A Common

Stock

Basic

$

0.97

$

1.40

$

3.61

$

4.25

Diluted

$

0.95

$

1.32

$

3.51

$

3.99

Weighted-Average Shares of Class A Common

Stock Outstanding

Basic

25,213,986

24,898,355

25,077,835

24,959,382

Diluted

26,974,129

42,117,482

26,616,640

42,358,705

PJT Partners Inc.

Reconciliations of GAAP to

Non-GAAP Financial Data (unaudited)

(Dollars in Thousands, Except

Share and Per Share Data)

Three Months Ended

December 31,

Year Ended

December 31,

2022

2021

2022

2021

GAAP Net Income

$

46,070

$

64,118

$

164,772

$

189,955

Less: GAAP Provision for Taxes

13,923

10,721

36,699

29,494

GAAP Pretax Income

59,993

74,839

201,471

219,449

Adjustments to GAAP Pretax

Income

Transaction-Related Compensation

Expense(1)

19

4,162

11,765

14,888

Amortization of Intangible Assets(2)

1,230

1,927

6,506

7,777

Spin-Off-Related Payable Due to

Blackstone(3)

33

64

804

199

Adjusted Pretax Income

61,275

80,992

220,546

242,313

Adjusted Taxes(4)

13,814

14,099

40,020

35,087

Adjusted Net Income

47,461

66,893

180,526

207,226

If-Converted Adjustments

Less: Adjusted Taxes(4)

(13,814

)

(14,099

)

(40,020

)

(35,087

)

Add: If-Converted Taxes(5)

16,121

17,007

57,264

54,073

Adjusted Net Income, If-Converted

$

45,154

$

63,985

$

163,282

$

188,240

GAAP Net Income Per Share of Class A

Common Stock

Basic

$

0.97

$

1.40

$

3.61

$

4.25

Diluted

$

0.95

$

1.32

$

3.51

$

3.99

GAAP Weighted-Average Shares of Class A

Common Stock Outstanding

Basic

25,213,986

24,898,355

25,077,835

24,959,382

Diluted

26,974,129

42,117,482

26,616,640

42,358,705

Adjusted Net Income, If-Converted Per

Share

$

1.08

$

1.52

$

3.92

$

4.44

Weighted-Average Shares Outstanding,

If-Converted

41,812,119

42,120,075

41,663,773

42,363,237

PJT Partners Inc.

Reconciliations of GAAP to

Non-GAAP Financial Data – continued (unaudited)

(Dollars in Thousands)

Three Months Ended

December 31,

Year Ended

December 31,

2022

2021

2022

2021

GAAP Compensation and Benefits Expense

$

180,242

$

205,174

$

669,141

$

640,040

Transaction-Related Compensation

Expense(1)

(19

)

(4,162

)

(11,765

)

(14,888

)

Adjusted Compensation and Benefits

Expense

$

180,223

$

201,012

$

657,376

$

625,152

Non-Compensation Expenses

Occupancy and Related

$

9,422

$

8,898

$

35,253

$

34,686

Travel and Related

7,726

4,094

25,197

9,073

Professional Fees

5,548

3,193

27,200

27,209

Communications and Information

Services

4,078

4,512

16,897

18,060

Depreciation and Amortization

3,319

4,215

15,475

15,750

Other Expenses

9,625

8,341

34,871

27,678

GAAP Non-Compensation Expense

39,718

33,253

154,893

132,456

Amortization of Intangible Assets(2)

(1,230

)

(1,927

)

(6,506

)

(7,777

)

Spin-Off-Related Payable Due to

Blackstone(3)

(33

)

(64

)

(804

)

(199

)

Adjusted Non-Compensation Expense

$

38,455

$

31,262

$

147,583

$

124,480

PJT Partners Inc. Summary of Shares Outstanding

(unaudited)

The following table provides a summary of weighted-average

shares outstanding for the three months and year ended December 31,

2022 and 2021 for both basic and diluted shares. The table also

provides a reconciliation to If-Converted Shares Outstanding

assuming that all Partnership Units and unvested PJT Partners Inc.

restricted stock units (“RSUs”) were converted to shares of the

Company’s Class A common stock:

Three Months Ended

December 31,

Year Ended

December 31,

2022

2021

2022

2021

Weighted-Average Shares Outstanding -

GAAP

Basic Shares Outstanding, GAAP

25,213,986

24,898,355

25,077,835

24,959,382

Dilutive Impact of Unvested RSUs(6)

1,760,143

1,942,167

1,538,805

1,680,900

Dilutive Impact of Partnership

Units(7)

—

15,276,960

—

15,718,423

Diluted Shares Outstanding, GAAP

26,974,129

42,117,482

26,616,640

42,358,705

Weighted-Average Shares Outstanding -

If-Converted

Basic Shares Outstanding, GAAP

25,213,986

24,898,355

25,077,835

24,959,382

Unvested RSUs(8)

1,760,143

1,944,760

1,540,744

1,685,432

Partnership Units(7)

14,837,990

15,276,960

15,045,194

15,718,423

If-Converted Shares Outstanding

41,812,119

42,120,075

41,663,773

42,363,237

As of December 31,

2022

2021

Fully-Diluted Shares Outstanding(9)

43,599,438

43,798,482

As of December 31, 2022, 1.1 million Partnership Units and 1.5

million RSUs that have yet to satisfy certain market conditions

were excluded from any share count calculations.

Of the total 2.6 million share equivalents subject to market

conditions, 1.3 million require the Company to achieve a dividend

adjusted volume-weighted average share price over any consecutive

20-day trading period (“20-day VWAP”) of $100 prior to February 26,

2027. The remaining 1.3 million vest ratably upon the Company

achieving a 20-day VWAP between $100 and $130 prior to February 26,

2027. The awards are also subject to a five year service based

vesting requirement, with 20% vesting per annum.

Footnotes

(1)

This adjustment adds back to GAAP

Pretax Income transaction-related compensation expense for

Partnership Units with both time-based vesting and market

conditions as well as equity-based and cash awards granted in

connection with the acquisition of CamberView.

(2)

This adjustment adds back to GAAP

Pretax Income amounts for the amortization of intangible assets

that are associated with Blackstone’s IPO, the acquisition of PJT

Capital LP on October 1, 2015 and the acquisition of CamberView on

October 1, 2018.

(3)

This adjustment adds back to GAAP

Pretax Income the net change to the amount the Company has agreed

to pay Blackstone related to the net realized cash benefit from

certain compensation-related tax deductions. Such amounts are

reflected in Other Expenses in the Condensed Consolidated

Statements of Operations.

(4)

Represents taxes on Adjusted

Pretax Income, considering both current and deferred income tax

effects for the current ownership structure.

(5)

Represents taxes on Adjusted

Pretax Income, assuming all Partnership Units (excluding the

unvested Partnership Units that have yet to satisfy market

conditions) were exchanged for shares of the Company’s Class A

common stock, resulting in all of the Company’s income becoming

subject to corporate-level tax, considering both current and

deferred income tax effects. This tax rate excludes a number of

adjustments, including the tax benefits of the adjustments for

transaction-related compensation expense and amortization

expense.

(6)

Represents the dilutive impact

under the treasury method of unvested, non-participating RSUs that

have a remaining service requirement.

(7)

Represents the number of shares

assuming the conversion of all Partnership Units, excluding

Partnership Units that have yet to satisfy certain market

conditions.

(8)

Represents the dilutive impact of

unvested RSUs that have a remaining service requirement.

(9)

Assumes all Partnership Units and

unvested RSUs have been converted to shares of the Company’s Class

A common stock. As of December 31, 2022, 1.1 million Partnership

Units and 1.5 million RSUs that have yet to satisfy certain market

conditions were excluded from any share count calculations.

Note:

Amounts presented in tables above

may not add or recalculate due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230206005622/en/

Media Relations: Jon Keehner Joele Frank, Wilkinson

Brimmer Katcher Tel: +1 212.355.4449 PJT-JF@joelefrank.com

Investor Relations: Sharon Pearson PJT Partners Inc. Tel:

+1 212.364.7120 pearson@pjtpartners.com

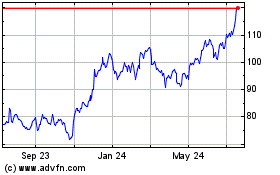

PJT Partners (NYSE:PJT)

Historical Stock Chart

From Apr 2024 to May 2024

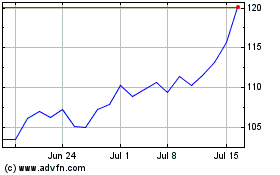

PJT Partners (NYSE:PJT)

Historical Stock Chart

From May 2023 to May 2024