0001745916

false

0001745916

2023-10-25

2023-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 25, 2023

PennyMac

Financial Services, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-35916 |

83-1098934 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| 3043 Townsgate Road, Westlake Village, California |

91361 |

| (Address of principal executive offices) |

(Zip Code) |

(818) 224-7442

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

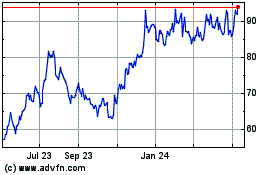

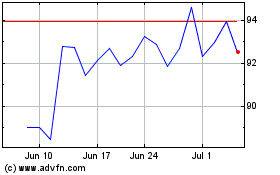

| Common Stock, $0.0001 par value |

PFSI |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On October 25, 2023, PennyMac Financial Services, Inc. (“Company”), through its direct wholly owned subsidiary, Private National

Mortgage Acceptance Company, LLC (“PNMAC”) and two of its indirect, wholly owned subsidiaries, PNMAC GMSR ISSUER TRUST (“Issuer

Trust”) and PennyMac Loan Services, LLC (“PLS”), entered into a syndicated series of term loans (the “Series 2023-GTL2

Loan”), as part of the structured finance transaction that PLS uses to finance Ginnie Mae mortgage servicing rights and related

excess servicing spread and servicing advance receivables. The Company entered into a Series 2023-GTL2 Indenture Supplement and Loan Agreement

by and among Issuer Trust, as issuer, PLS, as administrator and servicer, Atlas Securitized Products, L.P., as administrative agent (“Atlas”),

and the syndicated lenders party thereto (the “Series 2023-GTL2 Loan Agreement”), related to the servicing spread. The initial

5-year term of the Series 2023-GTL2 Loan is set to expire on October 25, 2028.

The Series 2023-GTL2 Loan provides more financing for Ginnie Mae mortgage

servicing rights and related excess servicing spread in addition to (i) the previously issued term notes, (ii) the Series 2023-GTL1 Loan,

(iii) that certain Amended and Restated Series 2016-MSRVF1 Master Repurchase Agreement by and among PLS, as seller, Atlas, as administrative

agent to the buyers, Nexera Holdings LLC, as a buyer, Citibank, N.A. (“Citibank”), as a buyer, and PNMAC, as a guarantor,

dated July 30, 2021 (the “Syndicated GMSR Servicing Spread Agreement”), (iv) a Series 2023-MSRVF1 Master Repurchase Agreement

by and among PLS, as seller, Goldman Sachs Bank USA, as administrative agent and buyer, and PNMAC, as a guarantor (the “GS Servicing

Spread Agreement”), and (v) a Series 2023-MSRVF1 Master Repurchase Agreement by and among PLS, as seller, Nomura Corporate Funding

Americas, LLC, as administrative agent and buyer, and PNMAC, as a guarantor (the “Nomura Servicing Spread Agreement”).

The initial note balance of the Series 2023-GTL2 Loan is $125 million.

During the term of the loan, PLS is required to repay the syndicated lenders monthly for accrued interest (at a rate reflective of the

current market based on a spread above the Secured Overnight Financing Rate).

The Series 2023-GTL2 Loan Agreement requires that PLS and the Issuer

Trust make certain representations, warranties and covenants customary for this type of transaction.

The Series 2023-GTL2 Loan Agreement contains certain advance rate reduction

events, early amortization events, and scheduled principal payment events (subject to certain thresholds) that would require the Issuer

Trust to make early payments of principal on the Series 2023-GTL2 Loan. In addition, the Third Amended and Restated Base Indenture, dated

as of April 1, 2020, by and among Issuer Trust, Citibank, PLS, Atlas and Pentalpha Surveillance LLC (the “Third Amended and Restated

Base Indenture”) contains margin call provisions and events of default (subject to certain materiality thresholds and grace periods),

including payment defaults, breaches of covenants and/or certain representations and warranties, cross-defaults, guarantor defaults, bankruptcy

or insolvency proceedings and other events of default customary for this type of transaction, that apply to the Series 2023-GTL2 Loan.

The remedies for such events of default include the acceleration of the principal amount outstanding under the Series 2023-GTL2 Loan Agreement.

The foregoing descriptions do not purport

to be complete and are qualified in their entirety by reference to the other descriptions and the full text of the agreements and amendments

in the following: (i) Series 2023-GTL2 Loan Agreement, which has been filed with this Current Report on Form 8-K as Exhibit 10.1, (ii)

the Series 2023-GTL1 Loan Agreement, which was filed on March 3, 2023 with the Company’s Report on Form 8-K as Exhibit 10.1, (iii)

the Nomura Servicing Spread Agreement, which was filed on August 10, 2023 with the Company’s Report on Form 8-K as Exhibit 10.1,

(iv) the GS Servicing Spread Agreement, which was filed on February 13, 2023 with the Company’s Report on Form 8-K as Exhibit 10.1,

(v) the Syndicated GMSR Servicing Spread Agreement, which was filed on August 5, 2021 with the Company’s Current Report on Form

8-K as Exhibit 10.1, (vi) the Third Amended and Restated Base Indenture, which was filed on April 7, 2020 with the Company’s Current

Report on Form 8-K as Exhibit 10.5, and (vii) the full text of all other amendments to the foregoing filed thereafter with the

SEC.

Item 2.02 Results of Operations and Financial

Condition.

On October 26, 2023, the Company

issued a press release and a slide presentation announcing its financial results for the fiscal quarter ended September 30, 2023. A copy

of the press release and slide presentation are furnished as Exhibit 99.1 and Exhibit 99.2, respectively.

In addition, the Company has made available other supplemental financial information for the fiscal

quarter ended September 30, 2023 on its website at pfsi.pennymac.com.

The information in Item 2.02 of this report, including the exhibits

hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject

to the liabilities of Section 18, nor shall it be deemed incorporated by reference into any disclosure document relating to the Company,

except to the extent, if any, expressly set forth by specific reference in such filing.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this report is incorporated

herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description |

| |

|

| 10.1^ |

Series 2023-GTL2 Indenture Supplement and Loan Agreement, dated as of October 25, 2023, by and among PNMAC GMSR ISSUER TRUST, as issuer, PennyMac Loan Services, LLC, as administrator and servicer, Atlas Securitized Products, L.P., as administrative agent, and the syndicated lenders party thereto. |

| 99.1 |

Press Release, dated October 26, 2023, issued by PennyMac Financial Services, Inc. pertaining to its financial results for the fiscal quarter ended September 30, 2023. |

| 99.2 |

Slide Presentation for use beginning on October 26, 2023 in connection with a recorded presentation of financial results for the fiscal quarter ended September 30, 2023. |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

^ Portions of the exhibit have been redacted.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

PENNYMAC FINANCIAL SERVICES, INC. |

| |

|

| Dated: October 26, 2023 |

/s/ Daniel S. Perotti |

| |

Daniel S. Perotti

Senior Managing Director and Chief Financial Officer |

EXHIBIT 10.1

[Information indicated

with brackets has been excluded from this exhibit because it is

not material and

would be competitively harmful if publicly disclosed]

PNMAC GMSR ISSUER TRUST,

as Issuer

and

CITIBANK, N.A.,

as Indenture Trustee, Calculation Agent, Paying Agent and Securities Intermediary

and

PENNYMAC LOAN SERVICES, LLC,

as Administrator and Servicer

and

ATLAS SECURITIZED PRODUCTS, L.P.,

as Administrative Agent

and

CAPITAL ONE, NATIONAL ASSOCIATION,

as Lead Arranger and a Lender

and

OTHER LENDERS FROM TIME TO TIME PARTY HERETO

as Noteholders

SERIES 2023-GTL2 INDENTURE SUPPLEMENT AND LOAN

AGREEMENT

Dated as of October 25, 2023

To

THIRD AMENDED AND RESTATED BASE INDENTURE

Dated as of April 1, 2020

MSR COLLATERALIZED PROMISSORY NOTES,

SERIES 2023-GTL2

Table

of Contents

Page

| Section

1. | |

The

Series 2023-GTL2 Loan and Creation of the Series 2023-GTL2 Promissory Term Notes | |

2 |

| | |

| |

|

| Section

2. | |

Defined Terms | |

2 |

| | |

| |

|

| Section

3. | |

Form of the

Series 2023-GTL2 Promissory Term Notes; Transfer Restrictions | |

11 |

| | |

| |

|

| Section

4. | |

Payments

and Allocation of Funds on Payment Dates; No Series Reserve Account | |

11 |

| | |

| |

|

| Section

5. | |

Optional

Redemption and Refinancing | |

12 |

| | |

| |

|

| Section

6. | |

Reserved | |

12 |

| | |

| |

|

| Section

7. | |

Assignment | |

12 |

| | |

| |

|

| Section

8. | |

Conditions

Precedent Satisfied | |

15 |

| | |

| |

|

| Section

9. | |

Representations

and Warranties | |

15 |

| | |

| |

|

| Section

10. | |

Determination

of Note Interest Rate and Benchmark | |

15 |

| | |

| |

|

| Section

11. | |

Amendments | |

17 |

| | |

| |

|

| Section

12. | |

Counterparts | |

19 |

| | |

| |

|

| Section

13. | |

Entire Agreement | |

20 |

| | |

| |

|

| Section

14. | |

Limited Recourse | |

20 |

| | |

| |

|

| Section

15. | |

Owner Trustee

Limitation of Liability | |

20 |

| | |

| |

|

| Section

16. | |

No Note Rating | |

21 |

| | |

| |

|

| Section

17. | |

No Compliance

with EU Securitization Regulation and UK Securitization Regulation Due Diligence Requirements | |

21 |

| | |

| |

|

| Section

18. | |

Administrative

Fee | |

21 |

| | |

| |

|

| Section

19. | |

Return of

Payments and Erroneous Payments | |

21 |

| | |

| |

|

| Section

20. | |

Resignation

of Administrative Agent | |

23 |

| | |

| |

|

| Section

21. | |

Limited Liability

and Indemnification | |

23 |

| | |

| |

|

| Section

22. | |

Term Loan

Reports and Confidentiality | |

24 |

This SERIES 2023-GTL2 INDENTURE

SUPPLEMENT AND LOAN AGREEMENT (this “Indenture Supplement”), dated as of October 25, 2023, is made by and among PNMAC

GMSR ISSUER TRUST, a statutory trust organized under the laws of the State of Delaware, as issuer (the “Issuer”),

CITIBANK, N.A., a national banking association, as indenture trustee (in such capacity, the “Indenture Trustee”),

as calculation agent (in such capacity, the “Calculation Agent”), as paying agent (in such capacity, the “Paying

Agent”) and as securities intermediary (in such capacity, the “Securities Intermediary”), PENNYMAC LOAN

SERVICES, LLC, a limited liability company organized under the laws of the State of Delaware (“PLS”), as administrator

(in such capacity, the “Administrator”) and servicer (in such capacity, the “Servicer”), ATLAS

SECURITIZED PRODUCTS, L.P. (“ASP”), a Delaware limited partnership, as administrative agent (the “Administrative

Agent”), CAPITAL ONE, NATIONAL ASSOCIATION, as lead arranger (the “Lead Arranger”) and a Lender, and other

Lenders (as defined herein) from time to time. This Indenture Supplement relates to and is executed pursuant to that certain Third Amended

and Restated Base Indenture, dated as of April 1, 2020, including the schedules and exhibits thereto (as amended by Amendment No. 1,

dated as of June 8, 2022, Amendment No. 2, dated as of June 9, 2022, and Amendment No. 3, dated as of February 7, 2023, and as may be

further amended, restated, supplemented or otherwise modified from time to time, the “Base Indenture” and together

with this Indenture Supplement, the “Indenture”), among the Issuer, the Administrator, the Servicer, the Indenture

Trustee, the Calculation Agent, the Paying Agent, the Securities Intermediary, Pentalpha Surveillance LLC, a Delaware limited liability

company, as credit manager, ASP, as Administrative Agent, and the “Administrative Agents” from time to time parties thereto,

all the provisions of which are incorporated herein as modified hereby and shall be a part of this Indenture Supplement as if set forth

herein in full.

Capitalized terms used and

not otherwise defined herein shall have the respective meanings given them in the Base Indenture, and the rules of interpretation set

forth in Section 1.2 of the Base Indenture shall apply equally herein.

PRELIMINARY STATEMENT

WHEREAS, the Lenders

desire to loan funds to the Issuer pursuant to the terms of this Indenture Supplement;

WHEREAS, the Issuer

desires to borrow funds from the Lenders on the terms and conditions set forth in this Indenture Supplement and the Base Indenture;

WHEREAS, to evidence

each aforementioned lending arrangement (the “Series 2023-GTL2 Loan”) in the form of a promissory note, the Lenders

have requested and the Issuer has duly authorized the issuance of a Series of Term Notes, the Series 2023-GTL2 Promissory Term Notes

(as defined below). The parties are entering into this Indenture Supplement to document the terms of the issuance of the Series 2023-GTL2

Promissory Term Notes pursuant to the Base Indenture, which provides for the issuance of Notes in multiple series from time to time;

and

WHEREAS, the Lenders

are also Noteholders and the Series 2023-GTL2 Promissory Term Notes are also Notes, and more specifically, a Series of Term Notes, as

such terms are defined in the Base Indenture and shall be afforded the rights as set forth in the Base Indenture, including as such rights

relate to the other Noteholders as described therein.

NOW, THEREFORE, in

consideration of the mutual agreements set forth herein, and other good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, the Issuer, the Indenture Trustee, the Calculation Agent, the Paying Agent, the Securities Intermediary, the

Administrator, the Servicer, the Administrative Agent and the Lenders hereby agree as follows:

Section 1.

The Series 2023-GTL2 Loan and Creation of the Series 2023-GTL2 Promissory Term Notes.

To evidence the Series 2023-GTL2

Loan being provided by Lenders to Issuer hereunder on the Issuance Date, there are hereby created the Series 2023-GTL2 Promissory Term

Notes, to be issued as a Series of Term Notes pursuant to the Base Indenture and this Indenture Supplement, to be known as “PNMAC

GMSR Issuer Trust MSR Collateralized Promissory Notes, Series 2023-GTL2” (the “Series 2023-GTL2 Promissory Term Notes”).

The Series 2023-GTL2 Promissory Term Notes will not be rated and shall be subordinated to the Series 2016-MBSADV1 Notes, the Series 2021-MBSADV1

Notes, Series 2023-MBSADV1 Notes, Series 2023-MBSADV2 Notes and other MBS Advance VFNs issued from time to time. The Series 2023-GTL2

Promissory Term Notes will represent a single loan tranche, and the terms of the Series 2023-GTL2 Loan shall be represented by the Initial

Note Balance (and each Lender’s Pro Rata Share thereof), Stated Maturity Date, Note Interest Rate and other terms as specified

in this Indenture Supplement. The Series 2023-GTL2 Loan shall be secured by the Trust Estate Granted to the Indenture Trustee pursuant

to the Base Indenture. The Indenture Trustee shall hold the Trust Estate as collateral security for the benefit of the Noteholders of

all Series of Notes issued under the Base Indenture as described therein, including the Lenders, as Noteholders of the Series 2023-GTL2

Promissory Term Notes. In the event that any term or provision contained in this Indenture Supplement shall conflict with or be inconsistent

with any term or provision contained in the Base Indenture, with respect to the Series 2023-GTL2 Promissory Term Notes, the terms and

provisions of this Indenture Supplement shall govern to the extent of such conflict.

Section 2.

Defined Terms.

With respect to the Series

2023-GTL2 Loan and in addition to or in replacement of the definitions set forth in Section 1.1 of the Base Indenture, the following

definitions shall be assigned to the defined terms set forth below:

“Administrative

Agent” means, (i) with respect to the provisions of this Indenture Supplement, ASP, or an Affiliate or successor thereto, and

(ii) with respect to the provisions of the Base Indenture, together ASP and such other parties as set forth in any other Indenture Supplement,

or a respective Affiliate or any respective successor thereto, and recognized as an Administrative Agent pursuant to the Base Indenture.

For the avoidance of doubt, reference to “it” or “its” with respect to the Administrative Agent in this Indenture

Supplement or in the Base Indenture shall mean “them” and “their,” and reference to the singular herein and therein

in relation to the Administrative Agent will be construed as if plural.

“Advance Rate”

means [**]%; provided, that, upon the occurrence of an Advance Rate Reduction Event, the Advance Rate will decrease by [****]%

per month until the Advance Rate Reduction Event is cured in all respects subject to the satisfaction of the Administrative Agent, at

which point the Advance Rate will revert to the value it had prior to the occurrence of such Advance Rate Reduction Event.

“Assignment Agreement”

means an Assignment and Assumption Agreement substantially in the form of Exhibit A, with such amendments or modifications

as may be approved by the Administrative Agent.

“Base Indenture”

has the meaning assigned to such term in the Preamble.

“Benchmark”

means, with respect to any Interest Accrual Period, initially Term SOFR; provided, that, if the Designated Transaction

Representatives determine that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to

Term SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement as of the related Benchmark

Reference Time on the Benchmark Determination Date.

“Benchmark Determination

Date” means (i) for the first Payment Date and the related Interest Accrual Period following the Issuance Date, October 20,

2023, and (ii) for each Payment Date and the related Interest Accrual Period following the first Payment Date, means (1) if the Benchmark

is Term SOFR, the SOFR Determination Date and (2) if the Benchmark is not Term SOFR, the date determined by the Designated Transaction

Representatives in accordance with the Benchmark Replacement Conforming Changes for each Payment Date and the related Interest Accrual

Period.

“Benchmark Reference

Time” means, with respect to any determination of the Benchmark, (i) if the Benchmark is Term SOFR, the SOFR Determination

Time and (ii) if the Benchmark is not Term SOFR, the time determined by the Designated Transaction Representatives in accordance with

the Benchmark Replacement Conforming Changes for each Payment Date and the related Interest Accrual Period.

“Benchmark Replacement”

means, the first applicable alternative set forth in the order below that can be determined by the Calculation Agent as of the applicable

Benchmark Replacement Date:

(1) the

sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement

for the then-current Benchmark for the applicable Corresponding Tenor and (b) the Benchmark Replacement Adjustment;

(2) the

sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or

(3) the

sum of: (a) the alternate rate of interest that has been selected in the sole and good faith discretion of the Designated Transaction

Representatives as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to

any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar denominated syndicated credit

facilities at such time and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement

Adjustment” means the first alternative set forth in the order below that can be determined by the Designated Transaction Representatives

as of the applicable Benchmark Replacement Date:

(1) the

spread adjustment (which may be a positive or negative value or zero), or method for calculating or determining such spread adjustment,

that has been selected, endorsed or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

(2) if

the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment; or

(3) the

spread adjustment (which may be a positive or negative value or zero) that has been selected by the Designated Transaction Representatives

giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment,

for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar denominated syndicated

credit facilities at such time.

“Benchmark Replacement

Conforming Changes” means, in connection with the determination of any Benchmark Transition Event or Benchmark Replacement

Date or the adoption of any Benchmark Replacement, Unadjusted Benchmark Replacement or Benchmark Replacement Adjustment, any technical,

administrative or operational changes (including changes to timing and frequency of determining rates and making payments of interest,

changes to the definition of “Corresponding Tenor” and other administrative matters) that the Designated Transaction Representatives,

in their sole and good faith discretion, decide may be appropriate to reflect such determination or adoption in a manner substantially

consistent with the market practice (or, if the Designated Transaction Representatives decide that adoption of any portion of such market

practice is not administratively feasible or if the Designated Transaction Representatives determine that no such market practice exists,

in such other manner as the Designated Transaction Representatives determine is reasonably necessary), in each case as notified to the

Indenture Trustee, the Calculation Agent and the Administrative Agent at least twenty (20) calendar days prior to the posting of such

Benchmark Replacement Conforming Changes with the Payment Date Report notifying the other Lenders of such changes and such Benchmark

Replacement Conforming Changes taking effect, which such changes shall automatically become effective without further action on behalf

of any party (upon being provided with such Payment Date Report). The Benchmark Replacement Conforming Changes will be prepared by the

Designated Transaction Representatives and delivered to the Indenture Trustee and Calculation Agent for posting with the Payment Date

Report.

“Benchmark Replacement

Date” means the earliest to occur of the following events with respect to then current Benchmark (including the daily published

component used in the calculation thereof):

(1) in

the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date

of the public statement or publication of information referenced therein and (b) the date on which the administrator of the relevant

Benchmark permanently or indefinitely ceases to provide the Benchmark (or such component); or

(2) in

the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication

of information referenced therein.

If the Designated Transaction

Representatives determine that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the Benchmark

Reference Time in respect of any determination of the Benchmark on any date, the Benchmark Replacement shall replace the then-current

Benchmark for all purposes with respect to the Series 2023-GTL2 Loan in respect of such determination on such date and all determinations

on all subsequent dates.

For the avoidance of doubt,

if the event that gives rise to the applicable Benchmark Replacement Date occurs on the same day as, but earlier than, the Benchmark

Reference Time in respect of any determination, the Benchmark Replacement Date shall be deemed to have occurred prior to the Benchmark

Reference Time for such determination.

“Benchmark Transition

Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark (including the

daily published component used in the calculation thereof):

(1) a

public statement or publication of information by or on behalf of the administrator of the Benchmark (or such component) announcing that

such administrator has ceased or will cease to provide the Benchmark (or such component), permanently or indefinitely, provided that,

at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such

component);

(2) a

public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark (or such component),

the central bank for the currency of the Benchmark (or such component), an insolvency official with jurisdiction over the administrator

for the Benchmark (or such component), a resolution authority with jurisdiction over the administrator for the Benchmark (or such component)

or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark (or such component),

which states that the administrator of the Benchmark (or such component) has ceased or will cease to provide the Benchmark (or such component)

permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will

continue to provide the Benchmark (or such component); or

(3) a

public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the

Benchmark is no longer representative.

“Corporate Trust

Office” means the corporate trust offices of the Indenture Trustee at which at any particular time its corporate trust business

with respect to the Issuer shall be administered, which offices at the Issuance Date are located at Citibank, N.A., Agency & Trust,

388 Greenwich Street, Trading, New York, NY 10013, Attention: PNMAC GMSR Issuer Trust MSR Collateralized Notes, and, with respect to

Note transfer, exchange or surrender purposes, Citibank, N.A., 480 Washington Boulevard, 30th Floor, Jersey City, New Jersey

07310, Attention: Agency & Trust – PNMAC GMSR Issuer Trust MSR Collateralized Notes.

“Corresponding Tenor”

means a tenor (including overnight) having the length (disregarding any business day adjustment) of 30 days or one month, and with respect

to a Benchmark Replacement, a tenor (including overnight) having approximately the same length (disregarding any business day adjustment)

as the applicable tenor for the then-current Benchmark.

“Cumulative Interest

Shortfall Amount Rate” means [****]% per annum.

“Default Supplemental

Fee” means, under this Indenture Supplement and each Payment Date during the Full Amortization Period and on the date of final

payment of the Series 2023-GTL2 Loan (if the Full Amortization Period is continuing on such final payment date), a fee equal to (1) the

related Cumulative Default Supplemental Fee Shortfall Amount, plus (2) the product of:

(i) the Default Supplemental Fee Rate;

(ii) the average daily loan amount

represented by the average daily Note Balance since the prior Payment Date of the Series 2023-GTL2 Promissory Term Notes; and

(iii) a fraction, the numerator of

which is the number of days elapsed from and including the prior Payment Date (or, if later, the commencement of the Full Amortization

Period) to but excluding such Payment Date and the denominator of which equals 360.

“Default Supplemental

Fee Rate” means [****]% per annum.

“Designated Transaction

Representatives” means the Series Required Noteholders.

“Early Amortization

Event” occurs with respect to the Series 2023-GTL2 Promissory Term Notes when:

(i) the

amount currently funded with respect to all Series of VFNs, measured individually, by a Noteholder of an MBS Advance VFN is less than

$50,000,000;

(ii) an

Advance Rate Reduction Event has occurred and has been continuing for six (6) consecutive months; or

(iii) the

unpaid principal balance of the Portfolio is less than $35 billion.

“Early Amortization

Event Payment Amount” means, with respect to the Series 2023-GTL2 Promissory Term Notes, the sum of (i) one-thirty-sixth (1/36)

of the outstanding loan amount represented by the Note Balance of the Series 2023-GTL2 Promissory Term Notes as of the date on which

an Early Amortization Event occurs and (ii) the product of (a) the Series Allocation Percentage of the Series 2023-GTL2 Promissory Term

Notes and (b) the amounts in the Collection and Funding Account that are designated as “Advance Rate Reduction Event Reserve Amounts”

on such Payment Date, if applicable.

“Early Termination

Event” means, with respect to the Series 2023-GTL2 Loan, not applicable.

“Early Termination

Event Payment Amount” means, with respect to the Series 2023-GTL2 Loan, not applicable.

“Eligible Assignee”

means (i) any Affiliate of a Lender, (ii) any commercial bank, insurance company, investment or mutual fund or other entity that is a

“qualified institutional buyer” (as defined under Rule 144A), that extends credit or buys loans as one of its businesses

and that has total assets in excess of $100,000,000, and (iii) any other Person (other than a natural Person) approved by the Administrator

that has total assets in excess of $100,000,000.

“Federal Reserve

Bank of New York’s Website” means the website of the Federal Reserve Bank of New York at http://www.newyorkfed.org, or

any successor source.

“Fee Letter”

means, a Fee Letter, dated as of October 25, 2023, by the Administrative Agent and accepted and agreed to by the Issuer and Company.

“Indenture”

has the meaning assigned to such term in the Preamble.

“Indenture Supplement”

has the meaning assigned to such term in the Preamble, which such Indenture Supplement, for the avoidance of doubt, constitutes a Transaction

Document.

“Initial Note Balance”

means, with respect to the Series 2023-GTL2 Promissory Term Notes representing the Series 2023-GTL2 Loan, $125,000,000. The Initial Note

Balance and any subsequent Note Balance may be increased from time to time as set forth in Section 11(a). Each Lender’s

Pro Rata Share of the Note Balance shall be reflected in Exhibit B hereto, as such Exhibit may be updated from time to time by

the Administrator with the consent of the Administrative Agent. To the extent Exhibit B is updated, PLS shall promptly deliver

the updated Exhibit B to the Paying Agent and the Lenders.

“Interest Accrual

Period” means, for the Series 2023-GTL2 Promissory Term Notes, (i) with respect to the first Payment Date, the period that

will commence on the Issuance Date and will end on the day immediately preceding the Payment Date in November 2023, and (ii) with respect

to any subsequent Payment Dates, the period that will commence on the immediately preceding Payment Date and end on the day immediately

preceding the current Payment Date. The Interest Payment Amount for the Series 2023-GTL2 Promissory Term Notes for each Payment Date

will be calculated based on the Interest Day Count Convention. The first Payment Date with respect to the Series 2023-GTL2 Promissory

Term Notes will be November 27, 2023.

“Interest Day Count

Convention” means the actual number of days in the related Interest Accrual Period divided by 360.

“ISDA Definitions”

means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended

or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment”

means the spread adjustment, (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing

the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable

tenor.

“ISDA Fallback Rate”

means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of

an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“Issuance Date”

means October 25, 2023.

“Lender”

means the Lead Arranger and each other Person listed on the signature pages to this Indenture Supplement as a Noteholder and other Lenders

added from time to time, together with their successors, and any “Assignee” who becomes a lender hereunder pursuant to an

Assignment Agreement as set forth in Section 7(c) hereof, other than any such Person that ceases to be a Lender pursuant to this

Indenture Supplement.

“Margin”

means, for the Series 2023-GTL2 Promissory Term Notes representing the Series 2023-GTL2 Loan, [****]% per annum.

“Note Interest Rate”

means, for the Series 2023-GTL2 Promissory Term Notes representing the Series 2023-GTL2 Loan, with respect to any Interest Accrual Period,

the sum of (a) the Benchmark plus (b) the applicable Margin.

“PLS”

has the meaning assigned to such term in the Preamble.

“Pro Rata Share”

means, with respect to a Lender's right to receive payments of interest, fees and principal with respect to the Series 2023-GTL2 Loan

and all other rights, obligations and matters concerning the Lenders, the percentage obtained by dividing (i) the sum of the unpaid principal

amount of such Lender’s portion of the Series 2023-GTL2 Loan by (ii) the sum of the aggregate unpaid principal amount of the Series

2023-GTL2 Loan.

“Relevant Governmental

Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened

by the Federal Reserve Board and/or the Federal Reserve Bank of New York or any successor thereto.

“Scheduled Principal

Payment Amount” means, with respect to any Payment Date following a Scheduled Principal Payment Event, an amount equal to the

sum of the Series Principal Payment Amounts due and payable on each Series of Term Notes then outstanding, including the Series 2023-GTL2

Loan represented by the Series 2023-GTL2 Promissory Term Notes.

“Scheduled Principal

Payment Events” means, for any Payment Date with respect to the Series 2023-GTL2 Promissory Term Notes, a Series Principal

Payment Amount will be due on a one-time basis on any Payment Date following the occurrence of any of the following events (each, a “Scheduled

Principal Payment Event”):

(i)

the unpaid principal balance of the Portfolio is less than $85 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(ii)

the unpaid principal balance of the Portfolio is less than $80 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(iii)

the unpaid principal balance of the Portfolio is less than $75 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(iv)

the unpaid principal balance of the Portfolio is less than $70 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(v)

the unpaid principal balance of the Portfolio is less than $65 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(vi)

the unpaid principal balance of the Portfolio is less than $60 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(vii)

the unpaid principal balance of the Portfolio is less than $55 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(viii)

the unpaid principal balance of the Portfolio is less than $50 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date;

(ix)

the unpaid principal balance of the Portfolio is less than $45 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date; or

(x)

the unpaid principal balance of the Portfolio is less than $40 billion and a Borrowing Base Deficiency exists as of the close

of business on the last day of the related Collection Period, prior to the paydown of the VFN Principal Balance of any Outstanding Class

of VFNs from the preceding Payment Date.

“Series 2023-GTL2

Loan” has the meaning assigned to such term in Preliminary Statement of this Indenture Supplement.

“Series 2023-GTL2

Promissory Term Notes” has the meaning assigned to such term in Section 1 of this Indenture Supplement.

“Series Principal

Payment Amount” means, upon the occurrence of a Scheduled Principal Payment Event, an amount equal to the product of (i) the

Series Allocation Percentage of the Series 2023-GTL2 Promissory Term Notes and (ii) the product of (a) $5,000,000,000, (b) the Market

Value Percentage (as calculated using clause (b)(ii) of the definition thereof) and (c) the related Advance Rate in respect of the Series

2023-GTL2 Loan.

“Series Required

Noteholders” means, for so long as the Series 2023-GTL2 Promissory Term Notes are Outstanding, Noteholders of the Series 2023-GTL2

Promissory Term Notes constituting the Majority Noteholders of such Series, which, for the avoidance of doubt will be the Lenders whose

Pro Rata Share of the Series 2023-GTL2 Loan is greater than 50% of the outstanding aggregate Series 2023-GTL2 Loan amount.

“SOFR”

means, with respect to any day, the greater of (i) the secured overnight financing rate published for such day by the Federal Reserve

Bank of New York (or a successor administrator), as the administrator of the benchmark on the Federal Reserve Bank of New York’s

Website (or such successor administrator’s website) and (ii) 0%.

“SOFR Determination

Date” means the second U.S. Government Securities Business Day before each Interest Accrual Period begins.

“SOFR Determination

Time” means 3:00 p.m. (New York time) on a U.S. Government Securities Business Day, at which time Term SOFR is published on

the Federal Reserve Bank of New York’s Website.

“Specified Call

Premium Amount” means, as of any date of determination, the greater of (i) $0 and (ii) the product of (a) the quotient

of (1) the product of (x) the Note Interest Rate multiplied by (y) the outstanding Note Balance of the Series 2023-GTL2

Loan being prepaid divided by (2) 360 multiplied by (b) the difference between (1) 180 and (2) the number of days

from and including the date the Series 2023-GTL2 Promissory Term Notes were issued through and including the date on which the Series

2023-GTL2 Loan is prepaid and the Series 2023-GTL2 Promissory Term Notes are redeemed.

“Stated Maturity

Date” means the Payment Date in October 2028.

“Term SOFR”

means the forward-looking term rate for the applicable Corresponding Tenor based on SOFR that has been selected or recommended by the

Relevant Governmental Body as may initially be increased or decreased by a spread adjustment value that is either (i) set or recommended

by the Relevant Governmental Body for such term rate or (ii) determined in accordance with the methodology endorsed by the Relevant Governmental

Body for such term rate.

“Unadjusted Benchmark

Replacement” means the Benchmark Replacement excluding the applicable Benchmark Replacement Adjustment.

“U.S. Government

Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial

Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading

in U.S. government securities.

“WSFS”

has the meaning assigned to such term in Section 15 hereof.

Section 3.

Form of the Series 2023-GTL2 Promissory Term Notes; Transfer Restrictions.

(a)

The form of Definitive Rule 144A Note that may be used to evidence the Series 2023-GTL2 Loan in the circumstances described in

Section 5.2(c) of the Base Indenture is attached to the Base Indenture as Exhibit A-2.

(b)

The Series 2023-GTL2 Promissory Term Notes shall not have a CUSIP or other identifying number and any assignment thereof or any

interest therein shall be subject to the restrictions described in Section 7 and shall bear a legend referring to such transfer

restrictions.

(c)

The Series 2023-GTL2 Promissory Term Notes will be issued in an aggregate amount equal to the Initial Note Balance, and each Series

2023-GTL2 Promissory Term Note will reflect the related Lender’s Pro Rata Share of such amount. The Series 2023-GTL2 Promissory

Term Notes will be issued in minimum denominations of $30,000,000 and integral multiples of $1 in excess thereof.

Section 4.

Payments and Allocation of Funds on Payment Dates; No Series Reserve Account.

(a)

Except as otherwise expressly set forth herein, all payments made on the Series 2023-GTL2 Promissory Term Notes, including those

made on each Payment Date in accordance with Section 4.5 of the Base Indenture, shall be made by the Paying Agent to the Administrative

Agent on behalf of the Lenders. Upon receipt of any such amounts from the Paying Agent, the Administrative Agent shall allocate each

Lender’s Pro Rata Share of such amounts to the related Lender in accordance with the related wire instructions set forth on Exhibit

B. Each Lender confirms the Paying Agent will make such payments to the Administrative Agent described in this Section 4(a)

in accordance with the wire instructions set forth in Schedule 5 of the Base Indenture.

(b)

There will be no Series Reserve Account for the Series 2023-GTL2 Promissory Term Notes.

(c)

The Administrative Agent and the Issuer further confirm that the Series 2023-GTL2 Loan shall be certificated at the request of

the Lenders and the Series 2023-GTL2 Promissory Term Notes issued on the Issuance Date pursuant to this Indenture Supplement shall represent

such Series 2023-GTL2 Loan and shall be issued in the name of the related Lender set forth on Exhibit B with respect to the Pro

Rata Share of the Series 2023-GTL2 Loan as set forth therein.

(d)

The Issuer and the Administrative Agent hereby direct the Indenture Trustee to issue the Series 2023-GTL2 Promissory Term Notes

in the name of each Lender set forth in Exhibit B hereto in the amount of the Pro Rata Share set forth therein.

Section 5.

Optional Redemption and Refinancing.

(a) The

Issuer may, at any time, subject to Section 13.1 of the Base Indenture, upon at least five (5) Business Days’ prior written notice

to the Administrative Agent, the Indenture Trustee and the Lenders, prepay the Series 2023-GTL2 Loan and redeem in whole or in part and/or

terminate and cause retirement of the Series 2023-GTL2 Promissory Term Notes (so long as, in the case of any partial prepayment and redemption,

such prepayment and redemption is funded using the proceeds of the issuance and sale of one or more new Classes of Notes or from any

other cash or funds of PLS and not Collections on the MSRs). In anticipation of a prepayment of the Series 2023-GTL2 Loan and a redemption

of the Series 2023-GTL2 Promissory Term Notes at the end of their Revolving Period, the Issuer may issue a new Series or one or more

Classes of Notes within the ninety (90) day period prior to the end of such Revolving Period and reserve all or a portion of the cash

proceeds of the issuance for the sole purpose of paying the principal balance and all accrued and unpaid interest on the Series 2023-GTL2

Loan, on the last day of their Revolving Period.

(b) If

the Issuer prepays the Series 2023-GTL2 Loan and redeems the Series 2023-GTL2 Promissory Term Notes within 6 months from and including

the Issuance Date (the “Early Redemption Date”), the Issuer shall pay to the Lenders as part of the Redemption Amount

an amount equal to the Specified Call Premium Amount on the Early Redemption Date for such Series.

Section 6.

Reserved.

Section 7.

Assignment.

(a)

Each Series 2023-GTL2 Promissory Term Note is a promissory note evidencing an interest in a loan, and is not registered under

the 1933 Act, or the securities laws of any other jurisdiction, and any transfer or assignment of an interest in the Series 2023-GTL2

Loan represented by the Series 2023-GTL2 Promissory Term Notes will not require registration or qualification. A Lender may sell, assign,

pledge or transfer its beneficial interest in the Series 2023-GTL2 Loan under this Indenture Supplement to any person that such Lender

reasonably believes is, and who has certified that it is an, Eligible Assignee, who also satisfies the provisions set forth in Section

6.5 of the Base Indenture, with the prior written consent of the Administrator; provided, that, any Lender may sell, assign,

pledge or transfer its beneficial interest in the Series 2023-GTL2 Loan under this Indenture Supplement to any Person meeting the criteria

of clause (i) of the definition of the term “Eligible Assignee,” who also satisfies the provisions set forth in Section 6.5

of the Base Indenture, upon providing fourteen (14) calendar days prior written notice to the Issuer, the Administrator, the Indenture

Trustee and the Administrative Agent and satisfaction of the other transfer provisions set forth in the Base Indenture with respect to

such Series 2023-GTL2 Promissory Term Note. An assigning Lender and the assignee lender shall execute and deliver to the Issuer, the

Administrator, the Indenture Trustee and the Administrative Agent an Assignment Agreement, together with such other documentation required

for transfers of Notes or required by any Noteholder pursuant to the Base Indenture.

(b)

A Lender, upon execution and delivery hereof or, upon executing and delivering an Assignment Agreement, any assignee Lender, as

the case may be, represents and warrants as of such date that (i) in the case of an assignee Lender, it is an Eligible Assignee; (ii)

it has experience and expertise in the making of or investing in commitments or loans such as the Series 2023-GTL2 Loan; (iii) it will

make or invest in, as the case may be, the Series 2023-GTL2 Loan for its own account in the ordinary course of its business and without

a view to distribution of such loans within the meaning of the 1933 Act or the 1934 Act or other federal securities laws (it being understood

that, subject to the provisions of this Section 7, the disposition of the Series 2023-GTL2 Loan or any interests therein shall

at all times remain within its exclusive control); and (iv) such Lender is in compliance with all U.S. economic sanctions laws, executive

orders and implementing regulations as promulgated by the Office of Foreign Assets Control of the U.S. Department of the Treasury, including

with regard to the source of funds used to make the Series 2023-GTL2 Loan.

(c)

Subject to the terms and conditions of this Section 7 and the provisions of the Base Indenture, as of the effective date

of the applicable Assignment Agreement:

(i)

the assignee thereunder shall have the rights and obligations of the “Lender” hereunder to the extent such rights

and obligations hereunder have been assigned to it pursuant to such Assignment Agreement and shall thereafter be a party hereto, a Noteholder

and the “Lender” for all purposes hereof;

(ii)

the assigning Lender thereunder shall relinquish its rights and be released from its obligations hereunder and such Lender shall

cease to be a party hereto;

(iii)

the assigning Lender shall surrender the Series 2023-GTL2 Promissory Term Note to the Indenture Trustee for cancellation and exchange

in accordance with the provisions of the Base Indenture; and

(iv)

to the extent the Administrative Agent is informed of an assignment and such relevant information necessary to update Exhibit

B is provided to the Administrative Agent, the Administrative Agent shall provide an updated Exhibit B.

(d)

A Lender may at any time pledge or assign a security interest in all or any portion of its rights under this Indenture Supplement

to secure obligations of such Lender; provided that no such pledge or assignment of a security interest shall release Lender from any

of its obligations hereunder or substitute any such pledgee or assignee for Lender as a party hereto and such pledge or assignment of

a security interest is subject to the Acknowledgment Agreement.

(e)

Participations.

(i)

A Lender may, in the ordinary course of its business and in accordance with requirements of law, at any time (and from time to

time) sell to one or more banks or other entities (each a “Participant”), participating interests in the Series 2023-GTL2

Loan. In the event of any such sale by a Lender of a participating interest to a Participant: (i) such Lender’s obligations hereunder

and under the other Transaction Documents shall remain unchanged; (ii) such Lender shall remain solely responsible hereunder for the

performance of such obligations; and (iii) such Lender shall remain the owner of its Pro Rata Share of the Series 2023-GTL2 Loan and

the Noteholder of the Series 2023-GTL2 Promissory Term Note issued to it in evidence thereof for all purposes under the Transaction Documents.

All amounts payable under this Indenture Supplement and the Transaction Documents shall be determined as if such Lender had not sold

such participating interests. The parties hereto and Lenders shall continue to deal solely and directly with each other in connection

with Lenders’ rights and obligations under this Indenture Supplement and the Transaction Documents. Each Lender shall, acting solely

for this purpose as agent of the Issuer, maintain a register in the United States on which it enters the name and address of each Participant

and the principal amounts (and stated interest) of each Participant’s interest in the Series 2023-GTL2 Loan, the Series 2023-GTL2

Promissory Term Notes or other obligations under the Transaction Documents (the “Participant Register”); provided

that no Lender shall have any obligation to disclose all or any portion of the Participant Register (including the identity of any Participant

or any other information relating to a Participant’s interest in any commitments, the Series 2023-GTL2 Loan, the Series 2023-GTL2

Promissory Term Notes, letters of credit or other obligations under any Transaction Document) to any Person except to the extent that

such disclosure is necessary to establish that such commitment, the Series 2023-GTL2 Loan, the Series 2023-GTL2 Promissory Term Notes,

letter of credit or other obligation is in registered form under Section 5f.103-1(c) of the United States Treasury Regulations. The entries

in the Participant Register shall be conclusive absent manifest error, and each Lender shall treat each Person whose name is recorded

in the Participant Register as the owner of such participation for all purposes of this Indenture Supplement notwithstanding any notice

to the contrary. For avoidance of doubt, neither the Administrative Agent (in its capacity as Administrative Agent) nor the Indenture

Trustee (in any of its capacities) shall have any responsibility for maintaining a Participant Register.

(ii)

Each Lender shall retain the sole right to approve, without the consent of any Participant, any amendment, modification or waiver

of any provision of the Transaction Documents to the extent Lender approval is required under a Transaction Document for such amendment,

modification or waiver; provided, that any amendment, modification, or waiver with respect the Series 2023-GTL2 Loan in which such Participant

has an interest which (i) forgives principal, interest, or fees or reduces the interest rate, principal amount or fees payable with respect

to the Series 2023-GTL2 Loan, (ii) extends the Stated Maturity Date, (iii) increases the Note Balance, (iv) postpones any date fixed

for any regularly scheduled payment of principal of, or interest or fees on, the Series 2023-GTL2 Loan or (v) releases all or substantially

all of the Collateral (other than as expressly permitted pursuant to the Transaction Documents), may, in each such case, require the

consent of the Participants. The Indenture Trustee (in any of its capacities) has no obligation to verify that any required Participant

consent has been obtained and is entitled to rely on a certification from a Lender that the required Participant consents, if applicable,

have been obtained.

(f)

Pursuant to Section 6.5 of the Base Indenture, the Indenture Trustee shall serve as the Note Registrar and maintain a Note Register

in which it enters the name and address of each Lender as a Noteholder of the Series 2023-GTL2 Promissory Term Notes and the principal

amounts (and stated interest) of each Noteholder’s interest in the Series 2023-GTL2 Promissory Term Notes. It is intended that

the Series 2023-GTL2 Promissory Term Notes will be in registered form for purposes of Section 5f.103-1(c) of the United States Treasury

Regulations.

Section 8.

Conditions Precedent Satisfied.

The Issuer hereby represents

and warrants to each Lender and the Indenture Trustee that, as of the Issuance Date each of the conditions precedent set forth in the

Base Indenture, including those conditions precedent set forth in Section 6.10(b) of the Base Indenture and Article XII thereof, as applicable,

to the issuance of the Series 2023-GTL2 Promissory Term Notes and each of the conditions precedent set forth in Schedule I hereto

have been satisfied or waived in accordance with the terms thereof.

Section 9.

Representations and Warranties.

(a)

The Issuer, the Administrator, the Servicer and the Indenture Trustee hereby restate as of the related Issuance Date, or as of

such other date as is specifically referenced in the body of such representation and warranty, all of the representations and warranties

set forth in Sections 9.1, 10.1 and 11.14, respectively, of the Base Indenture.

(b)

PLS hereby represents and warrants that it is not in default with respect to any material contract under which a default should

reasonably be expected to have a material adverse effect on the ability of PLS to perform its duties under any Transaction Document to

which it is a party, or with respect to any order of any court, administrative agency, arbitrator or governmental body which would have

a material adverse effect on the transactions contemplated hereunder, and no event has occurred which with notice or lapse of time or

both would constitute such a default with respect to any such contract or order of any court, administrative agency, arbitrator or governmental

body.

Section 10.

Determination of Note Interest Rate and Benchmark.

(a)

At least one (1) Business Day prior to each Determination Date, the Calculation Agent shall calculate the Note Interest Rate for

the related Interest Accrual Period and the Interest Payment Amount for the Series 2023-GTL2 Loan for the upcoming Payment Date, and

include a report of such amount in the related Payment Date Report.

(b)

On each Benchmark Determination Date, the Calculation Agent will calculate the Benchmark for a one-month period for the succeeding

Interest Accrual Period for the related Series 2023-GTL2 Loan on the basis of the procedures specified in the definition of “Benchmark.”

(c)

In connection with the implementation of a Benchmark Replacement, the Designated Transaction Representatives will have the right

from time to time to make Benchmark Replacement Conforming Changes as described in the definition thereof.

(d)

Written notice or materials relating to the occurrence of a Benchmark Transition Event and its related Benchmark Replacement Date,

the determination of a Benchmark Replacement and the making of any Benchmark Replacement Conforming Changes received by the Paying Agent

in a format suitable for posting shall be posted with the relevant Payment Date Report. Notwithstanding anything in the Base Indenture,

any Indenture Supplement or any other Transaction Document to the contrary, upon such information being provided with the Payment Date

Report, the Base Indenture, any Indenture Supplement or any other relevant Transaction Document, as applicable, shall be deemed to have

been amended to reflect the new Unadjusted Benchmark Replacement, Benchmark Replacement Adjustment, Benchmark Replacement Conforming

Changes without further compliance with the amendment provisions of the Base Indenture, any Indenture Supplement or any other relevant

Transaction Document.

(e)

Any determination, decision or election that may be made by the Designated Transaction Representatives in connection with a Benchmark

Transition Event or a Benchmark Replacement as described above, including any determination with respect to a tenor, rate or adjustment

or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or

any selection, shall be conclusive and binding absent manifest error, may be made in the Designated Transaction Representatives’

sole and good faith discretion, and, notwithstanding anything to the contrary in the Transaction Documents, shall become effective without

consent from any other party. The Designated Transaction Representatives shall provide notice of any determination, decision or election

made by the Designated Transaction Representatives in connection with a Benchmark Transition Event or a Benchmark Replacement as described

above at least twenty (20) days prior to the proposed posting of such changes with the related Payment Date Report. None of the Issuer,

Owner Trustee, the Indenture Trustee, the Calculation Agent, the Paying Agent, the Securities Intermediary, the Administrator, the Designated

Transaction Representatives, the Administrative Agent, the Servicer or any other transaction party will have any liability for any determination

made by or on behalf of the Issuer by any party, including the Designated Transaction Representatives or any action or inaction by the

Administrative Agent, in connection with a Benchmark Transition Event, any Benchmark Replacement Date, the determination of or a Benchmark

Replacement and the making of any Benchmark Replacement Conforming Changes as described above, and each Lender as Noteholder of the Series

2023-GTL2 Promissory Term Notes, by its acceptance of a Note or a beneficial interest in a Note, shall be deemed to waive and release

any and all claims against any of the Issuer, Owner Trustee, the Indenture Trustee, the Calculation Agent, the Securities Intermediary,

the Administrator, the Designated Transaction Representatives, the Administrative Agent or the Servicer relating to any such determinations.

(f)

The establishment of the Benchmark by the Calculation Agent and the Designated Transaction Representatives, as applicable, and

the Calculation Agent’s subsequent calculation of the Benchmark, the Note Interest Rate and the Interest Payment Amount on the

Series 2023-GTL2 Loan for the relevant Interest Accrual Period based on the determination made by the Designated Transaction Representatives,

in the absence of manifest error, will be final and binding.

(g)

No Designated Transaction Representative or any of its directors, officers, agents or employees shall be liable for any action

taken or omitted to be taken by it under or in connection with this Indenture Supplement or the other Transaction Documents in their

capacity as Designated Transaction Representatives, other than action or inaction undertaken with gross negligence, willful misconduct

or bad faith. Without limiting the foregoing and notwithstanding any understanding to the contrary, no other Lender shall have any right

of action whatsoever against a Designated Transaction Representative as a result of such Designated Transaction Representative acting

or refraining from acting under this Indenture Supplement, the Series 2023-GTL2 Loan or any of the other Transaction Documents in its

own interests or otherwise, other than as a result of gross negligence, willful misconduct or bad faith by such Designated Transaction

Representative.

Section 11.

Amendments.

(a)

Notwithstanding any provisions to the contrary in Article XII of the Base Indenture but subject to the provisions set forth in

Sections 12.1, 12.2 and 12.3 of the Base Indenture, without the consent of the Lenders, as Noteholders of the Series 2023-GTL2 Promissory

Term Notes, or the Noteholders of any Notes but with the consent of the Issuer (evidenced by its execution of such amendment), the Indenture

Trustee, the Administrator, the Servicer (solely in the case of any amendment that adversely affects the rights or obligations of the

Servicer or adds new obligations or increases existing obligations of the Servicer), and the Administrative Agent, at any time and from

time to time, upon delivery of an Issuer Tax Opinion and upon delivery by the Issuer to the Indenture Trustee of an Officer’s Certificate

to the effect that the Issuer reasonably believes that such amendment will not have a material Adverse Effect, may amend any Transaction

Document for any of the following purposes: (i) to correct any mistake or typographical error or cure any ambiguity, or to cure, correct

or supplement any defective or inconsistent provision therein or in any other Transaction Document; (ii) to amend any other provision

of this Indenture Supplement; or (iii) with prior notice to each Note Rating Agency that is then rating any Outstanding Notes, to increase

the Note Balance from time to time to add additional Lenders or increase the Note Balance of the Notes held by existing Lenders with

respect to the Series 2023-GTL2 Loan funded by such Lender. Further, the Lenders are deemed to consent to any amendments made to the

Transaction Documents as a result of amendments to the Acknowledgment Agreement that Ginnie Mae and the Servicer agree to effect from

time to time or changes that Ginnie Mae may make to the Ginnie Mae Guide from time to time.

(b)

Notwithstanding any provisions to the contrary in Section 6.10 or Article XII of the Base Indenture except for amendments otherwise

permitted as described in Sections 12.1 and 12.2 of the Base Indenture and in the immediately preceding paragraph, no supplement, amendment

or indenture supplement entered into with respect to the issuance of a new Series of Notes or pursuant to the terms and provisions of

Section 12.2 of the Base Indenture may, without the consent of the Series Required Noteholders, supplement, amend or revise any term

or provision of this Indenture Supplement; provided, that, with respect to the following amendments, the consent of each Lender

of each Outstanding Series 2023-GTL2 Promissory Term Note materially and adversely affected thereby shall be required:

| (i) | any change to the scheduled payment date

of any payment of interest on the Series 2023-GTL2 Loan funded by such Lender, or change

a Payment Date or Stated Maturity Date of the related Note held by such Lender; |

| (ii) | any reduction of the Note Balance of,

or the Note Interest Rate or the Default Supplemental Fee Rate on any Notes held by such

Lender, or change the method of computing the Note Balance or Note Interest Rate in a manner

that is adverse to such Lender; |

| (iii) | any impairment of the right to institute

suit for the enforcement of any payment on any Note held by such Lender; |

| (iv) | any reduction of the percentage of Noteholders

of the Outstanding Notes (or of the Outstanding Notes of any Series or Class), for which

consent is required for any such amendment, or the consent of whose Noteholders is required

for any waiver of compliance with the provisions of the Indenture or any Indenture Supplement

or of defaults thereunder and their consequences, provided for in the Base Indenture or any

Indenture Supplement; |

| (v) | any modification or any amendment of the

Indenture, except to increase any percentage of Noteholders required to consent to any such

amendment or to provide that other provisions of the Indenture or any Indenture Supplement

cannot be modified or waived without the consent of the Noteholders adversely affected thereby; |

| (vi) | any modification to permit the creation

of any lien or other encumbrance on the collateral that is prior to the lien in favor of

the Indenture Trustee for the benefit of the Noteholders; |

| (vii) | any modification to change the method

of computing the amount of principal of, or interest on, any Note held by such Lender on

any date; |

| (viii) | any modification to increase any Advance

Rates in respect of Notes held by such Lender or eliminate or decrease any collateral value

exclusions in respect of Notes held by such Lender; |

| (ix) | any change, modification or waiver of

any Scheduled Principal Payment Amount; or |

| (x) | any change or modification of the definition

of Scheduled Principal Payment Event; |

provided, that, written notice

of the occurrence of a Benchmark Transition Event and its related Benchmark Replacement Date, the determination of a Benchmark Replacement

and the making of any Benchmark Replacement Conforming Changes received by the Paying Agent in a format suitable for posting shall be

posted with the relevant Payment Date Report, and notwithstanding anything in the Base Indenture, any Indenture Supplement or any other

Transaction Document to the contrary, upon such information being provided with such Payment Date Report, the Base Indenture, any Indenture

Supplement or any other relevant Transaction Document, as applicable, shall be deemed to have been amended to reflect the new Unadjusted

Benchmark Replacement, Benchmark Replacement Adjustment, Benchmark Replacement Conforming Changes without further compliance with the

amendment provisions of the Base Indenture, any Indenture Supplement or any other relevant Transaction Document.

(c)

For the avoidance of doubt, the consent of the Servicer is not required for (i) the waiver of any Event of Default or (ii) any

other modification or amendment to any Event of Default except those related to the actions and omissions of the Servicer.

(d)

For the avoidance of doubt, the Issuer and the Administrator hereby covenant that the Issuer shall not issue any future Series

of Notes without designating an entity to act as “Administrative Agent” under the related Indenture Supplement with respect

to such Series of Notes.

(e)

Any amendment of this Indenture Supplement which affects the rights, duties, immunities, obligations or liabilities of the Owner

Trustee in its capacity as owner trustee under the Trust Agreement shall require the written consent of the Owner Trustee.

(f)

If, in connection with any proposed amendment, waiver or consent requiring the consent of each Noteholder or each Noteholder materially

and adversely affected thereby, the consent of the Series Required Noteholders is obtained, but the consent of other necessary Noteholders

is not obtained (any such Noteholder whose consent is necessary but not obtained being referred to herein as a “Non-Consenting

Lender”), then PLS may direct the Issuer to (x) redeem such Non-Consenting Lender’s Series 2023-GTL2 Promissory Term

Note(s) at par value and pay to such Non-Consenting Lender in same day funds on the day of such redemption all interest, fees and other

amounts then accrued but unpaid to such Non-Consenting Lender by the Issuer hereunder to and including the date of termination and, upon

such payment, such Non-Consenting Lender shall be immediately terminated without further action from any Person or (y) replace any Non-Consenting

Lender as a Lender to this Indenture Supplement; provided, that, concurrently with such replacement described in clause (y) above

(i) another bank or other entity which is reasonably satisfactory to the Issuer shall agree, as of such date, to purchase at par value

as set forth in and subject to an Assignment Agreement and to become a Lender for all purposes under this Indenture Supplement and to

assume all obligations of the Non-Consenting Lender and to comply with Section 3 and (ii) the Issuer shall cause to be paid to

such Non-Consenting Lender in same day funds on the day of such replacement all interest, fees and other amounts then accrued but unpaid

to such Non-Consenting Lender by the Issuer hereunder to and including the date of termination and, upon such payment, such Non-Consenting

Lender shall be immediately terminated without further action from any Person.

Section 12.

Counterparts.

This Indenture Supplement

may be executed in any number of counterparts and all of such counterparts shall together constitute one and the same instrument. The

parties agree that this Indenture Supplement, any addendum or amendment hereto or any other document necessary for the consummation of

the transactions contemplated by this Indenture Supplement may be accepted, executed or agreed to through the use of an electronic signature

in accordance with the Electronic Signatures in Global and National Commerce Act, 15 U.S.C. § 7001 et seq, Official Text of the

Uniform Electronic Transactions Act as approved by the National Conference of Commissioners on Uniform State Laws at its Annual Conference

on July 29, 1999 and any applicable state law. Any document accepted, executed or agreed to in conformity with such laws will be binding

on all parties hereto to the same extent as if it were physically executed and each party hereby consents to the use of any secure third

party electronic signature capture service with appropriate document access tracking, electronic signature tracking and document retention.

Section 13.

Entire Agreement.

This Indenture Supplement,

together with the Base Indenture incorporated herein by reference and the related Transaction Documents, constitutes the entire agreement

among the parties hereto with respect to the subject matter hereof, and fully supersedes any prior or contemporaneous agreements relating

to such subject matter.

Section 14.

Limited Recourse.

Notwithstanding any other

terms of this Indenture Supplement, the Series 2023-GTL2 Loan, the Series 2023-GTL2 Promissory Term Notes, any other Transaction Documents

or otherwise, the obligations of the Issuer under the Series 2023-GTL2 Promissory Term Notes, this Indenture Supplement and each other

Transaction Document to which it is a party are limited recourse obligations of the Issuer, payable solely from the Trust Estate, and

following realization of the Trust Estate and application of the proceeds thereof in accordance with the terms of this Indenture Supplement,

none of the Lenders, the Indenture Trustee or any of the other parties to the Transaction Documents shall be entitled to take any further

steps to recover any sums due but still unpaid hereunder or thereunder, all claims in respect of which shall be extinguished and shall