UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

OneMain

Holdings, Inc.

(Name of Issuer)

COMMON STOCK, par value $0.01 per share

(Title of Class of Securities)

68268W103

(CUSIP Number)

Andrew Malone

Värde Partners, Inc.

901 Marquette Ave. S, Suite 3300

Minneapolis, MN 55402

(952) 893-1554

February 10, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

| CUSIP No. 68268W103 |

|

Page

2

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

UNIFORM INVESTCO LP |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

8,268,916 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

8,268,916 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,268,916 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 6.84% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

3

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

UNIFORM INVESTCO GP LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

8,268,916 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

8,268,916 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,268,916 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 6.84% |

| 14. |

|

Type of Reporting

Person OO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

4

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE FUND VI-A, L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

354,958 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

354,958 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

354,958 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.29% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

5

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE INVESTMENT PARTNERS, L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,431,724 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,431,724 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,431,724 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.19% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

6

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE INVESTMENT PARTNERS (OFFSHORE) MASTER, L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,206,503 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,206,503 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,206,503 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.00% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

7

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE INVESTMENT PARTNERS G.P., L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

2,993,185 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

2,993,185 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,993,185 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 2.48% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

8

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE INVESTMENT PARTNERS UGP, LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

2,993,185 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

2,993,185 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,993,185 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 2.48% |

| 14. |

|

Type of Reporting

Person OO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

9

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE SKYWAY MASTER FUND, L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

853,409 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

853,409 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

853,409 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.71% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

10

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE SKYWAY FUND G.P., L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

853,409 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

853,409 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

853,409 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.71% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

11

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE SKYWAY FUND UGP, LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

853,409 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

853,409 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

853,409 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.71% |

| 14. |

|

Type of Reporting

Person OO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

12

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE FUND XII (MASTER), L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,306,546 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,306,546 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,306,546 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.08% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

13

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE FUND XII G.P., L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,306,546 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,306,546 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,306,546 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.08% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

14

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE FUND XII UGP, LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,306,546 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,306,546 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,306,546 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.08% |

| 14. |

|

Type of Reporting

Person OO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

15

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE CREDIT PARTNERS MASTER, L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,037,695 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,037,695 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,037,695 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.86% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

16

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE CREDIT PARTNERS G.P., L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,037,695 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,037,695 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,037,695 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.86% |

| 14. |

|

Type of Reporting

Person OO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

17

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE CREDIT PARTNERS UGP, LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,037,695 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,037,695 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,037,695 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.86% |

| 14. |

|

Type of Reporting

Person OO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

18

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE SFLT, L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

2,078,081 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

2,078,081 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,078,081 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.72% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

19

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE SPECIALTY FINANCE FUND G.P., L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

2,078,081 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

2,078,081 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,078,081 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.72% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

20

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

THE VÄRDE SPECIALITY FINANCE FUND U.G.P., LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

2,078,081 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

2,078,081 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,078,081 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 1.72% |

| 14. |

|

Type of Reporting

Person OO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

21

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

Uniform InvestCo Sub L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

4,944,066 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

4,944,066 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

4,944,066 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 4.09% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

22

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE PARTNERS, L.P. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

8,268,916 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

8,268,916 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,268,916 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 6.84% |

| 14. |

|

Type of Reporting

Person PN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

23

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

VÄRDE PARTNERS, INC. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

8,268,916 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

8,268,916 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,268,916 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 6.84% |

| 14. |

|

Type of Reporting

Person CO |

|

|

|

| CUSIP No. 68268W103 |

|

Page

24

|

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

ILFRYN C. CARSTAIRS |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Australia and the United

Kingdom |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

8,268,916 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

8,268,916 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,268,916 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 6.84% |

| 14. |

|

Type of Reporting

Person IN |

|

|

|

| CUSIP No. 68268W103 |

|

Page

25

|

Schedule 13D/A

Amendment No. 5

| ITEM 1. |

SECURITY AND ISSUER |

This Statement on Schedule 13D relates to the common stock, par value $0.01 per share (the “Common Stock”), of OneMain Holdings, Inc. (the

“Issuer”). The principal executive offices of the Issuer are located at 601 N.W. Second Street, Evansville, IN 47708.

This Amendment No. 5

(“Amendment No. 5”) amends and supplements the Schedule 13D filed by the Reporting Persons on Schedule 13D filed by the Reporting Persons on July 3, 2018, as amended by Amendment No. 1 thereto filed on February 20,

2020, Amendment No. 2 thereto filed on February 18, 2021, Amendment No. 3 thereto filed on May 7, 2021, and Amendment No. 4 thereto filed on October 18, 2021 (as so amended by this Amendment No. 5, the

“Schedule 13D”). This Amendment No. 5 is filed, in part, to reflect a change in the percentages previously reported as a result of the change in the outstanding shares of the Issuer’s Common Stock reported by the Issuer in its

Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 10, 2023 and certain purchases and sales by the Reporting Persons. Except as specifically

provided herein, this Amendment No. 5 does not modify any of the information previously reported on the Schedule 13D. Capitalized terms used but not otherwise defined in this Amendment No. 5 shall have the meanings ascribed to them in the

Schedule 13D.

| ITEM 2. |

IDENTITY AND BACKGROUND |

Item 2 of this Schedule 13D is amended to delete references to Mr. George G. Hicks because Mr. Hicks is no longer the co-chief executive officer of the General Partner.

Item 2 of this Schedule 13D is amended to replace references to

Mr. Ilfryn C. Carstairs as the co-chief executive officer of Värde Partners, Inc. (the “General Partner”) with references to Mr. Carstairs as the chief executive officer of the

General Partner.

Appendix A of the Schedule 13D is amended and restated in its entirety by the Appendix A attached hereto.

| ITEM 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

Item 3 of this Schedule 13D is amended to include the following information.

In December 2021, Uniform Investco Sub LP (“InvestCo Sub”) acquired 989,624 shares of the Common Stock in open market transactions at the purchase

prices and on the dates set forth on Appendix B for an aggregate purchase price of approximately $49,894,116 in cash. InvestCo Sub used cash on hand to fund such purchases.

On February 14, 2023, InvestCo Sub sold 273,000 shares of Common Stock in open market transactions at the prices set forth on Appendix C for an aggregate sale

price of $12,492,480.

| ITEM 4. |

PURPOSE OF TRANSACTION |

Item 4 of this Schedule 13D is amended and restated in its entirety as follows:

All of the shares of Common Stock that are held of record by the Reporting Persons and that may be deemed to be beneficially owned by the Reporting Persons, as

reported herein, were acquired for investment purposes. The Reporting Persons intend to participate in the management of the Issuer through representation on the Issuer’s board of directors (the “Board”) and through certain rights

pursuant to the Amended and Restated Stockholders Agreement and Letter Agreement described below in Item 6 and included hereto as Exhibits B and Exhibit C, respectively. The Reporting Persons retain the right to change their investment intent, from

time to time, to acquire additional shares of Common Stock or other securities of the Issuer, or to sell or otherwise dispose of all or part of the Common Stock or other securities of the Issuer, if any, beneficially owned by them, in any manner

permitted by law and the Amended and Restated Stockholders Agreement and Letter Agreement. The Reporting Persons may engage from time to time in ordinary course transactions with respect to the securities described herein. Depending on market

conditions and other factors (including evaluation of the Issuer’s businesses and prospects, availability of funds, alternative uses of funds and general economic conditions), the Reporting Persons may from time to time acquire additional

securities of the Issuer or dispose of all or a portion of their investment in the Issuer. Except as described above, none of the Reporting Persons currently has any other plans or proposals that would be related to or would result in any of the

matters described in Items 4(a)-(j) of the Instructions to Schedule 13D.

|

|

|

| CUSIP No. 68268W103 |

|

Page

26

|

However, as part of the ongoing evaluation of investment and investment alternatives, the Reporting Persons

may consider such matters and, subject to applicable law, may formulate a plan with respect to such matters, and, from time to time, may hold discussions with or make formal proposals to management or the Board or other third parties regarding such

matters.

| ITEM 5. |

INTEREST IN SECURITIES OF THE ISSUER |

Item 5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

OMH Holdings LP (“Holdings”) and/or one or more of its subsidiaries are the record owners of an aggregate of 2,608,226 shares of the Issuer’s

Common Stock, which represents approximately 2.16% of the Issuer’s outstanding Common Stock. Through its interest in Holdings, Uniform InvestCo LP (“InvestCo”) has a beneficial interest in 2,608,226 shares of Issuer’s Common

Stock, which represents approximately 2.16% of the outstanding shares of Issuer’s Common Stock. InvestCo Sub is the sole record owner of an aggregate of 4,944,066 shares of Issuer’s Common Stock, which represents approximately 4.09% of the

outstanding shares of the Issuer’s Common Stock. Through its interest in InvestCo Sub, InvestCo has a beneficial interest in 4,944,066 shares of Issuer’s Common Stock, which represents approximately 4.09% of the outstanding shares of the

Issuer’s Common Stock. Each of Fund VI-A, VIP, VIP Offshore, Skyway, Fund XII, Credit Partners and SFLT own an interest in Uniform Topco LP. Uniform InvestCo Holdings Sarl, a wholly-owned subsidiary of

Uniform Topco LP, and InvestCo GP own 99.99% and 0.01%, respectively, of the outstanding partnership interests of InvestCo. InvestCo and InvestCo GP own 99.99% and 0.01%, respectively, of the outstanding partnership interests of InvestCo Sub.

Each Reporting Person disclaims beneficial ownership of any shares of the Issuer’s Common Stock owned of record by Holdings and/or one or more of its

subsidiaries, in each case, except to the extent of any pecuniary interest therein, and this report shall not be deemed an admission that any such entity is the beneficial owner of or has any pecuniary interest in, such securities for purposes of

Section 16 of the Securities Exchange Act of 1934, as amended, or for any other purpose.

(a) See also the information contained on the cover pages

of this Statement on Schedule 13D which is incorporated herein by reference. The percentage of Common Stock reported as beneficially owned by each Reporting Person is based on 120,811,795 shares of Common Stock outstanding as of January 31,

2023, based upon information provided in the Annual Report on Form 10-K filed by the Issuer with the SEC on February 10, 2023.

(b) No change.

(c) On February 14, 2023, InvestCo Sub sold

273,000 shares of Common Stock in open market transactions at the prices set forth on Appendix C for an aggregate sale price of $12,492,480. Except as described in this 13D/A, there have been no reportable transactions with respect to the Common

Stock of the Issuer within the last 60 days by the Reporting Persons.

(d) To the knowledge of the Reporting Persons, no other person has the right to

receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Issuer’s Common Stock.

(e) Not applicable.

| ITEM 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

No change.

|

|

|

| CUSIP No. 68268W103 |

|

Page

27

|

| ITEM 7. |

MATERIAL TO BE FILED AS EXHIBITS |

Item 7 of the Schedule 13D is hereby amended and supplemented as follows:

|

|

|

| Exhibit |

|

Description |

|

|

| Exhibit A |

|

Share Purchase Agreement, dated as of January 3, 2018, by and among OneMain Holdings, Inc., OMH Holdings, L.P., and Springleaf Financial Holdings, LLC (attached as Exhibit 10.1 to the Issuer’s Current Report on Form 8-K (File No. 001-36129) filed with the Securities and Exchange Commission on January 4, 2018 and incorporated herein in its entirety by reference). |

|

|

| Exhibit B |

|

Amended and Restated Stockholders Agreement, dated as of June 25, 2018, by and among OneMain Holdings, Inc. and OMH Holdings, L.P. (attached as Exhibit 10.1 to the Issuer’s Current Report on Form 8-K (File No. 001-36129) filed with the Securities and Exchange Commission on June 25, 2018 and incorporated herein in its entirety by reference). |

|

|

| Exhibit C |

|

Letter Agreement, dated as of June 25, 2018, by and among Apollo Uniform GP, LLC, Uniform InvestCo LP, Uniform Co-Invest, L.P., Apollo VIII Uniform Investor, L.P. and Apollo Structured

Credit Recovery Master Fund IV LP (attached as Exhibit C to the Schedule 13D filed by the Reporting Persons with the Securities and Exchange Commission on July 3, 2018 and incorporated herein in its entirety by reference). |

|

|

| Exhibit D |

|

Joint Filing Agreement, dated as of February 15, 2023, by and among the Reporting Persons. |

|

|

|

| CUSIP No. 68268W103 |

|

Page

28

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 15, 2023

|

|

|

| UNIFORM INVESTCO LP |

|

| By: Uniform InvestCo GP LLC, its General Partner |

| By: Värde Partners, Inc., its Manager |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| UNIFORM INVESTCO GP LLC |

|

| By: Värde Partners, Inc., its Manager |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE FUND VI-A, L.P. |

|

| By: Värde Investment Partners G.P., L.P., its General Partner |

| By: Värde Investment Partners UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| VÄRDE INVESTMENT PARTNERS, L.P. |

|

| By: Värde Investment Partners G.P., L.P., its General Partner |

| By: Värde Investment Partners UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

|

|

| CUSIP No. 68268W103 |

|

Page

29

|

|

|

|

|

| VÄRDE INVESTMENT PARTNERS (OFFSHORE) MASTER, L.P. |

|

| By: Värde Investment Partners G.P., L.P., its General Partner |

| By: Värde Investment Partners UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| VÄRDE INVESTMENT PARTNERS G.P., L.P. |

|

| By: Värde Investment Partners UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| VÄRDE INVESTMENT PARTNERS UGP, LLC |

|

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE SKYWAY MASTER FUND, L.P. |

|

| By: The Värde Skyway Fund G.P., L.P., its General Partner |

| By: The Värde Skyway Fund UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE SKYWAY FUND G.P., L.P. |

|

| By: The Värde Skyway Fund UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

|

|

| CUSIP No. 68268W103 |

|

Page

30

|

|

|

|

|

| THE VÄRDE SKYWAY FUND UGP, LLC |

|

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE FUND XII (MASTER), L.P. |

|

| By: The Värde Fund XII G.P., L.P., its General Partner |

| By: The Värde Fund XII UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE FUND XII G.P., L.P. |

|

| By: The Värde Fund XII UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE FUND XII UGP, LLC |

|

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| VÄRDE CREDIT PARTNERS MASTER, L.P. |

|

| By: Värde Credit Partners G.P., L.P., its General Partner |

| By: Värde Credit Partners UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| VÄRDE CREDIT PARTNERS G.P., L.P. |

|

| By: Värde Credit Partners UGP, LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

|

|

| CUSIP No. 68268W103 |

|

Page

31

|

|

|

|

|

| VÄRDE CREDIT PARTNERS UGP, LLC |

|

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| VÄRDE SFLT, L.P. |

|

| By: The Värde Specialty Finance Fund G.P., L.P., its General Partner |

| By: The Värde Specialty Finance Fund U.G.P., LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE SPECIALTY FINANCE FUND G.P., L.P. |

|

| By: The Värde Specialty Finance Fund U.G.P., LLC, its General Partner |

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| THE VÄRDE SPECIALTY FINANCE FUND U.G.P., LLC |

|

| By: Värde Partners, L.P., its Managing Member |

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| UNIFORM INVESTCO SUB L.P. |

|

| By: Uniform InvestCo GP LLC, its General Partner |

| By: Värde Partners, Inc., its Manager |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

|

|

| CUSIP No. 68268W103 |

|

Page

32

|

|

|

|

|

| VÄRDE PARTNERS, L.P. |

|

| By: Värde Partners, Inc., its General Partner |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| VÄRDE PARTNERS, INC. |

|

|

| By: |

|

/s/ Andrew Malone |

| Name: |

|

Andrew Malone |

| Title: |

|

General Counsel |

|

| ILFRYN CARSTAIRS |

|

|

| By: |

|

/s/ Ilfryn Carstairs |

|

|

|

| CUSIP No. 68268W103 |

|

Page

33

|

APPENDIX A

The following sets forth information with respect to certain of the executive officers and managers of the General Partner. Except as noted below, the

business address of each of the below individuals is 901 Marquette Ave S, Suite 3300, Minneapolis, MN 55402.

|

|

|

| Name |

|

Principal occupation or employment and address of any corporation or other organization in which such employment is conducted |

|

|

| Marcia L. Page |

|

Executive Chair of Värde Partners, Inc., 901 Marquette Ave. S., Suite 3300, Minneapolis, MN 55402 |

|

|

| George Hicks |

|

Executive Chair of Värde Partners, Inc., 901 Marquette Ave. S., Suite 3300, Minneapolis, MN 55402 |

|

|

| Bradley P. Bauer |

|

Principal of Värde Partners, Inc., 2 St. James’s Market, 3rd Floor, London SW1Y 4AH |

|

|

| Andrew P. Lenk |

|

Principal of Värde Partners, Inc., 901 Marquette Ave. S., Suite 3300, Minneapolis, MN 55402 |

|

|

| Ilfryn C. Carstairs |

|

Principal of Värde Partners, Inc., 88 Market Street #23-04, Singapore 048948 |

|

|

| Andrew Malone |

|

Principal of Värde Partners, Inc., 901 Marquette Ave. S., Suite 3300, Minneapolis, MN 55402 |

|

|

| Giuseppe Naglieri |

|

Principal of Värde Partners, Inc., 2 St. James’s Market, 3rd Floor, London SW1Y 4AH |

|

|

| Timothy J. Mooney |

|

Principal of Värde Partners, Inc., 520 Madison Avenue, 34th Floor, New York 10022 |

|

|

| Jonathan Fox |

|

Principal of Värde Partners, Inc., 520 Madison Avenue, 34th Floor, New York 10022 |

|

|

| Haseeb Malik |

|

Principal of Värde Partners, Inc., 88 Market Street #23-04, Singapore 048948 |

|

|

| Mark Schein |

|

Global Chief Compliance Officer of Värde Partners, Inc., 520 Madison Avenue, 34th Floor, New York 10022 |

|

|

| Scott Hartman |

|

Principal of Värde Partners, Inc., 901 Marquette Ave. S., Suite 3300, Minneapolis, MN 55402 |

|

|

| Francisco Milone |

|

Principal of Värde Partners, Inc., 520 Madison Avenue, 34th Floor, New York 10022 |

|

|

| James Dunbar |

|

Principal of Värde Partners, Inc., 901 Marquette Ave. S., Suite 3300, Minneapolis, MN 55402 |

|

|

| Aneek Mamik |

|

Principal of Värde Partners, Inc., 520 Madison Avenue, 34th Floor, New York 10022 |

|

|

| Carlos Sanz Esteve |

|

Principal of Värde Partners, Inc., 2 St. James’s Market, 3rd Floor, London SW1Y 4AH |

|

|

|

| CUSIP No. 68268W103 |

|

Page

34

|

Appendix B

|

|

|

|

|

|

|

|

|

| Date |

|

Price |

|

|

Number of Shares |

|

| 12/6/2021 |

|

|

51.5805 |

|

|

|

25,000.00 |

|

| 12/7/2021 |

|

|

51.9845 |

|

|

|

25,000.00 |

|

| 12/8/2021 |

|

|

51.4227 |

|

|

|

60,000.00 |

|

| 12/9/2021 |

|

|

50.8867 |

|

|

|

75,000.00 |

|

| 12/10/2021 |

|

|

50.6412 |

|

|

|

50,000.00 |

|

| 12/13/2021 |

|

|

50.0973 |

|

|

|

151,962.00 |

|

| 12/14/2021 |

|

|

50.5316 |

|

|

|

150,000.00 |

|

| 12/15/2021 |

|

|

50.3998 |

|

|

|

125,662.00 |

|

| 12/16/2021 |

|

|

50.3753 |

|

|

|

200,000.00 |

|

| 12/17/2021 |

|

|

49.3704 |

|

|

|

127,000.00 |

|

Appendix C

|

|

|

|

|

|

|

|

|

| Date |

|

Price |

|

|

Number of Shares |

|

| 2/14/2023 |

|

|

45.0000-45.9950 |

|

|

|

221,119 |

(a) |

| 2/14/2023 |

|

|

46.0000-46.2200 |

|

|

|

51,881 |

(b) |

| (a) |

These shares of Common Stock were sold in multiple transactions within the price range set forth above at a

weighted average sale price of $45.69. The Reporting Persons hereby undertake to provide upon request by the Securities and Exchange Commission staff full information regarding the number of shares of Common Stock sold at each separate price.

|

| (b) |

These shares of Common Stock were sold in multiple transactions within the price range set forth above at a

weighted average sale price of $46.07. The Reporting Persons hereby undertake to provide upon request by the Securities and Exchange Commission staff full information regarding the number of shares of Common Stock sold at each separate price.

|

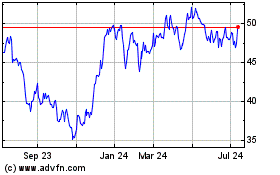

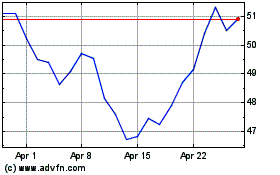

OneMain (NYSE:OMF)

Historical Stock Chart

From Aug 2024 to Sep 2024

OneMain (NYSE:OMF)

Historical Stock Chart

From Sep 2023 to Sep 2024