Company raises full-year earnings outlook

- Sales of $1.9 billion, up 13

percent

- Backlog of $9.5 billion, up $572

million or 6 percent from a year ago

- Generated $338 million of operating

cash flow, up 25 percent

- GAAP earnings per share (EPS) of $1.43,

up 14 percent

- Non-GAAP EPS* of $1.94, up 27

percent

Motorola Solutions, Inc. (NYSE: MSI) today reported its earnings

results for the third quarter of 2018. Click here for a printable

news release and financial tables.

"Q3 was another strong quarter of revenue and earnings growth,”

said Greg Brown, chairman and CEO of Motorola Solutions. “Our

overall business performance, along with our record Q3 backlog,

provides solid momentum moving forward.”

KEY FINANCIAL RESULTS (presented in millions, except per

share data and percentages)

Q3 2018 Q3 2017 % Change

Sales

$1,862 $1,645 13 %

GAAP

Operating Earnings

$294 $347 (15 )% % of Sales

15.8 % 21.1 % EPS

$1.43 $1.25

14 %

Non-GAAP Operating Earnings

$452 $412 10

% % of Sales

24.3 % 25.0 % EPS

$1.94

$1.53 27 %

Products and Systems Integration

Segment Sales

$1,288 $1,174 10 % GAAP Operating Earnings

$183 $266 (31 )% % of Sales

14.2 % 22.7 %

Non-GAAP Operating Earnings

$276 $285 (3 )% % of Sales

21.4 % 24.3 %

Services

and Software Segment Sales

$574 $471 22 % GAAP Operating

Earnings

$111 $81 37 % % of Sales

19.3 % 17.2

% Non-GAAP Operating Earnings

$176 $127 39 % % of Sales

30.7 % 27.0 %

*Non-GAAP financial information excludes the after-tax impact of

approximately $0.51 per diluted share related to share-based

compensation, intangible assets amortization expense and

highlighted items. Details on these non-GAAP adjustments and the

use of non-GAAP measures are included later in this news

release.

OTHER SELECTED FINANCIAL RESULTS

- Revenue - Sales increased $217

million, or 13 percent from the year-ago quarter, driven by growth

in the Americas and EMEA. Approximately $145 million of revenue

growth was related to acquisitions, and $19 million was related to

the adoption of accounting standard ASC 606. The Products and

Systems Integration segment grew 10 percent driven by the Americas

and EMEA. The Services and Software segment grew 22 percent with

growth in all regions.

- Operating margin - GAAP

operating margin was 15.8 percent of sales, compared with 21.1

percent in the year-ago quarter. The decline was primarily due to

higher operating expenses related to acquisitions and an increase

to an existing environmental reserve related to a legacy business,

partially offset by higher gross margins in Services and Software.

Non-GAAP operating margin was 24.3 percent of sales, compared with

25.0 percent in the year-ago quarter due to higher operating

expenses related to acquisitions partially offset by higher sales

and favorable gross margin mix.

- Taxes - The GAAP effective tax

rate was 8 percent, compared with 26 percent in the year-ago

quarter. The Non-GAAP effective tax rate was 18 percent compared

with 30 percent in the year-ago quarter. Both the GAAP and Non-GAAP

tax rates were favorably affected by the recognition of U.S.

federal return to provision adjustments and the tax benefits

related to share-based compensation; however, certain return to

provision benefits that relate to the Tax Cuts and Jobs Act of 2017

were excluded from the Non-GAAP tax rate.

- Cash flow - Operating cash flow

was $338 million, compared with $270 million of operating cash

generated in the year-ago quarter. Free cash flow1 was $292

million, compared with $185 million of free cash flow generated in

the year-ago quarter. Cash flow for the quarter increased on higher

earnings, improved working capital and lower capital

expenditures.

- Capital allocation - The company

paid $84 million in cash dividends. From a debt perspective, the

company repaid the remaining $300 million on the revolving credit

facility ahead of schedule; $200 million was repaid during the

quarter, and $100 million was repaid subsequent to the quarter-end.

The company also repurchased 20% of the Silver Lake convertible

note for $369 million; the $200 million of principal was repaid

with new senior unsecured debt and the $169 million premium was

paid in cash.

- Backlog - The company ended the

quarter with backlog of $9.5 billion, up $572 million from the

year-ago quarter. Products and Systems Integration segment backlog

was up 9 percent or $277 million, and Services and Software was up

5 percent or $295 million. Land mobile radio demand led by the

Americas continues to drive backlog growth.

KEY HIGHLIGHTS

Services and Software wins

- $19 million digital evidence management

solution contract for the city of Las Vegas

- $18 million computer aided dispatch

(CAD) & mobile records contract for Chesterfield County,

Virginia

- $17 million multi-year services

contract for Petrobras (Brazil)

Products and Systems Integration

wins

- $50+ million Tetra system upgrade in

Europe

- $21 million P25 system and device

upgrade for city of Indianapolis and Marion County, Indiana

- $15 million P25 device order for city

of Austin, Texas

- $12 million P25 system order for city

of Augusta, Georgia

BUSINESS OUTLOOK

- Fourth-quarter 2018 - Motorola

Solutions expects revenue growth of approximately 13.5 percent

compared with the fourth quarter of 2017. The company expects

non-GAAP earnings in the range of $2.50 to $2.55 per share. This

assumes current foreign exchange rates, approximately 173 million

fully diluted shares and a 25 percent effective tax rate.

- Full-year 2018 - The

company continues to expect revenue growth of approximately 14.5

percent, and now expects non-GAAP earnings per share in the range

of $7.00 to $7.05, up from the prior guidance of $6.79 to $6.89.

This assumes current foreign exchange rates, approximately 172

million fully diluted shares and a 22.5 percent effective tax

rate.

CONFERENCE CALL AND WEBCAST Motorola Solutions will host

its quarterly conference call beginning at 4 p.m. U.S. Central

Daylight Time (5 p.m. U.S. Eastern Daylight Time) on Thursday, Nov.

1. The conference call will be webcast live at

www.motorolasolutions.com/investor.

CONSOLIDATED GAAP RESULTS (presented in millions,

except per share data)

A comparison of results from operations is as follows:

Q3 2018

Q3 2017 Net sales

$1,862 $1,645 Gross

margin

901 794 Operating earnings

294 347 Amounts attributable to Motorola Solutions,

Inc. common stockholders Net earnings

247 212 Diluted EPS

$1.43 $1.25 Weighted average diluted common shares

outstanding

172.6 169.0

HIGHLIGHTED ITEMS AND SHARE-BASED COMPENSATION

EXPENSE

The table below includes highlighted items, share-based

compensation expense and intangible amortization for the third

quarter of 2018.

(per diluted common share)

Q3

2018 GAAP Earnings $1.43

Highlighted Items: Share-based compensation expense $0.08

Reorganization of business charges 0.11 Intangibles amortization

expense 0.21 Avigilon purchase accounting adjustment 0.04 Gain from

the extinguishment of convertible debt (0.03 ) Fair value

adjustments to equity investments (0.03 ) Loss on legal settlement

0.01 Environmental reserve expense 0.25 Sale of investments (0.03 )

Return-to-provision adjustments as related to federal tax reform

(0.10 )

Non-GAAP Diluted EPS

$1.94

USE OF NON-GAAP FINANCIAL INFORMATION

In addition to the GAAP results included in this presentation,

Motorola Solutions also has included non-GAAP measurements of

results. The company has provided these non-GAAP measurements to

help investors better understand its core operating performance,

enhance comparisons of core operating performance from period to

period and allow better comparisons of operating performance to its

competitors. Among other things, management uses these operating

results, excluding the identified items, to evaluate performance of

the businesses and to evaluate results relative to certain

incentive compensation targets. Management uses operating results

excluding these items because it believes this measurement enables

it to make better period-to-period evaluations of the financial

performance of core business operations. The non-GAAP measurements

are intended only as a supplement to the comparable GAAP

measurements and the company compensates for the limitations

inherent in the use of non-GAAP measurements by using GAAP measures

in conjunction with the non-GAAP measurements. As a result,

investors should consider these non-GAAP measurements in addition

to, and not in substitution for or as superior to, measurements of

financial performance prepared in accordance with generally

accepted accounting principles.

Highlighted items: The company has excluded the effects of

highlighted items including, but not limited

to, acquisition-related transaction costs, tangible and

intangible asset impairments, restructuring charges, non-cash

pension adjustments, significant litigation and other

contingencies, significant gains and losses on investments, and the

income tax effects of significant tax matters, from its

non-GAAP operating expenses and net income measurements because the

company believes that these historical items do not reflect

expected future operating earnings or expenses and do not

contribute to a meaningful evaluation of the company's current

operating performance or comparisons to the company's past

operating performance. For the purposes of management's internal

analysis over operating performance, the company uses financial

statements that exclude highlighted items, as these charges do not

contribute to a meaningful evaluation of the company's current

operating performance or comparisons to the company's past

operating performance.

Share-based compensation expense: The company has excluded

share-based compensation expense from its non-GAAP operating

expenses and net income measurements. Although share-based

compensation is a key incentive offered to the company’s employees

and the company believes such compensation contributed to the

revenue earned during the periods presented and also believes it

will contribute to the generation of future period revenues, the

company continues to evaluate its performance excluding share-based

compensation expense primarily because it represents a significant

non-cash expense. Share-based compensation expense will recur in

future periods.

Intangible assets amortization expense: The company has excluded

intangible assets amortization expense from its non-GAAP operating

expenses and net earnings measurements, primarily because it

represents a non-cash expense and because the company evaluates its

performance excluding intangible assets amortization expense.

Amortization of intangible assets is consistent in amount and

frequency but is significantly affected by the timing and size of

the company’s acquisitions. Investors should note that the use of

intangible assets contributed to the company’s revenues earned

during the periods presented and will contribute to the company’s

future period revenues as well. Intangible assets amortization

expense will recur in future periods.

Details of the above items and reconciliations of the non-GAAP

measurements to the corresponding GAAP measurements can be found at

the end of this press release.

BUSINESS RISKS

This news release contains "forward-looking statements" within

the meaning of applicable federal securities law. These statements

are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995 and generally include

words such as “believes,” “expects,” “intends,” “anticipates,”

“estimates” and similar expressions. The company can give no

assurance that any actual or future results or events discussed in

these statements will be achieved. Any forward-looking statements

represent the company’s views only as of today and should not be

relied upon as representing the company’s views as of any

subsequent date. Readers are cautioned that such forward-looking

statements are subject to a variety of risks and uncertainties that

could cause the company’s actual results to differ materially from

the statements contained in this release. Such forward-looking

statements include, but are not limited to, Motorola Solutions’

financial outlook for the fourth quarter and full year of 2018.

Motorola Solutions cautions the reader that the risk factors below,

as well as those on pages 8 through 20 in Item 1A of Motorola

Solutions’ 2017 Annual Report on Form 10-K and in its other SEC

filings available for free on the SEC’s website at www.sec.gov and

on Motorola Solutions’ website at www.motorolasolutions.com, could

cause Motorola Solutions’ actual results to differ materially from

those estimated or predicted in the forward-looking statements.

Many of these risks and uncertainties cannot be controlled by

Motorola Solutions, and factors that may impact forward-looking

statements include, but are not limited to: (1) the economic

outlook for the government communications industry; (2) the impact

of foreign currency fluctuations on the company; (3) the level of

demand for the company's products; (4) the company's ability to

refresh existing and introduce new products and technologies in a

timely manner; (5) exposure under large systems and managed

services contracts, including risks related to the fact that

certain customers require that the company build, own and operate

their systems, often over a multi-year period; (6) negative impact

on the company's business from global economic and political

conditions, which may include: (i) continued deferment or

cancellation of purchase orders by customers; (ii) the inability of

customers to obtain financing for purchases of the company's

products; (iii) increased demand to provide vendor financing to

customers; (iv) increased financial pressures on third-party

dealers, distributors and retailers; (v) the viability of the

company's suppliers that may no longer have access to necessary

financing; (vi) counterparty failures negatively impacting the

company’s financial position; (vii) changes in the value of

investments held by the company's pension plan and other defined

benefit plans, which could impact future required or voluntary

pension contributions; and (viii) the company’s ability to access

the capital markets on acceptable terms and conditions; (7) the

impact of a security breach or other significant disruption in the

company’s IT systems, those of its partners or suppliers or those

it sells to or operates or maintains for its customers; (8) the

outcome of ongoing and future tax matters; (9) the company's

ability to purchase sufficient materials, parts and components to

meet customer demand, particularly in light of global economic

conditions and reductions in the company’s purchasing power; (10)

risks related to dependence on certain key suppliers,

subcontractors, third-party distributors and other representatives;

(11) the impact on the company's performance and financial results

from strategic acquisitions or divestitures; (12) risks related to

the company's manufacturing and business operations in foreign

countries; (13) the creditworthiness of the company's customers and

distributors, particularly purchasers of large infrastructure

systems; (14) the ownership of certain logos, trademarks, trade

names and service marks including “MOTOROLA” by Motorola Mobility

Holdings, Inc.; (15) variability in income received from licensing

the company's intellectual property to others, as well as expenses

incurred when the company licenses intellectual property from

others; (16) unexpected liabilities or expenses, including

unfavorable outcomes to any pending or future litigation or

regulatory or similar proceedings; (17) the impact of the

percentage of cash and cash equivalents held outside of the United

States; (18) the ability of the company to pay future dividends due

to possible adverse market conditions or adverse impacts on the

company’s cash flow; (19) the ability of the company to complete

acquisitions or repurchase shares under its repurchase program due

to possible adverse market conditions or adverse impacts on the

company’s cash flow; (20) the impact of changes in governmental

policies, laws or regulations; (21) negative consequences from the

company's use of third party vendors for various activities,

including certain manufacturing operations, information technology

and administrative functions; and (22) the company’s ability to

settle the par value of its Senior Convertible Notes in cash.

Motorola Solutions undertakes no obligation to publicly update any

forward-looking statement or risk factor, whether as a result of

new information, future events or otherwise

DEFINITIONS

1 Free cash flow represents operating cash flow less capital

expenditures.

ABOUT MOTOROLA SOLUTIONS

Motorola Solutions (NYSE: MSI) is a technology company that

provides mission-critical communications, software and video

solutions that help build safer cities and thriving communities.

Public safety and commercial customers globally depend on the

company’s two-way radios, broadband technology, video surveillance

and analytics solutions, services and software to keep them

connected, from extreme to everyday moments. Learn more at

http://www.motorolasolutions.com

MOTOROLA, MOTOROLA SOLUTIONS and the Stylized M Logo are

trademarks or registered trademarks of Motorola Trademark Holdings,

LLC and are used under license. All other trademarks are the

property of their respective owners. ©2018 Motorola Solutions, Inc.

All rights reserved.

GAAP-1 Motorola Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations (In

millions, except per share amounts)

Three Months Ended September 29, 2018

September 30, 2017 Net sales from products $ 1,151 $ 989 Net

sales from services 711 656 Net sales

1,862 1,645 Costs of products sales 516 428 Costs of

services sales 445 423 Costs of sales

961 851 Gross margin 901

794 Selling, general and administrative

expenses 323 259 Research and development expenditures 158 141

Other charges 80 8 Intangibles amortization 46

39 Operating earnings 294 347

Other income (expense): Interest expense, net (59 ) (52 )

Gains on sales of investments and businesses, net 6 — Other

29 (9 ) Total other expense (24 ) (61 )

Net earnings before income taxes 270 286 Income tax expense

22 73 Net earnings 248 213 Less:

Earnings attributable to noncontrolling interests 1

1 Net earnings attributable to Motorola Solutions,

Inc. $ 247 $ 212

Earnings per common

share:

Basic $ 1.52 $ 1.30 Diluted $ 1.43 $ 1.25

Weighted average

common shares outstanding:

Basic 162.6 162.3 Diluted 172.6 169.0

Percentage of Net Sales* Net sales from

products 61.8 % 60.1 % Net sales from services 38.2 %

39.9 % Net sales 100.0 % 100.0 % Costs of products sales

44.8 % 43.3 % Costs of services sales 62.6 % 64.5 %

Costs of sales 51.6 % 51.7 % Gross margin 48.4

% 48.3 % Selling, general and administrative expenses

17.3 % 15.7 % Research and development expenditures 8.5 % 8.6 %

Other charges 4.3 % 0.5 % Intangibles amortization 2.5 %

2.4 % Operating earnings 15.8 % 21.1 %

Other income (expense): Interest expense, net (3.2 )% (3.2 )% Gains

on sales of investments and businesses, net 0.3 % — % Other

1.6 % (0.5 )% Total other expense (1.3 )% (3.7

)% Net earnings before income taxes 14.5 % 17.4 % Income tax

expense 1.2 % 4.4 % Net earnings 13.3 % 12.9 %

Less: Earnings attributable to noncontrolling interests 0.1

% 0.1 % Net earnings attributable to Motorola Solutions,

Inc. 13.3 % 12.9 % * Percentages may not add

up due to rounding

GAAP-2

Motorola Solutions, Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations

(In millions, except per share

amounts)

Nine Months Ended September

29, 2018 September 30, 2017 Net sales from

products $ 2,993 $ 2,540 Net sales from services 2,096

1,883 Net sales 5,089 4,423 Costs of

products sales 1,383 1,167 Costs of services sales 1,314

1,202 Costs of sales 2,697

2,369 Gross margin 2,392 2,054

Selling, general and administrative expenses 918 760

Research and development expenditures 472 413 Other charges 123 (11

) Intangibles amortization 140 111

Operating earnings 739 781 Other

income (expense): Interest expense, net (163 ) (154 ) Gains on

sales of investments and businesses, net 16 3 Other 45

(20 ) Total other expense (102 ) (171 )

Net earnings before income taxes 637 610 Income tax expense

91 188 Net earnings 546 422 Less:

Earnings attributable to noncontrolling interests 2

2 Net earnings attributable to Motorola Solutions,

Inc. $ 544 $ 420

Earnings per common

share:

Basic $ 3.36 $ 2.57 Diluted $ 3.17 $ 2.48

Weighted average

common shares outstanding:

Basic 162.0 163.2 Diluted 171.6 169.3

Percentage of Net Sales* Net sales from

products 58.8 % 57.4 % Net sales from services 41.2 %

42.6 % Net sales 100.0 % 100.0 % Costs of products sales

46.2 % 45.9 % Costs of services sales 62.7 % 63.8 %

Costs of sales 53.0 % 53.6 % Gross margin 47.0

% 46.4 % Selling, general and administrative expenses

18.0 % 17.2 % Research and development expenditures 9.3 % 9.3 %

Other charges 2.4 % (0.2 )% Intangibles amortization 2.8 %

2.5 % Operating earnings 14.5 % 17.7 %

Other income (expense): Interest expense, net (3.2 )% (3.5 )% Gains

on sales of investments and businesses, net 0.3 % 0.1 % Other

0.9 % (0.5 )% Total other expense (2.0 )%

(3.9 )% Net earnings before income taxes 12.5 % 13.8 %

Income tax expense 1.8 % 4.3 % Net earnings

attributable to Motorola Solutions, Inc. 10.7 % 9.5 %

* Percentages may not add up due to rounding

GAAP-3

Motorola Solutions, Inc. and Subsidiaries Condensed

Consolidated Balance Sheets (In millions)

September 29, 2018 December 31, 2017

Assets Cash and cash equivalents $ 839 $ 1,205 Restricted cash

12 63 Total cash and cash equivalents

851 1,268 Accounts receivable, net 1,179 1,523 Contract assets 917

— Inventories, net 367 327 Other current assets 350

832 Total current assets 3,664

3,950 Property, plant and equipment, net 892 856

Investments 176 247 Deferred income taxes 949 1,023 Goodwill 1,541

938 Intangible Assets 1,297 861 Other assets 444

333

Total assets $ 8,963 $ 8,208

Liabilities and Stockholders' Equity Current portion of

long-term debt $ 337 $ 52 Accounts payable 456 593 Contract

liabilities 1,127 — Accrued liabilities 1,168

2,286 Total current liabilities 3,088

2,931 Long-term debt 5,095 4,419 Other liabilities

2,175 2,585 Total Motorola Solutions, Inc. stockholders’

equity (deficit) (1,411 ) (1,742 ) Noncontrolling interests

16 15

Total liabilities and

stockholders’ equity $ 8,963 $ 8,208

GAAP-4 Motorola Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (In

millions) Three Months Ended

September 29, 2018 September 30, 2017

Operating Net earnings attributable to Motorola Solutions,

Inc. $ 247 $ 212 Earnings attributable to noncontrolling interests

1 1 Net earnings 248 213 Adjustments to

reconcile Net earnings to Net cash provided by operating

activities: Depreciation and amortization 89 88 Non-cash other

charges 44 8 Non-U.S. pension settlement loss — 21 Share-based

compensation expense 19 16 Gains on sales of investments and

businesses, net (6 ) — Changes in assets and liabilities, net of

effects of acquisitions, dispositions, and foreign currency

translation adjustments: Accounts receivable, contract assets and

contract liabilities (20 ) (152 ) Inventories 24 29 Other current

assets (180 ) (129 ) Accounts payable and accrued liabilities 170

152 Other assets and liabilities (38 ) (12 ) Deferred income taxes

(12 ) 36 Net cash provided by operating

activities 338 270

Investing

Acquisitions and investments, net (5 ) (243 ) Proceeds from sales

of investments and businesses, net 11 102 Capital expenditures

(46 ) (85 ) Net cash used for investing activities

(40 ) (226 )

Financing Repayment of debt (215

) (9 ) Issuance of common stock 80 33 Purchases of common stock —

(100 ) Payments of dividends (84 ) (76 ) Settlement of conversion

premium on convertible debt (169 ) — Net cash

used for financing activities (388 ) (152 )

Effect of exchange rate changes on cash and cash equivalents

— 20 Net decrease in cash and cash

equivalents (90 ) (88 ) Cash and cash equivalents, beginning of

period 941 805 Cash and cash

equivalents, end of period $ 851 $ 717

Financial Ratios: Free cash flow* $ 292 $ 185 *Free

cash flow = Net cash provided by operating activities - Capital

Expenditures

GAAP-5 Motorola Solutions, Inc. and

Subsidiaries Condensed Consolidated Statements of Cash

Flows (In millions) Nine

Months Ended September 29, 2018 September 30,

2017 Operating Net earnings attributable to Motorola

Solutions, Inc. $ 544 $ 420 Earnings attributable to noncontrolling

interests 2 2 Net earnings 546 422

Adjustments to reconcile Net earnings to Net cash provided by

operating activities: Depreciation and amortization 267 254

Non-cash other charges 50 29 Non-U.S. pension settlement loss — 46

Share-based compensation expense 53 49 Gains on sales of

investments and businesses, net (16 ) (3 ) Changes in assets and

liabilities, net of effects of acquisitions, dispositions, and

foreign currency translation adjustments: Accounts receivable,

contract assets and contract liabilities 186 81 Inventories 61 (83

) Other current assets (137 ) (142 ) Accounts payable and accrued

liabilities (170 ) (178 ) Other assets and liabilities (596 ) 11

Deferred income taxes 19 99 Net cash

provided by operating activities 263 585

Investing Acquisitions and investments, net (1,158 )

(383 ) Proceeds from sales of investments and businesses, net 90

174 Capital expenditures (128 ) (206 ) Net cash used

for investing activities (1,196 ) (415 )

Financing Repayment of debt (412 ) (15 ) Net proceeds from

issuance of debt 1,295 — Proceeds from financing through capital

leases — 7 Issuance of common stock 139 61 Purchases of common

stock (66 ) (358 ) Payments of dividends (252 ) (230 ) Payments of

dividend to non-controlling interest (1 ) (2 ) Settlement of

conversion premium on convertible debt (169 ) —

Net cash provided by (used for) financing activities

534 (537 ) Effect of exchange rate

changes on cash and cash equivalents (18 ) 54

Net decrease in cash and cash equivalents (417 ) (313 ) Cash and

cash equivalents, beginning of period 1,268

1,030 Cash and cash equivalents, end of period $ 851

$ 717

Financial Ratios: Free cash flow* $ 135

$ 379 *Free cash flow = Net cash provided by operating

activities - Capital Expenditures

GAAP-6 Motorola

Solutions, Inc. and Subsidiaries Segment Information

(In millions) Net Sales

Three Months Ended September

29, 2018 September 30, 2017 % Change Products and

systems integration $ 1,288 $ 1,174 10 % Services and software

574 471 22 % Total Motorola Solutions $

1,862 $ 1,645 13 %

Nine

Months Ended September 29, 2018

September 30, 2017 % Change Products and systems

integration $ 3,429 $ 3,076 11 % Services and software 1,660

1,347 23 % Total Motorola Solutions $ 5,089

$ 4,423 15 %

Operating Earnings

Three Months Ended

September 29, 2018 September 30, 2017 % Change

Products and systems integration $ 183 $ 266 (31 )% Services and

software 111 81 37 % Total Motorola

Solutions $ 294 $ 347 (15 )%

Nine Months Ended September 29,

2018 September 30, 2017 % Change Products and

systems integration $ 449 $ 553 (19 )% Services and software

290 228 27 % Total Motorola Solutions $ 739

$ 781 (5 )%

Operating Earnings %

Three Months Ended

September 29, 2018 September 30, 2017 Products

and systems integration 14.2 % 22.7 % Services and software 19.3 %

17.2 % Total Motorola Solutions 15.8 % 21.1 %

Nine Months Ended September

29, 2018 September 30, 2017 Products and systems

integration 13.1 % 18.0 % Services and software 17.5 % 16.9 % Total

Motorola Solutions 14.5 % 17.7 %

Non-GAAP-1

Motorola Solutions, Inc. and Subsidiaries Non-GAAP

Adjustments (Intangibles Amortization Expense, Share-Based

Compensation Expense and Highlighted Items) Q1

2018 Non-GAAP

Adjustments Statement Line

PBT

(Inc)/Exp

Tax

Inc/(Exp)

PAT

(Inc)/Exp

EPS impact Share-based compensation expense Cost of

sales, SG&A and R&D $ 17 $ 4 $ 13 $ 0.08 Reorganization of

business charges Cost of sales and Other charges 13 3 10 0.06

Intangibles amortization expense Intangibles amortization 41 8 33

0.19 Loss on legal settlements Other charges 1 — 1 0.01 Loss on

derivative instruments related to Avigilon purchase Other expense

14 4 10 0.06 Release of FIN 48 reserve Income tax expense — 1 (1 )

(0.01 ) Sale of investments (Gain) or Loss on Sales of Investments

and Businesses, net (11 ) (3 ) (8 ) (0.05 ) Acquisition-related

transaction fees Other charges 17 5 12 0.07

Total impact on Net earnings $ 92 $ 22 $ 70 $ 0.41

Q2 2018 Non-GAAP Adjustments Statement

Line

PBT

(Inc)/Exp

Tax

Inc/(Exp)

PAT

(Inc)/Exp

EPS impact Share-based compensation expense Cost of

sales, SG&A and R&D $ 17 $ 4 $ 13 $ 0.08 Reorganization of

business charges Cost of sales and Other charges 25 6 19 0.10

Intangibles amortization expense Intangibles amortization 53 12 41

0.23 Avigilon purchase accounting adjustment Cost of sales 10 3 7

0.04 Sale of investments (Gain) or Loss on Sales of Investments and

Businesses, net 1 — 1 0.01 Loss on foreign currency related to

Avigilon purchase Other expense 1 — 1 0.01 FIN 48 reserve Income

tax expense — (1 ) 1 0.01 State audit settlement Income tax expense

— 12 (12 ) (0.07 ) Total impact on Net

earnings $ 107 $ 36 $ 71 $ 0.41

Q3 2018

Non-GAAP Adjustments Statement Line

PBT

(Inc)/Exp

Tax

Inc/(Exp)

PAT

(Inc)/Exp

EPS impact Share-based compensation expense Cost of

sales, SG&A and R&D $ 19 $ 5 $ 14 $ 0.08 Reorganization of

business charges Cost of sales and Other charges 25 6 19 0.11

Intangibles amortization expense Intangibles amortization 46 10 36

0.21 Avigilon purchase accounting adjustment Cost of sales 9 2 7

0.04 Gain from the extinguishment of convertible debt Other income

(6 ) — (6 ) (0.03 ) Fair value adjustments to equity investments

Other income (7 ) (2 ) (5 ) (0.03 ) Loss on legal settlement Other

charges 2 1 1 0.01 Environmental reserve expense Other charges 57

14 43 0.25 Sale of investments (Gain) or Loss on Sales of

Investments and Businesses, net (6 ) (1 ) (5 ) (0.03 )

Return-to-provision adjustments as related to federal tax reform

Income tax expense — 16 (16 ) (0.10 )

Total impact on Net earnings $ 139 $ 51 $ 88 $ 0.51

Non-GAAP-2 Motorola Solutions, Inc. and Subsidiaries

Non-GAAP Segment Information (In millions)

Net Sales Three Months

Ended September 29, 2018

September 30, 2017 % Change

Products and systems integration

$ 1,288 $ 1,174 10 % Services and software 574

471 22 % Total Motorola Solutions $ 1,862 $ 1,645

13 %

Nine Months Ended

September 29, 2018 September 30, 2017

% Change Products and systems integration $ 3,429 $ 3,076 11

% Services and software 1,660 1,347 23

% Total Motorola Solutions $ 5,089 $ 4,423 15 %

Non-GAAP Operating Earnings

Three Months Ended September

29, 2018 September 30, 2017 % Change Products and

systems integration $ 276 $ 285 (3 )% Services and software

176 127 39 % Total Motorola Solutions $ 452

$ 412 10 %

Nine Months

Ended September 29, 2018

September 30, 2017 % Change Products and systems

integration $ 627 $ 591 6 % Services and software 463

349 33 % Total Motorola Solutions $ 1,090 $

940 16 %

Non-GAAP Operating Earnings %

Three Months Ended

September 29, 2018 September 30, 2017 Products and

systems integration 21.4 % 24.3 % Services and software 30.7 % 27.0

% Total Motorola Solutions 24.3 % 25.0 %

Nine Months Ended September

29, 2018 September 30, 2017 Products and systems

integration 18.3 % 19.2 % Services and software 27.9 % 25.9 % Total

Motorola Solutions 21.4 % 21.3 %

Non-GAAP-3

Motorola Solutions, Inc. and Subsidiaries Operating

Earnings after Non-GAAP Adjustments Q1 2018

TOTAL

Products and

Systems Integration

Services and

Software

Net sales $ 1,468 $ 952 $ 516 Operating earnings ("OE") $

171 $ 90 $ 81 Above-OE non-GAAP

adjustments: Share-based compensation expense 17 12 5

Reorganization of business charges 13 9 4 Intangibles amortization

expense 41 1 40 Acquisition-related transaction fees 17 12 5 Loss

on legal settlements 1 1 —

Total above-OE non-GAAP adjustments 89 35 54

Operating earnings after non-GAAP adjustments

$ 260 $ 125 $ 135

Operating earnings as a percentage of net sales - GAAP 11.6 % 9.5 %

15.7 % Operating earnings as a percentage of net sales - after

non-GAAP adjustments 17.7 % 13.1 % 26.2 %

Q2 2018

TOTAL

Products and

Systems Integration

Services and

Software

Net sales $ 1,760 $ 1,189 $ 571 Operating earnings ("OE") $

273 $ 175 $ 98 Above-OE non-GAAP

adjustments: Share-based compensation expense 17 12 5

Reorganization of business charges 25 19 6 Intangibles amortization

expense 53 10 43 Avigilon purchase accounting adjustment 10

10 — Total above-OE non-GAAP

adjustments 105 51 54 Operating

earnings after non-GAAP adjustments $ 378 $ 226

$ 152 Operating earnings as a

percentage of net sales - GAAP 15.5 % 14.7 % 17.2 % Operating

earnings as a percentage of net sales - after non-GAAP adjustments

21.5 % 19.0 % 26.6 %

Q3 2018

TOTAL

Products and

Systems Integration

Services and

Software

Net sales $ 1,862 $ 1,288 $ 574 Operating earnings ("OE") $

294 $ 183 $ 111 Above-OE non-GAAP

adjustments: Share-based compensation expense 19 13 6

Reorganization of business charges 25 19 6 Intangibles amortization

expense 46 11 35 Avigilon purchase accounting adjustment 9 9 — Loss

on legal settlement 2 1 1 Environmental reserve expense 57

40 17 Total above-OE non-GAAP

adjustments 158 93 65 Operating

earnings after non-GAAP adjustments $ 452 $ 276

$ 176 Operating earnings as a

percentage of net sales - GAAP 15.8 % 14.2 % 19.3 % Operating

earnings as a percentage of net sales - after non-GAAP adjustments

24.3 % 21.4 % 30.7 %

Non-GAAP-4

Motorola Solutions, Inc. and Subsidiaries Non-GAAP

Organic Revenue Total Motorola Solutions

Three Months Ended

September 29, 2018 September 30,

2017 % Change Net sales $ 1,862 $ 1,645

13 % Non-GAAP adjustments: Acquisitions (149 ) (4 )

ASC 606 impact (19 ) — Organic revenue

1,694 1,641 3 % Less foreign exchange impact

9 — Organic revenue in constant

currency $ 1,703 $ 1,641 4 %

Nine Months Ended

September 29, 2018 September 30, 2017 % Change Net

sales $ 5,089 $ 4,423 15 % Non-GAAP

adjustments: Acquisitions (356 ) (9 ) ASC 606 impact (58 )

— Organic revenue 4,675 4,414

6 % Less foreign exchange impact (56 )

— Organic revenue in constant currency $ 4,619

$ 4,414 5 %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181101006058/en/

MEDIA CONTACTTama McWhinneyMotorola Solutions+1

847-538-1865tama.mcwhinney@motorolasolutions.comorINVESTOR

CONTACTChris KutsorMotorola Solutions+1

847-576-4995chris.kutsor@motorolasolutions.com

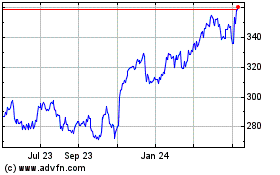

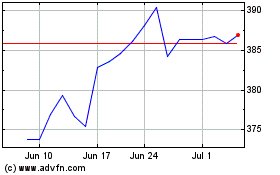

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Jul 2023 to Jul 2024