Current Report Filing (8-k)

February 25 2022 - 8:07AM

Edgar (US Regulatory)

00009276538-K02/25/2022false00009276532022-02-252022-02-250000927653us-gaap:CommonStockMember2022-02-252022-02-250000927653mck:A1.500NotesDue2025Member2022-02-252022-02-250000927653mck:A1.625NotesDue2026Member2022-02-252022-02-250000927653mck:A3.125NotesDue2029Member2022-02-252022-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 25, 2022

McKESSON CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 1-13252 | | 94-3207296 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

6555 State Hwy 161

Irving, TX 75039

(Address of Principal Executive Offices, and Zip Code)

(972) 446-4800

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common stock, $0.01 par value | | MCK | | New York Stock Exchange |

| | | | |

| 1.500% Notes due 2025 | | MCK25 | | New York Stock Exchange |

| 1.625% Notes due 2026 | | MCK26 | | New York Stock Exchange |

| 3.125% Notes due 2029 | | MCK29 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 1.01 | Entry into a Material Definitive Agreement. |

On February 25, 2022, McKesson Corporation ("Company") and two other United States pharmaceutical distribution companies (collectively, "Distributors") determined that there is sufficient State and subdivision participation to proceed with an agreement ("Settlement") to settle a substantial majority of opioids-related lawsuits filed against the Distributors by U.S. states, territories and local governmental entities (collectively, "Settling Governmental Entities").

The Settlement will become effective on April 2, 2022. If all conditions to the Settlement are satisfied, including the receipt of approval by relevant courts of consent decrees to dismiss the lawsuits, the Distributors would pay the Settling Governmental Entities up to approximately $19.5 billion over 18 years, with up to approximately $7.4 billion to be paid by the Company for its 38.1% portion. Under the Settlement, a minimum of 85% of the settlement payments must be used by state and local governmental entities to remediate the opioid epidemic. Most of the remaining percentage relates to plaintiffs’ attorneys’ fees and costs, and would be payable over a shorter time period. Under the Settlement, the Distributors will establish a clearinghouse to consolidate their controlled-substance distribution data, which will be available to the settling U.S. states to use as part of their anti-diversion efforts. The Settlement provides that the Distributors do not admit liability or wrongdoing and do not waive any defenses.

The terms under which the Distributors previously agreed to settle opioids claims of the states of New York, Ohio, Rhode Island, Florida and Texas, and each of their participating subdivisions, will become part of the Settlement. The previously disclosed agreement for the Distributors to settle opioids claims of the attorney general of West Virginia will remain a separate settlement arrangement that is not part of the Settlement. Accordingly, as previously disclosed, 46 of 49 eligible states, as well as the District of Columbia and all eligible territories, have agreed to join the Settlement. A list of the Distributors, states and territories that have agreed to the Settlement is attached as Exhibit 99.1.

A news release issued by the Distributors on February 25, 2021 to announce the Settlement is attached as Exhibit 99.2.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 99.1 | | | |

| 99.2 | | | |

| 104 | | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 25, 2022

| | | | | | | | |

| | |

| McKesson Corporation |

| |

| By: | /s/ Lori A. Schechter |

| | Lori A. Schechter |

| | Executive Vice President, Chief Legal Officer |

| | and General Counsel |

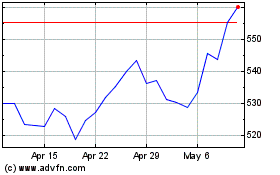

McKesson (NYSE:MCK)

Historical Stock Chart

From Oct 2024 to Nov 2024

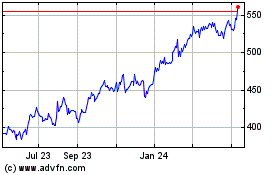

McKesson (NYSE:MCK)

Historical Stock Chart

From Nov 2023 to Nov 2024