0001129155

false

0001129155

2023-10-25

2023-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT

OF 1934

Date of Report (Date

of earliest event reported): October 25, 2023

MARINE PRODUCTS CORPORATION

(Exact name of registrant as specified in

its charter)

_________________________

| Delaware |

1-16263 |

58-2572419 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification

No.) |

2801 Buford Highway NE, Suite 300, Atlanta, Georgia 30329

(Address of principal executive office) (zip code)

Registrant's telephone

number, including area code: (404) 321-7910

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.10 par value |

|

MPX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On October 25, 2023, Marine Products Corporation issued a press release

titled “Marine

Products Corporation Reports Third Quarter 2023 Financial Results,” announcing the financial results for the third quarter ended

September 30, 2023.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Marine Products Corporation has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

| |

Marine Products Corporation |

| |

|

| Date: October 25, 2023 |

/s/ Michael L. Schmit |

| |

Michael L. Schmit |

| |

Vice President and Chief Financial Officer |

Exhibit 99.1

Marine Products

Corporation Reports

Third Quarter

2023 Financial Results

ATLANTA, October 25, 2023 – Marine

Products Corporation (NYSE: MPX) announced its unaudited results for the quarter ended September 30, 2023. Marine Products is a leading

manufacturer of fiberglass boats under the brand names of Chaparral and Robalo. Chaparral’s sterndrive models include SSi Sportboats

and SSX Luxury Sportboats, along with the SURF Series. Chaparral’s outboard offerings include OSX Luxury Sportboats and SSi Outboard

Bowriders. Robalo builds an array of outboard sport fishing boats, which include Center Consoles, Dual Consoles and Cayman Bay Boats.

For the quarter ended September 30,

2023, Marine Products generated net sales of $77.8 million, a 22 percent decrease compared to $100.1 million in

the third quarter of the prior year. The decrease in net sales was primarily due to a 24 percent decrease in the number of boats

sold during the quarter, partially offset by a five percent increase in average selling price. Average selling price per boat

increased primarily due to a favorable model mix and, to a lesser extent, price increases to cover higher costs of materials and

components. Unit sales decreased during the quarter compared to the prior year as production has been adjusted to align more with

current demand, including seasonally lower dealer demand during the third quarter of each calendar year. In addition, unit sales

were impacted during the quarter by severe weather-related production shutdowns.

Gross profit for the

third quarter of 2023 was $19.2 million compared to $25.0 million in the third quarter of the prior year. Gross margin as a percentage

of net sales was 24.7 percent in the third quarter of 2023 compared to 25.0 percent in the prior year period. Operating income for the

third quarter of 2023 was $12.4 million, a decrease of 15 percent compared to operating profit of $14.7 million in the third quarter

of the prior year. Selling, general and administrative expenses were $8.8 million in the third quarter of 2023 compared to $10.3 million

in the third quarter of 2022. The decrease in selling, general and administrative expenses was due to costs that vary with sales and

profitability, such as incentive compensation, sales commissions and warranty expense. These expenses were 11.3 percent of net sales

in the third quarter of 2023 compared to 10.3 percent in the third quarter of 2022.

Net gain on the disposition

of assets was $2.0 million during the quarter, which includes $1.8 million related to a real estate transaction. Net interest income

of $860 thousand increased significantly compared to the prior year due to a higher cash balance and higher interest yields.

Page 2

Third Quarter 2023 Earnings Press Release

Net income for

the third quarter of 2023 was $10.4 million, a decrease of 9 percent compared to net income of $11.5 million in the third quarter of

2022. Net income as a percentage of net sales was 13.4 percent in the third quarter of 2023 as compared to 11.5 percent in the prior

year period. Earnings before interest, taxes, depreciation and amortization (EBITDA)1 for

the third quarter of 2023 was $13.0 million, a decrease of 14 percent, compared to $15.2 million in the third quarter of 2022.

EBITDA as a percentage of net sales was 16.7 percent in the third quarter of 2023 as compared to 15.1 percent in the prior year period.

Diluted earnings per share in the third

quarter of 2023 were $0.30, a decrease of 12 percent compared to $0.34 in the third quarter of the prior year. The effective tax rate

was 21.6 percent in the third quarter of 2023 compared to 22.3 percent in the third quarter of 2022.

Net sales for the nine months ended

September 30, 2023 were $312.9 million, an increase of 15 percent compared to the first nine months of 2022. Net income for the nine-month

period was $36.3 million or $1.05 diluted earnings per share, compared to net income of $28.5 million or $0.83 diluted earnings per share

in the comparable prior year period.

“Our third quarter results reflect

the reduction in production and delivery rates due to normalization of retail boat demand that has occurred during 2023, following significant

post-COVID demand. In addition, our production in the third quarter was adversely impacted by Hurricane Idalia,” stated Ben M.

Palmer, Marine Products’ President and Chief Executive Officer. “We were pleased with the orders placed during our annual

dealer conference in August. Dealer inventories are reasonable by historical standards and remain below pre-pandemic levels, and we have

firm production scheduled into 2024. We, along with our dealers, will reassess retail demand during the winter boat shows. While we are

still experiencing some delays in timely receipts of certain components used in our manufacturing operations, these issues are less of

a problem than earlier this year,” concluded Palmer.

Marine Products Corporation will hold

a conference call today, October 25, 2023, at 8:00 a.m. Eastern Time to discuss the results for the quarter. Interested parties may listen

in by accessing a live webcast in the investor relations section of Marine Products’ website at marineproductscorp.com. Additionally,

the live conference call can be accessed by calling (888) 660-6357, or (929) 201-6127 for international callers, and using conference

ID number 9979064. A replay will be available in the investor relations section of Marine Products’ website beginning approximately

two hours after the call.

1

EBITDA and EBITDA as a percentage of net sales are financial measures which do not conform to GAAP. Additional disclosure regarding

these non-GAAP financial measures and their reconciliations to the nearest GAAP financial measures, is disclosed in Appendix A to this

press release.

Page 3

Third Quarter 2023 Earnings Press Release

Marine

Products Corporation is a leading manufacturer of high-quality fiberglass boats under the brand names Chaparral and Robalo. Chaparral’s

sterndrive models include SSi Sportboats and SSX Luxury Sportboats, and the SURF Series. Chaparral’s outboard offerings

include OSX Luxury Sportboats and the SSi Outboard Bowriders. Robalo builds an array of outboard sport fishing models, which include

Center Consoles, Dual Consoles and Cayman Bay Boats. The Company continues to diversify its product lines through product innovation.

With these premium brands, a solid capital structure, and a strong independent dealer network, Marine Products Corporation is prepared

to capitalize on opportunities to increase its market share and generate superior financial performance to build long-term shareholder

value. For more information on Marine Products Corporation visit our website at MarineProductsCorp.com.

Certain statements and information included

in this press release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. Such forward-looking statements include statements that look forward in time or express management’s beliefs, expectations

or hopes. In particular, such statements include, without limitation, the statement regarding our belief that dealer inventories are

reasonable by historical standards and our belief that we are prepared to capitalize on opportunities to increase our market share and

generate superior financial performance to build long-term shareholder value. Risk factors that could cause such future events not to

occur as expected include the following: our manufacturing operations and our supply chain; economic conditions, unavailability of credit

and possible decreases in the level of consumer confidence impacting discretionary spending; business interruptions due to adverse weather

conditions, increased interest rates. Additional discussion of factors that could cause the actual results to differ materially from

management’s projections, forecasts, estimates and expectations is contained in Marine Products’ Annual Report on Form 10-K,

filed with the U.S. Securities and Exchange Commission (the “SEC”) for the year ended December 31, 2022.

For information

about Marine Products Corporation or this event, please contact:

Michael L. Schmit

Chief Financial

Officer

(404) 321-7910

irdept@marineproductscorp.com

Jim Landers

Vice President

Corporate Services

(404) 321-2162

jlanders@marineproductscorp.com

Page 4

Third Quarter 2023 Earnings Press Release

MARINE

PRODUCTS CORPORATION AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS (In thousands except per share data)

| Periods ended September 30, (Unaudited) | |

Third Quarter | | |

Nine Months | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net sales | |

$ | 77,786 | | |

$ | 100,061 | | |

$ | 312,858 | | |

$ | 272,486 | |

| Cost of goods sold | |

| 58,548 | | |

| 75,056 | | |

| 235,942 | | |

| 206,089 | |

| Gross profit | |

| 19,238 | | |

| 25,005 | | |

| 76,916 | | |

| 66,397 | |

| Selling, general and administrative expenses | |

| 8,789 | | |

| 10,326 | | |

| 35,495 | | |

| 29,449 | |

| Gain on disposition of assets, net | |

| (1,962 | ) | |

| - | | |

| (1,962 | ) | |

| - | |

| Operating income | |

| 12,411 | | |

| 14,679 | | |

| 43,383 | | |

| 36,948 | |

| Interest income, net | |

| 860 | | |

| 76 | | |

| 2,066 | | |

| 52 | |

| Income before income taxes | |

| 13,271 | | |

| 14,755 | | |

| 45,449 | | |

| 37,000 | |

| Income tax provision | |

| 2,868 | | |

| 3,283 | | |

| 9,176 | | |

| 8,510 | |

| Net income | |

$ | 10,403 | | |

$ | 11,472 | | |

$ | 36,273 | | |

$ | 28,490 | |

| | |

| | | |

| | | |

| | | |

| | |

| EARNINGS PER SHARE | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.30 | | |

$ | 0.34 | | |

$ | 1.05 | | |

$ | 0.83 | |

| Diluted | |

$ | 0.30 | | |

$ | 0.34 | | |

$ | 1.05 | | |

$ | 0.83 | |

| | |

| | | |

| | | |

| | | |

| | |

| AVERAGE SHARES OUTSTANDING | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 34,467 | | |

| 34,225 | | |

| 34,435 | | |

| 34,172 | |

| Diluted | |

| 34,467 | | |

| 34,225 | | |

| 34,435 | | |

| 34,172 | |

Page 5

Third Quarter 2023 Earnings Press Release

MARINE

PRODUCTS CORPORATION AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

| | |

(in thousands) | |

| | |

SEPTEMBER 30,

2023 | | |

DECEMBER 31,

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 60,705 | | |

$ | 43,171 | |

| Accounts receivable, net | |

| 10,743 | | |

| 5,340 | |

| Inventories | |

| 69,784 | | |

| 73,015 | |

| Income taxes receivable | |

| 199 | | |

| 28 | |

| Prepaid expenses and other current assets | |

| 3,784 | | |

| 3,444 | |

| Total current assets | |

| 145,215 | | |

| 124,998 | |

| Property, plant and equipment, net | |

| 21,356 | | |

| 14,965 | |

| Goodwill | |

| 3,308 | | |

| 3,308 | |

| Other intangibles, net | |

| 465 | | |

| 465 | |

| Deferred income taxes | |

| 7,833 | | |

| 6,027 | |

| Other assets | |

| 18,556 | | |

| 13,952 | |

| Total assets | |

$ | 196,733 | | |

$ | 163,715 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Accounts payable | |

$ | 12,066 | | |

$ | 8,250 | |

| Accrued expenses and other liabilities | |

| 16,218 | | |

| 15,340 | |

| Total current liabilities | |

| 28,284 | | |

| 23,590 | |

| Retirement plan liabilities | |

| 16,714 | | |

| 14,440 | |

| Other long-term liabilities | |

| 1,622 | | |

| 1,304 | |

| Total liabilities | |

| 46,620 | | |

| 39,334 | |

| Common stock | |

| 3,447 | | |

| 3,422 | |

| Capital in excess of par value | |

| - | | |

| - | |

| Retained earnings | |

| 146,678 | | |

| 122,954 | |

| Accumulated other comprehensive loss | |

| (12 | ) | |

| (1,995 | ) |

| Total stockholders' equity | |

| 150,113 | | |

| 124,381 | |

| Total liabilities and stockholders' equity | |

$ | 196,733 | | |

$ | 163,715 | |

Page 6

Third Quarter 2023 Earnings Press Release

Appendix A

Marine Products Corporation has used

the non-GAAP financial measures of earnings before interest, taxes, depreciation and amortization (EBITDA) in today's earnings release,

and anticipates using them in today's earnings conference call. They should not be considered in isolation or as a substitute for operating

income, net income or other performance measures prepared in accordance with GAAP.

Marine Products Corporation uses EBITDA

as a measure of operating performance because they allow us to compare performance consistently over various periods without regard to

changes in our capital structure.

A non-GAAP financial measure is a numerical

measure of financial performance, financial position, or cash flows that either 1) excludes amounts, or is subject to adjustments that

have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance

with GAAP in the statement of operations, balance sheet or statement of cash flows, or 2) includes amounts, or is subject to adjustments

that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. Set

forth below is a reconciliation of EBITDA with Net Income, the most comparable GAAP measure. These reconciliations also appears on Marine

Products Corporation’s investor website, which can be found on the Internet at marineproductscorp.com.

(Unaudited)

| Periods ended September 30, | |

Three Months Ended | | |

Nine Months Ended | |

| (In thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of Net Income to EBITDA | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

$ | 10,403 | | |

$ | 11,472 | | |

$ | 36,273 | | |

$ | 28,490 | |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Income tax provision | |

| 2,868 | | |

| 3,283 | | |

| 9,176 | | |

| 8,510 | |

| Depreciation and amortization | |

| 610 | | |

| 480 | | |

| 1,750 | | |

| 1,416 | |

| Less: | |

| | | |

| | | |

| | | |

| | |

| Interest income, net | |

| 860 | | |

| 76 | | |

| 2,066 | | |

| 52 | |

| EBITDA | |

$ | 13,021 | | |

$ | 15,159 | | |

$ | 45,133 | | |

$ | 38,364 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

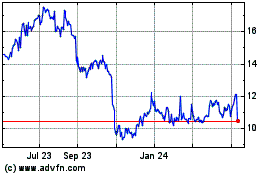

Marine Products (NYSE:MPX)

Historical Stock Chart

From Dec 2024 to Jan 2025

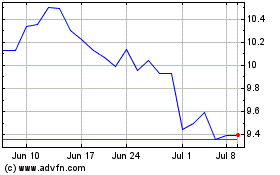

Marine Products (NYSE:MPX)

Historical Stock Chart

From Jan 2024 to Jan 2025