|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

|

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

LOEWS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| ☒ |

No fee required. |

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

(5) |

Total fee paid: |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

|

667 Madison Avenue

New York, NY 10065-8087

|

Notice of

2022

Annual Meeting

of Shareholders

AGENDA:

|

1 |

To elect twelve directors named in this proxy statement; |

|

2 |

To approve, on an advisory basis, the company’s executive compensation; |

|

3 |

To ratify the appointment of our independent auditors for 2022; and |

|

4 |

To transact any other business as may properly come before the meeting or any adjournment or postponement. |

Shareholders of record at the close of business on March 15, 2022 are entitled to notice of and to vote at the meeting and any adjournment or postponement.

|

DATE:

Tuesday, May 10, 2022

TIME:

11:00 a.m. New York City Time

PLACE:

Via the Internet

www.virtualshareholdermeeting.com/L2022

RECORD DATE:

March 15, 2022

|

YOUR VOTE IS IMPORTANT. PLEASE VOTE AS PROMPTLY AS POSSIBLE BY USING THE INTERNET OR

TELEPHONE, OR IF YOU RECEIVED A PAPER COPY OF THE PROXY MATERIALS, BY SIGNING, DATING AND RETURNING THE ACCOMPANYING PROXY CARD.

By order of the Board of Directors,

Marc A. Alpert

Senior Vice President, General Counsel and Secretary

March 30, 2022

Table of Contents

Contents

We are providing this Proxy Statement in connection with the solicitation by our Board of Directors (our “Board”) of proxies to be voted at our 2022 Annual Meeting of Shareholders (our

“Annual Meeting”), which will be held virtually at www.virtualshareholdermeeting.com/L2022, on Tuesday, May 10, 2022, at 11:00 a.m., New York City Time.

Our mailing address is 667 Madison Avenue, New York, New York 10065-8087. Please note that throughout this Proxy Statement we refer to Loews Corporation as “we,” “us,” “our,” “Loews” or

the “company.”

Information and reports on websites that we refer to in this Proxy Statement will not be deemed a part of, or otherwise incorporated by reference in, this Proxy Statement.

| 2 |

Loews Corporation 2022 Proxy |

Proxy Summary

Proxy Summary

Important Notice Regarding the Availability of Proxy Materials for our Annual Meeting.

This Proxy Statement, our 2021 Annual Report, including our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 8, 2022, and the proxy card are available at www.loews.com/reports.

AGENDA AND VOTING MATTERS

| Proposal |

Board

Recommendation

|

Page

Reference |

| Proposal 1: Elect the twelve directors listed below |

FOR |

5 |

| Proposal 2: Approve, on an advisory basis, the company’s executive compensation |

FOR |

21 |

| Proposal 3: Ratify the appointment of the company’s independent auditors for

2022 |

FOR |

49 |

| Transact such other business as may properly come before the meeting or any adjournment or postponement thereof |

|

|

DIRECTOR NOMINEES

| |

|

|

Board Committee Membership |

| Name & Title |

Age |

Director

Since

|

Audit |

Compensation |

Nominating &

Governance

|

Executive |

|

Ann E. Berman

Retired Senior Advisor to the President, Harvard University

|

69 |

2006 |

■ |

|

|

|

|

Joseph L. Bower

Donald K. David Professor Emeritus, Harvard Business School

|

83 |

2001 |

■ |

■

CHAIR |

■ |

|

|

Charles D. Davidson

Venture Partner, Quantum Energy Partners

|

72 |

2015 |

|

■ |

|

|

|

Charles M. Diker

Chairman, Diker Management, LLC

|

87 |

2003 |

■ |

■ |

|

|

|

Paul J. Fribourg

Chairman, President and CEO, Continental Grain Company Lead Independent Director

|

68 |

1997 |

■ |

■ |

■

CHAIR |

|

|

Walter L. Harris

Former President and CEO, FOJP Service Corp. and Hospital Insurance Co.

|

70 |

2004 |

■

CHAIR |

|

■ |

|

|

Philip A. Laskawy

Retired Chairman and CEO, Ernst & Young LLP

|

80 |

2003 |

■ |

|

|

|

|

Susan P. Peters

Retired Chief Human Resources Officer, General Electric Company

|

68 |

2018 |

|

■ |

|

|

|

Andrew H. Tisch

Retired Member of the Office of the President, Co-Chairman of the Board, Loews Corporation

|

72 |

1985 |

|

|

|

■

CHAIR |

|

James S. Tisch

Office of the President, President and Chief Executive Officer, Loews Corporation

|

69 |

1986 |

|

|

|

■ |

|

Jonathan M. Tisch

Office of the President, Co-Chairman of the Board, Loews Corporation; Chairman and CEO, Loews Hotels & Co

|

68 |

1986 |

|

|

|

■ |

|

Anthony Welters

Founder, Chairman and CEO, CINQ Care Inc.

|

67 |

2013 |

|

|

■ |

|

Further information regarding our director nominees is included under the heading “Director

Nominees” beginning on page 7.

| Loews Corporation 2022 Proxy |

3 |

Proxy Summary

Corporate Governance highlights

Our corporate governance framework reinforces our goal of building long-term value for shareholders.

| Board

Independence |

▪ The

Board has determined that all of our directors and nominees (other than James, Andrew and Jonathan Tisch) are independent under our independence standards and the New York Stock Exchange listing standards.

▪ Members

of our Office of the President are our only management directors.

▪ Independent

directors regularly hold executive sessions at Board meetings, which are chaired by our lead director.

|

| Accountability to Shareholders |

▪ All of

our directors are elected annually.

▪ Our

directors are elected by a majority voting standard in uncontested elections.

▪ Shareholders

are invited to submit questions to our Chief Executive Officer and Chief Financial Officer on our quarterly earnings calls.

|

| Board Composition and Evaluation |

▪ Our

Board consists of directors with a diverse mix of skills, experience and backgrounds.

▪ Our

Board and Board committees undertake robust annual self-evaluations.

|

| Board Committees |

▪ We

have four Board committees — Audit, Compensation, Nominating and Governance, and Executive.

▪ Each

of our Audit, Compensation and Nominating and Governance Committees is composed entirely of independent directors.

|

| Leadership Structure |

▪ We

have a separate Chief Executive Officer and Co-Chairmen of the Board.

▪ Our

lead director is fully independent and empowered with broadly defined authorities and responsibilities. Our lead director is also Chairman of our Nominating and Governance Committee, which is responsible for developing our

corporate governance principles.

|

| Risk Oversight |

▪ Our Board is responsible for risk oversight. It regularly reviews enterprise risk management and related policies, processes and controls, and oversees management in its assessment and mitigation of risk. |

| Director and Officer Stock Ownership |

▪ Our

non-employee directors are required to own shares of our stock having a value of at least three times their annual cash retainer.

▪ Our

executive officers and directors as a group own a substantial percentage of our outstanding common stock.

▪ We

only have a single class of common stock, which directly aligns the interests of our executive officers and directors with those of our other shareholders.

▪ We

have an anti-hedging and pledging policy for directors and executive officers.

|

| Compensation Governance |

▪ Our

fully independent Compensation Committee oversees all aspects of our executive compensation program.

▪ We

have an annual shareholder advisory vote to approve named executive officer compensation.

▪ We

have a clawback policy that allows for the recoupment of incentive compensation.

▪ We do

not maintain employment agreements or agreements to pay severance upon a change in control with any of our executive officers.

▪ We

structure a large majority of our executive officers’ compensation to be performance based.

|

| Ethics and Corporate Responsibilities |

▪ Our

Code of Business Conduct and Ethics is disclosed on our website.

▪ We

have an active and robust ethics and compliance program, which includes regular employee training.

|

| 4 |

Loews Corporation 2022 Proxy |

Proposal No. 1: Election of Directors

Proposal No. 1:

Election of Directors

At the Annual Meeting, shareholders will vote to elect a Board of twelve directors to serve until the next annual meeting of shareholders and until their respective successors are duly

elected and qualified. It is the intention of the persons named in the accompanying form of proxy, unless you specify otherwise, to vote for the election of the nominees named below, each of whom is a current director. Our Board has no reason to

believe that any of the persons named will be unable or unwilling to serve as a director and each has agreed to be nominated in this Proxy Statement.

If any nominee is unable or unwilling to serve, we anticipate that either:

|

▪ |

proxies will be voted for the election of a substitute nominee or nominees recommended by our Nominating and Governance Committee and approved by our Board; or |

|

▪ |

our Board will adopt a resolution reducing the number of directors constituting our full Board. |

Director Nominating Process

In evaluating potential director nominees for recommendation to our Board, our Nominating and Governance Committee seeks individuals with exceptional talent and ability and experience

from a wide variety of backgrounds to provide a diverse spectrum of experience and expertise relevant to a diversified business enterprise such as ours.

|

In identifying, evaluating and nominating individuals to serve as directors, our Board and its Nominating

and Governance Committee do not rely on any preconceived diversity guidelines or rules. Rather, our Board and its Nominating and Governance Committee believe that Loews is best served by directors with a wide range of perspectives,

professional experiences, skills and other individual qualities and attributes.

|

Although we have no minimum qualifications, a candidate should represent the interests of all shareholders, and not those of a special interest group, have a reputation for integrity and be willing to make a

significant commitment to fulfilling the duties of a director.

Our Nominating and Governance Committee will screen and evaluate all recommended director nominees (including those validly proposed by shareholders) based on these criteria,

as well as other relevant considerations. Further information regarding the process for a shareholder to recommend a director nominee can be found below under “Submissions of Nominations or Other Proposals for Our 2023 Annual Meeting” on p. 54. Our

Nominating and Governance Committee will retain full discretion in considering its nomination recommendations to our Board.

| Loews Corporation 2022 Proxy |

5 |

Proposal No. 1: Election of Directors

Director Independence

Our Board has determined that the following directors, constituting a majority of our directors, are independent under our independence standards and the listing standards of the New York

Stock Exchange: Ann E. Berman, Joseph L. Bower, Charles D. Davidson, Charles M. Diker, Paul J. Fribourg, Walter L. Harris, Philip A. Laskawy, Susan P. Peters and Anthony Welters. We refer to these directors in this Proxy Statement as our “independent

directors.” Our Board considered all relevant facts and circumstances and applied the independence standards described below, which are consistent with New York Stock Exchange listing standards, in determining that none of our independent directors has

any material relationship with us or our subsidiaries.

Our Board has established the following standards to determine director independence.

A director would not be considered independent if any of the following relationships exists:

|

▪ |

during the past three years the director has been an employee, or an immediate family member has been an executive officer, of Loews; |

|

▪ |

the director or an immediate family member received, during any twelve-month period within the past three years, more than $120,000 in direct compensation from Loews, excluding director and committee fees, pension payments and certain forms of

deferred compensation; |

|

▪ |

the director is a current partner or employee or an immediate family member is a current partner of a firm that is Loews’s internal or external auditor, an immediate family member is a current employee of such a firm and personally works on the

company’s audit or, within the last three years, the director or an immediate family member was a partner or employee of such a firm and personally worked on Loews’s audit within that time; |

|

▪ |

the director or an immediate family member has at any time during the past three years been employed as an executive officer of another company where any of Loews’s present executive officers at the same time serves or served on that company’s

compensation committee; or |

|

▪ |

the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, Loews for property or services in an amount which, in any of the last three

years, exceeded the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

| 6 |

Loews Corporation 2022 Proxy |

Proposal No. 1: Election of Directors

Director Nominees

Information about each nominee for director and the nominee’s age, principal occupation during the past five

years and individual qualifications and attributes are set forth below. Unless otherwise noted in this Proxy Statement, no entity related to a nominee is affiliated with Loews.

| Ann E. Berman |

|

AGE:

69

DIRECTOR SINCE:

2006

|

Retired advisor to the President of Harvard University. Ms. Berman is also a director of Immuneering

Corporation and Renalytix plc. Ms. Berman was a director of Eaton Vance Corporation from 2006 to 2021 and of Cantel Medical Corp. from 2011 to 2021.

EXPERIENCE: Ms. Berman’s experience, including having served as Vice President of Finance and Chief Financial Officer of Harvard University, has provided her with a deep knowledge of the complex financial issues faced by large

institutions such as Loews. In addition, her past service on the board of the Harvard Management Company, which oversees the management of Harvard’s endowment, gives her extensive experience in dealing with large and diverse investment

portfolios such as those maintained by Loews and its subsidiaries. This knowledge and experience are valuable to our Board and qualify her to serve as one of the two financial experts on our Board’s Audit Committee.

|

| Joseph L. Bower |

|

AGE:

83

DIRECTOR SINCE:

2001

|

A faculty member of Harvard Business School from 1963 to 2014, Professor Bower has been the Donald K.

David Professor Emeritus of Business Administration since 2014. Professor Bower is also a director of New America High Income Fund, Inc. He was a director of Anika Therapeutics, Inc. from 1993 to 2021.

EXPERIENCE: Professor Bower served as a Professor of Business Administration for over 55 years. For many years his scholarship has had a particular emphasis on corporate management, organization and leadership. His study and knowledge in

this area serve to enhance our Board’s ability to fulfill its oversight responsibility with respect to Loews’s management.

|

| Loews Corporation 2022 Proxy |

7 |

Proposal No. 1: Election of Directors

| Charles D. Davidson |

|

AGE:

72

DIRECTOR SINCE:

2015

|

Venture Partner at Quantum Energy Partners, a private equity fund specializing in investments in energy

businesses. Mr. Davidson served as Chief Executive Officer of Noble Energy Inc., an independent producer of oil and natural gas, from 2000 through 2014, and was Chairman of the Board of Noble until his retirement in 2015. Mr. Davidson was

also a director, from 2016, and Chairman of the Board, from 2018, of Jagged Peak Energy, Inc. until 2020.

EXPERIENCE: Mr. Davidson has worked in the oil and gas industry for over 45 years, including as Chief Executive Officer of Noble. His extensive experience with oil and gas operations, as well as management of a large, complex,

multinational organization, give him knowledge and insights that are valuable to our Board, particularly in overseeing the business of our energy industry subsidiary, Boardwalk Pipelines Partners, LP (Boardwalk Pipelines).

|

| Charles M. Diker |

|

AGE:

87

DIRECTOR SINCE:

2003

|

Chairman of Diker Management LLC, a registered investment adviser. Mr. Diker was a director, from 1985,

and Chairman of the Board, from 1986, of Cantel Medical Corp. until 2021.

EXPERIENCE: Mr. Diker has had wide-ranging experience in the investment advisory field, as well as in the management or on the boards of several operating businesses. This combination of experiences as an investment professional and a

key executive at operating companies is a valuable attribute Mr. Diker brings to our Board, particularly in light of Loews’s varied investment and business interests.

|

| Paul J. Fribourg |

|

AGE:

68

DIRECTOR SINCE:

1997

Lead Director

|

Chairman of the Board and Chief Executive Officer of Continental Grain Company, an international

agribusiness and investment company. Mr. Fribourg is also a director of Estee Lauder Companies, Inc., Restaurant Brands International, Inc., and Bunge Limited. He was a director of Apollo Global Management, LLC from 2011 until 2018.

EXPERIENCE: Mr. Fribourg has had extensive and practical hands-on experience as the Chief Executive Officer of Continental Grain Company, a major industrial company with broad international operations. This background gives Mr. Fribourg

particular insight into many of the business decisions that come before our Board.

|

| 8 |

Loews Corporation 2022 Proxy |

Proposal No. 1: Election of Directors

| Walter L. Harris |

|

AGE:

70

DIRECTOR SINCE:

2004

|

From 2014 until 2019, President and Chief Executive Officer of FOJP Service Corporation, a provider of

risk management services to hospitals, long-term care facilities and social service agencies in New York City, and Hospitals Insurance Company, a provider of insurance coverages and services to hospitals, long-term care facilities, physicians

and healthcare professionals in New York State. Mr. Harris was Chairman of the Board of Directors of Watford Holdings Ltd. from 2014 until 2021.

EXPERIENCE: Mr. Harris has extensive experience and knowledge regarding the commercial insurance industry, which is particularly valuable to our Board in light of Loews’s significant interest in the insurance industry as represented by

one of our principal subsidiaries, CNA.

|

| Philip A. Laskawy |

|

AGE:

80

DIRECTOR SINCE:

2003

|

Retired Chairman and Chief Executive Officer of Ernst & Young LLP, an international accounting firm.

Mr. Laskawy is also a director of Henry Schein, Inc., Covetrus, Inc. and Lazard Ltd.

EXPERIENCE: Mr. Laskawy brings to our Board extensive knowledge of and skills in financial and accounting matters, having served as Chairman and Chief Executive Officer of one of the largest public accounting firms in the United States.

This qualifies him to serve as one of the two financial experts on our Board’s Audit Committee. Mr. Laskawy’s knowledge and skills are especially valuable to our Board in understanding and dealing with complex financial and accounting issues.

|

| Susan P. Peters |

|

AGE:

68

DIRECTOR SINCE:

2018

|

Retired Senior Vice President of Human Resources of General Electric Company, a high-tech industrial

company, a position which she held from 2013 until 2017. Ms. Peters is also a director of Hydrofarm Holdings Group, Inc.

EXPERIENCE: Ms. Peters’ experience during her 38-year career at General Electric, in which she held positions of increasing responsibility and which culminated in her serving as the chief human resources officer and a member of the

senior leadership team, has provided her with deep domain expertise in talent management, operational optimization, executive compensation and leadership development at the highest level that serve our Board extremely well.

|

| Loews Corporation 2022 Proxy |

9 |

Proposal No. 1: Election of Directors

| Andrew H. Tisch |

|

AGE:

72

DIRECTOR SINCE:

1985

|

Retired member of the Office of the President, a position which he held from 1999 until 2021, and

Co-Chairman of the Board and Chairman of the Executive Committee of the Board of Loews. Mr. Tisch is also a director of our subsidiary, CNA. He was a director of K12 Inc. from 2001 to 2017, Diamond Offshore Drilling, Inc. (Diamond Offshore)

from 2011 to 2020 and the general partner of Boardwalk Pipelines from 2005 until 2021.

EXPERIENCE: Mr. Tisch’s long tenure as a member of Loews’s Office of the President and, before that, in a number of other executive positions, has provided him with broad knowledge of and insight into Loews, its operations and the

businesses in which it is engaged, and has enabled him to be instrumental in providing our company with both strategic direction and operational oversight. His direct experience in managing Loews’s business, as well as his institutional

knowledge, is of critical importance to our Board in fulfilling its responsibilities.

|

| James S. Tisch |

|

AGE:

69

DIRECTOR SINCE:

1986

|

President and Chief Executive Officer and a member of the Office of the President of Loews. Mr. Tisch is

also a director of General Electric Company and our subsidiary, CNA. He was a director of Diamond Offshore from

1989 until 2021.

EXPERIENCE: Mr. Tisch has served as a member of Loews’s Office of the President since 1999 and, prior to that time, had served the company in a number of other executive positions, giving him extensive knowledge of Loews, its operations

and the businesses in which it is engaged, and enabling him to be instrumental in providing our company with both strategic direction and day-to-day operational oversight. His direct experience in managing Loews’s business, as well as his

institutional knowledge, is of critical importance to our Board in fulfilling its responsibilities.

|

| 10 |

Loews Corporation 2022 Proxy |

Proposal No. 1: Election of Directors

| Jonathan M. Tisch |

|

AGE:

68

DIRECTOR SINCE:

1986

|

Member of the Office of the President and Co-Chairman of the Board of Loews, and Chairman and Chief

Executive Officer of our subsidiary, Loews Hotels.

EXPERIENCE: Mr. Tisch has served as a member of Loews’s Office of the President since 1999 and, prior to that time, had served the company in a number of other executive positions. This experience has provided him with broad knowledge of

and insight into Loews and its operations and businesses and has enabled him to be instrumental in providing our company with strategic direction and operational oversight. His direct experience in managing the Loews Hotels business, as well

as his institutional knowledge, is of critical importance to our Board in fulfilling its responsibilities.

|

| Anthony Welters |

|

AGE:

67

DIRECTOR SINCE:

2013

|

Founder, Chairman and Chief Executive Officer, since 2021, of CINQ Care Inc., a physician-led,

community-based ambulatory care delivery system that delivers whole person care in the home, whenever possible, to black and brown communities. Mr. Welters is also Executive Chairman, since 2014, of BlackIvy Group, LLC, which builds and grows

commercial enterprises in Sub-Saharan Africa, including logistics and infrastructure solutions and businesses that serve the growing consumer class, and Co-Founder and Chairman, since 2017, of Somatus, Inc., a leading provider of value-based

kidney solutions to payors, health systems and other organizations seeking alternatives to traditional fee for service dialysis. From 2002 until his retirement in 2016, Mr. Welters served in various senior executive positions at UnitedHealth

Group Incorporated. Mr. Welters is also a director of the Carlyle Group and Gilead Sciences, Inc., and was a director of C.R. Bard, Inc. from 1999 to 2017.

EXPERIENCE: Mr. Welters’ experience as a senior executive at a large, complex health insurance company, as well as his service as a director of several public companies and his work with numerous educational and philanthropic

organizations, give him a range of knowledge and skills that are extremely valuable to our Board.

|

Board diversity.

A number of institutional investors have requested the following disclosure: Two of our nine independent

directors are female, and one of our independent directors is black.

Family Relationships.

James S. Tisch and Andrew H. Tisch are brothers. Jonathan M. Tisch is the cousin of James S. Tisch and Andrew H.

Tisch.

|

Our Board recommends a vote FOR each of the nominees listed above to be elected as a director of our Company. |

| Loews Corporation 2022 Proxy |

11 |

Board Governance Information

Board Governance Information

Corporate Governance

Effective corporate governance reinforces our goal of building long-term value for shareholders. Our governance

principles are detailed in our Corporate Governance Guidelines, which are reviewed annually and updated as needed, including in response to evolving best practices and regulatory requirements. We also have a Code of Business Conduct and Ethics which

applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer.

For more information on our governance practices and policies, please see “Corporate Governance Highlights” on

p. 4 in the Proxy Summary section.

|

Governance Documents

The following governance documents are available on our website in the “Investors/Media” section under “Governance” at www.loews.com and are available in print to any

shareholder who requests a copy by writing to our Corporate Secretary:

|

| |

|

| ▪ Corporate Governance Guidelines |

▪ Compensation Committee Charter |

| |

|

| ▪ Code of Business Conduct and Ethics |

▪ Nominating and Governance Committee Charter |

| |

|

| ▪ Audit Committee Charter |

|

| |

|

Board Leadership Structure

Our Board’s current leadership structure consists of two Co-Chairmen of the Board, Andrew H. Tisch and Jonathan

M. Tisch, and a lead director, presently Paul J. Fribourg, who is also Chairman of our Board’s Nominating and Governance Committee. Loews’s Chief Executive Officer, James S. Tisch, does not currently serve in a formal leadership capacity on our

Board.

Our Board believes that this structure provides input, guidance and leadership for the Board from both senior

management and non-management directors, which assists the Board in effectively fulfilling its oversight role. Our Board also believes that the current exclusion of Loews’s Chief Executive Officer from its leadership structure helps to achieve an

appropriate balance between the differing perspectives of management and non-management directors during the course of its proceedings.

The lead director plays an important role in our Board’s leadership structure. Non-management

directors meet in executive session after each regular meeting of our Board. The lead director chairs these meetings of non-management directors. Our lead director also currently serves as Chairman of the Nominating and Governance Committee, the

principal Board committee charged with responsibility for the Board’s leadership structure. In this dual role, the lead director facilitates the ability of non-management directors to fulfill their responsibilities and provides a structure for

communicating any concerns that non-management directors may have directly to Loews’s senior management.

| 12 |

Loews Corporation 2022 Proxy |

Board Governance Information

Board Committees

Our Board has a standing Audit Committee, Compensation Committee, Nominating and Governance Committee and

Executive Committee.

The following table shows the current members and chairs of each of our Audit, Compensation and Nominating and

Governance Committees and their primary responsibilities.

| AUDIT |

|

CHAIR: Walter Harris

OTHER MEMBERS:

Ann E. Berman Joseph L. Bower

Charles M. Diker Paul J. Fribourg

Philip A. Laskawy

2021 MEETINGS HELD: 8

Each of the members is an independent director and satisfies the additional independence and other

requirements for Audit Committee members provided for in the listing standards of the New York Stock Exchange and the rules of the Securities and Exchange Commission.

Additionally, Ms. Berman and Mr. Laskawy have been designated as “audit committee financial experts”

under the rules of the Securities and Exchange Commission.

|

PRIMARY ROLE

The Audit Committee assists our Board in fulfilling its responsibility to oversee:

▪ the integrity of our financial

statements;

▪ our compliance with legal and

regulatory requirements;

▪ the qualifications and independence of

our independent auditors;

▪ the performance of our internal audit

function and independent auditors;

▪ our systems of disclosure controls and

procedures and internal controls over financial reporting;

▪ cybersecurity risk management; and

▪ compliance with ethical

standards adopted by Loews.

Our Audit Committee has sole authority to appoint, retain, compensate, evaluate and terminate our

independent auditors and to approve all engagement fees and terms for our independent auditors.

|

| COMPENSATION |

|

CHAIR: Joseph L. Bower

OTHER MEMBERS:

Charles D. Davidson Charles M. Diker

Paul J. Fribourg Susan P. Peters

2021 MEETINGS HELD: 3

Each of the members is an independent director and satisfies the additional independence requirements for

Compensation Committee members provided for in the listing standards

of the New York Stock Exchange and the

rules of the Securities and Exchange Commission.

|

PRIMARY ROLE

The Compensation Committee assists our Board in discharging its responsibilities relating to compensation

of our executive officers. These responsibilities include:

▪ reviewing our general compensation

philosophy for executive officers;

▪ overseeing the development and

implementation of executive compensation programs;

▪ reviewing compensation levels,

including incentive and equity-based compensation, for executive officers, directors and Board committee members; and

▪ reviewing our management

succession planning.

Our Compensation Committee determines and approves compensation for our executive officers and

administers our incentive and equity-based compensation plans.

|

| Loews Corporation 2022 Proxy |

13 |

Board Governance Information

| NOMINATING AND GOVERNANCE COMMITTEE |

|

CHAIR: Paul J. Fribourg

OTHER MEMBERS:

Joseph L. Bower Anthony Welters

Walter L. Harris

2021 MEETINGS HELD: 2

Each of the members is an independent director.

|

PRIMARY ROLE

The Nominating and Governance Committee identifies individuals qualified to become members of our Board

and recommends to our Board a slate of director nominees for election at our annual meetings of shareholders. It also recommends directors for membership on our Board committees.

The Nominating and Governance Committee also develops and recommends to our Board a set of corporate

governance principles, which are detailed in our Corporate Governance Guidelines.

|

Executive Sessions of

Independent Directors

Our independent directors meet in regular executive sessions without management participation. Paul J. Fribourg,

who serves as our lead director, presides at these meetings.

Director Attendance at

Meetings

During 2021, there were thirteen meetings of our Board, eight meetings of our Audit Committee,

three meetings of our Compensation Committee and two meetings of our Nominating and Governance Committee. During 2021, each of our directors attended at least 75% of the total number of meetings of our Board and committees of our Board on which that

director served. Our Board encourages all directors to attend our annual meetings of shareholders. All of our directors attended our 2021 annual meeting of shareholders.

| 14 |

Loews Corporation 2022 Proxy |

Board Governance Information

Board Oversight of Risk Management

Our Board recognizes the importance of understanding, evaluating and, to the extent practicable, managing

enterprise risk to the financial health of Loews and its business enterprises.

|

BOARD

|

|

Our Board is responsible for overseeing management in its efforts to systematically identify, assess and manage the principal risks

facing us and our subsidiaries, and implement policies and practices that promote a culture that actively balances risk and reward. Our Board exercises this responsibility, and evaluates our risk management practices, through its Board and

Committee meetings, during which it hears reports on, and actively discusses, a variety of risk management matters. In addition, our Board regularly formally reviews our enterprise risk management framework.

|

|

| LEAD INDEPENDENT DIRECTOR |

AUDIT COMMITTEE |

|

| MANAGEMENT |

| Our management team is responsible for assessing and managing our various

exposures to risk on a day-to-day basis, including the creation of appropriate risk management programs and policies to help determine how best to identify, manage and mitigate risks. Management is supported in these efforts by the groups

described below. Management regularly reports to our Board and Audit Committee, including through executive sessions chaired by the lead director, on a variety of risk management matters. |

|

Risk Council

Chair: Chief Financial Officer

Other Members: Representatives of Various Functional Areas

|

The Risk Council assists Loews’s

management in developing and implementing our enterprise risk management framework, including reviewing the strategies, policies, procedures and systems established by our and our subsidiaries’ management teams to identify, assess and manage

the material risks facing us and our subsidiaries. |

|

ESG Working Group

Chair: Chief Financial Officer

Other Members: Representatives of Various Functional Areas

|

The ESG Working Group helps Loews’s

management develop risk management and external reporting strategies with respect to environmental, social and governance matters. |

|

Cyber Risk Committee

Chair: Senior IT Leadership

Other Members: Representatives of Various Functional Areas

|

The Cyber Risk Committee helps Loews’s

management evaluate and manage cybersecurity related risks across the Loews enterprise. |

|

Business Continuity Working Group

Co-Chairs: Senior IT and Corporate Communications Leadership

Other Members: Representatives of Various Functional Areas

|

The Business Continuity Working Group helps Loews’s management plan and

prepare to be able to operate our critical business functions during emergency events, such as the COVID-19 pandemic. |

| |

|

|

| Loews Corporation 2022 Proxy |

15 |

Board Governance Information

Share Ownership Guidelines for Directors

Our Board has adopted minimum share ownership guidelines for directors who are not employees or officers of

Loews. Under these guidelines, each non-management director is required to own shares having a value (determined as of the time the shares are acquired) of at least three times the annual cash retainer payable to directors (which is currently

$100,000 per year). Newly elected directors have until the date of the third annual meeting after they were first elected to accumulate the requisite shares. Shares owned by immediate family members or in certain trusts and unissued shares underlying

restricted stock units are counted toward satisfying the requirement. Our Nominating and Governance Committee, or the committee chair acting by delegated authority, has the authority to grant exceptions to the guidelines for hardship reasons.

Director Compensation

During 2021, each of our non-management directors received a cash retainer of $25,000 per quarter and an annual

award of restricted stock units (“RSUs”) having a value of $100,000 at the date of grant under the Loews Corporation 2016 Incentive Compensation Plan (our “Incentive Compensation Plan”).

In addition, members of our Audit Committee each received a cash retainer of $6,250 per quarter, and the

committee chair received an additional $10,000 per quarter. Members of our Compensation Committee and Nominating and Governance Committee each also received a cash retainer of $2,500 per quarter, and the committee chairs received an additional $5,000

per quarter. Our lead director received an additional quarterly retainer of $5,000.

All of our directors are reimbursed for reasonable expenses incurred in connection with attending board of

director and committee meetings.

Our non-management directors may elect to defer some or all of their cash and equity compensation.

The following table shows information regarding the compensation of our non-management directors during the year

ended December 31, 2021.

| Name |

Fees Earned or

Paid in Cash |

Stock

Awards |

(1) |

Option/SAR

Awards |

(2) |

Total |

| Ann E. Berman |

$125,000 |

$100,000 |

|

$0 |

|

$225,000 |

| Joseph L. Bower |

165,000 |

100,000 |

|

0 |

|

265,000 |

| Charles D. Davidson |

110,000 |

100,000 |

|

0 |

|

210,000 |

| Charles M. Diker |

135,000 |

100,000 |

|

0 |

|

235,000 |

| Paul J. Fribourg |

185,000 |

100,000 |

|

0 |

|

285,000 |

| Walter L. Harris |

175,000 |

100,000 |

|

0 |

|

275,000 |

| Philip A. Laskawy |

125,000 |

100,000 |

|

0 |

|

225,000 |

| Susan P. Peters |

110,000 |

100,000 |

|

0 |

|

210,000 |

| Anthony Welters |

110,000 |

100,000 |

|

0 |

|

210,000 |

| (1) |

These amounts represent the grant date fair value of RSUs, calculated in accordance with the Financial Accounting Standards Board’s (“FASB”) Accounting Standards

Codification (“ASC”) Topic 718. At December 31, 2021, the aggregate number of RSUs outstanding for each non-management director was 1,725. |

| (2) |

Prior to 2016, our non-management directors were granted stock appreciation rights (“SARs”) under the Loews Corporation Stock Option Plan (our “Stock Option Plan”). At

December 31, 2021, the aggregate number of SAR awards outstanding for each non-management director was as follows: Ann E. Berman, 36,000; Joseph L. Bower, 36,000; Charles D. Davidson, 9,000; Charles M. Diker, 36,000; Paul J. Fribourg, 36,000;

Walter L. Harris, 36,000; Philip A. Laskawy, 36,000; Susan P. Peters, 0; and Anthony Welters, 20,250. |

| 16 |

Loews Corporation 2022 Proxy |

Board Governance Information

Transactions with Related Persons

Our Audit Committee Charter requires our Audit Committee to review and approve all related party transactions

required to be disclosed under Securities and Exchange Commission rules. It has been our Audit Committee’s practice, however, to review and approve or ratify any transaction, regardless of the size or amount, involving us or any of our subsidiaries

in which any of our directors, director nominees, executive officers, principal shareholders or any of their immediate family members has had or will have a direct or indirect material interest, without the participation of any member who may be

involved in the transaction. All such related party transactions are submitted to our General Counsel for review and reported to our Audit Committee for its consideration. In each case, the Audit Committee considers, in light of all of the facts and

circumstances it deems relevant, whether the transaction is fair and reasonable to us.

Our Audit Committee reviewed and approved or ratified each of the following 2021 related party transactions:

Andrew H. Tisch, James S. Tisch and Jonathan M. Tisch and members of their families have chartered our aircraft

for personal travel from time to time. For the use of our owned aircraft, charters are done through an unaffiliated management company and the charterer pays us a fixed hourly rate plus a fuel surcharge which equals or exceeds our out-of-pocket

operating costs. For the use of an aircraft in which we hold a fractional interest, the charterer pays us a rate that closely approximates our incremental cost. The total amount reimbursed or paid to us

in 2021 in connection with this aircraft travel was $930,447.

Alexander Tisch, son of Andrew H. Tisch, is employed as a Vice President of Loews and as President of Loews

Hotels. Alexander Tisch earned cash compensation (including bonus) of $1,377,980 in 2021 and participated in benefit programs available to salaried employees generally. In February 2021, he was granted 7,460 restricted stock units under our Incentive

Compensation Plan.

Benjamin Tisch, son of James S. Tisch, is employed as a Vice President of Loews. Benjamin Tisch earned cash

compensation (including bonus) of $1,265,000 for 2021 and participated in benefit programs available to salaried employees generally. In February 2021, he was granted 7,460 restricted stock units under our Incentive Compensation Plan.

| Loews Corporation 2022 Proxy |

17 |

Stock Ownership

Stock Ownership

Principal Shareholders

The following table shows certain information about all persons who, to our knowledge, were the beneficial owners

of 5% or more of our common stock as of March 15, 2022 (unless otherwise indicated). All shares reported were owned beneficially by the persons indicated unless otherwise indicated below.

| Name and Address |

Amount Beneficially Owned |

Percent of Class |

|

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355

|

22,823,409(1) |

9.0% |

|

T. Rowe Price Associates, Inc.

100 E. Pratt Street

Baltimore, MD 21202

|

19,515,531(2) |

7.6% |

|

James S. Tisch

c/o Barry L. Bloom

655 Madison Avenue, 11th Floor

New York, NY 10065

|

17,015,466(3) |

6.9% |

|

JPMorgan Chase & Co.

383 Madison Avenue

New York, NY 10179

|

16,617,210(4) |

6.5% |

|

Andrew H. Tisch

c/o Barry L. Bloom

655 Madison Avenue, 11th Floor

New York, NY 10065

|

15,918,650(5) |

6.5% |

|

BlackRock, Inc.

55 East 52nd Street

New York, NY 10055

|

14,619,153(6) |

5.8% |

|

(1) |

This information is based on a Schedule 13G report filed on February 10, 2022 by The Vanguard Group (Vanguard). According to the report, Vanguard has shared voting power with respect to 320,218 shares, sole

investment power with respect to 22,010,468 shares and shared investment power with respect to 812,941 shares. Vanguard provides investment management services through mutual funds to our Employee Savings Plan and our non-qualified deferred

compensation plans. Fees for these services are incorporated into the fund NAV and fully disclosed as a fund expense included in the fund’s expense ratio. As a result, these fees are paid by participants and not by us. Fees fluctuate based on

participants’ allocation decisions. Fees paid to Vanguard for these investment management services are reviewed by the benefits committee administering our retirement plans. |

|

(2) |

This information is based on a Schedule 13G report filed on February 14, 2022 by T. Rowe Price Associates, Inc. (T. Rowe Price). According to the report, T. Rowe Price has sole voting power with respect to 7,953,650

shares and sole investment power with respect to 19,515,531 shares. T. Rowe Price provides recordkeeper and administration services for our Employee Savings Plan. Fees for these services are paid on a quarterly basis by participants and not by

us. In addition, T. Rowe Price provides investment management services through mutual funds to our Employee Savings Plan and our non-qualified deferred compensation plans. Fees for these services are incorporated into the fund NAV and fully

disclosed as a fund expense included in the fund’s expense ratio. As a result, these fees are paid by participants and not by us. Fees fluctuate based on participants’ allocation decisions. All fees paid to T. Rowe Price are reviewed by the

benefits committee administering our retirement plans. |

|

(3) |

The amount beneficially owned includes: 11,457,441 shares held by trusts of which he is trustee; 4,306,296 shares held by his wife or trusts of which his wife is trustee; 985,000 shares held by a charitable

foundation of which he is a director; 56,591 shares issuable upon the exercise of SARs that are currently exercisable; and 46,388 shares underlying vested RSUs of which he deferred receipt that could be delivered to him within 60 days of March

15, 2022 if his service with the company terminated during that time. He has sole voting and investment power with respect to 11,621,191 shares and shared voting and investment power with respect to 5,291,296 shares. |

|

(4) |

This information is based on a Schedule 13G report filed on January 12, 2022 by JPMorgan Chase & Co. (JPMorgan). According to the report, JPMorgan has sole voting power with respect to 16,622,605 shares, sole

dispositive power with respect to 16,607,355 shares and shared dispositive power with respect to 5,225 shares. From time to time, we and our subsidiaries have had banking relationships with JPMorgan. |

|

(5) |

The amount beneficially owned includes: 14,832,391 shares held by trusts of which he is trustee; 955,000 shares held by a charitable foundation of which he is a director; 56,591 shares issuable upon the exercise of

SARs that are currently exercisable; 74,054 shares underlying vested RSUs of which he deferred receipt that are deliverable to him within 60 days of March 15, 2022 in connection with his retirement on December 31, 2021 (subject to the six-month

delay required under Section 409A of the Internal Revenue Code); and 614 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. He has sole voting and investment power with respect to 14,832,391 shares and shared

voting and investment power with respect to 955,000 shares. |

|

(6) |

This information is based on a Schedule 13G report filed on February 1, 2022 by BlackRock, Inc. (BlackRock). According to the report, BlackRock has sole voting power with respect to 12,346,951 shares and sole

dispositive power with respect to 14,619,153 shares. |

| 18 |

Loews Corporation 2022 Proxy |

Stock Ownership

Director and Officer Holdings

The following table shows certain information, as of March 15, 2022, regarding the shares of our common stock beneficially owned by

each director and nominee, each executive officer named in the Summary Compensation Table and all of our executive officers and directors as a group, based on data furnished by them.

| Name |

Amount Beneficially Owned |

(1) (2) |

Percent of Class |

| Ann E. Berman |

24,478 |

(3)

|

* |

| Joseph L. Bower |

33,156 |

(4) |

* |

| Charles D. Davidson |

27,050 |

(5) |

* |

| Charles M. Diker |

27,449 |

(6) |

* |

| David B. Edelson |

79,485 |

(7) |

* |

| Paul J. Fribourg |

24,478 |

(8) |

* |

| Walter L. Harris |

30,449 |

(9) |

* |

| Philip A. Laskawy |

29,198 |

(10) |

* |

| Susan P. Peters |

8,955 |

(11) |

* |

| Kenneth I. Siegel |

6,993 |

|

* |

| Andrew H. Tisch |

15,918,650 |

(12) |

6.5% |

| James S. Tisch |

17,015,466 |

(13) |

6.9% |

| Jonathan M. Tisch |

9,942,451 |

(14) |

4.0% |

| Anthony Welters |

16,268 |

(15) |

* |

| All executive officers and directors as a group (16 persons including those listed above) |

43,260,993 |

(16) |

17.5% |

|

* |

Represents less than 1% of the outstanding shares. |

|

(1) |

Except as otherwise indicated, the persons listed as beneficial owners of the shares have sole voting and investment power with respect to those shares. |

|

(2) |

The number of shares included for shares issuable upon the exercise of SARs granted under our Stock Option Plan is the number of shares each person would have received had such person

exercised his or her SARs, based on the fair market value per share of $61.75 for our common stock, calculated under the terms of our Stock Option Plan, on March 15, 2022. |

|

(3) |

Includes: (i) 10,816 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 11,937 shares underlying vested RSUs of which the director deferred receipt that could be

delivered to the director within 60 days of March 15, 2022 if the director’s service as a director terminated during that time; and (iii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. |

|

(4) |

Includes: (i) 10,816 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 7,828 shares underlying vested RSUs of which the director deferred receipt that could be

delivered to the director within 60 days of March 15, 2022 if the director’s service as a director terminated during that time; and (iii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. |

|

(5) |

Includes: (i) 3,417 shares issuable upon the exercise of SARs that are currently exercisable; and (ii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. |

|

(6) |

Includes: (i) 10,816 shares issuable upon the exercise of SARs that are currently exercisable; and (ii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. |

|

(7) |

Includes: (i) 42,443 shares issuable upon the exercise of SARs that are currently exercisable; and (ii) 1,673 shares underlying vested RSUs of which the officer deferred receipt that could

be delivered to the officer within 60 days of March 15, 2022 if his service with the company terminated during that time. In addition, Mr. Edelson owns beneficially 2,000 shares of CNA. |

|

(8) |

Includes: (i) 10,816 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 11,937 shares underlying vested RSUs of which the director deferred receipt that could be

delivered to the director within 60 days of March 15, 2022 if the director’s service as a director terminated during that time; and (iii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. |

|

(9) |

Includes: (i) 10,816 shares issuable upon the exercise of SARs that are currently exercisable; and (ii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022.

In addition, Mr. Harris owns beneficially 1,830 shares of CNA. |

|

(10) |

Includes: (i) 10,816 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 3,292 shares underlying vested RSUs of which the director deferred receipt that could be

delivered to the director within 60 days of March 15, 2022 if the director’s service as a director terminated during that time; (iii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022; and (iv) 6,000 shares

owned beneficially by Mr. Laskawy’s wife. |

| Loews Corporation 2022 Proxy |

19 |

Stock Ownership

|

(11) |

Includes: (i) 5,271 shares underlying vested RSUs of which the director deferred receipt that could be delivered to the director within 60 days of March 15, 2022 if the director’s service as

a director terminated during that time; and (ii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. |

|

(12) |

Includes: (i) 56,591 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 74,054 shares underlying vested RSUs of which Mr. Andrew Tisch deferred receipt that are

deliverable to him within 60 days of March 15, 2022 in connection with his retirement on December 31, 2021 (subject to the six-month delay required under Section 409A); (iii) 614 shares underlying unvested RSUs that will vest within 60 days of

March 15, 2022; (iv) 14,832,391 shares held by trusts of which Mr. Andrew Tisch is trustee; and (v) 955,000 shares held by a charitable foundation as to which Mr. Andrew Tisch has shared voting and investment power. In addition, Mr. Andrew

Tisch is the managing trustee and beneficiary of a trust that owns beneficially 106,100 shares of CNA. |

|

(13) |

Includes: (i) 56,591 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 46,388 shares underlying vested RSUs of which Mr. James Tisch deferred receipt that could

be delivered to him within 60 days of March 15, 2022 if his service with the company terminated during that time; (iii) 11,457,441 shares held by trusts of which Mr. James Tisch is trustee; (iv) 985,000 shares held by a charitable foundation as

to which Mr. James Tisch has shared voting and investment power; and (v) 4,306,296 shares held by his wife or trusts of which his wife is trustee as to which Mr. James Tisch has shared voting and investment power. In addition, Mr. James Tisch

is also the managing trustee and beneficiary of a trust that owns beneficially 106,100 shares of CNA. |

|

(14) |

Includes: (i) 56,591 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 9,383,932 shares held by trusts of which Mr. Jonathan Tisch is trustee; (iii) 251,928

shares held by a charitable foundation as to which Mr. Jonathan Tisch is the sole trustee; and (iv) 250,000 shares held by a charitable foundation as to which Mr. Jonathan Tisch has shared voting and investment power. |

|

(15) |

Includes: (i) 6,669 shares issuable upon the exercise of SARs that are currently exercisable; (ii) 2,150 shares underlying vested RSUs of which the director deferred receipt that could be

delivered to the director within 60 days of March 15, 2022 if the director’s service as a director terminated during that time and (ii) 1,725 shares underlying unvested RSUs that will vest within 60 days of March 15, 2022. |

|

(16) |

Includes 313,753 shares issuable upon the exercise of SARs that are currently exercisable. |

| 20 |

Loews Corporation 2022 Proxy |

Proposal No. 2: Advisory Resolution to Approve Executive Compensation

Proposal No. 2:

Advisory Resolution to Approve Executive Compensation

As required by Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”) and pursuant to the Dodd-Frank Wall Street

Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), we provide our shareholders with an annual advisory vote to approve named executive officer compensation. This advisory vote, commonly known as a “say-on-pay” vote, is a non-binding

vote on the compensation paid to our named executive officers as disclosed under the heading “Executive Compensation” beginning on page 22 of this Proxy Statement.

Our executive compensation program is designed to attract, motivate and retain highly qualified executives who are able to help

achieve the company’s objectives and create shareholder value over the long term. Our executive compensation programs and objectives are described in detail under the heading “Compensation Discussion and Analysis” and the level of compensation paid

to our named executive officers during the last three years is set out in the Summary Compensation Table and related information. Our Compensation Committee believes that our executive compensation program is effective in achieving our objectives.

This advisory vote to approve named executive officer compensation is not binding on our Board. However, the Board values our

shareholders’ input and will take into account the result of the vote when determining future executive compensation arrangements.

|

Accordingly, our Board recommends a vote FOR the following resolution: |

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation paid to the company’s named executive officers as

disclosed under the heading “Executive Compensation” in the Proxy Statement for the 2022 Annual Meeting of Shareholders.”

| Loews Corporation 2022 Proxy |

21 |

Executive Compensation

Executive Compensation

Compensation Discussion

and Analysis

Executive Summary

This Compensation Discussion and Analysis contains information about the compensation we pay to our executive officers whose

compensation is required to be disclosed in the Executive Compensation tables that follow under Securities and Exchange Commission rules (“named executive officers”).

| Our Named Executive Officers for 2021 were: |

| James S. Tisch |

David B. Edelson* |

Andrew H. Tisch** |

Jonathan M. Tisch |

Kenneth I. Siegel |

| President and Chief Executive Officer, Office of the President |

Senior Vice President and Chief Financial Officer |

Office of the President,

Co-Chairman of the Board, Chairman of the Executive Committee |

Office of the President,

Co-Chairman of the Board, Loews Corporation; Chairman and Chief Executive Officer,

Loews Hotels |

Senior Vice President |

*David B. Edelson has informed us that he will resign as our Chief Financial Officer on May 10, 2022, and as Senior Vice President on June 30, 2022. He will

remain a senior advisor after June 30, 2022. Jane Wang, currently a Vice President, will succeed him as Senior Vice President and Chief Financial Officer.

**Andrew H. Tisch retired from his executive duties and the Office of the President on December 31, 2021. He continues to serve on our Board as Co-Chairman and

Chairman of the Executive committee.

Who We are

Loews Corporation is a holding company. We own significant interests in a diverse portfolio of businesses, including:

|

|

|

|

CNA Financial Corporation is a property and casualty insurer

(89.6% ownership interest) |

Boardwalk Pipelines is a provider of natural gas and liquids transportation and storage services

(100% ownership interest) |

Loews Hotels is an operator and manager of hotels

(100% ownership interest)

|

Altium Packaging is a manufacturer of rigid plastic packaging

(52.7% ownership interest)*

|

* Following our sale of 47% of Altium Packaging on April 1, 2021 to affiliates of GIC,

Singapore’s sovereign wealth fund, Altium Packaging was deconsolidated from our financial statements and our investment in Altium Packaging is now accounted for under the equity method of accounting.

In addition, we had approximately $3.4 billion of cash and investments at the holding company level as of December 31, 2021.

| 22 |

Loews Corporation 2022 Proxy |

Executive Compensation

Our primary function is to allocate our capital in ways that drive long-term value creation and returns for our shareholders. To do

this we make decisions related to investments in our subsidiaries, repurchases of our shares, acquisitions and dispositions of subsidiaries and prudent investment of our cash and investment assets.

In light of our business model, our most critical asset is our people — our human capital — including our senior leadership team

that drives our capital allocation decisions. All of our executive officers and other employees are located in our headquarters office and a neighboring building in New York City. We not only compete for leadership talent with our and our

subsidiaries’ peer companies, but also with New York City-based financial services firms, including investment and commercial banks, private equity funds, hedge funds, insurance and reinsurance companies and other sophisticated financial firms. Our

compensation policies and practices are driven by our need to attract and retain highly qualified, financially sophisticated executive officers in this competitive marketplace and motivate them to provide a high level of performance for our

shareholders.

Our Compensation Philosophy

We have maintained a consistent compensation philosophy for many years, which takes into account that the quality

of our leadership has a direct impact on our performance. Our compensation philosophy is based on the following objectives:

|

▪ |

Motivating superior long-term financial performance and the creation of shareholder value over the long term; |

|

▪ |

Discouraging unreasonable risk taking; |

|

▪ |

Aligning compensation with our long-term strategy and focus and the interests of our shareholders; |

|

▪ |

Providing market-competitive compensation; |

|

▪ |

Avoiding excessive compensation; and |

|

▪ |

Attracting and retaining high-caliber executive talent. |

We believe in recognizing the performance of our executive officers primarily through a combination of cash

compensation, made up of a fixed base salary and incentive compensation, and stock-based compensation, which, in 2021, consisted of performance-based restricted stock units. Because cash incentive compensation and our restricted stock unit awards are

tied to performance, a large majority of the compensation paid to our executive officers is performance-based and, other than their fixed base salaries, no compensation is guaranteed.

How We Structure our Executive Compensation Program

We structure our executive compensation to avoid the possibility of excessive compensation in any given year,

including through:

|

▪ |

the Compensation Committee’s ability to exercise negative discretion in determining cash incentive compensation; |

|

▪ |

setting what we believe to be reasonable, but achievable, performance targets for both cash incentive compensation and stock-based awards; and |

|

▪ |

generally not paying cash incentive compensation in excess of pre-established target levels set by the Compensation Committee. |

We believe this structure provides ample motivation for our executive officers to maximize their performance and

focus on the long-term success of the company, while deterring unreasonable risk taking with an eye toward short-term results.

| Loews Corporation 2022 Proxy |

23 |

Executive Compensation

The fixed base salary for our named executive officers has generally comprised substantially less than half of

their total potential cash compensation, with the balance coming from our performance-based Incentive Compensation Plan. In setting potential awards under that plan, our Compensation Committee sets what it believes are reasonable, but achievable,

target levels, but reserves broad discretion to reduce or eliminate incentive compensation. The Compensation Committee also establishes maximum award levels that will not be exceeded.

In selecting and allocating the elements of our executive compensation program, we have considered, among other

things, our historical compensation policies as they have evolved over the years and benchmarking information regarding executive compensation paid by comparably sized companies engaged in businesses similar to ours and our principal subsidiaries as

well as others with which we compete for talent in the New York City marketplace. To assist in gathering this information and benchmarking our executive compensation practices against the practices at these companies, our human resources group

engaged the compensation consultant, Semler Brossy.

Our Goal is to increase Shareholder Value Over the Long term

Our compensation program is intended to align the interests of our senior executives with those of our

shareholders. Our goal is to increase shareholder value over the long term and to reasonably reward superior performance that supports that goal. In establishing the aggregate amount of targeted compensation for each named executive officer, we do

not rely on formula-driven plans, which could result in unreasonably high compensation levels and encourage excessive risk taking. Instead, aggregate target compensation is based on an evaluation of the individual’s performance, skills, leadership

and expected future contributions in the context of our financial performance and seeks to achieve the objectives of our compensation philosophy set forth above. Based on these considerations, we determine an overall level of target cash

compensation, a portion of which is to be paid as base salary and the balance of which is structured to be performance-based cash compensation, and a level of stock-based awards. We consider the aggregate compensation (earned or potentially

available) to each named executive officer in establishing each element of compensation.

EXECUTIVE COMPENSATION RESPONSE TO COVID-19

The COVID-19 pandemic, particularly in 2020, significantly affected the global economy, including certain of the

industries in which our subsidiaries operate. The hospitality industry, in which Loews Hotels & Co operates, was particularly strained. In response to the pandemic’s impact on Loews Hotels & Co team members, and to demonstrate their

leadership and dedication to Loews, each of James, Andrew and Jonathan Tisch voluntarily agreed to forego 50% of his base salary from April 1, 2020 through December 31, 2020 and 50% of any annual cash incentive compensation award for the 2020

performance year earned under our Incentive Compensation Plan.

2021 Total Cash and Stock-Based Compensation

These charts show each of the three principal elements of our compensation program as a percentage of total cash

and stock-based compensation for our Chief Executive Officer and other named executive officers in 2021.

CEO

|

Base Salary

16.7%

|

Cash Incentive Compensation

67.8%

|

Stock-Based Awards

15.5%

|

| |

Incentive Compensation: 83.3% |

|

OTHER NEOs

|

Base Salary

18.0% – 20.6%

|

Cash Incentive Compensation

60.3% – 68.9%

|

Stock-Based Awards

13.1% – 19.0%

|

| |

Incentive Compensation: 79.4% – 82.0% |

|

| 24 |

Loews Corporation 2022 Proxy |

Executive Compensation

Say on Pay Vote

At our 2021 annual meeting of shareholders, 92% of the shares voted approved, on an advisory basis, our executive

compensation program. We believe this result represents a strong endorsement of our executive compensation philosophy and practices.

|

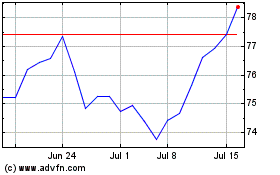

Say on pay vote approval

In the last five years, we received an average approval of approximately 92% in our annual advisory vote

of shareholders on our executive compensation program.

|

|

Compensation Governance

We are committed to good compensation governance and design and administer our executive compensation program to

be consistent with our business goals and in the best interests of our shareholders. In that regard, we:

|

▪ |

maintain a fully independent Compensation Committee, which oversees all aspects of our executive compensation and monitors, reviews and approves all executive

compensation decisions; |

|

▪ |

structure our cash incentive compensation awards to executive officers so that the Compensation Committee may exercise negative discretion over these awards; |

|

▪ |

structure our executive officers’ stock-based compensation to be performance-based; |

|

▪ |

have a clawback policy that allows for the recoupment of incentive compensation; |

|

▪ |

do not have employment agreements with, or guarantee compensation to, any of our executive officers; |

|

▪ |

do not maintain agreements with any of our executive officers to pay severance upon a change in

control; and |

|

▪ |

conduct an annual advisory vote of shareholders on our executive compensation practices. We have received a large majority advisory vote in favor of our executive pay

program every year since implementing this vote. |

Compensation Program Structure and Process

The principal components of compensation for our named executive officers are:

|

▪ |

performance-based cash incentive compensation awards; |

|

▪ |

performance-based stock-based awards; and |

|

▪ |

retirement, medical and related benefits. |

Each year, our Chief Executive Officer, after consulting with the other members of the Office of the President and

our Vice President, Human Resources, reviews with the Compensation Committee the performance of each named executive officer and each other executive officer, and makes a recommendation to the Compensation Committee with respect to their annual

compensation, including the setting of

| Loews Corporation 2022 Proxy |

25 |

Executive Compensation

parameters for cash incentive compensation awards and stock-based awards. The Compensation Committee then meets in executive session without

the Chief Executive Officer present and makes the final determination regarding the compensation for our Chief Executive Officer and each of the other named executive officers, as well as our other executive officers. The other named executive

officers do not play any role in their own compensation determination other than discussing their performance with the Chief Executive Officer, and neither our Chief Executive Officer nor any other executive officer participates in the Compensation

Committee’s final deliberations on compensation matters.

Base Salary

The Compensation Committee has established the base salary for each of our named executive officers at

approximately $1 million per year for at least the last ten years. Historically, this reflected the impact of provisions of the Internal Revenue Code that limited the amount of non-performance-based compensation we were able to deduct for federal

income tax purposes to $1 million for certain of the named executive officers. While these provisions are no longer applicable, the base salary established for each of our named executive officers in 2021 remained approximately $1 million as the

relative lower weight of base salary to performance-based compensation is consistent with the Compensation Committee’s belief that performance-based compensation should be the greater part of the compensation of each of our named executive officers.

Cash incentive compensation awards

The largest portion of the compensation earned by our named executive officers in 2021 came from cash awards under

our Incentive Compensation Plan. This element of our compensation program ensures that a significant portion of each executive’s annual compensation is dependent on Loews’s annual achievement of a metric that we call “performance-based income.”

|

Defining Performance-based Income

Performance-based income is defined in our Incentive Compensation Plan as our consolidated net income as adjusted by the Compensation Committee under the terms of our Incentive

Compensation Plan to account for specific factors that may impact our business, but which the Compensation Committee deems reasonable and appropriate to exclude or include in determining performance for incentive compensation purposes.

|

Process of Establishing Annual Incentive Compensation Awards

| STEP 1 |

Establish annual performance bonus pool |

First quarter of each year |

| First, the Compensation Committee establishes an annual performance bonus pool expressed as a percentage of our

performance-based income for that year. |

|

The performance bonus pool is not an expectation of the bonus amounts that will, in fact, be paid; rather,

it sets the outer limit of compensation that can be paid to all executive officers in our incentive compensation program for the year.

The Committee allocates a portion of the performance bonus pool to each of the named executive officers

and other executive officers who participate in the incentive compensation program.

|

| 26 |

Loews Corporation 2022 Proxy |

Executive Compensation