Financial Advisory operating revenue

reflected high levels of activity globally

Asset Management fundamental investment

style well‑positioned in current market environment

Returned $526 million in capital to

shareholders, including the repurchase of 10.6 million shares

year‑to‑date

Lazard Ltd (NYSE: LAZ) today reported operating revenue1 of $676

million for the quarter ended June 30, 2022. Net income, as

adjusted2, was $96 million, or $0.92 per share (diluted) for the

quarter. On a U.S. GAAP basis, second-quarter 2022 net income was

$95 million, or $0.92 per share (diluted).

First-half 2022 net income, as adjusted, was $211 million, or

$1.97 per share (diluted). On a U.S. GAAP basis, first-half 2022

net income was $209 million, or $1.97 per share (diluted).

“Our results demonstrate the resilience, diversification and

discipline of our business model, and we are well-positioned for

the current economic environment,” said Kenneth M. Jacobs, Chairman

and Chief Executive Officer of Lazard. “We continue to invest for

growth while remaining focused on delivering innovative client

solutions, generating significant cash flow and returning capital

to shareholders.”

($ in millions, except

Quarter Ended

Six Months Ended

per share data and AUM)

June 30,

June 30,

2022

2021

%'22-'21

2022

2021

%'22-'21

Net

Income

U.S. GAAP

$95

$123

(22%)

$209

$210

(1%)

Per share, diluted

$0.92

$1.08

(15%)

$1.97

$1.83

8%

Adjusted2

$96

$146

(34%)

$211

$247

(15%)

Per share, diluted

$0.92

$1.28

(28%)

$1.97

$2.15

(8%)

Operating

Revenue1

Total operating revenue

$676

$821

(18%)

$1,375

$1,469

(6%)

Financial Advisory

$407

$471

(14%)

$795

$788

1%

Asset Management

$266

$343

(23%)

$577

$671

(14%)

AUM ($ in

billions)

Period end

$217

$277

(22%)

Average

$230

$276

(17%)

$243

$269

(9%)

Note: Endnotes are on page 7 of this release. A reconciliation

of adjusted GAAP to U.S. GAAP is on pages 14-15.

OPERATING REVENUE

Operating revenue1 was $676 million for the second quarter of

2022, and $1,375 million for the first half of 2022, 18% and 6%

lower, respectively, from the comparable 2021 periods.

Financial Advisory

Our Financial Advisory results include M&A Advisory, Capital

Advisory, Capital Raising, Restructuring, Shareholder Advisory,

Sovereign Advisory, and other strategic advisory work for

clients.

For the second quarter of 2022, Financial Advisory operating

revenue was $407 million, 14% lower than the second quarter of

2021.

For the first half of 2022, Financial Advisory operating revenue

was $795 million, 1% higher than the first half of 2021.

During and since the second quarter of 2022, Lazard has been

engaged in significant and complex M&A transactions and other

advisory assignments globally, including the following (clients are

in italics): Vivendi's €3.6 billion tender offer for Lagardère;

Resource REIT’s $3.7 billion sale to Blackstone Real Estate Income

Trust; Oi's BRL 20.0 billion fiber assets carve-out to a BTG

Pactual-led consortium; Ferro Corporation's $2.1 billion sale to

Prince International; Tivity Health's $2.0 billion acquisition by

Stone Point Capital; Sierra Oncology's $1.9 billion sale to GSK;

Alpargatas’ strategic partnership and investment in Rothy's;

Beeline’s investment from Stone Point Capital; and Q-Energy’s sale

of its GW renewable platform to Verbund AG.

Lazard has one of the world’s preeminent restructuring

practices. During and since the second quarter of 2022, we have

been engaged in a broad range of visible and complex restructuring

and debt advisory assignments for debtors or creditors, including

roles involving: Alto Maipo S.P.A.; Andrade Gutierrez; Brazos

Electric Power Cooperative; Corp Group Banking S.A.; GenapSys;

Grupo GICSA; HEXO; Imagina Media Audiovisual; Nordic Aviation

Capital; Rockall Energy; Stoneway Capital; and Vue

Entertainment.

Our Capital and Shareholder Advisory practices remain active

globally, advising on a broad range of public and private

assignments. Our Sovereign Advisory practice continues to be active

advising governments, sovereign and sub-sovereign entities across

developed and emerging markets.

For a list of publicly announced Financial Advisory transactions

on which Lazard advised in the second quarter of 2022, or continued

to advise or completed since June 30, 2022, please visit our

website at www.lazard.com/businesses/transactions.

Asset Management

In the text portion of this press release, we present our Asset

Management results as 1) Management fees and other revenue, and 2)

Incentive fees.

For the second quarter of 2022, Asset Management operating

revenue was $266 million, 23% lower than the second quarter of

2021. For the first half of 2022, Asset Management operating

revenue was $577 million, 14% lower than the first half of

2021.

For the second quarter of 2022, management fees and other

revenue was $258 million, 16% lower than the second quarter of

2021, and 10% lower than the first quarter of 2022. For the first

half of 2022, management fees and other revenue was $545 million,

10% lower than the first half of 2021.

Average assets under management (AUM) for the second quarter of

2022 was $230 billion, 17% lower than the second quarter of 2021,

and 10% lower than the first quarter of 2022. Average AUM for the

first half of 2022 was $243 billion, 9% lower than the first half

of 2021.

AUM as of June 30, 2022, was $217 billion, down 14% from March

31, 2022, and down 22% from June 30, 2021. The sequential decrease

from March 31, 2022 was driven by market depreciation of $23.2

billion, foreign exchange depreciation of $8.2 billion and net

outflows of $4.6 billion.

For the second quarter of 2022, incentive fees were $7 million,

compared to $34 million for the second quarter of 2021. For the

first half of 2022, incentive fees were $33 million, compared to

$67 million for the first half of 2021.

OPERATING EXPENSES

Compensation and

Benefits

In managing compensation and benefits expense, we focus on

annual awarded compensation (cash compensation and benefits plus

deferred incentive compensation with respect to the applicable

year, net of estimated future forfeitures and excluding charges), a

non-GAAP measure. We believe annual awarded compensation reflects

the actual annual compensation cost more accurately than the GAAP

measure of compensation cost, which includes applicable-year cash

compensation and the amortization of deferred incentive

compensation principally attributable to previous years’ deferred

compensation. We believe that by managing our business using

awarded compensation with a consistent deferral policy, we can

better manage our compensation costs, increase our flexibility in

the future and build shareholder value over time.

For the second quarter of 2022, we accrued compensation and

benefits expense at an adjusted compensation1 ratio of 58.5%,

compared to the second-quarter 2021 ratio of 59.5%. This resulted

in $395 million of compensation and benefits expense, compared to

$489 million for the second quarter of 2021.

For the first half of 2022, adjusted compensation and benefits

expense1 was $804 million, compared to $874 million for the first

half of 2021.

We manage our compensation and benefits expense based on awarded

compensation with a consistent deferral policy. We take a

disciplined approach to compensation, and our goal is to maintain a

compensation-to-operating revenue ratio over the cycle in the mid-

to high-50s percentage range on both an awarded and adjusted basis,

with consistent deferral policies.

Non-Compensation Expense

Adjusted non-compensation expense1 for the second quarter of

2022, was $131 million, 10% higher than the second quarter of 2021.

The increase primarily reflects higher marketing and business

development expenses and technology investments. The ratio of

adjusted non-compensation expense to operating revenue for the

second quarter of 2022 was 19.4%, compared to 14.5% for the second

quarter of 2021.

Adjusted non-compensation expense1 for the first half of 2022

was $248 million, 12% higher than the first half of 2021. The ratio

of adjusted non-compensation expense to operating revenue for the

first half of 2022 was 18.0%, compared to 15.1% for the first half

of 2021.

Our goal remains to achieve an adjusted non-compensation

expense-to-operating revenue ratio over the cycle of 16% to

20%.

TAXES

The provision for taxes, on an adjusted basis1, was $34 million

for the second quarter and $73 million for the first half of 2022.

The effective tax rate on the same basis was 26.4% for the second

quarter and 25.9% for the first half of 2022, compared to 25.2% and

26.7% for the respective 2021 periods.

CAPITAL MANAGEMENT AND BALANCE SHEET

Our primary capital management goals include managing debt and

returning capital to shareholders through dividends and share

repurchases.

In the second quarter of 2022, Lazard returned $246 million to

shareholders, which included: $46 million in dividends; $199

million in share repurchases of our common stock; and $1 million in

satisfaction of employee tax obligations in lieu of share issuances

upon vesting of equity grants.

In the first half of 2022, Lazard returned $526 million to

shareholders, which included: $93 million in dividends; $375

million in share repurchases of our common stock; and $58 million

in satisfaction of employee tax obligations in lieu of share

issuances upon vesting of equity grants.

During the first half of 2022, we repurchased 10.6 million

shares, which included 5.9 million shares repurchased in the second

quarter. On July 27, 2022, our Board of Directors authorized

additional share repurchases of up to $500 million, which expires

as of December 31, 2024, bringing our total outstanding share

repurchase authorization to $559 million.

In addition, on July 27, 2022, our Board of Directors voted to

increase the quarterly dividend on Lazard’s outstanding common

stock by 6% to $0.50 per share. The dividend is payable on August

19, 2022, to stockholders of record on August 8, 2022.

Lazard’s financial position remains strong. As of June 30, 2022,

our cash and cash equivalents were $907 million, and stockholders’

equity related to Lazard’s interests was $716 million.

CONFERENCE CALL

Lazard will host a conference call at 8:00 a.m. EDT on July 28,

2022, to discuss the company’s financial results for the second

quarter and first half of 2022. The conference call can be accessed

via a live audio webcast available through Lazard’s Investor

Relations website at www.lazard.com,

or by dialing 1 800-420-1271 (U.S. and Canada) or +1 785-424-1603

(outside of the U.S. and Canada), 15 minutes prior to the start of

the call.

A replay of the conference call will be available by 10:00 a.m.

EDT, July 28, 2022, via the Lazard Investor Relations website at

www.lazard.com, or by dialing 1 (888) 215-1280 (U.S. and Canada) or

+1 (402) 220-4937 (outside of the U.S. and Canada).

ABOUT LAZARD

Lazard, one of the world's preeminent financial advisory and

asset management firms, operates from 41 cities across 26 countries

in North, Central and South America, Europe, Asia and Australia.

With origins dating to 1848, the firm provides advice on mergers

and acquisitions, strategic matters, restructuring and capital

structure, capital raising and corporate finance, as well as asset

management services to corporations, partnerships, institutions,

governments and individuals. For more information on Lazard, please

visit www.lazard.com. Follow Lazard at @Lazard.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements. In some

cases, you can identify these statements by forward-looking words

such as “may”, “might”, “will”, “should”, “could”, “would”,

“expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”,

“potential”, “target,” “goal”, or “continue”, and the negative of

these terms and other comparable terminology. These forward-looking

statements, which are subject to known and unknown risks,

uncertainties and assumptions about us, may include projections of

our future financial performance based on our growth strategies,

business plans and initiatives and anticipated trends in our

business. These forward-looking statements, including with respect

to the current COVID-19 pandemic, are only predictions based on our

current expectations and projections about future events. There are

important factors that could cause our actual results, level of

activity, performance or achievements to differ materially from the

results, level of activity, performance or achievements expressed

or implied by these forward-looking statements.

These factors include, but are not limited to, those discussed

in our Annual Report on Form 10-K under Item 1A “Risk Factors,” and

also discussed from time to time in our reports on Forms 10-Q and

8-K, including the following:

- A decline in general economic conditions or the global or

regional financial markets;

- A decline in our revenues, for example due to a decline in

overall mergers and acquisitions (M&A) activity, our share of

the M&A market or our assets under management (AUM);

- Losses caused by financial or other problems experienced by

third parties;

- Losses due to unidentified or unanticipated risks;

- A lack of liquidity, i.e., ready access to funds, for use in

our businesses; and

- Competitive pressure on our businesses and on our ability to

retain and attract employees at current compensation levels.

Although we believe the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, level of activity, performance or achievements.

Neither we nor any other person assumes responsibility for the

accuracy or completeness of any of these forward-looking

statements. You should not rely upon forward-looking statements as

predictions of future events. We are under no duty to update any of

these forward-looking statements after the date of this release to

conform our prior statements to actual results or revised

expectations and we do not intend to do so.

Lazard Ltd is committed to providing timely and accurate

information to the investing public, consistent with our legal and

regulatory obligations. To that end, Lazard and its operating

companies use their websites, Lazard’s Twitter account

(twitter.com/Lazard) and other social media sites to convey

information about their businesses, including the anticipated

release of quarterly financial results, quarterly financial,

statistical and business-related information, and the posting of

updates of assets under management in various mutual funds, hedge

funds and other investment products managed by Lazard Asset

Management LLC and Lazard Frères Gestion SAS. Investors can link to

Lazard and its operating company websites through

www.lazard.com.

ENDNOTES

1 A non-U.S. GAAP measure. See attached financial schedules and

related notes for a detailed explanation of adjustments to

corresponding U.S. GAAP results. We believe that presenting our

results on an adjusted basis, in addition to the U.S. GAAP results,

is the most meaningful and useful way to compare our operating

results across periods.

2 Second-quarter and first-half 2022 adjusted results1 exclude

pre-tax charges of $0.9 million and $2.0 million, respectively,

relating to office space reorganization. On a U.S. GAAP basis,

these resulted in a net charge of $0.6 million, or $0.01 (diluted)

per share, for the second quarter, and a net charge of $1.4

million, or $0.01 (diluted) per share, for the first half of

2022.

LAZ-EPE

LAZARD LTD

UNAUDITED CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

(U.S. GAAP)

Three Months Ended

% Change From

June 30,

March 31,

June 30,

March 31,

June 30,

($ in thousands, except per share

data)

2022

2022

2021

2022

2021

Total revenue

$

660,658

$

716,144

$

843,264

(8%)

(22%)

Interest expense

(21,112

)

(21,252

)

(20,127

)

Net revenue

639,546

694,892

823,137

(8%)

(22%)

Operating expenses:

Compensation and benefits

363,830

396,841

514,918

(8%)

(29%)

Occupancy and equipment

29,409

31,239

29,875

Marketing and business development

22,673

14,123

9,332

Technology and information services

42,067

37,931

35,774

Professional services

16,549

16,029

19,996

Fund administration and outsourced

services

28,551

29,703

31,302

Amortization of intangible assets related

to acquisitions

15

15

15

Other

10,614

9,283

15,664

Subtotal

149,878

138,323

141,958

8%

6%

Operating expenses

513,708

535,164

656,876

(4%)

(22%)

Operating income

125,838

159,728

166,261

(21%)

(24%)

Provision for income taxes

34,187

38,753

41,345

(12%)

(17%)

Net income

91,651

120,975

124,916

(24%)

(27%)

Net income (loss) attributable to

noncontrolling interests

(3,829

)

7,099

1,738

Net income attributable to Lazard Ltd

$

95,480

$

113,876

$

123,178

(16%)

(22%)

Attributable to Lazard Ltd Common

Stockholders:

Weighted average shares

outstanding:

Basic

98,660,173

102,547,277

106,746,654

(4%)

(8%)

Diluted

102,753,336

108,186,642

113,603,478

(5%)

(10%)

Net income per share:

Basic

$

0.96

$

1.09

$

1.14

(12%)

(16%)

Diluted

$

0.92

$

1.05

$

1.08

(12%)

(15%)

LAZARD LTD

UNAUDITED CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

(U.S. GAAP)

Six Months Ended

June 30,

June 30,

($ in thousands, except per share

data)

2022

2021

% Change

Total revenue

$

1,376,802

$

1,523,168

(10%)

Interest expense

(42,364

)

(39,924

)

Net revenue

1,334,438

1,483,244

(10%)

Operating expenses:

Compensation and benefits

760,671

916,464

(17%)

Occupancy and equipment

60,648

64,623

Marketing and business development

36,796

15,983

Technology and information services

79,998

69,444

Professional services

32,578

34,944

Fund administration and outsourced

services

58,254

60,581

Amortization of intangible assets related

to acquisitions

30

30

Other

19,897

20,624

Subtotal

288,201

266,229

8%

Operating expenses

1,048,872

1,182,693

(11%)

Operating income

285,566

300,551

(5%)

Provision for income taxes

72,940

84,809

(14%)

Net income

212,626

215,742

(1%)

Net income attributable to noncontrolling

interests

3,270

5,264

Net income attributable to Lazard Ltd

$

209,356

$

210,478

(1%)

Attributable to Lazard Ltd Common

Stockholders:

Weighted average shares

outstanding:

Basic

100,603,724

107,019,107

(6%)

Diluted

105,469,988

114,712,885

(8%)

Net income per share:

Basic

$

2.05

$

1.94

6%

Diluted

$

1.97

$

1.83

8%

LAZARD LTD

UNAUDITED CONDENSED

CONSOLIDATED

STATEMENT OF FINANCIAL

CONDITION

(U.S. GAAP)

June 30,

December 31,

($ in thousands)

2022

2021

ASSETS

Cash and cash equivalents

$

907,472

$

1,465,022

Deposits with banks and short-term

investments

1,700,961

1,347,544

Restricted cash

617,057

617,448

Receivables

739,702

805,809

Investments

787,139

1,007,339

Property

231,502

250,005

Goodwill and other intangible assets

378,004

379,571

Operating lease right-of-use assets

435,450

466,054

Deferred tax assets

408,187

435,308

Other assets

506,322

373,081

Total Assets

$

6,711,796

$

7,147,181

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS &

STOCKHOLDERS' EQUITY

Liabilities

Deposits and other customer payables

$

1,831,825

$

1,442,701

Accrued compensation and benefits

494,464

972,303

Operating lease liabilities

520,025

552,522

Tax receivable agreement obligation

192,473

213,434

Senior debt

1,686,471

1,685,227

Other liabilities

583,871

628,030

Total liabilities

5,309,129

5,494,217

Commitments and contingencies

Redeemable noncontrolling interests

575,710

575,000

Stockholders' equity

Preferred stock, par value $.01 per

share

-

-

Common stock, par value $.01 per share

1,128

1,128

Additional paid-in capital

71,918

144,729

Retained earnings

1,628,182

1,560,636

Accumulated other comprehensive loss, net

of tax

(290,029

)

(223,847

)

Subtotal

1,411,199

1,482,646

Class A common stock held by subsidiaries,

at cost

(695,537

)

(507,426

)

Total Lazard Ltd stockholders' equity

715,662

975,220

Noncontrolling interests

111,295

102,744

Total stockholders' equity

826,957

1,077,964

Total liabilities, redeemable

noncontrolling interests and stockholders' equity

$

6,711,796

$

7,147,181

LAZARD LTD

SELECTED SUMMARY FINANCIAL

INFORMATION (a)

(Non-GAAP - unaudited)

Three Months Ended

% Change From

June 30,

March 31,

June 30,

March 31,

June 30,

($ in thousands, except per share

data)

2022

2022

2021

2022

2021

Revenues:

Financial Advisory

$

406,792

$

388,130

$

471,075

5%

(14%)

Asset Management

265,707

311,781

343,453

(15%)

(23%)

Corporate

3,412

(1,276

)

6,918

NM

(51%)

Operating revenue (b)

$

675,911

$

698,635

$

821,446

(3%)

(18%)

Expenses:

Adjusted compensation and benefits

expense (c)

$

395,407

$

408,702

$

488,760

(3%)

(19%)

Ratio of adjusted compensation to

operating revenue

58.5%

58.5%

59.5%

Non-compensation expense (d)

$

130,941

$

117,126

$

118,830

12%

10%

Ratio of non-compensation to operating

revenue

19.4%

16.8%

14.5%

Earnings:

Earnings from operations (e)

$

149,563

$

172,807

$

213,856

(13%)

(30%)

Operating margin (f)

22.1%

24.7%

26.0%

Adjusted net income (g)

$

96,108

$

114,692

$

145,798

(16%)

(34%)

Diluted adjusted net income per

share

$

0.92

$

1.05

$

1.28

(12%)

(28%)

Diluted weighted average shares (h)

104,767,897

109,178,143

114,058,944

(4%)

(8%)

Effective tax rate (i)

26.4%

25.4%

25.2%

This presentation includes non-U.S. GAAP

("non-GAAP") measures. Our non-GAAP measures are not meant to be

considered in isolation or as a substitute for the corresponding

U.S. GAAP measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with U.S.

GAAP. For a detailed explanation of the adjustments made to the

corresponding U.S. GAAP measures, see Reconciliation of U.S. GAAP

to Selected Summary Financial Information and Notes to Financial

Schedules.

LAZARD LTD

SELECTED SUMMARY FINANCIAL

INFORMATION (a)

(Non-GAAP - unaudited)

Six Months Ended

June 30,

June 30,

($ in thousands, except per share

data)

2022

2021

% Change

Revenues:

Financial Advisory

$

794,922

$

788,375

1%

Asset Management

577,488

671,367

(14%)

Corporate

2,136

9,566

(78%)

Operating revenue (b)

$

1,374,546

$

1,469,308

(6%)

Expenses:

Adjusted compensation and benefits

expense (c)

$

804,109

$

874,238

(8%)

Ratio of adjusted compensation to

operating revenue

58.5%

59.5%

Non-compensation expense (d)

$

248,067

$

221,310

12%

Ratio of non-compensation to operating

revenue

18.0%

15.1%

Earnings:

Earnings from operations (e)

$

322,370

$

373,760

(14%)

Operating margin (f)

23.5%

25.4%

Adjusted net income (g)

$

210,800

$

247,019

(15%)

Diluted adjusted net income per

share

$

1.97

$

2.15

(8%)

Diluted weighted average shares (h)

106,973,019

114,958,432

(7%)

Effective tax rate (i)

25.9%

26.7%

This presentation includes non-GAAP

measures. Our non-GAAP measures are not meant to be considered in

isolation or as a substitute for the corresponding U.S. GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with U.S.

GAAP. For a detailed explanation of the adjustments made to the

corresponding U.S. GAAP measures, see Reconciliation of U.S. GAAP

to Selected Summary Financial Information and Notes to Financial

Schedules.

LAZARD LTD

ASSETS UNDER MANAGEMENT

("AUM")

(unaudited)

($ in millions)

As of

Variance

June 30,

March 31,

December 31,

2022

2022

2021

Qtr to Qtr

YTD

Equity:

Emerging Markets

$

22,656

$

26,575

$

31,227

(14.7%)

(27.4%)

Global

48,742

55,810

59,516

(12.7%)

(18.1%)

Local

46,617

53,832

56,310

(13.4%)

(17.2%)

Multi-Regional

52,259

64,810

73,953

(19.4%)

(29.3%)

Total Equity

170,274

201,027

221,006

(15.3%)

(23.0%)

Fixed Income:

Emerging Markets

9,948

11,997

12,231

(17.1%)

(18.7%)

Global

12,380

13,881

14,410

(10.8%)

(14.1%)

Local

5,302

5,652

6,022

(6.2%)

(12.0%)

Multi-Regional

12,299

13,454

13,623

(8.6%)

(9.7%)

Total Fixed Income

39,929

44,984

46,286

(11.2%)

(13.7%)

Alternative Investments

4,145

4,483

4,203

(7.5%)

(1.4%)

Private Equity

1,268

1,256

1,290

0.9%

(1.7%)

Cash Management

1,010

925

954

9.2%

5.9%

Total AUM

$

216,626

$

252,675

$

273,739

(14.3%)

(20.9%)

Three Months Ended June 30,

Six Months Ended June 30,

2022

2021

2022

2021

AUM - Beginning of Period

$

252,675

$

264,852

$

273,739

$

258,642

Net Flows

(4,649

)

(828

)

(11,174

)

(2,507

)

Market and foreign exchange

appreciation (depreciation)

(31,400

)

13,354

(45,939

)

21,243

AUM - End of Period

$

216,626

$

277,378

$

216,626

$

277,378

Average AUM

$

230,162

$

275,851

$

243,263

$

268,657

% Change in average AUM

(16.6%)

(9.5%)

Note: Average AUM generally represents the

average of the monthly ending AUM balances for the period.

LAZARD LTD

RECONCILIATION OF U.S. GAAP TO

SELECTED SUMMARY FINANCIAL INFORMATION (a)

(unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

($ in thousands, except per share

data)

2022

2022

2021

2022

2021

Operating Revenue

Net revenue - U.S. GAAP Basis

$

639,546

$

694,892

$

823,137

$

1,334,438

$

1,483,244

Adjustments:

Revenue related to noncontrolling

interests (j)

(660

)

(10,795

)

(5,754

)

(11,455

)

(12,115

)

(Gains) losses related to Lazard Fund

Interests ("LFI") and other similar arrangements

35,098

14,323

(16,491

)

49,421

(23,978

)

Distribution fees, reimbursable deal

costs, bad debt expense and other (k)

(17,083

)

(18,822

)

(21,625

)

(35,905

)

(38,335

)

Losses associated with restructuring and

closing of certain offices (l)

-

-

23,579

-

23,579

Interest expense

19,010

19,037

18,600

38,047

36,913

Operating revenue, as adjusted (b)

$

675,911

$

698,635

$

821,446

$

1,374,546

$

1,469,308

Compensation and Benefits

Expense

Compensation and benefits expense - U.S.

GAAP Basis

$

363,830

$

396,841

$

514,918

$

760,671

$

916,464

Adjustments:

(Charges) credits pertaining to LFI and

other similar arrangements

35,098

14,323

(16,491

)

49,421

(23,978

)

Expenses associated with restructuring and

closing of certain offices (m)

-

-

(7,287

)

-

(13,910

)

Compensation related to noncontrolling

interests (j)

(3,521

)

(2,462

)

(2,380

)

(5,983

)

(4,338

)

Compensation and benefits expense, as

adjusted (c)

$

395,407

$

408,702

$

488,760

$

804,109

$

874,238

Non-Compensation

Expense

Non-compensation expense - Subtotal - U.S.

GAAP Basis

$

149,878

$

138,323

$

141,958

$

288,201

$

266,229

Adjustments:

Expenses related to office space

reorganization (n)

(871

)

(1,124

)

(1,237

)

(1,995

)

(2,653

)

Distribution fees, reimbursable deal

costs, bad debt expense and other (k)

(17,083

)

(18,822

)

(21,625

)

(35,905

)

(38,335

)

Amortization of intangible assets related

to acquisitions

(15

)

(15

)

(15

)

(30

)

(30

)

Income (expenses) associated with

restructuring and closing of certain offices (m)

-

-

1,586

-

(1,385

)

Non-compensation expense related to

noncontrolling interests (j)

(968

)

(1,236

)

(1,837

)

(2,204

)

(2,516

)

Non-compensation expense, as adjusted

(d)

$

130,941

$

117,126

$

118,830

$

248,067

$

221,310

Pre-Tax Income and Earnings

From Operations

Operating Income - U.S. GAAP Basis

$

125,838

$

159,728

$

166,261

$

285,566

$

300,551

Adjustments:

Losses associated with restructuring and

closing of certain offices (l)

-

-

23,579

-

23,579

Expenses related to office space

reorganization (n)

871

1,124

1,237

1,995

2,653

Expenses associated with restructuring and

closing of certain offices (m)

-

-

5,701

-

15,295

Net income (loss) related to

noncontrolling interests (j)

3,829

(7,099

)

(1,738

)

(3,270

)

(5,264

)

Pre-tax income, as adjusted

130,538

153,753

195,040

284,291

336,814

Interest expense

19,010

19,037

18,600

38,047

36,913

Amortization of intangible assets related

to acquisitions and other

15

17

216

32

33

Earnings from operations, as adjusted

(e)

$

149,563

$

172,807

$

213,856

$

322,370

$

373,760

Net Income attributable to

Lazard Ltd

Net income attributable to Lazard Ltd -

U.S. GAAP Basis

$

95,480

$

113,876

$

123,178

$

209,356

$

210,478

Adjustments:

Losses associated with restructuring and

closing of certain offices (l)

-

-

23,579

-

23,579

Expenses related to office space

reorganization (n)

871

1,124

1,237

1,995

2,653

Expenses associated with restructuring and

closing of certain offices (m)

-

-

5,701

-

15,295

Tax benefit allocated to adjustments

(243

)

(308

)

(7,897

)

(551

)

(4,986

)

Net income, as adjusted (g)

$

96,108

$

114,692

$

145,798

$

210,800

$

247,019

Diluted Weighted Average

Shares Outstanding

Diluted Weighted Average Shares

Outstanding - U.S. GAAP Basis

102,753,336

108,186,642

113,603,478

105,469,988

114,712,885

Adjustment: participating securities

including profits interest participation rights

2,014,561

991,501

455,466

1,503,031

245,547

Diluted Weighted Average Shares

Outstanding, as adjusted (h)

104,767,897

109,178,143

114,058,944

106,973,019

114,958,432

Diluted net income per share:

U.S. GAAP Basis

$

0.92

$

1.05

$

1.08

$

1.97

$

1.83

Non-GAAP Basis, as adjusted

$

0.92

$

1.05

$

1.28

$

1.97

$

2.15

This presentation includes non-GAAP

measures. Our non-GAAP measures are not meant to be considered in

isolation or as a substitute for the corresponding U.S. GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with U.S.

GAAP. For a detailed explanation of the adjustments made to the

corresponding U.S. GAAP measures, see Notes to Financial

Schedules.

See Notes to Financial

Schedules

LAZARD LTD

RECONCILIATION OF

NON-COMPENSATION U.S. GAAP TO ADJUSTED (a)

(unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

($ in thousands)

2022

2022

2021

2022

2021

Non-compensation expense - U.S. GAAP

Basis:

Occupancy and equipment

$

29,409

$

31,239

$

29,875

$

60,648

$

64,623

Marketing and business development

22,673

14,123

9,332

36,796

15,983

Technology and information services

42,067

37,931

35,774

79,998

69,444

Professional services

16,549

16,029

19,996

32,578

34,944

Fund administration and outsourced

services

28,551

29,703

31,302

58,254

60,581

Amortization of intangible assets related

to acquisitions

15

15

15

30

30

Other

10,614

9,283

15,664

19,897

20,624

Non-compensation expense - Subtotal - U.S.

GAAP Basis

$

149,878

$

138,323

$

141,958

$

288,201

$

266,229

Non-compensation expense -

Adjustments:

Occupancy and equipment (j) (m) (n)

$

(932

)

$

(1,183

)

$

788

$

(2,115

)

$

(3,397

)

Marketing and business development (j) (k)

(m)

(2,043

)

(1,225

)

(1,247

)

(3,268

)

(1,452

)

Technology and information services (j)

(k) (m)

(61

)

(30

)

(88

)

(91

)

(102

)

Professional services (j) (k) (m) (n)

(403

)

(738

)

(2,054

)

(1,141

)

(3,515

)

Fund administration and outsourced

services (j) (k)

(15,680

)

(16,512

)

(16,826

)

(32,192

)

(32,096

)

Amortization of intangible assets related

to acquisitions

(15

)

(15

)

(15

)

(30

)

(30

)

Other (j) (k) (n)

197

(1,494

)

(3,686

)

(1,297

)

(4,327

)

Subtotal Non-compensation adjustments

$

(18,937

)

$

(21,197

)

$

(23,128

)

$

(40,134

)

$

(44,919

)

Non-compensation expense, as adjusted:

Occupancy and equipment

$

28,477

$

30,056

$

30,663

$

58,533

$

61,226

Marketing and business development

20,630

12,898

8,085

33,528

14,531

Technology and information services

42,006

37,901

35,686

79,907

69,342

Professional services

16,146

15,291

17,942

31,437

31,429

Fund administration and outsourced

services

12,871

13,191

14,476

26,062

28,485

Amortization of intangible assets related

to acquisitions

-

-

-

-

-

Other

10,811

7,789

11,978

18,600

16,297

Non-compensation expense, as adjusted

(d)

$

130,941

$

117,126

$

118,830

$

248,067

$

221,310

This presentation includes non-GAAP

measures. Our non-GAAP measures are not meant to be considered in

isolation or as a substitute for the corresponding U.S. GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with U.S.

GAAP. For a detailed explanation of the adjustments made to the

corresponding U.S. GAAP measures, see Notes to Financial

Schedules.

See Notes to Financial

Schedules

LAZARD LTD

Notes to Financial

Schedules

(a)

Selected Summary Financial Information are

non-GAAP measures. Lazard believes that presenting results and

measures on an adjusted basis in conjunction with U.S. GAAP

measures provides a meaningful and useful basis for comparison of

its operating results across periods.

(b)

A non-GAAP measure which excludes (i)

revenue related to noncontrolling interests (see (j) below), (ii)

(gains) losses related to the changes in the fair value of

investments held in connection with Lazard Fund Interests and other

similar deferred compensation arrangements for which a

corresponding equal amount is excluded from compensation &

benefits expense, (iii) revenue related to distribution fees,

reimbursable deal costs in accordance with the revenue recognition

guidance, bad debt expense, and other (see (k) below), (iv) for the

three and six month periods ended June 30, 2021, losses associated

with restructuring and closing of certain offices (see (l) below),

and (v) interest expense primarily related to corporate financing

activities.

(c)

A non-GAAP measure which excludes (i)

(charges) credits related to the changes in the fair value of the

compensation liability recorded in connection with Lazard Fund

Interests and other similar deferred compensation arrangements,

(ii) for the three and six month periods ended June 30, 2021,

expenses associated with restructuring and closing of certain

offices (see (m) below), and (iii) compensation and benefits

related to noncontrolling interests (see (j) below).

(d)

A non-GAAP measure which excludes (i)

expenses related to office space reorganization (see (n) below),

(ii) expenses related to distribution fees, reimbursable deal costs

in accordance with the revenue recognition guidance, bad debt

expense, and other (see (k) below), (iii) amortization of

intangible assets related to acquisitions, (iv) for the three and

six month periods ended June 30, 2021, income (expenses) associated

with restructuring and closing of certain offices (see (m) below),

and (v) expenses related to noncontrolling interests (see (j)

below).

(e)

A non-GAAP measure which excludes (i) for

the three and six month periods ended June 30, 2021, losses

associated with restructuring and closing of certain offices (see

(l) below), (ii) expenses related to office space reorganization

(see (n) below), (iii) for the three and six month periods ended

June 30, 2021, expenses associated with restructuring and closing

of certain offices (see (m) below), (iv) net revenue and expenses

related to noncontrolling interests (see (j) below), (v) interest

expense primarily related to corporate financing activities, and

(vi) amortization of intangible assets related to acquisitions.

(f)

Represents earnings from operations as a

percentage of operating revenue, and is a non-GAAP measure.

(g)

A non-GAAP measure which excludes (i) for

the three and six month periods ended June 30, 2021, losses

associated with restructuring and closing of certain offices (see

(l) below), (ii) expenses related to office space reorganization

(see (n) below), and (iii) for the three and six month periods

ended June 30, 2021, expenses associated with restructuring and

closing of certain offices (see (m) below), net of tax

benefits.

(h)

A non-GAAP measure which includes units of

the long-term incentive compensation program consisting of profits

interest participation rights, which are equity incentive awards

that, subject to certain conditions, may be exchanged for shares of

our common stock. Certain profits interest participation rights and

other participating securities may be excluded from the computation

of outstanding stock equivalents for U.S. GAAP net income per

share.

(i)

Effective tax rate is a non-GAAP measure

based upon the U.S. GAAP rate with adjustments for the tax

applicable to the non-GAAP adjustments to operating income,

generally based upon the effective marginal tax rate in the

applicable jurisdiction of the adjustments. The computation is

based on a quotient, the numerator of which is the provision for

income taxes of $34,430, $39,061, and $49,242 for the three month

periods ended June 30, 2022, March 31, 2022, and June 30, 2021,

respectively, $73,491 and $89,795 for the six month periods ended

June 30, 2022 and 2021 and the denominator of which is pre-tax

income of $130,538, $153,753, and $195,040 for the three month

periods ended June 30, 2022, March 31, 2022, and June 30, 2021,

respectively, $284,291 and $336,814 for the six month periods ended

June 30, 2022 and 2021.

(j)

Noncontrolling interests include revenue

and expenses principally related to Edgewater, ESC Funds and a

Special Purpose Acquisition Company.

(k)

Represents certain distribution,

introducer and management fees paid to third parties and

reimbursable deal costs for which an equal amount is excluded from

both non-GAAP operating revenue and non-compensation expense,

respectively, and excludes bad debt expense, which represents fees

that are deemed uncollectible.

(l)

Represents losses related to the

reclassification of currency translation adjustments to earnings

from accumulated other comprehensive loss associated with

restructuring and closing of certain of our offices.

(m)

Expenses associated with restructuring and

closing of certain offices.

(n)

Represents building depreciation and other

costs related to office space reorganization.

NM

Not meaningful

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220728005296/en/

Media Contact: Judi Frost Mackey +1 212 632 1428

judi.mackey@lazard.com Investor Contact: Alexandra Deignan +1 212

632 6886 alexandra.deignan@lazard.com

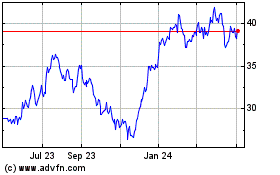

Lazard (NYSE:LAZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

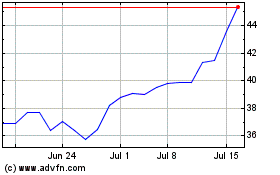

Lazard (NYSE:LAZ)

Historical Stock Chart

From Apr 2023 to Apr 2024