Kinetik Announces $200 Million Private Placement of Additional 6.625% Sustainability-Linked Senior Notes due 2028

December 15 2023 - 8:24AM

Business Wire

Kinetik Holdings Inc. (NYSE: KNTK) (“Kinetik”) announced

today that its subsidiary, Kinetik Holdings LP (the

“Issuer”), intends to offer, subject to market and other

conditions, $200 million aggregate principal amount of

sustainability-linked senior notes due 2028 (the “Senior

Notes”) in an offering (the “Offering”) pursuant to Rule

144A and Regulation S under the Securities Act of 1933, as amended

(the “Securities Act”). The Senior Notes are being offered

as additional notes under the indenture dated as of December 6,

2023, as may be supplemented from time to time (the

“Indenture”), pursuant to which the Issuer has previously

issued $500 million aggregate principal amount of 6.625%

Sustainability-Linked Senior Notes due 2028 (the “Existing

Notes”). The Senior Notes will have substantially identical

terms, other than the issue date and issue price, as the Existing

Notes, and the Senior Notes and the Existing Notes will be treated

as a single series of securities under the Indenture and will vote

together as a single class. The Issuer intends to use the net

proceeds from the Offering to repay a portion of the outstanding

borrowings under its existing Term Loan Credit Facility.

The interest rate on the Senior Notes is linked to Kinetik’s

performance against sustainability performance targets related to

greenhouse gas and methane emissions reduction targets and the

representation of women in corporate officer positions. Kinetik

published a Sustainability-Linked Financing Framework (the

“Framework”) on May 16, 2022 and obtained a second party

opinion (“SPO”) on the Framework from ISS ESG. The Framework

and the SPO are available on Kinetik’s website.

The Senior Notes have not been and will not be registered under

the Securities Act or the securities laws of any state and may not

be offered or sold in the United States absent registration or an

applicable exemption from the registration requirements under the

Securities Act and applicable state securities laws.

The Senior Notes will be offered only to persons reasonably

believed to be qualified institutional buyers under Rule 144A under

the Securities Act and to non-U.S. persons outside the United

States under Regulation S under the Securities Act.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor shall there be

any sale of any securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Kinetik Holdings Inc.

Kinetik is a fully integrated, pure-play, Permian-to-Gulf Coast

midstream C-corporation operating in the Delaware Basin. Kinetik is

headquartered in Midland, Texas and has a significant presence in

Houston, Texas. Kinetik provides comprehensive gathering,

transportation, compression, processing and treating services for

companies that produce natural gas, natural gas liquids, crude oil

and water.

Forward-looking statements

This news release includes certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws. Forward-looking statements include, but are not

limited to, statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “seeks,” “possible,” “potential,”

“predict,” “project,” “prospects,” “guidance,” “outlook,” “should,”

“would,” “will,” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. These statements

include, but are not limited to, statements about Kinetik’s future

plans, expectations, and objectives for Kinetik’s operations,

including statements about strategy, synergies, and future

operations, sustainability initiatives, the Offering and the use of

proceeds therefrom. While forward-looking statements are based on

assumptions and analyses made by us that we believe to be

reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties which could cause our actual

results, performance, and financial condition to differ materially

from our expectations. See Part I, Item 1A. Risk Factors in our

Annual Report on Form 10-K for the year ended December 31, 2022.

Any forward-looking statement made by us in this news release

speaks only as of the date on which it is made. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

development, or otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231215226328/en/

Kinetik Investors: (713) 487-4832 Maddie Wagner (713) 574-4743

Alex Durkee

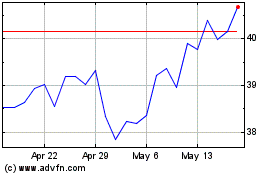

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Oct 2024 to Nov 2024

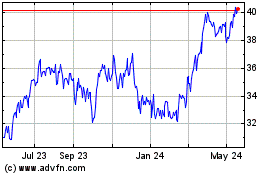

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Nov 2023 to Nov 2024