SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF A FOREIGN ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

April 30, 2015

Commission File Number 001-36761

Kenon

Holdings Ltd.

1 Temasek Avenue #36-01

Millenia Tower

Singapore

039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

If ‘‘Yes’’ is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM

S-8 (FILE NO. 333-201716) OF KENON HOLDINGS LTD. AND IN THE PROSPECTUSES RELATING TO SUCH REGISTRATION STATEMENT.

Exhibits

|

|

|

|

|

| 99.1 |

|

Press Release dated April 30, 2015: Kenon Provides Updates on its Interests in Tower and Qoros |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

KENON HOLDINGS LTD. |

|

|

|

|

| Date: April 30, 2015 |

|

|

|

By: |

|

/s/ Yoav Doppelt |

|

|

|

|

Name: |

|

Yoav Doppelt |

|

|

|

|

Title: |

|

Chief Executive Officer |

Exhibit 99.1

Kenon Provides Updates on its Interests in Tower and Qoros

For immediate release

Singapore, April 30, 2015

Key Highlights

| |

• |

|

Kenon Holdings Ltd.’s (“Kenon”) Board of Directors has approved the convocation of an Extraordinary General Meeting (“EGM”) to seek approval for a capital reduction in connection with

Kenon’s proposed distribution of Kenon’s shares in Tower Semiconductor Ltd. (“Tower”) |

| |

• |

|

Kenon’s Board of Directors has approved an investment of RMB400 million (approximately $65 million) in Qoros Automotive Co., Ltd (“Qoros”) and a RMB175 million (approximately $28 million) guarantee of

a new Qoros bank financing |

Kenon is providing the following updates in respect of its stake in Tower, a specialty foundry manufacturer

listed on the NASDAQ Global Select Stock Market and Tel Aviv Stock Exchange in which Kenon has an approximately 24% interest, and its interest in Qoros, an automotive company based in China, in which Kenon indirectly owns a 50% interest.

Tower

Kenon’s Board of Directors Approves

Convocation of EGM and Proxy Solicitation in Respect of Kenon’s Proposed Distribution of Shares of Tower

Kenon’s Board of Directors has

approved the convocation of an EGM at which Kenon’s shareholders will be asked to approve a capital reduction to enable Kenon to distribute, on a pro rata basis, some, or all, of the 18,030,041 ordinary shares of Tower held by Kenon, as well as

1,699,795 ordinary shares of Tower underlying the 1,699,795 Series 9 Warrants of Tower (the “Warrants”) held by Kenon) (the “Proposed Distribution”). A Notice of EGM is expected to be announced, and a proxy solicitation is

expected to be commenced, on or about May 1, 2015. The EGM would be held not less than 21 days following the Notice of EGM. Further information about the Proposed Distribution, including tax consequences in certain jurisdictions, will be

included in a Proxy and Information Statement to be published at the time the EGM is announced.

The Proposed Distribution is one of the first key steps

in the implementation of Kenon’s strategy, and will provide Kenon’s shareholders with direct access to Tower, which Kenon believes is in the best interests of Kenon’s shareholders. For further information on Kenon’s strategies,

see Kenon’s Annual Report on Form 20-F filed with the SEC.

Qoros

Kenon’s Board of Directors Approves Kenon’s Provision of a RMB400 million (Approximately $65 Million) Shareholder Loan to Qoros and a RMB175

Million (Approximately $28 Million) Guarantee in Connection with Qoros’ Entry into a New Financing Agreement

Kenon’s Board of Directors has

approved a RMB400 million (approximately $65 million) shareholder loan to Qoros to promote its growth and development, subject to Chery Automobile Co. Ltd.’s (“Chery”) concurrent provision of a RMB400 million shareholder loan to

Qoros. In addition, Kenon’s Board of Directors has approved Kenon’s provision of a RMB175 million (approximately $28 million) direct, or back-to-back, guarantee (as discussed below) in connection with Qoros’ entry into a new

financing agreement, subject to Chery’s provision of a similar guarantee. Kenon’s investment in Qoros and the guarantee of its new financing facility is consistent with Kenon’s strategy to provide Qoros with additional equity capital,

loans, and/or credit support to assist it as it continues to pursue its commercial growth strategy.

Kenon expects all, or a portion, of the RMB400 million (approximately $65 million) shareholder loan to

convert into additional equity in Qoros upon the satisfaction of certain conditions, including the approval by the relevant Chinese authority. Chery, which (indirectly) owns the other 50% in Qoros, is expected to provide a RMB400 million shareholder

loan to Qoros concurrently with, and subject to the same terms and conditions as, Kenon’s shareholder loan to Qoros. As a result, Kenon’s ownership percentage in Qoros will not increase upon Qoros’ full, or partial, conversion of

Kenon’s RMB400 million shareholder loan into equity.

Kenon intends to fund the RMB400 million shareholder loan through drawdowns of $65 million

under its $200 million credit facility from Israel Corporation Ltd. (“IC”) (the “Credit Facility”). Under the terms of the Credit Facility, these drawdowns will require Kenon to pledge an additional 6.5% of its interest in IC

Power to IC. As a result of these drawdowns, the aggregate drawdowns under the Credit Facility will be $110 million and an aggregate 59.5% of Kenon’s equity interest in IC Power will be pledged to IC.

Qoros is negotiating a new RMB700 million (approximately $113 million) financing agreement, pursuant to which Qoros would initially be able to drawdown

up to RMB350 million (approximately $56 million). Any drawdowns in excess of RMB350 million would require approval from Qoros’ Board of Directors, and may require additional credit support from Qoros’ shareholders. Kenon has agreed to

provide a RMB175 million (approximately $28 million) guarantee of this facility, subject to Chery’s provision of a similar guarantee. Kenon’s guarantee may be provided as a back-to-back guarantee to Chery or directly to the banks. Any

credit support from Kenon in excess of the RMB175 million guarantee would require additional approval from Kenon’s Board of Directors.

The

shareholder loans and guarantees described above are in addition to the existing commitments of Kenon and Chery. Chery has previously agreed to provide a RMB400 loan to Qoros to match a corresponding RMB400 million loan made by Kenon earlier in

2015, subject to certain conditions, including the release of Chery’s RMB1.5 billion (approximately $242 million) guarantee of Qoros’ existing RMB3 billion credit facility. Kenon has agreed that if Chery’s loan is provided

without the corresponding release of Chery’s RMB 1.5 billion guarantee, Kenon and Chery will find an appropriate mechanism to restore equality between Chery and Kenon in respect of Chery’s guarantee of this credit facility, and such a

mechanism could involve Kenon providing further credit support to Qoros. In April 2015, Chery made a RMB200 million (approximately $32 million) shareholder loan to Qoros (representing half of the RMB400 million (approximately $65 million)

shareholder loan Chery had previously committed to provide to Qoros). There was no release of Chery’s guarantee in connection with its provision of this shareholder loan in April 2015.

About Kenon

Kenon is a newly-incorporated

holding company that operates dynamic, primarily growth-oriented businesses. The companies it owns, in whole or in part, are at various stages of development, ranging from established, cash generating businesses to early stage development companies.

Kenon’s businesses consist of:

| |

• |

|

IC Power (100% interest) – a leading owner, developer and operator of power generation facilities in the Latin American, Caribbean and Israeli power generation markets; |

| |

• |

|

Qoros (50% interest) – a China-based automotive company; |

| |

• |

|

ZIM Integrated Shipping Services, Ltd. (32% interest) – an international shipping company; |

| |

• |

|

Tower (24% of the currently outstanding shares of Tower) – a global foundry manufacturer, with shares traded on NASDAQ and the TASE; and |

| |

• |

|

Two early stage businesses in the renewable energy sector – Primus Green Energy, Inc. (91% interest) – a developer of alternative fuel technology and HelioFocus Ltd. (70% interest) – a developer of solar

technologies. |

Kenon’s primary focus is to grow and develop its primary businesses, IC Power and Qoros. Following the growth and

development of its primary businesses, Kenon intends to provide its shareholders with direct access to these businesses, when we believe it is in the best interests of its shareholders for it to do so based on factors specific to each business,

market conditions and other relevant information. Kenon intends to support the development of its non-primary businesses, and to act to realize their value for its shareholders by distributing its interests in its non-primary businesses to its

shareholders or selling its interests in its non-primary businesses, rationally and expeditiously. For further information on Kenon’s businesses and strategy, see Kenon’s publicly available filings, which can be found on the SEC’s

website at www.sec.gov. Please also see http://www.kenon-holdings.com for additional information.

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, (i) with respect to the Proposed Distribution, statements about the timing and convocation of an EGM, statements about the Proposed Distribution, including the maximum number of shares that may be distributed, conditions

to the Proposed Distribution, statements concerning the objectives of the Distribution and (ii) with respect to the loan to Qoros and the guarantee of Qoros’ new financing agreement, statements about Kenon’s approval of a loan to

Qoros and guarantee of certain of Qoros’ indebtedness, Kenon’s and Chery’s commitments to provide further loans and credit support to Qoros , statements about Kenon’s and Chery’s agreement to provide a mechanism for equality

in respect of Chery’s RMB1.5 billion guarantee of Chery’s existing credit facility (in the event that the loan Chery has previously committed to provide to Qoros is not accompanied by a release of this guarantee), statements about

Kenon’s strategy and other non-historical matters. These statements are based on Kenon’s management’s current expectations or beliefs, and are subject to uncertainty and changes in circumstances. These forward-looking statements are

subject to a number of risks and uncertainties, many of which are beyond Kenon’s control, which could cause the actual results to differ materially from those indicated in Kenon’s forward-looking statements. Such risks include

(i) with respect to the Proposed Distribution, risks related to a failure to successfully satisfy the conditions of the Proposed Distribution, including the receipt of required shareholder and any other required approvals or otherwise a failure

by Kenon to complete the Proposed Distribution, the number of shares ultimately distributed in the Proposed Distribution (which Kenon has not yet determined), and timing of the Proposed Distribution as well as tax consequences of the Proposed

Distribution and (ii) with respect to the loan to Qoros and the guarantee of Qoros’ new financing agreement, risks relating to the expected loans to Qoros and guarantees of its debt, including the conditions relating thereto, availability

of funding under Qoros’ new financing facility and possible conditions (including possible requirements for additional shareholder credit support) for drawings in excess of RMB350 million and other risks and factors, including those set forth

under the heading “Risk Factors” in Kenon’s Annual Report on Form 20-F, filed with the SEC. Except as required by law, Kenon undertakes no obligation to update these forward-looking statements, whether as a result of new information,

future events, or otherwise.

Contact Info

Kenon Holdings Ltd.

|

|

|

| Barak Cohen

VP Business Development and IR

barakc@kenon-holdings.com

Tel: +65 6351 1780; +972-54-3301100 |

|

Zongda Huang Associate Director,

Business Development & IR huangz@kenon-holdings.com Tel: +65 6351 1780 |

|

|

| External Investor Relations

Ehud Helft / Kenny Green

GK Investor Relations

kenon@gkir.com

Tel: 1 646 201 9246 |

|

|

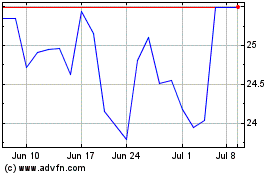

Kenon (NYSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kenon (NYSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024