|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

FORM N-Q

|

|

|

|

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

|

|

MANAGEMENT INVESTMENT COMPANIES

|

|

|

|

Investment Company Act file number

811- 8568

|

|

|

|

John Hancock Bank and Thrift Opportunity Fund

|

|

(Exact name of registrant as specified in charter)

|

|

|

|

601 Congress Street, Boston, Massachusetts 02210

|

|

(Address of principal executive offices) (Zip code)

|

|

|

|

Salvatore Schiavone

|

|

|

|

Treasurer

|

|

|

|

601 Congress Street

|

|

|

|

Boston, Massachusetts 02210

|

|

|

|

(Name and address of agent for service)

|

|

|

|

Registrant's telephone number, including area code:

617-663-4497

|

|

|

|

Date of fiscal year end:

|

October 31

|

|

|

|

|

|

Date of reporting period:

|

July 31, 2009

|

ITEM 1. SCHEDULE OF INVESTMENTS

John Hancock Bank and Thrift Opportunity Fund

Securities owned by the Fund on

July 31, 2009 (Unaudited)

|

|

|

|

|

|

|

|

Common stocks 88.70%

|

|

|

|

|

$295,858,761

|

|

(Cost $323,916,267)

|

|

|

|

|

|

|

|

|

Asset Management & Custody Banks 8.26%

|

|

|

|

|

27,564,573

|

|

Bank of New York Mellon Corp.

|

|

|

|

426,946

|

11,672,704

|

|

Northern Trust Corp.

|

|

|

|

78,712

|

4,707,765

|

|

State Street Corp.

|

|

|

|

222,348

|

11,184,104

|

|

|

|

Diversified Banks 9.49%

|

|

|

|

|

31,640,916

|

|

Comerica, Inc.

|

|

|

|

248,691

|

5,928,793

|

|

U.S. Bancorp.

|

|

|

|

744,625

|

15,197,796

|

|

Wells Fargo & Co.

|

|

|

|

429,858

|

10,514,327

|

|

|

|

Diversified Financial Services 9.85%

|

|

|

|

|

32,853,617

|

|

Bank of America Corp.

|

|

|

|

1,390,067

|

20,559,091

|

|

JPMorgan Chase & Co.

|

|

|

|

318,099

|

12,294,526

|

|

|

|

Regional Banks 52.37%

|

|

|

|

|

174,689,938

|

|

Avenue Bank

|

|

|

|

300,000

|

491,028

|

|

Bank of Marin Bancorp

|

|

|

|

14,868

|

474,289

|

|

BB&T Corp.

|

|

|

|

325,399

|

7,445,129

|

|

Beverly National Corp.

|

|

|

|

97,500

|

2,047,500

|

|

Bridge Capital Holdings (I)

|

|

|

|

150,564

|

925,969

|

|

Camden National Corp.

|

|

|

|

69,218

|

2,323,648

|

|

Centerstate Banks Inc.

|

|

|

|

251,686

|

1,759,285

|

|

City Holding Co.

|

|

|

|

41,459

|

1,335,809

|

|

CoBiz Financial, Inc. (L)

|

|

|

|

407,772

|

1,839,052

|

|

Cullen/Frost Bankers, Inc.

|

|

|

|

301,389

|

14,475,714

|

|

CVB Financial Corp.

|

|

|

|

201,122

|

1,516,460

|

|

DNB Financial Corp.

|

|

|

|

78,515

|

588,863

|

|

Eastern Virginia Bankshares, Inc.

|

|

|

|

100,000

|

874,000

|

|

ECB Bancorp, Inc.

|

|

|

|

27,504

|

446,665

|

|

F.N.B. Corp.

|

|

|

|

999,322

|

7,754,739

|

|

Fifth Third Bancorp

|

|

|

|

258,381

|

2,454,619

|

|

First Bancorp, Inc.

|

|

|

|

146,499

|

2,866,985

|

|

First Horizon National Corp.

|

|

|

|

65,493

|

839,620

|

|

Hancock Holding Co.

|

|

|

|

232,176

|

9,377,589

|

|

Harleysville National Corp.

|

|

|

|

151,897

|

832,396

|

|

Heritage Financial Corp.

|

|

|

|

92,940

|

1,194,279

|

|

Heritage Oaks Bancorp (I)

|

|

|

|

99,950

|

634,683

|

|

Huntington Bancshares, Inc.

|

|

|

|

325,975

|

1,333,238

|

|

IBERIABANK Corp.

|

|

|

|

126,717

|

5,935,424

|

|

Independent Bank Corp.

|

|

|

|

23,467

|

500,551

|

|

International Bancshares Corp. (L)

|

|

|

|

166,029

|

2,188,262

|

|

Investors Bancorp, Inc. (I)

|

|

|

|

45,534

|

450,331

|

|

KeyCorp

|

|

|

|

852,048

|

4,924,837

|

|

Lakeland Financial Corp.

|

|

|

|

144,802

|

2,835,223

|

|

M&T Bank Corp. (L)

|

|

|

|

219,416

|

12,796,341

|

|

MB Financial, Inc.

|

|

|

|

156,100

|

2,146,375

|

|

Northrim Bancorp., Inc.

|

|

|

|

77,232

|

1,135,310

|

|

Pacific Continental Corp.

|

|

|

|

242,191

|

2,574,491

|

|

Pinnacle Financial Partners, Inc. (I)

|

|

|

|

185,170

|

2,888,652

|

|

PNC Financial Services Group, Inc.

|

|

|

|

305,689

|

11,206,559

|

|

Prosperity Bancshares, Inc.

|

|

|

|

19,787

|

663,062

|

|

Regions Financial Corp. (L)

|

|

|

|

1,005,675

|

4,445,083

|

|

S&T Bancorp, Inc. (L)

|

|

|

|

154,700

|

2,120,937

|

|

S.Y. Bancorp, Inc. (L)

|

|

|

|

28,933

|

711,173

|

|

SCBT Financial Corp.

|

|

|

|

78,056

|

2,005,259

|

|

Signature Bank (I)

|

|

|

|

365,903

|

10,786,820

|

John Hancock Bank and Thrift Opportunity Fund

Securities owned by the Fund on

July 31, 2009 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

Value

|

|

|

|

Regional Banks (continued)

|

|

|

|

|

|

|

Smithtown Bancorp, Inc.

|

|

|

|

133,069

|

1,538,278

|

|

South Financial Group, Inc.

|

|

|

|

1,517,444

|

2,443,085

|

|

Southcoast Financial Corp. (I)

|

|

|

|

64,413

|

334,303

|

|

SunTrust Banks, Inc.

|

|

|

|

227,039

|

4,427,260

|

|

SVB Financial Group (I)

|

|

|

|

338,489

|

11,931,737

|

|

Synovus Financial Corp.

|

|

|

|

517,302

|

1,815,730

|

|

TCF Financial Corp. (L)

|

|

|

|

355,338

|

5,024,479

|

|

Texas Capital Bancshares, Inc. (I)

|

|

|

|

130,106

|

2,161,061

|

|

Valley National Bancorp (L)

|

|

|

|

116,056

|

1,476,232

|

|

Washington Trust Bancorp, Inc.

|

|

|

|

198,110

|

3,597,678

|

|

Westamerica Bancorp

|

|

|

|

30,499

|

1,593,878

|

|

Zions Bancorp (L)

|

|

|

|

309,276

|

4,199,968

|

|

|

|

Thrifts & Mortgage Finance 8.73%

|

|

|

|

|

29,109,717

|

|

Beneficial Mutual Bancorp, Inc. (I)

|

|

|

|

7,497

|

66,948

|

|

Berkshire Hills Bancorp, Inc.

|

|

|

|

358,903

|

8,204,523

|

|

Dime Community Bancshares, Inc.

|

|

|

|

138,688

|

1,669,804

|

|

ESSA Bancorp, Inc.

|

|

|

|

78,292

|

1,054,593

|

|

Flushing Financial Corp.

|

|

|

|

136,439

|

1,447,618

|

|

Hingham Institution for Savings

|

|

|

|

80,000

|

2,708,000

|

|

LSB Corp.

|

|

|

|

65,000

|

701,350

|

|

Northwest Bancorp, Inc.

|

|

|

|

97,108

|

1,989,743

|

|

Parkvale Financial Corp.

|

|

|

|

17,600

|

153,120

|

|

People's United Financial, Inc.

|

|

|

|

590,723

|

9,599,249

|

|

WSFS Financial Corp.

|

|

|

|

56,374

|

1,514,769

|

|

|

|

|

|

|

|

Shares

|

Value

|

|

|

|

Preferred Stocks 4.28%

|

|

|

|

|

$14,279,596

|

|

(Cost $10,294,163)

|

|

|

|

|

|

|

|

|

Diversified Banks 0.15%

|

|

|

|

|

514,614

|

|

Wells Fargo & Co., 8.000%

|

|

|

|

21,487

|

514,614

|

|

|

|

Diversified Financial Services 3.24%

|

|

|

|

|

10,815,774

|

|

Bank of America Corp., 8.200% (L)

|

|

|

|

192,685

|

4,181,264

|

|

Bank of America Corp., 8.625%

|

|

|

|

196,064

|

4,454,574

|

|

East West Bancorp, Inc., Series A, 8.000%

|

|

|

|

1,166

|

885,111

|

|

Keycorp, Series A, 7.750%

|

|

|

|

12,500

|

1,010,000

|

|

Regions Financial Corp., Series B, 10.000%

|

|

|

|

269

|

284,825

|

|

|

|

Regional Banks 0.59%

|

|

|

|

|

1,948,708

|

|

CBG Florida REIT Corp., 7.114% (I) (S)

|

|

|

|

2,100,000

|

21,000

|

|

Fifth Third Capital Trust V, 7.250%

|

|

|

|

32,598

|

644,462

|

|

Fifth Third Capital Trust VI, 7.250%

|

|

|

|

32,589

|

643,307

|

|

Fifth Third Capital Trust VII, 8.875%

|

|

|

|

6,039

|

139,320

|

|

Keycorp Capital VIII, 7.000%

|

|

|

|

16,174

|

321,863

|

|

Keycorp Capital X, 8.000%

|

|

|

|

8,557

|

178,756

|

|

|

|

Thrifts & Mortgage Finance 0.30%

|

|

|

|

|

1,000,500

|

|

Webster Capital Trust IV, 7.650%

|

|

|

|

1,725,000

|

1,000,500

|

John Hancock Bank and Thrift Opportunity Fund

Securities owned by the Fund on

July 31, 2009 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Par value

|

Value

|

|

|

|

Convertible Preferred Stocks 1.64%

|

|

|

|

|

$5,459,140

|

|

(Cost $6,210,238)

|

|

|

|

|

|

|

|

|

Regional Banks 1.64%

|

|

|

|

|

5,459,140

|

|

Huntington Bancshares, Inc., 8.500%

|

|

|

|

5,267

|

3,829,109

|

|

South Financial Group, Inc., Series ND-V, 10.000%

|

|

|

|

793

|

196,466

|

|

South Financial Group, Inc., Series NDNV, 10.000%

|

|

|

|

2,638

|

653,565

|

|

Webster Financial Corp., 8.500%

|

|

|

|

1,000

|

780,000

|

|

|

|

|

|

|

|

Par value

|

Value

|

|

|

|

Capital Preferred Securities 0.00%

|

|

|

|

|

$600

|

|

(Cost $5,735,377)

|

|

|

|

|

|

|

|

|

Diversified Financial Services 0.00%

|

|

|

|

|

600

|

|

Preferred Term Securities XXV, Ltd., 6-22-37(I)

|

|

|

|

3,000,000

|

300

|

|

Preferred Term Securities XXVII, Ltd., 3-22-38(I)

|

|

|

|

3,000,000

|

300

|

|

|

|

|

|

Rate

|

|

Shares

|

Value

|

|

|

|

Short-term investments 12.77%

|

|

|

|

|

$42,599,948

|

|

(Cost $42,573,617)

|

|

|

|

|

|

|

|

|

Cash Equivalents 8.01%

|

|

|

|

|

26,727,864

|

|

John Hancock Collateral Investment Trust (T)(W)

|

|

0.4185% (Y)

|

|

2,669,876

|

26,727,864

|

|

|

|

|

|

|

|

|

|

|

Maturity

|

|

|

|

|

|

Rate

|

date

|

|

Par value

|

Value

|

|

|

|

Certificates of Deposit 0.02%

|

|

|

|

|

72,163

|

|

Country Bank For Savings

|

2.960%

|

08/31/10

|

|

1,785

|

1,785

|

|

First Bank Richmond

|

3.690

|

12/05/10

|

|

17,016

|

17,016

|

|

First Bank System, Inc.

|

2.374

|

04/01/11

|

|

4,585

|

4,585

|

|

First Federal Savings Bank of Louisiana

|

2.980

|

12/07/09

|

|

2,847

|

2,847

|

|

Framingham Cooperative Bank

|

4.500

|

09/10/09

|

|

3,401

|

3,401

|

|

Home Bank

|

4.150

|

12/04/10

|

|

16,275

|

16,275

|

|

Machias Savings Bank

|

1.980

|

05/24/11

|

|

1,782

|

1,782

|

|

Middlesex Savings Bank

|

3.500

|

08/19/10

|

|

1,818

|

1,818

|

|

Midstate Federal Savings and Loan

|

1.880

|

05/27/10

|

|

1,863

|

1,863

|

|

Milford Bank

|

3.400

|

06/04/11

|

|

1,666

|

1,666

|

|

Milford Federal Savings and Loan Assn.

|

3.150

|

02/28/10

|

|

1,836

|

1,836

|

|

Mount Mckinley Savings Bank

|

4.030

|

12/03/09

|

|

1,564

|

1,564

|

|

Mt. Washington Bank

|

3.200

|

10/13/09

|

|

1,965

|

1,965

|

|

Natick Savings Bank

|

1.580

|

08/31/09

|

|

1,832

|

1,832

|

|

Newburyport Bank

|

2.750

|

10/21/10

|

|

1,904

|

1,904

|

|

Newton Savings Bank

|

3.750

|

06/15/10

|

|

1,674

|

1,674

|

|

OBA Federal Savings and Loan

|

3.150

|

06/15/10

|

|

1,221

|

1,221

|

|

Plymouth Savings Bank

|

1.340

|

04/21/11

|

|

1,857

|

1,857

|

|

Randolph Savings Bank

|

4.000

|

09/13/09

|

|

1,714

|

1,714

|

|

Salem Five Cents Savings Bank

|

1.490

|

12/17/09

|

|

1,694

|

1,694

|

|

Sunshine Federal Savings and Loan Assn.

|

2.460

|

05/10/11

|

|

1,864

|

1,864

|

|

|

|

|

|

U.S. Government Agency 4.74%

|

|

|

|

|

15,799,921

|

|

Federal Home Loan Bank,

|

|

|

|

|

|

|

Discount Note

|

0.090%

|

08/03/09

|

|

15,800,000

|

15,799,921

|

John Hancock Bank and Thrift Opportunity Fund

Securities owned by the Fund on

July 31, 2009 (Unaudited)

|

|

|

|

Total investments (Cost $388,729,662)† 107.39%

|

$358,198,045

|

|

Other assets and liabilities, net (7.39%)

|

($24,637,247)

|

|

Total net assets 100.00%

|

$333,560,798

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of July 31, 2009.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(T) Represents investment of securities lending collateral.

(W) Issuer is an affiliate of John Hancock Advisers, LLC (the Adviser).

(Y) The rate shown is the annualized seven-day yield as of July 31, 2009.

† At July 31, 2009, the aggregate cost of investment securities for federal income tax purposes was $388,751,238. Net unrealized depreciation aggregated $30,553,193, of which $46,237,410 related to appreciated investment securities and $76,790,603 related to depreciated investment securities.

Notes to the Schedule of Investments (Unaudited)

Security valuation

Security Valuation Investments are stated at value as of the close of the regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. Equity securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated price if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent quotation service. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Equity and debt obligations, for which there are no prices available from an independent pricing service, are value based on broker quotes or fair valued as described below. Certain short-term debt instruments are valued at amortized cost. John Hancock Collateral Investment Trust (JHCIT), an affiliated registered investment company managed by MFC Global Investment Management (U.S.), LLC, a subsidiary of Manulife Financial Corporation (MFC), is valued at its net asset value each business day. JHCIT is a floating rate fund investing in money market instruments.

Other portfolio securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Fund’s Pricing Committee in accordance with procedures adopted by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of the Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic and market conditions, interest rates, investor perceptions and market liquidity.

Fair value measurements

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs and the valuation techniques used are summarized below:

•

Level 1 — Exchange traded prices in active markets for identical securities. This technique is used for exchange-traded domestic common and preferred equities, certain foreign equities, warrants, rights, options and futures. In addition, investment companies, including mutual Fund, are valued using this technique.

•

Level 2 — Prices determined using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and are based on an evaluation of the inputs described. These techniques are used for certain domestic preferred equities, certain foreign equities, unlisted rights and warrants, and fixed income securities. Also, over-the-counter derivative contracts, including swaps, foreign forward currency contracts, and certain options use these techniques.

•

Level 3 — Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity for an investment, unobservable inputs may be used. Unobservable inputs reflect the Trust’s Pricing Committee’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available. Securities using this technique are generally thinly traded or privately placed, and may be valued using broker quotes, which may not only use observable or unobservable inputs but may also include the use of the brokers’ own judgments about the assumptions that market participants would use.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of July 31, 2009, by major security category or security type.

|

|

|

|

|

|

|

Investments in

|

|

|

|

|

|

Securities

|

Level 1

|

Level 2

|

Level 3

|

Totals

|

|

Financials

|

$311,569,827

|

$ 3,340,476

|

$687,794

|

$315,598,097

|

|

Short-term Investments

|

26,727,864

|

15,872,084

|

-

|

42,599,948

|

|

Totals Investments in

|

|

|

|

|

|

Securities

|

$338,297,691

|

$19,212,560

|

$687,794

|

$358,198,045

|

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

|

|

|

|

|

Financials

|

|

Balance as of October 31, 2008

|

$8,745,400

|

|

Accrued discounts/premiums

|

1,826

|

|

Realized gain (loss)

|

-

|

|

Change in unrealized appreciation (depreciation)

|

(2,399,432)

|

|

Net purchases (sales)

|

-

|

|

Transfers in and/or out of level 3

|

(5,660,000)

|

|

Balance as of July 31, 2009

|

$687,794

|

Securities lending

The Fund may lend portfolio securities from time to time in order to earn additional income. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends associated with securities and to participate in any changes in their value. On the settlement date of the loan, the Fund receives cash collateral against the loaned securities and maintains the cash collateral in an amount no less than the market value of the loaned securities.

The market value of the loaned securities is determined at the close of business of the Fund. Any additional required cash collateral is delivered to the Fund or excess collateral is returned to the borrower on the next business day. Cash collateral received is invested in JHCIT. JHCIT is not a stable value fund and thus the Fund receives the benefit of any gains and bears any losses generated by JHCIT.

The Fund may receive compensation for lending their securities either in the form of fees, and/or by retaining a portion of interest on the investment of any cash received as collateral. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other

reasons, the Fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. The Fund bears the risk in the event that invested collateral is not sufficient to meet obligations due on loans.

Risk and uncertainties

Sector risk

The Fund may concentrate investments in a particular industry, sector of the economy or invest in a limited number of companies. The concentration is closely tied to a single sector of the economy which may cause the Fund to underperform other sectors. Specifically, financial services companies can be hurt by economic declines, changes in interest rates, regulatory and market impacts. Accordingly, the concentration may make the Fund’s value more volatile and investment values may rise and fall more rapidly.

ITEM 2. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-Q, the registrant's principal executive officer and principal accounting officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 3. EXHIBITS.

Separate certifications for the registrant's principal executive officer and principal accounting officer, as required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Bank and Thrift Opportunity Fund

By: /s/ Keith F. Hartstein

-------------------------------------

Keith F. Hartstein

President and Chief Executive Officer

Date: September 15, 2009

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Keith F. Hartstein

-------------------------------------

Keith F. Hartstein

President and Chief Executive Officer

Date: September 15, 2009

By: /s/ Charles A. Rizzo

-------------------------------------

Charles A. Rizzo

Chief Financial Officer

Date: September 15, 2009

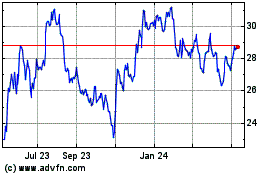

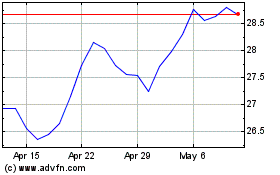

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jul 2023 to Jul 2024