Gift Cards Are the Go-To Holiday Gifts of 2020

December 23 2020 - 9:02AM

Dow Jones News

By Suzanne Kapner

It isn't just the PlayStation 5 and Lego Star Wars sets that are

in high demand this year. Gift cards are one of the hottest holiday

presents.

Shoppers worried about visiting stores, as Covid-19 cases surge,

and unwilling to risk gifts arriving late because of shipping

delays are snapping up the prepaid debit cards, according to

companies that measure gift-card sales.

Gift-card purchases in the first week of December were twice the

rate in the same period last year, according to InMarket, a

data-analytics company. Gift card sales jumped 48% last weekend,

compared with earlier in the week, as deadlines for free shipping

with guaranteed Christmas delivery expired, according to Rise.ai,

which manages electronic gift card programs for more than 5,000

brands, including Allbirds and Milk Bar.

Tim Maynard has already spent nearly $300 on gift cards this

year at retailers ranging from Amazon.com Inc. to Target Corp. to

Home Depot Inc. In past years, the 32-year-old financial analyst

said he shied away from giving the cards because they felt

impersonal.

"It was sort of a last resort this year," said the St. Clair,

Mo., resident. "Not having the ability to get in stores and see

things makes it hard to buy gifts."

The gift-card boom might not help holiday sales. Retailers can't

record the revenue until the cards are redeemed, according to

Nathan Ehrlich, chairman of the Retail Gift Card Association.

The cards could spur sales next year, though, as shoppers return

to stores or redeem them online. "We believe a boom in gift cards

will lead to a shift in spending in the first quarter of next year

and beyond," said Todd Dipaola, InMarket's chief executive.

There are two types of gift cards. So-called closed-loop cards

are issued by banks and branded merchants including Macy's or

Amazon. They typically have no fees and don't expire but can only

be used at the retailer with its brand on the card, according to

David Nelyubin, a senior research analyst at Mercator Advisory

Group Inc., a payments consulting firm.

Open-loop cards operate on card networks such as those run by

Mastercard Inc. and Visa Inc. These cards can be used anywhere

those brands are accepted but typically hit recipients with fees.

"If you don't use the money, the fees will eat away at the

balance," Mr. Nelyubin said.

The top-selling gift cards this year are Visa, Amazon, Microsoft

Corp.'s Xbox, Kohl's Corp. and Lowe's Cos., according to

InMarket.

The average shopper is spending 17.6% more on gift cards in

2020, compared with 2019, while the average number of gift-card

transactions per shopper is up 12.3% compared with last year,

InMarket said.

A sizable portion of gift cards go unused, allowing merchants

and card issuers to later book some of those funds as revenue under

accounting rules. Mercator estimates merchants keep roughly $3.5

billion of unredeemed balances annually.

A portion of unused balances goes back to the states. Some

states assume responsibility for returning the funds to consumers.

In cases in which consumers can't be located, the money goes to the

state where the issuing company is domiciled, according to Mr.

Ehrlich of the gift-card association.

Concerned about rising Covid-19 cases, Debika Sihi has stopped

going to stores and is instead buying her friends and family

electronic gift cards from local shops this year.

"With UPS and FedEx under so much pressure, I'm worried that if

I mail a gift, it might not get there before Christmas," the

38-year-old Austin, Texas, resident said.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

December 23, 2020 08:47 ET (13:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

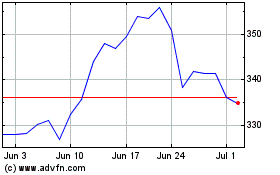

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024