Helmerich & Payne, Inc. (“H&P” or the “Company”) (NYSE:

HP) today announced its supplemental shareholder return plan and

capital budget for fiscal year 2023. The Company also announced the

timing of the upcoming conference call and webcast for its fiscal

fourth quarter of 2022.

President and CEO John Lindsay commented, “I am pleased to

announce the Company’s 2023 supplemental shareholder return plan,

which augments our long-standing commitment to returning cash to

shareholders. Our current base dividend of $1/share per annum is

meant to serve as a foundation of that cash return commitment

throughout the cycles inherent in our industry. The supplemental

dividend for fiscal 2023, which we anticipate will be approximately

$100 million in aggregate, is meant to further boost shareholder

returns. This plan, and any potential subsequent ones for future

fiscal years, are not only designed to further enhance base cash

returns, but also allow the Company the flexibility to further

invest in the business, supplement additional dividend returns,

and/or repurchase shares as those opportunities arise.

“Implementation of this plan is also reflective of the Company’s

ability to execute across multiple capital allocation strategies

simultaneously. In North America Solutions, we plan to reactivate

up to 16 rigs by March 31, 2023, for appropriate prices and terms.

This would take our rig count from 176 as of September 30, 2022, to

an upper target of 192 active rigs for fiscal 2023. H&P’s

continued efforts to expand its international presence and

operations in fiscal 2023 is another such strategy. We realize some

of the international capital investments H&P makes this fiscal

year, captured in our capex budget, will take time to fully develop

and generate returns for the Company. However, we have previously

stated that our international strategy, particularly with regards

to the Middle East, is a long-term play, knowing that there will be

upfront investments to secure our success.”

2023 Supplemental Shareholder Return Plan:

The Company has established its 2023 supplemental shareholder

return plan, which is currently projected to provide approximately

$100 million in additional cash returns to shareholders in the form

of additional dividends. These supplemental dividends are expected

to be paid in four, approximately equal, installments during fiscal

2023. These additional cash returns represent approximately 50% of

the Company’s projected cash flow generation in fiscal 2023 after

planned capital expenditures and after the Company’s already

established “base” annual dividend of $1.00/share, which is roughly

$110 million on an annualized basis. All such established base and

supplemental dividends are subject to the determination and

approval of the Company’s Board of Directors on a quarterly

basis.

Under the plan, the Company may utilize remaining cash flow

projected to be generated in fiscal year 2023, after planned

capital expenditures, established base and supplemental dividends,

as well as cash on hand, to fund additional supplemental dividends

or opportunistically repurchase shares of its common stock under

its evergreen four million shares per annum repurchase

authorization. Such repurchases will be dependent upon several

factors, including market and industry conditions and other

investment opportunities available to the Company.

The 2023 supplemental shareholder return plan is specific to

fiscal year 2023 and is derived from current forecasts and

projections for fiscal year 2023, which are subject to change based

on industry factors and market conditions. The intention is to

refresh the plan in subsequent fiscal years with adjustments made

based on relevant factors and market conditions at that time,

including the Company’s projected cash flow generation, and

accretive investment opportunities.

On October 17, 2022, the Board of Directors of the Company

declared a quarterly cash supplemental dividend of $0.235 per

share, payable on December 1, 2022, to stockholders of record at

the close of business on November 15, 2022. The payable date and

record date of this supplemental dividend coincide with the dates

applicable to the Company’s base dividend of $0.25 per share, which

was declared on September 7, 2022.

Capex for Fiscal Year 2023:

The Company has set its initial fiscal year 2023 capex budget to

range between $425 and $475 million, representing a sizeable

sequential increase and highlighting the capital-intensive nature

of H&P’s business as well as planned international expansion.

H&P’s North America Solutions segment accounts for

approximately two-thirds of the expected spend as the Company plans

to reactivate up to 16 idle rigs from its super-spec FlexRig®

fleet, of which six rigs will be converted to a walking

configuration and as maintenance capex per rig is expected to

modestly exceed the high-end of the historic normalized range. The

Company’s International Solutions segment accounts for roughly a

quarter of the planned expenditures in anticipation of reactivating

more rigs during the fiscal year, upgrading five rigs in Argentina

to super-spec and converting six additional super-spec rigs

domiciled in the U.S. to walking configurations that are currently

planned to be exported to international operations later in the

fiscal year. The remainder of the fiscal 2023 capex budget is

slated for corporate and information technology purposes as the

Company continues to invest in and modernize its own operational

and business-driven technologies.

Senior Vice President and CFO Mark Smith also commented, “The

Company has consistently maintained its strong financial position

and is able to capitalize on that position to the benefit of its

shareholders. H&P is well-positioned to execute on its capital

allocation plans for fiscal 2023, which cumulatively represent over

$650 million - $425 million to $475 million in capex plus

approximately $210 million of expected cash returns to

shareholders. Furthermore, based on current expectations, we look

to have additional cash generation beyond our planned capital

commitments which can be used for opportunistic share repurchases,

additional supplemental dividends or other investment

opportunities.

“Our North America Solutions segment’s fiscal 2023 capital

expenditures budget is adversely impacted by higher maintenance

capex, which looks to modestly exceed the historic range of $750

thousand to $1 million per rig per year. The fiscal 2023 range is

expected to be between $1.1 million and $1.3 million per active

rig. The reasons for this are twofold – one is due to the reduced

spending during the pandemic years in which time the Company

judiciously preserved capital spending by utilizing component

equipment from idle rigs - we now must make up for those capital

spending deferments, and two is due to the current inflationary

environment and supply chain challenges that the industry is

experiencing. Capital expenditures for our International Solutions

segment are much more meaningful in fiscal 2023 as we anticipate

converting some super-spec rigs in the U.S. to walking

configurations that are earmarked for export and upgrading some

international rigs to super-spec. Both of these planned spends are

indicative of international markets escalating their focus on

unconventional drilling.

“To re-iterate, the supplemental shareholder return plan

represents our current intention of returning capital to

shareholders during fiscal 2023 based upon our outlook of market

and industry conditions at present, including our current

expectations surrounding rig pricing, activity levels, margins,

cash generation, capital expenditures and other investments

opportunities. In determining whether to proceed with the 2023

supplemental shareholder return plan as originally intended and any

future supplemental shareholder return plans in later fiscal years,

management and our board of directors will continue to review the

Company’s financial position and performance together with relative

market conditions at that time.

“Our focus on a complete fiscal year multi-pronged capital

allocation plan is in part a result of our customers’ and the

upstream energy industry’s adhering to their annual budgets, which

underpins confidence in our annual planning horizon. We believe the

announced supplemental shareholder return plan will boost our

already competitive yield. Additionally, the plan provides

flexibility to allow for share repurchases or other investment

opportunities, which remain prominent options to the deployment of

capital.”

John Lindsay concluded, “These planned actions of enhancing

shareholder cash returns and investing in future growth of the

Company would not be possible without our strong capital

stewardship and financial discipline. These principles will

continue to drive our actions going forward enabling the Company to

be a leader within the oilfield service industry in not only

providing financial returns, but also returns in the form of cash

to shareholders as we continue our 60-year history of dividend

payments.”

Investor slides for October 2022 are available for download on

the Company’s website, within Investors, under Presentations.

Fiscal Fourth Quarter 2022 Conference Call and

Webcast:

The Company’s financial guidance for the fiscal fourth quarter

of 2022 and full fiscal year 2022 are consistent with those

provided in the Company’s press release dated July 27, 2022. Those

items are enumerated below:

Fiscal Fourth Quarter 2022:

- North America Solutions direct margins(1) are now expected to

be towards the high end of the previous expected range of $185-$205

million

- North America Solutions active rig count was 176 rigs as of

September 30, 2022

- International Solutions direct margins(1) are still expected to

be between $4-$7 million, exclusive of any foreign exchange gains

or losses

- Offshore Gulf of Mexico direct margins(1) are still expected to

be between $9-$11 million

Fiscal Year 2022:

- Gross capital expenditures are still expected to be

approximately $250 to $270 million

- Depreciation and amortization expenses are still expected to be

approximately $405 million

- Research and development expenses are still expected to be

roughly $27 million

- Selling, general and administrative expenses are still expected

to be just over $180 million

- Cash, cash equivalents and short-term investments are now

expected to be towards the low end of the previous expected range

of $350-$400 million

The financial guidance set forth above do not represent a

comprehensive statement of operational results or financial

position for or as of the fiscal quarter and fiscal year ended

September 30, 2022. The final comprehensive statements of

operational results and financial position for and as of the fiscal

quarter and fiscal year ended September 30, 2022, will be contained

in our Annual Report on Form 10-K. Our final operational results

and audited financial statements may vary from the financial

guidance described above as our quarterly and yearly financial

statement close processes are not yet complete and additional

developments and adjustments may arise between now and the time the

financial information and operational results for these periods are

finalized. In addition, the financial guidance is not necessarily

indicative of the results to be achieved for any future period.

The Company’s fiscal fourth quarter 2022 conference call will

take place on Thursday, November 17, 2022, at 11:00 a.m. (ET) with

John Lindsay, President and CEO, Mark Smith, Senior Vice President

and CFO, and Dave Wilson, Vice President of Investor Relations.

Investors may listen to the conference call either by phone or

audio webcast.

What:

Helmerich & Payne, Inc.’s

Fiscal Fourth Quarter 2022 Earnings Release. Other material

developments may also be discussed.

When:

11:00 a.m. ET (10:00 a.m. CT),

Thursday, November 17, 2022

Via Phone:

Domestic: 877-830-2596 Access

Code: Helmerich

International: 785-424-1877

Access Code: Helmerich

Via Internet:

Visit http://www.helmerichpayne.com then click on

“Investors” and then click on “News & Events – Event &

Presentations” to find the link to the webcast.

Questions:

Dave Wilson,

investor.relations@hpinc.com, 918-588-5190

If you are unable to listen during the live webcast, the call

will be archived for 365 days on Helmerich & Payne, Inc.’s

website, http://www.helmerichpayne.com, under “News & Events –

Event & Presentations”, which can be accessed through the

“Investors” section of the website.

About Helmerich & Payne, Inc.

Founded in 1920, Helmerich & Payne, Inc. is committed to

delivering industry leading drilling productivity and reliability.

H&P operates with the highest level of integrity, safety and

innovation to deliver superior results for our customers and

returns for shareholders. Through its subsidiaries, the Company

designs, fabricates and operates high-performance drilling rigs in

conventional and unconventional plays around the world. H&P

also develops and implements advanced automation, directional

drilling and survey management technologies. For more information,

visit www.helmerichpayne.com.

Forward Looking Statements

This release includes “forward-looking statements” within the

meaning of the Securities Act of 1933 and the Securities Exchange

Act of 1934, and such statements are based on current expectations

and assumptions that are subject to risks and uncertainties. All

statements other than statements of historical facts included in

this release, including, without limitation, statements regarding

our future cash flow, use of generated cash flow, dividend amounts

and timing, supplemental shareholder return plans, future financial

position, operations outlook, business strategy, share repurchases,

investments, budgets, projected costs and plans, objectives of

management for future operations, contract terms, financing and

funding, capex spending, outlook for international markets, actions

by customers, and results of completed periods are forward-looking

statements. For information regarding risks and uncertainties

associated with the Company’s business, please refer to the “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of the Company’s SEC

filings, including but not limited to its annual report on Form

10‑K and quarterly reports on Form 10‑Q. As a result of these

factors, Helmerich & Payne, Inc.’s actual results may differ

materially from those indicated or implied by such forward-looking

statements. Investors are cautioned not to put undue reliance on

such statements, including preliminary estimates of the results of

completed periods. We undertake no duty to publicly update or

revise any forward-looking statements, whether as a result of new

information changes in internal estimates, expectations or

otherwise, except as required under applicable securities laws.

Helmerich & Payne uses its website as a channel of

distribution for material company information. Such information is

routinely posted and accessible on its investor relations website

at www.helmerichpayne.com. Information

on our website is not part of this release.

(1) Direct margin, which is considered a

non-GAAP metric, is defined as operating revenues less direct

operating expenses and is included as a supplemental disclosure. We

believe it is useful in assessing and understanding our current

operational performance, especially in making comparisons over

time. Expected direct margin for the fourth quarter of fiscal 2022

is provided on a non-GAAP basis only because certain information

necessary to calculate the most comparable GAAP measure is

unavailable due to the uncertainty and inherent difficulty of

predicting the occurrence and the financial statement impact of

certain items based on preliminary results. Therefore, as a result

of the uncertainty and variability of the nature and amount of

adjustments, which could be significant, we are unable to provide a

reconciliation of expected direct margin to the most comparable

GAAP measure without unreasonable effort.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221018006160/en/

Dave Wilson, investor.relations@hpinc.com,

918-588-5190

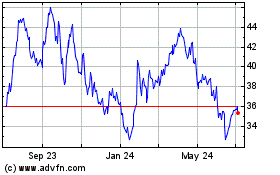

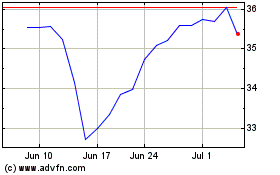

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Jul 2023 to Jul 2024