HCA Announces Proposed Public Offering of Senior Notes

August 07 2024 - 8:22AM

Business Wire

HCA Healthcare, Inc. (NYSE: HCA) today announced that its wholly

owned subsidiary, HCA Inc., proposes to offer senior notes, subject

to market and other considerations. Actual terms of the senior

notes, including maturity, interest rate and principal amount, will

depend on market conditions at the time of pricing. HCA Inc.

intends to use the net proceeds from this offering for general

corporate purposes, which may include the repayment of borrowings

outstanding under its senior secured asset-based revolving credit

facility.

Citigroup Global Markets Inc., BofA Securities, Inc., J.P.

Morgan Securities LLC and Wells Fargo Securities, LLC are acting as

the joint book-running managers for the offering.

The offering of the senior notes is being made pursuant to an

effective shelf registration statement filed with the Securities

and Exchange Commission. The offering is being made only by means

of a preliminary prospectus supplement and the accompanying

prospectus, copies of which may be obtained by contacting Citigroup

Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, NY 11717, by telephone: 1-800-831-9146 or

by email: prospectus@citi.com; BofA Securities, Inc.,

NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001,

Attn: Prospectus Department, by email:

dg.prospectus_requests@bofa.com or by telephone 1-800-294-1322;

J.P. Morgan Securities LLC, 383 Madison Avenue, New York, New York,

10179, Attention: Investment Grade Syndicate Desk, 3rd Floor,

telephone collect at 1-212-834-4533; or Wells Fargo Securities,

LLC, 608 2nd Avenue South, Suite 1000, Minneapolis, MN 55402, Attn:

WFS Customer Service, by email: wfscustomerservice@wellsfargo.com

or by telephone (toll-free): 1-800-645-3751.

You may also visit www.sec.gov to obtain an electronic copy of

the related preliminary prospectus supplement and the accompanying

prospectus.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the senior notes or any other

security and shall not constitute an offer, solicitation or sale in

any state or jurisdiction in which, or to any persons to whom, such

an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

FORWARD-LOOKING STATEMENTS

Information provided and statements contained in this press

release that are not purely historical are forward-looking

statements within the meaning of Section 27A of the Securities Act,

Section 21E of the Exchange Act and the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements only

speak as of the date of this press release and HCA assumes no

obligation to update the information included in this press

release. Such forward-looking statements include the expected use

of proceeds from the offering. These statements often include words

such as “may,” “believe,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “initiative” or “continue.” These

forward-looking statements are not historical facts and are based

on current expectations, estimates and projections about HCA’s

industry, management’s beliefs and certain assumptions made by

management, many of which, by their nature, are inherently

uncertain and beyond HCA’s control. Accordingly, readers are

cautioned that any such forward-looking statements are not

guarantees of future performance or occurrence of events and are

subject to certain risks, uncertainties and assumptions that are

difficult to predict. Although HCA believes that the expectations

reflected in such forward-looking statements are reasonable as of

the date made, expectations may prove to have been materially

different from the results expressed or implied by such

forward-looking statements. More information about potential risks

and uncertainties that could affect the Company’s business and

results of operations is included in the “Risk Factors” and

“Forward-Looking Statements” sections in the Annual Report on Form

10-K filed by the Company with the SEC on February 16, 2024 and our

other filings with the Securities and Exchange Commission. Unless

otherwise required by law, HCA also disclaims any obligation to

update its view of any such risks or uncertainties or to announce

publicly the result of any revisions to the forward-looking

statements made in this press release.

All references to the “Company” and “HCA” as

used throughout this press release refer to HCA Healthcare,

Inc. and its affiliates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240804864116/en/

INVESTOR CONTACT: Frank Morgan 615-344-2688

MEDIA CONTACT: Harlow Sumerford 615-344-1851

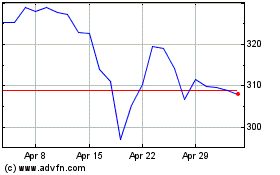

HCA Healthcare (NYSE:HCA)

Historical Stock Chart

From Dec 2024 to Jan 2025

HCA Healthcare (NYSE:HCA)

Historical Stock Chart

From Jan 2024 to Jan 2025