Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 22 2023 - 12:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Dated 22 December 2023

Commission File Number 001-31318

Gold Fields Limited

(Translation of registrant’s name into English)

150 Helen Rd.

Sandown, Sandton 2196

South Africa

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Gold Fields Limited |

| | |

| Date: 22 December 2023 | By: | /s/ Martin Preece |

| | Name: | Martin Preece |

| | Title: | Interim Chief Executive Officer |

INDEX TO EXHIBITS

1 GOLD FIELDS SELLS ITS 45% SHAREHOLDING IN ASANKO Johannesburg, 21 December 2023: Gold Fields Limited (Gold Fields) (JSE, NYSE: GFI) has announced the divestment of its 45% shareholding in the Asanko gold mine in Ghana to TSX-listed joint venture partner Galiano Gold for a total consideration of US$170m. Gold Fields will also receive a 1% net smelter royalty on future production from the Nkran deposit, the main deposit at the mine. The Asanko mine is currently owned 45% each by Gold Fields and Galiano Gold, with Galiano managing the mine. The Government of Ghana holds the remaining 10%. The transaction will be settled by Galiano to Gold Fields through a combination of upfront, deferred and contingent consideration as follows: • US$85m which will be settled with US$65m in cash and US$20m in Galiano shares on completion of the transaction; • US$25m to be paid on 31 December 2025; • US$30m to be paid on 31 December 2026; and • US$30m plus a 1% net smelter royalty to be paid once more than 100koz of gold equivalent is produced from the Nkran deposit. The royalty is capped at a volume of 447koz. Gold Fields currently has a 9.8% shareholding in Galiano and the share purchase agreement limits the shareholding that Gold Fields can raise this to 19.9%. Should the market value of Galiano shares be less than the requisite US$20m, Galiano will make up the difference with an additional cash payment. Martin Preece, Gold Fields Interim CEO, comments on the divestment: “We are pleased to have concluded this agreement with Galiano. It is clear that the committed path forward for the Asanko mine requires consolidated ownership. Gold Fields is pleased to realise value for its holding now, while providing flexibility to Galiano in the recapitalisation of the mine and resuming mining to maximise its prospects of success. “Divestment of our interest in Asanko is part of our ongoing disciplined portfolio management process and releases capital for deployment by the Company in line with our other capital allocation priorities,” Preece adds. The current transaction, which is expected to be completed during Q1 2024, is subject to a number of conditions, including regulatory approvals. - Ends -

2 Notes to editors About Gold Fields Gold Fields is a globally diversified gold producer with eight operating mines in Australia, South Africa, Ghana and Peru and two projects in Canada and Chile. We have total attributable annual gold-equivalent production of approximately 2.40Moz, proved and probable gold Mineral Reserves of 46.1Moz, measured and indicated gold Mineral Resources of 31.1Moz (excluding Mineral Reserves) and inferred Gold Mineral Resources of 11.2Moz (excluding Mineral Reserves). Our shares are listed on the Johannesburg Stock Exchange (JSE) and our American depositary shares trade on the New York Exchange (NYSE). Sponsor: J.P. Morgan Equities South Africa (Pty) Ltd Forward-looking statements This announcement contains forward-looking statements within the meaning of the “safe harbour” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this announcement may be forward-looking statements. Forward-looking statements may be identified by the use of words such as “aim”, “anticipate”, “will”, “would”, “expect”, “may”, “could”, “believe”, “target”, “estimate”, “project” and words of similar meaning. These forward-looking statements, including among others, those relating to Gold Fields’ future business prospects, financial positions, production and operational guidance, climate and ESG-related statements, targets and metrics, are necessary estimates reflecting the best judgement of the senior management of Gold Fields and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in Gold Fields’ Integrated Annual Report 2022 filed with the Johannesburg Stock Exchange and annual report on Form 20-F filed with the United States Securities and Exchange Commission (SEC) on 30 March 2023 (SEC File no. 001-31318). Readers are cautioned not to place undue reliance on such statements. These forward-looking statements speak only as of the date they are made. Gold Fields undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this announcement or to reflect the occurrence of unanticipated events. These forward-looking statements have not been reviewed or reported on by the Company’s external auditors.

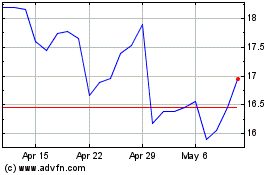

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Oct 2024 to Nov 2024

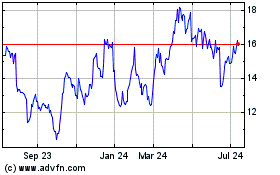

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Nov 2023 to Nov 2024