Filed by: Berry Global Group, Inc.

Commission File No.: 001-35672

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company:

Glatfelter Corporation (Commission File No.: 001-03560)

Below is a communication made by Berry Global Group, Inc. on February 7, 2024:

To HH&S Colleagues,

As you know, Berry entered a process

in 2023 to explore strategic alternatives for our HH&S business, which would optimize our portfolio and deliver value to our stakeholders.

After 10 months of exploring our options, we have arrived at a solution that is beneficial to both Berry and the HHNF team.

I am genuinely excited to share the

news about the planned spin-off and combination of Berry’s Health, Hygiene and Specialties Global Nonwovens and Films business (“HHNF”)

with Glatfelter. As Kevin mentioned, this transaction provides a unique opportunity to create a leader in the growing specialty materials

industry, and to help customers around the world address their toughest challenges.

Glatfelter’s portfolio of innovative

capabilities and sustainability solutions spans across diverse applications, ranging from beverage filtration and personal hygiene products

to home improvement and industrial technologies. Berry’s HHNF business and Glatfelter have significantly complementary products

serving our global healthcare and hygiene customers. Together, we will offer a highly complementary product suite, including both polymer-based

and fiber-based solutions, supported by strong innovation capabilities, with significant geographic diversification and a presence in

all major markets. These important factors drove our decision to combine HHNF with Glatfelter, and I look forward to connecting with you

live to talk about the significant opportunities ahead.

Each of you has contributed to the

work helping us reach this milestone. Looking ahead, what I’m most excited about is our drivers for growth. The field of specialty

materials is rapidly evolving, and because of your efforts, we are positioned to benefit from global growth trends arising from the growing

middle class, an aging population, the increasing globalization of supply chains, and a heightened focus on personal hygiene, sustainability

and safety products. We are confident that with Glatfelter, we will be even better positioned to capitalize on these mega trends and drive

growth for employees, customers, and shareholders alike.

In the weeks and months ahead, we

will continue to provide updates about our integration plans. Until the transaction closes, which is expected to occur in the second half

of 2024, the HHNF business will remain a part of Berry, and we will continue to operate as usual. By staying focused and working in the

same collaborative spirit that has gotten us to this point, we will get to the finish line quicker and will be in a great position to

start our next chapter with Glatfelter. Following the closing of the transaction, I will be the CEO of the combined business.

On behalf of the Berry senior leadership

team, thank you for your hard work that has made this combination possible. I’m confident we have great opportunities ahead and

I hope you share my excitement for the future.

Sincerely,

Curt Begle

President, Health, Hygiene, &

Specialties

Cautionary Statement Concerning Forward-Looking

Statements

Statements

in this communication that are not historical, including statements relating the expected timing, completion and effects of the proposed

transaction between Berry and Glatfelter, are considered “forward looking” within the meaning of the federal securities laws

and are presented pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking

statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,”

“would,” “could,” “seeks,” “approximately,” “intends,” “plans,”

“estimates,” “projects,” “outlook,” “anticipates” or “looking forward,” or

similar expressions that relate to strategy, plans, intentions, or expectations. All statements relating to estimates and statements about

the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, benefits

of the transaction, including future financial and operating results, the combined company’s plans, objectives, expectations and

intentions, and other statements that are not historical facts are forward-looking statements. In addition, senior management of Berry

and Glatfelter, from time to time make forward-looking public statements concerning expected future operations and performance and other

developments.

Actual results

may differ materially from those that are expected due to a variety of factors, including without limitation: the occurrence of any event,

change or other circumstances that could give rise to the termination of the proposed transaction; the risk that Glatfelter shareholders

may not approve the transaction proposals; the risk that the necessary regulatory approvals may not be obtained or may be obtained subject

to conditions that are not anticipated; risks that any of the other closing conditions to the proposed transaction may not be satisfied

in a timely manner; risks that the anticipated tax treatment of the proposed transaction is not obtained; risks related to potential litigation

brought in connection with the proposed transaction; uncertainties as to the timing of the consummation of the proposed transaction; unexpected

costs, charges or expenses resulting from the proposed transaction; risks and costs related to the implementation of the separation of

Berry’s HH&S global nonwovens and films business into a new entity (“Spinco”), including timing anticipated to complete

the separation; any changes to the configuration of the businesses included in the separation if implemented; the risk that the integration

of the combined companies is more difficult, time consuming or costly than expected; risks related to financial community and rating agency

perceptions of each of Berry and Glatfelter and its business, operations, financial condition and the industry in which they operate;

risks related to disruption of management time from ongoing business operations due to the proposed transaction; failure to realize the

benefits expected from the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the

ability of the parties to retain customers and retain and hire key personnel and maintain relationships with their counterparties, and

on their operating results and businesses generally; and other risk factors detailed from time to time in Glatfelter’s and Berry’s

reports filed with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other

documents filed with the SEC. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed

in the registration statements, proxy statement/prospectus and other documents that will be filed with the SEC in connection with the

proposed transaction. The foregoing list of important factors may not contain all of the material factors that are important to you. New

factors may emerge from time to time, and it is not possible to either predict new factors or assess the potential effect of any such

new factors. Accordingly, readers should not place undue reliance on those statements. All forward-looking statements are based upon information

available as of the date hereof. All forward-looking statements are made only as of the date hereof and neither Berry nor Glatfelter undertake

any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as

otherwise required by law.

Additional Information and Where to Find

It

This communication

may be deemed to be solicitation material in respect of the proposed transaction between Berry and Glatfelter. In connection with the

proposed transaction, Berry and Glatfelter intend to file relevant materials with the SEC, including a registration statement on Form

S-4 by Glatfelter that will contain a proxy statement/prospectus relating to the proposed transaction. In addition, Spinco expects to

file a registration statement in connection with its separation from Berry. This communication is not a substitute for the registration

statements, proxy statement/prospectus or any other document which Berry and/or Glatfelter may file with the SEC. STOCKHOLDERS OF BERRY

AND GLATFELTER ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS,

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain

copies of the registration statements and proxy statement/prospectus (when available) as well as other filings containing information

about Berry and Glatfelter, as well as the Spinco, without charge, at the SEC’s website, http://www.sec.gov. Copies of documents

filed with the SEC by Berry or the Spinco will be made available free of charge on Berry’s investor relations website at https://ir.berryglobal.com.

Copies of documents filed with the SEC by Glatfelter will be made available free of charge on Glatfelter's investor relations website

at https://www.glatfelter.com/investors.

No Offer or Solicitation

This communication

is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to

sell, subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer

of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration or qualification

under the securities laws of any such jurisdiction. No offer or sale of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in Solicitation

Berry and

its directors and executive officers, and Glatfelter and its directors and executive officers, may be deemed to be participants in the

solicitation of proxies from the holders of Glatfelter capital stock and/or the offering of securities in respect of the proposed transaction.

Information about the directors and executive officers of Berry, including a description of their direct or indirect interests, by security

holdings or otherwise, is set forth under the caption “Security Ownership of Beneficial Owners and Management” in the definitive

proxy statement for Berry’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on January 4, 2024 (https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001378992/000110465924001073/tm2325571d6_def14a.htm).

Information about the directors and executive officers of Glatfelter including a description of their direct or indirect interests, by

security holdings or otherwise, is set forth under the caption “Ownership of Company Stock” in the proxy statement for Glatfelter's

2023 Annual Meeting of Shareholders, which was filed with the SEC on March 31, 2023 (https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0000041719/000004171923000012/glt-20230331.htm).

In addition, Curt Begle, the current President of the Berry’s Health, Hygiene & Specialties Division, will be appointed as Chief

Executive Officer of the combined company. Investors may obtain additional information regarding the interest of such participants by

reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

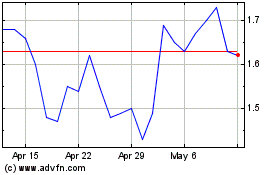

Glatfelter (NYSE:GLT)

Historical Stock Chart

From Apr 2024 to May 2024

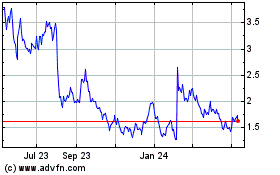

Glatfelter (NYSE:GLT)

Historical Stock Chart

From May 2023 to May 2024