false

0001517006

0001517006

2024-11-11

2024-11-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 11, 2024

GATOS SILVER, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation) |

001-39649

(Commission File

Number) |

27-2654848

(I.R.S. Employer

Identification No.) |

|

925 W Georgia Street, Suite

910

Vancouver,

British Columbia, Canada

(Address of principal executive offices)

|

V6C 3L2

(Zip Code) |

Registrant’s telephone number, including

area code: (604) 424-0984

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

GATO |

New York Stock Exchange

Toronto Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On November 11, 2024, Gatos Silver, Inc. (the “Company”)

issued a press release announcing its financial results for the quarter and nine months ended September 30, 2024 and providing certain

other updates. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference

herein.

The information included in Item 2.02 of this Current Report on Form

8-K and Exhibit 99.1 attached hereto are intended to be furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before

or after the date of this report, regardless of any general incorporation language in the filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GATOS SILVER, INC. |

| |

|

| |

|

| Date: November 12, 2024 |

By: |

/s/ Dale Andres

|

| |

|

Dale Andres |

| |

|

Chief Executive Officer |

Exhibit 99.1

|

925

W Georgia St, Suite 910

Vancouver, British

Columbia V6C 3L2

(604) 424-0984

www.gatossilver.com |

GATOS SILVER REPORTS

THIRD QUARTER 2024 RESULTS INCLUDING A 200% INCREASE IN EARNINGS PER SHARE

Vancouver, BC

— November 11, 2024 — Gatos Silver, Inc. (NYSE/TSX: GATO) (“Gatos Silver” or the “Company”)

today announced its third quarter of 2024 financial and operating results including earnings per share of $0.14, up 200% from $0.05 in

the third quarter of 2023. The Company will host an investor and analyst call on November 12, 2024,

details of which are provided below.

The

Company has a 70% interest in the Los Gatos Joint Venture (“LGJV”), which in turn owns the Cerro Los Gatos (“CLG”)

mine in Mexico. The Company’s reporting currency is US dollars.

On

September 5, 2024, Gatos Silver and First Majestic Silver Corp. (“First Majestic”) announced that they entered into a definitive

merger agreement pursuant to which First Majestic will acquire all of the issued and outstanding common shares of Gatos Silver (the “Merger”).

The proposed Merger is expected to close in the first quarter of 2025 and would consolidate three world-class, producing silver mining

districts in Mexico to create a leading intermediate primary silver producer.

On

September 25, 2024, Gatos Silver reported an updated life of mine plan (“LOM plan”) that adds two years of additional reserves

and a 36% increase in silver equivalent production compared with the prior LOM plan at CLG.

Production

for the third quarter of 2024 and improved guidance for the full year were disclosed on October 9, 2024.

“CLG’s

strong third quarter 2024 production and cost performance together with higher metal prices resulted in record quarterly free cash flow

at the LGJV and a record quarter-end cash balance for Gatos Silver,” said Dale Andres, CEO of Gatos Silver. “We believe we

are well positioned to deliver significant value into the combination with First Majestic given the Company’s strong cash position

and free cash flow generation together with CLG’s track record of performance, the extended mine plan disclosed in September and

ongoing exploration efforts across the broader Los Gatos district.”

Summary

LGJV Q3 2024 results

compared to Q3 2023 (100% basis):

| • | Revenue

of $93.8 million, up 40% from $67.0 million |

| • | Cost

of sales of $31.2 million, down 1% from $31.4 million |

| • | Record

net income of $25.7 million, up 71% from $15.1 million |

| • | Record

EBITDA1 of $57.2 million, up 87% from $30.6 million |

| • | Record

cash flow from operations of $58.2 million, up 98% from $29.4 million |

| • | Record

free cash flow1 of $42.6 million, up 199% from $14.3 million |

| • | Silver

production of 2.42 million ounces, up 9% from 2.22 million ounces |

| • | Silver

equivalent production2 of 3.84 million ounces, up 11% from 3.46 million ounces |

| • | Co-product

AISC1 of $16.13 per ounce of payable silver equivalent, down 9% from $17.64 |

| • | By-product

AISC1 of $9.61 per ounce of payable silver, down 35% from $14.71 |

Gatos Silver Q3

2024 results compared to Q3 2023:

| • | Net

income of $9.9 million, up from $3.3 million, and adjusted net income1 of $15.2

million |

| • | Basic

and diluted earnings per share of $0.14, up from $0.05 per share, and adjusted basic and

diluted earnings per share1 of $0.22 and $0.21, respectively |

| • | EBITDA1

of $9.1 million, compared to $3.2 million, and adjusted EBITDA1 of $14.4

million |

| • | Cash

flow provided by operating activities and free cash flow1 of $34.2 million, compared

to $33.3 million |

1

See “Non-GAAP Financial Measures” below.

2

See definition of silver equivalent production below.

At the LGJV, the

40% increase in revenue in Q3 2024, compared to the same quarter in 2023, was primarily attributable to higher sales volumes and higher

realized metal prices. Cost of sales decreased by 1% despite the higher sales volumes. Site operating unit costs of $96.93/t milled were

8% lower than in Q3 2023 primarily due to higher mill throughput in the quarter. By-product AISC1 per ounce of payable silver

decreased to $9.61 primarily due to significantly higher silver and by-product production and sales volumes.

For Gatos Silver,

higher unadjusted and adjusted net income, earnings per share and EBITDA1 for Q3 2024 were primarily attributable to the higher

equity income from the LGJV and higher interest income. General and administrative expenses were higher in Q3 2024, mainly due to $5.3

million of costs related to the proposed Merger with First Majestic (which are excluded from adjusted net income1, adjusted

earnings per share and adjusted EBITDA1 as described below), partially offset by a decrease of $1.1 million in non-cash stock-based

compensation expense, a $0.9 million decrease in legal and consulting fees not associated with the proposed Merger, and a $0.4 million

decrease in insurance expense.

As of September

30, 2024, the Company and the LGJV reported cash and cash equivalents of $116.7 million and $33.9 million, respectively. The Company’s

quarter-end cash balance was a new record, up 40% from $82.5 million at the end of June 30, 2024. The increase in cash was due to $37.9

million of cash distributions received during the third quarter. As of October 31, 2024, the Company and the LGJV had cash and cash equivalents

of $114.8 million and $47.3 million, respectively. On November 7, 2024, the LGJV made a capital distribution to its partners of

$40.0 million, of which the Company received $28.0 million. The Company continues to be debt free with $50.0 million available under

the Revolving Credit Facility.

Financial and Operating Results

Below is select

operational and financial information for the three and nine months ended September 30, 2024 and 2023. For a detailed discussion of the

three and nine months ended September 30, 2024 financial and operating results refer to the Form 10-Q expected to be filed on November 12,

2024 on both the EDGAR and SEDAR+ systems and posted on the Company’s website at https://gatossilver.com.

Los Gatos

Joint Venture

LGJV

100% Basis Selected

Financial Information (Unaudited) | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in millions, except where otherwise stated) | |

2024 | |

2023 | |

2024 | |

2023 |

| Revenue | |

$ | 93.8 | | |

$ | 67.0 | | |

$ | 260.3 | | |

$ | 195.2 | |

| Cost of sales | |

| 31.2 | | |

| 31.4 | | |

| 93.9 | | |

| 83.3 | |

| Royalties and duties | |

| 0.6 | | |

| 0.3 | | |

| 1.7 | | |

| 1.0 | |

| Exploration | |

| 1.6 | | |

| 1.0 | | |

| 4.6 | | |

| 2.1 | |

| General and administrative | |

| 3.9 | | |

| 4.4 | | |

| 12.3 | | |

| 12.7 | |

| Depreciation, depletion and amortization | |

| 17.8 | | |

| 16.7 | | |

| 58.9 | | |

| 59.6 | |

| Other (income) expense | |

| (1.0 | ) | |

| (0.9 | ) | |

| 1.3 | | |

| (1.8 | ) |

| Income tax expense (recovery) | |

| 13.9 | | |

| (0.9 | ) | |

| 31.2 | | |

| 9.8 | |

| Net income and comprehensive income2 | |

$ | 25.7 | | |

$ | 15.1 | | |

$ | 56.4 | | |

$ | 28.5 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sustaining capital1 | |

$ | 12.9 | | |

$ | 9.1 | | |

$ | 33.2 | | |

$ | 29.9 | |

| Resource development drilling expenditures1 | |

$ | 2.1 | | |

$ | 3.5 | | |

$ | 7.2 | | |

$ | 10.5 | |

| EBITDA1 | |

$ | 57.2 | | |

$ | 30.6 | | |

$ | 146.4 | | |

$ | 97.2 | |

| Cash provided by operating activities | |

$ | 58.2 | | |

$ | 29.4 | | |

$ | 150.0 | | |

$ | 103.8 | |

| Free cash flow1 | |

$ | 42.6 | | |

$ | 14.3 | | |

$ | 108.8 | | |

$ | 62.6 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Results (CLG 100% Basis) | |

| | | |

| | | |

| | | |

| | |

| Tonnes milled (dmt) | |

| 298,586 | | |

| 268,312 | | |

| 885,570 | | |

| 794,082 | |

| Tonnes milled per day (dmt) | |

| 3,246 | | |

| 2,916 | | |

| 3,232 | | |

| 2,909 | |

| Average Grades | |

| | | |

| | | |

| | | |

| | |

| Silver grade (g/t) | |

| 285 | | |

| 285 | | |

| 281 | | |

| 293 | |

| Zinc grade (%) | |

| 4.04 | | |

| 3.82 | | |

| 4.19 | | |

| 3.92 | |

| Lead grade (%) | |

| 1.97 | | |

| 1.84 | | |

| 1.93 | | |

| 1.85 | |

| Gold grade (g/t) | |

| 0.30 | | |

| 0.30 | | |

| 0.29 | | |

| 0.29 | |

| Production - Contained Metal | |

| | | |

| | | |

| | | |

| | |

| Silver ounces (millions) | |

| 2.42 | | |

| 2.22 | | |

| 7.10 | | |

| 6.65 | |

| Zinc pounds – in zinc conc. (millions) | |

| 16.5 | | |

| 13.8 | | |

| 51.5 | | |

| 42.7 | |

| Lead pounds – in lead conc. (millions) | |

| 11.4 | | |

| 9.5 | | |

| 33.5 | | |

| 28.7 | |

| Gold ounces – in lead conc. (thousands) | |

| 1.45 | | |

| 1.28 | | |

| 4.20 | | |

| 3.86 | |

| Silver equivalent ounces (millions)3 | |

| 3.84 | | |

| 3.46 | | |

| 11.42 | | |

| 10.45 | |

| Co-product cash cost per ounce of payable silver equivalent1 | |

$ | 12.13 | | |

$ | 14.42 | | |

$ | 11.86 | | |

$ | 12.43 | |

| By-product cash cost per ounce of payable silver1 | |

$ | 3.69 | | |

$ | 10.04 | | |

$ | 3.67 | | |

$ | 6.42 | |

| Co-product AISC per ounce of payable silver equivalent1 | |

$ | 16.13 | | |

$ | 17.64 | | |

$ | 15.21 | | |

$ | 15.81 | |

| By-product AISC per ounce of payable silver1 | |

$ | 9.61 | | |

$ | 14.71 | | |

$ | 8.82 | | |

$ | 11.40 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales volume by payable metal | |

| | | |

| | | |

| | | |

| | |

| Silver ounces (millions) | |

| 2.18 | | |

| 1.96 | | |

| 6.45 | | |

| 5.99 | |

| Zinc pounds – in zinc conc. (millions) | |

| 14.7 | | |

| 12.4 | | |

| 44.3 | | |

| 36.2 | |

| Lead pounds – in lead conc. (millions) | |

| 10.6 | | |

| 8.7 | | |

| 31.6 | | |

| 26.6 | |

| Gold ounces – in lead conc. (thousands) | |

| 1.13 | | |

| 0.96 | | |

| 3.28 | | |

| 3.02 | |

| Copper pounds – in lead conc. (millions) | |

| 0.03 | | |

| — | | |

| 0.13 | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Average realized price by payable metal | |

| | | |

| | | |

| | | |

| | |

| Average realized price per silver ounce4 | |

$ | 29.62 | | |

$ | 24.24 | | |

$ | 27.09 | | |

$ | 25.08 | |

| Average realized price per zinc pound4 | |

$ | 1.26 | | |

$ | 0.89 | | |

$ | 1.30 | | |

$ | 1.10 | |

| Average realized price per lead pound4 | |

$ | 0.93 | | |

$ | 0.97 | | |

$ | 0.92 | | |

$ | 0.98 | |

| Average realized price per gold ounce4 | |

$ | 2,362 | | |

$ | 1,885 | | |

$ | 2,162 | | |

$ | 1,828 | |

| Average realized price per copper pound4 | |

$ | 3.28 | | |

$ | — | | |

$ | 3.72 | | |

$ | — | |

1 See

Non-GAAP Financial Measures below.

2 Totals

may not add up due to rounding.

3

Silver equivalent production for 2024 is calculated using prices of $23/oz silver, $1.20/lb zinc, $0.90/lb lead and $1,800/oz gold

to “convert” zinc, lead and gold production contained in concentrate to “equivalent” silver ounces (contained

metal, multiplied by price, divided by silver price). For 2023, silver equivalent production was calculated using prices of $22/oz silver,

$1.20/lb zinc, $0.90/lb lead and $1,700/oz gold. For comparative purposes, the calculated silver equivalent production for the three

and nine months ended September, 2023 would be 3.41 million ounces and 10.30 million

ounces, respectively, using price assumptions for 2024.

4 Realized prices include the

impact of final settlement adjustments from prior period sales.

Gatos Silver,

Inc.

| Selected Financial Information (Unaudited) | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in millions, except where otherwise stated) | |

2024 | |

2023 | |

2024 | |

2023 |

| Exploration | |

$ | 0.1 | | |

$ | — | | |

$ | 0.2 | | |

$ | — | |

| General and Administrative | |

| 10.4 | | |

| 7.5 | | |

| 25.3 | | |

| 19.2 | |

| Total expenses2 | |

| 10.6 | | |

| 7.5 | | |

| 25.5 | | |

| 19.3 | |

| Equity income in affiliates | |

| 18.2 | | |

| 9.4 | | |

| 40.0 | | |

| 15.9 | |

| Other income, net | |

| 2.8 | | |

| 1.3 | | |

| 7.8 | | |

| 3.9 | |

| Total net other income2 | |

| 21.0 | | |

| 10.8 | | |

| 47.8 | | |

| 19.8 | |

| Income tax expense | |

| 0.5 | | |

| — | | |

| 0.7 | | |

| — | |

| Net income and comprehensive income2 | |

$ | 9.9 | | |

$ | 3.3 | | |

$ | 21.6 | | |

$ | 0.5 | |

| Net income per share basic | |

$ | 0.14 | | |

$ | 0.05 | | |

$ | 0.31 | | |

$ | 0.01 | |

| Net income per share diluted | |

$ | 0.14 | | |

$ | 0.05 | | |

$ | 0.30 | | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted net income1 | |

$ | 15.2 | | |

$ | 3.3 | | |

$ | 28.3 | | |

$ | 0.5 | |

| Adjusted net income per share (basic)1 | |

$ | 0.22 | | |

$ | 0.05 | | |

$ | 0.41 | | |

$ | 0.01 | |

| Adjusted net income per share (diluted)1 | |

$ | 0.21 | | |

$ | 0.05 | | |

$ | 0.40 | | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| EBITDA1 | |

$ | 9.1 | | |

$ | 3.2 | | |

$ | 19.1 | | |

$ | 0.6 | |

| Adjusted EBITDA1 | |

$ | 14.4 | | |

$ | 3.2 | | |

$ | 25.8 | | |

$ | 0.6 | |

| Net cash provided by operating activities | |

$ | 34.2 | | |

$ | 33.3 | | |

$ | 61.2 | | |

$ | 25.5 | |

| Free cash flow1 | |

$ | 34.2 | | |

$ | 33.3 | | |

$ | 61.2 | | |

$ | 25.5 | |

1 See

Non-GAAP Financial Measures below.

2 Totals

may not add up due to rounding.

Financial Results Webcast and Conference

Call

Investors and analysts

are invited to attend the financial results webcast and conference call as follows:

Date: Tuesday, November

12, 2024

Time: 11:00 a.m.

ET

Listen-Only Webcast:

https://events.q4inc.com/attendee/627122313

Direct Event Registration Link (for Analysts

only): https://registrations.events/direct/Q4I98433625

An archive of the

webcast will be available on the Company’s website at: https://gatossilver.com within 24 hours.

About Gatos Silver

Gatos Silver is

a silver dominant exploration, development and production company that discovered a new silver and zinc-rich mineral district in southern

Chihuahua State, Mexico. As a 70% owner of the Los Gatos Joint Venture (“LGJV”), the Company is primarily focused on operating

the Cerro Los Gatos mine and on growth and development of the Los Gatos district. The LGJV includes approximately 103,000 hectares of

mineral rights, representing a highly prospective and under-explored district with numerous silver-zinc-lead epithermal mineralized zones

identified as priority targets.

On September 5,

2024, Gatos Silver and First Majestic Silver Corp. (“First Majestic”) announced that they entered into a definitive merger

agreement pursuant to which First Majestic will acquire all of the issued and outstanding common shares of Gatos Silver (the “Merger”).

The proposed Merger would consolidate three world-class, producing silver mining districts in Mexico to create a leading intermediate

primary silver producer. Information relating to the proposed Merger can be found at the Company’s website at www.gatossilver.com.

Qualified Person

Scientific and technical

disclosure in this press release was approved by Anthony (Tony) Scott, P.Geo., Senior Vice President of Corporate Development and Technical

Services of Gatos Silver who is a “Qualified Person” as defined in S-K 1300 and NI 43-101.

Non-GAAP Financial Measures

We use certain measures

that are not defined by GAAP to evaluate various aspects of our business. These non-GAAP financial measures are intended to provide additional

information only and do not have any standardized meaning prescribed by GAAP and should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with GAAP. The measures are not necessarily indicative of operating profit or cash

flow from operations as determined under GAAP.

Cash Costs and All-In Sustaining

Costs

Cash costs and all-in

sustaining costs (“AISC”) are non-GAAP measures. AISC was calculated based on guidance provided by the World Gold Council

(“WGC”). WGC is not a regulatory industry organization and does not have the authority to develop accounting standards for

disclosure requirements. Other mining companies may calculate AISC differently as a result of differences in underlying accounting principles

and policies applied, as well as definitional differences of sustaining versus expansionary (i.e. non-sustaining) capital expenditures

based upon each company’s internal policies. Current GAAP measures used in the mining industry, such as cost of sales, do not capture

all of the expenditures incurred to discover, develop and sustain production. Therefore, we believe that cash costs and AISC are non-GAAP

measures that provide additional information to management, investors and analysts that aid in the understanding of the economics of

the Company’s operations and performance compared to other producers and provides investors visibility by better defining the total

costs associated with production.

Cash costs include

all direct and indirect operating cash costs related directly to the physical activities of producing metals, including mining, processing

and other plant costs, treatment and refining costs, general and administrative costs, royalties and mining production taxes. AISC includes

total production cash costs incurred at the LGJV’s mining operations plus sustaining capital expenditures. The Company believes

this measure represents the total sustainable costs of producing silver from current operations and provides additional information of

the LGJV’s operational performance and ability to generate cash flows. As the measure seeks to reflect the full cost of silver

production from current operations, new project and expansionary capital at current operations are not included. Certain cash expenditures

such as exploration, new project spending, tax payments, dividends, and financing costs are not included.

Adjusted Net

Income

Management uses

adjusted net income, which exclude costs associated with the strategic review resulting in the proposed Merger with First Majestic, to

evaluate the Company’s operating performance. The Company believes the use of adjusted net income reflects the underlying performance

of our business and allows investors and analysts to compare the results of the Company to our historical results and to similar results

of other mining companies. Management’s determination of the components of adjusted net income are evaluated periodically and is

based, in part, on a review of non-GAAP financial measures used by mining industry analysts.

EBITDA

Management uses

EBITDA to evaluate the Company’s operating performance, to plan and forecast its operations, and assess leverage levels and liquidity

measures. EBITDA is defined as net income adjusted for interest expense, interest income, income tax expense and depreciation, depletion

and amortization expense. The Company believes the use of EBITDA reflects the underlying operating performance of our core business and

allows investors and analysts to compare results of the Company to similar results of other mining companies. EBITDA does not represent,

and should not be considered an alternative to, net income or cash flow from operations as determined under GAAP. Other companies may

calculate EBITDA differently and those calculations may not be comparable to our presentation.

Adjusted EBITDA

Management uses

adjusted EBITDA to evaluate the Company’s ongoing operating performance, without the impact of costs associated with the strategic

review resulting in the proposed Merger with First Majestic. The Company believes the use of adjusted EBITDA reflects the underlying

operating performance of our core business and allows investors and analysts to compare the results of the Company to our historical

results and to similar results of other mining companies. Adjusted EBITDA does not represent, and should not be considered an alternative

to, net income or cash flow from operations as determined under GAAP. Other companies may calculate adjusted EBITDA differently and those

calculations may not be comparable to our presentation.

Free Cash

Flow

Management uses

free cash flow as a non-GAAP measure to analyze cash flows generated from operations. Free cash flow is cash provided by (used in) operating

activities less cash flow from investing activities as presented on the consolidated statements of cash flows. The Company believes free

cash flow is also useful as one of the bases for comparing the Company’s performance with its competitors. Although free cash flow

and similar measures are frequently used as measures of cash flows generated from operations by other companies, the Company’s

calculation of free cash flow is not necessarily comparable to such other similarly titled captions of other companies.

Reconciliation of GAAP to non-GAAP

measures

The table below

presents a reconciliation between the most comparable GAAP measure of the LGJV’s expenses to the non-GAAP measures of (i) cash

costs, (ii) cash costs, net of by-product credits, (iii) co-product AISC and (iv) by-product AISC for our operations.

CLG

100% Basis Financial | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in thousands, except where otherwise stated) | |

2024 | |

2023 | |

2024 | |

2023 |

| Expenses | |

$ | 55,215 | | |

$ | 53,809 | | |

$ | 171,408 | | |

$ | 158,648 | |

| Depreciation, depletion and amortization | |

| (17,824 | ) | |

| (16,712 | ) | |

| (58,901 | ) | |

| (59,558 | ) |

| Exploration1 | |

| (1,605 | ) | |

| (998 | ) | |

| (4,577 | ) | |

| (2,118 | ) |

| Treatment and refining costs2 | |

| 3,420 | | |

| 4,793 | | |

| 9,716 | | |

| 12,865 | |

| Cash costs | |

$ | 39,206 | | |

$ | 40,892 | | |

$ | 117,646 | | |

$ | 109,837 | |

| Sustaining capital3 | |

| 12,919 | | |

| 9,128 | | |

| 33,220 | | |

| 29,870 | |

| Co-product all-in sustaining costs | |

$ | 52,125 | | |

$ | 50,020 | | |

$ | 150,866 | | |

$ | 139,707 | |

| By-product credits4 | |

| (31,168 | ) | |

| (21,246 | ) | |

| (93,986 | ) | |

| (71,407 | ) |

| All-in sustaining costs, net of by-product credits | |

$ | 20,957 | | |

$ | 28,774 | | |

$ | 56,880 | | |

$ | 68,300 | |

| Cash costs, net of by-product credits | |

$ | 8,038 | | |

$ | 19,646 | | |

$ | 23,660 | | |

$ | 38,430 | |

| | |

| | | |

| | | |

| | | |

| | |

| Payable ounces of silver equivalent5 | |

| 3,232 | | |

| 2,835 | | |

| 9,917 | | |

| 8,837 | |

| Co-product cash cost per ounce of payable silver equivalent | |

$ | 12.13 | | |

$ | 14.42 | | |

$ | 11.86 | | |

$ | 12.43 | |

| Co-product AISC per ounce of payable silver equivalent | |

$ | 16.13 | | |

$ | 17.64 | | |

$ | 15.21 | | |

$ | 15.81 | |

| | |

| | | |

| | | |

| | | |

| | |

| Payable ounces of silver | |

| 2,180 | | |

| 1,956 | | |

| 6,448 | | |

| 5,989 | |

| By-product cash cost per ounce of payable silver | |

$ | 3.69 | | |

$ | 10.04 | | |

$ | 3.67 | | |

$ | 6.42 | |

| By-product AISC per ounce of payable silver | |

$ | 9.61 | | |

$ | 14.71 | | |

$ | 8.82 | | |

$ | 11.40 | |

1 Exploration

costs are not related to current operations.

2 Represent

reductions on customer invoices and included in sales of the LGJV combined statement of operations and income.

3 Sustaining

capital excludes resource development drilling costs related to resource development drilling of the CLG deposit.

4 By-product

credits reflect realized metal prices of zinc, lead and gold for the applicable period, which includes any final settlement adjustments

from prior periods.

5 Silver

equivalents utilize the average realized prices during the nine months ended September 30, 2024, of $27.09/oz silver, $1.30/lb zinc,

$0.92/lb lead, $2,162/oz gold and $3.72/lb copper and the average realized prices during the three months ended September 30, 2024, of

$29.62/oz silver, $1.26/lb zinc, $0.93/lb lead and $2,362/oz gold and $3.28/lb copper. Silver equivalents utilize the average realized

prices during the nine months ended September 30, 2023, of $25.08/oz silver, $1.10/lb zinc, $0.98/lb lead and $1,828/oz gold and the

average realized prices during the three months ended September 30, 2023, of $24.24/oz silver, $0.89/lb zinc, $0.97/lb lead and $1,885/oz

gold. The average realized prices are determined based on revenue inclusive of final settlements.

The

following table provides a breakdown of cash flows used by investing activities of the LGJV and a reconciliation of sustaining capital

and resource development drilling to that measure:

| | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in thousands) | |

2024 | |

2023 | |

2024 | |

2023 |

| Cash flow used by investing activities | |

$ | 15,591 | | |

$ | 15,168 | | |

$ | 41,148 | | |

$ | 41,160 | |

| Sustaining capital | |

| 12,919 | | |

| 9,128 | | |

| 33,220 | | |

| 29,870 | |

| Resource development drilling | |

| 2,092 | | |

| 3,452 | | |

| 7,199 | | |

| 10,499 | |

| Materials & supplies | |

| — | | |

| 1,826 | | |

| — | | |

| 503 | |

| Change in capital-related accounts payable | |

| 580 | | |

| 762 | | |

| 729 | | |

| 288 | |

| Total | |

$ | 15,591 | | |

$ | 15,168 | | |

$ | 41,148 | | |

$ | 41,160 | |

The table below

reconciles adjusted net income and adjusted net income per share (basic and diluted), which are non-GAAP measures to net income and net

income per share (basic and diluted), respectively, for the Company:

| | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in thousands) | |

2024 | |

2023 | |

2024 | |

2023 |

| Net income | |

$ | 9,884 | | |

$ | 3,288 | | |

$ | 21,572 | | |

$ | 530 | |

| Costs related to the proposed Merger with First Majestic | |

| 5,314 | | |

| — | | |

| 6,747 | | |

| — | |

| Adjusted net income | |

$ | 15,198 | | |

$ | 3,288 | | |

$ | 28,319 | | |

$ | 530 | |

| Weighted average shares: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 69,343,979 | | |

| 69,162,223 | | |

| 69,247,280 | | |

| 69,162,223 | |

| Diluted | |

| 71,613,178 | | |

| 69,524,838 | | |

| 71,110,386 | | |

| 69,381,222 | |

| Net income per share (basic) | |

$ | 0.14 | | |

$ | 0.05 | | |

$ | 0.31 | | |

$ | 0.01 | |

| Costs related to the proposed Merger with First Majestic per share (basic) | |

$ | 0.08 | | |

$ | — | | |

$ | 0.10 | | |

$ | — | |

| Adjusted net income per share (basic) | |

$ | 0.22 | | |

$ | 0.05 | | |

$ | 0.41 | | |

$ | 0.01 | |

| Costs related to the proposed Merger with First Majestic per share (diluted) | |

$ | 0.07 | | |

$ | — | | |

$ | 0.09 | | |

$ | — | |

| Adjusted net income per share (diluted) | |

$ | 0.21 | | |

$ | 0.05 | | |

$ | 0.40 | | |

$ | 0.01 | |

The table below

reconciles EBITDA and adjusted EBITDA, which are non-GAAP measures, to net income for the Company:

| | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in thousands) | |

2024 | |

2023 | |

2024 | |

2023 |

| Net income | |

$ | 9,884 | | |

$ | 3,288 | | |

$ | 21,572 | | |

$ | 530 | |

| Interest expense | |

| — | | |

| 332 | | |

| — | | |

| 679 | |

| Interest income | |

| (1,322 | ) | |

| (389 | ) | |

| (3,206 | ) | |

| (676 | ) |

| Income tax expense | |

| 529 | | |

| — | | |

| 701 | | |

| — | |

| Depreciation, depletion and amortization | |

| 4 | | |

| 3 | | |

| 11 | | |

| 74 | |

| EBITDA | |

$ | 9,095 | | |

$ | 3,234 | | |

$ | 19,078 | | |

$ | 607 | |

| Costs related to the strategic review resulting in the Merger Agreement with First Majestic | |

$ | 5,314 | | |

| — | | |

$ | 6,747 | | |

| — | |

| Adjusted EBITDA | |

$ | 14,409 | | |

$ | 3,234 | | |

$ | 25,825 | | |

$ | 607 | |

The table below

reconciles EBITDA, a non-GAAP measure, to the LGJV’s net income:

| | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in thousands) | |

2024 | |

2023 | |

2024 | |

2023 |

| Net income | |

$ | 25,720 | | |

$ | 15,053 | | |

$ | 56,379 | | |

$ | 28,500 | |

| Interest expense | |

| 102 | | |

| 343 | | |

| 851 | | |

| 484 | |

| Interest income | |

| (349 | ) | |

| (592 | ) | |

| (892 | ) | |

| (1,147 | ) |

| Income tax expense (recovery) | |

| 13,867 | | |

| (884 | ) | |

| 31,186 | | |

| 9,814 | |

| Depreciation, depletion and amortization | |

| 17,824 | | |

| 16,712 | | |

| 58,901 | | |

| 59,558 | |

| EBITDA | |

$ | 57,164 | | |

$ | 30,632 | | |

$ | 146,425 | | |

$ | 97,209 | |

The following table

sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to cash provided by operating activities for the Company,

which the Company believes to be the GAAP financial measure most directly comparable to free cash flow.

| | |

Three

Months Ended September

30, | |

Nine

Months Ended September

30, |

| (in thousands) | |

2024 | |

2023 | |

2024 | |

2023 |

| Net cash provided by operating activities | |

$ | 34,236 | | |

$ | 33,330 | | |

$ | 61,171 | | |

$ | 25,465 | |

| Net cash used by investing activities | |

| — | | |

| — | | |

| — | | |

| — | |

| Free cash flow | |

$ | 34,236 | | |

$ | 33,330 | | |

$ | 61,171 | | |

$ | 25,465 | |

The following table

sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to cash provided by operating activities for the LGJV.

| | |

Three Months Ended September 30, | |

Nine Months Ended September 30, |

| (in thousands) | |

2024 | |

2023 | |

2024 | |

2023 |

| Net cash provided by operating activities | |

$ | 58,175 | | |

$ | 29,424 | | |

$ | 149,983 | | |

$ | 103,789 | |

| Net cash used by investing activities | |

| (15,591 | ) | |

| (15,168 | ) | |

| (41,148 | ) | |

| (41,160 | ) |

| Free cash flow | |

$ | 42,584 | | |

$ | 14,256 | | |

$ | 108,835 | | |

$ | 62,629 | |

Please see Appendix

A for the unaudited condensed consolidated balance sheets of the Company and the LGJV as of September 30, 2024 and December 31, 2023,

the related unaudited condensed consolidated statements of income and comprehensive income of the Company, the unaudited combined statements

of operations and comprehensive income of the LGJV for the three and nine months ended September 30, 2024 and 2023, and the unaudited

statements of cash flows for the nine months ended September 30, 2024 and 2023.

Forward-Looking Statements

This press release

contains statements that constitute “forward looking information” and “forward-looking statements” within the

meaning of U.S. and Canadian securities laws. All statements other than statements of historical facts contained in this press release,

including statements regarding our updated LOM plan, 2024 revised guidance and the expected timing, benefits, impacts, and completion

of the proposed Merger with First Majestic, are forward-looking statements. Forward-looking statements are based on management’s

beliefs and assumptions and on information currently available to management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or implied in the forward-looking statements, and such other risks and

uncertainties described in our filings with the U.S. Securities and Exchange Commission and Canadian securities commissions. Gatos Silver

expressly disclaims any obligation or undertaking to update the forward-looking statements contained in this press release to reflect

any change in its expectations or any change in events, conditions, or circumstances on which such statements are based unless required

to do so by applicable law. No assurance can be given that such future results will be achieved. Forward-looking statements speak only

as of the date of this press release.

Investors and Media Contact

André van

Niekerk

Chief Financial

Officer

investors@gatossilver.com

(604) 424 0984

APPENDIX A

GATOS SILVER, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

September 30, | |

December 31, |

| (US$ in thousands) | |

2024 | |

2023 |

| ASSETS | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 116,732 | | |

$ | 55,484 | |

| Related party receivables | |

| 292 | | |

| 560 | |

| Other current assets | |

| 1,215 | | |

| 22,642 | |

| Total current assets | |

| 118,239 | | |

| 78,686 | |

| Non-Current Assets | |

| | | |

| | |

| Investment in affiliates | |

| 285,454 | | |

| 321,914 | |

| Deferred tax assets | |

| 222 | | |

| 266 | |

| Other non-current assets | |

| 348 | | |

| 38 | |

| Total Assets | |

$ | 404,263 | | |

$ | 400,904 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and other accrued liabilities | |

$ | 12,226 | | |

$ | 33,357 | |

| Non-Current Liabilities | |

| | | |

| | |

| Lease liability | |

| 187 | | |

| — | |

| Stockholders’ Equity | |

| | | |

| | |

| Common Stock, $0.001 par value; 700,000,000 shares authorized; 69,352,645 and 69,181,047 shares outstanding as of September 30, 2024 and December 31, 2023, respectively | |

| 117 | | |

| 117 | |

| Paid-in capital | |

| 556,050 | | |

| 553,319 | |

| Accumulated deficit | |

| (164,317 | ) | |

| (185,889 | ) |

| Total stockholders’ equity | |

| 391,850 | | |

| 367,547 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 404,263 | | |

$ | 400,904 | |

GATOS SILVER, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF INCOME AND COMPREHENSIVE INCOME

(UNAUDITED)

| | |

Three Months Ended September 30, | |

Nine months ended September 30, |

| (US$ in thousands, except for share data) | |

2024 | |

2023 | |

2024 | |

2023 |

| Expenses | |

| |

| |

| |

|

| Exploration | |

$ | 144 | | |

$ | — | | |

$ | 219 | | |

$ | 26 | |

| General and administrative | |

| 10,435 | | |

| 7,494 | | |

| 25,270 | | |

| 19,157 | |

| Amortization | |

| 4 | | |

| 3 | | |

| 11 | | |

| 74 | |

| Total expenses | |

| 10,583 | | |

| 7,497 | | |

| 25,500 | | |

| 19,257 | |

| Other income | |

| | | |

| | | |

| | | |

| | |

| Equity income in affiliates | |

| 18,171 | | |

| 9,437 | | |

| 39,985 | | |

| 15,922 | |

| Interest expense | |

| — | | |

| (332 | ) | |

| — | | |

| (679 | ) |

| Interest income | |

| 1,322 | | |

| 389 | | |

| 3,206 | | |

| 676 | |

| Other income | |

| 1,503 | | |

| 1,291 | | |

| 4,582 | | |

| 3,868 | |

| Other income | |

| 20,996 | | |

| 10,785 | | |

| 47,773 | | |

| 19,787 | |

| Income before taxes | |

| 10,413 | | |

| 3,288 | | |

| 22,273 | | |

| 530 | |

| Income tax expense | |

| 529 | | |

| — | | |

| 701 | | |

| — | |

| Net income and comprehensive income | |

$ | 9,884 | | |

$ | 3,288 | | |

$ | 21,572 | | |

$ | 530 | |

| Net income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.14 | | |

$ | 0.05 | | |

$ | 0.31 | | |

$ | 0.01 | |

| Diluted | |

$ | 0.14 | | |

$ | 0.05 | | |

$ | 0.30 | | |

$ | 0.01 | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 69,343,979 | | |

| 69,162,223 | | |

| 69,247,280 | | |

| 69,162,223 | |

| Diluted | |

| 71,613,178 | | |

| 69,524,838 | | |

| 71,110,386 | | |

| 69,381,222 | |

GATOS SILVER, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(UNAUDITED)

| | |

Nine months ended September 30, |

| (US$ in thousands) | |

2024 | |

2023 |

| OPERATING ACTIVITIES | |

| | | |

| | |

| Net income | |

$ | 21,572 | | |

$ | 530 | |

| | |

| | | |

| | |

| Adjustments to reconcile net income to net cash provided (used) by operating activities: | |

| | | |

| | |

| Amortization | |

| 11 | | |

| 74 | |

| Stock-based compensation expense | |

| 4,319 | | |

| 3,327 | |

| Equity income in affiliates | |

| (39,985 | ) | |

| (15,922 | ) |

| Distributions and dividends received from affiliate | |

| 76,445 | | |

| 35,000 | |

| Other | |

| 94 | | |

| 837 | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Receivables from related-parties | |

| 268 | | |

| 678 | |

| Accounts payable and other accrued liabilities | |

| (23,007 | ) | |

| 5 | |

| Other current assets | |

| 21,454 | | |

| 936 | |

| Net cash provided by operating activities | |

| 61,171 | | |

| 25,465 | |

| | |

| | | |

| | |

| INVESTING ACTIVITIES | |

| | | |

| | |

| Net cash used by investing activities | |

| — | | |

| — | |

| | |

| | | |

| | |

| FINANCING ACTIVITIES | |

| | | |

| | |

| Repayment of Credit facility | |

| — | | |

| (9,000 | ) |

| Lease payments | |

| (89 | ) | |

| — | |

| Proceeds from exercise of stock options | |

| 166 | | |

| — | |

| Net cash provided (used) by financing activities | |

| 77 | | |

| (9,000 | ) |

| Net increase in cash and cash equivalents | |

| 61,248 | | |

| 16,465 | |

| Cash and cash equivalents, beginning of period | |

| 55,484 | | |

| 17,004 | |

| Cash and cash equivalents, end of period | |

$ | 116,732 | | |

$ | 33,469 | |

| | |

| | | |

| | |

| Interest paid | |

$ | 16 | | |

$ | 417 | |

| Interest earned | |

$ | 3,206 | | |

$ | 690 | |

LOS GATOS JOINT VENTURE

COMBINED BALANCE SHEETS

(UNAUDITED)

| | |

September 30, | |

December 31, |

| (US$ in thousands) | |

2024 | |

2023 |

| ASSETS | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 33,884 | | |

$ | 34,303 | |

| Receivables | |

| 13,646 | | |

| 12,634 | |

| Inventories | |

| 16,180 | | |

| 16,397 | |

| VAT receivable | |

| 13,417 | | |

| 12,610 | |

| Income tax receivable | |

| 9,296 | | |

| 20,185 | |

| Other current assets | |

| 3,435 | | |

| 1,253 | |

| Total current assets | |

| 89,858 | | |

| 97,382 | |

| Non-Current Assets | |

| | | |

| | |

| Mine development, net | |

| 231,060 | | |

| 234,980 | |

| Property, plant and equipment, net | |

| 159,220 | | |

| 171,965 | |

| Deferred tax assets | |

| 699 | | |

| 9,568 | |

| Total non-current assets | |

| 390,979 | | |

| 416,513 | |

| Total Assets | |

$ | 480,837 | | |

$ | 513,895 | |

| LIABILITIES AND OWNERS’ CAPITAL | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 33,999 | | |

$ | 29,100 | |

| VAT payable | |

| 11,873 | | |

| 8,684 | |

| Income taxes payable | |

| 11,204 | | |

| 920 | |

| Related party payable | |

| 270 | | |

| 560 | |

| Total current liabilities | |

| 57,346 | | |

| 39,264 | |

| Non-Current Liabilities | |

| | | |

| | |

| Lease liability | |

| 155 | | |

| 208 | |

| Asset retirement obligation | |

| 12,245 | | |

| 11,593 | |

| Deferred tax liabilities | |

| 4,974 | | |

| 3,885 | |

| Total non-current liabilities | |

| 17,374 | | |

| 15,686 | |

| Owners’ Capital | |

| | | |

| | |

| Capital contributions | |

| 360,638 | | |

| 455,638 | |

| Paid-in capital | |

| 18,186 | | |

| 18,186 | |

| Retained earnings (accumulated deficit) | |

| 27,293 | | |

| (14,879 | ) |

| Total owners’ capital | |

| 406,117 | | |

| 458,945 | |

| Total Liabilities and Owners’ Capital | |

$ | 480,837 | | |

$ | 513,895 | |

LOS GATOS JOINT VENTURE

COMBINED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME

(UNAUDITED)

| | |

Three months ended September 30, | |

Nine months ended September 30, |

| (US$ in thousands) | |

2024 | |

2023 | |

2024 | |

2023 |

| Revenue | |

$ | 93,839 | | |

$ | 67,038 | | |

$ | 260,255 | | |

$ | 195,162 | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 31,204 | | |

| 31,446 | | |

| 93,931 | | |

| 83,255 | |

| Royalties and duties | |

| 639 | | |

| 298 | | |

| 1,682 | | |

| 1,024 | |

| Exploration | |

| 1,605 | | |

| 998 | | |

| 4,577 | | |

| 2,118 | |

| General and administrative | |

| 3,943 | | |

| 4,355 | | |

| 12,317 | | |

| 12,693 | |

| Depreciation, depletion and amortization | |

| 17,824 | | |

| 16,712 | | |

| 58,901 | | |

| 59,558 | |

| Total expenses | |

| 55,215 | | |

| 53,809 | | |

| 171,408 | | |

| 158,648 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other (income) expense | |

| | | |

| | | |

| | | |

| | |

| Accretion expense | |

| 217 | | |

| 273 | | |

| 652 | | |

| 866 | |

| Interest expense | |

| 102 | | |

| 343 | | |

| 851 | | |

| 484 | |

| Interest income | |

| (349 | ) | |

| (592 | ) | |

| (892 | ) | |

| (1,147 | ) |

| Other (income) expense | |

| (13 | ) | |

| (18 | ) | |

| 635 | | |

| 13 | |

| Foreign exchange (gain) loss | |

| (920 | ) | |

| (946 | ) | |

| 36 | | |

| (2,016 | ) |

| | |

| (963 | ) | |

| (940 | ) | |

| 1,282 | | |

| (1,800 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income before taxes | |

| 39,587 | | |

| 14,169 | | |

| 87,565 | | |

| 38,314 | |

| Income tax expense (recovery) | |

| 13,867 | | |

| (884 | ) | |

| 31,186 | | |

| 9,814 | |

| Net income and comprehensive income | |

$ | 25,720 | | |

$ | 15,053 | | |

$ | 56,379 | | |

$ | 28,500 | |

LOS GATOS JOINT VENTURE

COMBINED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

Nine months ended September 30, |

| (US$ in thousands) | |

2024 | |

2023 |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 56,379 | | |

$ | 28,500 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation, depletion and amortization | |

| 58,901 | | |

| 59,558 | |

| Accretion | |

| 652 | | |

| 866 | |

| Deferred taxes | |

| 10,210 | | |

| 4,743 | |

| Unrealized loss (gain) on foreign currency rate change | |

| 105 | | |

| (5,007 | ) |

| Other | |

| — | | |

| (6 | ) |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| VAT receivable | |

| (1,326 | ) | |

| 11,215 | |

| Receivables | |

| (1,012 | ) | |

| 16,725 | |

| Inventories | |

| (1,379 | ) | |

| (1,429 | ) |

| Other current assets | |

| (2,190 | ) | |

| 403 | |

| Income tax receivable | |

| 8,495 | | |

| (633 | ) |

| Accounts payable and other accrued liabilities | |

| 21,438 | | |

| (8,596 | ) |

| Payables to related parties | |

| (290 | ) | |

| (730 | ) |

| Asset Retirement Obligation | |

| — | | |

| (1,820 | ) |

| Net cash provided by operating activities | |

| 149,983 | | |

| 103,789 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Mine development | |

| (32,263 | ) | |

| (27,151 | ) |

| Purchase of property, plant and equipment | |

| (8,885 | ) | |

| (13,506 | ) |

| Materials and supplies inventory | |

| — | | |

| (503 | ) |

| Net cash used by investing activities | |

| (41,148 | ) | |

| (41,160 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Equipment loan and lease payments | |

| (47 | ) | |

| (532 | ) |

| Capital distributions | |

| (95,000 | ) | |

| (50,000 | ) |

| Dividends paid to partners | |

| (14,207 | ) | |

| — | |

| Net cash used by financing activities | |

| (109,254 | ) | |

| (50,532 | ) |

| | |

| | | |

| | |

| Net (decrease) Increase in cash and cash equivalents | |

| (419 | ) | |

| 12,097 | |

| Cash and cash equivalents, beginning of period | |

| 34,303 | | |

| 34,936 | |

| Cash and cash equivalents, end of period | |

$ | 33,884 | | |

$ | 47,033 | |

| Interest paid | |

$ | 851 | | |

$ | 484 | |

| Interest earned | |

$ | 892 | | |

$ | 1,147 | |

v3.24.3

Cover

|

Nov. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 11, 2024

|

| Entity File Number |

001-39649

|

| Entity Registrant Name |

GATOS SILVER, INC.

|

| Entity Central Index Key |

0001517006

|

| Entity Tax Identification Number |

27-2654848

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

925 W Georgia Street

|

| Entity Address, Address Line Two |

Suite

910

|

| Entity Address, City or Town |

Vancouver

|

| Entity Address, State or Province |

BC

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

V6C 3L2

|

| City Area Code |

604

|

| Local Phone Number |

424-0984

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

GATO

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

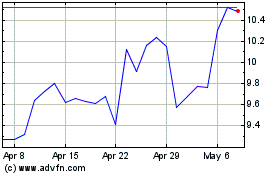

Gatos Silver (NYSE:GATO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gatos Silver (NYSE:GATO)

Historical Stock Chart

From Nov 2023 to Nov 2024