false0000821189

0000821189

2019-11-06

2019-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2019

_______________

EOG RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 1-9743 | 47-0684736 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1111 Bagby, Sky Lobby 2

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

713-651-7000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

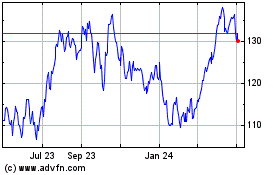

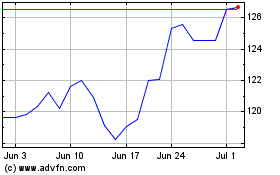

Common Stock, par value $0.01 per share | EOG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EOG RESOURCES, INC.

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2019, EOG Resources, Inc. issued a press release announcing third quarter 2019 financial and operational results and fourth quarter and full year 2019 forecast and benchmark commodity pricing information (see Item 7.01 below). A copy of this release is attached as Exhibit 99.1 to this filing and is incorporated herein by reference. This information shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or Securities Exchange Act of 1934, as amended.

Item 7.01 Regulation FD Disclosure.

Accompanying the press release announcing third quarter 2019 financial and operational results attached hereto as Exhibit 99.1 is fourth quarter and full year 2019 forecast and benchmark commodity pricing information for EOG Resources, Inc., which information is incorporated herein by reference. This information shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (formatted as Inline XBRL).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | EOG RESOURCES, INC. (Registrant) |

| | |

| | |

| | |

Date: November 6, 2019 | By: | /s/ TIMOTHY K. DRIGGERS Timothy K. Driggers Executive Vice President and Chief Financial Officer (Principal Financial Officer and Duly Authorized Officer) |

EXHIBIT 99.1

November 6, 2019

EOG Resources Reports Outstanding Third Quarter 2019 Results; Announces Two New Delaware Basin Plays and Adds 1,700 Net Premium Locations

| |

• | Exceeded Crude Oil Production Target Range and Raised Full-Year 2019 U.S. Crude Oil Growth Target from 14 to 15 Percent |

| |

• | Capital Expenditures Near Low End of Target Range |

| |

• | Generated Significant Net Cash From Operating Activities and Free Cash Flow |

| |

• | Reduced YTD Well Costs 5 Percent |

| |

• | Per-Unit Lease and Well and DD&A Expense Rates Below Low End of Target Ranges |

| |

• | Added 1,700 Net Premium Locations to Inventory Now Totaling 10,500 Locations and Representing Over 14 Years of Drilling Inventory |

| |

• | New Delaware Basin Wolfcamp M and Third Bone Spring Plays Add 1.6 BnBoe Net Resource Potential |

HOUSTON - EOG Resources, Inc. (EOG) today reported third quarter 2019 net income of $615 million, or $1.06 per share, compared with third quarter 2018 net income of $1.2 billion, or $2.05 per share. Net cash provided by operating activities for the third quarter 2019 was $2.1 billion.

Adjusted non-GAAP net income for the third quarter 2019 was $654 million, or $1.13 per share, compared with adjusted non-GAAP net income of $1.0 billion, or $1.75 per share, for the same prior year period. Please refer to the attached tables for the reconciliation of non-GAAP measures to GAAP measures.

Third Quarter 2019 Operating Review

Total crude oil volumes of 464,100 barrels of oil per day (Bopd) in the third quarter 2019 increased 12 percent compared to the same prior year period and were above the high end of the target range. Natural gas liquids (NGLs) and natural gas volumes each grew 11 percent. EOG incurred total expenditures of $1.6 billion in the third quarter. Cash capital expenditures before acquisitions of $1.5 billion were near the low end of the target range. Please refer to the attached tables for the reconciliation of non-GAAP measures to GAAP measures.

EOG continued to lower operating costs during the third quarter 2019. Per-unit transportation costs declined nine percent compared to the same prior-year period, depreciation, depletion and amortization expenses fell seven percent year-over-year, and lease and well expenses declined three percent year-over-year.

EOG generated $2.0 billion of discretionary cash flow in the third quarter 2019. After considering cash capital expenditures before acquisitions of $1.5 billion and dividend payments of $166 million, EOG generated free cash flow during the third quarter 2019 of $337 million. Please refer to the attached tables for the reconciliation of non-GAAP measures to GAAP measures.

“EOG’s operating performance has never been better. The company generated outstanding financial results in the third quarter driven by improvements in every area,” said William R. “Bill” Thomas, Chairman and Chief Executive Officer. “We reduced operating expenses, grew volumes at double-digit rates while lowering well costs and generated substantial free cash flow. EOG has never been in a better position to sustain this success long into the future.”

New Delaware Basin Plays and Premium Inventory Update

EOG expanded its lineup of premium plays in the Delaware Basin with the addition of the Wolfcamp M and the Third Bone Spring. The drilling locations in these two plays are highly economic at a flat $40 oil price and flat $2.50 natural gas price, consistent with EOG’s definition of premium inventory. The company continues to deepen its technical knowledge of the Delaware Basin as it executes its development program. EOG collects significant amounts of data on each well, integrates it with existing models and incorporates analysis from numerous spacing and targeting tests.

EOG has identified an initial 855 net premium drilling locations in the Wolfcamp M, with estimated net resource potential of 1.0 billion barrels of oil equivalent across its 193,000 net acre position. The wells in this deeper section of the Wolfcamp formation produce roughly equal parts oil, NGLs and natural gas. Benefiting from EOG’s low well costs, Wolfcamp M wells deliver strong premium economics and exceptionally low finding costs.

To define the play, EOG has gathered extensive subsurface information and has completed six Wolfcamp M wells, including two during 2019. The Green Drake 16 Fed Com #759H was completed in Lea County, NM with a treated lateral length of 7,200 feet and a 30-day initial production rate of 4,165 barrels of oil equivalent per day (Boed), or 2,145 Bopd, 1,070 barrels per day (Bpd) of NGLs and 5.7 million cubic feet per day (MMcfd) of natural gas. In Reeves County, TX, the State Correa #3H was completed with a treated lateral length of 9,900 feet and a 30-day initial production rate of 2,800 Boed, or 1,175 Bopd, 845 Bpd of NGLs and 4.7 MMcfd of natural gas.

EOG has identified an initial 615 net premium drilling locations in the Third Bone Spring, with estimated net resource potential of 585 million barrels of oil equivalent across its 200,000 net acre position. EOG’s early focus in the Delaware Basin has been on development of the Wolfcamp formation, which sits below the Third Bone Spring. Each of the Wolfcamp wells has drilled through the Third Bone Spring, providing significant technical data and helping to delineate multiple targets within the play.

EOG has completed over 50 Third Bone Spring wells to date, including 10 net wells in 2019. The McGregor D 5 #592H targeted the Third Bone Spring Carbonate and was completed in Loving County, TX with a treated lateral length of 9,700 feet and a 30-day initial production rate of 2,865 Boed, or 1,990 Bopd, 500 Bpd of NGLs and 2.3 MMcfd of natural gas. In Lea County, NM, the Caravan 28 State Com #601H and the Convoy 28 State Com #606H targeted the Third Bone Spring Sand and were completed with an average treated lateral length of 10,000 feet per well and average 30-day initial production rates per well of 3,985 Boed, or 2,730 Bopd, 670 Bpd of NGLs and 3.5 MMcfd of natural gas.

In total, EOG added 1,700 net premium drilling locations to its undrilled premium inventory in the third quarter 2019. Taking into account approximately 640 net wells drilled to date in 2019 and updated location counts across its portfolio, EOG’s premium inventory now totals 10,500 net locations, representing more than 14 years of high-return drilling inventory.

“EOG is a returns-focused company where organic growth is driven by exploration and low-cost development. The announcement of two more premium plays in the Delaware Basin and the addition of 1,700 new net premium drilling locations demonstrate the sustainability of our unique business model,”

Thomas continued. “EOG continues to demonstrate its ability to generate attractive returns on capital through reinvestment in an improving inventory of premium wells across multiple plays. Our best-in-class assets prove that EOG can adapt to changing industry conditions and create significant shareholder value for years to come.”

Financial Review

EOG further strengthened its financial position during the third quarter 2019. At September 30, 2019, EOG’s total debt outstanding was $5.2 billion for a debt-to-total capitalization ratio of 20 percent. Considering $1.6 billion of cash on the balance sheet at the end of the third quarter, EOG’s net debt was $3.6 billion for a net debt-to-total capitalization ratio of 15 percent. For a reconciliation of non-GAAP measures to GAAP measures, please refer to the attached tables.

Third Quarter 2019 Results Webcast

Thursday, November 7, 2019, 9:00 a.m. Central time (10:00 a.m. Eastern time)

Webcast will be available on EOG website for one year.

http://investors.eogresources.com/Investors

About EOG

EOG Resources, Inc. (NYSE: EOG) is one of the largest crude oil and natural gas exploration and production companies in the United States with proved reserves in the United States, Trinidad, and China. To learn more visit www.eogresources.com.

Investor Contacts

David Streit 713-571-4902

Neel Panchal 713-571-4884

Media and Investor Contact

Kimberly Ehmer 713-571-4676

This press release may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, including, among others, statements and projections regarding EOG's future financial position, operations, performance, business strategy, returns, budgets, reserves, levels of production, capital expenditures, costs and asset sales, statements regarding future commodity prices and statements regarding the plans and objectives of EOG's management for future operations, are forward-looking statements. EOG typically uses words such as "expect," "anticipate," "estimate," "project," "strategy," "intend," "plan," "target," “aims,” "goal," "may," "will," "should" and "believe" or the negative of those terms or other variations or comparable terminology to identify its forward-looking statements. In particular, statements, express or implied, concerning EOG's future operating results and returns or EOG's ability to replace or increase reserves, increase production, generate returns, replace or increase drilling locations, reduce or otherwise control operating costs and capital expenditures, generate cash flows, pay down or refinance indebtedness or pay and/or increase dividends are forward-looking statements. Forward-looking statements are not guarantees of performance. Although EOG believes the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, EOG's forward-looking statements may be affected by known, unknown or currently unforeseen risks, events or circumstances that may be outside EOG's control. Furthermore, this press release and any accompanying disclosures may include or reference certain forward-looking, non-GAAP financial measures, such as free cash flow or discretionary cash flow, and certain related estimates regarding future performance, results and financial position. Any such forward-looking measures and estimates are intended to be illustrative only and are not intended to reflect the results that EOG will necessarily achieve for the period(s) presented; EOG’s actual results may differ materially from such measures and estimates. Important factors that could cause EOG's actual results to differ materially from the expectations reflected in EOG's forward-looking statements include, among others:

| |

• | the timing, extent and duration of changes in prices for, supplies of, and demand for, crude oil and condensate, natural gas liquids, natural gas and related commodities; |

| |

• | the extent to which EOG is successful in its efforts to acquire or discover additional reserves; |

| |

• | the extent to which EOG is successful in its efforts to economically develop its acreage in, produce reserves and achieve anticipated production levels from, and maximize reserve recovery from, its existing and future crude oil and natural gas exploration and development projects; |

| |

• | the extent to which EOG is successful in its efforts to market its crude oil and condensate, natural gas liquids, natural gas and related commodity production; |

| |

• | the availability, proximity and capacity of, and costs associated with, appropriate gathering, processing, compression, storage, transportation and refining facilities; |

| |

• | the availability, cost, terms and timing of issuance or execution of, and competition for, mineral licenses and leases and governmental and other permits and rights-of-way, and EOG’s ability to retain mineral licenses and leases; |

| |

• | the impact of, and changes in, government policies, laws and regulations, including tax laws and regulations; climate change and other environmental, health and safety laws and regulations relating to air emissions, disposal of produced water, drilling fluids and other wastes, hydraulic fracturing and access to and use of water; laws and regulations imposing conditions or restrictions on drilling and completion operations and on the transportation of crude oil and natural gas; laws and regulations with respect to derivatives and hedging activities; and laws and regulations with respect to the import and export of crude oil, natural gas and related commodities; |

| |

• | EOG's ability to effectively integrate acquired crude oil and natural gas properties into its operations, fully identify existing and potential problems with respect to such properties and accurately estimate reserves, production and costs with respect to such properties; |

| |

• | the extent to which EOG's third-party-operated crude oil and natural gas properties are operated successfully and economically; |

| |

• | competition in the oil and gas exploration and production industry for the acquisition of licenses, leases and properties, employees and other personnel, facilities, equipment, materials and services; |

| |

• | the availability and cost of employees and other personnel, facilities, equipment, materials (such as water and tubulars) and services; |

| |

• | the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise; |

| |

• | weather, including its impact on crude oil and natural gas demand, and weather-related delays in drilling and in the installation and operation (by EOG or third parties) of production, gathering, processing, refining, compression, storage and transportation facilities; |

| |

• | the ability of EOG's customers and other contractual counterparties to satisfy their obligations to EOG and, related thereto, to access the credit and capital markets to obtain financing needed to satisfy their obligations to EOG; |

| |

• | EOG's ability to access the commercial paper market and other credit and capital markets to obtain financing on terms it deems acceptable, if at all, and to otherwise satisfy its capital expenditure requirements; |

| |

• | the extent to which EOG is successful in its completion of planned asset dispositions; |

| |

• | the extent and effect of any hedging activities engaged in by EOG; |

| |

• | the timing and extent of changes in foreign currency exchange rates, interest rates, inflation rates, global and domestic financial market conditions and global and domestic general economic conditions; |

| |

• | geopolitical factors and political conditions and developments around the world (such as the imposition of tariffs or trade or other economic sanctions, political instability and armed conflict), including in the areas in which EOG operates; |

| |

• | the use of competing energy sources and the development of alternative energy sources; |

| |

• | the extent to which EOG incurs uninsured losses and liabilities or losses and liabilities in excess of its insurance coverage; |

| |

• | acts of war and terrorism and responses to these acts; |

| |

• | physical, electronic and cybersecurity breaches; and |

| |

• | the other factors described under ITEM 1A, Risk Factors, on pages 13 through 22 of EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and any updates to those factors set forth in EOG's subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. |

In light of these risks, uncertainties and assumptions, the events anticipated by EOG's forward-looking statements may not occur, and, if any of such events do, we may not have anticipated the timing of their occurrence or the duration or extent of their impact on our actual results. Accordingly, you should not place any undue reliance on any of EOG's forward-looking statements. EOG's forward-looking statements speak only as of the date made, and EOG undertakes no obligation, other than as required by applicable law, to update or revise its forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise.

The United States Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only “proved” reserves (i.e., quantities of oil and gas that are estimated to be recoverable with a high degree of confidence), but also “probable” reserves (i.e., quantities of oil and gas that are as likely as not to be recovered) as well as “possible” reserves (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable

reserves). Statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve or resource estimates provided in this press release that are not specifically designated as being estimates of proved reserves may include "potential" reserves, “resource potential” and/or other estimated reserves or estimated resources not necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. Investors are urged to consider closely the disclosure in EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, available from EOG at P.O. Box 4362, Houston, Texas 77210-4362 (Attn: Investor Relations). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC's website at www.sec.gov. In addition, reconciliation and calculation schedules for non-GAAP financial measures can be found on the EOG website at www.eogresources.com.

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Financial Report (Unaudited; in millions, except per share data) |

|

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | |

Operating Revenues and Other | $ | 4,303.5 |

| | $ | 4,781.6 |

| | $ | 13,059.7 |

| | $ | 12,700.9 |

|

Net Income | $ | 615.1 |

| | $ | 1,191.0 |

| | $ | 2,098.4 |

| | $ | 2,526.3 |

|

Net Income Per Share | | | | | | | |

Basic | $ | 1.06 |

| | $ | 2.06 |

| | $ | 3.63 |

| | $ | 4.38 |

|

Diluted | $ | 1.06 |

| | $ | 2.05 |

| | $ | 3.61 |

| | $ | 4.35 |

|

Average Number of Common Shares | | | | | | | |

Basic | 577.8 |

| | 577.3 |

| | 577.5 |

| | 576.4 |

|

Diluted | 581.3 |

| | 581.6 |

| | 581.2 |

| | 580.4 |

|

| | | | | | | |

|

| | | | | | | | | | | | | | | |

Summary Income Statements (Unaudited; in thousands, except per share data) |

|

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Operating Revenues and Other | | | | |

Crude Oil and Condensate | $ | 2,418,989 |

| | $ | 2,655,278 |

| | $ | 7,148,258 |

| | $ | 7,134,114 |

|

Natural Gas Liquids | 164,736 |

| | 353,704 |

| | 569,748 |

| | 861,473 |

|

Natural Gas | 269,625 |

| | 311,713 |

| | 874,489 |

| | 912,324 |

|

Gains (Losses) on Mark-to-Market Commodity Derivative Contracts | 85,902 |

| | (52,081 | ) | | 242,622 |

| | (297,735 | ) |

Gathering, Processing and Marketing | 1,334,450 |

| | 1,360,992 |

| | 4,121,490 |

| | 3,899,250 |

|

Gains (Losses) on Asset Dispositions, Net | (523 | ) | | 115,944 |

| | 3,650 |

| | 94,658 |

|

Other, Net | 30,276 |

| | 36,074 |

| | 99,470 |

| | 96,779 |

|

Total | 4,303,455 |

| | 4,781,624 |

| | 13,059,727 |

| | 12,700,863 |

|

Operating Expenses | | | | | | | |

Lease and Well | 348,883 |

| | 321,568 |

| | 1,032,455 |

| | 936,236 |

|

Transportation Costs | 199,365 |

| | 196,027 |

| | 549,988 |

| | 550,781 |

|

Gathering and Processing Costs | 127,549 |

| | 114,063 |

| | 351,487 |

| | 324,577 |

|

Exploration Costs | 34,540 |

| | 32,823 |

| | 103,386 |

| | 115,137 |

|

Dry Hole Costs | 24,138 |

| | 358 |

| | 28,001 |

| | 5,260 |

|

Impairments | 105,275 |

| | 44,617 |

| | 289,761 |

| | 160,934 |

|

Marketing Costs | 1,343,293 |

| | 1,326,974 |

| | 4,114,265 |

| | 3,853,827 |

|

Depreciation, Depletion and Amortization | 953,597 |

| | 918,180 |

| | 2,790,496 |

| | 2,515,445 |

|

General and Administrative | 135,758 |

| | 111,284 |

| | 364,210 |

| | 310,065 |

|

Taxes Other Than Income | 203,098 |

| | 209,043 |

| | 600,418 |

| | 582,395 |

|

Total | 3,475,496 |

| | 3,274,937 |

| | 10,224,467 |

| | 9,354,657 |

|

| | | | | | | |

Operating Income | 827,959 |

| | 1,506,687 |

| | 2,835,260 |

| | 3,346,206 |

|

| | | | | | | |

Other Income (Expense), Net | 9,118 |

| | 3,308 |

| | 23,233 |

| | (4,516 | ) |

| | | | | | | |

Income Before Interest Expense and Income Taxes | 837,077 |

| | 1,509,995 |

| | 2,858,493 |

| | 3,341,690 |

|

| | | | | | | |

Interest Expense, Net | 39,620 |

| | 63,632 |

| | 144,434 |

| | 189,032 |

|

| | | | | | | |

Income Before Income Taxes | 797,457 |

| | 1,446,363 |

| | 2,714,059 |

| | 3,152,658 |

|

| | | | | | | |

Income Tax Provision | 182,335 |

| | 255,411 |

| | 615,670 |

| | 626,386 |

|

| | | | | | | |

Net Income | $ | 615,122 |

| | $ | 1,190,952 |

| | $ | 2,098,389 |

| | $ | 2,526,272 |

|

| | | | | | | |

Dividends Declared per Common Share | $ | 0.2875 |

| | $ | 0.2200 |

| | $ | 0.7950 |

| | $ | 0.5900 |

|

| | | | | | | |

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Operating Highlights (Unaudited) |

| | |

| Three Months Ended | | | | Nine Months Ended | | |

| September 30, | | | | September 30, | | |

| 2019 | | 2018 | | % Change | | 2019 | | 2018 | | % Change |

Wellhead Volumes and Prices | | | | | | | | | | | |

Crude Oil and Condensate Volumes (MBbld) (A) | | | | | | | |

United States | 463.2 |

| | 409.2 |

| | 13 | % | | 451.2 |

| | 382.9 |

| | 18 | % |

Trinidad | 0.8 |

| | 0.8 |

| | 0 | % | | 0.7 |

| | 0.8 |

| | -13 | % |

Other International (B) | 0.1 |

| | 5.0 |

| | -98 | % | | 0.1 |

| | 4.1 |

| | -98 | % |

Total | 464.1 |

| | 415.0 |

| | 12 | % | | 452.0 |

| | 387.8 |

| | 17 | % |

| | | | | | | | | | | |

Average Crude Oil and Condensate Prices ($/Bbl) (C) | | | | | | | | | | | |

United States | $ | 56.67 |

| | $ | 69.53 |

| | -18 | % | | $ | 57.95 |

| | $ | 67.35 |

| | -14 | % |

Trinidad | 48.36 |

| | 61.71 |

| | -22 | % | | 47.26 |

| | 58.91 |

| | -20 | % |

Other International (B) | 59.87 |

| | 72.81 |

| | -18 | % | | 58.43 |

| | 71.83 |

| | -19 | % |

Composite | 56.66 |

| | 69.55 |

| | -19 | % | | 57.93 |

| | 67.38 |

| | -14 | % |

| | | | | | | | | | | |

Natural Gas Liquids Volumes (MBbld) (A) | | | | | | | | | | | |

United States | 141.3 |

| | 127.8 |

| | 11 | % | | 130.8 |

| | 113.9 |

| | 15 | % |

Other International (B) | — |

| | — |

| | | | — |

| | — |

| | |

Total | 141.3 |

| | 127.8 |

| | 11 | % | | 130.8 |

| | 113.9 |

| | 15 | % |

| | | | | | | | | | | |

Average Natural Gas Liquids Prices ($/Bbl) (C) | | | | | | | | | | | |

United States | $ | 12.67 |

| | $ | 30.09 |

| | -58 | % | | $ | 15.96 |

| | $ | 27.71 |

| | -42 | % |

Other International (B) | — |

| | — |

| | | | — |

| | — |

| | |

Composite | 12.67 |

| | 30.09 |

| | -58 | % | | 15.96 |

| | 27.71 |

| | -42 | % |

| | | | | | | | | | | |

Natural Gas Volumes (MMcfd) (A) | | | | | | | | | | | |

United States | 1,079 |

| | 948 |

| | 14 | % | | 1,043 |

| | 905 |

| | 15 | % |

Trinidad | 260 |

| | 260 |

| | 0 | % | | 267 |

| | 278 |

| | -4 | % |

Other International (B) | 34 |

| | 28 |

| | 21 | % | | 36 |

| | 31 |

| | 16 | % |

Total | 1,373 |

| | 1,236 |

| | 11 | % | | 1,346 |

| | 1,214 |

| | 11 | % |

| | | | | | | | | | | |

Average Natural Gas Prices ($/Mcf) (C) | | | | | | | | | | | |

United States | $ | 1.97 |

| | $ | 2.67 |

| | -26 | % | | $ | 2.23 |

| | $ | 2.66 |

| | -16 | % |

Trinidad | 2.52 |

| | 2.88 |

| | -12 | % | | 2.71 |

| | 2.91 |

| | -7 | % |

Other International (B) | 4.25 |

| | 3.83 |

| | 11 | % | | 4.29 |

| | 4.10 |

| | 5 | % |

Composite | 2.13 |

| | 2.74 |

| | -22 | % | | 2.38 |

| | 2.75 |

| | -14 | % |

| | | | | | | | | | | |

Crude Oil Equivalent Volumes (MBoed) (D) | | | | | | | | | | | |

United States | 784.3 |

| | 695.0 |

| | 13 | % | | 755.8 |

| | 647.6 |

| | 17 | % |

Trinidad | 44.1 |

| | 44.1 |

| | 0 | % | | 45.1 |

| | 47.2 |

| | -4 | % |

Other International (B) | 5.8 |

| | 9.7 |

| | -40 | % | | 6.2 |

| | 9.2 |

| | -33 | % |

Total | 834.2 |

| | 748.8 |

| | 11 | % | | 807.1 |

| | 704.0 |

| | 15 | % |

| | | | | | | | | | | |

Total MMBoe (D) | 76.7 |

| | 68.9 |

| | 11 | % | | 220.3 |

| | 192.2 |

| | 15 | % |

| |

(A) | Thousand barrels per day or million cubic feet per day, as applicable. |

| |

(B) | Other International includes EOG's United Kingdom, China and Canada operations. The United Kingdom operations were sold in the fourth quarter of 2018. |

| |

(C) | Dollars per barrel or per thousand cubic feet, as applicable. Excludes the impact of financial commodity derivative instruments (see Note 12 to the Condensed Consolidated Financial Statements in EOG's Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2019). |

| |

(D) | Thousand barrels of oil equivalent per day or million barrels of oil equivalent, as applicable; includes crude oil and condensate, NGLs and natural gas. Crude oil equivalent volumes are determined using a ratio of 1.0 barrel of crude oil and condensate or NGLs to 6.0 thousand cubic feet of natural gas. MMBoe is calculated by multiplying the MBoed amount by the number of days in the period and then dividing that amount by one thousand. |

|

| | | | | | | |

EOG RESOURCES, INC. Summary Balance Sheets (Unaudited; in thousands, except share data) |

|

| September 30, | | December 31, |

| 2019 | | 2018 |

ASSETS |

Current Assets | | | |

Cash and Cash Equivalents | $ | 1,583,105 |

| | $ | 1,555,634 |

|

Accounts Receivable, Net | 1,927,996 |

| | 1,915,215 |

|

Inventories | 778,120 |

| | 859,359 |

|

Assets from Price Risk Management Activities | 122,627 |

| | 23,806 |

|

Income Taxes Receivable | 135,680 |

| | 427,909 |

|

Other | 272,203 |

| | 275,467 |

|

Total | 4,819,731 |

| | 5,057,390 |

|

|

Property, Plant and Equipment | | | |

Oil and Gas Properties (Successful Efforts Method) | 61,620,033 |

| | 57,330,016 |

|

Other Property, Plant and Equipment | 4,394,486 |

| | 4,220,665 |

|

Total Property, Plant and Equipment | 66,014,519 |

| | 61,550,681 |

|

Less: Accumulated Depreciation, Depletion and Amortization | (35,810,197 | ) | | (33,475,162 | ) |

Total Property, Plant and Equipment, Net | 30,204,322 |

| | 28,075,519 |

|

Deferred Income Taxes | 1,998 |

| | 777 |

|

Other Assets | 1,516,218 |

| | 800,788 |

|

Total Assets | $ | 36,542,269 |

| | $ | 33,934,474 |

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

Current Liabilities | | | |

Accounts Payable | $ | 2,395,080 |

| | $ | 2,239,850 |

|

Accrued Taxes Payable | 302,774 |

| | 214,726 |

|

Dividends Payable | 166,215 |

| | 126,971 |

|

Current Portion of Long-Term Debt | 1,014,200 |

| | 913,093 |

|

Current Portion of Operating Lease Liabilities | 384,348 |

| | — |

|

Other | 211,096 |

| | 233,724 |

|

Total | 4,473,713 |

| | 3,728,364 |

|

| | | |

| | | |

Long-Term Debt | 4,163,115 |

| | 5,170,169 |

|

Other Liabilities | 1,858,357 |

| | 1,258,355 |

|

Deferred Income Taxes | 4,922,804 |

| | 4,413,398 |

|

Commitments and Contingencies | | | |

| | | |

Stockholders' Equity | | | |

Common Stock, $0.01 Par, 1,280,000,000 Shares Authorized and 582,066,483 Shares Issued at September 30, 2019 and 580,408,117 Shares Issued at December 31, 2018 | 205,821 |

| | 205,804 |

|

Additional Paid in Capital | 5,769,073 |

| | 5,658,794 |

|

Accumulated Other Comprehensive Loss | (3,689 | ) | | (1,358 | ) |

Retained Earnings | 15,179,381 |

| | 13,543,130 |

|

Common Stock Held in Treasury, 289,903 Shares at September 30, 2019 and 385,042 Shares at December 31, 2018 | (26,306 | ) | | (42,182 | ) |

Total Stockholders' Equity | 21,124,280 |

| | 19,364,188 |

|

Total Liabilities and Stockholders' Equity | $ | 36,542,269 |

| | $ | 33,934,474 |

|

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Summary Statements of Cash Flows (Unaudited; in thousands) |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Cash Flows from Operating Activities | | | | | | | |

Reconciliation of Net Income to Net Cash Provided by Operating Activities: | | | | | | | |

Net Income | $ | 615,122 |

| | $ | 1,190,952 |

| | $ | 2,098,389 |

| | $ | 2,526,272 |

|

Items Not Requiring (Providing) Cash | | | | | | | |

Depreciation, Depletion and Amortization | 953,597 |

| | 918,180 |

| | 2,790,496 |

| | 2,515,445 |

|

Impairments | 105,275 |

| | 44,617 |

| | 289,761 |

| | 160,934 |

|

Stock-Based Compensation Expenses | 54,670 |

| | 49,001 |

| | 132,323 |

| | 116,290 |

|

Deferred Income Taxes | 184,282 |

| | 334,116 |

| | 508,576 |

| | 681,702 |

|

(Gains) Losses on Asset Dispositions, Net | 523 |

| | (115,944 | ) | | (3,650 | ) | | (94,658 | ) |

Other, Net | (1,284 | ) | | 1,807 |

| | 4,155 |

| | 15,314 |

|

Dry Hole Costs | 24,138 |

| | 358 |

| | 28,001 |

| | 5,260 |

|

Mark-to-Market Commodity Derivative Contracts | | | | | | | |

Total (Gains) Losses | (85,902 | ) | | 52,081 |

| | (242,622 | ) | | 297,735 |

|

Net Cash Received from (Payments for) Settlements of Commodity Derivative Contracts | 108,418 |

| | (91,894 | ) | | 139,708 |

| | (180,228 | ) |

Other, Net | (424 | ) | | 1,913 |

| | 1,215 |

| | 1,652 |

|

Changes in Components of Working Capital and Other Assets and Liabilities | | | | | | | |

Accounts Receivable | 63,891 |

| | (243,778 | ) | | (5,855 | ) | | (553,529 | ) |

Inventories | 66,857 |

| | (94,598 | ) | | 55,598 |

| | (286,817 | ) |

Accounts Payable | 7,400 |

| | 81,548 |

| | 134,253 |

| | 537,525 |

|

Accrued Taxes Payable | 34,767 |

| | (59,426 | ) | | 88,047 |

| | (36,891 | ) |

Other Assets | (92,814 | ) | | (40,491 | ) | | 394,573 |

| | (103,334 | ) |

Other Liabilities | 39,791 |

| | 38,392 |

| | (18,315 | ) | | (14,776 | ) |

Changes in Components of Working Capital Associated with Investing and Financing Activities | (16,643 | ) | | 122,763 |

| | (38,677 | ) | | 95,484 |

|

Net Cash Provided by Operating Activities | 2,061,664 |

| | 2,189,597 |

| | 6,355,976 |

| | 5,683,380 |

|

| | | | | | | |

Investing Cash Flows | | | | | | | |

Additions to Oil and Gas Properties | (1,420,385 | ) | | (1,591,646 | ) | | (4,866,882 | ) | | (4,571,932 | ) |

Additions to Other Property, Plant and Equipment | (70,469 | ) | | (57,526 | ) | | (187,350 | ) | | (202,384 | ) |

Proceeds from Sales of Assets | 17,767 |

| | 3,306 |

| | 35,409 |

| | 11,582 |

|

Other Investing Activities | — |

| | (19,993 | ) | | — |

| | (19,993 | ) |

Changes in Components of Working Capital Associated with Investing Activities | 16,621 |

| | (122,791 | ) | | 38,677 |

| | (95,541 | ) |

Net Cash Used in Investing Activities | (1,456,466 | ) | | (1,788,650 | ) | | (4,980,146 | ) | | (4,878,268 | ) |

| | | | | | | |

Financing Cash Flows | | | | | | | |

Lont-Term Debt Repayments | — |

| | — |

| | (900,000 | ) | | — |

|

Dividends Paid | (166,170 | ) | | (107,465 | ) | | (420,851 | ) | | (311,075 | ) |

Treasury Stock Purchased | (13,835 | ) | | (26,535 | ) | | (22,238 | ) | | (58,558 | ) |

Proceeds from Stock Options Exercised and Employee Stock Purchase Plan | 863 |

| | 953 |

| | 9,558 |

| | 12,098 |

|

Debt Issuance Costs | (114 | ) | | — |

| | (5,016 | ) | | — |

|

Repayment of Capital Lease Obligation | (3,235 | ) | | (1,698 | ) | | (9,638 | ) | | (5,052 | ) |

Changes in Components of Working Capital Associated with Financing Activities | 22 |

| | 28 |

| | — |

| | 57 |

|

Net Cash Used in Financing Activities | (182,469 | ) | | (134,717 | ) | | (1,348,185 | ) | | (362,530 | ) |

| | | | | | | |

Effect of Exchange Rate Changes on Cash | (109 | ) | | (313 | ) | | (174 | ) | | (2,678 | ) |

| | | | | | | |

Increase in Cash and Cash Equivalents | 422,620 |

| | 265,917 |

| | 27,471 |

| | 439,904 |

|

Cash and Cash Equivalents at Beginning of Period | 1,160,485 |

| | 1,008,215 |

| | 1,555,634 |

| | 834,228 |

|

Cash and Cash Equivalents at End of Period | $ | 1,583,105 |

| | $ | 1,274,132 |

| | $ | 1,583,105 |

| | $ | 1,274,132 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Third Quarter 2019 Well Results by Play (Unaudited) |

| | | | | | | | | | | | | | |

| | Wells Online | | | | Initial Gross 30-Day Average Production Rate |

| | Gross | | Net | | Lateral Length (ft) | | Crude Oil and Condensate (Bbld) (A) | | Natural Gas Liquids (Bbld) (A) | | Natural Gas (MMcfd) (A) | | Crude Oil Equivalent (Boed) (B) |

Delaware Basin | | | | | | | | | | | | | | |

Wolfcamp | | 51 |

| | 48 |

| | 7,300 |

| | 1,950 |

| | 650 |

| | 3.3 |

| | 3,150 |

|

Bone Spring | | 24 |

| | 21 |

| | 5,900 |

| | 1,600 |

| | 350 |

| | 1.9 |

| | 2,300 |

|

Leonard | | 2 |

| | 1 |

| | 9,700 |

| | 2,000 |

| | 600 |

| | 3.0 |

| | 3,100 |

|

| | | | | | | | | | | | | | |

South Texas Eagle Ford | | 81 |

| | 74 |

| | 7,900 |

| | 1,150 |

| | 100 |

| | 0.6 |

| | 1,350 |

|

| | | | | | | | | | | | | | |

South Texas Austin Chalk | | 4 |

| | 2 |

| | 4,600 |

| | 1,850 |

| | 350 |

| | 1.8 |

| | 2,500 |

|

| | | | | | | | | | | | | | |

Powder River Basin | | | | | | | | | | | | | | |

Turner/Parkman | | 7 |

| | 6 |

| | 9,800 |

| | 800 |

| | 200 |

| | 3.3 |

| | 1,550 |

|

Niobrara | | 1 |

| | 1 |

| | 10,200 |

| | 1,250 |

| | 250 |

| | 4.0 |

| | 2,200 |

|

| | | | | | | | | | | | | | |

DJ Basin Codell/Niobrara | | 5 |

| | 4 |

| | 9,700 |

| | 800 |

| | 50 |

| | 0.4 |

| | 900 |

|

| | | | | | | | | | | | | | |

Williston Basin Bakken/Three Forks | | 15 |

| | 13 |

| | 10,600 |

| | 2,150 |

| | 300 |

| | 2.0 |

| | 2,800 |

|

| | | | | | | | | | | | | | |

Anadarko Basin Woodford Oil Window | | 16 |

| | 14 |

| | 9,900 |

| | 950 |

| | 100 |

| | 0.7 |

| | 1,150 |

|

| | | | | | | | | | | | | | |

(A) Barrels per day or million cubic feet per day, as applicable. |

(B) Barrels of oil equivalent per day; includes crude oil and condensate, natural gas liquids and natural gas. Crude oil equivalent volumes are determined using a ratio of 1.0 barrel of crude oil and condensate or natural gas liquids to 6.0 thousand cubic feet of natural gas. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Reconciliation of Adjusted Net Income (Unaudited; in thousands, except per share data) |

| | | | | | | | |

| | | | | | | | |

The following chart adjusts the three-month and nine-month periods ended September 30, 2019 and 2018 reported Net Income (GAAP) to reflect actual net cash received from (payments for) settlements of commodity derivative contracts by eliminating the unrealized mark-to-market (gains) losses from these transactions, to eliminate the net (gains) losses on asset dispositions in 2019 and 2018, to add back impairment charges related to certain of EOG's assets in 2019 and 2018 and to eliminate certain adjustments in 2018 related to the 2017 U.S. tax reform. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust reported company earnings to match hedge realizations to production settlement months and make certain other adjustments to exclude non-recurring and certain other items. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| | | | | | | | |

| Three Months Ended | | Three Months Ended |

| September 30, 2019 | | September 30, 2018 |

| | | | | | | | |

| Before Tax | | Income Tax Impact | | After Tax | | Diluted Earnings per Share | | Before Tax | | Income Tax Impact | | After Tax | | Diluted Earnings per Share |

Reported Net Income (GAAP) | $ | 797,457 |

| | $ | (182,335 | ) | | $ | 615,122 |

| | $ | 1.06 |

| | $ | 1,446,363 |

| | $ | (255,411 | ) | | $ | 1,190,952 |

| | $ | 2.05 |

|

Adjustments: | | | | | | | | | | | | | | | |

(Gains) Losses on Mark-to-Market Commodity Derivative Contracts | (85,902 | ) | | 18,854 |

| | (67,048 | ) | | (0.12 | ) | | 52,081 |

| | (11,472 | ) | | 40,609 |

| | 0.07 |

|

Net Cash Received from (Payments for) Settlements of Commodity Derivative Contracts | 108,418 |

| | (23,796 | ) | | 84,622 |

| | 0.15 |

| | (91,894 | ) | | 20,241 |

| | (71,653 | ) | | (0.12 | ) |

Add: (Gains) Losses on Asset Dispositions, Net | 523 |

| | (89 | ) | | 434 |

| | — |

| | (115,944 | ) | | 28,934 |

| | (87,010 | ) | | (0.15 | ) |

Add: Certain Impairments | 27,215 |

| | (5,973 | ) | | 21,242 |

| | 0.04 |

| | — |

| | — |

| | — |

| | — |

|

Less: Tax Reform Impact | — |

| | — |

| | — |

| | — |

| | — |

| | (57,127 | ) | | (57,127 | ) | | (0.10 | ) |

Adjustments to Net Income | 50,254 |

| | (11,004 | ) | | 39,250 |

| | 0.07 |

| | (155,757 | ) | | (19,424 | ) | | (175,181 | ) | | (0.30 | ) |

| | | | | | | | | | | | | | | |

Adjusted Net Income (Non-GAAP) | $ | 847,711 |

| | $ | (193,339 | ) | | $ | 654,372 |

| | $ | 1.13 |

| | $ | 1,290,606 |

| | $ | (274,835 | ) | | $ | 1,015,771 |

| | $ | 1.75 |

|

| | | | | | | | | | | | | | | |

Average Number of Common Shares (GAAP) | | | | | | | | | | | | | | | |

Basic | | | | | | | 577,839 |

| | | | | | | | 577,254 |

|

Diluted | | | | | | | 581,271 |

| | | | | | | | 581,559 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | | Nine Months Ended |

| September 30, 2019 | | September 30, 2018 |

| | | | | | | | | | | | | | | |

| Before Tax | | Income Tax Impact | | After Tax | | Diluted Earnings per Share | | Before Tax | | Income Tax Impact | | After Tax | | Diluted Earnings per Share |

Reported Net Income (GAAP) | $ | 2,714,059 |

| | $ | (615,670 | ) | | $ | 2,098,389 |

| | $ | 3.61 |

| | $ | 3,152,658 |

| | $ | (626,386 | ) | | $ | 2,526,272 |

| | $ | 4.35 |

|

Adjustments: | | | | | | | | | | | | | | | |

(Gains) Losses on Mark-to-Market Commodity Derivative Contracts | (242,622 | ) | | 53,251 |

| | (189,371 | ) | | (0.34 | ) | | 297,735 |

| | (65,582 | ) | | 232,153 |

| | 0.40 |

|

Net Cash Received from (Payments for) Settlements of Commodity Derivative Contracts | 139,708 |

| | (30,663 | ) | | 109,045 |

| | 0.19 |

| | (180,228 | ) | | 39,699 |

| | (140,529 | ) | | (0.24 | ) |

Add: (Gains) Losses on Asset Dispositions, Net | (3,650 | ) | | 910 |

| | (2,740 | ) | | — |

| | (94,658 | ) | | 24,235 |

| | (70,423 | ) | | (0.12 | ) |

Add: Certain Impairments | 116,249 |

| | (25,514 | ) | | 90,735 |

| | 0.16 |

| | 20,876 |

| | (4,598 | ) | | 16,278 |

| | 0.03 |

|

Less: Tax Reform Impact | — |

| | — |

| | — |

| | — |

| | — |

| | (63,651 | ) | | (63,651 | ) | | (0.11 | ) |

Adjustments to Net Income | 9,685 |

| | (2,016 | ) | | 7,669 |

| | 0.01 |

| | 43,725 |

| | (69,897 | ) | | (26,172 | ) | | (0.04 | ) |

| | | | | | | | | | | | | | | |

Adjusted Net Income (Non-GAAP) | $ | 2,723,744 |

| | $ | (617,686 | ) | | $ | 2,106,058 |

| | $ | 3.62 |

| | $ | 3,196,383 |

| | $ | (696,283 | ) | | $ | 2,500,100 |

| | $ | 4.31 |

|

| | | | | | | | | | | | | | | |

Average Number of Common Shares (GAAP) | | | | | | | | | | | | | | | |

Basic | | | | | | | 577,498 |

| | | | | | | | 576,431 |

|

Diluted | | | | | | | 581,190 |

| | | | | | | | 580,442 |

|

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Reconciliation of Discretionary Cash Flow (Unaudited; in thousands)

Calculation of Free Cash Flow (Unaudited; in thousands) |

| | | | | | | |

The following chart reconciles the three-month and nine-month periods ended September 30, 2019 and 2018 Net Cash Provided by Operating Activities (GAAP) to Discretionary Cash Flow (Non-GAAP). EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust Net Cash Provided by Operating Activities for Exploration Costs (excluding Stock-Based Compensation Expenses), Other Non-Current Income Taxes - Net Receivable (Payable), Changes in Components of Working Capital and Other Assets and Liabilities, and Changes in Components of Working Capital Associated with Investing and Financing Activities. EOG defines Free Cash Flow (Non-GAAP) for a given period as Discretionary Cash Flow (Non-GAAP) (see below reconciliation) for such period less the total cash capital expenditures before acquisitions incurred (Non-GAAP) during such period and dividends paid (GAAP) during such period, as is illustrated below for the three months and nine months ended September 30, 2019 and 2018. EOG management uses this information for comparative purposes within the industry. |

|

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | |

Net Cash Provided by Operating Activities (GAAP) | $ | 2,061,664 |

| | $ | 2,189,597 |

| | $ | 6,355,976 |

| | $ | 5,683,380 |

|

| | | | | | | |

Adjustments: | | | | | | | |

Exploration Costs (excluding Stock-Based Compensation Expenses) | 29,374 |

| | 27,032 |

| | 85,250 |

| | 96,716 |

|

Other Non-Current Income Taxes - Net Receivable (Payable) | 33,855 |

| | (129,941 | ) | | 179,537 |

| | 62,421 |

|

Changes in Components of Working Capital and Other Assets and Liabilities | | | | | | | |

Accounts Receivable | (63,891 | ) | | 243,778 |

| | 5,855 |

| | 553,529 |

|

Inventories | (66,857 | ) | | 94,598 |

| | (55,598 | ) | | 286,817 |

|

Accounts Payable | (7,400 | ) | | (81,548 | ) | | (134,253 | ) | | (537,525 | ) |

Accrued Taxes Payable | (34,767 | ) | | 59,426 |

| | (88,047 | ) | | 36,891 |

|

Other Assets | 92,814 |

| | 40,491 |

| | (394,573 | ) | | 103,334 |

|

Other Liabilities | (39,791 | ) | | (38,392 | ) | | 18,315 |

| | 14,776 |

|

Changes in Components of Working Capital Associated with Investing and Financing Activities | 16,643 |

| | (122,763 | ) | | 38,677 |

| | (95,484 | ) |

| | | | | | | |

Discretionary Cash Flow (Non-GAAP) | $ | 2,021,644 |

| | $ | 2,282,278 |

| | $ | 6,011,139 |

| | $ | 6,204,855 |

|

| | | | | | | |

Discretionary Cash Flow (Non-GAAP) - Percentage Decrease | -11 | % | | | | -3 | % | | |

| | | | | | | |

Discretionary Cash Flow (Non-GAAP) | $ | 2,021,644 |

| | $ | 2,282,278 |

| | $ | 6,011,139 |

| | $ | 6,204,855 |

|

Less: | | | | | | | |

Total Cash Capital Expenditures Before Acquisitions (Non-GAAP) (a) | (1,518,019 | ) | | (1,671,922 | ) | | (4,846,221 | ) | | (4,869,951 | ) |

Dividends Paid (GAAP) | (166,170 | ) | | (107,465 | ) | | (420,851 | ) | | (311,075 | ) |

Free Cash Flow (Non-GAAP) | $ | 337,455 |

| | $ | 502,891 |

| $ | $ | 744,067 |

| | $ | 1,023,829 |

|

| | | | | | | |

|

| | | | | | | | | | | | | | | |

(a) See below reconciliation of Total Expenditures (GAAP) to Total Cash Expenditures Excluding Acquisitions (Non-GAAP) for the three month and nine-month periods ended September 30, 2019 and 2018: |

| | | | | | | |

Total Expenditures (GAAP) | $ | 1,629,343 |

| | $ | 1,828,348 |

| | $ | 5,394,389 |

| | $ | 5,201,921 |

|

Less: | | | | | | | |

Asset Retirement Costs | (90,970 | ) | | (10,834 | ) | | (151,551 | ) | | (41,789 | ) |

Non-Cash Expenditures of Other Property, Plant and Equipment | — |

| | (1,257 | ) | | (586 | ) | | (48,937 | ) |

Non-Cash Acquisition Costs of Unproved Properties | (10,666 | ) | | (101,821 | ) | | (64,387 | ) | | (161,823 | ) |

Acquisition Costs of Proved Properties | (9,688 | ) | | (42,514 | ) | | (331,644 | ) | | (79,421 | ) |

Total Cash Capital Expenditures Before Acquisitions (Non-GAAP) | $ | 1,518,019 |

| | $ | 1,671,922 |

| | $ | 4,846,221 |

| | $ | 4,869,951 |

|

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Total Expenditures (Unaudited; in millions) |

|

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | |

Exploration and Development Drilling | $ | 1,173 |

| | $ | 1,340 |

| | $ | 3,865 |

| | $ | 3,843 |

|

Facilities | 161 |

| | 178 |

| | 499 |

| | 518 |

|

Leasehold Acquisitions | 56 |

| | 159 |

| | 201 |

| | 331 |

|

Property Acquisitions | 10 |

| | 42 |

| | 332 |

| | 79 |

|

Capitalized Interest | 10 |

| | 7 |

| | 28 |

| | 18 |

|

Subtotal | 1,410 |

| | 1,726 |

| | 4,925 |

| | 4,789 |

|

Exploration Costs | 34 |

| | 33 |

| | 103 |

| | 115 |

|

Dry Hole Costs | 24 |

| | — |

| | 28 |

| | 5 |

|

Exploration and Development Expenditures | 1,468 |

| | 1,759 |

| | 5,056 |

| | 4,909 |

|

Asset Retirement Costs | 91 |

| | 11 |

| | 151 |

| | 42 |

|

Total Exploration and Development Expenditures | 1,559 |

| | 1,770 |

| | 5,207 |

| | 4,951 |

|

Other Property, Plant and Equipment | 70 |

| | 58 |

| | 187 |

| | 251 |

|

Total Expenditures | $ | 1,629 |

| | $ | 1,828 |

| | $ | 5,394 |

| | $ | 5,202 |

|

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Reconciliation of Adjusted EBITDAX (Unaudited; in thousands) |

| | | | | | | |

The following chart adjusts the three-month and nine-month periods ended September 30, 2019 and 2018 reported Net Income (GAAP) to Earnings Before Interest Expense (Net), Income Taxes (Income Tax Provision), Depreciation, Depletion and Amortization, Exploration Costs, Dry Hole Costs and Impairments (EBITDAX) (Non-GAAP) and further adjusts such amount to reflect actual net cash received from (payments for) settlements of commodity derivative contracts by eliminating the unrealized mark-to-market (MTM) (gains) losses from these transactions and to eliminate the (gains) losses on asset dispositions (Net). EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust reported Net Income (GAAP) to add back Interest Expense (Net), Income Taxes (Income Tax Provision), Depreciation, Depletion and Amortization, Exploration Costs, Dry Hole Costs and Impairments and further adjust such amount to match realizations to production settlement months and make certain other adjustments to exclude non-recurring and certain other items. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | |

Net Income (GAAP) | $ | 615,122 |

| | $ | 1,190,952 |

| | $ | 2,098,389 |

| | $ | 2,526,272 |

|

| | | | | | | |

Adjustments: | | | | | | | |

Interest Expense, Net | 39,620 |

| | 63,632 |

| | 144,434 |

| | 189,032 |

|

Income Tax Provision | 182,335 |

| | 255,411 |

| | 615,670 |

| | 626,386 |

|

Depreciation, Depletion and Amortization | 953,597 |

| | 918,180 |

| | 2,790,496 |

| | 2,515,445 |

|

Exploration Costs | 34,540 |

| | 32,823 |

| | 103,386 |

| | 115,137 |

|

Dry Hole Costs | 24,138 |

| | 358 |

| | 28,001 |

| | 5,260 |

|

Impairments | 105,275 |

| | 44,617 |

| | 289,761 |

| | 160,934 |

|

EBITDAX (Non-GAAP) | 1,954,627 |

| | 2,505,973 |

| | 6,070,137 |

| | 6,138,466 |

|

Total (Gains) Losses on MTM Commodity Derivative Contracts | (85,902 | ) | | 52,081 |

| | (242,622 | ) | | 297,735 |

|

Net Cash Received from (Payments for) Settlements of Commodity Derivative Contracts | 108,418 |

| | (91,894 | ) | | 139,708 |

| | (180,228 | ) |

(Gains) Losses on Asset Dispositions, Net | 523 |

| | (115,944 | ) | | (3,650 | ) | | (94,658 | ) |

| | | | | | | |

Adjusted EBITDAX (Non-GAAP) | $ | 1,977,666 |

| | $ | 2,350,216 |

| | $ | 5,963,573 |

| | $ | 6,161,315 |

|

| | | | | | | |

Adjusted EBITDAX (Non-GAAP) - Percentage Decrease | -16 | % | | | | -3 | % | | |

|

| | | | | | | | | | | |

EOG RESOURCES, INC. Reconciliation of Net Debt and Total Capitalization Calculation of Net Debt-to-Total Capitalization Ratio (Unaudited; in millions, except ratio data) |

| | | | |

The following chart reconciles Current and Long-Term Debt (GAAP) to Net Debt (Non-GAAP) and Total Capitalization (GAAP) to Total Capitalization (Non-GAAP), as used in the Net Debt-to-Total Capitalization ratio calculation. A portion of the cash is associated with international subsidiaries; tax considerations may impact debt paydown. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who utilize Net Debt and Total Capitalization (Non-GAAP) in their Net Debt-to-Total Capitalization ratio calculation. EOG management uses this information for comparative purposes within the industry. |

| | | | |

| At | | At | | At |

| September 30, | | December 31, | | September 30, |

| 2019 | | 2018 | | 2018 |

| | | | |

Total Stockholders' Equity - (a) | $ | 21,124 |

| | $ | 19,364 |

| | $ | 18,538 |

|

| | | | | |

Current and Long-Term Debt (GAAP) - (b) | 5,177 |

| | 6,083 |

| | 6,435 |

|

Less: Cash | (1,583 | ) | | (1,556 | ) | | (1,274 | ) |

Net Debt (Non-GAAP) - (c) | 3,594 |

| | 4,527 |

| | 5,161 |

|

| | | | | |

Total Capitalization (GAAP) - (a) + (b) | $ | 26,301 |

| | $ | 25,447 |

| | $ | 24,973 |

|

| | | | | |

Total Capitalization (Non-GAAP) - (a) + (c) | $ | 24,718 |

| | $ | 23,891 |

| | $ | 23,699 |

|

| | | | | |

Debt-to-Total Capitalization (GAAP) - (b) / [(a) + (b)] | 20 | % | | 24 | % | | 26 | % |

| | | | | |

Net Debt-to-Total Capitalization (Non-GAAP) - (c) / [(a) + (c)] | 15 | % | | 19 | % | | 22 | % |

|

| | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Reconciliation of Total Exploration and Development Expenditures For Drilling Only and Total Exploration and Development Expenditures Calculation of Reserve Replacement Costs ($ / BOE) (Unaudited; in millions, except ratio data) |

| | | | | | | | | |

The following chart reconciles Total Costs Incurred in Exploration and Development Activities (GAAP) to Total Exploration and Development Expenditures for Drilling Only (Non-GAAP) and Total Exploration and Development Expenditures (Non-GAAP), as used in the calculation of Reserve Replacement Costs per Boe. There are numerous ways that industry participants present Reserve Replacement Costs, including “Drilling Only” and “All-In”, which reflect total exploration and development expenditures divided by total net proved reserve additions from extensions and discoveries only, or from all sources. Combined with Reserve Replacement, these statistics provide management and investors with an indication of the results of the current year capital investment program. Reserve Replacement Cost statistics are widely recognized and reported by industry participants and are used by EOG management and other third parties for comparative purposes within the industry. Please note that the actual cost of adding reserves will vary from the reported statistics due to timing differences in reserve bookings and capital expenditures. Accordingly, some analysts use three or five year averages of reported statistics, while others prefer to estimate future costs. EOG has not included future capital costs to develop proved undeveloped reserves in exploration and development expenditures. |

| | | | | | | | | |

| 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

| | | | | | | | | |

Total Costs Incurred in Exploration and Development Activities (GAAP) | $ | 6,419.7 |

| | $ | 4,439.4 |

| | $ | 6,445.2 |

| | $ | 4,928.3 |

| | $ | 7,904.8 |

|

Less: Asset Retirement Costs | (69.7 | ) | | (55.6 | ) | | 19.9 |

| | (53.5 | ) | | (195.6 | ) |

Non-Cash Acquisition Costs of Unproved Properties | (290.5 | ) | | (255.7 | ) | | (3,101.8 | ) | | — |

| | — |

|

Acquisition Costs of Proved Properties | (123.7 | ) | | (72.6 | ) | | (749.0 | ) | | (480.6 | ) | | (139.1 | ) |

Total Exploration and Development Expenditures for Drilling Only (Non-GAAP) (a) | $ | 5,935.8 |

| | $ | 4,055.5 |

| | $ | 2,614.3 |

| | $ | 4,394.2 |

| | $ | 7,570.1 |

|

| | | | | | | | | |

Total Costs Incurred in Exploration and Development Activities (GAAP) | $ | 6,419.7 |

| | $ | 4,439.4 |

| | $ | 6,445.2 |

| | $ | 4,928.3 |

| | $ | 7,904.8 |

|

Less: Asset Retirement Costs | (69.7 | ) | | (55.6 | ) | | 19.9 |

| | (53.5 | ) | | (195.6 | ) |

Non-Cash Acquisition Costs of Unproved Properties | (290.5 | ) | | (255.7 | ) | | (3,101.8 | ) | | — |

| | — |

|

Non-Cash Acquisition Costs of Proved Properties | (70.9 | ) | | (26.2 | ) | | (732.3 | ) | | — |

| | — |

|

Total Exploration and Development Expenditures (Non-GAAP) (b) | $ | 5,988.6 |

| | $ | 4,101.9 |

| | $ | 2,631.0 |

| | $ | 4,874.8 |

| | $ | 7,709.2 |

|

| | | | | | | | | |

Net Proved Reserve Additions From All Sources - Oil Equivalents (MMBoe) | | | | | | | | | |

Revisions Due to Price (c) | 34.8 |

| | 154.0 |

| | (100.7 | ) | | (573.8 | ) | | 52.2 |

|

Revisions Other Than Price | (39.5 | ) | | 48.0 |

| | 252.9 |

| | 107.2 |

| | 48.4 |

|

Purchases in Place | 11.6 |

| | 2.3 |

| | 42.3 |

| | 56.2 |

| | 14.4 |

|

Extensions, Discoveries and Other Additions (d) | 669.7 |

| | 420.8 |

| | 209.0 |

| | 245.9 |

| | 519.2 |

|

Total Proved Reserve Additions (e) | 676.6 |

| | 625.1 |

| | 403.5 |

| | (164.5 | ) | | 634.2 |

|

Sales in Place | (10.8 | ) | | (20.7 | ) | | (167.6 | ) | | (3.5 | ) | | (36.3 | ) |

Net Proved Reserve Additions From All Sources (f) | 665.8 |

| | 604.4 |

| | 235.9 |

| | (168.0 | ) | | 597.9 |

|

| | | | | | | | | |

Production (g) | 265.0 |

| | 224.4 |

| | 207.1 |

| | 211.2 |

| | 219.1 |

|

| | | | | | | | | |

RESERVE REPLACEMENT COSTS ($ / Boe) | | | | | | | | | |

Total Drilling, Before Revisions (a / d) | $ | 8.86 |

| | $ | 9.64 |

| | $ | 12.51 |

| | $ | 17.87 |

| | $ | 14.58 |

|

All-in Total, Net of Revisions (b / e) | $ | 8.85 |

| | $ | 6.56 |

| | $ | 6.52 |

| | $ | (29.63 | ) | | $ | 12.16 |

|

All-in Total, Excluding Revisions Due to Price (b / ( e - c)) | $ | 9.33 |

| | $ | 8.71 |

| | $ | 5.22 |

| | $ | 11.91 |

| | $ | 13.25 |

|

|

| | | | | | | |

EOG RESOURCES, INC. Crude Oil and Natural Gas Financial Commodity Derivative Contracts |

|

| | | | |

EOG accounts for financial commodity derivative contracts using the mark-to-market accounting method. Prices received by EOG for its crude oil production generally vary from NYMEX West Texas Intermediate prices due to adjustments for delivery location (basis) and other factors. EOG has entered into crude oil basis swap contracts in order to fix the differential between pricing in Midland, Texas, and Cushing, Oklahoma (Midland Differential). Presented below is a comprehensive summary of EOG's Midland Differential basis swap contracts through October 29, 2019. The weighted average price differential expressed in $/Bbl represents the amount of reduction to Cushing, Oklahoma, prices for the notional volumes expressed in Bbld covered by the basis swap contracts. |

|

Midland Differential Basis Swap Contracts |

| | Volume (Bbld) | | Weighted Average Price Differential ($/Bbl) |

2019 | | | | |

January 1, 2019 through November 30, 2019 (closed) | | 20,000 |

| | $ | 1.075 |

|

December 2019 | | 20,000 |

| | 1.075 |

|

|

| | | | | | | |

EOG has also entered into crude oil basis swap contracts in order to fix the differential between pricing in the U.S. Gulf Coast and Cushing, Oklahoma (Gulf Coast Differential). Presented below is a comprehensive summary of EOG's Gulf Coast Differential basis swap contracts through October 29, 2019. The weighted average price differential expressed in $/Bbl represents the amount of addition to Cushing, Oklahoma, prices for the notional volumes expressed in Bbld covered by the basis swap contracts. |

|

Gulf Coast Differential Basis Swap Contracts |

| | Volume (Bbld) | | Weighted Average Price Differential ($/Bbl) |

2019 | | | | |

January 1, 2019 through November 30, 2019 (closed) | | 13,000 |

| | $ | 5.572 |

|

December 2019 | | 13,000 |

| | 5.572 |

|

|

| | | | | | | | |

| | Presented below is a comprehensive summary of EOG's crude oil price swap contracts through October 29, 2019, with notional volumes expressed in Bbld and prices expressed in $/Bbl. |

| | |

| | Crude Oil Price Swap Contracts |

| | | | Volume (Bbld) | | Weighted Average Price ($/Bbl) |

| |

| |

| | 2019 | | | | |

| | April 2019 (closed) | | 25,000 |

| | $ | 60.00 |

|

| | May 1, 2019 through September 30, 2019 (closed) | | 150,000 |

| | 62.50 |

|

| | October 1, 2019 through December 31, 2019 | | 150,000 |

| | 62.50 |

|

|

| | | | | | | | |

| | Prices received by EOG for its natural gas production generally vary from NYMEX Henry Hub prices due to adjustments for delivery location (basis) and other factors. EOG has entered into natural gas basis swap contracts in order to fix the differential between pricing in the Rocky Mountain area and NYMEX Henry Hub prices (Rockies Differential). Presented below is a comprehensive summary of EOG's Rockies Differential basis swap contracts through October 29, 2019. The weighted average price differential expressed in $/MMBtu represents the amount of reduction to NYMEX Henry Hub prices for the notional volumes expressed in MMBtud covered by the basis swap contracts. |

| | |

| | Rockies Differential Basis Swap Contracts |

| | | | Volume (MMBtud) | | Weighted Average Price Differential ($/MMBtu) |

| |

| |

| | 2020 | | | | |

| | January 1, 2020 through December 31, 2020 | | 30,000 |

| | $ | 0.549 |

|

|

| | | | | | | |

Presented below is a comprehensive summary of EOG's natural gas price swap contracts through October 29, 2019, with notional volumes expressed in MMBtud and prices expressed in $/MMBtu. |

|

Natural Gas Price Swap Contracts |

| | Volume (MMBtud) | | Weighted Average Price ($/MMBtu) |

2019 | | | | |

April 1, 2019 through October 31, 2019 (closed) | | 250,000 |

| | $ | 2.90 |

|

|

| | |

Definitions |

Bbld | | Barrels per day |

$/Bbl | | Dollars per barrel |

MMBtud | | Million British thermal units per day |

$/MMBtu | | Dollars per million British thermal units |

NYMEX | | U.S. New York Mercantile Exchange |

|

|

EOG RESOURCES, INC. |

Direct After-Tax Rate of Return (ATROR) |

|

The calculation of our direct after-tax rate of return (ATROR) with respect to our capital expenditure program for a particular play or well is based on the estimated recoverable reserves ("net" to EOG’s interest) for all wells in such play or such well (as the case may be), the estimated net present value (NPV) of the future net cash flows from such reserves (for which we utilize certain assumptions regarding future commodity prices and operating costs) and our direct net costs incurred in drilling or acquiring (as the case may be) such wells or well (as the case may be). As such, our direct ATROR with respect to our capital expenditures for a particular play or well cannot be calculated from our consolidated financial statements. |

|

Direct ATROR |

Based on Cash Flow and Time Value of Money |

- Estimated future commodity prices and operating costs |

- Costs incurred to drill, complete and equip a well, including facilities |

Excludes Indirect Capital |

- Gathering and Processing and other Midstream |

- Land, Seismic, Geological and Geophysical |

|

Payback ~12 Months on 100% Direct ATROR Wells |

First Five Years ~1/2 Estimated Ultimate Recovery Produced but ~3/4 of NPV Captured |

|

|

Return on Equity / Return on Capital Employed |

Based on GAAP Accrual Accounting |

Includes All Indirect Capital and Growth Capital for Infrastructure |

- Eagle Ford, Bakken, Permian Facilities |

- Gathering and Processing |

Includes Legacy Gas Capital and Capital from Mature Wells |

|

| | | | | | | |

EOG RESOURCES, INC. Reconciliation of After-Tax Net Interest Expense, Adjusted Net Income, Net Debt and Total Capitalization Calculations of Return on Capital Employed and Return on Equity (Unaudited; in millions, except ratio data) |

| | | |

The following chart reconciles Net Interest Expense (GAAP), Net Income (GAAP), Current and Long-Term Debt (GAAP) and Total Capitalization (GAAP) to After-Tax Net Interest Expense (Non-GAAP), Adjusted Net Income (Non-GAAP), Net Debt (Non-GAAP) and Total Capitalization (Non-GAAP), respectively, as used in the Return on Capital Employed (ROCE) and Return on Equity (ROE) calculations. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who utilize After-Tax Net Interest Expense, Adjusted Net Income, Net Debt and Total Capitalization (Non-GAAP) in their ROCE and ROE calculations. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| 2018 | | 2017 |

Return on Capital Employed (ROCE) (Non-GAAP) | | | |

Net Interest Expense (GAAP) | $ | 245 |

| | |

Tax Benefit Imputed (based on 21%) | (51 | ) | | |

After-Tax Net Interest Expense (Non-GAAP) - (a) | $ | 194 |

| |

|

| | | |

Net Income (GAAP) - (b) | $ | 3,419 |

| | |

Adjustments to Net Income, Net of Tax (See Accompanying Schedule) | (201 | ) | (1) | |

Adjusted Net Income (Non-GAAP) - (c) | $ | 3,218 |

| |

|

| | | |

Total Stockholders' Equity - (d) | $ | 19,364 |

| | $ | 16,283 |

|

| | | |

Average Total Stockholders' Equity * - (e) | $ | 17,824 |

| | |

| | | |

Current and Long-Term Debt (GAAP) - (f) | $ | 6,083 |

| | $ | 6,387 |

|

Less: Cash | (1,556 | ) | | (834 | ) |

Net Debt (Non-GAAP) - (g) | $ | 4,527 |

| | $ | 5,553 |

|

| | | |

Total Capitalization (GAAP) - (d) + (f) | $ | 25,447 |

| | $ | 22,670 |

|

| | | |

Total Capitalization (Non-GAAP) - (d) + (g) | $ | 23,891 |

| | $ | 21,836 |

|

| | | |

Average Total Capitalization (Non-GAAP) * - (h) | $ | 22,864 |

| | |

| | | |

ROCE (GAAP Net Income) - [(a) + (b)] / (h) | 15.8 | % | | |

| | | |

ROCE (Non-GAAP Adjusted Net Income) - [(a) + (c)] / (h) | 14.9 | % | | |

| | | |

Return on Equity (ROE) | | | |

| | | |

ROE (GAAP Net Income) - (b) / (e) | 19.2 | % | | |

| | | |

ROE (Non-GAAP Adjusted Net Income) - (c) / (e) | 18.1 | % | | |

| | | |

* Average for the current and immediately preceding year |

| | | |

Adjustments to Net Income (GAAP)

|

| | | | | | | | | | | | |

(1) See below schedule for detail of adjustments to Net Income (GAAP) in 2018: |

| | Year Ended December 31, 2018 |

| | Before

Tax | | Income Tax Impact | | After

Tax |

Adjustments: | | | | | |

Add: | Mark-to-Market Commodity Derivative Contracts Impact | $ | (93 | ) | | $ | 20 |

| | $ | (73 | ) |

Add: | Impairments of Certain Assets | 153 |

| | (34 | ) | | 119 |

|

Less: | Net Gains on Asset Dispositions | (175 | ) | | 38 |

| | (137 | ) |

Less: | Tax Reform Impact | — |

| | (110 | ) | | (110 | ) |

Total | | $ | (115 | ) | | $ | (86 | ) | | $ | (201 | ) |

|

| | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC.

Reconciliation of After-Tax Net Interest Expense, Net Debt and Total Capitalization Calculation of Return on Capital Employed (Unaudited; in millions, except ratio data) |

| | | | | | | | | |

The following chart reconciles Net Interest Expense (GAAP), Current and Long-Term Debt (GAAP) and Total Capitalization (GAAP) to After-Tax Net Interest Expense (Non-GAAP), Net Debt (Non-GAAP) and Total Capitalization (Non-GAAP), respectively, as used in the Return on Capital Employed (ROCE) (Non-GAAP) calculation. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who utilize After-Tax Net Interest Expense, Net Debt and Total Capitalization (Non-GAAP) in their ROCE calculation. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

Return on Capital Employed (ROCE) (Non-GAAP) (Calculated Using GAAP Net Income) | | | | | | | | | |

| | | | | | | | | |

Net Interest Expense (GAAP) | $ | 274 |

| | $ | 282 |

| | $ | 237 |

| | $ | 201 |

| | $ | 235 |

|

Tax Benefit Imputed (based on 35%) | (96 | ) | | (99 | ) | | (83 | ) | | (70 | ) | | (82 | ) |

After-Tax Net Interest Expense (Non-GAAP) - (a) | $ | 178 |

| | $ | 183 |

| | $ | 154 |

| | $ | 131 |

| | $ | 153 |

|

| | | | | | | | | |

Net Income (Loss) (GAAP) - (b) | $ | 2,583 |

| | $ | (1,097 | ) | | $ | (4,525 | ) | | $ | 2,915 |

| | $ | 2,197 |

|

| | | | | | | | | |

Total Stockholders' Equity - (d) | $ | 16,283 |

| | $ | 13,982 |

| | $ | 12,943 |

| | $ | 17,713 |

| | $ | 15,418 |

|

| | | | | | | | | |

Average Total Stockholders' Equity* - (e) | $ | 15,133 |

| | $ | 13,463 |

| | $ | 15,328 |

| | $ | 16,566 |

| | $ | 14,352 |

|

| | | | | | | | | |

Current and Long-Term Debt (GAAP) - (f) | $ | 6,387 |

| | $ | 6,986 |

| | $ | 6,655 |

| | $ | 5,906 |

| | $ | 5,909 |

|

Less: Cash | (834 | ) | | (1,600 | ) | | (719 | ) | | (2,087 | ) | | (1,318 | ) |

Net Debt (Non-GAAP) - (g) | $ | 5,553 |

| | $ | 5,386 |

| | $ | 5,936 |

| | $ | 3,819 |

| | $ | 4,591 |

|

| | | | | | | | | |

Total Capitalization (GAAP) - (d) + (f) | $ | 22,670 |

| | $ | 20,968 |

| | $ | 19,598 |

| | $ | 23,619 |

| | $ | 21,327 |

|

| | | | | | | | | |

Total Capitalization (Non-GAAP) - (d) + (g) | $ | 21,836 |

| | $ | 19,368 |

| | $ | 18,879 |

| | $ | 21,532 |

| | $ | 20,009 |

|

| | | | | | | | | |

Average Total Capitalization (Non-GAAP)* - (h) | $ | 20,602 |

| | $ | 19,124 |

| | $ | 20,206 |

| | $ | 20,771 |

| | $ | 19,365 |

|

| | | | | | | | | |

ROCE (GAAP Net Income) - [(a) + (b)] / (h) | 13.4 | % | | -4.8 | % | | -21.6 | % | | 14.7 | % | | 12.1 | % |

| | | | | | | | | |

Return on Equity (ROE) (GAAP) | | | | | | | | | |

| | | | | | | | | |

ROE (GAAP Net Income) - (b) / (e) | 17.1 | % | | -8.1 | % | | -29.5 | % | | 17.6 | % | | 15.3 | % |

| | | | | | | | | |

| | | | | | | | | |

* Average for the current and immediately preceding year | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC.

Reconciliation of After-Tax Net Interest Expense, Net Debt and Total Capitalization Calculation of Return on Capital Employed (Unaudited; in millions, except ratio data) |

| | | | | | | | | |