0001757073FALSE00017570732023-08-072023-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 7, 2023

_____________________________________________

ENVISTA HOLDINGS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

_____________________________________________

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | |

|

| |

| 001-39054 | 83-2206728 |

| (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

|

| | |

| 200 S. Kraemer Blvd., Building E | 92821 |

| Brea, | California |

| (Address of Principal Executive Offices) | (Zip Code) |

(714) 817-7000

(Registrant’s Telephone Number, Including Area Code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

|

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | NVST | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01 OTHER EVENTS

On August 7, 2023, Envista Holdings Corporation (the “Company”) issued a press release announcing its intent to offer, subject to market conditions and other factors, $435,000,000 in aggregate principal amount of Convertible Senior Notes due 2028 (the “Notes”) in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

Neither this Current Report on Form 8-K nor the press release constitutes an offer to sell, or the solicitation of an offer to buy, the Notes or the shares of the Company’s common stock, $0.01 par value per share, if any, issuable upon conversion of the Notes.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| | |

| | ENVISTA HOLDINGS CORPORATION |

| | | |

| | | |

| Date: August 7, 2023 | By: | /s/ Mark E. Nance |

| | | Mark E. Nance |

| | | Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Envista Holdings Corporation Announces Proposed Convertible Senior Notes Offering

BREA, Calif.—(PRNewswire)—August 7, 2023—Envista Holdings Corporation (NYSE: NVST) (“Envista”) today announced its intention to offer, subject to market and other conditions, $435,000,000 in aggregate principal amount of Convertible Senior Notes due 2028 (the “notes”) in a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). Envista also expects to grant the initial purchasers of the notes an option to purchase, for settlement within a period of 13 days from, and including, the date the notes are first issued, up to an additional $65,250,000 aggregate principal amount of notes.

The notes will be senior, unsecured obligations of Envista, will accrue interest payable semi-annually in arrears and will mature on August 15, 2028, unless earlier converted, redeemed or repurchased. Noteholders will have the right to convert their notes in certain circumstances and during specified periods. Envista will settle conversions by (i) paying the principal amount of any such converted notes in cash and (ii) paying or delivering, as applicable, any conversion value in excess of the principal amount of such notes in cash or a combination of cash and shares of Envista’s common stock, at its election, based on the applicable conversion rate(s).

The notes will be redeemable, in whole or in part (subject to certain limitations), at Envista’s option at any time, and from time to time, on or after August 17, 2026 and on or before the 40th scheduled trading day immediately before the maturity date, but only if the last reported sale price per share of Envista’s common stock exceeds 130% of the conversion price for a specified period of time. The redemption price will be equal to the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date.

If certain corporate events that constitute a “fundamental change” occur, then, subject to a limited exception, noteholders may require Envista to repurchase their notes for cash. The repurchase price will be equal to the principal amount of the notes to be repurchased, plus accrued and unpaid interest, if any, to, but excluding, the applicable repurchase date.

The interest rate, initial conversion rate and other terms of the notes will be determined at the pricing of the offering.

Envista expects to use a portion of the net proceeds from the offering to pay the cash portion of the consideration in the concurrent exchange transactions described below. Envista intends to use the remainder of the net proceeds for general corporate purposes, which may include subsequently retiring the 2.375% Convertible Senior Notes due 2025 (the “2025 Notes”) by exchanges or redemptions. Concurrently with the offering, in separate, privately negotiated transactions, Envista expects to enter into exchange agreements with a limited number of holders of the 2025 Notes to exchange or repurchase a portion of the outstanding 2025 Notes for a combination of cash and shares of Envista’s common stock. Following the completion of the offering, Envista may engage in additional exchanges, or Envista may repurchase or induce conversions, of the 2025 Notes. Holders of the 2025 Notes that participate in any of these exchanges, repurchases or induced conversions may purchase or sell shares of Envista’s common stock in the open market to unwind any hedge positions they may have with respect to the 2025 Notes or to hedge their exposure in connection with these transactions. These activities may adversely affect the trading price of Envista’s common stock and the notes Envista is offering. Moreover, market activities by holders of the 2025 Notes that participate in the concurrent exchanges may impact the initial conversion price of the notes Envista is offering.

In connection with issuing the 2025 Notes, Envista entered into capped call transactions (the “Existing Capped Call Transactions”) with certain financial institutions (the “Existing Option Counterparties”). In connection with the intended exchange of the 2025 Notes, Envista expects to enter into agreements with the Existing Option Counterparties to terminate a portion of the Existing Capped Call Transactions in a notional amount corresponding to the amount of 2025 Notes exchanged or repurchased. In connection with any termination of any of the Existing Capped Call Transactions, Envista expects the Existing Option Counterparties or their respective affiliates to unwind a portion of their related hedge positions by entering into, or unwinding, derivatives transactions with respect to Envista’s common stock economically equivalent to buying shares of Envista’s common stock and/or buying shares of Envista’s common stock in the open market or in secondary market transactions. This hedge unwind activity could increase (or reduce the size of any decrease in) the market price of Envista’s common stock, the 2025 Notes or the notes. Envista cannot predict the magnitude of the market activities described above or the overall effect they will have on the price of Envista’s common stock, the 2025 Notes or the notes.

The offer and sale of the notes and any shares of common stock issuable upon conversion of the notes or issuable pursuant to the concurrent exchange transactions have not been, and will not be, registered under the Securities Act or any other securities laws, and the notes and any such shares cannot be offered or sold except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and any other applicable securities laws. This press release does not constitute an offer to sell, or the solicitation of an offer to buy, the notes or any shares of common stock issuable upon conversion of the notes or issuable pursuant to the concurrent exchange transactions, nor will there be any sale of the notes or any such shares, in any state or other jurisdiction in which such offer, sale or solicitation would be unlawful.

About Envista

Envista is a global family of more than 30 trusted dental brands, including Nobel Biocare, Ormco, DEXIS, and Kerr, united by a shared purpose: to partner with professionals to improve lives. Envista helps its customers deliver the best possible patient care through industry-leading dental consumables, solutions, technology, and services. Its comprehensive portfolio, including dental implants and treatment options, orthodontics, and digital imaging technologies, covers a wide range of dentists' clinical needs for diagnosing, treating, and preventing dental conditions as well as improving the aesthetics of the human smile. With a foundation comprised of the proven Envista Business System (EBS) methodology, an experienced leadership team, and a strong culture grounded in continuous improvement, commitment to innovation, and deep customer focus, Envista is well equipped to meet the end-to-end needs of dental professionals worldwide. Envista is one of the largest global dental products companies, with significant market positions in some of the most attractive segments of the dental products industry.

Forward-Looking Statements

Certain statements in this press release are "forward-looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual results, developments and business decisions to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include, among other things, the conditions in the U.S. and global economy, the impact of inflation and increasing interest rates, international economic, political, legal, compliance and business factors, the trading price and volatility of Envista’s common stock, the markets served by Envista and the financial markets, the impact of the COVID-19 pandemic, the impact of Envista’s debt obligations on its operations and liquidity, developments and uncertainties in trade policies and regulations, contractions or growth rates and cyclicality of markets Envista serves, risks relating to product manufacturing, commodity costs and surcharges, Envista’s ability to adjust purchases and manufacturing capacity to reflect market conditions, reliance on sole or limited sources of supply, disruptions relating to war, terrorism, climate change, widespread protests and civil unrest, man-made and natural disasters, public health issues and other events, security breaches or other disruptions of Envista’s information technology systems or violations of data privacy laws, fluctuations in inventory of Envista’s distributors and customers, loss of a key distributor, Envista’s relationships with and the performance of its channel partners, competition, Envista’s ability to develop and successfully market new products and services, Envista’s ability to attract, develop and retain its key personnel, the potential for improper conduct by Envista’s employees, agents or business partners, Envista’s compliance with applicable laws and regulations (including regulations relating to medical devices and the health care industry), the results of Envista’s clinical trials and perceptions thereof, penalties associated with any off-label marketing of Envista’s products, modifications to Envista’s products that require new marketing clearances or authorizations, Envista’s ability to effectively address cost reductions and other changes in the health care industry, Envista’s ability to successfully identify and consummate appropriate acquisitions and strategic investments, Envista’s ability to integrate the businesses it acquires and achieve the anticipated benefits of such acquisitions, contingent liabilities relating to acquisitions, investments and divestitures, Envista’s ability to adequately protect its intellectual property, the impact of Envista’s restructuring activities on its ability to grow, risks relating to currency exchange rates, changes in tax laws applicable to multinational companies, litigation and other contingent liabilities including intellectual property and environmental, health and safety matters, risks relating to product, service or software defects, the impact of regulation on demand for Envista’s products and services, and labor matters. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in Envista’s SEC filings, including Envista’s Annual Report on Form 10-K for fiscal year 2022 and Envista’s Quarterly reports on Form 10-Q. Envista may not consummate the proposed offering described in this press release and, if the proposed offering is consummated, cannot provide any assurances regarding the final terms of the offering or the notes or its ability to effectively apply the net proceeds as described above. These forward-looking statements speak only as of the date of this press release and except to the extent required by applicable law, Envista does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise.

Contact Information

Stephen Keller

Vice President Investor Relations

200 S. Kraemer Blvd., Building E

Brea, CA 92821

Telephone: (714) 817-7000

v3.23.2

Cover

|

Aug. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2023

|

| Entity Registrant Name |

ENVISTA HOLDINGS CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39054

|

| Entity Tax Identification Number |

83-2206728

|

| Entity Address, Address Line One |

200 S. Kraemer Blvd., Building E

|

| Entity Address, City or Town |

Brea,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92821

|

| City Area Code |

714

|

| Local Phone Number |

817-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

NVST

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001757073

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

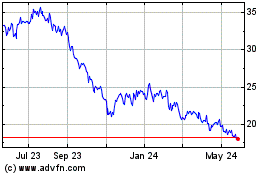

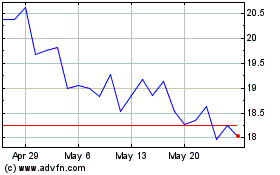

Envista (NYSE:NVST)

Historical Stock Chart

From Apr 2024 to May 2024

Envista (NYSE:NVST)

Historical Stock Chart

From May 2023 to May 2024