0001590714FALSE00015907142023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________

FORM 8-K

________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

________________________________________________________

Element Solutions Inc

________________________________________________________

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | 001-36272 | | | 37-1744899 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | | | (IRS Employer Identification No.) |

| | | | |

| 500 East Broward Boulevard, | Suite 1860 | | 33394 |

| Fort Lauderdale, | Florida | | | (Zip Code) |

| (Address of principal executive offices) | | | |

Registrant's telephone number, including area code: (561) 207-9600

Not Applicable

________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | ESI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 25, 2023, Element Solutions Inc ("Element Solutions") issued a press release announcing its financial results for the three and nine months ended September 30, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States ("GAAP"), within the press release, Element Solutions provided the following non-GAAP financial measures: EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted EPS, adjusted common shares outstanding, free cash flow, net debt to adjusted EBITDA ratio (including with the estimated annual benefit from the ViaForm® transaction), organic net sales growth and full year 2023 guidance for adjusted EBITDA, adjusted EPS and free cash flow. Element Solutions also evaluates and presents its results of operations on a constant currency basis. Investors are encouraged to refer to the Non-GAAP Measures section in the press release for definitions of these measures, descriptions of non-GAAP adjustments and reconciliations to their most directly comparable GAAP financial measures.

The information in this Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any filing of Element Solutions, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished herewith:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL)(furnished only) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ELEMENT SOLUTIONS INC |

| | | (Registrant) |

| October 25, 2023 | | /s/ Michael Russnok |

| (Date) | | Michael Russnok |

| | Chief Accounting Officer |

EXHIBIT 99.1

Element Solutions Inc

Announces 2023 Third Quarter Financial Results

•Net sales of $599 million, a decrease of 3% from the third quarter last year on a reported basis and organic basis

•GAAP diluted loss per share of $0.13, inclusive of a $0.33 negative impact from Graphics Solutions' goodwill impairment

•Reported net loss of $32 million, as compared to net income of $53 million in the same period last year

•Adjusted EPS of $0.36

•Adjusted EBITDA of $134 million, an increase of 2% from the third quarter of last year on a constant currency basis

•Third quarter 2023 cash from operating activities of $87 million and free cash flow of $75 million

Miami, Fla., October 25, 2023 -- Element Solutions Inc (NYSE:ESI) (“Element Solutions” or the “Company”), a global and diversified specialty chemicals company, today announced its financial results for the three and nine months ended September 30, 2023.

Executive Commentary

President and Chief Executive Officer Benjamin Gliklich said, “Element Solutions reported strong sequential adjusted EBITDA growth this quarter driven by a recovery in electronics and increasing margins, in line with our expectation for meaningful improvement against the first half of 2023. With our ongoing focus on operational excellence and accelerated customer activity for next-generation handset production, we experienced a stronger than expected third quarter. Our industrial performance was consistent with the first half despite changing demand dynamics across regions and end-markets. Cash flow generation remains strong, and we are on track to deliver leverage below 3.5 times by year end.”

Mr. Gliklich continued, “Heading into the fourth quarter, we expect to see a typical seasonal slowdown in electronics. An incremental foreign exchange headwind since our prior guidance and a shift in order patterns from our semiconductor customers due to our ViaForm transaction earlier in the year account for a modest reduction in our full year 2023 outlook. We see an uncertain macro environment given ongoing industrial weakness in Europe and China and the UAW strike, but solid execution around cost recovery and durable secular growth in key portions of our business, such as electric vehicles and advanced packaging applications, should deliver year-over-year growth in the fourth quarter. This should not change as we enter 2024, and, with the electronics market recovering, we are optimistic about our trajectory."

Third Quarter 2023 Highlights (compared with third quarter 2022)

•Net sales on a reported basis for the third quarter of 2023 were $599 million, a decrease of 3% over the third quarter of 2022. Organic net sales decreased 3%.

◦Electronics: Net sales decreased 6% to $367 million. Organic net sales decreased 5%.

◦Industrial & Specialty: Net sales increased 1% to $232 million. Organic net sales decreased 1%.

•Third quarter of 2023 earnings per share (EPS) performance:

◦GAAP diluted loss per share was $0.13 for the third quarter of 2023 as compared to earnings per share of $0.22 for the third quarter of 2022.

◦Adjusted EPS was $0.36 for the third quarter of 2023 and 2022, respectively.

•Reported net loss was $32 million for the third quarter of 2023 as compared to net income of $53 million for the third quarter of 2022.

•Adjusted EBITDA for the third quarter of 2023 was $134 million, relatively flat when compared to the third quarter of 2022. On a constant currency basis, adjusted EBITDA increased 2%.

◦Electronics: Adjusted EBITDA was $90 million, a decrease of 1%. On a constant currency basis, adjusted EBITDA increased 1%.

◦Industrial & Specialty: Adjusted EBITDA was $44 million, an increase of 3%. On a constant currency basis, adjusted EBITDA increased 2%.

◦Adjusted EBITDA margin increased 80 basis points to 22.4% on a reported basis. On a constant currency basis, adjusted EBITDA margin increased 110 basis points.

Updated 2023 Guidance

The Company expects full year 2023 adjusted EBITDA of approximately $485 million, adjusted EPS of approximately $1.30 and free cash flow of approximately $265 million.

Graphics Solutions Goodwill Impairment

During the third quarter of 2023, the Company conducted an interim goodwill impairment test on its Graphics Solutions reporting unit which resulted in an $80.0 million impairment charge to reduce the carrying value of this reporting unit to its estimated fair value. This impairment charge was primarily driven by the reduction of the expected future cash flows for the business due to profit margin pressures from raw material inflation across the packaging supply chain, the recent loss of a significant newspaper customer and a higher weighted average cost of capital (WACC) as compared to the assumptions used by the Company for its 2022 annual goodwill impairment test. This charge is a non-cash expense and is not tax deductible.

Conference Call

Element Solutions will host a webcast/dial-in conference call to discuss its 2023 third quarter financial results at 8:30 a.m. (Eastern Time) on Thursday, October 26, 2023. Participants on the call will include President and Chief Executive Officer Benjamin Gliklich, Chief Financial Officer Carey J. Dorman and Executive Chairman Sir Martin E. Franklin.

To listen to the call by telephone, please dial 888-510-2346 (domestic) or 646-960-0111 (international) and provide the Conference ID: 3799230. The call will be simultaneously webcast at www.elementsolutionsinc.com. A replay of the call will be available after completion of the live call at www.elementsolutionsinc.com.

About Element Solutions

Element Solutions Inc is a leading global specialty chemicals company whose businesses supply a broad range of solutions that enhance the performance of products people use every day. Developed in multi-step technological processes, these innovative solutions enable customers' manufacturing processes in several key industries, including consumer electronics, power electronics, semiconductor fabrication, communications and data storage infrastructure, automotive systems, industrial surface finishing, consumer packaging and offshore energy.

More information about the Company is available at www.elementsolutionsinc.com.

Forward-Looking Statements

This release is intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995 as it contains "forward-looking statements" within the meaning of the federal securities laws. These statements will often contain words such as "expect," "anticipate," "project," "will," "should," "believe," "intend," "plan," "assume," "estimate," "predict," "seek," "continue," "outlook," "may," "might," "aim," "can have," "likely," "potential," "target," "hope," "goal," "priority," "guidance" or "confident" and variations of such words and similar expressions. Examples of forward-looking statements include, but are not limited to, statements, beliefs, projections and expectations regarding meaningful improvements against the first half of 2023; focus on commercial excellence; accelerated customer activity for next-generation handset production; changing demand dynamics across regions and end-markets impacting the Company's industrial performance; cash flow generation; delivering leverage below 3.5 times by year end; seasonal slowdown in the fourth quarter in electronics; impacts of incremental foreign exchange headwind and order patterns from the Company's semiconductor customers; overall macro environment; execution and secular growth in key portions of the Company's business delivering growth in the fourth quarter and into 2024; electronics market recovery; the Company's trajectory; and full-year 2023 guidance for adjusted EBITDA, adjusted EPS and free cash flow. These projections and statements are based on management's estimates, assumptions or expectations with respect to future events and financial performance, and are believed to be reasonable, though are inherently uncertain and difficult to predict. Such projections and statements are based on the assessment of information available as of the current date, and the Company does not undertake any obligations to provide any further updates. Actual results could differ materially from those expressed or implied in these forward-looking statements if one or more of the underlying estimates, assumptions or expectations prove to be inaccurate or are unrealized. Important factors that could cause actual results to differ materially from those suggested by the forward-looking statements include, but are not limited to, the continuing economic impact of the coronavirus (COVID-19) and its variants on the global economy, the Company's business, financial results, customers, suppliers, vendors and/or stock price, including the impact of related governmental responses, the efficacy of vaccines and treatments targeting COVID-19 and/or its variants; the general impact of the ongoing conflict between Russia and Ukraine and the evolving nature of the conflicts in the Middle East on economic activity, including financial market instability and disruption of global supply chains, and on the Company's customers, employees, suppliers, vendors and other stakeholders; inflation and fluctuations in foreign exchange rates; business and management strategies; outstanding debt and debt leverage ratio; shares repurchases; debt and/or equity issuance or retirement; returns to stockholders; and the impact of acquisitions, divestitures, restructurings, refinancings, impairments and other unusual items, including the Company's ability to integrate and obtain the anticipated benefits, results and synergies from these items or other related strategic initiatives. Additional information concerning these and other factors that could cause actual results to vary is, or will be, included in the Company's periodic and other reports filed with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Certain information contained in this release is based on historical results and forecasts provided in connection with the ViaForm® and Kuprion transactions. Use of different methods for preparing, calculating or presenting such information may lead to different results and such differences may be material. While the Company believes this information is reliable and appropriate, investors are cautioned not to place undue reliance on this information.

ELEMENT SOLUTIONS INC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (dollars in millions, except per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 599.3 | | | $ | 618.5 | | | $ | 1,759.8 | | | $ | 1,975.6 | |

| Cost of sales | 357.4 | | | 396.6 | | | 1,061.6 | | | 1,240.9 | |

| Gross profit | 241.9 | | | 221.9 | | | 698.2 | | | 734.7 | |

| Operating expenses: | | | | | | | |

| Selling, technical, general and administrative | 149.9 | | | 131.4 | | | 445.8 | | | 431.3 | |

| Research and development | 12.9 | | | 11.3 | | | 54.3 | | | 38.2 | |

| Goodwill impairment | 80.0 | | | — | | | 80.0 | | | — | |

| Total operating expenses | 242.8 | | | 142.7 | | | 580.1 | | | 469.5 | |

| Operating (loss) profit | (0.9) | | | 79.2 | | | 118.1 | | | 265.2 | |

| Other (expense) income: | | | | | | | |

| Interest expense, net | (13.3) | | | (12.3) | | | (37.0) | | | (39.6) | |

| Foreign exchange (loss) gain | (5.3) | | | 0.9 | | | 8.6 | | | 2.9 | |

| Other income, net | 3.1 | | | 2.0 | | | 1.8 | | | 5.2 | |

| Total other expense | (15.5) | | | (9.4) | | | (26.6) | | | (31.5) | |

| (Loss) income before income taxes and non-controlling interests | (16.4) | | | 69.8 | | | 91.5 | | | 233.7 | |

| Income tax expense | (15.3) | | | (16.5) | | | (53.4) | | | (60.4) | |

| Net (loss) income from continuing operations | (31.7) | | | 53.3 | | | 38.1 | | | 173.3 | |

| Income from discontinued operations, net of tax | — | | | — | | | 2.9 | | | 1.8 | |

| Net (loss) income | (31.7) | | | 53.3 | | | 41.0 | | | 175.1 | |

| Net income attributable to non-controlling interests | (0.1) | | | (0.1) | | | — | | | (0.6) | |

| Net (loss) income attributable to common stockholders | $ | (31.8) | | | $ | 53.2 | | | $ | 41.0 | | | $ | 174.5 | |

| | | | | | | |

| (Loss) earnings per share | | | | | | | |

| Basic from continuing operations | $ | (0.13) | | | $ | 0.22 | | | $ | 0.16 | | | $ | 0.70 | |

| Basic from discontinued operations | — | | | — | | | 0.01 | | | 0.01 | |

| Basic attributable to common stockholders | $ | (0.13) | | | $ | 0.22 | | | $ | 0.17 | | | $ | 0.71 | |

| | | | | | | |

| Diluted from continuing operations | $ | (0.13) | | | $ | 0.22 | | | $ | 0.16 | | | $ | 0.70 | |

| Diluted from discontinued operations | — | | | — | | | 0.01 | | | 0.01 | |

| Diluted attributable to common stockholders | $ | (0.13) | | | $ | 0.22 | | | $ | 0.17 | | | $ | 0.71 | |

| | | | | | | |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 241.5 | | | 244.7 | | | 241.4 | | | 246.4 | |

| Diluted | 241.5 | | | 245.0 | | | 241.8 | | | 247.2 | |

ELEMENT SOLUTIONS INC

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) | | | | | | | | | | | |

| September 30, | | December 31, |

| (dollars in millions) | 2023 | | 2022 |

| Assets | | | |

| Cash & cash equivalents | $ | 329.6 | | | $ | 265.6 | |

| Accounts receivable, net of allowance for doubtful accounts of $14.0 and $14.4 at September 30, 2023 and December 31, 2022, respectively | 449.5 | | | 455.8 | |

| Inventories | 322.8 | | | 290.7 | |

| Prepaid expenses | 31.3 | | | 38.5 | |

| Other current assets | 166.3 | | | 138.1 | |

| | | |

| Total current assets | 1,299.5 | | | 1,188.7 | |

| Property, plant and equipment, net | 279.2 | | | 277.2 | |

| Goodwill | 2,281.5 | | | 2,412.8 | |

| Intangible assets, net | 889.6 | | | 805.5 | |

| Deferred income tax assets | 49.8 | | | 51.5 | |

| Other assets | 169.2 | | | 168.0 | |

| | | |

| Total assets | $ | 4,968.8 | | | $ | 4,903.7 | |

| Liabilities and stockholders' equity | | | |

| Accounts payable | $ | 143.8 | | | $ | 132.2 | |

| Current installments of long-term debt | 11.5 | | | 11.5 | |

| Accrued expenses and other current liabilities | 221.4 | | | 200.7 | |

| | | |

| Total current liabilities | 376.7 | | | 344.4 | |

| Debt | 2,027.8 | | | 1,883.8 | |

| Pension and post-retirement benefits | 34.6 | | | 36.7 | |

| Deferred income tax liabilities | 104.4 | | | 121.2 | |

| Other liabilities | 179.1 | | | 168.5 | |

| | | |

| Total liabilities | 2,722.6 | | | 2,554.6 | |

| | | |

| Stockholders' equity | | | |

| | | |

| Common stock: 400.0 shares authorized (2023: 266.2 shares issued; 2022: 265.1 shares issued) | 2.7 | | | 2.7 | |

| Additional paid-in capital | 4,197.7 | | | 4,185.9 | |

| Treasury stock (2023: 24.6 shares; 2022: 24.3 shares) | (341.9) | | | (334.2) | |

| Accumulated deficit | (1,241.2) | | | (1,223.8) | |

| Accumulated other comprehensive loss | (387.1) | | | (298.1) | |

| Total stockholders' equity | 2,230.2 | | | 2,332.5 | |

| Non-controlling interests | 16.0 | | | 16.6 | |

| Total equity | 2,246.2 | | | 2,349.1 | |

| Total liabilities and stockholders' equity | $ | 4,968.8 | | | $ | 4,903.7 | |

ELEMENT SOLUTIONS INC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | Nine Months Ended |

| | | September 30, |

| (dollars in millions) | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | | | | |

Net (loss) income | $ | (31.7) | | | $ | 29.7 | | | $ | 43.0 | | | | $ | 41.0 | | | $ | 175.1 | |

| Net income from discontinued operations, net of tax | — | | | 2.9 | | | — | | | | 2.9 | | | 1.8 | |

Net (loss) income from continuing operations | (31.7) | | | 26.8 | | | 43.0 | | | | 38.1 | | | 173.3 | |

Reconciliation of net (loss) income to net cash flows provided by operating activities: | | | | | | | | | | |

| Depreciation and amortization | 44.5 | | | 41.1 | | | 39.1 | | | | 124.7 | | | 122.0 | |

| Deferred income taxes | (10.6) | | | 2.9 | | | (0.4) | | | | (8.1) | | | 3.9 | |

Foreign exchange loss (gain) | 5.6 | | | (8.8) | | | (7.3) | | | | (10.5) | | | (1.0) | |

| Incentive stock compensation | 2.9 | | | 3.3 | | | 4.4 | | | | 10.6 | | | 12.8 | |

Goodwill impairment | 80.0 | | | — | | | — | | | | 80.0 | | | — | |

| Other, net | 2.3 | | | 21.3 | | | 2.2 | | | | 25.8 | | | 10.7 | |

| Changes in assets and liabilities, net of acquisitions: | | | | | | | | | | |

| Accounts receivable | (6.2) | | | 2.2 | | | (2.6) | | | | (6.6) | | | (23.3) | |

| Inventories | 2.4 | | | (10.5) | | | (29.1) | | | | (37.2) | | | (63.1) | |

| Accounts payable | 2.8 | | | (8.1) | | | 18.6 | | | | 13.3 | | | 32.1 | |

| Accrued expenses | 3.9 | | | 10.4 | | | (22.3) | | | | (8.0) | | | (47.9) | |

| Prepaid expenses and other current assets | 1.4 | | | (0.7) | | | 2.7 | | | | 3.4 | | | (22.0) | |

| Other assets and liabilities | (9.9) | | | 1.0 | | | 5.2 | | | | (3.7) | | | (2.1) | |

| Net cash flows provided by operating activities | 87.4 | | | 80.9 | | | 53.5 | | | | 221.8 | | | 195.4 | |

| Cash flows from investing activities: | | | | | | | | | | |

| Capital expenditures | (13.4) | | | (13.8) | | | (9.1) | | | | (36.3) | | | (32.8) | |

| Proceeds from disposal of property, plant and equipment | 0.9 | | | — | | | 0.5 | | | | 1.4 | | | 3.4 | |

| Acquisitions, net of cash acquired | (0.3) | | | (188.3) | | | — | | | | (188.6) | | | (22.6) | |

| Other, net | 0.3 | | | — | | | (3.0) | | | | (2.7) | | | (9.9) | |

| Net cash flows used in investing activities | (12.5) | | | (202.1) | | | (11.6) | | | | (226.2) | | | (61.9) | |

| Cash flows from financing activities: | | | | | | | | | | |

| Debt proceeds | — | | | 150.0 | | | — | | | | 150.0 | | | — | |

| Repayments of borrowings | (2.8) | | | (2.9) | | | (2.9) | | | | (8.6) | | | (11.9) | |

| | | | | | | | | | |

| Repurchases of common stock | — | | | — | | | — | | | | — | | | (113.5) | |

| Dividends | (19.4) | | | (19.3) | | | (19.4) | | | | (58.1) | | | (59.2) | |

| Payment of financing fees | (0.3) | | | (0.7) | | | — | | | | (1.0) | | | — | |

| Other, net | (0.2) | | | (0.3) | | | (7.2) | | | | (7.7) | | | (27.0) | |

Net cash flows (used in) provided by financing activities | (22.7) | | | 126.8 | | | (29.5) | | | | 74.6 | | | (211.6) | |

| | | | | | | | | | |

| Net cash flows provided by operating activities of discontinued operations | — | | | 2.9 | | | — | | | | 2.9 | | | 1.8 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | (5.0) | | | (5.1) | | | 1.0 | | | | (9.1) | | | (19.8) | |

| Net increase (decrease) in cash and cash equivalents | 47.2 | | | 3.4 | | | 13.4 | | | | 64.0 | | | (96.1) | |

| Cash and cash equivalents at beginning of period | 282.4 | | | 279.0 | | | 265.6 | | | | 265.6 | | | 330.1 | |

| Cash and cash equivalents at end of period | $ | 329.6 | | | $ | 282.4 | | | $ | 279.0 | | | | $ | 329.6 | | | $ | 234.0 | |

ELEMENT SOLUTIONS INC

ADDITIONAL FINANCIAL INFORMATION

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

I. SEGMENT RESULTS (1) | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (dollars in millions) | 2023 | | 2022 | | Reported | | Constant Currency | | Organic | | 2023 | | 2022 | | Reported | | Constant Currency | | Organic |

| Net sales |

| Electronics | $ | 367.0 | | | $ | 389.4 | | | (6)% | | (5)% | | (5)% | | $ | 1,062.4 | | | $ | 1,271.8 | | | (16)% | | (14)% | | (8)% |

| Industrial & Specialty | 232.3 | | | 229.1 | | | 1% | | (1)% | | (1)% | | 697.4 | | | 703.8 | | | (1)% | | 0% | | 0% |

| Total | $ | 599.3 | | | $ | 618.5 | | | (3)% | | (3)% | | (3)% | | $ | 1,759.8 | | | $ | 1,975.6 | | | (11)% | | (9)% | | (6)% |

| | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA |

| Electronics | $ | 90.4 | | | $ | 90.9 | | | (1)% | | 1% | | | | $ | 239.4 | | | $ | 293.0 | | | (18)% | | (15)% | | |

| Industrial & Specialty | 43.7 | | | 42.6 | | | 3% | | 2% | | | | 123.1 | | | 125.7 | | | (2)% | | 1% | | |

| Total | $ | 134.1 | | | $ | 133.5 | | | 0% | | 2% | | | | $ | 362.5 | | | $ | 418.7 | | | (13)% | | (10)% | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Constant Currency | | Nine Months Ended September 30, | | Constant Currency |

| 2023 | | 2022 | | Change | | 2023 | | Change | | 2023 | | 2022 | | Change | | 2023 | | Change |

| Adjusted EBITDA Margin | | | | | | | | | | |

| Electronics | 24.6% | | 23.3% | | 130bps | | 24.8% | | 150bps | | 22.5% | | 23.0% | | (50)bps | | 22.8% | | (20)bps |

| Industrial & Specialty | 18.9% | | 18.6% | | 30bps | | 19.3% | | 70bps | | 17.7% | | 17.9% | | (20)bps | | 17.9% | | 0bps |

| Total | 22.4% | | 21.6% | | 80bps | | 22.7% | | 110bps | | 20.6% | | 21.2% | | (60)bps | | 20.9% | | (30)bps |

(1) Reflects the transfer in the first quarter of 2023 of the operational responsibility of the Company's Films business from its Graphics Solutions business in its Industrial & Specialty segment to its Circuitry Solutions business in its Electronics segment and the transfer of certain product lines between its Assembly Solutions business and its Semiconductor Solutions business, both of which are part of its Electronics segment. Historical information has been reclassified to reflect these changes for all periods presented.

| | | | | | | | | | | | | | | | | | | | | | | |

| II. CAPITAL STRUCTURE |

| (dollars in millions) | | | Maturity | | Interest Rate | | September 30, |

| | | | | 2023 |

| Instrument | | | | | | | |

| | | | | | | |

| Term Loans A | (1) | | 1/31/2026 | | SOFR plus 1.75% | | $ | 150.0 | |

| Term Loans B | (1) | | 1/31/2026 | | SOFR plus 2.00% | | 1,105.4 | |

| | | | | | | |

| Total First Lien Debt | | | | | | | 1,255.4 | |

| Senior Notes due 2028 | | | 9/1/2028 | | 3.875% | | 800.0 | |

| | | | | | | |

| Total Debt | | | | | | | 2,055.4 | |

| Cash Balance | | | | | | | 329.6 | |

| Net Debt | | | | | | | $ | 1,725.8 | |

| Adjusted Shares Outstanding | (2) | | | | | | 243.9 | |

Market Capitalization | (3) | | | | | | $ | 4,782.9 | |

| Total Capitalization | | | | | | | $ | 6,508.7 | |

(1) Element Solutions swapped its floating term loan rate to a fixed rate for all of its outstanding term loans through the use of interest rate swaps and cross-currency swaps which mature in January 2024, January 2025 or January 2026, as applicable. At September 30, 2023, approximately 100% of the Company's debt was fixed.

(2) See "Adjusted Common Shares Outstanding at September 30, 2023 and 2022" following the footnotes under the "Adjusted Earnings Per Share (EPS)" reconciliation table below.

(3) Based on the closing price of the shares of Element Solutions of $19.61 at September 29, 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| III. SELECTED FINANCIAL DATA | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Interest expense | $ | 15.7 | | | $ | 13.1 | | | $ | 43.5 | | | $ | 41.1 | |

| Interest paid | 22.9 | | | 19.2 | | | 48.7 | | | 43.7 | |

| Income tax expense | 15.3 | | | 16.5 | | | 53.4 | | | 60.4 | |

| Income taxes paid | 17.5 | | | 14.0 | | | 49.0 | | | 45.6 | |

| Capital expenditures | 13.4 | | | 11.1 | | | 36.3 | | | 32.8 | |

| Proceeds from disposal of property, plant and equipment | 0.9 | | | — | | | 1.4 | | | 3.4 | |

Non-GAAP Measures

To supplement its financial measures prepared in accordance with GAAP, Element Solutions presents in this release the following non-GAAP financial measures: EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted EPS, adjusted common shares outstanding, free cash flow, net debt to adjusted EBITDA ratio (including with the estimated annual benefit from the ViaForm® transaction), organic net sales growth and full year 2023 guidance for adjusted EBITDA, adjusted EPS and free cash flow. The Company also evaluates and presents its results of operations on a constant currency basis.

Management internally reviews these non-GAAP measures to evaluate performance on a comparative period-to-period basis in terms of absolute performance, trends and expected future performance with respect to the Company’s business and believes that these non-GAAP measures provide investors with an additional perspective on trends and underlying operating results on a period-to-period comparable basis. The Company also believes that investors find this information helpful in understanding the ongoing performance of its operations separate from items that may have a disproportionate positive or negative impact on its financial results in any particular period or are considered to be associated with its capital structure. These non-GAAP financial measures, however, have limitations as analytical tools, and should not be considered in isolation from, a substitute for, or superior to, the related financial information that Element Solutions reports in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements and may not be completely comparable to similarly titled measures of other companies due to potential differences in calculation methods. In addition, these measures are subject to inherent limitations as they reflect the exercise of judgment by management about which items are excluded or included in determining these non-GAAP financial measures. Investors are encouraged to review the definitions and reconciliations of these non-GAAP financial measures to their most comparable GAAP financial measures included in this press release, and not to rely on any single financial measure to evaluate the Company's businesses.

The Company only provides the expected contribution of the ViaForm® transaction to annual adjusted EBITDA and full year 2023 guidance for adjusted EBITDA, adjusted EPS and free cash flow on a non-GAAP basis. Reconciliations of such forward-looking non-GAAP measures to GAAP are excluded in reliance upon the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K due to the inherent difficulty in forecasting and quantifying, without unreasonable efforts, certain amounts that are necessary for such reconciliations, including adjustments that could be made for restructurings, refinancings, impairments, divestitures, integration and acquisition-related expenses, share-based compensation amounts, non-recurring, unusual or unanticipated charges, expenses or gains, adjustments to inventory and other charges reflected in reconciliations of historic numbers, the amount of which, based on historical experience, could be significant.

Constant Currency:

The Company discloses net sales and adjusted EBITDA on a constant currency basis by adjusting results to exclude the impact of changes due to the translation of foreign currencies of its international locations into U.S. dollar. Management believes this non-GAAP financial information facilitates period-to-period comparison in the analysis of trends in business performance, thereby providing valuable supplemental information regarding its results of operations, consistent with how the Company internally evaluates its financial results.

The impact of foreign currency translation is calculated by converting the Company's current-period local currency financial results into U.S. dollar using the prior period's exchange rates and comparing these adjusted amounts to its prior period reported results. The difference between actual growth rates and constant currency growth rates represents the estimated impact of foreign currency translation.

Organic Net Sales Growth:

Organic net sales growth is defined as net sales excluding the impact of foreign currency translation, changes due to the pass-through pricing of certain metals and acquisitions and/or divestitures, as applicable. Management believes this non-GAAP financial measure provides investors with a more complete understanding of the underlying net sales trends by providing comparable net sales over differing periods on a consistent basis.

The following table reconciles GAAP net sales growth to organic net sales growth for the three and nine months ended September 30, 2023: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 |

| | Reported Net Sales Growth | | Impact of Currency | | Constant Currency | | Change in Pass-Through Metals Pricing | | Acquisitions | | Organic Net Sales Growth |

| Electronics | | (6)% | | 1% | | (5)% | | 0% | | 0% | | (5)% |

| Industrial & Specialty | | 1% | | (2)% | | (1)% | | —% | | 0% | | (1)% |

| Total | | (3)% | | 0% | | (3)% | | 0% | | 0% | | (3)% |

| | | | | | | | | | | | |

| | Nine Months Ended September 30, 2023 |

| | Reported Net Sales Growth | | Impact of Currency | | Constant Currency | | Change in Pass-Through Metals Pricing | | Acquisitions | | Organic Net Sales Growth |

| Electronics | | (16)% | | 2% | | (14)% | | 6% | | 0% | | (8)% |

| Industrial & Specialty | | (1)% | | 1% | | 0% | | —% | | (1)% | | 0% |

| Total | | (11)% | | 2% | | (9)% | | 4% | | 0% | | (6)% |

NOTE: Totals may not sum due to rounding.

For the three months ended September 30, 2023, Electronics' consolidated results were positively impacted by $1.4 million of pass-through metals pricing and negatively impacted by $0.3 million of acquisitions and Industrial & Specialty's consolidated results were positively impacted by $1.1 million of acquisitions. For the nine months ended September 30, 2023, Electronics' consolidated results were negatively impacted by $73.5 million of pass-through metals pricing and positively impacted by $1.1 million of acquisitions and Industrial & Specialty's consolidated results were positively impacted by $3.8 million of acquisitions.

Adjusted Earnings Per Share (EPS):

Adjusted EPS is a key metric used by management to measure operating performance and trends as management believes the exclusion of certain expenses in calculating adjusted EPS facilitates operating performance comparisons on a period-to-period basis. Adjusted EPS is defined as net income attributable to common stockholders adjusted to reflect adjustments consistent with the Company's definition of adjusted EBITDA. Additionally, the Company eliminates amortization expense associated with intangible assets, incremental depreciation associated with the step-up of fixed assets and incremental cost of sales associated with the step-up of inventories recognized in purchase accounting for acquisitions. Further, the Company adjusts its effective tax rate to 20% for the three and nine months ended September 30, 2023 and 2022, respectively, as described in footnote (9) under the reconciliation table below.

The resulting adjusted net income is then divided by the Company's adjusted common shares outstanding. Adjusted common shares outstanding represent the shares outstanding as of the balance sheet date for the quarter-to-date period and an average of each quarter for the year-to-date period plus shares issuable upon exercise or vesting of all outstanding equity awards (assuming a performance achievement target level for equity awards with targets considered probable).

The following table reconciles GAAP "Net (loss) income attributable to common stockholders" to "Adjusted net income attributable to common stockholders" and presents the number of adjusted common shares outstanding used in calculating adjusted EPS for each period presented below: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (dollars in millions, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) income attributable to common stockholders | | $ | (31.8) | | | $ | 53.2 | | | $ | 41.0 | | | $ | 174.5 | |

| Net income from discontinued operations attributable to common stockholders | | — | | | — | | | 2.9 | | | 1.8 | |

| Net (loss) income from continuing operations attributable to common stockholders | | (31.8) | | | 53.2 | | | 38.1 | | | 172.7 | |

| Reversal of amortization expense | (1) | 32.7 | | | 29.2 | | | 93.3 | | | 90.5 | |

| Adjustment to reverse incremental depreciation expense from acquisitions | (1) | 0.4 | | | 0.5 | | | 1.2 | | | 1.7 | |

| Inventory step-up | (1) | — | | | — | | | — | | | 0.5 | |

| Restructuring expense | (2) | 2.1 | | | 2.9 | | | 6.3 | | | 6.1 | |

| Acquisition and integration expense | (3) | 5.0 | | | 2.2 | | | 13.3 | | | 6.2 | |

| Foreign exchange loss (gain) on intercompany loans | (4) | 6.5 | | | 2.5 | | | (7.6) | | | 3.2 | |

| Goodwill impairment | (5) | 80.0 | | | — | | | 80.0 | | | — | |

| Kuprion Acquisition research and development charge | (6) | — | | | — | | | 15.7 | | | — | |

| Adjustment of stock compensation previously not probable | (7) | — | | | — | | | — | | | 1.3 | |

| | | | | | | | |

| Other, net | (8) | (0.9) | | | 4.0 | | | 1.6 | | | 6.1 | |

| Tax effect of pre-tax non-GAAP adjustments | (9) | (25.2) | | | (8.3) | | | (40.8) | | | (23.1) | |

| Adjustment to estimated effective tax rate | (9) | 18.6 | | | 2.6 | | | 35.1 | | | 13.6 | |

| Adjusted net income attributable to common stockholders | | $ | 87.4 | | | $ | 88.8 | | | $ | 236.2 | | | $ | 278.8 | |

| | | | | | | | |

| Adjusted earnings per share | (10) | $ | 0.36 | | | $ | 0.36 | | | $ | 0.97 | | | $ | 1.12 | |

| | | | | | | | | |

| Adjusted common shares outstanding | (10) | 243.9 | | | 245.2 | | | 243.9 | | | 247.9 | |

(1) The Company eliminates the amortization expense associated with intangible assets, incremental depreciation associated with the step-up of fixed assets and incremental cost of sales associated with the step-up of inventories recognized in purchase accounting for acquisitions. The Company believes these adjustments provide insight with respect to the cash flows necessary to maintain and enhance its product portfolio.

(2) The Company adjusts for costs of restructuring its operations, including those related to its acquired businesses. The Company adjusts these costs because it believes they are not reflective of ongoing operations.

(3) The Company adjusts for costs associated with acquisition and integration activity, including costs of obtaining related financing, legal and accounting fees and transfer taxes. The Company adjusts these costs because it believes they are not reflective of ongoing operations.

(4) The Company adjusts for foreign exchange gains and losses on intercompany loans because it expects the period-to-period movement of the applicable currencies to offset on a long-term basis and because these gains and losses are not fully realized due to their long-term nature. The Company does not exclude foreign exchange gains and losses on short-term intercompany and third-party payables and receivables.

(5) The Company recorded a non-cash impairment charge of $80.0 million related to its Graphics Solutions reporting unit in its Industrial & Specialty segment in the third quarter of 2023. The Company adjusts this cost because it believes it is not reflective of ongoing operations.

(6) The Company adjusts for research and development costs associated with the purchase accounting related to the acquisition of Kuprion, Inc. The Company adjusts these costs because it believes they are not reflective of ongoing operations.

(7) The Company adjusts for costs relating to certain stretch target performance-based restricted stock units granted to certain key executives as the achievement of the performance target for these awards was not deemed probable prior to the second quarter of 2021 and, therefore, compensation expense for these awards did not begin to be recognized until the second quarter of 2021 when achievement of the performance target became probable. The Company adjusts these costs to provide a meaningful comparison of its performance between periods.

(8) The Company's adjustments are primarily comprised of certain professional consulting fees and unrealized gains/losses on metals derivative contracts. The Company adjusts for professional consulting fees because it believes they are not reflective of ongoing operations. The Company adjusts for unrealized gains/losses on metals derivative contracts to provide a meaningful comparison of its

performance between periods.

(9) The Company adjusts its effective tax rate to 20% for the three and nine months ended September 30, 2023 and 2022, respectively. This adjustment does not reflect the Company’s current or near-term tax structure, including limitations on its ability to utilize net operating losses and foreign tax credits in certain jurisdictions. The Company also applies an effective tax rate of 20% to pre-tax non-GAAP adjustments for the three and nine months ended September 30, 2023 and 2022, respectively. These effective tax rate adjustments are made because they provide a meaningful comparison of its performance between periods.

(10) The Company defines "Adjusted common shares outstanding" as the number of shares of its common stock outstanding as of the balance sheet date for the quarter-to-date period and an average of each quarter for the year-to-date period, plus the shares issuable upon exercise or vesting of all outstanding equity awards (assuming a performance achievement target level for equity awards with targets considered probable). The Company adjusts the number of its outstanding common shares for this calculation to provide an understanding of its results of operations on a per share basis. See the table below for further information.

Adjusted Common Shares Outstanding at September 30, 2023 and 2022

The following table shows the Company's adjusted common shares outstanding at each period presented: | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, | | Year-to-Date Average |

| | September 30, |

| (amounts in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Basic common shares outstanding | 241.5 | | | 242.8 | | | 241.5 | | | 245.5 | |

| | | | | | | |

| Number of shares issuable upon vesting of granted Equity Awards | 2.4 | | | 2.4 | | | 2.4 | | | 2.4 | |

| Adjusted common shares outstanding | 243.9 | | | 245.2 | | | 243.9 | | | 247.9 | |

EBITDA and Adjusted EBITDA:

EBITDA represents earnings before interest, provision for income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA, excluding the impact of additional items included in GAAP earnings which the Company believes are not representative or indicative of its ongoing business or are considered to be associated with its capital structure, as described in the footnotes located under the "Adjusted Earnings Per Share (EPS)" reconciliation table above. Adjusted EBITDA for each segment also includes an allocation of corporate costs, such as compensation expense and professional fees. Management believes adjusted EBITDA and adjusted EBITDA margin provide investors with a more complete understanding of the long-term profitability trends of Element Solutions' business and facilitate comparisons of its profitability to prior and future periods.

The following table reconciles GAAP "Net (loss) income attributable to common stockholders" to "Adjusted EBITDA" for each of the periods presented: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (dollars in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) income attributable to common stockholders |

| $ | (31.8) | | | $ | 53.2 | | | $ | 41.0 | | | $ | 174.5 | |

| Add (subtract): | | | | | | | | |

| Net income attributable to non-controlling interests |

| 0.1 | | | 0.1 | | | — | | | 0.6 | |

| Income from discontinued operations, net of tax | | — | | | — | | | (2.9) | | | (1.8) | |

| Income tax expense |

| 15.3 | | | 16.5 | | | 53.4 | | | 60.4 | |

| Interest expense, net | | 13.3 | | | 12.3 | | | 37.0 | | | 39.6 | |

| Depreciation expense | | 11.8 | | | 10.6 | | | 31.4 | | | 31.5 | |

| Amortization expense | | 32.7 | | | 29.2 | | | 93.3 | | | 90.5 | |

| EBITDA |

| 41.4 | | | 121.9 | | | 253.2 | | | 395.3 | |

| Adjustments to reconcile to Adjusted EBITDA: | | | | | | | | |

| Inventory step-up | (1) | — | | | — | | | — | | | 0.5 | |

| Restructuring expense | (2) | 2.1 | | | 2.9 | | | 6.3 | | | 6.1 | |

| Acquisition and integration expense | (3) | 5.0 | | | 2.2 | | | 13.3 | | | 6.2 | |

| Foreign exchange loss (gain) on intercompany loans | (4) | 6.5 | | | 2.5 | | | (7.6) | | | 3.2 | |

| Goodwill impairment | (5) | 80.0 | | | — | | | 80.0 | | | — | |

| Kuprion Acquisition research and development charge | (6) | — | | | — | | | 15.7 | | | — | |

| Adjustment of stock compensation previously not probable | (7) | — | | | — | | | — | | | 1.3 | |

| | | | | | | | |

| Other, net | (8) | (0.9) | | | 4.0 | | | 1.6 | | | 6.1 | |

| Adjusted EBITDA |

| $ | 134.1 | | | $ | 133.5 | | | $ | 362.5 | | | $ | 418.7 | |

NOTE: For the footnote descriptions, please refer to the footnotes located under the "Net (loss) income attributable to common stockholders" reconciliation table above.

Net Debt to Adjusted EBITDA Ratio:

Net debt to adjusted EBITDA ratio is defined as total debt (current installments of long-term debt, revolving credit facilities and long-term debt), excluding unamortized discounts and debt issuance costs, which totaled $16.1 million at September 30, 2023, less cash divided by adjusted EBITDA.

The following table presents the Company's net debt to adjusted EBITDA ratio of 3.7x on a trailing twelve month basis: | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | | | | | 2022 | | Trailing Twelve Months |

| (dollars in millions) | YTD | | | | | | Q4 | |

| Net income attributable to common stockholders | $ | 41.0 | | | | | | | $ | 12.7 | | | $ | 53.7 | |

| Add (subtract): | | | | | | | | | |

Net income attributable to non-controlling interests | — | | | | | | | 0.2 | | | 0.2 | |

| Income from discontinued operations, net of tax | (2.9) | | | | | | | — | | | (2.9) | |

| Income tax expense | 53.4 | | | | | | | 25.4 | | | 78.8 | |

| Interest expense, net | 37.0 | | | | | | | 11.6 | | | 48.6 | |

| Depreciation expense | 31.4 | | | | | | | 10.1 | | | 41.5 | |

| Amortization expense | 93.3 | | | | | | | 29.2 | | | 122.5 | |

| EBITDA | 253.2 | | | | | | | 89.2 | | | 342.4 | |

| Adjustments to reconcile to Adjusted EBITDA: | | | | | | | | | |

| | | | | | | | | |

| Restructuring expense | 6.3 | | | | | | | 3.4 | | | 9.7 | |

| Acquisition and integration expense | 13.3 | | | | | | | 4.4 | | | 17.7 | |

| Foreign exchange (gain) loss on intercompany loans | (7.6) | | | | | | | 4.6 | | | (3.0) | |

Goodwill impairment | 80.0 | | | | | | | — | | | 80.0 | |

| Kuprion Acquisition research and development charge | 15.7 | | | | | | | — | | | 15.7 | |

| | | | | | | | | |

| | | | | | | | | |

| Other, net | 1.6 | | | | | | | 6.3 | | | 7.9 | |

| Adjusted EBITDA | $ | 362.5 | | | | | | | $ | 107.9 | | | $ | 470.4 | |

| | | | | | | | | |

| Net debt | | | | | | | | | $ | 1,725.8 | |

| | | | | | | | | |

| Net debt to adjusted EBITDA ratio | | | | | | | | | 3.7x |

| | | | | | | | | |

Reacquired ViaForm® distribution rights adjusted EBITDA (8 months) | | | | | | | | | 10.1 | |

Adjusted EBITDA including ViaForm® transaction | | | | | | | | | 480.5 | |

Net debt to adjusted EBITDA ratio including ViaForm® transaction | | | | | | | | | 3.6x |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Free Cash Flow:

Free cash flow is defined as net cash flows from operating activities less net capital expenditures. Net capital expenditures include capital expenditures less proceeds from the disposal of property, plant and equipment. Management believes that free cash flow, which measures the Company’s ability to generate cash from its business operations, is an important financial measure for evaluating the Company's financial performance. However, free cash flow should be considered in addition to, rather than as a substitute for, net cash provided by operating activities as a measure of the Company’s liquidity.

The following table reconciles "Cash flows from operating activities" to "Free cash flow:"

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2023 |

| (dollars in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities | | $ | 87.4 | | | $ | 126.7 | | | $ | 221.8 | | | $ | 195.4 | |

| Capital expenditures | | (13.4) | | | (11.1) | | | (36.3) | | | (32.8) | |

| Proceeds from disposal of property, plant and equipment | | 0.9 | | | — | | | 1.4 | | | 3.4 | |

| Free cash flow | | $ | 74.9 | | | $ | 115.6 | | | $ | 186.9 | | | $ | 166.0 | |

Investor Relations:

Varun Gokarn

Senior Director, Strategy and Finance

Element Solutions Inc

1-203-952-0369

IR@elementsolutionsinc.com

Media:

Scott Bisang / Ed Hammond / Tali Epstein

Collected Strategies

1-212-379-2072

esi@collectedstrategies.com

v3.23.3

Cover Document

|

Oct. 25, 2023 |

| Cover Page [Abstract] |

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Written Communications |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 25, 2023

|

| Entity Registrant Name |

Element Solutions Inc

|

| Entity File Number |

001-36272

|

| Entity Tax Identification Number |

37-1744899

|

| Entity Address, Address Line One |

500 East Broward Boulevard,

|

| Entity Address, Address Line Two |

Suite 1860

|

| Entity Address, Postal Zip Code |

33394

|

| Entity Address, City or Town |

Fort Lauderdale,

|

| Entity Address, State or Province |

FL

|

| City Area Code |

561

|

| Local Phone Number |

207-9600

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

ESI

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0001590714

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

esi_CoverPageAbstract |

| Namespace Prefix: |

esi_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

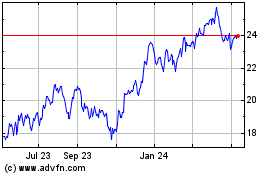

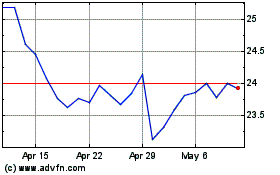

Element Solutions (NYSE:ESI)

Historical Stock Chart

From Apr 2024 to May 2024

Element Solutions (NYSE:ESI)

Historical Stock Chart

From May 2023 to May 2024