UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06416

DTF Tax-Free Income 2028 Term Fund Inc.

(Exact name of registrant as specified in charter)

200 South Wacker Drive, Suite 500, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

|

|

|

| Alan M. Meder |

|

Lawrence R. Hamilton, Esq. |

| DTF Tax-Free Income 2028 Term Fund Inc. |

|

Mayer Brown LLP |

| 200 South Wacker Drive, Suite 500 |

|

71 South Wacker Drive |

| Chicago, Illinois 60606 |

|

Chicago, Illinois 60606 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (800) 338-8214

Date of fiscal year end: October 31

Date of reporting period:

April 30, 2023

| ITEM 1. |

REPORTS TO STOCKHOLDERS |

DTF Tax-Free Income

2028 Term Fund Inc.

Semi-Annual Report

April 30, 2023

LETTER TO

SHAREHOLDERS

June 15, 2023

IMPORTANT INFORMATION ABOUT YOUR FUND

FUND DIVIDEND

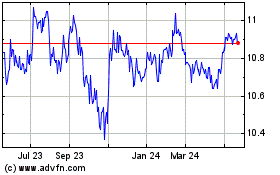

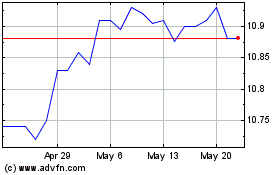

As of April 30, 2023, the DTF Fund was paying a $0.39 per share annualized dividend and had a closing

price of $11.00 per share. The Fund’s monthly distribution was maintained at 3.25¢ per share for the previous twelve months.

On March 6, 2023, the DTF Fund amended its distribution policy to allow the Fund’s monthly

distribution to include return of capital as well as net investment income. While a portion of future monthly distributions is expected to come from return of capital, the amended policy enables the Fund to maintain a more stable distribution, which

is likely to be supportive of the Fund’s market price. A periodic return of capital also aligns with the short-term nature of the term structure of the Fund. The Fund’s policy of making annual distributions of capital gains is unaffected

by this change.

BENCHMARK CHANGE

Reflective of the Fund’s remaining five-year horizon, its performance benchmark was

changed to the Bloomberg 5-Year Municipal Bond Index from the Bloomberg U.S. Municipal Index, effective March 15, 2023. The average maturity (4.89 years) and duration (3.62 years) of the new

benchmark are more in line with the term date of the Fund. The new benchmark is expected to provide a more accurate basis for relative performance comparisons.

THE CURRENT MUNICIPAL MARKET ENVIRONMENT AND

YOUR FUND

We begin our discussion of DTF Tax-Free Income

2028 Term Fund Inc. (the “DTF Fund” or the “Fund”) for the six months ended April 30, 2023, with a review of the municipal market environment in which the DTF Fund invests.

During the six-months ended April 30, 2023, tax-exempt

interest rates moved sharply lower across the entire maturity curve as municipal investors digested signs of a slowing economy and a potential pause to increases in the Federal Funds rate. Declining inflation readings, limited tax-exempt supply, and a rush to safety in the face of a banking crisis were tailwinds that fueled a volatile rally. Yields on the two-year

AAA-rated municipal curve moved 50 basis points lower during the period, while the ten-year and 30-year yields moved 104 basis

points and 73 basis points lower, respectively. (One basis point is equal to one-hundredth of one percent or 0.01%.) The Bloomberg U.S. Municipal Index (a broad measure of the municipal market) returned 7.65%

for the period. Bonds with maturities longer than 22 years and bonds rated BBB produced the largest gains over the six months ended April 30, 2023, more than 11% and 9% respectively.

The late 2022 rally continued into early 2023, when investors soon found themselves chasing too few bonds while trying to capture what was

thought to be the peak in yields. Mutual funds saw inflows turn positive during January as more than $12 billion was added in the face of supply that was nearly 20% less year over year. February reminded investors that inflation was relentless

and that there was more work ahead for the Federal Reserve, causing yields to reverse course. March saw a flight to safety as duration mismanagement by two California banks led to fear of a spreading crisis in the banking industry. In April, an

overpriced market corrected in reaction to a spike in issuance and fears surrounding the liquidation of failed bank portfolios. During the six months ended April 30, 2023, the Bloomberg U.S. Municipal Index outperformed the Bloomberg Treasury

Index (5.78%); the Bloomberg U.S. Aggregate Bond Index (6.91%) and the Bloomberg U.S. Government/Credit Index (7.01%) while underperforming the Bloomberg Corporate Index (9.21%).

1

Credit fundamentals in the municipal market remain mostly sound. State and local governments

started their fiscal 2023 with record levels of reserves, giving their credits significant flexibility and the ability to weather periods of volatility. This was attributable to the large infusions of federal relief aid, robust property tax assessed

valuations, and better-than-expected sales and income tax collections. Looking ahead to fiscal 2024, some state and local budgets are showing signs of fatigue while others are considering tax relief measures. Credit analysis will be critical as the

potential effects of a slowing economy, higher inflation and higher interest rates take hold.

While there are increasing indications that

an economic downturn lies ahead, municipal credit has typically fared better in a recession than other investment options, as there is a lag between the onset of a recession and when municipalities begin to see their financial positions

significantly challenged. That is especially relevant for local municipalities that rely on property tax revenues, as the sizeable increases in housing values across the country are expected to continue to provide a strong source of revenue.

Credit risk premiums (which refer to the additional yield that investors expect to receive as compensation for buying lower-rated securities)

were slightly wider during the six-months ended April 30, 2023 for investment grade rated bonds (more so for BBB-rated bonds). Similarly, below investment grade

rated bond risk spreads were also wider. Our investment strategy continues to focus on higher quality municipalities that exhibit value for the longer term. While the federal stimulus may have helped bolster the overall economy and municipal

fundamentals, we believe that credits are not created equal and need to be analyzed with a longer-term horizon. Municipalities still face serious challenges in funding large capital expenditures to rebuild America’s aging infrastructure,

improve pension plan funding, and protect communities against climate change.

LOOKING AHEAD

Municipal bonds will likely be attractive in 2023, fueled by strong investor demand and constrained supply. Absolute rates

remain near decade highs and credit fundamentals remain stable. Supply is likely to remain modest until interest rates stabilize, creating a favorable imbalance in the supply-demand dynamic. Further, municipals continue to benefit from a lack of

correlation to other asset classes, while defaults continue to be rare and well communicated to investors.

THE

FUND

In managing the DTF Fund, we continue to emphasize our longstanding investment strategy of investing mostly

in higher-quality, investment grade bonds. The municipal bond market currently remains confident about the near-term credit outlook as most states are in a strong fiscal position thanks to revenue growth outpacing budget forecasts and unprecedented

federal pandemic aid. As such, we remain committed to our higher-quality approach to the portfolio that we have repeatedly articulated. The portfolio is distributed along the maturity and credit risk curve, with higher levels of “A” rated

bonds relative to the Bloomberg U.S. Municipal Index and the Bloomberg Municipal Bond 5 Year Index.

As of April 30, 2023, the Fund

held more than 90% of its total assets in municipal bonds rated “A” or higher across multiple sectors and states. The Fund is diversified across twelve industry sectors of the municipal bond market, with revenue sectors like pre-refunded, special tax, transportation, education, and healthcare bonds constituting the Fund’s top five sector exposures. Revenue bonds have consistently outweighed general obligation bonds in the Fund, as

we prefer the dedicated revenue streams and the more settled legal protections these types of bonds have historically offered. Geographically, the Fund is well diversified with exposure to 32 states and the District of Columbia. The Fund continues

to invest across the entire maturity spectrum of the municipal bond market to manage the risk of changes in interest rates and/or the shape of the yield curve.

Maturity and duration are measures of the sensitivity of a fund’s portfolio of investments to changes in interest rates. More

specifically, duration refers to the percentage change in a bond’s price for a given change in rates (typically +/- 100 basis points). In general, the greater the duration of a portfolio, the greater is the potential percentage price

volatility for a given change in interest rates. As of April 30, 2023, the modified adjusted duration of the Fund’s portfolio of investments was 3.86 years, versus the duration of the investments constituting the Bloomberg U.S.

Municipal Index, which was 6.07 years, and the Bloomberg Municipal 5 Year Index was 3.62 years.

In addition to the risk of disruptions in

the broader credit market, the level of interest rates can be a primary driver of bond fund total returns, including the Fund’s returns. As a practical matter, it is not possible for the Fund to be completely insulated from turmoil in the

global financial markets, pandemics, or unexpected moves in interest rates. Any sudden or unexpected rise in interest rates would likely reduce the total return of bond funds, since higher interest rates could be expected to depress the

2

valuations of fixed-rate bonds held in a portfolio. Further, if the municipal yield curve flattens (when the difference between short-term interest rates and long-term rates narrows) or inverts

(when short-term rates exceed long-term rates), the Fund’s total return may be pressured lower. Management believes that over the long term, the diversification of the portfolio across multiple states and sectors, in addition to the

distribution of assets along the yield curve, positions the Fund to take advantage of future opportunities while limiting credit risk and volatility to some degree. However, a sustained and meaningful rise in interest rates from current levels would

have the potential to significantly reduce the total return of leveraged bond funds, including the Fund, and would likely put downward pressure on both the net asset value and market prices of such funds.

FUND PERFORMANCE

The following table compares the DTF Fund’s total return to the Bloomberg U.S. Municipal Index and the Bloomberg Municipal Bond 5 Year

Index. It is important to note that the index returns stated below include no fees or expenses, whereas the DTF Fund’s NAV returns are net of fees and expenses. The Fund’s use of leverage can magnify the effect of any gains or losses to a

greater extent than if leverage were not used.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return1

For the period indicated through April 30, 2023 |

|

| |

|

Six Months |

|

|

One Year |

|

|

Five Years

(annualized) |

|

|

Ten Years

(annualized) |

|

| DTF

Tax-Free Income 2028 Term Fund Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Market Value2 |

|

|

3.7 |

% |

|

|

(6.7 |

)% |

|

|

0.2 |

% |

|

|

0.4 |

% |

| Net Asset Value3 |

|

|

6.9 |

% |

|

|

(2.6 |

)% |

|

|

(0.2 |

)% |

|

|

1.0 |

% |

| Bloomberg U.S. Municipal Index4 |

|

|

7.6 |

% |

|

|

2.9 |

% |

|

|

2.1 |

% |

|

|

2.2 |

% |

|

Bloomberg Municipal Bond 5 Year Index5 |

|

|

4.8 |

% |

|

|

3.0 |

% |

|

|

1.7 |

% |

|

|

1.5 |

% |

| 1 |

Past performance is not indicative of future results. Current performance may be lower or higher than the

performance in historical periods. |

| 2 |

Total return on market value assumes a purchase of common stock at the opening market price on the first

business day and a sale at the closing market price on the last business day of each period shown in the table and assumes reinvestment of dividends at the actual reinvestment prices obtained under the terms of the DTF Fund’s dividend

reinvestment plan. In addition, when buying or selling stock, you would ordinarily pay brokerage expenses. Because brokerage expenses are not reflected in the above calculations, your total return net of brokerage expenses would be lower than the

total returns on market value shown in the table. Source: Administrator of the DTF Fund. |

| 3 |

Total return on NAV uses the same methodology as is described in note 2, but with use of NAV for beginning,

ending and reinvestment values. Because the DTF Fund’s expenses (ratios detailed on page 16 of this report) reduce the DTF Fund’s NAV, they are already reflected in the DTF Fund’s total return on NAV shown in the table. NAV represents

the underlying value of the DTF Fund’s net assets, but the market price per share may be higher or lower than the NAV. Source: Administrator of the DTF Fund. |

| 4 |

The Bloomberg U.S. Municipal Index (formerly known as the Bloomberg Barclays Municipal Bond Index) is a market

capitalization-weighted index that is designed to measure the long-term tax-exempt bond market. The index is calculated on a total return basis with dividends

reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment. Source: Bloomberg. |

| 5 |

The Bloomberg Municipal Bond 5 Year Index is the 5 Year component of the Bloomberg U.S. Municipal Index. It is

designed to measure the four-to-six-year area of the tax-exempt bond market. The index is

calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment. Source: Bloomberg. |

3

BOARD OF DIRECTORS MEETINGS

At the regular March and June 2023 meetings of the DTF Fund’s Board of Directors, the Board authorized the following

monthly dividends:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cents Per

Share |

|

|

|

Record

Date |

|

|

|

Payable

Date |

|

|

|

|

|

Cents Per

Share |

|

|

|

Record

Date |

|

|

|

Payable

Date |

|

|

| |

|

3.25 |

|

|

|

April 17 |

|

|

|

April 28 |

|

|

|

|

|

3.25 |

|

|

|

July 17 |

|

|

|

July 31 |

|

|

| |

|

3.25 |

|

|

|

May 15 |

|

|

|

May 31 |

|

|

|

|

|

3.25 |

|

|

|

August 15 |

|

|

|

August 31 |

|

|

| |

|

3.25 |

|

|

|

June 15 |

|

|

|

June 30 |

|

|

|

|

|

3.25 |

|

|

|

September 15 |

|

|

|

September 29 |

|

|

ABOUT YOUR FUND

The Fund’s investment objective is current income exempt from regular federal income tax consistent with the preservation of capital. The

Fund seeks to achieve its investment objective by investing primarily (at least 80% of its total assets) in a diversified portfolio of investment-grade tax-exempt obligations. The Fund may not invest more than

25% of its total assets (taken at market value at the time of each investment) in the securities of issuers in a single industry; provided that, for purposes of this restriction, tax exempt securities of issuers that are states, municipalities or

their political subdivisions are not considered to be the securities of issuers in any single industry.

The use of leverage enables the

Fund to borrow at short-term rates and invest at longer-term rates. As of April 30, 2023, the Fund’s leverage represented approximately 31% of the Fund’s total assets. Given the recent shape of the municipal yield curve and the

resultant reduced benefits of leverage, on May 16, 2023, the Fund filed notice that it would voluntarily redeem $25 million of its outstanding preferred shares on June 15, 2023. That redemption will reduce the Fund’s leverage to

$15 million, which is expected to represent approximately 16% of the Fund’s total assets. It is also possible that additional preferred shares will be redeemed at a future date, although no date has yet been set for any such future

redemptions.

The amount and type of leverage used is reviewed by the Board of Directors based on the Fund’s expected earnings

relative to the anticipated costs (including fees and expenses) associated with the leverage. In addition, the long-term expected benefits of leverage are weighed against the potential effect of increasing the volatility of both the Fund’s net

asset value and the market value of its common stock. If the DTF Fund were to conclude that the use of leverage was likely to cease being beneficial, it could modify the amount and type of leverage it uses or eliminate the use of leverage entirely.

PORTFOLIO MANAGER RETIREMENT

On June 15, 2023, Ronald Schwartz retired as co-portfolio manager of the DTF Fund. Dusty Self, who has served as a portfolio manager of

the Fund since July 1, 2022 and has over 30 years of experience focused on investment grade municipal strategies, has taken on the role of lead portfolio manager.

It is a privilege and honor to serve you and we are excited for the future.

|

|

|

| Dusty L. Self Vice President |

|

David D. Grumhaus, Jr. President and Chief

Executive Officer |

Certain statements in this report are forward-looking statements. Discussions of specific investments are

for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein, are those of the portfolio managers as of the date of this report. Actual future results or

occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The DTF Fund disclaims any obligation to

update publicly or revise any forward-looking statements or views expressed herein.

4

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS

April 30, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

LONG-TERM INVESTMENTS—141.6% |

|

|

|

|

|

Alabama—2.4% |

|

|

|

|

| |

$2,000 |

|

|

Jefferson Cnty. Brd. of Ed. Pub. Sch.

Warrants,

5.00%, 2/01/46 |

|

|

$2,097,305 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alaska—0.3% |

|

|

|

|

| |

290 |

|

|

Anchorage Elec. Util. Rev.,

5.00%, 12/01/36

Prerefunded 12/01/24 @ $100 (b) |

|

|

298,222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arizona—5.2% |

|

|

|

|

| |

1,350 |

|

|

Arizona Brd. of Regents Rev.,

Arizona St. Univ.,

5.00%, 7/01/37 |

|

|

1,414,954 |

|

| |

650 |

|

|

Arizona St. Hlth. Fac. Auth. Rev., HonorHealth Hosp. Proj.,

5.00%, 12/01/42 |

|

|

656,643 |

|

| |

1,000 |

|

|

Maricopa Cnty. Indl. Dev. Auth. Rev., Banner Hlth.,

4.00%, 1/01/34 |

|

|

1,019,396 |

|

| |

190 |

|

|

Northern Arizona Univ. Rev.,

5.00%, 6/01/40

Prerefunded 6/01/24 @ $100 (b) |

|

|

193,913 |

|

| |

310 |

|

|

Northern Arizona Univ. Rev.,

5.00%, 6/01/40 |

|

|

312,662 |

|

| |

1,000 |

|

|

Northern Arizona Univ. SPEED Rev., (Stimulus Plan for Econ. and Edl. Dev.),

5.00%,

8/01/38

Prerefunded 8/01/23 @ $100 (b) |

|

|

1,004,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,601,908 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California—17.9% |

|

|

|

|

| |

1,260 |

|

|

California St. Hlth. Facs. Fin. Auth. Rev., Kaiser Permanente,

4.00%, 11/01/44 |

|

|

1,233,471 |

|

| |

330 |

|

|

California St. Hlth. Facs. Fin. Auth. Rev., Providence St. Joseph Hlth.,

4.00%,

10/01/36 |

|

|

333,364 |

|

| |

1,660 |

|

|

California St. Hlth. Facs. Fin. Auth. Rev., Sutter Hlth.,

5.00%, 11/15/46

Prerefunded

11/15/25 @ $100 (b) |

|

|

1,757,261 |

|

| |

1,000 |

|

|

California St. Gen. Oblig.,

5.00% 10/01/28 |

|

|

1,029,907 |

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

$

1,000 |

|

|

California St. Pub. Wks. Brd. Lease Rev., Dept. of Corrections and Rehab.,

5.25%,

9/01/29 |

|

|

$

1,006,192 |

|

| |

600 |

|

|

Contra Costa Cnty. Successor Agy.

to Redev. Agy., Tax Allocation,

5.00%, 8/01/35,

BAM |

|

|

652,640 |

|

| |

1,000 |

|

|

Garden Grove Successor Agy. to Agy. Cmty. Dev., Tax Allocation,

5.00%, 10/01/31, BAM |

|

|

1,068,347 |

|

| |

2,000 |

|

|

Gilroy Unified Sch. Dist. Gen. Oblig.,

4.00%, 8/01/41 |

|

|

2,006,149 |

|

| |

280 |

|

|

Lancaster Successor Agy. to Redev. Agy., Tax Allocation,

5.00%, 8/01/33, AGM |

|

|

301,337 |

|

| |

250 |

|

|

Palm Desert Successor Agy. to Redev. Agy., Tax Allocation,

5.00%, 10/01/28, BAM |

|

|

271,787 |

|

| |

1,215 |

|

|

San Marcos Successor Agy. to Redev. Agy., Tax Allocation,

5.00%, 10/01/32 |

|

|

1,283,795 |

|

| |

2,000 |

|

|

San Mateo Successor Agy. to Redev. Agy., Tax Allocation,

5.00%, 8/01/30 |

|

|

2,102,071 |

|

| |

1,000 |

|

|

Temple City Unified Sch. Dist. Gen. Oblig.,

4.00%, 8/01/43 |

|

|

1,002,284 |

|

| |

1,750 |

|

|

Univ. of California Rev.,

4.00%, 5/15/48 |

|

|

1,730,807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,779,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado—6.2% |

|

|

|

|

| |

925 |

|

|

Colorado St. Bldg. Excellent Schs. Today COP,

5.00%, 3/15/29 |

|

|

1,023,075 |

|

| |

1,000 |

|

|

Denver City and Cnty. Arpt. Rev.,

5.50%, 11/15/30 |

|

|

1,155,489 |

|

| |

2,150 |

|

|

Public Auth. for Colorado Energy,

Natural Gas Purch. Rev.,

6.25%, 11/15/28 |

|

|

2,323,475 |

|

| |

1,000 |

|

|

Univ. of Colorado Enterprise Rev.,

4.00%, 6/01/43 |

|

|

1,001,812 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,503,851 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Connecticut—8.9% |

|

|

|

|

| |

935 |

|

|

Connecticut St. Gen. Oblig.,

5.00%, 9/15/35 |

|

|

1,029,863 |

|

The accompanying notes are

an integral part of these financial statements.

5

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

$

730 |

|

|

Connecticut St. Gen. Oblig.,

4.00%, 4/15/38 |

|

|

$

741,360 |

|

| |

1,265 |

|

|

Connecticut St. Hlth. & Edl. Facs. Auth. Rev., Yale Univ.,

5.00%, 7/01/40 |

|

|

1,412,535 |

|

| |

550 |

|

|

Connecticut St. Hlth. & Edl. Facs. Auth. Rev., Yale-New

Haven Hosp.,

5.00%, 7/01/48 |

|

|

550,285 |

|

| |

390 |

|

|

Connecticut St. Hsg. Auth. Rev.,

3.00%, 5/15/33 |

|

|

365,540 |

|

| |

365 |

|

|

Connecticut St. Hsg. Auth. Rev.,

3.20%, 11/15/33 |

|

|

357,802 |

|

| |

130 |

|

|

Connecticut St. Hsg. Auth. Rev.,

1.85%, 5/15/38 |

|

|

92,383 |

|

| |

1,250 |

|

|

Hartford Cnty. Met. Dist. Clean Wtr. Proj. Rev.,

5.00%, 2/01/33 |

|

|

1,464,871 |

|

| |

400 |

|

|

Univ. of Connecticut Rev.,

5.00%, 5/01/30 |

|

|

462,067 |

|

| |

1,300 |

|

|

Univ. of Connecticut Spec. Oblig. Rev.,

5.00%, 11/15/43 |

|

|

1,387,256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,863,962 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

District of Columbia—1.2% |

|

|

|

|

| |

1,000 |

|

|

District of Columbia Gen. Oblig.,

5.00%, 6/01/43 |

|

|

1,070,211 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida—22.2% |

|

|

|

|

| |

780 |

|

|

Brevard Cnty. Sch. Brd. Ref. COP,

5.00%, 7/01/32 |

|

|

846,957 |

|

| |

1,000 |

|

|

Central Florida Expwy. Auth. Rev.,

4.00%, 7/01/36 |

|

|

1,009,574 |

|

| |

2,350 |

|

|

Florida St. Brd. of Gov. Florida State Univ. Dorm Rev.,

5.00%, 5/01/33

Refunded 5/02/23 @

$100 (b) |

|

|

2,350,000 |

|

| |

1,000 |

|

|

Hillsborough Cnty. Aviation Auth. Rev., Tampa Int’l. Arpt.,

5.00%, 10/01/44

Prerefunded

10/01/24 @ $100 (b) |

|

|

1,019,856 |

|

| |

500 |

|

|

Lee Cnty. Tran. Fac. Rev.,

5.00%, 10/01/35, AGM |

|

|

507,853 |

|

| |

1,080 |

|

|

Miami Beach Hlth. Facs. Auth. Rev., Mt. Sinai Med. Ctr.,

5.00%, 11/15/39 |

|

|

1,087,425 |

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

$

500 |

|

|

Miami Beach Redev. Agy. Rev.,

5.00%, 2/01/40, AGM |

|

|

$

497,161 |

|

| |

1,250 |

|

|

Miami-Dade Cnty. Ed. Facs. Auth. Rev., Univ. of Miami,

5.00%, 4/01/45 |

|

|

1,272,353 |

|

| |

2,220 |

|

|

Miami-Dade Cnty. Sch. Brd. Ref. COP,

5.00%, 2/01/34 |

|

|

2,301,643 |

|

| |

1,000 |

|

|

Reedy Creek Impvt. Dist. Gen. Oblig., 5.00%, 6/01/38

Prerefunded 6/01/23 @ $100 (b) |

|

|

1,001,380 |

|

| |

2,035 |

|

|

Seminole Cnty. Sales Tax Rev.,

5.25%, 10/01/31, NRE |

|

|

2,373,529 |

|

| |

2,190 |

|

|

Seminole Cnty. Sch. Brd. COP,

5.00%, 7/01/33 |

|

|

2,308,160 |

|

| |

830 |

|

|

S. Florida Wtr. Mgmt. Dist. COP,

5.00%, 10/01/35 |

|

|

867,093 |

|

| |

470 |

|

|

Tallahassee Hlth. Facs. Rev., Tallahassee Memorial Hlthcare.,

5.00%, 12/01/41 |

|

|

472,035 |

|

| |

665 |

|

|

Tampa-Hillsborough Cnty. Expwy. Auth. Rev.,

4.00%, 7/01/42 |

|

|

644,663 |

|

| |

1,000 |

|

|

Tampa-Hillsborough Cnty. Expwy. Auth. Rev.,

5.00%, 7/01/47 |

|

|

1,040,908 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,600,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia—0.6% |

|

|

|

|

| |

500 |

|

|

Atlanta Arpt. Passenger Fac. Charge Gen. Rev.,

5.00%, 1/01/32 |

|

|

505,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Idaho—0.3% |

|

|

|

|

| |

240 |

|

|

Idaho St. Hlth. Facs. Auth. Rev.,

St. Luke’s Hlth. Sys.,

5.00%, 3/01/37 |

|

|

249,177 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Illinois—17.4% |

|

|

|

|

| |

500 |

|

|

Chicago Multi-Family Hsg. Rev.,

Paul G. Stewart (Phases I and II),

4.90%, 3/20/44,

FHA |

|

|

500,195 |

|

| |

1,000 |

|

|

Chicago O’Hare Intl. Arpt. Rev., Customer Fac. Charge,

5.125%, 1/01/30, AGM |

|

|

1,002,534 |

|

The accompanying notes are

an integral part of these financial statements.

6

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

$

620 |

|

|

Chicago O’Hare Intl. Arpt. Rev.,

5.25%, 1/01/42 |

|

|

$

649,328 |

|

| |

250 |

|

|

Chicago Sales Tax Rev.,

5.00%, 1/01/30

Prerefunded 1/01/25 @ $100 (b) |

|

|

258,209 |

|

| |

250 |

|

|

Chicago Wtrwks. Rev.,

5.00%, 11/01/30 |

|

|

262,710 |

|

| |

665 |

|

|

Chicago Wtrwks. Rev.,

5.25%, 11/01/32, AGM |

|

|

723,524 |

|

| |

250 |

|

|

Chicago Wtrwks. Rev.,

5.00%, 11/01/36, AGM |

|

|

264,848 |

|

| |

865 |

|

|

Chicago Wtrwks. Rev.,

5.00%, 11/01/44 |

|

|

869,714 |

|

| |

170 |

|

|

Illinois St. Fin. Auth. Rev.,

Advocate Hlth. Care Network,

5.00%, 5/01/45

Prerefunded

5/01/25 @ $100 (b) |

|

|

176,505 |

|

| |

1,055 |

|

|

Illinois St. Fin. Auth. Rev.,

Advocate Hlth. Care Network,

5.00%, 5/01/45

Prerefunded

5/01/25 @ $100 (b) |

|

|

1,098,494 |

|

| |

525 |

|

|

Illinois St. Fin. Auth. Rev., Northwestern Memorial Hlthcare.,

5.00%, 9/01/42

Prerefunded

9/01/24 @ $100 (b) |

|

|

538,086 |

|

| |

1,090 |

|

|

Illinois St. Fin. Auth. Rev.,

Rush Univ. Med. Ctr.,

4.00%, 11/15/39 |

|

|

1,055,287 |

|

| |

1,000 |

|

|

Illinois St. Gen. Oblig.,

5.00%, 2/01/27 |

|

|

1,059,314 |

|

| |

2,020 |

|

|

Illinois St. Gen. Oblig.,

5.50%, 1/01/29 |

|

|

2,259,877 |

|

| |

600 |

|

|

Illinois St. Gen. Oblig.,

5.00%, 2/01/29 |

|

|

636,061 |

|

| |

1,180 |

|

|

Illinois St. Hsg. Dev. Auth. Rev.,

2.375%, 10/01/42 |

|

|

843,836 |

|

| |

750 |

|

|

Illinois St. Toll Hwy. Auth. Rev.,

5.00%, 1/01/41 |

|

|

778,416 |

|

| |

330 |

|

|

Railsplitter Tobacco Settlement Auth. Rev.,

5.00%, 6/01/27 |

|

|

350,585 |

|

| |

1,000 |

|

|

Sales Tax Securitization Corp. Rev.,

5.00%, 1/01/48 |

|

|

1,033,636 |

|

| |

1,000 |

|

|

Univ. of Illinois Aux. Facs. Sys. Rev.,

5.00%, 4/01/34 |

|

|

1,006,424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,367,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

|

|

|

|

Indiana—4% |

|

|

|

|

| |

$

240 |

|

|

Indiana St. Fin. Auth. Hosp. Rev., Indiana Univ. Hlth.,

5.00%, 12/01/28 |

|

|

$

248,174 |

|

| |

2,000 |

|

|

Indiana St. Fin. Auth. Hosp. Rev., Parkview Hlth.,

5.00%, 11/01/43 |

|

|

2,079,835 |

|

| |

1,120 |

|

|

Indianapolis Local Public Impt. Bond Bank Rev.,

Indianapolis Arpt. Auth Proj.,

5.25%,

1/01/42 |

|

|

1,206,149 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,534,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kentucky—1.1% |

|

|

|

|

| |

900 |

|

|

Kentucky Bond Dev. Corp.

Transient Room Tax Rev.,

5.00%, 9/01/43 |

|

|

951,639 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisiana—3.9% |

|

|

|

|

| |

1,250 |

|

|

Louisiana St. Stadium & Exposition Dist. Rev.,

5.00%, 7/01/30 |

|

|

1,250,730 |

|

| |

605 |

|

|

Louisiana St. Stadium & Exposition Dist. Rev.,

5.00%, 7/01/36 |

|

|

605,293 |

|

| |

1,250 |

|

|

Louisiana St. Tran. Auth. Rev.,

5.00%, 8/15/38

Prerefunded 8/15/23 @ $100 (b) |

|

|

1,256,113 |

|

| |

300 |

|

|

New Orleans Swr. Svc. Rev.,

5.00%, 6/01/44

Prerefunded 6/01/24 @ $100 (b) |

|

|

305,857 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,417,993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maine—2.4% |

|

|

|

|

| |

100 |

|

|

Maine St. Hlth. & Hgr. Edl. Facs. Auth. Rev.,

5.00%, 7/01/33,

Prerefunded 7/01/23 @ $100

(b) |

|

|

100,276 |

|

| |

905 |

|

|

Maine St. Hlth. & Hgr. Edl. Facs. Auth. Rev.,

5.00%, 7/01/33 |

|

|

905,409 |

|

| |

610 |

|

|

Portland General Arpt. Rev.,

5.00%, 7/01/31 |

|

|

611,617 |

|

| |

540 |

|

|

Portland General Arpt. Rev.,

5.00%, 7/01/32 |

|

|

541,420 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,158,722 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are

an integral part of these financial statements.

7

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

|

|

|

|

Maryland—1.5% |

|

|

|

|

| |

$

500 |

|

|

Maryland St. Cmnty. Dev. Admin., Dept. of Hsg. And Cmnty. Dev. Rev.,

1.95%, 9/01/41 |

|

|

$

332,858 |

|

| |

1,000 |

|

|

Maryland St. Hlth. & Hgr. Edl. Facs. Auth. Rev.,

Luminis Hlth.,

5.00%,

7/01/39

Prerefunded 7/01/24 @ $100 (b) |

|

|

1,020,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,353,558 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts—4.6% |

|

|

|

|

| |

1,945 |

|

|

Massachusetts St. Gen. Oblig.,

5.50%, 8/01/30, AMBAC |

|

|

2,317,436 |

|

| |

700 |

|

|

Massachusetts St. Hsg. Fin. Agy. Rev.,

2.30%, 12/01/40 |

|

|

520,629 |

|

| |

300 |

|

|

Massachusetts St. Hsg. Fin. Agy. Rev.,

3.00%, 12/01/45 |

|

|

233,441 |

|

| |

1,000 |

|

|

Massachusetts St. Port Auth. Rev.,

5.00%, 7/01/47 |

|

|

1,022,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,093,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michigan—2.4% |

|

|

|

|

| |

550 |

|

|

Michigan St. Fin. Auth. Rev.,

Beaumont Hlth. Credit Group,

5.00%, 11/01/44 |

|

|

559,167 |

|

| |

540 |

|

|

Michigan St. Bldg. Auth. Rev.,

4.00%, 10/15/36 |

|

|

550,467 |

|

| |

1,020 |

|

|

Michigan St. Hsg. Dev. Auth. Rev.,

2.80%, 12/01/45 |

|

|

759,307 |

|

| |

225 |

|

|

Royal Oak Hosp. Fin. Auth. Rev., Beaumont Hlth. Credit Group,

5.00%, 9/01/39

Prerefunded

3/01/24 @ $100 (b) |

|

|

227,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,096,879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota—0.2% |

|

|

|

|

| |

200 |

|

|

Minnesota St. Hsg. Fin. Agy.,

2.70%, 7/01/44 |

|

|

160,560 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mississippi—0.7% |

|

|

|

|

| |

600 |

|

|

Mississippi St. Gen. Oblig.,

4.00%, 10/01/39 |

|

|

606,064 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska—2.4% |

|

|

|

|

| |

1,925 |

|

|

Omaha Gen. Oblig.,

5.25%, 4/01/27 |

|

|

2,116,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

|

|

|

|

New Jersey—2.6% |

|

|

|

|

| |

$

400 |

|

|

Camden Cnty. Impvt. Auth. Hlthcare. Redev. Rev., Cooper Hlth. Sys.,

5.00%, 2/15/33 |

|

|

$

403,314 |

|

| |

295 |

|

|

New Jersey St. COVID-19 Gen. Oblig. Emergency

Bonds,

4.00%, 6/01/31 |

|

|

322,066 |

|

| |

1,125 |

|

|

New Jersey St. Tpk. Auth. Rev.,

5.00%, 1/01/34 |

|

|

1,207,690 |

|

| |

305 |

|

|

New Jersey St. Tpk. Auth. Rev.,

4.00%, 1/01/35 |

|

|

314,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,247,262 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York—5.4% |

|

|

|

|

| |

530 |

|

|

Long Island Pwr. Auth. Elec. Sys. Gen. Rev.,

5.00%, 9/01/42 |

|

|

569,120 |

|

| |

510 |

|

|

New York City Mun. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev.,

Adjustable Rate Bond,

3.75%,

06/15/48 |

|

|

510,000 |

|

| |

2,035 |

|

|

New York St. Dorm. Auth.,

Personal Inc. Tax Rev.,

5.00%, 03/15/31 |

|

|

2,113,728 |

|

| |

900 |

|

|

Port Auth. of New York and New Jersey Rev.,

5.00%, 6/01/33 |

|

|

908,969 |

|

| |

500 |

|

|

Triborough Bridge & Tunnel Auth. Rev.,

5.00%, 11/15/30

Refunded 5/15/23 @ $100

(b) |

|

|

500,308 |

|

| |

195 |

|

|

TSASC Inc. Tobacco Settlement Rev.,

5.00%, 6/01/34 |

|

|

203,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,805,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North Carolina—0.2% |

|

|

|

|

| |

185 |

|

|

North Carolina St. Hsg. Fin. Agy. Rev.,

2.85%, 1/01/43 |

|

|

147,711 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio—1.1% |

|

|

|

|

| |

570 |

|

|

Northeast Ohio Regl. Swr. Dist. Rev.,

4.00%, 11/15/43 |

|

|

571,549 |

|

| |

495 |

|

|

Ohio St. Hsg. Fin. Agy. Rev.,

2.45%, 9/01/45 |

|

|

381,093 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

952,642 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are

an integral part of these financial statements.

8

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

|

|

|

|

Oregon—4.4% |

|

|

|

|

| |

$

1,500 |

|

|

Oregon St. Dept. of Admin. Svcs., Lottery Rev.,

5.00%, 5/01/41 |

|

|

$

1,707,204 |

|

| |

500 |

|

|

Oregon St. Gen. Oblig.,

5.00%, 5/01/41 |

|

|

520,825 |

|

| |

570 |

|

|

Port of Portland Intl. Arpt. Rev.,

5.00%, 7/01/32 |

|

|

577,164 |

|

| |

1,000 |

|

|

Washington Cnty. Sch. Dist. 48J (Beaverton), Gen. Oblig.

5.00%, 6/15/36 |

|

|

1,066,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,871,896 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania—2.3% |

|

|

|

|

| |

2,000 |

|

|

Delaware River Port Auth. Rev.,

5.00%, 1/01/34

Prerefunded 1/01/24 @ $100 (b) |

|

|

2,024,622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rhode Island—1.2% |

|

|

|

|

| |

1,070 |

|

|

Rhode Island St. Clean Wtr. Fin. Agy., Wtr. Poll. Control Rev.,

5.00%, 10/01/32

Prerefunded

10/01/24 @ $100 (b) |

|

|

1,097,951 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Carolina—0.3% |

|

|

|

|

| |

290 |

|

|

SCAGO Edl. Facs. Corp. Rev.,

Pickens Cnty. Sch. Dist.,

5.00%, 12/01/24 |

|

|

297,725 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tennessee—2.8% |

|

|

|

|

| |

250 |

|

|

Chattanooga-Hamilton Cnty. Hosp. Auth. Rev.,

Erlanger Hlth. Sys.,

5.00%, 10/01/34 |

|

|

254,506 |

|

| |

110 |

|

|

Tennessee St. Hsg. Dev. Agy.,

3.625%, 7/01/32 |

|

|

108,928 |

|

| |

2,000 |

|

|

Tennessee St. Sch. Bond Auth. Rev.,

5.00%, 11/01/42 |

|

|

2,135,702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,499,136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas—13% |

|

|

|

|

| |

670 |

|

|

Dallas Area Rapid Transit Rev.,

5.00%, 12/01/41

Prerefunded 12/01/25 @ $100 (b) |

|

|

705,322 |

|

| |

1,250 |

|

|

Houston Arpt. Sys. Rev.,

5.00%, 7/01/39 |

|

|

1,339,016 |

|

| |

1,410 |

|

|

Houston Util. Sys. Rev.,

5.00%, 11/15/32

Prerefunded 11/15/23 @ $100 (b) |

|

|

1,423,476 |

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

$

1,000 |

|

|

Lewisville Indep. Sch. Dist. Gen. Oblig.,

3.00%, 8/15/39, PSF |

|

|

$

864,450 |

|

| |

1,505 |

|

|

North Texas Twy. Auth. Rev., Convertible CAB,

0.00%, 9/01/43

Prerefunded 9/01/31 @ $100

(b) |

|

|

1,889,759 |

|

| |

1,135 |

|

|

North Texas Twy. Auth. Rev.,

4.00%, 1/01/43 |

|

|

1,110,361 |

|

| |

700 |

|

|

San Antonio Indep. Sch. Dist. Sch. Bldg. Gen. Oblig.,

5.00%, 8/15/38, PSF |

|

|

735,484 |

|

| |

1,000 |

|

|

Texas St. Wtr. Development Brd. Rev., St. Wtr. Implementation Fund,

4.00%, 10/15/47 |

|

|

984,108 |

|

| |

2,400 |

|

|

Univ. of Texas Permanent. Univ. Fnd. Sys. Rev.,

Adjustable Rate Bond,

3.80%, 7/01/38 |

|

|

2,400,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,451,976 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vermont—0.6% |

|

|

|

|

| |

500 |

|

|

Vermont St. Edl. and Hlth. Bldg. Fin. Agy. Rev.,

Univ. of Vermont Med. Center,

5.00%,

12/01/35 |

|

|

522,689 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin—1.9% |

|

|

|

|

| |

1,400 |

|

|

Wisconsin St. Pub. Fin. Auth. Hosp. Rev.,

Renown Reg. Med. Ctr.,

5.00%, 6/01/40 |

|

|

1,425,520 |

|

| |

250 |

|

|

Wisconsin St. Pub. Fin. Auth.,

Solid Waste Disp. Rev.,

2.875%, 5/01/27 |

|

|

237,573 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,663,093 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Long-Term Investments

(Cost $126,739,102) |

|

|

125,008,776 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS—141.6% |

|

|

|

|

|

(Cost $126,739,102) |

|

|

125,008,776 |

|

|

|

|

|

Remarketable Variable Rate MuniFund Term Preferred Shares at liquidation

value—(45.3)% |

|

|

(40,000,000 |

) |

|

|

|

|

Other assets less other liabilities—3.7% |

|

|

3,261,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS APPLICABLE TO COMMON STOCK—100.0% |

|

|

$88,270,634 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are

an integral part of these financial statements.

9

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2023

(Unaudited)

| (a) |

The following abbreviations are used in the portfolio descriptions: |

AGM—Assured Guaranty Municipal Corp.*

AMBAC—Ambac Assurance Corporation*

BAM—Build America Mutual Assurance Company*

CAB—Capital Appreciation Bond

COP—Certificate of Participation

FHA—Federal Housing Authority*

NRE—National Public Finance Guarantee Corporation*

PSF—Texas Permanent School Fund*

| * |

Indicates an obligation of credit support, in whole or in part. |

| (b) |

Prerefunded and refunded issues are secured by escrowed cash, U.S. government obligations, or other securities.

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets

applicable to common stock of the Fund.

The Fund’s investments are carried at fair value which is defined as the price that the Fund

might reasonably expect to receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. The three-tier hierarchy of inputs established to classify fair value

measurements for disclosure purposes is summarized in the three broad levels listed below.

| Level 1— |

quoted prices in active markets for identical securities |

| Level 2— |

other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment

speeds, credit risks, etc.) |

| Level 3— |

significant unobservable inputs (including the Fund’s own assumptions in determining fair value of

investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk

associated with investing in these securities. The following is a summary of the inputs used to value each of the Fund’s investments at April 30, 2023:

|

|

|

|

|

| |

|

Level 2 |

|

| Municipal bonds |

|

|

$125,008,776 |

|

|

|

|

|

|

There were no Level 1 or Level 3 priced securities held and there were no transfers into or out of

Level 3.

Summary of Ratings

as a Percentage of Long-Term Investments

|

|

|

|

|

| Rating** |

|

% |

|

| AAA |

|

|

7.6 |

|

| AA |

|

|

49.1 |

|

| A |

|

|

37.2 |

|

| BBB |

|

|

3.3 |

|

| BB |

|

|

0.0 |

|

| B |

|

|

0.0 |

|

| NR |

|

|

2.8 |

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

| ** |

Individual ratings are grouped based on the lower rating of Standard & Poor’s Financial Services

LLC (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”) and are expressed using the S&P ratings scale. If a particular security is rated by either S&P or Moody’s, but not both, then the single rating

is used. If a particular security is not rated by either S&P or Moody’s, then a rating from Fitch Ratings, Inc. is used, if available. The Fund does not evaluate these ratings but simply assigns them to the appropriate credit quality

category as determined by the ratings agencies, as applicable. Securities that have not been rated by S&P, Moody’s or Fitch totaled 2.8% of the portfolio at the end of the reporting period. |

Portfolio Composition

as a

Percentage of Long-Term Investments

|

|

|

|

|

| |

|

% |

|

| Pre-Refunded |

|

|

16.2 |

|

| General Obligation |

|

|

15.5 |

|

| Education |

|

|

11.6 |

|

| Healthcare |

|

|

10.5 |

|

| Special Tax |

|

|

8.3 |

|

| Leasing |

|

|

7.4 |

|

| Airports |

|

|

6.9 |

|

| Transportation |

|

|

6.0 |

|

| Tax Allocation |

|

|

5.0 |

|

| Water & Sewer |

|

|

4.5 |

|

| Other |

|

|

8.1 |

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

The accompanying notes are

an integral part of these financial statements.

10

DTF TAX-FREE INCOME 2028 TERM

FUND INC.

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2023

(Unaudited)

|

|

|

|

|

| ASSETS: |

|

|

|

|

|

|

| Investments, at value (cost $126,739,102) |

|

|

$125,008,776 |

|

|

|

| Cash |

|

|

3,255,038 |

|

|

|

| Interest receivable |

|

|

1,704,192 |

|

|

|

| Prepaid expenses |

|

|

46,908 |

|

|

|

|

|

|

|

|

| Total assets |

|

|

130,014,914 |

|

|

|

|

|

|

|

|

| LIABILITIES: |

|

|

|

|

|

|

| Payable for securities purchased |

|

|

1,708,275 |

|

|

|

| Investment advisory fee (Note 3) |

|

|

53,045 |

|

|

|

| Administrative fee (Note 3) |

|

|

10,250 |

|

|

|

| Accrued expenses |

|

|

42,560 |

|

|

|

| Remarketable Variable Rate MuniFund Term Preferred Shares (400 shares issued and outstanding,

liquidation preference $100,000 per share, net of deferred offering costs of $69,850) (Note 6) |

|

|

39,930,150 |

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

41,744,280 |

|

|

|

|

|

|

|

|

| NET ASSETS APPLICABLE TO COMMON STOCK |

|

|

$88,270,634 |

|

|

|

|

|

|

|

|

| CAPITAL: |

|

|

|

|

|

|

| Common stock ($0.01 par value per share; 599,996,750 shares authorized, 7,029,567 issued and

outstanding) |

|

|

$70,296 |

|

|

|

| Additional paid-in capital |

|

|

96,299,508 |

|

|

|

| Total distributable earnings (accumulated losses) |

|

|

(8,099,170 |

) |

|

|

|

|

|

|

|

| Net assets applicable to common stock |

|

|

$88,270,634 |

|

|

|

|

|

|

|

|

| NET ASSET VALUE PER SHARE OF COMMON STOCK |

|

|

$12.56 |

|

|

|

|

|

|

The accompanying notes are an integral

part of these financial statements.

11

DTF TAX-FREE INCOME 2028 TERM

FUND INC.

STATEMENT OF OPERATIONS

For the six months ended April 30, 2023

(Unaudited)

|

|

|

|

|

| INVESTMENT INCOME: |

|

|

|

|

|

|

| Interest |

|

|

$2,226,889 |

|

|

|

|

|

|

|

|

| EXPENSES: |

|

|

|

|

|

|

| Interest expense and amortization of deferred offering costs on preferred shares (Note 6) |

|

|

910,213 |

|

|

|

| Investment advisory fees (Note 3) |

|

|

324,738 |

|

|

|

| Administrative fees (Note 3) |

|

|

61,095 |

|

|

|

| Professional fees |

|

|

51,975 |

|

|

|

| Reports to shareholders |

|

|

44,450 |

|

|

|

| Custodian fees |

|

|

32,450 |

|

|

|

| Transfer agent fees |

|

|

23,425 |

|

|

|

| Directors’ fees |

|

|

7,504 |

|

|

|

| Other expenses |

|

|

40,404 |

|

|

|

|

|

|

|

|

| Total expenses |

|

|

1,496,254 |

|

|

|

|

|

|

|

|

| Net investment income |

|

|

730,635 |

|

|

|

|

|

|

|

|

| REALIZED AND UNREALIZED GAIN (LOSS): |

|

|

|

|

|

|

| Net realized loss on investments |

|

|

(636,203 |

) |

|

|

| Net change in unrealized appreciation/depreciation on investments |

|

|

5,688,413 |

|

|

|

|

|

|

|

|

| Net realized and unrealized gain (loss) on investments |

|

|

5,052,210 |

|

|

|

|

|

|

|

|

| NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCK RESULTING FROM

OPERATIONS |

|

|

$5,782,845 |

|

|

|

|

|

|

The accompanying notes are an integral

part of these financial statements.

12

DTF TAX-FREE INCOME 2028 TERM

FUND INC.

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

|

|

|

|

|

|

| |

|

For the six

months ended

April 30, 2023

(Unaudited) |

|

|

For the

year ended

October 31, 2022 |

|

|

|

|

| OPERATIONS: |

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

$730,635 |

|

|

|

$2,340,207 |

|

|

|

|

| Net realized loss |

|

|

(636,203 |

) |

|

|

(5,507,254 |

) |

|

|

|

| Net change in unrealized appreciation/depreciation |

|

|

5,688,413 |

|

|

|

(19,558,805 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in net assets applicable to common stock resulting from operations |

|

|

5,782,845 |

|

|

|

(22,725,852 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| DISTRIBUTIONS TO COMMON STOCKHOLDERS: |

|

|

|

|

|

|

|

|

|

|

|

| Net investment income and net realized gains |

|

|

(1,370,766 |

) |

|

|

(3,898,154 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Decrease in net assets from distributions to common stockholders |

|

|

(1,370,766 |

) |

|

|

(3,898,154 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total increase (decrease) in net assets |

|

|

4,412,079 |

|

|

|

(26,624,006 |

) |

|

|

|

| TOTAL NET ASSETS APPLICABLE TO COMMON STOCK: |

|

|

|

|

|

|

|

|

|

|

|

| Beginning of period |

|

|

83,858,555 |

|

|

|

110,482,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| End of period |

|

|

$88,270,634 |

|

|

|

$83,858,555 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral

part of these financial statements.

13

DTF TAX-FREE INCOME 2028 TERM

FUND INC.

STATEMENT OF CASH FLOWS

For the six months ended April 30, 2023

(Unaudited)

|

|

|

|

|

| INCREASE (DECREASE) IN CASH |

|

|

|

|

|

|

| Cash flows provided by (used in) operating activities: |

|

|

|

|

|

|

| Net increase in net assets resulting from operations |

|

|

$5,782,845 |

|

|

|

|

|

|

|

|

| Adjustments to reconcile net increase in net assets resulting from operations to cash provided

by operating activities: |

|

|

|

|

|

|

| Purchase of investment securities |

|

|

(4,786,950 |

) |

|

|

| Proceeds from sales and maturities of investment securities |

|

|

8,475,607 |

|

|

|

| Net amortization and accretion of premiums and discounts on debt securities |

|

|

607,838 |

|

|

|

| Net realized loss on investments |

|

|

636,203 |

|

|

|

| Net change in unrealized appreciation/depreciation on investments |

|

|

(5,688,413 |

) |

|

|

| Amortization of deferred offering costs |

|

|

67,973 |

|

|

|

| Decrease in interest receivable |

|

|

84,540 |

|

|

|

| Decrease in prepaid and accrued expenses—net |

|

|

(57,165 |

) |

|

|

|

|

|

|

|

| Cash provided by operating activities |

|

|

5,122,478 |

|

|

|

|

|

|

|

|

| Cash flows provided by (used in) financing activities: |

|

|

|

|

|

|

| Payment for partial redemption of RVMTP Shares |

|

|

(25,000,000 |

) |

|

|

| Distributions paid to common stockholders |

|

|

(1,370,766 |

) |

|

|

|

|

|

|

|

| Cash used in financing activities |

|

|

(26,370,766 |

) |

|

|

|

|

|

|

|

| Net decrease in cash |

|

|

(21,248,288 |

) |

|

|

|

|

|

|

|

| Cash at beginning of period |

|

|

24,503,326 |

|

|

|

|

|

|

|

|

| Cash at end of period |

|

|

$3,255,038 |

|

|

|

|

|

|

|

|

| Supplemental cash flow information: |

|

|

|

|

| Cash paid during the period for interest expense |

|

|

$842,240 |

|

|

|

|

|

|

The accompanying notes are an integral

part of these financial statements.

14

DTF TAX-FREE INCOME 2028 TERM

FUND INC.

FINANCIAL HIGHLIGHTS—SELECTED PER SHARE DATA AND RATIOS

The table below provides information about income and capital changes for a share of common stock outstanding throughout the periods indicated

(excluding supplemental data provided below):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the six

months ended

April 30, 2023

(Unaudited) |

|

|

For the year ended October 31, |

|

| PER SHARE DATA: |

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

|

|

|

|

|

|

|

| Net asset value, beginning of period |

|

|

$11.93 |

|

|

|

$15.72 |

|

|

|

$15.79 |

|

|

|

$15.75 |

|

|

|

$14.62 |

|

|

|

$15.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

0.10 |

|

|

|

0.33 |

|

|

|

0.43 |

|

|

|

0.44 |

|

|

|

0.39 |

|

|

|

0.47 |

|

|

|

|

|

|

|

|

| Net realized and unrealized gain (loss) |

|

|

0.72 |

|

|

|

(3.57 |

) |

|

|

(0.01 |

) |

|

|

0.08 |

|

|

|

1.29 |

|

|

|

(0.92 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) from investment operations applicable to common stock |

|

|

0.82 |

|

|

|

(3.24 |

) |

|

|

0.42 |

|

|

|

0.52 |

|

|

|

1.68 |

|

|

|

(0.45 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions on common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

(0.19 |

) |

|

|

(0.39 |

) |

|

|

(0.49 |

) |

|

|

(0.48 |

) |

|

|

(0.43 |

) |

|

|

(0.59 |

) |

|

|

|

|

|

|

|

| Net realized gains |

|

|

— |

|

|

|

(0.16 |

) |

|

|

— |

(1) |

|

|

— |

(1) |

|

|

(0.12 |

) |

|

|

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total distributions |

|

|

(0.19 |

) |

|

|

(0.55 |

) |

|

|

(0.49 |

) |

|

|

(0.48 |

) |

|

|

(0.55 |

) |

|

|

(0.62 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value, end of period |

|

|

$12.56 |

|

|

|

$11.93 |

|

|

|

$15.72 |

|

|

|

$15.79 |

|

|

|

$15.75 |

|

|

|

$14.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share market value, end of period |

|

|

$11.00 |

|

|

|

$10.79 |

|

|

|

$14.26 |

|

|

|

$14.21 |

|

|

|

$14.18 |

|

|

|

$12.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|