Current Report Filing (8-k)

October 05 2021 - 4:29PM

Edgar (US Regulatory)

DOMINION ENERGY, INC false 0000715957 0000715957 2021-10-05 2021-10-05 0000715957 us-gaap:CommonStockMember 2021-10-05 2021-10-05 0000715957 d:TwoThousandAndNineteenSeriesACorporateUnitsMember 2021-10-05 2021-10-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) October 5, 2021

Dominion Energy, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Virginia

|

|

001-08489

|

|

54-1229715

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

120 Tredegar Street

Richmond, Virginia

|

|

23219

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code (804) 819-2000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, no par value

|

|

D

|

|

New York Stock Exchange

|

|

2019 Series A Corporate Units

|

|

DCUE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On October 5, 2021, Dominion Energy, Inc. (the Company) announced that its wholly owned intermediate holding company, Dominion Energy Questar Corporation (Dominion Energy Questar), entered into a Purchase and Sale Agreement (the Q-Pipe Purchase Agreement) with Southwest Gas Holdings, Inc. (Southwest Gas) providing for Dominion Energy Questar to sell Dominion Energy Questar Pipeline, LLC and related entities to Southwest Gas (the Q-Pipe Transaction) for a purchase price of approximately $1.545 billion (subject to certain adjustments) and the assumption of approximately $430 million of existing long-term debt. The Company expects the Q-Pipe Transaction will close on or prior to December 31, 2021.

The completion of the Q-Pipe Transaction is subject to customary closing conditions, including customary conditions regarding the accuracy of the representations and warranties and compliance by the parties in all material respects with their respective obligations under the Q-Pipe Purchase Agreement. The Q-Pipe Transaction is not subject to a financing condition.

Pursuant to the Q-Pipe Purchase Agreement, employees transferred as part of the Q-Pipe Transaction will have certain employment protections for generally 24 months following the closing date.

The Q-Pipe Purchase Agreement contains customary representations, warranties and covenants related to the conduct of the business and the Q-Pipe Transaction. Dominion Energy Questar and Southwest Gas each have agreed to indemnify the other party for losses arising from certain breaches of representations, warranties and covenants contained in the Q-Pipe Purchase Agreement and other liabilities, subject to certain limitations.

FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements, with respect to certain future plans concerning the Q-Pipe Transaction. Factors that could cause actual results to differ include, but are not limited to: the risk that Dominion Energy or Southwest Gas may be unable to obtain necessary regulatory approvals for the Q-Pipe Transaction or required regulatory approvals may delay the Q-Pipe Transaction and the risk that conditions to the closing of the Q-Pipe Transaction may not be satisfied. Other risk factors are detailed from time to time in Dominion Energy’s quarterly reports on Form 10-Q and most recent annual report on Form 10-K filed with the Securities and Exchange Commission.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibits

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DOMINION ENERGY, INC.

|

|

|

|

Registrant

|

|

|

|

/s/ James R. Chapman

|

|

Name:

|

|

James R. Chapman

|

|

Title:

|

|

Executive Vice President, Chief Financial Officer and Treasurer

|

Date: October 5, 2021

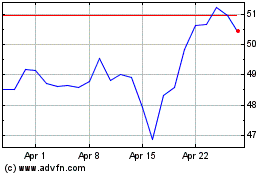

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

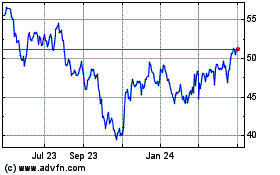

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024