CRH Lifts Earnings Outlook, Dividend After Sales Grow

November 21 2023 - 2:47AM

Dow Jones News

By Joe Hoppe

CRH lifted its outlook after delivering earnings and sales

growth in the third quarter of the year.

The building-materials supplier said Tuesday that it now expects

to deliver earnings before interest, taxes, depreciation and

amortization of $6.3 billion for 2023, up from $5.6 billion a year

before and prior guidance at the half-year point of $6.2

billion.

The company also said it will increase its dividend by 5% for

the full year to $1.33, and expects pretax profit to be well ahead

of 2022's $3.5 billion. CRH expects strong underlying demand in its

key end-use markets in 2024, underpinned by significant

infrastructure investment and increased re-industrialization

activity, notwithstanding some macroeconomic uncertainty.

For the third quarter, the company delivered an 8% increase in

sales to $26.3 billion, and Ebitda improved by 14% to $4.8 billion.

CRH said this reflects positive momentum and strong commercial

progress across its key markets.

"Our integrated solutions strategy continues to deliver superior

growth, while our strong cash generation and disciplined approach

to capital allocation enables us to create additional value for our

shareholders," Chief Executive Albert Manifold said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

November 21, 2023 02:32 ET (07:32 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

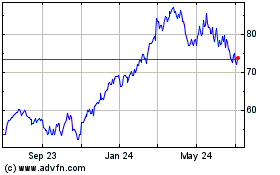

CRH (NYSE:CRH)

Historical Stock Chart

From Apr 2024 to May 2024

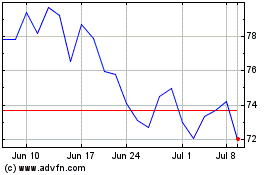

CRH (NYSE:CRH)

Historical Stock Chart

From May 2023 to May 2024