UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPANIA CERVECERIAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23

rd

floor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No

X

TENDER OFFER INITIATION NOTICE

TENDER OFFER OF SHARES

OF

VIÑA SAN PEDRO TARAPACÁ S.A.

A

SOCIEDAD ANÓNIMA ABIERTA

(A PUBLICLY-HELD CORPORATION)

REGISTERED WITH THE SVS CHILEAN SECURITIES REGISTER N° 393

BY

CCU INVERSIONES S.A.

CCU INVERSIONES S.A.

(“

CCU Inversiones

”) OFFERS TO PURCHASE 13,103,203,129 SHARES OF

VIÑA SAN PEDRO TARAPACÁ S.A.

("

VSPT

") EQUIVALENT TO 100% OF THE SHARES ISSUED BY SUCH COMPANY AND NOT OWNED BY CCU INVERSIONES FOR THE PRICE OF Ch$7.8 (SEVEN POINT EIGHT PESOS) PER SHARE THROUGH A TENDER OFFER IN THE TERMS AND CONDITIONS SET FORTH HEREIN (THE "

TENDER OFFER INITIATION NOTICE

") AND IN THE CORRESPONDING PROSPECTUS (the "

Prospectus

") MADE AVAILABLE TO THE INTERESTED PARTIES AND OTHER PERSONS AS SET FORTH IN THE

LEY DE MERCADO DE VALORES

N° 18.045

(CHILEAN SECURITIES MARKET LAW) AND THE

SUPERINTENDENCIA DE VALORES Y SEGUROS

(CHILEAN SUPERINTENDENCE OF SECURITIES AND INSURANCE) (the "

Offer

").

The lead manager of the Offer is Credicorp Capital S.A. Corredores de Bolsa (the “

Lead Manager

”).

-

OFFEROR's IDENTIFICATION AND EQUITY INTEREST IN THE ISSUER

The offeror is

CCU INVERSIONES S.A.,

Tax ID N° 76.593.550-4, a

sociedad anónima

(stock corporation) with principal place of business at Avenida Presidente Eduardo Frei Montalva No. 1,500, Comuna de Renca, in the City of Santiago.

The controllig company of CCU Inversiones is

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

, Tax ID N° 90.413.000-1, a

sociedad anónima

(stock corporation) which directly and indirectly owns (through Millahue S.A. Tax ID N° 91.022.000-4) shares in CCU Inversiones, equivalent to 99.97% of the shares into which the capital of CCU Inversiones is divided.

In its turn,

COMPAÑÍA CERVERCERÍAS UNIDAS S.A

. is controlled by Inversiones y Rentas S.A., (Tax ID N° 96.427.000-7), which directly and indirectly owns, through its subsidiary Inversiones IRSA Limitada (Tax ID N° 76.313.970-0), 60% of its capital stock. The only shareholders of Inversiones y Rentas S.A. are Quiñenco S.A., (Tax ID N°

91.705.000-7), and Heineken Chile Limitada, (Tax ID N° 77.996.850-2), each of which owns 50% of the capital stock therein.

81.4% of the shares issued and paid-up in Quiñenco S.A. are owned by Andsberg Inversiones Ltda., Ruana Copper A.G. Agencia Chile, Inversiones Orengo S.A., Inversiones Consolidadas Ltda., Inversiones Salta SpA, Inversiones Alaska Ltda., Inmobiliaria e Inversiones Río Claro S.A. and Inversiones Río Claro Ltda. The Luksburg Foundation indirectly holds 100% of the equity rights in Andsberg Inversiones Ltda., 100% of the equity rights in Ruana Copper A.G. Agencia Chile and 99.76% of the shares in Inversiones Orengo S.A. Andrónico Mariano Luksic Craig (TAX ID N° 6.062.786-K) and his family hold 100% of the shares in Inversiones Consolidadas Ltda. and Inversiones Alaska Ltda. Mr. Andrónico Luksic Craig's family is the owner of 100% of the shares in Inversiones Salta SpA Inmobiliaria e Inversiones Río Claro S.A. and Inversiones Río Claro Ltda. are indirectly controlled by the Emian Foundation, in which the heirs of Mr. Guillermo Antonio Luksic Craig (Tax ID N° 6.578.597-8) hold equity interests.

Heineken Chile Limitada is a Chilean limited liability company currently controlled by Heineken Americas B.V., a Dutch limited liability company, a subsidiary of Heineken International B.V., which is, in turn, a subsidiary of Heineken N.V. The majority shareholder of Heineken N.V. is the Dutch company Heineken Holding N.V., a subsidiary of L'Arche Green N.V. which is a subsidiary of L'Arche Holdings S.A., the latter being controlled by the Heineken family. The owner of 99% of the shares in L'Arche Holdings S.A. is Mrs. C.L. de Carvalho-Heineken.

Currently, CCU Inversiones directly holds 26,866,493,503 shares in VSPT which are equivalent to 67.22% of its capital stock.

-

PURPOSE OF THE OFFER AND AGREEMENTS WITH THE SHAREHOLDERS REGARDING THE OFFER

.

The purpose of the Offer is to comply with the provisions set forth in article 199 bis of the Chilean Securities Market Law (“LMV”), which provides that if, as a result of any acquisition, a person or group of persons with a joint performance agreement, becomes the owner of two-thirds or more of the issued shares with voting rights of a

sociedad anónima abierta

(publicly-held corporation), it shall make a tender offer to purchase the remaining shares within 30 days from the date of such acquisition.

There are no agreements with other shareholders of VSPT concerning the Tender Offer.

-

CHARACTERISTICS OF THE OFFER

(i) Transaction Amount:

Should all the shares not owned by CCU Inversiones be finally acquired, the price to be paid will be Ch$102,204,984,406 (one hundred two billions two hundred four millions nine hundred eighty four thousand four hundred and six pesos) for the purchase of

13,103,203,129 shares in

VIÑA SAN PEDRO TARAPACÁ S.A

. at Ch$7.8 (seven point eight pesos) per share.

(ii)

Shares underlying the Offer

:

The Offer is made for 13,103,203,129 shares, equivalent to 32.78% of the total shares in VSPT, equivalent to 100% of the shares issued by VSPT which are not owned by CCU Inversiones.

The Offer is made on the local market because VSPT shares are not traded on foreign markets.

(iii)

Prorating mechanism:

Given that the Offer contemplates the acquisition of all VSPT shares, no prorating mechanisms are contemplated.

(iv)

Tender Offer´s

Effective Term

The Offer is valid for 30 (thirty) calendar days, beginning on the opening of the stock market on which the shares are registered on December 28, 2017 and expiring on closing of the stock market on which the shares are registered on January 26, 2018 (the "

Tender Offer Period"

). In accordance with the provisions set forth in the

Circular

N° 134/1982 of the

Superintendencia de Valores y Seguros

, the opening time will be 9:00 am and the closing time, 5:30 pm (the "

Stock Market Opening and Closing

Time

").

Shareholders may only submit their acceptances to the Offer, and withdraw when applicable, during the term of the Tender Offer Period.

As to date, CCU Inversiones does not contemplate extending the Tender Offer´s term. Notwithstanding the foregoing, if CCU Inversiones decides to extend the Tender Offer Period, as provided for in article 205 of the LMV, it must give notice thereof before 5:30 pm of January 26, 2018, (the “

Expiration Date

”) which will be simultaneously published in the newspapers

Diario Electrónico El Mostrado

r (www.elmostrador.cl) and

La Tercera Online

(www.latercera.com).

(v)

Offer Outcome

:

The Offer´s outcome (the “

Outcome Notice

”) shall be published as established in section 212 of the LMV on the third calendar day as of the Expiration Date or from the extension expiration date, if any, in the same newspapers in which the Tender Offer Initiation Notice was published by CCU Inversiones, that is, in

Diario Electrónico El Mostrador

(www.elmostrador.cl) and

La Tercera Online

(www.latercera.com).

(vi)

Recipients of the Offer

:

The Offer is addressed to all VSPT shareholders, who hold shares during the effective term of the Offer.

(vii)

Transaction system implementation

:

The transaction will be consummated over the counter through a computer system developed, maintained and operated by the

Bolsa de Comercio de Santiago

,

Bolsa de Valores

(Santiago Stock Exchange)

available at the trading terminals from Monday to Friday, excluding holidays, until the Expiration Date, from the opening until the closing of the Chilean stock exchange market on which the underlying shares of the Offer are registered.

-

PRICE AND PAYMENT TERMS

(i)

Price per share

:

The price amounts to Ch$7.8 per share of VSPT, to be paid in Chilean pesos.

It is hereby placed on record that as it is a mandatory tender offer of shares pursuant to article 199 bis of the LMV, and considering that the shares of VSPT are traded on the stock exchange, the minimum price payable per share is Ch$7.1 (calculated in accordance with the provisions set forth in article 132 of the

Reglamento de la Ley de Sociedades Anónimas

) (Regulation of the Chilean Corporation Law). Thus, the offered price of Ch$7.8 per share exceeds the mandatory minimum price set forth in the LMV.

(ii)

Control premium

:

Given that, as of the date of the Prospectus and of this Tender Offer Initiation Notice, CCU Inversiones already directly controls VSPT, no control premium is to be determined in relation to the market price.

(iii)

Terms, Conditions and Place of Payment

:

The price of the Offer will be paid on the second bank business day following the publication date of the Outcome Notice as follows: by electronic fund transfer to the account to be specified by the shareholder when submitting its Offer acceptance to the Lead Manager. In the event that the shareholder fails to indicate a checking account as stated above, the payment will be made through a non-endorsable

vale vista

(bank check) or a registered check issued in the name of the respective shareholder, which will remain at his disposal and may be withdrawn from the offices of the Lead Manager located at Avenida Apoquindo N°3721, 9

th

Floor, Comuna de Las Condes, Santiago, from Monday to Friday from 9:00 am to 5:00 pm, excluding holidays. Regarding shareholders who sell their shares under sales orders given to stock brokers other than the Lead Manager, payment of the corresponding price will be made directly to the respective stock broker by electronic transfer.

The price shall not accrue any interest.

CCU Inversiones will not pay any commissions to any securities dealers other than the Lead Manager for sales orders received from the shareholders.

In any case, neither CCU Inversiones nor the Lead Manager will be liable for any costs, expenses and taxes that affect or could affect the relevant purchase or transfer of shares, which will always be borne by each selling shareholder.

-

OFFER´S ACCEPTANCE PROCEDURE

The shares underlying the Offer should be registered at the corresponding Shareholders´ Register in the name of the selling shareholder, or its securities dealer, fully paid and free of any liens, encumbrances, prohibitions, attachments, litigations, preliminary injunctions, suspensive conditions and condition subsequent, preemptive rights or rights of first refusal of third parties, third parties’ personal rights (

rights in personam

) or security interests (

rights in rem

) enforceable against CCU Inversiones and, in general, any other circumstances that may prevent or restrict the free assignment or transfer thereof (the “

Liens

”).

(i)

Requirements for the acceptance of the Offer and necessary documents

:

Shareholders who wish to accept the Offer shall do so only during the effective term thereof by means of a written order to sell their shares subject to the terms and conditions of the Offer.

The shareholder who is to deliver his written sales order evidencing his acceptance to the Offer must simultaneously execute a transfer agreement for all the shares that he wants to sell, which must comply with all current regulations, in favor of the Lead Manager.

Moreover, the shareholders should deliver the following documents to the Lead Manager:

(a) The original share certificate representing the shares intended to be sold and held by such shareholder, or a certificate to be issued to such effect by DCV Registros S.A. (with principal place of buisness at Huérfanos N° 770, 22

nd

Floor, Santiago, Phone N° +56223939003, as entity in charge of the Shareholders´ Register of VSPT, evidencing that the stock certificate/s is/are deposited at DCV Registros S.A.;

(b) A certificate to be issued by DCV Registros S.A. as entity in charge of the Shareholders´ Register of VSPT, not later than 10 (ten) days prior to the date of delivery of the Offer to the Lead Manager or the securities dealer, evidencing that there is no proof in the corporate records that the shares are subject to any Liens, and that they may be registered in the name of the Lead Manager or the relevant securities dealer;

(c) A copy of both sides of the identity card of the individual shareholder, his/her representative, if appropriate, or of the representative of a shareholder if it is a legal entity,

the original of which is to be exhibited upon the signing of the acceptance. The fact that such copy is a faithful copy of the original must be certified by a notary public or verified by the Lead Manager or the respective securities dealer;

(d) The original or an authenticated copy of the power of attorney in force granted to the shareholders' representatives or attorneys-in-fact at least 30 (thirty) days prior to the filing thereof, which shall contain sufficient powers to act as such, duly authorised by a notary public; and

(e) An authenticated copy of all deeds of the corporate shareholders as well as those whose shares are registered in the name of communities or hereditary succession, including the articles of incorporation or bylaws, any amendments, good standing certificates thereof and other relevant resolutions as well as an authorized copy of all the documents evidencing their legal capacities to act as such with sufficient powers to represent them issued not earlier than 30 (thirty) days.

In the case of shareholders residing outside Santiago, please call +56224501635.

Moreover, the acceptor must execute the contract for the provision of services, provided that he has not signed it with the Lead Manager or the stock broker to whom he resorts, as well as any other documents that are required by them in accordance with applicable regulations.

The documents that are required from the shareholders to accept the Offer will be sent to DCV Registros S.A. as entity in charge of the Shareholders´ Register of VSPT, in order to register the underlying shares subject to acceptance of the Offer in the name of the Lead Manager or other securities dealers.

Should a transfer of shares be objected to for any legal reason by DCV Registros S.A., the entity in charge of handling the shareholders´ register of VSPT, or for not complying with the terms and conditions hereof, and should such objection not be cured within the effective term of the Offer, the corresponding acceptance shall be automatically canceled and deemed as never made to all purposes or effects. In such cases, the Lead Manager or the relevant securities broker shall return to the shareholder the share certificates and any other document furnished as stated below, without such shareholders being entitled to any compensation, payment or reimbursement whatsoever nor shall it imply, or result in any obligation or liability for CCU Inversiones, its attorneys-in-fact, agents, advisors or representatives.

In the event that the acceptance of the Offer is submitted by the shareholder to a securities dealer other than the Lead Manager, such acceptance shall be contingent upon the shareholder's submitting to the securities dealer other than the Lead Manager, all the documents singled out in this Section, and upon the fulfillment of any charges and obligations referred to in this Tender Offer Initiation Notice and in the Prospectus, and upon the fact that such securities dealer other than the Lead Manager complies with all the charges and obligations referred to in this Tender Offer Initiation Notice and the

Prospectus. Each participating securities dealer will be liable for verifying the existence and accuracy of the documents referred to in this Section, with respect to their clients.

The pension fund managing companies (

administradoras de fondos de pensiones

) and the mutual fund managing companies (

administradoras de fondos mutuos

), for funds managed by them, and other institutional investors who are required to keep their investments in their own name until the sale thereof and who decide to participate in the Offer, shall comply with those statutory procedures and mechanisms required by applicable legislation, and shall deliver the acceptance hereof exclusively to the Lead Manager within the effective term of the Offer, not being it necessary to deliver the transfer of shares nor the share certificate referred to in paragraph (a) above. In any case, such documents must be delivered to the Lead Manager together with the payment to the corresponding institutional investor of the price for their shares sold herein.

(ii)

Place and deadline to submit the acceptance of the Offer:

The acceptance must be delivered directly to the Lead Manager at its offices located at Avenida Apoquindo N° 3721, 9

th

Floor, Comuna de Las Condes, Santiago, or at the offices of any other securities dealer (to the extent that that securities dealer complies with all its charges and obligations referred to in this Tender Offer Initiation Notice and in the Prospectus), from Monday to Friday, within the Opening and Closing Time of the Stock Exchange.

(iii)

Return of shares

:

Should there be any shares not acquired by CCU Inversiones due to the fact that they do not comply with the terms and conditions of the Offer or as otherwise provided for by the competent authority, such shares will remain, together with any other documents and deeds submitted and transfers signed by the shareholders, immediately available to them at the offices of the Lead Manager located at Avenida Apoquindo N° 3721, 9

th

Floor, Comuna de Las Condes, Santiago, as of the publication date of the Outcome Notice, without the shareholders who have accepted the Offer being entitled to any compensation, payment or reimbursement, nor shall it imply any obligation or liability for CCU Inversiones, its agents, attorneys-in-fact, advisors or representatives, including the Lead Manager.

-

OFFER´S REVOCATION

The Offer does not contemplate any cause for revocation or expiration.

-

WITHDRAWAL RIGHT

Shareholders who have accepted the Offer may withdraw their acceptances, in all or in part, prior to the Expiration Date or until the expiration of any extension thereof in accordance with the law, by means of a written notice delivered by the shareholder or participating securities dealer at the offices of the Lead Manager, where the letter of acceptance and the documents attached thereto will be returned to the shareholder or the participating securities dealer, as appropriate.

Moreover, in accordance with article 212 of the LMV, those shareholders who have accepted the Offer may withdraw their acceptances in the event that CCU Inversiones fails to publish the Outcome Notice within the period of 3 (three) days referred to in the first subsection of such article.

Finally, it is hereby placed on record that in the event that any shareholder withdraws his acceptance as stated herein, the respective shares, if they have been actually delivered to the Lead Manager, will be returned to him as soon as he gives written notice of such withdrawal.

-

FINANCING OF THE OFFER

The Offer is financed out of a combination of the own resources of CCU Inversiones and funds provided by its controller, by mans of a loan and/or a capital increase.

The validity of the Offer is not subject to obtaining any financing.

-

GUARANTEE

The Offer does not contemplate the existence of any guarantee according to the provisions set forth in article 204 of LMV.

-

OFFER´S LEAD MANAGER

CCU Inversiones shall act, to all the effects of the Offer, through Credicorp Capital S.A. Corredores de Bolsa, Tax ID N° 96.489.000-5, with principal place of business at Avenida Apoquindo N° 3721, 9

th

Floor, Comuna de Las Condes, Santiago.

To that end, the Lead Manager is vested with the following powers: (i) act as agent for CCU Inversiones under the Offer, and answering any inquiries that may arise regarding the Offer´s mechanisms and conditions; (ii) receive any acceptances and withdrawals made by the shareholders, make transfers to custody deposit with DCV Registros S.A., as entity in charge of the Shareholders´ Register of VSPT, of shares received, reject any acceptances which do not comply with the requirements established in the Offer; (iii) make payments to the shareholders who have validly accepted the Offer and have not withdrawn it in accordance with its terms; and, (iv) in general, performing any other acts that are required to consummate the transaction.

-

INFORMATION PLACES

Copies of the Prospectus of this Offer are available to the interested parties at the following places:

(i)

At the offices of the Lead Manager, located at Avenida Apoquindo N° 3721, 9

th

Floor, Comuna de Las Condes, Santiago, from Monday to Friday from 9:00 am to 5:00 pm, excluding holidays, or call +56226519341.

(ii)

At the

Superintendencia de Valores y Seguros

, Avenida Libertador Bernardo O’Higgins N° 1449, Santiago, from Monday to Friday from 9:00 am to 01.30 pm or on the website www.svs.cl.

(iii)

At the offices of VSPT, located at Avenida Vitacura N° 2760, 16

th

floor, Comuna de Las Condes, Santiago, from Monday to Friday from 9:00 am to 4:00 pm.

(iv)

At the offices of CCU Inversiones, located at Avenida Vitacura N° 2670, 26

th

Floor, Comuna de Las Condes, Santiago, from Monday through Friday from 9:00 am to 4:00 pm.

Any publications under the Offer shall be made in the following newspapers:

Diario Electrónico El Mostrador

(www.elmostrador.cl) and

La Tercera Online

(www.latercera.com).

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

|

|

|

|

|

/s/ Felipe Dubernet

|

|

|

Chief Financial Officer

|

|

|

|

Date: December 29, 2017

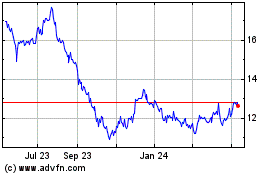

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

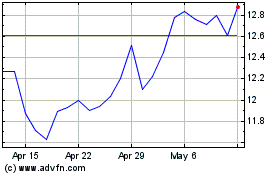

From Jul 2024 to Aug 2024

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Aug 2023 to Aug 2024