Report of Foreign Issuer (6-k)

September 07 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPANIA CERVECERIAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23

rd

floor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No

X

NOTICE OF ESSENTIAL EVENT

(Santiago, Chile, September 6, 2017) – Compañía Cervecerías Unidas S.A. ("CCU") announces that, on September 6

th

of the current year, CCU and

Compañía Cervecerías Unidas Argentina S.A. (“CCU-A”), entity organized under the laws of the Republic of Argentina and subsidiary of CCU, have agreed with Anheuser-Busch InBev S.A./N.V. (“ABI” and together with CCU-A the “Parties”), an offer letter (“Term Sheet”) which

,

amongst other matters, contemplates an early termination of the license agreement in Argentina of the brand “

Budweiser

”, signed between CCU-A and Anheuser-Busch, Incorporated (today Anheuser-Busch LLC, a subsidiary of ABI), dated March 26, 2008, which is subject to the laws of the State of New York, United States of America (the “License Agreement”).

The Transaction is subject to prior approval by the

Comisión Nacional de Defensa de la Competencia

(“CNDC”), the anti-trust authority in Argentina (the “Suspensive Condition”). Therefore, all steps that are described below will become effective upon fulfilment of the Suspensive Condition.

The Parties have agreed that the Suspensive Condition will need to be fulfilled on or before March 31, 2018, automatically extended until June 30, 2018.

The general aspects of the Transaction are as follows:

a) Description of the Transaction.

Subject to the Suspensive Condition, the Parties shall early terminate the License Agreement (the “Early Termination”). Considering the Early Termination of the License Agreement, ABI directly or through any of its subsidiaries (hereinafter together referred to as the “ABI Group”), will pay to CCU-A an amount of US$306,000,000 (three hundred and six million US dollars).

Also, and subject to the Suspensive Condition, ABI will transfer to CCU-A (x) the ownership of the brands Isenbeck and Diosa. This does not include the productive plant owned by Cervecería Argentina S.A. Isenbeck (“CASA Isenbeck”) located in Zárate, province of Buenos Aires, Argentina (which will continue to operate under the ownership of the ABI Group), nor the contracts with its employees and/or distributors, nor the transfer of any liability of CASA Isenbeck; (y) the ownership of the following registered brands in Argentina: Norte, Iguana and Báltica; and (z) the obligation of ABI to make its reasonable best efforts to cause that certain international

premium

beer brands are licensed to CCU-A (together with the brands identified in letter (y) above and with the brand Diosa referred to as the “Group of Brands”) in the Argentinean territory.

In order to establish a smooth transition of the brands that are transferred by virtue of the Transaction, the Parties will enter into the following contracts (all together with the Early Termination referred to as the “Transaction”):

(i) Contract by virtue of which CCU-A will produce for the ABI Group part or all of the volume of the beer Budweiser, for a period of up to one year;

(ii) Contract by virtue of which the ABI Group will produce for CCU-A part or all of the volume of the beer Isenbeck, for a period of up to one year;

(iii) Contract by virtue of which the ABI Group will produce and distribute the Group of Brands, on behalf of CCU-A, for a period of maximum three years; and

(iv) Other agreements, documents and/or contracts that the Parties deem necessary for the Transaction (the “Transaction Documents”).

b) Status of the Transaction.

The Parties have signed the Term Sheet which is binding. The execution of the Transaction Documents is pending. At the same time, and as previously indicated, the effects of the Transaction are subject to the fulfillment of the Suspensive Condition.

c) Estimated time for the Execution of the Transaction.

The Parties will present to the CNDC, as soon as possible, the information in order to obtain the respective authorization. Any relevant news regarding this process will be communicated in due course.

d) Effects of the Transaction on the Results of CCU.

Amongst the factors evaluated by the Board of Directors, it has been considered that this Transaction would have benefits for CCU in the following dimensions: (i) cash for the Early Termination for the amount referred to in the first paragraph of letter a); (ii) the possibility to establish a smooth transition of the Group of Brands, which in the interim period would generate an annual result of US$28,000,000 (twenty eight million US dollars); (iii) the circumstances that the production contracts referred to in point (i) and (ii) of letter a) above, will imply cross-charges for costs and a one-time lump sum payment to CCU-A of US$10,000,000 (ten million US dollars) (all effects previously mentioned are before taxes); and (iv) the fact that CCU-A will replace a brand licensed by its main competitor (ABI) for a group of brands that for more than 85% will correspond to proprietary brands, that currently together represent volumes similar to those of the brand “

Budweiser

”.

CCU is a diversified beverage company operating in Chile, Argentina, Bolivia, Colombia, Paraguay and Uruguay. CCU is the largest Chilean brewer, the second-largest Chilean carbonated soft drinks producer, the largest Chilean water and nectar producer, and the largest pisco producer. It is the second-largest Argentine brewer, and participates in the beer, water and soft drinks industries in Uruguay, Paraguay and Bolivia, and in the beer industry in Colombia. It is one of the largest Chilean wine producers, and the second-largest Chilean wine exporter. The Company´s principal licensing, distribution and / or joint venture agreements include Heineken Brouwerijen B.V., Anheuser-Busch Incorporated, PepsiCo Inc., Seven-up International, Schweppes Holdings Limited, Société des Produits Nestlé S.A., Pernod Ricard Chile S.A., Watt´s S.A., and Coors Brewing Company.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

|

|

|

|

|

/s/ Felipe Dubernet

|

|

|

Chief Financial Officer

|

|

|

|

Date: September 6, 2017

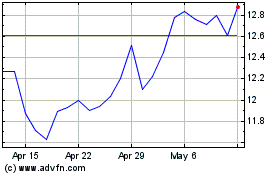

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Jul 2024 to Aug 2024

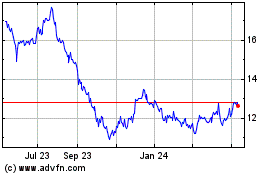

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Aug 2023 to Aug 2024