Filed

by Colombier Acquisition Corp. II

pursuant

to Rule 425 under the Securities Act of 1933

and

deemed filed pursuant to Rule 14a-12

under

the Securities Exchange Act of 1934

Subject

Company: Colombier Acquisition Corp. II

Commission

File No. 001-41874

Date:

January 17, 2025

On

January 17, 2025, the following article was published in QA Outdoors.

Is

There A Financial Revolution Ahead?

A

Conversation with Donald Trump, Jr., Omeed Malik of Colombier Acquisition Group and Marc Nemati of GrabAGun.com

There’s

little doubt that firearms and their related products are “disfavored” on Wall Street. From major banks closing longtime

customer accounts to a drying-up of funding sources for manufacturers, the battles have been fought with the Clinton, Obama and Biden

administrations. Today, a different sort of QA conversation looks at a single planned Wall Street SPAC (Special Purpose Acquisition Company)

transaction that closely resembles the SPAC that launched Truth Social, Rumble, and Public Square. They closely resemble each other because

this latest SPAC is being spearheaded by the duo that put that “First Amendment” financing group together. Omeed Malik, president

of 1789 Capital and founder/CEO of Farvahar Partners, an boutique investment bank and broker/dealer advising high-growth, venture backed

companies, and Donald Trump, Jr., have joined forces to take “mobile-focused online firearms retailer” GrabAGun public.

How

and why they plan to do it speaks to their support of both the First and Second Amendments. We’ll also speak with GrabAGun president

and CEO Marc Nemati about GrabAGun and its focus on a niche of the firearms marketplace all three gentlemen feel are underserved.

QA

Outdoors

Omeed,

you’re no stranger to Wall Street or the financial markets, but this seems like an unusual approach to funding and growing businesses.

How did you get here?

Omeed

Malik, Colombier Acquisition Corp.

I’ll

just give you a one minute overview of where we sit, what we’ve been working on for the past several years, and then we can talk specifically

about the transaction we’re doing with GrabAGun. But I think it’s important to understand the overall context in which this is occurring,

which has been a several year plan that Don and I have been working on.

So

the real catalyst here is in 2020 when the Biden administration took over.

Obviously,

these problems that we’re going to talk about have been going on for a long time, but what you saw with the Biden administration in particular,

in our opinion, was an assault on Constitutional rights, and it’s not just the Second Amendment, but also the First Amendment.

You’re

hearing that, even from people who believe they were prisoners during that period, like Mark Zuckerberg. He thinks that, you know, he

was being bullied and pressured into censoring people at the behest of the federal government.

So

during that COVID period the First Amendment was under assault. You know, where people who were telling the truth were made to feel like

they were liars.

You

started to see a really scary alliance between the largest companies in our economy and the feds. What the Feds were doing was trying

to take away our rights using private actors. They were trying to hide their own actions by having private actors do their bidding.

And

that doesn’t work.

You

can’t use a private actor to take away our rights and pretend that you’re not doing it.

So

while we were out of power during that period, politically, you had kind of a resurrection of federalism at the state level in places

like Texas and Florida.

People

like me who lived in New York left, Don also. We left New York and moved to Florida, made it our residence, and started have a reassertion

of states rights, which is the first step in the process.

But

something hadn’t happened in the past, that we knew that had to happen now: we had to also assert ourselves in the private sector.

So

historically in American history, capitalism and the private sector was the one area you probably didn’t have to worry about. But now

you did, because of woke capitalism.

So

woke capitalism started, meaning that the feds, as well as these large, big tech monopolies and other huge companies, were going to assert

their will on the American people, using, really a digital economy to take away our rights.

Their

north star - where they want to go -is what China is like under the CCP, where you have social credit scoring. You’re not going

to be able to be a free person unless you comply.

That’s

the backdrop; the intellectual basis for what we’re doing from a financial perspective, starts.

And

we do that fighting back in two ways.

The

first is that we started a private investment fund called 1789 Capital. That fund is named after the year the Bill of Rights was offered.

The

idea is that we’re going to put companies in business that are going to fight back against some of the issues that I’m talking about.

They’re not going to capitulate. We can get into some of the details about that in a second.

The

other thing we use are called SPACs (Special Purpose Acquisition Companies) which are public companies that we have on the New York Stock

Exchange. We’re going to find a private company to accelerate their growth by giving them hundreds of millions of dollars and putting

them immediately public.

You’ve

seen SPACs be used in a couple instances, whether it’s a company called Rumble,

Truth

Social, or the deal that this team did in Public Square, which, besides being a patriotic version of Amazon, is also a payment processor

in the two-way space. That’s because it’s another area where they’ve tried to take away the Second Amendment: not processing

transactions, as you know.

So

those are the two entities that I oversee, and that Don’s a part of. And in particular with Grab A Gun.

We

spent a lot of time investing. We put Tucker Carlson in business with his new company through 1789. We invested in the free speech platform

Substack using 1789. We’ve been very active.

Obviously,

Don sits on the board of Truth Social. He was a day one investor with our other partner in Rumble. So we really fought back. This is

the core group of financiers fighting for our rights using the private sector.

The

next step, I think, for us, logically, was to protect the Second Amendment, and that’s what GrabAGun represents. This is an area that

has been adversely affected by woke capital and ESG mandates.

You

can’t get loans. There are great, really important businesses that need help.

Our

idea is to start picking the best of the best in each respective sector of the Second Amendment and fuel their growth.

We

are using one of our SPACs to take GrabAGun public. They’re going to be a public company, trading on the New York Stock Exchange. We’re

going to give them 170 million of cash at the end of this transaction, and we’re going to make them the consolidator in the space, using

their cutting edge technology, which is the future of how people are going to be purchasing these products.

You

know, the last thing I’d say, is that one of the nice things about SPACs is that because it’s about a five month process between when

you announce the deal, which we did last week, to the end of the process, regular people who believe in what we’re doing are able to

support the mission by going and buying CLBR stock during that period of time. That’s what people are doing right now. They’re buying

CLBR to express their happiness with what we’re doing and support this movement that we’re that we’re all engaged in.

So

I’ll stop there. Hopefully that was helpful background.

QA

Outdoors

Okay,

let me ask you about private investors buying into to the SPAC. What happens when the name changes. Does their stock holding just change,

or are they diluted?

Donald

Trump, Jr.

It’s

exactly what you said: it totally changes. Basically, we’ve agreed to a merger with GrabAGun. What’s going to happen is Colombier, which

is the CLBR name will go away, and it will then be trading under P-E-W. GrabAGun is what they’re going to get at the end.

So

they’re buying Grab A Gun now under CLBR, and that’s what happens. The only thing that changes is the ticker, Jim, so they can buy it

now; they don’t have to worry about, you know, switching it up or getting out and getting back in.

It

just flips over once it goes, you know, public officially in about five months.

Okay,

that’s what a lot of people did with Truth Social, which trades under DJT but prior to that, was trading under DWAC, which was the name

of the SPAC, or where they did it Rumble.

QA

Outdoors

Reading

through this, it seems that you guys believe the long play is to the new generation. That would almost seem counterintuitive to a lot

of us, because they’re the ones that want ESG, they want this changed, they want thatchanged. They they run to their “safe spaces”.

Speak to that, please. Don if you’d like to do it, go ahead.

Donald

Trump, Jr.

You

know, I think with COVID, with what you’re seeing with the open border policies and the crime associated therewith, changed things.

Look

at this last election and you’ll say, “hey, wait a second. Trump won 50% of the 18 to 29 vote”.

I

mean, those are first time gun buyers that probably would have never thought about it. But they’ve seen some of the disasters taking

place in our country, and are now very interested in that Second Amendment. They’re interested in being able to protect themselves.

I

see the outreach. I see a huge uptick in the amount of women, even women that are probably left-leaning in places that I used to live,

that are very left-leaning. They are saying, hey, you know what? I would have never thought about this before.

I

used to do this back in the early 2000s when I first got back to New York after living in Colorado for a while. People who were very

anti Second Amendment were my friends. And I’d say, “You know what? Give me an afternoon. You know, come upstate with me. We’re

gonna go to the range. We’re gonna do this.”

And,

you know, people that were vehemently against it would come up, and within about one hour, they’re like, “Well, how do I get one

of these?” It was just they weren’t aware. They never understood it. And once they get a little bit of that exposure, and you know,

whether that’s through, you know, an organic event like that, or through necessity, which is what we’ve seen over the last few

years, those people are into it.

So,

there’s always going to be the traditional, you know, guys that are in the marketplace. We’ll see all of them dressed up in, you

know, 12 pocket cargo shorts at SHOT Show next week. Whether they’re the guys that are real operators in in shape, or whether they’re

475 pounds, they will be in the same pants. You know, it’s fine.

But

the amount of people that have come up to me, asking for recommendations in the last few years, “what would you be buying Don?”

And

I think Chris (Cox) can vouch for my bona fides, because I was basically his dancing monkey in 2015 when the NRA started looking at Trump.

You know, I was probably the reassurance that we actually knew what we’re talking about in this stuff.

But

those new people are coming out. They understand the importance. It’s becoming a priority. They’re looking to purchase. Many of them

had not purchased prior to this. So it’s a great market.

More

importantly, that market does not purchase the way perhaps a lot of traditional gun buyers had purchased, right? These are people who

are used to buying literally everything else in their life online.

Obviously,

we’re doing that legally, going through an FFL process. And I think that still benefits those local shop owners, because that buy comes

with perhaps training or, you know, they’re buying their ammunition that way. I think it’s the kind of thing where everyone wins.

But

we’re going to that market. We’re going to that new place in the market as well as, you know, older people and you know, boomers, who

are adapting because, you know, it’s just become the way so many people are purchasing. But, you know, obviously, the growth is going

to be in those young people- and getting them where they are with Grab A Gun.

I

think the tech stack is great. It’s easy to navigate, it’s clear, it’s simple, concise. This is the way people are buying. I think this

is the wave of the future.

Marc

Namati, Grab A Gun

We’ve

seen younger people come to market to buy firearms. I think mostly around the self-defense aspect. I think that’ll eventually transition

more into like the outdoor shooting sport, but I think the younger buyers are typically focused on the self defense, or defending their

family.

Obviously,

I come from the tech background, and we’ve developed our e-Commerce platform to be very we call mobile centric. A lot of younger buyers

not just shopping online, they’re shopping using their phones and their mobile devices. So we want to make sure that the workflow they

have can go from start to finish on a on a transaction that’s a little bit more complicated than just buying a pair of stocks online

or something.

Obviously

there are extra regular regulatory steps just to go through by shipping to an FFL. So we want to make sure that that the flow is easy

for somebody, especially the first time buyers. We do a lot with making sure that our our interface is kind of up-to-date and best of

breed. We’re also understanding of how a lot of young buyers are price conscious, so part of our tech stack is optimizing our supply

chain to making sure that we’re getting the best possible deal on a on a product that we can then pass off the savings to to consumers.

You’ll notice the younger generation, are particularly price conscious.

It

speaks a little bit to the payment methods. So obviously, you can check out using a credit card, but the Cordova/Public Square integration

with buy now, pay later, or what we call “shoot now, pay later” also leans in to the Gen Z and millennials. I think fewer

of them open credit cards, so the buy now/pay later option across e-commerce in general is something they prioritize and take advantage

of.

So

again, that’s what we’re focusing on. We’ve been doing the “shoot now, pay later” moniker for for a long time. We’re

probably some of the first ones in the game to offer consumer financing for firearms to our customers.

Additionally,

we try to put out a bunch of information around all the various products that we offer. Again, that angle toward the first time gun buyer,

to try and get them an understanding of what products they can have. And the differences there are between products. And everything we

sell is new. I know one thing that’s going to come up is how we’re different from Gun Broker. We focus on the buyer, providing them all

new firearms, giving them ability to buy ammo, magazines, all the accessories they need for whatever they want to set up, versus an auction

style site.

I

think our offering and how and our digital forward focus definitely plays to that younger crowd, and they’re definitely becoming a bigger

cohort of shoppers.

QA

Outdoors

Some

of my older readers are going to be looking at this and asking “So what’s the difference between you and Brownells or Midway USA?”

I mean, it does sound like you’re selling the same stuff. How do you respond to that? How are you different?

Marc

Namati

In

the behind the scenes, so to speak. Our tech stack, and how we can get a better supply of product to to the buyer. We have a better assortment

of products, we have better pricing on products, and then our deliverability, how quickly we can get stuff to customers, typically faster

than some of those competitors that you’re mentioning.

We’re

scaling. I mean, we’re continuing to grow the relationships to get even larger catalog space and speeds. I think the main things there,

in terms of differentiating between other e-commerce firearms, people, is, is our breadth of catalog and speed and price.

QA

Outdoors

Okay,

I haven’t seen any sales numbers for you, but I know Midway and Brownells sell

a

hundreds of millions of dollars a year- each, and they have their storefronts. MidwayUSA has Columbia, Missouri and Brownells has Iowa.

You only have a small storefront in Texas, correct?

Marc

Namati

Yeah.

So we try and steer away from the store as much as possible, and focus our time on on e-commerce. One, that reduces overhead, and two,

it allows us to really focus on, you know, selling across the nation, not just focusing on our community wherever we decide to put up

the storefront. We’re really focused on the national brand versus a local store.

QA

Outdoors

To

me, guns seem to be a lot like cars. People want to see them before they buy them. I don’t think too many people are buying cars on Amazon

and picking them up at the dealer yet. That’s pretty much analogous to what you’re doing with Grab A Gun. What about return

policies, “satisfaction guarantees” - how do those operate?

Marc

Namati

Well,

I disagree a bit with with buying cars. I think there is a shift to buying cars kind of sight unseen, especially over the last few years

with supply chain limitations. I’m a big car guy, and I’ve bought several car side unseen, so maybe I’m just a little different there.

But

a lot of people will use the (online) builder to design and build their their vehicle and then pick it up later. I think it’s kind of

apropos to firearms.

We

do have a return policy, kind of dependent on where you take delivery of the firearm. When we ship that firearm to their FFL for them

to go pick up, they can play with it, look at it -can’t shoot it- prior to a background check. But prior to background check, if

they say “this gun isn’t for me” or there’s an issue with it, they can send it back. So we do give them the ability to kind

of make those returns.

QA

Outdoors

Your

customer seems to be a little more informed than the people you’re accustomed to seeing wander up to a counter in a gun shop and say,

I want to buy a gun. The younger customers tend to come in with information and motivation, the two things that they need. You may be

supplanting one of the issues that the gun industry has at retail: the so-called :expert” behind the counter that wants to tell

you why you don’t know what you’re talking about.

The

new generation doesn’t take that well. The old generation doesn’t take it well either, but it doesn’t, doesn’t keep the counter “experts”

from doing it.

Donald

Trump, Jr.

Yeah.

I can talk to that- extensively. Because I haven’t met too many people behind the gun counter at a lot of gun shops that actually know

much about anything. And I’m into some weirdo specialty stuff, whether it’s, you know, the long range stuff I used to shoot, F- class,

high power, all these things. You couldn’t go in any of the big box retailers and get anyone to tell you basically, anything other than,

you know, “30/06 is the one gun for everything” - the usual mantras from 75 years ago. So you’re right. And I bought, you

know, over the last 15-20 years, I’ve bought dozens of guns of gun. I know what I’m looking for. I’m looking for a Freedom Arms

Model 83, 454 Casul, Premiere Grade. If I can find that, I can figure that out. So I think you’re right. Newer purchasers are not

going to actually learn any more. Usually, in the gun store, everyone has their sort of pre-made mantras of what the “right gun”

is. That doesn’t necessarily work for women or people with smaller hands. Some of that has gone by the wayside as people have become

more informed. There’s more good information online. There are more vehicles for people to figure out the basics. We started talking

about this conceptually, when we did Public Square.

I

came from New York, and I worked in a business where we sold high-end real estate, and we did hotels. And I was used to catering to the

entire country.

Once

we put a little “R” next to our name… all of a sudden..that population cut in half. I was like, “this is a disaster.”

But as I’ve watched the continued attacks on all of these businesses, being able to create something not just like this, but what we’ve

done with Public Square - We have a vertically integrated process where every aspect of that transaction is protected.

I

truly believe half the country feels like they’ve been under attack, whether it’s financially, if you’re in the gun world, whether it’s

payment processing, your bank details, your credit cards, you saw people get de-banked. You saw the manufacturers get de-banked.

A

little machine shop, the guys I used for custom building for my long range guns - what they had to do to be able to get banking. They

saw that attack. What they see now are people actually fighting back. That’s a big part of what we’re doing here.

It’s

not just, hey, here’s one company that’s doing it. Here’s the entire chain of events, like I said, Public Square, which then acquired

Credova, which then made sure you’re going to keep your transaction safe and out of the hands of those guys. People are watching.

Some

bank isn’t going to shut you off because - as we’ve watched over the last few years- because you bought a gun and exercised your rights,

or because you bought a Bible, or because perhaps you bought MAGA swag. You’ve now been flagged.

So

we’re trying to take care of the entire chain of events with all of this.

This

is one big step in the in the greater thesis for what we’re doing across the board. I think there’s a pretty solid business protecting

the rights of 175 million Americans.

QA

Outdoors

I

couldn’t argue that. We’ve been doing this for 25 years, because we saw a hole that needed to be filled.

So

talk to me a bit about the companies that have been de-banked or disenfranchised. Are you doing outreach to them as well?

Or

are you sticking to your vertical integration? Private financing is a bit thing on the street these days, everyone’s getting into

it. Big firms are restructuring to get into private financing. Are you ahead of the game on this?

Omeed

Malik

I

mean, we’re the first, you know, we call it, we call it the E-I-G economy, because we’re totally opposed to E-S-G.

We’re

the first growth equity fund that is explicitly investing in what we’ll call these patriotic companies, right that are trying to fight

for our freedoms. We were the first to do it when we came out a couple years ago, and we’re the first one to take companies public in

this institutional manner. The next thing we’re going to do, that you’re getting at, is also provide credit. That’s another thing we

need to do. If the banks are telling you that they can’t lend to you, then we’re going to have to also start our own banks to Don’s point.

But

in the meantime, we’re going to be able to have credit funds as well, not just on the equity side. They’re going to be able to provide

some of that financing you’re speaking about. We are very clearly creating an entire ecosystem that can play off of itself. We put Tucker

Carlson in business, and his first advertiser is Public Square. That’s not a coincidence that we did that.

One

of the ways they worked their economic warfare was they would go pressure corporations to not advertise on on channels or with people

that didn’t speak what they wanted them to.

They

try to starve you financially. You know, that’s the back door way that they try to create manufactured consent, frankly.

So

we’re fighting them back in the same way.

And

we all know on this call that we’re actually the majority of the people out there. So, you know, one of the things that I like to say,

where I repeat that’s been out there for a long time, is that the politics is downstream from culture. What I add, though, is that business

is downstream from politics

So

with this most recent election, the people fought back, because we captured the culture. We now have the political system.

The

next step for us is to capture the business community.

Now

you’re seeing all these big guys who weren’t on our side doing mea culpas. It’s kind of funny to watch.

So

what I asked, like a very open question on CNBC last week was that, now that Zuckerberg has rediscovered the Constitution, is he going

to allow grab a gun to advertise on meta programs? Because right now, you can’t advertise guns on Facebook.

QA

Outdoors

I’m

aware you can’t advertise a lot of things on Facebook. But here’s the thing: how far does this kind of awakening that they’re having,

go?

Omeed

Malik

We’re

not going to wait to find out. We’re going to provide a ton of other options for people. That’s what’s so exciting about it. We can only

do so much. There’s a small group of us who, you know, have financial abilities. But the people have to support what we’re doing.

That’s why it’s important, particularly in a community like our 2A community. It’s been pushed around for a long time now.

When they have opportunities like this, we need their help, and that’s what this is all about.

We’re

trying to bring great companies out there that are well capitalized, that are not going to be teetering on bankruptcy. We’ve got a lot

of firepower behind us, but the 2A community has to come out in full force. That’s the only way we’re going to be able to take on woke

capital and Wall Street.

Donald

Trump, Jr.

I

talk about this a lot, we can start. We can be the catalyst. We can be the ones putting, sort of, the capital, the blood, the sweat,

the tears, to do it.

But

you need everyone to take part in this. Everyone has to be unafraid. We’ve seen the consequences of people standing up, and we get all

of that.

But

if people take those initial steps to do it, it’s really helpful to have that support. Once you have that support, you get the

critical mass. And all this nonsense goes away once people start being vocal. You’ve seen that frankly, in the last couple of weeks,

with all the social media platforms now going “hey, we’re changing our policies.”

Once

enough people were unafraid, once they were said, “Enough is enough of this” all of a sudden those people start catering

to them. When it’s one or two people that are vocal without much support, there may be a silent majority behind them, but if they’re

unwilling to participate, it doesn’t matter. You can’t effectuate real change.

But

once people start speaking up, once they start calling out the nonsense, once they’re vocal, then they realize they’re going to vote

with their wallet, so to speak. When they walk away from these places, all of a sudden, they are getting catered to again.

Whether

it’s meta, or any of these other platforms in the last few weeks, you’ve seen them make drastic 180s on policies that have been

very detrimental, whether it’s free speech, whether it’s to conservatism in general, and certainly to the Second Amendment and or the

hunting space. Those are obviously not the same. Jim, you know that, like me. When I got into this in 2015, I thought the concentric

circles of hunting and fishing overlap like 95%. Turns out, that’s like 5%, but once all those people band together and realize

that we may not agree on everything, and we may not share everything in common, but if we stick together we can do this. We can move

mountains and we can effectuate actual change.

QA

Outdoors

I

started the Outdoor Wire thinking the outdoors was just a bunch of people out in the woods singing Kumbaya, then shooting their own dinner.

So, yeah, I was a little naive about that as well.

So

how can I be cognizant of what’s going on here? How do I recognize the signs that maybe the people who were against me are now

going to try and weasel their way back into my good graces, especially the financial institutions?

Omeed

Malik

Well,

I don’t see a lot of big financial institutions really doing anything for us. Quite frankly, you’ll notice there’s no Goldman Sachs or

anything on this deal. It’s us.

We’re

a band of misfits. We’ve come together and stormed the palace.

We’re

in it now. We’re not going to give it up. We’ve been out there fighting. There are no large banks behind us at all. Most of Wall Street

is against us.

This

is going to be a people’s revolution. That’s the whole elegance of the SPAC concept.

The

SEC sell the product because they were scared that it’s one of the only financial product that actually democratizes capital markets.

That’s a very important feature here that thankfully we still have alive if people want to support the deal like they did with Don’s

father and Truth Social we can beat them, but this is the only way to do that. It’s not a conventional IPO. That’s what’s so important

for your readers to understand.

Donald

Trump, Jr.

Yeah,

Jim, that’s a really important point. To simplify it for those who aren’t going to be, as you know, financially savvy and all of this,

it’s not like Black Rock or one of these woke companies, and we’ve seen this, whether it’s Chernin Group investing in media or whatever

it may be, like, literally, people who would take away all of your Second Amendment rights, certainly starting with the A/R, but they’d

eventually take your musket if you went back to these things.

We’re

not backed by those groups who are happy to profit here off of people’s beliefs and off of the Second Amendment, and they’re pocketing

most of that money, or most of that upside. We’re totally independent.

Those

are not people that are investors with us. Those are not people that are in this deal.

They

are not making the back end upside, if there is any in any of these things. They’re totally out of the deal. Which, which does get confused

sometimes, when, when you talk about the, you know, the public markets.

Uh,

what we’re going through right now in that SPAC transition is, you know, you have that existing, probably the company, CLBR a lot of

that’s owned by institutions.

Once

the gun stuff comes about, those guys are getting out and it’s, it’s, it’s the transference from those institutions now to the people

who would be buying that stock, which will eventually become PEW, that takes them totally out of that loop.

Yeah,

I understand the concern, sort of the back end of your question, which is people are concerned about, you know, hey, it’s maybe good

for the 2A but, you know, in the end, we’re just feeding some sort of woke corporation or woke bank or woke investment company.

That’s

not the case here at all. Ideally, this is owned entirely by that real world people who believe in what we’re doing and continuing that

mission.

Omeed

Malik

And

this is one more step in taking away the power from those institutions who have been so negative to us. It’s how we circumvent them.

I mean, that’s our problem:. we don’t use the capital markets on our side. If you look at the New York Stock Exchange or the NASDAQ,

it’s completely dominated by companies that reflect the world views of the people against us.

We

need to start wising up and using these products for our own benefit. That’s the only way we’re going to be able to fight back.

We’ve

basically ceded control of so many aspects of our economy to the other side. That’s why it’s important to wake up now and start creating

our own businesses and creating our own financing solutions. Otherwise they’re going to take those all away from us. And so that’s really

what this is about.

QA

Outdoors

Gentlemen,

thanks for your time. We’ll be watching as this progresses, and we’ll keep everyone posted.

Additional

Information

GrabAGun

Digital Holdings Inc. (“Pubco”), Colombier Acquisition Corp. II (“Colombier

II”) and Metroplex Trading Company, LLC (d/b/a GrabAGun) (“GrabAGun”)

intend to file with the SEC a Registration Statement on Form S-4 (as may be amended, the “Registration Statement”), which

will include a preliminary proxy statement of Colombier II and a prospectus in connection with the proposed business combination (the

“Business Combination”) among Colombier II, Pubco, Gauge II Merger Sub Corp

(“Colombier Merger Sub”), Gauge II Merger Sub LLC, (“GrabAGun Merger Sub”)

and GrabAGun pursuant to the Business Combination Agreement, dated January 6, 2025, between the parties (the “Business Combination

Agreement”). The definitive proxy statement and other relevant documents will be mailed to shareholders of Colombier II as of a

record date to be established for voting on Colombier II’s proposed Business Combination with GrabAGun. SHAREHOLDERS OF COLOMBIER

II AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE

PROXY STATEMENT IN CONNECTION WITH COLOMBIER II’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING OF ITS SHAREHOLDERS TO BE HELD

TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT COLOMBIER II, GRABAGUN, PUBCO AND

THE BUSINESS COMBINATION. Shareholders will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus,

without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to: Colombier

Acquisition Corp. II, 214 Brazilian Avenue, Suite 200-A, Palm Beach, FL 33480; e-mail: clbr@icrinc.com.

Participants

in The Solicitation

Pubco,

Colombier II, GrabAGun, and their respective directors, executive officers and members, as applicable, may be deemed to be participants

in the solicitation of proxies from the shareholders of Colombier II in connection with the Business Combination. Colombier

II’s shareholders and other interested persons may obtain more detailed information regarding the names, affiliations, and interests

of certain of Colombier executive officers and directors in the solicitation by reading Colombier II’s final prospectus filed with

the SEC on November 20, 2023 in connection with Colombier II’s initial public offering (“IPO”), Colombier II’s

Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 25, 2024 and Colombier II’s other

filings with the SEC. A list of the names of such directors and executive officers and information regarding their interests in the Business

Combination, which may, in some cases, be different from those of shareholders generally, will be set forth in the Registration Statement

relating to the Business Combination when it becomes available. These documents can be obtained free of charge from the source indicated

above.

No

Offer Or Solicitation

This

communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful

prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made

except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking

Statements

The

information in this communication includes “forward-looking statements” within the meaning of the federal securities laws.

Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “may,” “will,” “expect,” “continue,” “should,”

“would,” “anticipate,” “believe,” “seek,” “target,” “predict,”

“potential,” “seem,” “future,” “outlook” or other similar expressions that predict or

indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that

a statement is not forward-looking. These forward-looking statements include, but are not limited to, references with respect to the

anticipated benefits of the proposed Business Combination; GrabAGun’s ability to successfully execute its expansion plans and business

initiatives; the sources and uses of cash of the proposed Business Combination; the anticipated capitalization and enterprise value of

the combined company following the consummation of the proposed Business Combination; and expectations related to the terms and timing

of the proposed Business Combination. These statements are based on various assumptions, whether or not identified in this communication,

and on the current expectations of GrabAGun’s and Colombier II’s management and are not predictions of actual performance.

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied

on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control

of GrabAGun and Colombier II. These forward-looking statements are subject to a number of risks and uncertainties, including the occurrence

of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement; the risk that

the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the transactions described

herein; the inability to recognize the anticipated benefits of the Business Combination; the inability of GrabAGun to maintain, and Pubco

to obtain, as necessary, any permits necessary for the conduct of GrabAGun’s business, including federal firearm licenses issued

pursuant to the Gun Control Act, 18 USC 921 et seq. and special occupational taxpayer stamps issued pursuant to the National Firearms

Act, 26 USC 5849 et seq.; the disqualification, revocation or modification of the status of those persons designated by GrabAGun as Responsible

Persons, as such term is defined in 18 U.S.C. 841(s); the ability to maintain the listing of Colombier II’s securities on a national

securities exchange; the ability to obtain or maintain the listing of Pubco’s securities on the NYSE, following the Business Combination;

costs related to the Business Combination; changes in business, market, financial, political and legal conditions; risks relating to

GrabAGun’s operations and business, including information technology and cybersecurity risks, and deterioration in relationships

between GrabAGun and its employees; GrabAGun’s ability to successfully collaborate with business partners; demand for GrabAGun’s

current and future offerings; risks that orders that have been placed for GrabAGun’s products are cancelled or modified; risks

related to increased competition; risks that GrabAGun is unable to secure or protect its intellectual property; risks of product liability

or regulatory lawsuits relating to GrabAGun’s products and services; risks that the post-combination company experiences difficulties

managing its growth and expanding operations; the risk that the Business Combination may not

be completed in a timely manner or at all, which may adversely affect the price of Colombier II’s securities; the risk that the

Business Combination may not be completed by Colombier II’s business combination deadline and the potential failure to obtain an

extension of the business combination deadline if sought by Colombier II; the failure to satisfy the conditions to the consummation

of the Business Combination; the outcome of any legal proceedings that may be instituted against GrabAGun, Colombier II, Pubco or others

following announcement of the proposed Business Combination and transactions contemplated thereby; the ability of GrabAGun to execute

its business model; and those risk factors discussed in documents of Pubco and Colombier II filed, or to be filed, with the SEC. If any

of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these

forward-looking statements. There may be additional risks that neither Colombier II nor GrabAGun presently know or that Colombier II

and GrabAGun currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect Colombier II’s, Pubco’s and GrabAGun’s expectations, plans

or forecasts of future events and views as of the date of this communication. Colombier II, Pubco and GrabAGun anticipate that subsequent

events and developments will cause Colombier II’s, Pubco’s and GrabAGun’s assessments to change. However, while Colombier

II, Pubco and GrabAGun may elect to update these forward-looking statements at some point in the future, Colombier II, Pubco and GrabAGun

specifically disclaim any obligation to do so. Readers are referred to the most recent reports filed with the SEC by Colombier II. Readers

are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and we undertake

no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by U.S. federal securities laws.

15

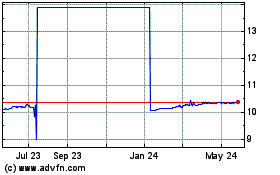

Colombier Acquisition (NYSE:CLBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

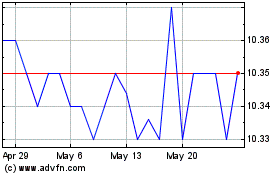

Colombier Acquisition (NYSE:CLBR)

Historical Stock Chart

From Jan 2024 to Jan 2025