UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2014

Commission File Number 1-12260

COCA-COLA FEMSA, S.A.B. de C.V.

(Translation of registrant’s name into English)

(Jurisdiction of incorporation or organization)

Mario Pani No. 100

Col. Santa Fe Cuajimalpa

Delegación Cuajimalpa

México, D.F. 03348

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes No X

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with

Rule 12g3-2(b): 82-__.

|

|

2014 THIRD - QUARTER AND FIRST NINE MONTHS RESULTS |

|

|

Third Quarter |

|

|

|

YTD |

|

|

|

|

|

2014 |

2013 |

Reported Δ% |

Excluding M&A Effects Δ%(5) |

|

2014 |

2013 |

Reported Δ% |

Excluding M&A Effects Δ%(5) |

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues |

41,781 |

37,494 |

11.4% |

2.5% |

|

123,114 |

109,737 |

12.2% |

1.2% |

|

Gross Profit |

19,585 |

17,575 |

11.4% |

4.5% |

|

57,636 |

51,512 |

11.9% |

3.3% |

|

Operating Income |

5,825 |

5,063 |

15.1% |

7.9% |

|

16,516 |

14,500 |

13.9% |

6.7% |

|

Net Income Attributable to equity holders of the company |

3,343 |

2,954 |

13.2% |

|

|

8,415 |

8,292 |

1.5% |

|

|

Earnings per Share (1) |

1.61 |

1.43 |

|

|

|

|

|

|

|

|

Operative cash flow(2) |

8,008 |

6,811 |

17.6% |

11.1% |

|

23,203 |

19,576 |

18.5% |

11.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LTM 3Q 2014 |

FY 2013 |

Δ% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Debt (3) |

39,953 |

45,155 |

-11.5% |

|

|

|

|

|

|

|

Net Debt / Operative cash flow (3) |

1.26 |

1.58 |

|

|

|

|

|

|

|

|

Operative cash flow/ Interest Expense, net (3) |

6.12 |

10.64 |

|

|

|

|

|

|

|

|

Capitalization (4) |

35.1% |

34.7% |

|

|

|

|

|

|

|

|

Expressed in millions of Mexican pesos. |

|

(1) Quarterly earnings / outstanding shares as of the end of period. Outstanding shares as of 3Q'13 were 2,072.9 million. Outstanding shares as of 3Q'14 were 2,072.9 million. |

|

(2) Operative cash flow = operating income + depreciation + amortization & other operative non-cash charges. |

|

(3) Net debt = total debt - cash |

|

(4) Total debt / (long-term debt + shareholders' equity) |

|

(5) Excluding M&A effects means, with respect to a year over year comparison, the increase in a given measure excluding the effects of mergers, acquisitions and divestitures. |

|

We believe this measure allows us to provide investors and other market participants with a better representation of the performance of our business. In preparing this measure, |

|

management has used its best judgment, estimates and assumptions in order to maintain comparability. |

|

Reported total revenues reached Ps. 41,781 million in the third quarter of 2014, an increase of 11.4% as compared to the third quarter of 2013. On a currency neutral basis and excluding the non-comparable effect of the integration of Companhia Fluminense de Refrigerantes(“Fluminense”) and Spaipa S.A. Industria Brasileira de Bebidas(“Spaipa”) in our Brazilian operation, total revenues grew 21.3%. Reported total revenues reached Ps. 41,781 million in the third quarter of 2014, an increase of 11.4% as compared to the third quarter of 2013. On a currency neutral basis and excluding the non-comparable effect of the integration of Companhia Fluminense de Refrigerantes(“Fluminense”) and Spaipa S.A. Industria Brasileira de Bebidas(“Spaipa”) in our Brazilian operation, total revenues grew 21.3%.

Reported operating income reached Ps. 5,825 million in the third quarter of 2014, an increase of 15.1% as compared to the same period of the previous year, resulting in an operating margin of 13.9%. Reported operating income reached Ps. 5,825 million in the third quarter of 2014, an increase of 15.1% as compared to the same period of the previous year, resulting in an operating margin of 13.9%.

Reported operative cash flow grew 17.6% to Ps. 8,008 million in the third quarter of 2014, as compared to the same period in 2013. Our reported operative cash flow margin expanded 100 basis points to 19.2%. Excluding the recently integrated territories in Brazil, operating cash flow grew 11.1% resulting in a margin expansion of 150 basis points to reach 19.7%. Reported operative cash flow grew 17.6% to Ps. 8,008 million in the third quarter of 2014, as compared to the same period in 2013. Our reported operative cash flow margin expanded 100 basis points to 19.2%. Excluding the recently integrated territories in Brazil, operating cash flow grew 11.1% resulting in a margin expansion of 150 basis points to reach 19.7%.

Reported consolidated net controlling interest income grew 13.2% to Ps. 3,343 million in the third quarter of 2014, resulting in earnings per share of Ps. 1.61. Reported consolidated net controlling interest income grew 13.2% to Ps. 3,343 million in the third quarter of 2014, resulting in earnings per share of Ps. 1.61.

Mexico City October 22, 2014, Coca-Cola FEMSA, S.A.B. de C.V. (BMV: KOFL, NYSE: KOF) (“Coca-Cola FEMSA” or the “Company”), the largest franchise bottler in the world, announces results for the third quarter of 2014.

“As we enter the final stretch of the year, we continue to build positive momentum in our operations. This quarter, our operators delivered solid bottom-line growth, despite the many challenges we face across our markets. In Mexico, superior point of sale execution, hard work, and packaging and brand innovation continue to yield encouraging results. Importantly, at the beginning of September, we launched Coca-Cola Life, a mid-calorie option naturally sweetened with Stevia and sugar, refreshing the Coke category in Mexico with benchmark results for the system. Colombia and Central America continue to accelerate volume growth in their operations, while our revenue management initiatives, coupled with the synergies captured from our recent integrations, have enabled us to improve the profitability of Brazil. Argentina and Venezuela delivered positive results, despite a difficult macroeconomic and operating environment. Our implementation of an improved route-to-market, an efficient supply chain, and a renewed portfolio underscore our long-term commitment to develop our Philippine operation to capture the potential that we envision together with our partner, The Coca-Cola Company, in that region. We look forward to 2015, recognizing that we have the right team to win in the marketplace, delivering sustained economic, social, and environmental value for all of our stakeholders,” said John Santa Maria Otazua, Chief Executive Officer of the Company. |

|

October 22, 2014 |

|

Page 1 |

All the financial information presented in this report was prepared under International Financial Reporting Standards (IFRS).

Starting on February 2013, we are incorporating our stake of the results of Coca-Cola Bottlers Philippines, Inc. through the equity method on an estimated basis.

As of the first quarter of 2014, Coca-Cola FEMSA has adopted the state-run Supplementary Currency Administration System (SICAD) alternate exchange rate to translate its Venezuelan operation’s results into its reporting currency, the Mexican peso. The SICAD exchange rate used to translate the third quarter and first nine months results of 2014 was 12.00 bolivars per U.S. dollar as per the auction held on September 25, 2014.

Our reported total revenues increased 11.4% to Ps. 41,781 million in the third quarter of 2014, compared to the third quarter of 2013, driven by the integration of Fluminense and Spaipa in our Brazilian territories(1) and revenue growth in our Mexican, Brazilian, Colombian, and Central American operations. Excluding the recently integrated territories in Brazil,(1) total revenues increased 2.5%. On a currency neutral basis and excluding the new franchises in Brazil,(1) total revenues grew 21.3%, driven by average price per unit case growth in most of our territories and volume growth in Colombia, Central America and Venezuela.

Reported total sales volume increased 7.5% to 855.4 million unit cases in the third quarter of 2014 as compared to the same period in 2013. Excluding the integration of Fluminense and Spaipa in Brazil,(1) volumes increased 0.7% to 800.8 million unit cases. On the same basis, our water portfolio, including bulk water, grew 2.6%, mainly driven by 2% growth in brand Ciel in Mexico. Our sparkling and still beverage categories remained flat.

Our reported gross profit increased 11.4% to Ps. 19,585 million in the third quarter of 2014, as compared to the same period of 2013. Lower sweetener and PET prices in most of our territories were offset by the depreciation of the average exchange rate of most of the currencies in our South America division and the Mexican peso(2) as applied to our U.S. dollar-denominated raw material costs. Reported gross margin remained flat at 46.9% in the third quarter of 2014.

Our reported operating income increased 15.1% to Ps. 5,825 million in the third quarter of 2014 and our reported operating margin was 13.9%. Excluding the integration of the new territories in Brazil,(1) operating income increased 7.9%, reaching Ps. 5,464 million and representing an operating margin of 14.2%. Excluding the non-comparable effect of Fluminense and Spaipa(1) operating expenses decreased as a percentage of revenues in the majority of our territories.

During the third quarter of 2014, the other operative expenses, net line recorded an expense of Ps. 103 million, mainly due to restructuring charges in our Mexican operation and operative currency fluctuation effects in most of our subsidiaries.

The share of the profits of associates and joint ventures line recorded a loss of Ps. 217 million in the third quarter of 2014, mainly due to an equity method loss from our participation in Coca-Cola Bottlers Philippines, Inc., and Estrella Azul in Panama, which were partially compensated by a gain in the participation of our non-carbonated beverage joint-ventures in Brazil.

Reported operative cash flow grew 17.6% to Ps. 8,008 million in the third quarter of 2014 as compared to the same period in 2013. Our reported operative cash flow margin expanded 100 basis points to reach 19.2% in the third quarter of 2014. Excluding the recently integrated territories in Brazil, operating cash flow margin expanded 150 basis points to 19.7%.

Our comprehensive financing result in the third quarter of 2014 recorded an expense of Ps. 2,046 million as compared to an expense of Ps. 457 million in the same period of 2013. The financing of the most recent acquisitions in Brazil generated an increase in interest expenses due to a larger debt position and higher interest rates related to the debt balance swapped to Brazilian reals. In addition, during the quarter we registered a foreign exchange loss as a result of the quarterly depreciation of the Mexican peso(2) as applied to our US dollar-denominated net debt position and a loss on the monetary position of Venezuela generated by a larger monetary asset position.

During the third quarter of 2014, income tax, as a percentage of income before taxes, was 14.2% as compared to 34.7% in the same period of 2013. The lower effective tax rate registered during the third quarter of 2014 is related to a one-time benefit resulting from the settlement of certain contingent tax liabilities under the tax amnesty program offered by the Brazilian tax authorities.

The benefit resulting from the settlement of this tax contingency was recorded as (i) a gain in the other non-operative expenses line due to the cancellation of a previously recorded provision and (ii) a reduction of income taxes.

Our reported consolidated net controlling interest grew 13.2% to Ps. 3,343 million in the third quarter of 2014. Earnings per share (EPS) in the third quarter of 2014 were Ps. 1.61 (Ps. 16.12 per ADS) computed on the basis of 2,072.9 million shares (each ADS represents 10 local shares).

(1) The Company’s South America division’s operating results include the non-comparable effect of Fluminense’s results for the months of July, 2014 and August, 2014, and Spaipa’s results for the months of July, 2014 through September, 2014.

(2) See page 13 for average and end of period exchange rates for the third quarter and the first nine months of 2014.

|

October 22, 2014 |

|

Page 2 |

As of September 30, 2014, we had a cash balance of Ps. 21,597 million, including US$513 million denominated in U.S. dollars, an increase of Ps. 6,291 million compared to December 31, 2013. This difference was mainly driven by cash generated by our operations.

As of September 30, 2014, total short-term debt was Ps. 1,636 million and long-term debt was Ps. 59,914 million. Total debt increased by Ps. 1,089 million, compared to year end 2013 mainly due to debt issuance at the beginning of the year and the negative translation effect resulting from the devaluation of the end of period exchange rate of the Mexican peso(1) as applied to our U.S. dollar denominated debt position. Net debt decreased Ps. 5,202 million compared to year end 2013.

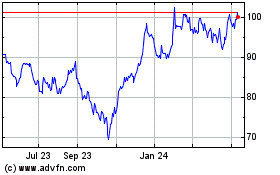

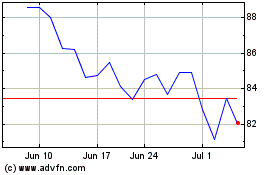

The weighted average cost of debt for the quarter was 7.94%. The following charts set forth the Company’s debt profile by currency and interest rate type and by maturity date as of September 30, 2014.

|

Currency |

% Total Debt(1) |

% Interest Rate Floating(1)(2) |

|

Mexican pesos |

30.1% |

24.9% |

|

U.S. dollars |

26.5% |

0.0% |

|

Colombian pesos |

1.3% |

100.0% |

|

Brazilian reals |

40.5% |

97.4% |

|

Argentine pesos |

1.6% |

36.8% |

(1) After giving effect to interest rate swaps

(2) Calculated by weighting each year’s outstanding debt balance mix

Debt Maturity Profile

|

Maturity Date |

2014 |

2015 |

2016 |

2017 |

2018 |

2019+ |

|

% of Total Debt |

1.0% |

1.8% |

7.8% |

0.4% |

29.1% |

59.9% |

(1) See page 13 for average and end of period exchange rates for the third quarter and the first nine months of 2014.

|

October 22, 2014 |

|

Page 3 |

For reporting purposes, all corporate expenses, including the equity method recorded from our stake of the results of Coca-Cola Bottlers Philippines, Inc., are included in the results of the Mexico and Central America division.

Revenues

Reported total revenues from our Mexico and Central America division increased 3.6% to Ps. 18,580 million in the third quarter of 2014, as compared to the same period in 2013, driven by revenue growth in all of our operations. Our average price per unit case, which is presented net of taxes, grew 3.4%, reaching Ps. 37.34, mainly supported by a price adjustment implemented in Mexico during the first quarter of 2014. On a currency neutral basis, total revenues in the division increased 3.8%.

Reported total sales volume increased 0.5% to 497.0 million unit cases in the third quarter of 2014, as compared to the third quarter of 2013. Our sparkling beverage category increased 0.6%, driven by 2% growth of brand Coca-Cola. Our water portfolio, including bulk water, grew 2.2%, mainly driven by 2% growth of brand Ciel. These increases compensated for a 5.9% decrease of our still beverage category.

Operating Income

Our reported gross profit increased 5.3% to Ps. 9,365 million in the third quarter of 2014 as compared to the same period in 2013. Lower sweetener and PET prices in the division were partially offset by the depreciation of the average exchange rate of most of our division’s currencies(1) as applied to our U.S. dollar-denominated raw material costs. Reported gross margin reached 50.4% in the third quarter of 2014, an expansion of 80 basis points as compared to the same period of the previous year.

Reported operating income(2) increased 1.3% to Ps. 2,869 million in the third quarter of 2014. Our reported operating margin reached 15.4% in the third quarter of 2014. Our operating expenses increased only 2.3% and decreased as a percentage of revenues in the division as compared with the third quarter of 2013.

Reported operative cash flow grew 6.8% to Ps. 4,093 million in the third quarter of 2014 as compared to the same period in 2013. Our reported operative cash flow margin was 22.0%, an expansion of 60 basis points.

(1) See page 13 for average and end of period exchange rates for the third quarter and the first nine months of 2014.

(2) For reporting purposes, all corporate expenses, including the equity method recorded from our stake of the results of Coca-Cola Bottlers Philippines, Inc., are included in the results of the Mexico and Central America division.

|

October 22, 2014 |

|

Page 4 |

As of the first quarter of 2014, Coca-Cola FEMSA has adopted the state-run Supplementary Currency Administration System (SICAD) alternate exchange rate to translate its Venezuelan operation’s results into its reporting currency, the Mexican peso. The SICAD exchange rate used to translate the third quarter and first nine months results of 2014 was 12.00 bolivars per U.S. dollar as per the auction held on September 25, 2014.

Volume and average price per unit case exclude beer results.

Revenues

Reported total revenues were Ps. 23,201 million in the third quarter of 2014, an increase of 18.6% as compared to the same period of 2013, as a result of (i) the integration of Fluminense and Spaipa in Brazil,(1) (ii) revenue growth in our Colombian and Brazilian operations, and (iii) despite the negative translation effect of the devaluation of the currencies in the division.(2) Excluding beer, which accounted for Ps. 1,589 million during the quarter, revenues increased 15.3% to Ps. 21,612 million. On a currency neutral basis and excluding Fluminense and Spaipa,(1) total revenues increased 37.3% due to average price per unit case increases in Venezuela, Brazil and Argentina, and volume growth in Colombia and Venezuela.

Reported total sales volume in our South America division increased 19.0% to 358.4 million unit cases in the third quarter of 2014 as compared to the same period of 2013, as a result of the integration of Fluminense and Spaipa in Brazil(1) and volume growth in Colombia and Venezuela. Excluding the non-comparable effect of the acquisitions in Brazil,(1) volume increased 0.9% to 303.8 million unit cases. On the same basis, our still beverage category grew 11.1% driven by the Jugos del Valle line of business in the division, including growth of del Valle Fresh in Colombia. Our bottled water category grew 9.5% driven by Aquarius and Bonaqua in Argentina and Crystal in Brazil. Our sparkling beverage category remained flat. These increases compensated for a volume decline in our bulk water category.

Operating Income

Reported gross profit reached Ps. 10,222 million, an increase of 17.8% in the third quarter of 2014, as compared to the same period of 2013. In local currency, lower sweetener and PET prices in most of our territories were compensated by the depreciation of the average exchange rate of most of the currencies in the division (2) as applied to our U.S. dollar-denominated raw material costs. Reported gross margin reached 44.1% in the third quarter of 2014.

Our reported operating income increased 32.5% to Ps. 2,957 million in the third quarter of 2014, compared to the same period of 2013, as a result of the integration of Fluminense and Spaipa in Brazil,(1) and operating income growth in all of the territories of our South America division. This growth was partially offset by the negative translation effect resulting from using the SICAD exchange rate to translate the results of our Venezuelan operation. Excluding the recently integrated territories in Brazil, operating expenses decreased 0.9% despite higher labor and freight costs in Venezuela, Colombia and Brazil, and continued marketing investments to support our marketplace execution and bolster our returnable packaging base in Brazil. Our reported operating margin expanded 130 basis points to 12.7% in the third quarter of 2014.

Reported operative cash flow grew 31.5% to Ps. 3,915 million in the third quarter of 2014 as compared to the same period in 2013. Our reported operative cash flow margin expanded 170 basis points to 16.9%. Excluding the recently integrated territories in Brazil, operating cash flow margin expanded 230 basis points to 17.5%.

(1) The Company’s South America division’s operating results include the non-comparable effect of Fluminense’s results for the months of July, 2014 and August, 2014, and Spaipa’s results for the months of July, 2014 through September, 2014.

(2) See page 13 for average and end of period exchange rates for the third quarter and the first nine months of 2014.

|

October 22, 2014 |

|

Page 5 |

The Company’s Mexico & Central America divisions’ operating results include the non-comparable effect of Grupo Yoli’s results for the months of January, 2014 through May, 2014.

The Company’s South America divisions’ operating results include the non-comparable effect of Fluminense’s results for the months of January, 2014 through August, 2014 and Spaipa’s results for the months of January, 2014 through September, 2014.

As of February 2013, we are incorporating our stake of the results of Coca-Cola Bottlers Philippines, Inc. through the equity method on an estimated basis.

As of the first quarter of 2014, Coca-Cola FEMSA has adopted the state-run Supplementary Currency Administration System (SICAD) alternate exchange rate to translate its Venezuelan operation’s results into its reporting currency, the Mexican peso. The SICAD exchange rate used to translate the third quarter and first nine months results of 2014 was 12.00 bolivars per U.S. dollar as per the auction held on September 25, 2014.

Our reported consolidated total revenues increased 12.2% to Ps. 123,114 million in the first nine months of 2014, as compared to the same period of 2013, driven by (i) the integration of Fluminense and Spaipa in our Brazilian territories and Yoli in Mexico,(1)(2) (ii) revenue growth in our Venezuelan operation, despite using the SICAD exchange rate for translation purposes, (iii) revenue growth in most of our territories, and (iv) despite the negative translation effect originated by the devaluation of the currencies in most of our territories.(3) Excluding the integrated territories in Brazil and Mexico,(1)(2) total revenues increased 1.2%. On a currency neutral basis and excluding the non-comparable effect of Fluminense and Spaipa in Brazil, and Yoli in Mexico,(1)(2) total revenues grew 22.4%, in the first nine months of 2014.

Reported total sales volume increased 8.5% to 2,520.5 million unit cases in the first nine months of 2014, as compared to the same period in 2013. Excluding the integration of Fluminense and Spaipa in Brazil, and Yoli in Mexico,(1)(2) volumes remained almost flat at 2,305.5 million unit cases, mainly due to the volume contraction originated by the price increases that were implemented due to the excise tax in Mexico. On the same basis, the bottled water portfolio grew 5.3%, driven by Crystal in Brazil, Nevada in Venezuela and Bonaqua in Argentina. The still beverage category grew 2.8%, mainly driven by the performance of the Jugos del Valle line of business and Powerade across most of our territories. These increases partially compensated for a volume decline in our sparkling beverage category and our bulk water business.

Our reported gross profit increased 11.9% to Ps. 57,636 million in the first nine months of 2014, as compared to the same period of 2013. Lower sweetener and PET prices in most of our operations were offset by the depreciation of the average exchange rate of the Argentine peso,(3) the Brazilian real,(3) the Colombian peso(3) and the Mexican peso(3) as applied to our U.S. dollar-denominated raw material costs. Reported gross margin remained almost flat at 46.8%.

Our reported operating income increased 13.9% to Ps. 16,516 million in the first nine months of 2014 and our reported operating margin was 13.4%. Excluding the integration of the new territories in Brazil and Mexico,(1)(2) operating income increased 6.7%, reaching Ps. 15,471 million, representing an operating margin of 13.9%. Excluding the non-comparable effect of Fluminense, Spaipa and Yoli,(1)(2) operating expenses decreased as a percentage of revenues in most of our territories.

During the first nine months of 2014, the other operative expenses, net line recorded an expense of Ps. 462 million, mainly related to (i) an operative currency fluctuation effect in Venezuela, (ii) restructuring charges in our Mexican operation and (iii) the loss on sale of certain fixed assets.

The share of the profits of associates and joint ventures line recorded a loss of Ps. 383 million in the first nine months of 2014, mainly due to an equity method loss from our participation in Coca-Cola Bottlers Philippines, Inc., and Estrella Azul in Panama, which were partially compensated by a gain in the participation of our non-carbonated beverage joint-ventures in Brazil.

Reported operative cash flow grew 18.5% to Ps. 23,203 million in the first nine months of 2014 as compared to the same period in 2013. Our reported operative cash flow margin expanded 100 basis points to 18.8%. Excluding the recently integrated territories in Brazil and Mexico,(1)(2) operating cash flow margin expanded 180 basis points to 19.6%.

During the first nine months of 2014, income tax, as a percentage of income before taxes, was 27.4% as compared to 32.5% in the same period of 2013. The lower effective tax rate registered during 2014 is related to a one-time benefit resulting from the settlement of certain contingent tax liabilities under the tax amnesty program offered by the Brazilian tax authorities.

The benefit resulting from the settlement of this tax contingency was recorded as (i) a gain in the other non-operative expenses line due to the cancellation of a previously recorded provision and (ii) a reduction of income taxes.

Our consolidated net controlling interest income grew 1.5% to Ps. 8,415 million in the first nine months of 2014. Earnings per share (EPS) in the first nine months of 2014 were Ps. 4.06 (Ps. 40.59 per ADS) computed on the basis of 2,072.9 million shares outstanding (each ADS represents 10 local shares).

(1) The Company’s South America division’s operating results include the non-comparable effect of Fluminense’s results for the months of January, 2014 through August, 2014 and Spaipa’s results for the months of January, 2014 through September, 2014.

(2) The Company’s Mexico & Central America division’s operating results include the non-comparable effect of Grupo Yoli’s results for the months of January, 2014 through May, 2014.

(3) See page 13 for average and end of period exchange rates for the third quarter and the first nine months of 2014.

|

October 22, 2014 |

|

Page 6 |

Philippines Operation

Volume in the third quarter of 2014 grew close to 3% as compared to the same period of 2013. Supported by the performance of our new one-way single-serve platform, brands Coca-Cola, Royal and Sprite grew 7%, 22% and 19%, respectively. We continue with the expansion of our route-to-market model, reaching now close to 500,000 clients through a team of more than 2,100 pre-sellers. To this date, we have installed 4 new production lines to reinforce our single-serve one-way PET capacity, supporting our portfolio strategy.

RECENT DEVELOPMENTS

On September 11, 2014, Coca-Cola FEMSA was the only Mexican beverage company as a part of the Dow Jones Sustainability Emerging Markets Index, comprised of a group of only 86 emerging markets companies. This is the second consecutive time that our Company has had the privilege to be part of this group.

On September 11, 2014, Coca-Cola FEMSA was the only Mexican beverage company as a part of the Dow Jones Sustainability Emerging Markets Index, comprised of a group of only 86 emerging markets companies. This is the second consecutive time that our Company has had the privilege to be part of this group.

As of the first quarter of 2014, Coca-Cola FEMSA has adopted the state-run Supplementary Currency Administration System (SICAD) currency rate to translate its Venezuelan operation’s results into its reporting currency, the Mexican peso. The exchange rate used to translate the third quarter and first nine months results was 12.00 bolivars per U.S. dollar as per the auction held on September 25, 2014. As of October 20, 2014, the SICAD II exchange rate was 49.99 bolivars per U.S. dollar.

As of the first quarter of 2014, Coca-Cola FEMSA has adopted the state-run Supplementary Currency Administration System (SICAD) currency rate to translate its Venezuelan operation’s results into its reporting currency, the Mexican peso. The exchange rate used to translate the third quarter and first nine months results was 12.00 bolivars per U.S. dollar as per the auction held on September 25, 2014. As of October 20, 2014, the SICAD II exchange rate was 49.99 bolivars per U.S. dollar.

As of November, 2014 we will pay the second installment of the 2013 dividend in the amount of Ps. 1.45 per share.

As of November, 2014 we will pay the second installment of the 2013 dividend in the amount of Ps. 1.45 per share.

CONFERENCE CALL INFORMATION

Our third quarter 2014 conference call will be held on October 22, 2014, at 11:00 A.M. Eastern Time (10:00 A.M. Mexico City Time). To participate in the conference call, please dial: Domestic U.S.: 888-430-8709 or International: 719-457-2645. Participant code: 9882269. We invite investors to listen to the live audiocast of the conference call on the Company’s website, www.coca-colafemsa.com. If you are unable to participate live, the conference call audio will be available at www.coca-colafemsa.com.

v v v

Coca-Cola FEMSA, S.A.B. de C.V. produces and distributes Coca-Cola, Fanta, Sprite, Del Valle, and other trademark beverages of The Coca-Cola Company in Mexico (a substantial part of central Mexico, including Mexico City, as well as southeast and northeast Mexico), Guatemala (Guatemala City and surrounding areas), Nicaragua (nationwide), Costa Rica (nationwide), Panama (nationwide), Colombia (most of the country), Venezuela (nationwide), Brazil (greater São Paulo, Campiñas, Santos, the state of Mato Grosso do Sul, the state of Paraná, part of the state of Goias, part of the state of Rio de Janeiro and part of the state of Minas Gerais), Argentina (federal capital of Buenos Aires and surrounding areas) and Philippines (nationwide), along with bottled water, juices, teas, isotonics, beer, and other beverages in some of these territories. The Company has 64 bottling facilities and serves more than 346 million consumers through close to 2,900,000 retailers with more than 120,000 employees worldwide.

v v v

This news release may contain forward-looking statements concerning Coca-Cola FEMSA’s future performance, which should be considered as good faith estimates by Coca-Cola FEMSA. These forward-looking statements reflect management’s expectations and are based upon currently available data. Actual results are subject to future events and uncertainties, many of which are outside Coca-Cola FEMSA’s control, which could materially impact the Company’s actual performance. References herein to “US$” are to United States dollars. This news release contains translations of certain Mexican peso amounts into U.S. dollars for the convenience of the reader. These translations should not be construed as representations that Mexican peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated.

v v v

(6 pages of tables to follow)

Mexican Stock Exchange Quarterly Filing

Coca-Cola FEMSA encourages the reader to refer to our quarterly filing to the Mexican Stock Exchange (Bolsa Mexicana de Valores or BMV) for more detailed information. This filing contains a detailed cash flow statement and selected notes to the financial statements, including segment information. This filing is available at www.bmv.com.mx in the Información Financiera section for Coca-Cola FEMSA (KOF).

|

October 22, 2014 |

|

Page 7 |

|

Consolidated Income Statement |

|

Expressed in millions of Mexican pesos(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q 14 |

% Rev |

|

3Q 13 |

% Rev |

|

Reported Δ% |

|

Excluding M&A Effects Δ% (9) |

|

YTD 14 |

% Rev |

|

YTD 13 |

% Rev |

|

Reported Δ% |

|

Excluding M&A Effects Δ%(9) |

|

Volume (million unit cases) (2) |

|

855.4 |

|

|

795.4 |

|

|

7.5% |

|

0.7% |

|

2,520.5 |

|

|

2,322.7 |

|

|

8.5% |

|

-0.7% |

|

Average price per unit case (2) |

|

46.88 |

|

|

45.83 |

|

|

2.3% |

|

2.1% |

|

46.83 |

|

|

45.91 |

|

|

2.0% |

|

0.8% |

|

Net revenues |

|

41,689 |

|

|

37,272 |

|

|

11.9% |

|

|

|

122,883 |

|

|

109,123 |

|

|

12.6% |

|

|

|

Other operating revenues |

|

92 |

|

|

222 |

|

|

-58.6% |

|

|

|

231 |

|

|

614 |

|

|

-62.4% |

|

|

|

Total revenues (3) |

|

41,781 |

100% |

|

37,494 |

100% |

|

11.4% |

|

2.5% |

|

123,114 |

100% |

|

109,737 |

100% |

|

12.2% |

|

1.2% |

|

Cost of goods sold |

|

22,196 |

53.1% |

|

19,919 |

53.1% |

|

11.4% |

|

|

|

65,478 |

53.2% |

|

58,225 |

53.1% |

|

12.5% |

|

|

|

Gross profit |

|

19,585 |

46.9% |

|

17,575 |

46.9% |

|

11.4% |

|

4.5% |

|

57,636 |

46.8% |

|

51,512 |

46.9% |

|

11.9% |

|

3.3% |

|

Operating expenses |

|

13,440 |

32.2% |

|

12,506 |

33.4% |

|

7.5% |

|

|

|

40,275 |

32.7% |

|

36,917 |

33.6% |

|

9.1% |

|

|

|

Mexico |

|

|

103 |

0.2% |

|

(22) |

-0.1% |

|

-568.2% |

|

|

|

462 |

0.4% |

|

216 |

0.2% |

|

113.9% |

|

|

|

Operative equity method (gain) loss in associates(4)(5) |

217 |

0.5% |

|

28 |

0.1% |

|

675.0% |

|

|

|

383 |

0.3% |

|

(121) |

-0.1% |

|

-416.5% |

|

|

|

Operating income (6) |

|

5,825 |

13.9% |

|

5,063 |

13.5% |

|

15.1% |

|

7.9% |

|

16,516 |

13.4% |

|

14,500 |

13.2% |

|

13.9% |

|

6.7% |

|

Other non operative expenses, net |

|

(291) |

-0.7% |

|

51 |

0.1% |

|

-672.5% |

|

|

|

(233) |

-0.2% |

|

232 |

0.2% |

|

-200.6% |

|

|

|

Non Operating equity method (gain) loss in associates(7) |

(24) |

-0.1% |

|

(48) |

-0.1% |

|

-48.7% |

|

|

|

(96) |

-0.1% |

|

(111) |

-0.1% |

|

-13.7% |

|

|

|

|

Interest expense |

|

1,454 |

|

|

623 |

|

|

133.4% |

|

|

|

4,305 |

|

|

1,830 |

|

|

135.2% |

|

|

|

|

Interest income |

|

85 |

|

|

220 |

|

|

-61.4% |

|

|

|

403 |

|

|

441 |

|

|

-8.6% |

|

|

|

|

Interest expense, net |

|

1,369 |

|

|

403 |

|

|

239.7% |

|

|

|

3,902 |

|

|

1,389 |

|

|

180.9% |

|

|

|

|

Foreign exchange loss (gain) |

|

375 |

|

|

162 |

|

|

131.5% |

|

|

|

322 |

|

|

319 |

|

|

0.9% |

|

|

|

|

Loss (gain) on monetary position in Inflationary subsidiries |

209 |

|

|

(76) |

|

|

-375.0% |

|

|

|

744 |

|

|

150 |

|

|

4.0 |

|

|

|

|

Market value (gain) loss on ineffective portion of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

derivative instruments |

|

93 |

|

|

(32) |

|

|

-390.6% |

|

|

|

(67) |

|

|

(18) |

|

|

272.2% |

|

|

|

Comprehensive financing result |

|

2,046 |

|

|

457 |

|

|

347.7% |

|

|

|

4,901 |

|

|

1,840 |

|

|

166.4% |

|

|

|

Income before taxes |

|

4,094 |

|

|

4,603 |

|

|

-11.1% |

|

|

|

11,944 |

|

|

12,539 |

|

|

-4.7% |

|

|

|

Income taxes |

|

581 |

|

|

1,596 |

|

|

-63.6% |

|

|

|

3,275 |

|

|

4,077 |

|

|

-19.7% |

|

|

|

Consolidated net income |

|

3,513 |

|

|

3,007 |

|

|

16.8% |

|

|

|

8,669 |

|

|

8,462 |

|

|

2.4% |

|

|

|

Net income attributable to equity holders of the Company |

3,343 |

8.0% |

|

2,954 |

7.9% |

|

13.2% |

|

|

|

8,415 |

6.8% |

|

8,292 |

7.6% |

|

1.5% |

|

|

|

Non-controlling interest |

|

170 |

|

|

53 |

|

|

220.8% |

|

|

|

254 |

|

|

170 |

|

|

49.4% |

|

|

|

Operating income (6) |

|

5,825 |

13.9% |

|

5,063 |

13.5% |

|

15.1% |

|

7.9% |

|

16,516 |

13.4% |

|

14,500 |

13.2% |

|

13.9% |

|

6.7% |

|

Depreciation |

|

1,520 |

|

|

1,562 |

|

|

-2.7% |

|

|

|

4,836 |

|

|

4,555 |

|

|

6.2% |

|

|

|

Amortization and other operative non-cash charges |

663 |

|

|

186 |

|

|

256.5% |

|

|

|

1,851 |

|

|

521 |

|

|

255.3% |

|

|

|

Operative cash flow (6)(8) |

|

8,008 |

19.2% |

|

6,811 |

18.2% |

|

17.6% |

|

11.1% |

|

23,203 |

18.8% |

|

19,576 |

17.8% |

|

18.5% |

|

11.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Except volume and average price per unit case figures. |

|

(2) Sales volume and average price per unit case exclude beer results. |

|

(3) Includes total revenues of Ps. 16,405 million from our Mexican operation and Ps. 10,147 million from our Brazilian operation. |

|

(4) Includes equity method in Jugos del Valle, Coca-Cola Bottlers Philippines, Inc., Leao Alimentos and Estrella Azul, among others. |

|

(5) As of February 2013, we are incorporating our stake of the results of Coca-Cola Bottlers Philippines, Inc. through the equity method on an estimated basis in this line. |

|

(6) The operating income and operative cash flow lines are presented as non-gaap measures for the convenience of the reader. |

|

(7) Includes equity method in PIASA, IEQSA, Beta San Miguel, IMER and KSP Participacoes. |

|

(8) Operative cash flow = operating income + depreciation, amortization & other operative non-cash charges. |

|

(9) Excluding M&A effects means, with respect to a year over year comparison, the increase in a given measure excluding the effects of mergers, acquisitions and divestitures. |

|

We believe this measure allows us to provide investors and other market participants with a better representation of the performance of our business. In preparing this measure, management has used its best judgment, estimates and assumptions in order to maintain comparability. |

|

As of June 2013, we integrated Grupo Yoli in our Mexican operation. |

|

As of September 2013, we integrated Fluminense in our Brazilian operation. |

|

As of November 2013, we integrated Spaipa in our Brazilian operation. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 22, 2014 |

|

Page 8 |

|

Consolidated Balance Sheet |

|

|

|

|

|

Expressed in millions of Mexican pesos. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

Sep-14 |

|

Dec-13 |

|

Current Assets |

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

Ps. |

21,597 |

Ps. |

15,306 |

|

Total accounts receivable |

|

8,647 |

|

9,958 |

|

Inventories |

|

|

|

8,427 |

|

9,130 |

|

Other current assets |

|

8,312 |

|

8,837 |

|

Total current assets |

|

46,983 |

|

43,231 |

|

Property, plant and equipment |

|

|

|

|

|

Property, plant and equipment |

|

86,464 |

|

86,961 |

|

Accumulated depreciation |

|

(35,170) |

|

(35,176) |

|

Total property, plant and equipment, net |

|

51,294 |

|

51,785 |

|

Investment in shares |

|

16,704 |

|

16,767 |

|

Intangibles assets and other assets |

|

102,372 |

|

103,556 |

|

Other non-current assets |

|

2,547 |

|

1,326 |

|

Total Assets |

|

|

Ps. |

219,900 |

Ps. |

216,665 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

Sep-14 |

|

Dec-13 |

|

Current Liabilities |

|

|

|

|

|

Short-term bank loans and notes payable |

Ps. |

1,636 |

Ps. |

3,586 |

|

Suppliers |

|

|

|

16,083 |

|

16,220 |

|

Other current liabilities |

|

18,138 |

|

12,592 |

|

Total Current Liabilities |

|

35,857 |

|

32,398 |

|

Long-term bank loans and notes payable |

|

59,914 |

|

56,875 |

|

Other long-term liabilities |

|

8,702 |

|

10,239 |

|

Total Liabilities |

|

|

|

104,473 |

|

99,512 |

|

Equity |

|

|

|

|

|

|

|

Non-controlling interest |

|

4,256 |

|

4,042 |

|

Total controlling interest |

|

111,171 |

|

113,111 |

|

Total equity (1) |

|

|

|

115,427 |

|

117,153 |

|

Total Liabilities and Equity |

Ps. |

219,900 |

Ps. |

216,665 |

| |

|

|

|

|

|

|

|

|

|

(1) Includes the effect originated by using the state-run SICAD exchange rate of 12.00 bolivars per U.S. dollar as of September 25, 2014. |

|

October 22, 2014 |

|

Page 10 |

|

Mexico & Central America Division |

|

Expressed in millions of Mexican pesos(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q 14 |

% Rev |

|

3Q 13 |

% Rev |

|

Reported Δ% |

|

Excluding M&A Effects Δ%(7) |

|

YTD 14 |

% Rev |

|

YTD 13 |

% Rev |

|

Reported Δ% |

|

Excluding M&A Effects Δ%(7) |

|

Volume (million unit cases) |

|

|

497.0 |

|

|

494.3 |

|

|

0.5% |

|

0.5% |

|

1,445.1 |

|

|

1,454.0 |

|

|

-0.6% |

|

-3.3% |

|

Average price per unit case |

|

|

37.34 |

|

|

36.09 |

|

|

3.4% |

|

3.4% |

|

37.25 |

|

|

35.83 |

|

|

4.0% |

|

3.7% |

|

Net revenues |

|

|

18,557 |

|

|

17,841 |

|

|

4.0% |

|

|

|

53,823 |

|

|

52,092 |

|

|

3.3% |

|

|

|

Other operating revenues |

|

|

23 |

|

|

94 |

|

|

-75.5% |

|

|

|

67 |

|

|

256 |

|

|

-73.8% |

|

|

|

Total revenues (2) |

|

|

18,580 |

100.0% |

|

17,935 |

100.0% |

|

3.6% |

|

3.6% |

|

53,890 |

100.0% |

|

52,348 |

100.0% |

|

2.9% |

|

-0.1% |

|

Cost of goods sold |

|

|

9,215 |

49.6% |

|

9,038 |

50.4% |

|

2.0% |

|

|

|

26,573 |

49.3% |

|

26,487 |

50.6% |

|

0.3% |

|

|

|

Gross profit |

|

|

9,365 |

50.4% |

|

8,897 |

49.6% |

|

5.3% |

|

5.3% |

|

27,317 |

50.7% |

|

25,861 |

49.4% |

|

5.6% |

|

2.8% |

|

Operating expenses |

|

|

6,187 |

33.3% |

|

6,048 |

33.7% |

|

2.3% |

|

|

|

18,189 |

33.8% |

|

17,460 |

33.4% |

|

4.2% |

|

|

|

Other operative expenses, net |

|

75 |

0.4% |

|

(21) |

-0.1% |

|

-457.1% |

|

|

|

216 |

0.4% |

|

59 |

0.1% |

|

266.1% |

|

|

|

Operative equity method (gain) loss in associates (3)(4) |

234 |

1.3% |

|

39 |

0.2% |

|

500.0% |

|

|

|

463 |

0.9% |

|

(97) |

-0.2% |

|

-577.3% |

|

|

|

Operating income (5) |

|

|

2,869 |

15.4% |

|

2,831 |

15.8% |

|

1.3% |

|

1.3% |

|

8,449 |

15.7% |

|

8,439 |

16.1% |

|

0.1% |

|

-1.0% |

|

Depreciation, amortization & other operative non-cash charges |

1,224 |

6.6% |

|

1,003 |

5.6% |

|

22.0% |

|

|

|

3,600 |

6.7% |

|

2,646 |

5.1% |

|

36.1% |

|

|

|

Operative cash flow (5)(6) |

|

|

4,093 |

22.0% |

|

3,834 |

21.4% |

|

6.8% |

|

6.8% |

|

12,049 |

22.4% |

|

11,085 |

21.2% |

|

8.7% |

|

7.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Except volume and average price per unit case figures. |

|

(2) Includes total revenues of Ps. 16,405 million from our Mexican operation. |

|

(3) Includes equity method in Jugos del Valle, Coca-Cola Bottlers Philippines, Inc. and Estrella Azul, among others. |

|

(4) As of February 2013, we are incorporating our stake of the results of Coca-Cola Bottlers Philippines, Inc. through the equity method on an estimated basis in this line. |

|

(5) The operating income and operative cash flow lines are presented as non-gaap measures for the convenience of the reader. |

|

(6) Operative cash flow = operating income + depreciation, amortization & other operative non-cash charges. |

|

(7) Excluding M&A effects means, with respect to a year over year comparison, the increase in a given measure excluding the effects of mergers, acquisitions and divestitures. |

|

We believe this measure allows us to provide investors and other market participants with a better representation of the performance of our business. In preparing this measure, management has used its best judgment, estimates and assumptions in order to maintain comparability. |

|

As of June 2013, we integrated Grupo Yoli in our Mexican operation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South America Division |

|

Expressed in millions of Mexican pesos(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q 14 |

% Rev |

|

3Q 13 |

% Rev |

|

Reported Δ% |

|

Excluding M&A Effects Δ%(7) |

|

YTD 14 |

% Rev |

|

YTD 13 |

% Rev |

|

Reported Δ% |

|

Excluding M&A Effects Δ%(7) |

|

Volume (million unit cases) (2) |

|

|

358.4 |

|

|

301.1 |

|

|

19.0% |

|

0.9% |

|

1,075.4 |

|

|

868.7 |

|

|

23.8% |

|

3.6% |

|

Average price per unit case (2) |

|

60.11 |

|

|

61.81 |

|

|

-2.8% |

|

0.8% |

|

59.70 |

|

|

62.79 |

|

|

-4.9% |

|

-2.2% |

|

Net revenues |

|

|

23,133 |

|

|

19,431 |

|

|

19.1% |

|

|

|

69,060 |

|

|

57,031 |

|

|

21.1% |

|

|

|

Other operating revenues |

|

|

68 |

|

|

128 |

|

|

-46.9% |

|

|

|

167 |

|

|

358 |

|

|

-53.4% |

|

|

|

Total revenues (3) |

|

|

23,201 |

100.0% |

|

19,559 |

100.0% |

|

18.6% |

|

1.6% |

|

69,227 |

100.0% |

|

57,389 |

100.0% |

|

20.6% |

|

2.4% |

|

Cost of goods sold |

|

|

12,979 |

55.9% |

|

10,881 |

55.6% |

|

19.3% |

|

|

|

38,907 |

56.2% |

|

31,738 |

55.3% |

|

22.6% |

|

|

|

Gross profit |

|

|

10,222 |

44.1% |

|

8,678 |

44.4% |

|

17.8% |

|

3.8% |

|

30,320 |

43.8% |

|

25,651 |

44.7% |

|

18.2% |

|

3.7% |

|

Operating expenses |

|

|

7,253 |

31.3% |

|

6,458 |

33.0% |

|

12.3% |

|

|

|

22,089 |

31.9% |

|

19,464 |

33.9% |

|

13.5% |

|

|

|

Other operative expenses, net |

|

29 |

0.1% |

|

(1) |

0.0% |

|

-3000.0% |

|

|

|

244 |

0.4% |

|

150 |

0.3% |

|

62.7% |

|

|

|

Operative equity method (gain) loss in associates (4) |

|

(17) |

-0.1% |

|

(11) |

-0.1% |

|

54.5% |

|

|

|

(80) |

-0.1% |

|

(24) |

0.0% |

|

233.3% |

|

|

|

Operating income (5) |

|

|

2,957 |

12.7% |

|

2,232 |

11.4% |

|

32.5% |

|

16.3% |

|

8,067 |

11.7% |

|

6,061 |

10.6% |

|

33.1% |

|

17.4% |

|

Depreciation, amortization & other operative non-cash charges |

958 |

4.1% |

|

745 |

3.8% |

|

28.6% |

|

|

|

3,088 |

4.5% |

|

2,430 |

4.2% |

|

27.1% |

|

|

|

Operative cash flow (5)(6) |

|

|

3,915 |

16.9% |

|

2,977 |

15.2% |

|

31.5% |

|

16.8% |

|

11,155 |

16.1% |

|

8,491 |

14.8% |

|

31.4% |

|

16.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Except volume and average price per unit case figures. |

|

(2) Sales volume and average price per unit case exclude beer results. |

|

(3) Includes total revenues of Ps. 10,147 million from our Brazilian operation. |

|

(4) Includes equity method in Leao Alimentos, among others. |

|

(5) The operating income and operative cash flow lines are presented as non-gaap measures for the convenience of the reader. |

|

(6) Operative cash flow = operating income + depreciation, amortization & other operative non-cash charges. |

|

(7) Excluding M&A effects means, with respect to a year over year comparison, the increase in a given measure excluding the effects of mergers, acquisitions and divestitures. |

|

We believe this measure allows us to provide investors and other market participants with a better representation of the performance of our business. In preparing this measure, management has used its best judgment, estimates and assumptions in order to maintain comparability. |

|

As of September 2013, we integrated Fluminense in our Brazilian operation. |

|

As of November 2013, we integrated Spaipa in our Brazilian operation. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 22, 2014 |

|

Page 10 |

|

SELECTED INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, 2014 and 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in millions of Mexican pesos. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q 14 |

|

|

|

|

|

3Q 13 |

|

|

Capex |

|

|

|

2,946.8 |

|

Capex |

|

|

|

3,458.3 |

|

|

Depreciation |

|

|

|

1,520.0 |

|

Depreciation |

|

|

|

1,562.0 |

|

|

Amortization & Other non-cash charges |

|

663.0 |

|

Amortization & Other non-cash charges |

|

186.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VOLUME |

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in million unit cases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mexico |

3Q 14 |

|

3Q 13 |

|

|

Sparkling |

Water (1) |

Bulk Water (2) |

Still |

Total |

|

Sparkling |

Water (1) |

Bulk Water (2) |

Still |

Total |

|

Mexico |

330.9 |

25.4 |

78.1 |

22.3 |

456.7 |

|

331.8 |

23.7 |

77.5 |

24.3 |

457.3 |

|

Central America |

33.6 |

2.4 |

0.1 |

4.2 |

40.3 |

|

30.9 |

1.8 |

0.1 |

4.2 |

37.0 |

|

Mexico & Central America |

364.5 |

27.8 |

78.2 |

26.5 |

497.0 |

|

362.7 |

25.5 |

77.6 |

28.5 |

494.3 |

|

Colombia |

54.1 |

6.3 |

7.1 |

7.8 |

75.3 |

|

48.9 |

5.6 |

7.7 |

5.8 |

68.0 |

|

Venezuela |

53.9 |

3.7 |

0.6 |

4.7 |

62.8 |

|

52.0 |

3.6 |

0.8 |

4.5 |

60.9 |

|

Brazil |

147.6 |

9.1 |

1.2 |

8.6 |

166.5 |

|

105.4 |

6.3 |

0.9 |

5.8 |

118.4 |

|

Argentina |

46.7 |

4.3 |

0.2 |

2.5 |

53.8 |

|

47.8 |

3.5 |

0.1 |

2.4 |

53.8 |

|

South America |

302.4 |

23.4 |

9.1 |

23.5 |

358.4 |

|

254.1 |

19.0 |

9.5 |

18.5 |

301.1 |

|

Total |

666.9 |

51.2 |

87.3 |

50.0 |

855.4 |

|

616.8 |

44.5 |

87.1 |

47.0 |

795.4 |

|

(1) Excludes water presentations larger than 5.0 Lt ; includes flavored water |

|

(2) Bulk Water = Still bottled water in 5.0, 19.0 and 20.0 - liter packaging presentations; includes flavored water |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORGANIC VOLUME (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in million unit cases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q 14 |

|

3Q 13 |

|

|

Sparkling |

Water (2) |

Bulk Water (3) |

Still |

Total |

|

Sparkling |

Water (2) |

Bulk Water (3) |

Still |

Total |

|

Brazil Organic |

98.4 |

6.7 |

0.9 |

5.9 |

111.8 |

|

105.4 |

6.3 |

0.9 |

5.8 |

118.4 |

|

South America Organic |

253.2 |

21.0 |

8.8 |

20.9 |

303.8 |

|

254.1 |

19.0 |

9.5 |

18.5 |

301.1 |

|

Total Organic |

617.7 |

48.8 |

87.0 |

47.4 |

800.8 |

|

616.8 |

44.5 |

87.1 |

47.0 |

795.4 |

|

(1) Excludes volume from Fluminense for the months of July, 2014 and August, 2014 and Spaipa for July, 2014 through September, 2014 |

|

|

|

|

(2) Excludes water presentations larger than 5.0 Lt ; includes flavored water |

|

(3) Bulk Water = Still bottled water in 5.0, 19.0 and 20.0 - liter packaging presentations; includes flavored water |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

October 22, 2014 |

|

Page 11 |

|

For the nine months ended September 30, 2014 and 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in millions of Mexican pesos. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YTD 14 |

|

|

|

|

|

YTD 13 |

|

|

Capex |

|

|

|

6,993.6 |

|

Capex |

|

|

|

8,091.5 |

|

|

Depreciation |

|

|

|

4,836.0 |

|

Depreciation |

|

|

|

4,555.0 |

|

|

Amortization & Other non-cash charges |

|

1,851.0 |

|

Amortization & Other non-cash charges |

|

521.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VOLUME |

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in million unit cases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YTD 14 |

|

YTD 13 |

|

|

Sparkling |

Water (1) |

Bulk Water (2) |

Still |

Total |

|

Sparkling |

Water (1) |

Bulk Water (2) |

Still |

Total |

|

Mexico |

949.3 |

77.8 |

229.4 |

67.6 |

1,324.1 |

|

957.5 |

72.4 |

237.1 |

72.8 |

1,339.8 |

|

Central America |

101.2 |

7.1 |

0.3 |

12.4 |

121.0 |

|

95.9 |

5.8 |

0.3 |

12.2 |

114.2 |

|

Mexico & Central America |

1,050.5 |

84.9 |

229.7 |

80.0 |

1,445.1 |

|

1,053.4 |

78.2 |

237.4 |

85.0 |

1,454.0 |

|

Colombia |

157.6 |

17.6 |

21.5 |

21.8 |

218.5 |

|

144.0 |

16.5 |

22.4 |

15.5 |

198.4 |

|

Venezuela |

154.6 |

10.0 |

1.6 |

14.1 |

180.4 |

|

146.2 |

8.9 |

2.1 |

11.7 |

168.9 |

|

Brazil |

456.9 |

29.7 |

3.8 |

27.2 |

517.7 |

|

303.2 |

17.8 |

2.4 |

17.5 |

340.9 |

|

Argentina |

139.0 |

12.3 |

0.4 |

7.1 |

158.8 |

|

142.2 |

11.0 |

0.4 |

6.9 |

160.5 |

|

South America |

908.1 |

69.6 |

27.4 |

70.3 |

1,075.4 |

|

735.6 |

54.2 |

27.3 |

51.6 |

868.7 |

|

Total |

1,958.6 |

154.5 |

257.1 |

150.3 |

2,520.5 |

|

1,789.0 |

132.4 |

264.7 |

136.6 |

2,322.7 |

|

(1) Excludes water presentations larger than 5.0 Lt ; includes flavored water |

|

(2) Bulk Water = Still bottled water in 5.0, 19.0 and 20.0 - liter packaging presentations; includes flavored water |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORGANIC VOLUME (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in million unit cases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YTD 14 |

|

YTD 13 |

|

|

Sparkling |

Water (2) |

Bulk Water (3) |

Still |

Total |

|

Sparkling |

Water (2) |

Bulk Water (3) |

Still |

Total |

|

Mexico Organic |

916.5 |

72.8 |

229.2 |

65.9 |

1,284.4 |

|

957.5 |

72.4 |

237.1 |

72.8 |

1,339.8 |

|

Mexico & Central America Organic |

1,017.7 |

79.9 |

229.5 |

78.3 |

1,405.4 |

|

1,053.4 |

78.2 |

237.4 |

85.0 |

1,454.0 |

|

Brazil Organic |

299.8 |

21.7 |

2.6 |

18.3 |

342.4 |

|

303.2 |

17.8 |

2.4 |

17.5 |

340.9 |

|

South America Organic |

751.0 |

61.6 |

26.1 |

61.4 |

900.1 |

|

735.6 |

54.2 |

27.3 |

51.6 |

868.7 |

|

Total Organic |

1,768.7 |

141.5 |

255.6 |

139.7 |

2,305.5 |

|

1,789.0 |

132.4 |

264.7 |

136.6 |

2,322.7 |

|

(1) Excludes volume from Yoli as of January, 2014 through May, 2014 and Fluminense and Spaipa as of January, 2014 through June, 2014 |

|

|

|

(2) Excludes water presentations larger than 5.0 Lt ; includes flavored water |

|

(3) Bulk Water = Still bottled water in 5.0, 19.0 and 20.0 - liter packaging presentations; includes flavored water |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

October 22, 2014 |

|

Page 12 |

|

September 2014 |

|

Macroeconomic Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inflation (1) |

|

|

|

|

|

|

|

|

|

|

|

|

LTM |

3Q 2014 |

|

YTD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mexico |

|

4.22% |

1.08% |

|

2.18% |

|

|

|

|

|

|

|

Colombia |

|

2.86% |

0.49% |

|

3.08% |

|

|

|

|

|

|

|

Venezuela (2) |

|

62.02% |

10.88% |

|

43.87% |

|

|

|

|

|

|

|

Brazil |

|

6.75% |

0.83% |

|

4.61% |

|

|

|

|

|

|

|

Argentina |

|

23.76% |

4.20% |

|

19.84% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Source: inflation is published by the Central Bank of each country. |

|

|

|

|

|

|

|

(2) Inflation based on unofficial publications as of October 15th, 2014. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Exchange Rates for each Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarterly Exchange Rate (local currency per USD) |

|

YTD Exchange Rate (local currency per USD) |

|

|

|

|

|

3Q 14 |

|

3Q 13 |

Δ% |

|

2014 |

2013 |

Δ% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mexico |

|

13.1114 |

|

12.9141 |

1.5% |

|

13.1167 |

12.6806 |

3.4% |

|

|

|

Guatemala |

|

7.7674 |

|

7.8847 |

-1.5% |

|

7.7706 |

7.8422 |

-0.9% |

|

|

|

Nicaragua |

|

26.1153 |

|

24.8717 |

5.0% |

|

25.7995 |

24.5709 |

5.0% |

|

|

|

Costa Rica |

|

544.7856 |

|

505.6211 |

7.7% |

|

545.1330 |

505.3980 |

7.9% |

|

|

|

Panama |

|

1.0000 |

|

1.0000 |

0.0% |

|

1.0000 |

1.0000 |

0.0% |

|

|

|

Colombia |

|

1,910.5851 |

|

1,907.6137 |

0.2% |

|

1,944.3202 |

1,853.7552 |

4.9% |

|

|

|

Venezuela |

|

11.2148 |

|

6.3000 |

78.0% |

|

9.7229 |

5.9825 |

62.5% |

|

|

|

Brazil |

|

2.2752 |

|

2.2883 |

-0.6% |

|

2.2896 |

2.1180 |

8.1% |

|

|

|

Argentina |

|

8.2982 |

|

5.5865 |

48.5% |

|

7.9937 |

5.2809 |

51.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

End of Period Exchange Rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange Rate (local currency per USD) |

|

Exchange Rate (local currency per USD) |

|

|

|

|

|

Sep 14 |

|

Sep 13 |

Δ% |

|

Jun 14 |

Jun 13 |

Δ% |

|

|

|

|

|