Nitrogen Fertilizer Maker CF Industries Names New CFO

May 31 2019 - 7:12PM

Dow Jones News

By Nina Trentmann

The new finance chief of CF Industries Holdings Inc., whose

nitrogen is used to fertilize farmland across the Americas, will

need to guide the company through a turbulent period for U.S.

agriculture.

The company on Friday promoted Christopher Bohn, a company

insider who will start as CFO on Sept. 1. He succeeds Dennis

Kelleher, who is retiring from the company after eight years in the

role.

A continuing trade conflict between the U.S. and China is

causing farmers to rethink which crops to grow -- a calculus that

was expected to benefit the Deerfield, Ill.-based manufacturer. But

floods have delayed the start of the planting season in the Farm

Belt, reducing demand for fertilizer.

While China last year levied 25% tariffs on U.S. soybeans and

corn imports, its appetite for American soybeans far outstrips its

demand for corn. China imported 8.3 million metric tons of soybeans

in 2018, compared with 289,757 metric tons of corn, according to

the U.S. Department of Agriculture. China has historically been the

top buyer of U.S. soybeans.

Soybeans are generally more profitable than corn, but the

Chinese tariffs take away some of that profit. As a result, U.S.

farmers are expected to plant more corn this year and less

soybeans. And while farmers rely heavily on Chinese exports to

drive demand for soybeans, demand for corn is driven by multiple

domestic sources including ethanol production, animal feed, food

ingredients and other uses.

"More corn means more nitrogen fertilizer that's required,

benefiting CF Industries," said Seth Goldstein, an analyst at

Morningstar Inc. Soybeans don't need to be fertilized with

nitrogen, he said.

But because of floods in several U.S. states, farmers have only

planted 49% of their intended corn fields, far below the 80%

average for this time of year, according to the Agriculture

Department.

"Farmers are running out of time to get their corn into the

ground," said Jonas Oxgaard, an analyst at Sanford C. Bernstein

& Co. That could limit demand for CF Industries' products. "If

farmers leave 5% or 10% of fields empty, we will see a significant

impact on their production," Mr. Oxgaard said.

CF Industries in May said sales volumes for the first quarter

were lower compared with the prior-year period because of U.S.

weather.

"Despite the recent challenges, the CFO is coming into a pretty

stable environment" for the company's finances, Mr. Oxgaard

said.

Mr. Bohn has worked for CF Industries for the past decade, most

recently serving as senior vice president of manufacturing and

distribution. In this role, he has overseen the company's nitrogen

plants and distribution facilities in Canada, the U.K. and the U.S.

During his time at the company, he also has held roles overseeing

supply chain corporate planning, CF Industries said in a

statement.

That experience could help the company during a period of

shifting demand.

Two new plants in Louisiana and Iowa will help CF Industries

react quickly to customer demand, which can change based on the

weather or planting decisions based on tariffs, Mr. Oxgaard

said.

The plants helped reduce the company's cash cost of goods sold

per product ton -- an industry efficiency measure -- by about 25%

between 2014 and 2018, Mr. Goldstein said.

Mr. Bohn's base salary will increase to $600,000 from $550,000

and his target bonus opportunity will rise to $480,000 from

$440,000, CF Industries said in a filing with regulators.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

May 31, 2019 18:57 ET (22:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

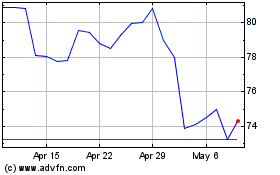

CF Industries (NYSE:CF)

Historical Stock Chart

From Mar 2024 to Apr 2024

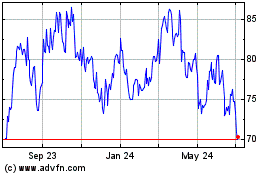

CF Industries (NYSE:CF)

Historical Stock Chart

From Apr 2023 to Apr 2024